Home » Categories of citizens » Pensioners » Mixed pension: military and civilian

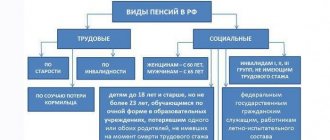

Russian legislation includes several different types of pensions - old-age pension, long-service pension, social pension, etc. All these payments are calculated according to different schemes.

Persons who have worked for 25 years in certain government agencies can retire earlier than they reach retirement age. Professions such as teachers, medical workers, and military personnel have the right to length of service. Each of the categories of persons has its own individual length of service - that is, the number of years that must be worked in order to retire early.

For example, military personnel must have 20 years of continuous work experience. The procedure for calculating pensions, as well as its size, is regulated by Federal Law No. 4468-1, adopted in 1993. Changes to the law are made every year, so you need to focus on the latest edition.

The serviceman pays insurance contributions to the Pension Fund. His future pension is formed from these contributions. Having served the required number of years, a citizen has the right to rest.

Often, in addition to military activities, a person also carries out civilian activities. It also includes deductions and insurance coverage. When assigning a pension, both types of insurance contributions are taken into account. Such military personnel will receive a pension based on mixed service. This usually happens in cases where a serviceman, having not completed 20 years of service, due to life circumstances, leaves service and switches to civilian activity.

What is mixed experience

You can answer the question posed in one sentence, since mixed length of service is the accounting time of a citizen’s work activity, consisting of military service and work in a civilian position.

Important! In order for a mixed pension to be calculated taking into account each period of activity, certain conditions must be met

This indicates some kind of legal support that directly follows from the above-mentioned federal law.

Article 13 of this document defines the basic conditions for receiving a military pension for length of service and consists of two points. According to the first paragraph, a pension for military personnel is due to military service officers or soldiers serving under contract, as well as employees of the Ministry of Internal Affairs, the Ministry of Emergency Situations, the Federal Penitentiary Service, the FSB, FAPSI, OBNON, and, according to the latest edition, to soldiers of the National Guard of the Russian Federation, if at the time of their retirement length of service is at least 20 years.

If no questions arise regarding the first paragraph of the article, since the definition is given in an accessible form, then the content of the second paragraph often has to be translated into a language more understandable to the common man. It states that the above categories can receive a pension without waiting for length of service, but all conditions must be met:

- Citizens have reached 45 years of age. This condition is associated with the fact that the military must leave service at the specified age

- The total length of service, summed up from civilian and military, is at least 25 years. Here you can trace the strict selection for compliance with this article. For example, if you retire at the age of 45, according to the second condition you need to start working at the age of 20. If we take into account that studying at a university is not included in the length of service, then only the first two conditions pose significant obstacles to receiving a pension for a significant part of military personnel, especially those who did not take part in hostilities

- Of the total length of service, military service must take at least 12.5 years

But the conditions don't end there. The reason for retirement should be considered the achievement of a certain threshold age at which the pensioner is obliged to leave service. Provision is made for leaving the service for disabled people if damage to health was caused as a result of the direct performance of official duty. The third reason is positioned as holding organizational and staffing events. They can mean, for example, reorganization or downsizing of a unit.

It remains to mention some exceptions. They are also defined by law, it’s just that practice shows that in terms of the number of requests, these cases are somewhat inferior to standard situations, which is why they are called exceptions.

When determining length of service for women, as well as for men, study at a military school cannot be taken into account, but the period of leave granted to care for a child is included here.

If the birth of a child occurred during military service, then the specified period is counted towards length of service.

Many government employees who are forced to work in the far north have certain benefits. We will only touch upon retirement age. In this regard, the serviceman expects the start of contributions after 15 years of service, that is, the northern pension is provided five years earlier than the usual one.

Types of length of service and principles for including military service in each of them

Military service for military personnel plays a big role in the formation of three main types of experience in the Russian Federation:

- labor or general;

- insurance;

- preferential

Moreover, accounting in each of them has some features.

Labor general

has not had a direct impact on the amount of pension payments

since 2002 , but it is important when:

- recalculation of pensions accumulated before the introduction of changes in 2002;

- establishing an increasing coefficient for employees working in certain regions;

- sending rural residents on vacation;

- assignment of veteran status;

- early retirement;

- registration of preferential pensions for military personnel.

This type of length of service includes the period of military service:

- According to its actual duration for military personnel serving under general conditions.

