Home / Labor Law / Payment and Benefits / Pension

Back

Published: 03/17/2016

Reading time: 14 min

0

8490

Military personnel, due to their professional activities, often become pensioners much earlier than ordinary citizens.

A completely young man or woman, having served a certain number of years, which is called length of service, has the right to a pension under special conditions. And their calculation of pensions differs from civil ones. Let's talk about this in more detail.

- Who is eligible?

- Conditions for granting a long service pension For military personnel

- For cosmonauts, pilots and testers they are citizens of the Russian Federation

- Example 1

What is length of service

It is known from the legal literature that this term refers to a certain period of work in one field. This time period is different for each industry. For military personnel, it is isolated from other professions related to civilian life.

The length of service affects many rights and social guarantees. For example, for a military personnel the following depends on the length of service:

- salary supplement;

- special conditions for retirement;

- solving the housing problem;

- receiving social support in the form of health improvement.

According to the general rule, all periods of service are counted according to the calendar type. The exception is service under special conditions, which is calculated in preferential terms. Serving in the Far North counts 1 month as 2. On the contrary, 1 year of study is included in the length of service as 6 months in the Armed Forces.

Conditions for calculating the second pension

Federal Law No. 136 establishes the rights of military personnel to receive not only a military pension, but also an old-age pension if there are contributions to the Pension Fund after completion of military service.

The procedure and terms for calculating the “second” pension for military personnel are the same as for other pensioners:

- 55 years for men and 60 years for women (if there are no grounds for preferential retirement);

- civil service experience of at least 8 years (in 2020 – 9 years);

- presence of a minimum number of pension points ( 11.4 in 2020);

- assignment of a military pension based on length of service or disability.

The length of service for establishing an insurance pension includes only the period of work after completion of military service or determination of disability.

The insurance pension of a military pensioner is also subject to annual indexation, as for other citizens of the country. The only difference will be that the pension in this case is established without a fixed payment .

Legislative regulation of the issue

The government has developed and implemented many laws on length of service in all sectors. But if we take into account directly people in military uniform, then for them there are the following individual standards:

- Federal Law No. 166 of 2001, which explains the concept of “length of service” in the context of pension provision and establishes the right to a pension for long service.

- Federal Law “On financial support for military personnel” of 2011. This legal act is a mechanism for receiving an additional monthly bonus for long service.

- Federal Law No. 992 “On the establishment of salaries for military personnel performing military service under a contract,” which regulates the issue of financial support for all contract military personnel.

- Order of the Ministry of Defense of the Russian Federation, which clearly states the rules for calculating the allowance, as well as the conditions themselves, according to which the circle of military personnel applying for additional monthly financial assistance is determined.

All standards are revised almost annually to improve the provision of military personnel

Allowances

Longevity bonuses are awarded to average employees under such conditions.

| Category of citizens | Description |

| Persons over 80 years of age and disabled people of group 1 | An additional payment of 100% of the RRP for compulsory necessary care is determined for the pension. |

| Pensioners who have stopped military activities and have dependents | If there is a dependent, the additional payment is 32% of the RRP. If there are two dependents - 64% of the RRP. If a pensioner has three or more dependents, the additional payment is 100% of the RRP. Dependents should not be recipients of an insurance or social pension. |

| Pensioners - participants of the Second World War who are disabled | This category of citizens receives a bonus of 32% of the RRP. Upon reaching the above category of persons of eighty years of age, the allowance increases to 64% of the RRP |

It should be taken into account that the bonus is not calculated for these persons if the pension has already been calculated according to Art. 16 of the Law.

The period of service is calculated according to the rules of Art. 18 of the Law. The calculation includes military service in the ranks of the Ministry of Internal Affairs and the Ministry of Emergency Situations, in drug control agencies, in criminal-executive punishment organizations, in the ranks of the National Guard.

Important! Service in extremely dangerous conditions is included in the grace period and is regulated by the Government of the Russian Federation.

The calculation of length of service includes military service in various bodies

Who benefits apply to?

If we consider professional affiliation in the issue of benefits for length of service in the context of pension content and determining the right to a pension, then the following citizens are entitled to them:

- civil servants of the federal civil service;

- military personnel of all branches of the military;

- astronauts;

- test pilots.

