Military pensions after discharge

Military personnel upon dismissal from service upon reaching the age limit, health conditions or in connection with organizational and staffing events are entitled to a one-time benefit, the amount of which depends on the duration of military service (Order of the Minister of Defense of the Russian Federation dated December 30, 2011 No. 2700):

- less than 20 years – 2 salaries;

- from 20 years and more - 7 salaries in cash. If military personnel were awarded a state order or awarded an honorary title of the USSR or the Russian Federation, the amount of the one-time benefit increases by one more salary.

Citizens whose military service under a contract was less than 20 years, after dismissal, can count on payment of salary according to their military rank for one year.

Benefits fixed at the federal level

All military retirees can count on:

- Improving living conditions , if this did not happen earlier (if you were not given an apartment upon dismissal);

- Partial (50%) or full compensation for utility bills , including contributions for major repairs. You can reduce bills for water supply, gas supply, electricity, housing maintenance and garbage removal. You can confirm your right to this benefit once every six months, or pay your bills in full, and then receive a cash refund of half of what you paid;

- Compensation for the cost of travel to and from vacation (no more than once a year and only within the territory of the Russian Federation);

- Tax benefits;

- Advantages for a military pensioner and his children when entering educational institutions;

- Some protection from layoffs if a military retiree after service gets a job at some civilian enterprise;

In addition, if a military pensioner himself or members of his family decide to relax in sanatorium-resort establishments that belong to the Ministry of Defense, the cost of their vouchers will decrease due to the military benefit ( 25% will be paid by the pensioner himself and 50% by his family members).

Pension

Persons who have served for 20 years or more are entitled to a long service pension. The long-service pension is paid through the Ministry of Defense, the Ministry of Internal Affairs, the FSB and other law enforcement agencies. But a retired military man can also apply for a second pension - an insurance one, through the Pension Fund, if he works in civilian life and has official employment. Read more about this here.

In addition, military pensioners are entitled to the following allowances:

- increase in the amount of long service pensions for disabled people: • persons who became disabled as a result of a military injury (disabled group I - by 300 percent of the calculated pension amount, disabled group II - by 250 percent, disabled group III - by 175 percent).

- supplements to pensions for length of service: • pensioners who are disabled people of group I or who have reached 80 years of age - for their care in the amount of 100 percent of the calculated pension amount; • non-working pensioners who are dependent on disabled family members (for one such family member - 32 percent, for two - 64 percent, for three or more - 100 percent);

(In accordance with the Federal Law “On pension provision for persons who served in military service, service in internal affairs bodies, the State Fire Service, authorities for control of the circulation of narcotic drugs and psychotropic substances, institutions and bodies of the penal system, and their families”).

Benefits for widows

The wife of a deceased serviceman may qualify for such material support from the state as:

- Pension payments – a widow has the right to choose her own pension or the pension payments of her deceased spouse. The choice depends on the amount of the pension. The main condition for receiving a military pension is the absence of remarriage.

- Federal and regional surcharges.

- A one-time payment if a serviceman dies after being injured or sick during service.

- Compensation for housing and communal services payments in the amount of 50%.

- Dependent's benefit

In addition to the listed bonuses, the widow may receive additional benefits, namely:

- repair of individual real estate (can be used once every 10 years);

- free medical care in specialized hospitals;

- provision of free medications with a doctor's prescription;

- discounts on vouchers to the sanatorium, including discounted travel to the sanatorium complex;

- reimbursement of moving expenses, including transportation of personal belongings (up to 20 tons).

V.V. spoke in support of military pensioners.

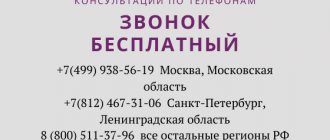

Putin, watch the video. In conclusion, it is worth recalling that some benefits are assigned directly by regional authorities. Therefore, in addition to studying this material on benefits for retirees and their families, former military personnel should additionally contact the local branch of the Pension Fund.

Benefits for military pensioners

Housing

The state provides housing to those military pensioners who have been registered as in need of improved housing conditions. The benefit is implemented in the following ways:

- in the form of a housing subsidy;

- in the form of a specific residential premises owned by a federal or regional government authority;

- in the form of a one-time cash payment for the construction of an individual residential building;

- in the form of a land plot for construction;

- in the form of the right to extraordinary entry into a housing construction cooperative;

- in the form of monetary compensation for the rental of residential premises.

Tax benefits

Military pensioners are exempt from paying tax on one piece of personal real estate (Clause 7, Article 407 of the Tax Code of the Russian Federation) and personal income tax on pensions, as well as on amounts of material assistance received at the place of work, and from the cost of vouchers to special medical institutions (Article 217 of the Tax Code of the Russian Federation). Civil pensioners also have this benefit.

Benefits for treatment

Military retirees retain the same benefits as active military personnel:

- free treatment in military medical institutions;

- free production and repair of dentures;

- free supply of medicines;

- 75% discount when purchasing vouchers to military sanatoriums;

- free round-trip travel by any type of transport to places of treatment and sanatorium recreation once a year.

Benefits for relatives of a military pensioner

- 50% discount on a trip for family members of a pensioner to military sanatoriums;

- free travel for family members of a pensioner to the place of treatment or sanatorium holiday once a year;

- children of military pensioners are admitted without a waiting list to kindergartens, schools and general military schools;

- for the wives of military pensioners, grace periods of living with their husbands on the territory of military camps, where women could not find employment in their specialty, are counted towards their length of service;

- in the event of the loss of a breadwinner, family members are entitled to an appropriate pension. If death occurs as a result of a military injury, relatives are entitled to compensation for utility bills and housing.

