Is it possible to increase your pension using maternal capital?

Federal Law No. 256-FZ clearly limits the options for spending money from the issued maternity capital. You cannot simply spend them at your own discretion, because the family is not given cash - the chosen method of spending must be confirmed with the Pension Fund of the Russian Federation and approved by the employees of the territorial office. Only after this, money from the individual account is transferred to the apartment seller, bank, non-state pension fund or other person/organization, depending on the specifics of the transaction.

In paragraph 3 of Art. 7 Federal Law No. 256 provides a complete list of possible ways to use maternal capital. pp. 3 just allows you to use money received from the state to form the funded part of the mother’s pension (such a right is not provided for the father of children). Additionally, the following conditions must be met:

- the woman and child for whom the certificate is issued is a citizen of the Russian Federation;

- the woman has 2 or more children;

- the child for whom the subsidy is issued was born no earlier than January 1, 2007.

These are the standard requirements for obtaining a family certificate. Consequently, if she has the document in hand, a woman can, at her own discretion, direct it to her pension, the main thing is that she is not deprived of parental rights to her children.

Art. 12 Federal Law No. 256 is entirely devoted to the option of spending maternity capital on the mother’s pension. If during retirement a woman has not spent the money allotted to her family, then she has the right to include it in her pension savings.

Link to document: Federal Law No. 256-FZ of December 29, 2006 “On additional measures of state support for families with children”

What are the conditions for receiving

The conditions on the basis of which maternity capital is issued comply 100% with the requirements of Russian legislation. This opportunity applies to the following categories of the population:

- Women with Russian citizenship who have given birth to a second child or more.

- Men acting as the sole adoptive parent of a second child or more. Moreover, it is important here that the adoption decision made by the court took place after 2007.

- Minor children who are given the right to receive financial assistance if their parents or adoptive parents lose this opportunity.

- In circumstances where the biological mother is legally deprived of parental rights, the MK is issued to the father or adoptive parent.

The issuance of financial assistance from the state is possible only in cases of possession of a certificate. Obtaining this very document is possible only under the following conditions:

- The fact of the birth or adoption of a second child or more;

- Mandatory Russian citizenship.

The possibility of children receiving money from MK is assumed only in situations where their parents or adoptive parents are deprived of such rights. Moreover, funds under the certificate will be available to a child under 18 years of age or a young person under 23 years of age if he is studying at a university.

Advantages and disadvantages

The unpopularity of spending family certificate money to increase a funded pension is explained by several factors:

- women do not fully understand the procedure for assigning funded pension payments;

- the money can be used only after retirement;

- Russians are afraid to risk the money they receive, because the state does not index money that has already been transferred from maternal capital, and the work of the selected pension fund may turn out to be unprofitable (as a result, the real value of money will be lower).

The ideal option, if a person does not want to take risks, is to wait until retirement and transfer the maternity capital to its funded part immediately before that. Then the amount of money on the certificate will be indexed.

If a family wants not just to save money, but to increase their wealth, then they should consider investing in their mother’s pension. This method has its advantages:

- the amount of the old-age pension for the mother of the children will eventually increase (and the final amount may turn out to be quite significant);

- there is every chance to receive investment income that will not only cover current inflation, but will also allow you to earn money;

- before retirement, you can withdraw money and use it for other purposes - no other form of spending this option implies;

- the possibility of inheriting accumulated amounts (if the funded part of the pension is formed at the expense of maternal capital, then either the father of the child, or his legal adoptive parent, or directly the child himself, for whom the subsidy was assigned, can receive the money).

Moreover, at any time a woman can transfer her funds from one fund to another, having previously assessed the level of profit.

Funded pension – what is it and why is it needed?

After the appearance of Federal Law No. 424-FZ in 2013, citizens received the right to receive a funded pension. In total, there are 2 types of pension insurance in the Russian Federation:

- state;

- non-state.