- Doubles for army personnel who were called up for service and for civil servants when determining their length of service.

- Triples for military personnel who participated in hostilities, i.e. were in conditions of increased risk to life and health.

At the same time, there is a nuance - in order for the length of service not to be interrupted, the person who has served must begin working again within a year after demobilization .

Therefore, in some cases, military service reduces the time when you should retire.

Insurance company

After the 2002 changes in pension legislation, the main role is played by the insurance period, which:

- Determines the amount of pension payments.

- Affects the amount of benefits paid to an employee when he goes on sick leave.

Military service is considered as a standard insurance period , despite the fact that during this period the employer did not make any contributions to the Pension Fund. Also, unlike labor, where this period can be taken into account in double or triple duration, military service is included in this type of length of service only according to its calendar duration.

Benefit society

Undoubtedly, the army period for some military personnel can be taken into account in the preferential length of service, which allows a citizen to retire:

- ahead of schedule if his work activity is associated with difficult and dangerous conditions (internal affairs bodies, hazardous production, the far north, participation in hostilities;

- according to length of service, if his position is included in the list approved by the Government of the Russian Federation (Article 3 of Federal Law No. 76).

Conditions for calculating state pension

Military personnel may apply for state benefits in the following cases:

- A monthly amount for length of service is awarded to those who have served at least 20 years in the armed forces of the Russian Federation. This monthly type of benefit can be counted on by military personnel who were discharged from the ranks of the Russian army upon reaching a certain period of service, for health reasons or due to internal job changes, and at the time of signing the dismissal order they reached the age of 45 years. Moreover, the total work experience must be 25 years, of which ½ was devoted to service.

- Disability pension benefits are assigned to persons who have lost their ability to work and received a certain injury while serving in the ranks of the armed forces of the Russian Federation, or no later than 3 months after signing the dismissal order. Disability must be confirmed by the relevant medical commissions; the cause must be a concussion, injury or other disease acquired during the period of service.

- Widows or persons caring for the children of the deceased can count on additional payment in the event of the loss of a breadwinner. A spouse who has remarried cannot claim this payment. The procedure for assigning and calculating additional payments is regulated by law.

- State additional payments are due to those persons who, having completed their activities in the field of military affairs, continued to work at enterprises and have the necessary work experience by retirement age.

Knowing about the main types of accruals, you can not waste time going through the authorities, but rather press a certain moment suitable for submitting documents for monthly accruals.

Military service for what types of length of service does it matter?

The State of the Russian Federation in Art. 59 of the Constitution stipulates that every male citizen of the country, from adulthood to twenty-seven years of age, must serve in the armed forces of the Russian Federation. At the same time, it is also not prohibited to perform military duties on a contract basis. But military personnel have a question: will the time spent in the army in any case (conscription or contract) be considered as work activity?

According to the law, labor activity includes not only the period of actual presence at the workplace, but its forced absence for certain reasons, for example, to serve in the armed forces of the Russian Federation.

The terms of provision and the size of the pension depended on the length of service mentioned in Federal Law No. 173. After changes in legislation in 2002, the amount of pension payments began to be determined by the insurance period , which is the period established by the pension insurance regime.

Therefore, military service, according to:

- Federal Law No. 173 is taken into account in the length of service;

- Federal Law No. 400 determines the amount of insurance coverage;

- Federal Law No. 76 is considered preferential length of service for a certain category of citizens.

Military service plays a role in all types of internships used in the Russian Federation, and this period has its own enrollment procedure.

Differences between regular and military pensions

Pension provision for military personnel, as usual, depends on the amount of salary and the length of service served.

The differences are as follows:

- For military personnel, the minimum length of service has been increased. Unlike civilians, for whom this indicator is set at 15 years, military personnel must serve at least 20 years

- When calculating monthly accruals for military personnel, pension coefficients are not taken into account

- Unlike civilians, military personnel can apply for a pension even at the age of 40. The only condition that must be met is that you have at least 20 years of service experience.

Types of military pension

The federal legal act on pension provision for military personnel establishes two methods (types) of military pensions for the above category of people:

- Basic cash support. This is a pension that is provided to a citizen who has continuously served in certain structures (army, police) for 20 years or more.

- Mixed service pension. This type of monetary security applies to those citizens who have a certain number of years of military service, taking into account their civilian experience. More details about the mixed pension for military personnel and its calculation will be discussed below.