Length of service is not always calculated in calendar terms. There are a number of unusual cases when a serviceman’s length of service is determined according to special calculations.

What pensions can military personnel receive?

The legislation on pension provision for military personnel for this category of citizens establishes three types of pensions :

- by length of service;

- due to disability;

- due to the loss of a breadwinner.

At the same time, the law stipulates some nuances when obtaining the right to pension provision:

- A long-service pension is assigned and paid to its recipient after his dismissal from service .

- The assignment of a disability or survivor's pension does not depend on the length of service of the military personnel .

- A pension benefit for disability is established if it occurs during service or within three months after dismissal, or even later, but arose due to illness or injury received during the period of service.

What is preferential calculation

There is also such a thing as “preferential calculation of length of service.” It means that certain periods of service can be included in the length of service on a preferential basis. These individual cases are enshrined in law.

These include service in the following departments:

- Flight trains.

- Related to skydiving.

- While at sea.

- Periods of command of the listed units, subject to service outside the Russian Federation.

For reference! If a citizen moves to a new place of service, the accumulated length of service remains with him. In order to calculate the existing length of service, it is necessary to add up the periods of work in different structures.

It also influences the calculation of length of service and place of service. If a serviceman took part in a combat mission or served at a time when a state of emergency was established in a certain area, then a special calculation is applied to this person.

For example, such military personnel are those who took an active part in counterterrorism operations in the North Caucasus.

The formula for calculating the length of service for these individuals is such that each month of service triples. Accordingly, the calculation of pensions for military personnel classified as persons who have been in special conditions will be made 1:3.

Government regulations of the Russian Federation indicate the existence of other cases when the calculation of length of service must be made using a preferential method of determination.

A preferential right to seniority can be used by a soldier who is serving and lives in a region with a climate unfavorable for the human body. These include the Far North, as well as other regions of our country equated to this region.

Important! If a military retiree resumes his activities in the profession, then this preferential payment will no longer be available. But after dismissal, the payment will be recalculated and resumed. In this case, an increase will be applied for each year of service.

Pension amount

- For persons with 20 years , the pension is assigned in the amount of 50% of the DD amount.

- Additionally, for each year exceeding 20 years of service, 3% is added, but not more than 85% .

In addition, the law defines the following points:

- For a pensioner who lives in an area where DD coefficients , for the period of his residence there they are used when calculating pensions, allowances and increases.

- For pensioners who have served in the Far North and equivalent areas for at least 15 and 20 years, when they move to a place of residence outside these areas, the pension (including allowances and increases) that was assigned using northern coefficients is preserved . And for those who live in areas where the coefficient is not established or is applied in a smaller amount than at the last place of service, the pension is calculated (including allowances and increases) using the coefficient at the last place of service (limit amount 1.5). At the same time, the time of applying for a pension does not depend.

How is it used when assigning a pension?

To resolve this issue, there is a separate legal act Federal Law No. 4468-1. According to this standard, a military serviceman is entitled to a pension for long service only if certain conditions are met.

These conditions include:

- Have at least 20 years of military experience.

- Having mixed experience according to the principle: employee’s age is at least 45 years, total experience is 25 years, military experience is 12.5 years.

- The dismissal of a serviceman is associated with reaching the retirement age limit.

- Termination of labor activity occurred due to health reasons of the military man.

- The dismissal is due to staff reorganization.

The rules for calculating length of service in the case of a preferential treatment during this period include:

Increasing length of service for military personnel

- Years of military service.

- Work in government agencies and civilian organizations (provided you remain enrolled in military service).

- Time spent in captivity. On the condition that the serviceman has not committed a crime against his country.

- In case of unjustified prosecution, which was accompanied by detention, the time of serving the sentence.

- The period of imprisonment in the event of repression, followed by rehabilitation.

- Time of training preceding entry into service, but not more than 5 years.

- Time of treatment and rehabilitation after injury or occupational illness.

- Appointment to an elected position.

- In case of illegal dismissal, recognized as such by a court decision, the entire period of suspension from service.

Attention! Time spent in hot spots or as responders at accident and disaster sites is selected for inclusion in the length of service separately.