Therefore, the size of the final pension for citizens may include the following components:

- insurance or social part (insurance is due, for example, upon retirement due to old age or length of service, social can be due due to disability or for other reasons and insufficient length of service);

- cumulative;

- voluntary.

Due to the funded part of the pension, a person can significantly increase the final amount of his pension. And if the entire amount of maternity capital is used to increase this part, then you can get a very good increase in the main part of the pension.

The insurance or social part is contained in the Pension Fund of Russia, and a person cannot manage it. With funded payments, everything is different - here a citizen can not only increase the amount of payments, but also transfer from one pension fund (not necessarily the state one) to another in order to increase investment profit.

Even if a woman suddenly dies before retirement or does not receive all payments from the funded part, then this amount will be legally inherited by children, spouse, parents (first) or brothers, sisters, grandparents, and grandchildren. True, that part of the pension that was formed at the expense of maternal capital can only be inherited by the child’s father or the child himself.

Terms of Use

The mother can transfer the maternity capital in whole or in part to the funded part of her pension. At the same time, she should have one. The modern pension system is designed in such a way that after 2020, women have the right to form a funded part only during the first 5 years of their working activity. Moreover, the recipient of the certificate must have time to declare her desire during this period. The rest lose the right to receive the funded part of the pension.

In the period from 2014 to 2020, the funded part of the pension was frozen. In this regard, the owners of family certificates could not use the money to increase it. In 2020, this moratorium no longer applies, so families can freely spend capital funds to increase the funded part of the pension for the mother of their children.

Is it possible to return family capital funds?

Law No. 256-FZ provides for the possibility of returning funds invested by the owner of the MSK certificate to a pension account. The reason for this could be:

- Lack of assigned funded pension (or refusal of it).

- The desire to direct MSCs to other purposes.

In order to return maternity capital funds, you must:

- Prepare an application and package of documents.

- Submit them to the Pension Fund at your place of residence or registration.

- Wait for a decision. Submitted documents are reviewed within 7 days. If the refund process is approved, they are sent to the Pension Fund within a month; if refused, the applicant receives a reasoned written explanation.

The package of documents is similar to what is submitted when transferring maternity capital to the Pension Fund, and the completed application must contain:

- certificate information;

- information about the owner;

- the reason for the return of funds indicating another direction of use;

- the amount of funds returned (in whole or in part).

How will the pension change?

It is impossible to determine the exact size of the funded part of the pension and the amount of the monthly payment, because the level of profitability of such investments is changeable. A person can only make speculative calculations. To do this, he needs to know the following parameters:

- investment amount;

- average profitability;

- retirement date.

How much will the investment increase?

In 2020, taking into account the pension reform, women will retire at age 56.5. Therefore, the number of years for investment is determined as follows: 56.5 years - current age . The result obtained is used to calculate the final amount of the increase. It is determined by the following formula:

Amount of invested maternity capital * (1 + average annual return) investment period

The level of profitability in NPFs changes from year to year, so in practice the final size will be slightly different.

Example . Evstratova Galina (36.5 years old) received maternity capital and decided to send 250,000 rubles to increase the funded part of her pension. Let’s assume that the average annual return in the non-state pension fund she has chosen is 8.4%. How much will the funded part of the pension increase in this case? Before retirement, the invested contribution will increase to: 250,000 * (1 + 0.084)20= 1,254,658.85 rubles. That is, the amount will increase almost 5 times.