Labor benefits

When looking for work through the labor exchange, military retirees have the right to priority employment. By the way, the “jobs for older people” section on our website can help you find a job. A military pensioner has the right to retain his job in the event of a threat of dismissal from the job (due to layoffs) that he took for the first time. (According to the Federal Law “On the Status of Military Personnel”). Monthly cash payment

It is established and paid by the territorial body of the Pension Fund of the Russian Federation to certain categories of citizens, indexed once a year from April 1, based on the level of inflation in the country for the previous year. So, the following are entitled to EDV:

- military personnel and members of the rank and file of internal affairs bodies, the state fire service, institutions and bodies of the penal system who have become disabled as a result of injury, concussion or injury received while performing military service duties (official duties);

- combat veterans;

- military personnel, including those transferred to the reserve (retired), private and commanding personnel of internal affairs bodies and state security bodies, persons who participated in operations during government combat missions to clear mines from territories and objects on the territory of the USSR and the territories of other states during the period from May 10, 1945 to December 31, 1951, including in combat minesweeping operations from May 10, 1945 to December 31, 1957;

- military personnel of automobile battalions sent to Afghanistan during the period of hostilities there to deliver goods;

- flight personnel who flew from the territory of the USSR on combat missions to Afghanistan during the period of hostilities there;

- family members of military personnel who died in the line of duty, in captivity or as a result of injury.

The size of the EDV is different for all categories of citizens; for registration you need to contact the territorial body of the Pension Fund of the Russian Federation.

(according to the Russian Pension Fund).

Additional monthly financial support

This type of benefit in the amount of 1000 rubles is provided to disabled people due to military injury. In this case, it does not matter during what period of military and equivalent service the citizen received a military injury.

(according to the decree of the President of the Russian Federation of August 1, 2005 No. 887 “On measures to improve the financial situation of disabled people due to war trauma”).

Benefits for a military personnel's family

Family members of a military personnel have the right to claim additional benefits. In accordance with the law, first of all, the wife and children of a military personnel .

This category of persons has the following privileges :

- Maintaining a job during layoffs if a woman is a single mother.

- Free medical care in a military hospital.

- Discount camp vouchers for children aged 6 to 15 years.

- Dental prosthetics.

- Preferential places in preschool and school institutions within a month after the appropriate application.

- Wife's length of service - the work book includes the period of residence with the spouse in military territory, where there was no work for the wife. Accounting is carried out in accordance with such time periods as: before 1992 - the entire period;

- 1992 – 2014 – wife’s period of incapacity for work for various reasons;

- 2015 and above - if a woman does not work, a period of no more than five years is taken into account.

Benefits for combat veterans

A wide range of benefits is provided to combat veterans, which include the following categories of military personnel:

- Military personnel, employees of the Department of Internal Affairs and authorities of the USSR who took part in hostilities while performing their official duties in the Russian Federation or the USSR.

- Military personnel who served in automobile battalions that delivered goods to Afghanistan during the period when hostilities were taking place there.

- Military personnel who took part in combat and flight operations in Afghanistan .

- Military personnel who were sent to work in Afghanistan in the period from December 1979 to December 1989, who served the period established upon deployment or were sent ahead of schedule for good reasons.

Benefits for combat veterans:

- providing housing for combat veterans in need of improved living conditions;

- compensation of expenses for fees for the maintenance of housing premises (compensation for rent or maintenance of housing premises, compensation of 50% of the contribution for major repairs);

- priority installation of a residential telephone;

- advantage when joining housing, housing-construction, garage cooperatives, horticultural, gardening and dacha non-profit associations of citizens;

- preservation of the right to receive medical care in institutions to which military personnel were assigned during the period of work before retirement, as well as extraordinary provision of medical care within the framework of the state guarantee program for the free provision of medical care in medical organizations (including in hospitals for war veterans);

- annual leave and unpaid leave;

- provision of prosthetics and prosthetic and orthopedic products.

Benefits provided to veterans who served in military units:

- maintaining the right to receive medical care and emergency medical care;

- priority provision of vouchers to sanatorium and resort organizations;

- advantage in admission to horticultural, gardening and dacha non-profit associations of citizens;

- priority installation of a residential telephone;

- annual leave and unpaid leave;

- providing housing for disabled combatants in the event of eviction from the service residential premises they occupy.

Benefits for veterans going to work in Afghanistan:

- extraordinary provision of vouchers to sanatorium and resort organizations;

- advantage when becoming a member of horticultural, gardening and dacha associations;

- annual leave;

- extraordinary right to install a residential telephone.

(According to the Federal Law “On Veterans”).

Medical benefits

In addition to social bonuses, former military personnel may qualify for medical benefits , such as:

- Preferential medical care in specialized medical institutions;

- Free prosthetics ;

- Preferential provision of medications with a doctor’s prescription;

- A trip to a sanatorium complex - most often the military pays only 25% of the cost, including free travel to the sanatorium.

But to receive these benefits, a military man must have more than 25 years of service.

In addition, the reason for dismissal must be related to illness, reaching retirement age, or the implementation of staffing and organizational measures.

Tax benefits

- Exemption from property tax;

- The right to a standard tax deduction in the amount of 500 rubles for each month of the tax period when calculating personal income tax in accordance with paragraphs. 2 p. 1 art. 218 Tax Code of the Russian Federation. If citizens become disabled, the amount of the deduction increases to 3,000 rubles.

To apply for these tax benefits, you must submit an application to the tax office. In addition, combat veterans are entitled to a monthly cash payment (see above).

Also, military pensioners may have benefits for transport or land taxes, which are determined by each region separately.

Please note that this material did not indicate benefits for veterans of the Great Patriotic War.