Conditions for increasing the amount of payments

For some categories of pensioners, the amount of payments for length of service is subject to increase, subject to their relationship to a particular group of recipients. As a percentage of the estimated pension amount (RRP) , established in the amount of the social pension (5606.17 rubles from April 1, 2020), the increase is made:

- disabled people as a result of military trauma from 175 to 300% of the RRP ;

- disabled people who participated in the Great Patriotic War and persons who received the award “Resident of Siege Leningrad” who became disabled - from 100 to 250% ;

- participants of the Great Patriotic War (WWII), combat veterans; former prisoners (minors) of fascist concentration camps, etc.; persons who received the award “Residents of besieged Leningrad” (if they do not receive a disability supplement); disabled people since childhood who were injured or maimed as a result of hostilities during the Second World War or their consequences - by 32% of the RRP ;

- those who were in military service for at least six months or worked during the Second World War, not including work in the temporarily occupied territories of the USSR, or have orders and medals of the USSR for selfless labor and impeccable military service during the Second World War, as well as those who were unreasonably politically repressed and then rehabilitated - by 16 percent of the RRP .

- Heroes of the Soviet Union, Russian Federation and awarded the Order of Glory of three degrees;

- Heroes of Socialist Labor, Labor of the Russian Federation;

- champions of the Olympic, Paralympic and Deaflympic Games;

- persons who received the Order of Labor Glory of three degrees or the Order “For Service to the Motherland in the Armed Forces of the USSR” of three degrees.

How does it affect the salary allowance?

Additional payment for length of service, taking into account the individual algorithm for calculating length of service, is the responsibility of local and regional budgets. Some payments are also covered by the federal budget. Payments made are controlled by a government special commission.

Commercial military organizations, in their activities when forming a remuneration mechanism, can assign such an increase for length of service, but this is only a recommendation, not an obligation. This is a significant difference between the budgetary structures of the Armed Forces and commercial organizations.

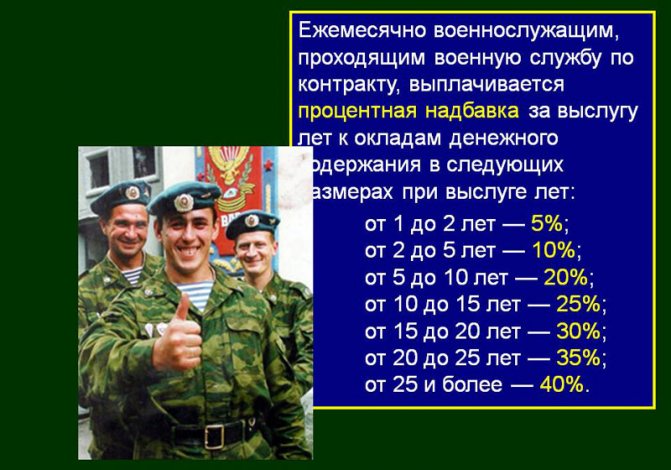

The bonus for length of service is calculated as a percentage of the DD of the assigned salary. Its size directly depends on the length of service in a particular structure or in conjunction with other organizations, but also in a military profile.

According to the law, the calculation is made according to the following principle shown in the table:

| Service life, years | Percentage of bonus for length of service,% |

| 2-5 | 10 |

| 5-10 | 15 |

| 10-15 | 20 |

| 15-20 | 25 |

| 20-25 | 30 |

| Over 25 | 40 |

The indicated percentage increases are included in the salary. In this case, a regional coefficient can also be added to the final amount if it is enshrined in budget regulations.

You should know! The allowance is treated as cash compensation and is therefore also subject to income tax, which can be calculated using the standard tax deduction formula.

Calculating the length of service of a military personnel can be done using an online length of service calculator.

Mechanism for receiving a pension

Disabled conscripts from among military personnel (soldiers, sailors) who were injured while performing their duties apply with an application for a pension to the branch of the Pension Fund of the Ministry of Defense of the Russian Federation at the place of registration. Pension provision is made for the current month by crediting the amounts to be issued to the pensioner's current account.

The procedure for transfers itself is determined by the relevant agreements between the Government of the Russian Federation, government agencies and financial organizations of the Russian Federation. Pension payments can be delivered to the pensioner by post at the expense of the state treasury. If a pensioner lives or is temporarily located in the territory of another country, payments are made in accordance with international (interstate) agreements.

Pension payments can be received by a third party by presenting a power of attorney executed by a notary or a financial institution, during the validity period (depending on the place and procedure for receiving funds). Funds transferred after the death of a pensioner are subject to return to the Pension Fund.