You need to remember that you can retire with mixed length of service in two cases. When a person reaches 45 years of age, or receives disability of the first or second group during service.

The right to a military pension for length of service and age in 2018

Grounds for assigning a military pension based on mixed service:

The current legislation establishes some legal differences when assigning a mixed military pension and a civil pension.

The mixed system necessarily includes military and civilian experience in strictly established time intervals.

Such security is accrued to military personnel in cases where they fall under certain legal criteria.

- A citizen belongs to the category of officials established by current legislation

- At the time of dismissal, the person served as a military, police, firefighter, or other law enforcement agency, work in which entitles him to a military pension

- Termination of employment occurred due to job reduction, liquidation, reaching 45 years of age, or due to deteriorating health

- At the time of termination of employment, the person had military experience of 13 years or more, civilian experience of 25 years or more

It must be remembered that if a woman is a military personnel, she also has the right to receive a pension for mixed service, just like males. But being on maternity leave also counts towards her length of service.

Conditions of appointment

A pension for mixed military service is awarded to those citizens whose length of service is less than 20 years. The following circumstances of dismissal may serve as grounds for this:

- for health;

- upon reaching the age threshold;

- in connection with the reorganization of the division;

- division reduction.

To assign a mixed pension, it is necessary to comply with the conditions regarding the total length of service, in particular:

- at least 12.5 years of experience in the ranks of military personnel;

- 25 years or more – total experience.

Until the beginning of 2002, a slightly different procedure for calculating mixed length of service was used, the scope of which could include the following periods:

- studying at a higher educational institution;

- residence of military spouses in places where there is no employment opportunity.

Currently, the above periods are not taken into account when calculating mixed-type pensions.

Women who were on maternity leave while serving in the military have the right to apply for the inclusion of the specified period in the length of service.

In case of non-compliance with the imperative conditions defined by the legislator in Federal Law No. 340-1, a military personnel can only be assigned an insurance pension arising from general grounds. That is, the right to financial support from the Ministry of Defense is canceled.

Pension registration procedure

Unfortunately, the retirement process is not going as smoothly as we would like, so each serviceman will be expected to follow a certain course of action. This delay is due to the fact that pension fund employees are required to check all data on civilian or military experience. Often you have to collect certificates proving work in a civilian position at a particular enterprise. The positive point is that all data is stored in archives, so it cannot be lost unless the citizen was officially employed.

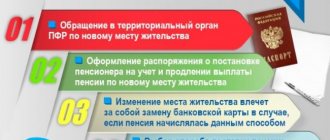

First of all, you need to determine where to go to apply for a pension. The choice is small, since all cases flow to the Pension Fund, which will consider each specific application, but the structural unit directly depends on the citizen’s registration.

Important! In the absence of permanent registration at the place of stay or place of residence, a citizen has the right to provide a package of documents to the unit that directly serves the territorial entity.

For the military, the application procedure is determined by a separate resolution and involves immediate registration of a pension upon receipt of the right, this means that you can contact any convenient division of the Pension Fund.

In addition to the standard application, a citizen in the process of applying for a pension is required to provide a certain package of documents:

- A passport is considered the main identification document indicating a citizen’s age, as well as place of residence (registration)

- Certificate of pension insurance as evidence that the applicant has an individual personal account

- Next, you will have to worry about documentary evidence of experience. It is necessary to take the established form of a certificate from the place of work, which will indicate the period and salary. Full information can be gleaned from the entries in the work book, so create this document immediately after starting work and make sure that the data is entered correctly

- A sample of 60 months of salary data should be made after preliminary consultation with Pension Fund employees

Related documents may be needed if there are specific features of the application. For example, a disability pension for military personnel is issued if there is a medical certificate confirming the provision of the group. Changes in personal data must also be documented and recorded. To receive payments directly, you will have to decide on the type of delivery. It is very convenient to use modern banking facilities (opening an account, plastic card).

It is quite difficult to calculate the monthly payment on your own. You can contact the Pension Fund or use special online calculators. We only note that the calculation procedure is determined by law, and length of service in a civilian position and military service are taken into account. The base amount is formed in the form of half the salary for 25 years, to which various coefficients are calculated.

The procedure for calculating pension payments

All charges are clearly regulated and controlled by the state. The most important condition that must be met is a certain length of service or length of service. The age of the serviceman and the amount of his allowance in this case do not have any influence.