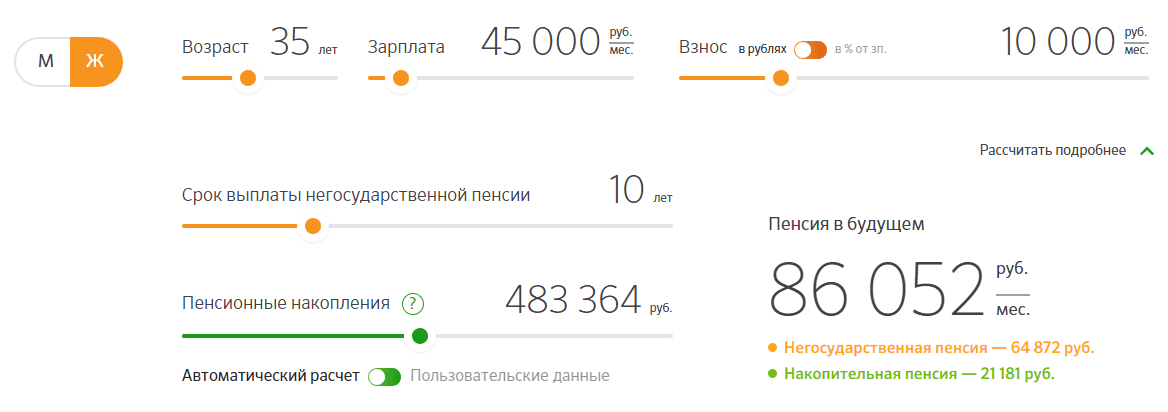

There is no need to do the calculations yourself. Many NPFs post special calculators on their official websites, with which you can find out the amount of your future pension. For example, in NPF Sberbank it looks like this:

It is enough to set your personal parameters and make calculations. But the calculator does not always provide the ability to indicate a one-time contribution.

What will be the pension supplement?

Although the income amounts look impressive, women want to know more what the increase in their pension will ultimately be. In this case, you need to remember that there are several options for receiving funds:

- Lifetime payments . The amount of the monthly supplement is determined by dividing the total amount by 240 months (this figure is determined by the Government).

- Urgent payments . The period is determined by the person individually (but not less than 10 years). The total amount is divided by the required number of months (in the case of 10 years - by 120).

- One-time payments . You can receive them only if the size of the funded part of the pension does not exceed 5% of the amount of the insurance part.

Example . If Evstratova Galina decides to receive lifetime payments, then the amount of the monthly additional payment from maternity capital will be equal to 1,254,658.85/240 = 5,227.74 rubles. With urgent payments over 10 years, this amount will be 2 times larger - 10,455.48 rubles per month.

How to increase benefits through the program

Agree, the retirement future is much closer than it might seem. And in order not to be content with only the amounts of state support in old age, you should worry in advance about resolving the issue in the following ways:

- Making voluntary contributions;

- Focus on mandatory contributions;

- Use the opportunity to contribute funds in accordance with the terms of the co-financing program.

The degree of benefit increase is directly related to the choice of method of receiving the accumulated payment. Namely:

- the minimum amount of savings/payment period equal to 453,026,120 months, in cases of urgent payments will be 3,775.22 rubles;

- the minimum amount of savings/payment period equal to 453,026,120 months, in the situation of a funded benefit will be 1,887 rubles.

What else the degree of profitability depends on is the results of investment on the part of the management company.

Direction of maternity capital to the funded part of the pension

If a mother decides to allocate maternity capital in full or in part to a funded pension, then she must wait until the child turns 3 years old - this format of spending cannot be used before. Moreover, the transfer cannot be made after the woman has been granted a pension.

To transfer money to her NPF, the child’s mother must contact the Pension Fund or use other channels for transmitting information (mail, MFC, State Services portal). When applying you will need the following documents:

- application for expenditure (use the established form);

- the certificate itself;

- passport (if there is no registration at the place of application, then in addition - a certificate of temporary registration);

- SNILS.

Application for disposal of maternity capital funds (form)

If a woman transfers funds to a non-state pension fund, she will first need to transfer them from the state pension fund.

Additionally, a compulsory pension insurance agreement must be concluded with a non-state pension fund. Without it, the Pension Fund will not approve the transfer of money from maternity capital funds.

If the decision is positive, the money is transferred to the individual NPF account specified in the application for spending. This usually takes 1 – 2 months.

