Humanity is rapidly aging; out of the total number of inhabitants of our planet, there are a billion people of retirement age. This is every sixth person. If we talk about Russia, then every fourth resident is a pensioner. Have you ever thought about what old age, life expectancy, or retirement mean?

Old age can be compared to the autumn of life - colors have faded, events of the past emerge in memory. When you are young and full of strength, it all seems so distant, illusory. But time spares no one - year after year, you are already thirty, forty, fifty years old. What seemed so far away becomes very close and tangible. Unfortunately, everyone has the same ending - a well-deserved rest. In the article you will learn what a pension and the survival period are. How are deadlines calculated? What is the savings part? What will be the payment amount? Who are the “early-term workers”?

Pension provision

A pension is a permanent cash payment that is provided on a regular basis to persons with a certain social status. Regular guaranteed salary is paid to the following categories:

- People who have lived to a certain age receive an old-age pension.

- People who have serious health problems since birth, as well as those who have suffered injuries and injuries that do not allow them to fully carry out work, are issued a disability pension.

- For minors, in case of loss of parents or guardians (death, etc.) - issued in connection with the loss of a breadwinner.

Pension payments are of two types:

- State guaranteed payments.

- Private (implemented by private pension funds).

The assigned pension payments are of an indefinite nature.

Estimated survival times

The term was approved by Decree of the Government of the Russian Federation No. 531 in 2015. The indicator is subject to annual adjustments, based on data from the Federal State Statistics Service. The calculation of the survival period is carried out by the state executive body - the Government of the Russian Federation. The data is processed, and as a result, the average period of a person’s life in retirement is calculated. The indicator is usually calculated in months. The survival periods of the male and female parts of the population of the Russian Federation differ in terms of timing. Women have more, men have less.

What to expect in the future

The average survival age will gradually affect every pensioner. This is due to the fact that there is no tendency to stop the reform, so changes will be introduced slowly but constantly.

The reform will be completed in 2022. During this time, the survival age in the Russian Federation will increase to three hundred and twenty months. By the way, now it is two hundred and forty months.

The high age of survival is the reason why monthly pension payments are small. Starting this year, the government will encourage those people who will retire later than they should.

Technology for calculating survival time

During the 2020 pension reform, the Cabinet of Ministers adopted Resolution No. 531, which approved the technology for calculating mandatory payments to older people. To calculate the pension, the survival period is set according to a certain formula. It looks like this:

- T = (Si × ei + Sj + ej / Si × Sj) × 12.

This technique requires detailed explanation. Each symbol has a certain meaning:

- The symbol T indicates the estimated period for which the transfers are expected to take place (expected payment period). The unit of measurement is one month.

- Symbols Si - indicate the size of the male population who have reached the age of sixty.

- Symbols Sj - indicate the female part of the population, whose age is fifty-five years.

- The symbols ei indicate the expected life span of the male half of the population.

- The symbols ej indicate the expected life span of the female half of the population.

Data are provided by statistics and accounting authorities.

How does an increased survival period affect urgent payments?

An increase in the average age of survival is not reflected if urgent payments are issued. A fixed-term pension is called monthly payments within the period specified by the pensioner. It is important that the term cannot be set less than ten years.

Those people who accumulated their pension using the state co-financing program can apply for this method of receiving a pension. Not only an individual, but also a company that provides work can participate in the program.

Urgent payments can also be received by those who formed their pension at the expense of maternity capital.

Features of the process before approving the survival period

There are some features that apply during the annual recalculation of the survival period. Before the annual approval of the updated deadlines, a comparison is made with current indicators. This procedure looks like this:

- In the event that the updated indicators are higher than the current values, the maximum current indicator for the outgoing year is approved.

- If the indicators are below the high point of the outgoing year, but above the established limits last year, then the period is accepted in the calculated (updated) amount.

- When the indicators are below the high point of the outgoing year, but not higher than the established limits for the previous reporting period, then the period is approved in the maximum amount that was determined for the past year.