The law stipulates 2 options for the occurrence of pension payments:

- Duration of service in the Russian Armed Forces for at least 20 years

- The serviceman carries out labor activities outside the walls of military institutions, has a total length of service equal to 25 years, of which he served more than half of the term

If a serviceman falls under both categories, this means that he will be accrued a military pension and an old-age pension at the same time.

What factors influence the amount of payments?

The main criterion is the amount of salary that a soldier receives monthly. Factors influencing this amount are as follows:

- Salary

- Allowance for the acquired position and title;

- Total length of service.

Accordingly, the higher the position or rank, the length of service, the higher the amount of payments will be. It is important to know that starting from 2020, the amount of pension benefit accruals has been increased from 54% to 62.12%, and with each subsequent year this coefficient will increase by 2%.

Those who received an injury or illness during military service can count on an allowance, the amount of which is determined depending on the assigned disability group.

For disabled people of group 1, the supplement is 300% of the pension benefit. Group 2 disabled people can count on an increase of 200%. Persons who have received a 3rd degree disability due to a work-related injury in the service are entitled to an additional benefit in the amount of 150% of the pension.

How is a mixed pension (military and civilian) calculated?

A mixed type pension (military and civilian) is calculated according to a special scheme reflected in the current legislation. There are a large number of different nuances.

The most important points that anyone applying for this type of payment needs to know are:

- When calculating the amount of payment, the civil service received for length of service is not taken into account

- If, after receiving a pension, a citizen continues to work without interrupting his work experience, his pension is indexed every August 1, and there is no need to write an application to the Pension Fund

Civil pensions for military pensioners will be paid only upon reaching the age of:

| Floor | Age |

| Man | 60 |

| Woman | 55 |

In 2020, legislation is being reformed and it will also affect mixed pensions. To receive this type of benefit, a law enforcement officer must have at least 6 years of civilian experience.

Otherwise, you will be entitled to only one type of pension - military. Moreover, in 2024, the minimum civil length of service will be increased to 15 years.

Although calculating a mixed pension is not complicated, some nuances should be taken into account

The procedure for calculating the amount of a mixed type pension is not complicated. But it is very important to take into account a large number of different nuances. All of them are designated in the legislation of the Russian Federation.

Minimum pension amount

The calculation of a regular military pension is indicated in Article No. 14 of Law No. 4468-1. But it should be remembered that for citizens planning to receive a mixed pension, the size of the military pension will be ½ of the salary for a total length of service of 25 years and 1% for every 12 months of service over 25 years.

When calculating a military pension, various salaries are included in the salary - based on position and length of service.

For example, the following salaries correspond to the following military ranks:

| Rank | Salary size |

| Private | 5 thousand rubles |

| Sergeant | 6.5 thousand rubles |

| Lieutenant | 10 thousand rubles |

| Senior Lieutenant | 10.5 thousand rubles |

| Captain | 11 thousand rubles |

| Lieutenant colonel | 12 thousand rubles |

| Colonel General | 25 thousand rubles |

The process of calculating the minimum pension for mixed length of service is as follows:

- Length of service is calculated and the right to a military pension is determined;

- Mixed type of experience is determined;

- The amount of monetary allowance is calculated when calculating a military pension;

- The size of the military pension is calculated.

Calculus Example

The easiest way to understand the process of calculating a mixed-type pension is to use an example.

The calculation was made for the position of a major who is an assistant chief of staff of the regiment (born in 1964). Studied at a university (civil) from 07/01/84 to 06/30/89.

He was employed in a civilian organization from 09/01/89 to 06/15/95. He completed military service from 01/31/10. He was dismissed upon reaching the age limit, does not work.

Determination of length of service:

The length of service is counted for the period from 06/16/95 to 01/31/10. The length of service in total is 14 full years, 7 months and two weeks. According to these data, the major does not fall under Article 13 of Law No. 4468-1.

Definition of mixed experience:

The period of study at a university is not included in the length of service. Basis - Article No. 92 of Law No. 340-1. Duration of training – 60 months. The length of civil service is 5 years 9 months and two weeks.

Thus, the duration of mixed experience is 25 years 4 months 28 calendar days. The amount of the military pension is 50%.

Calculation of the amount of monetary allowance:

The major's salary at the time of service was 2,660 rubles. The salary of a staff assistant is 3,853 rubles.