How to use maternity capital for your mother's pension

It is important that the following rules :

- the right to choose to form a funded pension after 2020: currently, this right is granted only to those newly hired and only during the first five years of their working activity ;

- other silent citizens could submit a corresponding application to the Pension Fund only until January 1, 2020 ;

It is important to understand that the result of using maternity capital in this area can only be felt after retirement.

Law No. 360-FZ of November 30, 2011 “On the procedure for financing payments from pension savings” provides several options for receiving these funds:

- in the form of a funded pension for life (the monthly amount paid is determined taking into account the expected payment period of 240 months, or 20 years , established by the Government);

- in the form of an urgent pension payment (the duration of which is determined by the pensioner independently for a period of 10 years or more);

- in the form of a lump sum payment (all pension savings are paid in one amount if the funded pension is less than 5% of the assigned amount of the insurance pension, taking into account the fixed payment as of the day of its appointment).

Application for disposal and required documents

You can send certificate funds to both the state (PFR) and non-state pension fund (NPF). However, in any case, in order to use maternity capital for the mother’s pension, the owner of the certificate must contact the Pension Fund of the Russian Federation with an application for the disposal of funds:

- at the place of residence - in accordance with registration at the place of residence;

- at the place of residence - on the basis of a registration certificate;

- at the place of actual residence.

The application for the disposal of maternity capital contains the following data :

- about the certificate itself;

- about the owner of the certificate;

- about a child, with whose birth the right to additional measures of state support arose;

- about the legal representative (if you contact the Pension Fund through him);

- about the chosen direction of use of funds;

- about the amount of transfers;

- about the absence of restrictions on parental rights.

The date and signature at the end of the application confirm the information contained in the document on the part of the certificate holder or his legal representative.

To apply in writing to the Pension Fund, you must submit the following documents :

- maternal certificate or its duplicate;

- document proving the identity and place of registration (stay) of the certificate holder;

- SNILS of the insured person who received the certificate;

- identification documents of the legal representative.

You can submit a written appeal in several ways :

- personally (or through a legal representative);

- electronically via the Internet;

- by post.

Specialists from the territorial body of the Pension Fund of Russia within a month , after which they make a decision:

- about satisfaction;

- or refusal to satisfy the application, indicating the reason.

Is it possible to cancel after transferring money?

The advantage of using maternity capital for a funded pension is the possibility of withdrawing these funds at any time before the day the funded pension is assigned (according to clause 2 of Article 12 of Federal Law No. 256). In this case, the returned amount can be used subsequently for the following purposes:

- improvement of living conditions;

- payment for children's education;

- payment for goods and services necessary for the social adaptation of disabled children.

The procedure for filing an application for such a case is set out in detail in Order of the Ministry of Labor of Russia No. 100n dated March 11, 2020 (last changes were made on January 26, 2020).

If the pension has already begun to be paid, then the money will not be redirected. But in this case, there is no need to worry. Even if the mother dies, her children or husband (father of the children) will be able to receive all this money by inheritance, unlike a regular pension.

Is it possible to transfer maternity capital to a non-state pension fund?

Family capital funds can be directed to the formation of pension savings not only in the state, but also in the non-state pension fund . To do this, the recipient of the certificate must conclude an agreement on compulsory pension insurance (OPI) with the NPF. This can be done at the office of the selected NPF; you must have with you:

- Identification document (passport).

- SNILS.

After the agreement with the NPF is concluded, you need to submit an application for disposal to the Pension Fund along with a standard list of documents and an additional application for transfer to the NPF .

When managing the funds of the MSK certificate, its recipient can change the insurer without losing investment income, in contrast to managing pension savings in the form of insurance contributions paid by the employer and their own investments in the event of an early transfer to the pension fund.

Citizens of the Russian Federation have the right to change their pension fund in one of two ways:

- urgent transfer (transfer of pension funds is carried out after 5 years from the date of application);

- early transfer (funds are transferred the following year after submitting the application).