Accumulative pension payments

Before we figure out how the funded pension and the survival period are related, let's talk about what such a payment means? These are funds that are accumulated into a single whole by adding employer contributions and income received from investing the collected amount. Monthly transfers by the employer for a legally employed person are equal to 22%, the share of the funded part is 6%. It is these two amounts that make up the savings in question.

How are payments made? The scheme looks quite simple:

- At the time of retirement, the collected amount begins to be transferred monthly along with the main pension payments. Simply put, it is an additional supplement to the mandatory part of the pension.

- The monthly paid portion is calculated using a formula. When making calculations, the expected payment period also plays a significant role.

The concept of expected periods of pension payment

Those citizens who have decided that, along with an insurance pension, they will also form a funded pension, upon reaching the age of retirement, have the right to count on two payments at once.

The calculation of the insurance pension is carried out by the state pension fund on the basis of the corresponding number of points that make up the IPC available by the time the required number of years is reached . Accordingly, the higher this indicator is, the more money a senior citizen can count on.

Cumulative is calculated according to some other principles. The funds transferred into account are not converted into any conventional units, but are accumulated in their direct expression. In addition, when calculating a funded pension, the income received by a citizen from investments is taken into account. It could also be other income, for example, maternity capital funds.

Thus, the most important parameter when determining the size of a funded pension is the total amount of accumulated funds by a citizen, taking into account investment income and other sources.

Next, we should consider how the funded part of a pension is paid to a citizen. Legislation distinguishes three such forms:

- Lump sum . Involves the payment of all available funds immediately after the right to receive them. However, it should be borne in mind that this is possible only in exceptional cases and does not depend in any way on the will of the citizen himself. It is possible to receive the entire amount at a time only in those cases that are directly defined by law. For example, people with disabilities or recipients of social benefits can take advantage of this opportunity. In addition, the entire amount can be paid if the accumulated amount is not very large.

- Urgent. The funds are paid over a period determined by the pensioner himself, but not less than 10 years.

- Indefinite. In this case, the pensioner can receive money for life or until the financial resources he has accumulated are exhausted. In this case, the amount of monthly security is calculated based on such an important parameter as the “expected payment period”.

It should be understood as the life expectancy of a citizen after retirement.

Reference! For convenience of calculations, the expected period of the labor pension is calculated in months.

Naturally, this parameter is averaged. It is calculated based on the data provided by official statistical bodies, and in this regard does not quite correctly reflect the real state of affairs. However, this parameter is mandatory for calculations, which is established by the relevant regulations.

Change in survival time over the past five years

For a long time, the parameter considered in this article was not subject to any significant changes. So, until 2015 it was equal to 19 years or 228 months. However, over subsequent periods this figure increased. To assess the corresponding dynamics, a table is presented below, which contains information regarding the established survival periods in relation to specific calendar years:

| Year | Survival time in months |

| 2014 | 228 |

| 2015 | 228 |

| 2016 | 234 |

| 2017 | 240 |

| 2018 | 246 |

Despite the conventionality of the justification for the annual increase in the survival period, it is not without foundation, since the average life expectancy in our country is actually growing, albeit at the rate that was stated.

Survival time in 2020

In 2020, the trend of increasing indicators of the parameter under consideration continued. So, this year the survival time is 252 months or 21 years. The increase compared to the previous year was six months.

There is no reason to believe that the survival period will remain at the level of 2019 in the future. It is already known that in 2020 it will be 21.5 years or 258 months.

Calculation method, specific amount and choice

The formula and final payout amount is calculated as follows:

- PEP = NPP + PD (or OPV);

Where:

- PEP – constant monthly payments;

- NPF – accumulated pension funds (funded part);

- PD – survival period (expected period of payments).

Let’s say the funded part of the funds at the time of retirement is 50,000 rubles. In this case, the calculation will look like this:

- 50 000 / 246 = 203,25

The amount of the monthly supplement will be 203 rubles 25 kopecks. How the expected period is calculated is described above.

The law also provides for the following types of receipt of the funded portion:

- One-time receipt. It is possible to pay the amount in full.

- Urgent receipt. The deadline is set by the pensioner, but not less than ten years.

- Standard savings payments calculated according to an approved formula.