Total:

(3,853+2,660)+(3,853+ 2600)×50%=9,769.5 rubles.

The amount of military pension is:

9769.5×½=4,884.7 rubles.

Assignment of mixed pension payments - conditions

Mixed experience (hereinafter referred to as SS) is assigned to a former military personnel if the following conditions are met:

- The dismissal occurred for one of the following reasons: reaching the appropriate age; deterioration of health; reduction.

- Military experience - from 13 years, and general - from 25 years. The minimum (civilian) experience is 6 years.

- The service took place in one of the following structures: criminal executive; fire department; nacrodepartment; armed forces; Ministry of Defense; OVD (internal affairs bodies).

What civil social benefits can you count on?

Under what conditions are military pensioners entitled to additional payments? This category includes those persons who have been assigned a pension by the Ministry of Defense for long service or disability.

For them, the law provides for the payment of a second social old-age pension.

This is due to the fact that many military personnel, when leaving their service, are in good moral and physical condition and are still able to benefit people by working in “civilian” enterprises.

A retired pensioner, engaged in labor activity after leaving the army, must pay appropriate deductions from wages to the Pension Fund. This gives him the right to receive a social civil labor pension.

Conditions for obtaining this benefit:

- Having the right age. For women it is 55 years old, and for the male part of the population - 60

- Developing insurance experience in civilian work for at least 6 years. According to the Ministry, this figure will increase annually by one year until it reaches 15 years

- The right to additional payments for military pensioners who have chosen enterprises with difficult working conditions or in areas with severe climatic conditions

Retirement from a military pension of the Ministry of Internal Affairs due to mixed length of service (benefits for pensioners of the Ministry of Internal Affairs)

Further work of a former employee of the Ministry of Internal Affairs “in civilian life” does not deprive him of the right to receive a military pension for length of service in the Ministry of Internal Affairs of Russia. That is, after leaving the service, it is quite possible to test your strength in any job that is not related to the activities of internal organs.

Pension benefits for civilians are formed from the Pension Fund, and former employees of the Ministry of Internal Affairs receive pensions from the state budget.

To be able to apply for a pension upon termination of service, an employee of the Ministry of Internal Affairs must obtain an insurance certificate of compulsory pension insurance (SNILS) from the Pension Fund of Russia. The issuance of a card indicates the availability of an individual personal account number for the citizen in the Pension Fund of Russia.

Documents for obtaining a civil pension for a military pensioner:

- Passport

- Application to the Pension Fund at the place of residence

- Certificate of pension insurance

- A certificate from the Pension Fund stating the period and amount of accrual for length of service

- Documents that serve as the basis for accurately determining length of service

Important! A serviceman's social civil pension will be assigned exactly from the moment an application is submitted to the Pension Fund.

Today, according to the law, military personnel can claim payment not only for length of service or in connection with an acquired disability, but also while continuing to work in the civilian field.

The pension provision, which is accrued by the relevant authorities, will depend on the size of the soldier’s salary and the period of insurance service.

Knowing what is included in a military pension and on what indicators its size depends, you can compare your calculations with the data offered by the Pension Fund.

Nuances of calculating payments for mixed experience

When determining the amount of cash payments, in addition to the calculation indicated above, the following nuances must also be taken into account:

- The total mixed work experience must be 25 years. If a person has worked more, for example 26 years, then another 1% is added to the 50% pension, so the payments will be equal to 51% of the average amount for the entire length of service. Accordingly, if 27 years old then 52% and so on

- If a citizen receives a disability during military or other service, he additionally receives a special pension supplement. Disabled people of the 1st group in the amount of 300% of the pension amount, disabled people of the 2nd group 200% and the third 150%

- Military retirees with mixed experience also have the right to receive housing through social state mortgage lending, as well as to count on other benefits and compensation established at the state and regional levels

Length of service before retirement (benefits for pensioners of the Ministry of Internal Affairs for mixed length of service)

Important!

From January 1, 2020, the minimum length of service that gives the right to a military pension is not 20, but 25 years.

The period of service in the Ministry of Internal Affairs will be taken into account by Pension Fund specialists at the time of retirement only if the employee meets the following conditions:

- Have reached at least 45 years of age.

- Served in the Ministry of Internal Affairs for at least 12.5 years.