Important! Otherwise, the recipient of payments faces liability. Providing information that is untrue and entails unnecessary expenditure of public funds may be fraught with recovery from the recipient of money.

The pension can be received by the disabled person himself or by a trusted person.

Persons who have completed military service under conscription apply for a pension to the branch of the Pension Fund of the Russian Federation of the Ministry of Defense at the place of registration (or the department where they served).

The pension fund independently requests the necessary documents from state and municipal structures that are necessary to confirm information about military service and disability. The application of the future pensioner is reviewed within 10 days from the moment it is submitted to the fund or from the moment the missing document is submitted, if the applicant is obliged to provide it independently. In addition to the application, the following documents are provided to the fund branch:

- copy of civil passport;

- a copy of the military ID;

- a copy of the medical document confirming the assignment of a disability group. Expert opinion of the military medical commission;

- documentation of dependents.

Important! The application can be sent by mail, submitted through the State Services website, through the nearest MFC point, or at a personal appointment.

If circumstances arise that necessitate a new calculation of additional payments and the amount of pension payments, the persons specified in Art. 1 of the Law, contact the Pension Fund branch.

Deadlines for the new calculation of pensions for persons who served in military service due to new circumstances:

- from the beginning of the month (from the first day), which follows the month in which the recalculation was made towards reducing payments;

- from the moment circumstances arise that lead to a new calculation of increased pension payments. At the same time, from the moment of application, the pensioner acquires the right to recalculate upward the difference between old and new payments for the past period of time, within one year.

If you need to recalculate your pension, you need to contact the Pension Fund office

Grounds for the emergence of the right to a civil pension

The pensioner can continue to work in structures not related to military service. He acquires the right to a civil pension. A military man transferred to the reserve (upon reaching age) or after becoming disabled has the right to a military pension and additional payments. But he can continue to work, be specially registered with the social insurance fund, and have an individual personal account with the Pension Fund. A pensioner earns pension points every year and increases his insurance period.

Important! You can calculate the amount of payments yourself, just enter the necessary personal data.

SP2 = BlP x C

where SP2 is the amount of the pension (second).

BlP - pension points. The data can be viewed in your personal account on the Pension Fund’s electronic website.

C is the price of one point; in 2020 it was 81.81 rubles 49 kopecks.

The Government of the Russian Federation can change the price of a pension point, which is fixed in the Resolution.

A military pensioner has the right to a mixed pension

True, that's not all. A fixed payment, additional payments for various privileges, etc. are also taken into account.

Military pensioners can use their savings in pension accounts at their own discretion. They can receive the entire amount of pension savings personally or to a current account, partially in the form of supplements to the insurance pension.

When assigning an old-age pension in 2020, a mandatory work experience of 9 years was required. Until 2024, this figure will increase by exactly one for each subsequent year (by 2024 it will reach 15 years).

The period of military service is not included in the length of service for the assignment of a civil pension; after transfer to the reserve, it is necessary to continue working. For an insurance pension, individuals apply to the Pension Fund of the Russian Federation, and for a military pension to the corresponding fund of the Ministry of Defense.

To receive a mixed pension, you must have a civilian career of at least 10 years

An example situation for assigning social benefits

A conscript soldier was wounded in the head during training in 2020. Based on the results of reviewing medical documents and a visual examination, a military medical expert commission established the first disability group for the serviceman; the conclusion stated that due to unfitness for health reasons, the serviceman is subject to dismissal from the army. This conclusion was confirmed by a higher military medical commission. The former serviceman contacted the Pension Fund of Russia with a package of documents and an application for a pension.

Important! Employees of the Pension Fund, having considered the pensioner’s application, on the basis of Art. 15 Federal Law-166 prescribed a payment equal to 300% of the social pension (SP).

From 04/01/2018 until 04/01/2019 the size of the social pension is equivalent to the amount of 5180.24 rubles. Amount to be paid to a disabled person: 5180.24 x 300/100 = 15540.72 rubles.

Due to the fact that since April 2020 the size of the joint venture amounted to 5382.27 rubles, the amount to be paid will be: 5382.27 x 300/100 = 16146.81 rubles.

If the injury was sustained during service, you can apply for it as a pension