Set dates

The maximum value of the expected payment period is calculated based on statistical indicators based on the country's population of retirement age. This indicator is used to avoid a sharp increase in the period of payment of savings.

Its value is determined by the appendix to Resolution No. 531 and is:

| Date from which OPV is established | OPV value (months) |

| 01.01.2017 | 240 |

| 01.01.2018 | 246 |

| 01.01.2019 | 252 |

| 01.01.2020 | 258 |

According to calculations made on the basis of the approved Methodology, the OPV for 2020 was two hundred and sixty-one months. Considering that the value turned out to be higher than the maximum value, which was set at two hundred forty-six months, to determine the funded part of the pension, the payment period was set at two hundred forty-six months.

Category "early term"

The pension legislation of the Russian Federation provides for the possibility of early retirement. The survival period for “early term recipients” differs from the generally accepted one. The category is divided into two lists, numbered 1 and 2. Starting in 2013, the period rises annually by twelve months. From the first list, the survival period is: from 2016 - 24 years, for the second list from 2021 - 29 years.

The reasons for this retirement are:

- Difficult working conditions (for example, working in a mine or hot shop).

- Harsh climatic conditions (work in the Arctic or Far North).

- A number of specific professions (ballerinas, rescuers, etc.) fall under this category.

- This also includes residents of regions exposed to radioactive contamination who have the appropriate status.

Citizens are divided into two main categories that give them the right to early exit:

- five years earlier;

- ten years earlier.

If such citizens do not stop legal work, then an additional preference is provided for them - a bonus for length of service. All other calculations follow the general formula. The complete lists of beneficiaries can be found on the website of the Pension Fund of the Russian Federation.

What does the Pension Fund plan in the future regarding the survival period?

The expected period may not currently apply to a particular category of recipient. Reform in the field of state support for persons who have retired will be carried out systematically.

Completion of innovations is scheduled for 2024. Lawmakers plan to increase the survival rate to 320 months. This change entails that the amount of pension income will be reduced.

The new system encourages later retirement. This will allow you to receive an increased amount.

Thus, survival time must be used when calculating benefits. This figure is increasing every year. This entails a reduction in the amount of payments.

Expected payment period for 2020

The survival period in Russia for this period is determined at 246 months. Based on data from the State Statistics Service, we can say that the indicators for the past 2020 exceeded the established maximum and were at 261 months. Accordingly, the maximum level was determined. Therefore, in the current year, the figure for calculation using the formula is 246. In dry language, the current period has increased by six months compared to the previous period.

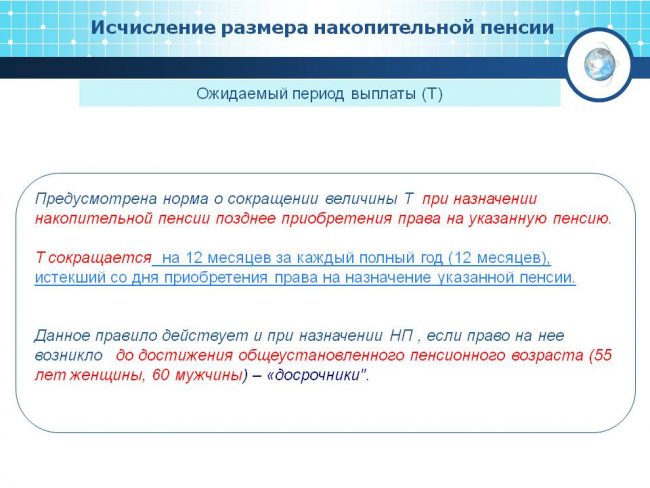

Expected period of payment of funded pension for early workers

A number of categories of citizens have the right to retire early. As a rule, this is due to the special specifics of workers’ activities, which leads to early loss of ability to work.

The survival period in this case is calculated taking into account the period by which the period of working activity was reduced due to the benefit provided.

In accordance with the law, citizens, along with an insurance pension, have the right to form a funded part of their material security in old age. When assigning it, a parameter such as the survival period is used, on which the size of monthly payments directly depends. At the same time, survival times tend to constantly increase. So, in 2020, the corresponding period is 252 months or 21 calendar years.