- Have a total work experience of at least 25 years (if the service was carried out in the Far North, 1 year of service is equivalent to two years, so the total work experience before retirement should be 12.5 years).

How to retire with mixed service for military personnel and employees of the Ministry of Emergency Situations?

The most important points that anyone applying for this type of payment needs to know are:

- When calculating the amount of payment, the civil service received for length of service is not taken into account

- If, after receiving a pension, a citizen continues to work without interrupting his work experience, his pension is indexed every August 1, and there is no need to write an application to the Pension Fund

Civil pensions for military pensioners will be paid only upon reaching the following age: Gender Age Male 60 Female 55 In 2018, legislation is being reformed and it will also affect mixed pensions. To receive this type of benefit, a law enforcement officer must have at least 6 years of civilian experience. Otherwise, you will be entitled to only one type of pension - military.

In this case, the total length of service must be:

- Military experience - twelve years and six months

- Work experience – at least twenty-five calendar years

It should be taken into account that in connection with paragraph “a” of Part 2 of Article 13 of Law No. 4468-1, only the length of service that is used for recalculation can be included in the mixed one, the basis for which is the federal law on labor pensions. Before it came into force, the Pension Fund was guided by the law of November 20, 1990 No. 340-1.

In accordance with it, the following periods could be included in the length of service (in our time this is no longer practiced):

- Accommodation for military spouses who are doing military service in a place where there is no employment opportunity.

- Studying at a university.

The above periods could be included in the mixed service record only until January 1, 2002. It is determined by current legislation. The main legislative regulations for determining the size of a mixed pension are Federal Law No. 156 and Federal Law No. 4468-1. The calculation is based on length of service and length of service. On their basis, the basic size of the mixed pension is calculated, which is adjusted by various coefficients defined in the methodology.

Each additional year of work after the pension is calculated gives the pensioner the opportunity to increase the amount of payments by 1%.

Recalculation is carried out annually before August 1. The size of the military pension, when calculating mixed length of service, is calculated based on ½ of the salary for a total length of service of 25 years.

The salary includes all types of payments corresponding to the position and length of service. Its composition and size are determined by special legislation. The length of service does not include the period of training at a military school. This provision is defined by Law No. 340-1.

Question answer

Question No. 1: I served in the army for more than 12.5 years, and was discharged in 1996 due to organizational and staffing measures. I recently turned 45 years old and have worked for 25 years. Am I eligible for a military pension?

Question No. 2. I served my military service, worked in civilian life for 10 years, then entered military service under a contract, served for 14.5 years. After reaching the age limit, he signed another contract for 3 years to receive a pension. Recently he was fired at the age of 46 due to non-compliance with the terms of the contract on the part of the serviceman (drinking alcohol). Am I entitled to a pension?

Answer. Article 13 of the Law of the Russian Federation of February 12, 1993 N 4468-1 “On pension provision for persons who served in military service...” provides for two possibilities for assigning a pension for long service. According to paragraph “a” of Article 13, military personnel who have 20 years of service or more in calendar terms on the day of dismissal from service have the right to a pension for length of service. This point, as a rule, does not raise questions.

According to point No. 2, military personnel discharged from military service due to the so-called “mixed length of service” have the right to a pension, when not only military service, but also “civilian” work is taken into account.

Let's read this paragraph carefully: The right to a pension for long service has: persons specified in Article 1 of this Law, dismissed from service upon reaching the maximum age for service, health conditions or in connection with organizational and staffing measures and having reached 45 on the day of dismissal -years of age, having a total work experience of 25 calendar years or more, of which at least 12 years and six months are military service, and (or) service in internal affairs bodies, and (or) service in the State Fire Service, and (or) service in the authorities for control over the circulation of narcotic drugs and psychotropic substances, and (or) service in institutions and bodies of the penal system.

Analysis of this paragraph allows us to conclude that for mixed length of service, a pension can be assigned if the following conditions are simultaneously met:

- On the day of dismissal, the serviceman turned 45 years old;

- Total length of service, also on the day of dismissal! amounted to 25 calendar years;

- Of these 25 years, at least 12.5 are military service;

- Dismissal on three grounds: Oshm

- Health status

- Reaching the age limit.

Failure to fulfill at least one of the listed conditions does not give the right to receive a pension from the Ministry of Defense (another department that provides for military service).

Thus, the answer to both the first and second questions, unfortunately, is negative.