general information

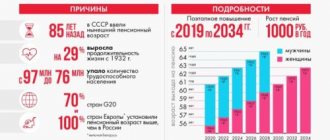

Pension provision for residents of the Khanty-Mansiysk Autonomous Okrug is carried out in accordance with all-Russian legislation. This means using the same accrual methodology for the entire country. In addition, the size is closely related to the basis for the purpose of the benefit. There are several types of these:

- 1. By old age:a. insurance is assigned if the criteria for length of service and points are met:

- after 60 years for women;

after 65 years for men;

- at a different age in the presence of preferential grounds;

- work experience of at least 15 years (this indicator will be relevant by 2024, in 2020 the minimum experience is 11 years, within 4 years it will increase by 1 year annually);

- 30 individual pension coefficients (in 2020, the minimum amount of pension points is 18.6, the required number will increase annually and will reach 30 by 2024)

b. social:

- women who have celebrated their 65th birthday;

- men over 70 years of age;

- foreign citizens and stateless persons permanently residing in the territory of the Russian Federation for at least 15 years and who have reached the specified age;

- state: assigned to citizens affected by radiation or man-made disasters;

- The state pension for long service is assigned to federal civil servants, military personnel, astronauts and flight test personnel.

2. For disability:

- insurance in the presence of disability and at least one day of insurance experience;

- social in the presence of disability and lack of insurance coverage;

- state is assigned to military personnel, citizens who suffered as a result of radiation or man-made disasters, participants in the Great Patriotic War, citizens awarded the “Resident of Siege Leningrad” badge, and cosmonauts;

3. In the event of the loss of a breadwinner, a pension is entitled to:

- insurance is assigned upon the death of the breadwinner, who was dependent on the applicant for pension provision. The main condition is that the deceased breadwinner has an insurance period (at least one day);

- social is assigned to children under the age of 18, as well as over this age, studying full-time in educational organizations, until they complete such training, but no longer than until they reach the age of 23, who have lost one or both parents, and children of a deceased single person mothers;

4. State pension is assigned to disabled family members of fallen (deceased) military personnel; citizens injured as a result of radiation or man-made disasters, astronauts.

Social supplement to pension

According to Article 12_1 of Federal Law No. 178-FZ “On State Social Assistance” (04/24/2020)

, the total amount of material support for a non-working pensioner cannot be less than the subsistence level of a pensioner in a constituent entity of the Russian Federation (in this case, in the Novosibirsk region).

If the amount is less, then a social supplement is assigned from the regional or federal budget. The surcharge is set in such an amount that the total amount of material support for the pensioner, taking into account this surcharge, reaches the cost of living for a pensioner established in the Novosibirsk region ( 9 487 ₽

).

What does the total amount of material support consist of?

When calculating the total amount of financial support for a pensioner, the amounts of the following monetary payments established in accordance with the legislation of the Russian Federation and the legislation of the constituent entities of the Russian Federation are taken into account:

- pensions, including the amount of the due old-age insurance pension, taking into account the fixed payment to the insurance pension, increases in the fixed payment to the insurance pension established in accordance with Federal Law N 400-FZ “On Insurance Pensions” (04/22/2020), and funded pension , established in accordance with Federal Law N 424-FZ “On funded pensions” (October 3, 2018), in the event of a pensioner’s refusal to receive these pensions;

- urgent pension payment;

- additional material (social) support;

- monthly cash payment (including the cost of a set of social services);

- other measures of social support (assistance) established by the legislation of the constituent entities of the Russian Federation in monetary terms (with the exception of measures of social support provided at a time).

The calculation does not take into account social support measures provided in kind, with the exception of cash equivalents of social support measures for paying for telephone use, for paying for residential premises and utilities, for paying for travel on all types of passenger transport (urban, suburban and intercity), and as well as monetary compensation for the costs of paying for these services.

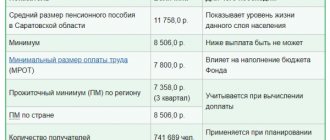

Amounts of pension payments

The size of old-age pensions depends on several factors. According to the new appointment system, the following are taken into account:

- seniority;

- the amount of the total contribution to the Pension Fund budget made for the employee by the employer (sum of pension points).

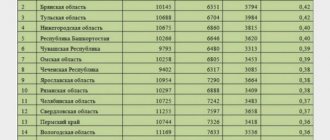

In addition, the authorities are constantly analyzing the income of the population. This is necessary to develop measures of social support for socially vulnerable groups. The research takes into account the following indicators for the region:

- pension: average - 22,477.91 rubles;

- minimum - 11,805 rubles;

Download for viewing and printing:

Federal Law “On Insurance Pensions” dated December 28, 2013 No. 400-FZ

Additional payments

An analysis of the application of the new methodology for generating payments showed that the majority of pensioners find themselves far below the poverty line.

The fact is that for current pensioners, their work experience includes work during the difficult periods of the collapse of the USSR and the formation of the new Russia. Not everyone was officially employed in those periods and received a standard salary. In order to prevent the impoverishment of elderly citizens at the federal level, a new rule has been introduced into the legislation:

- the authorities guarantee non-working pensioners an income at the level of the PM indicator: regional;

- federal;

- the largest one is selected.

The rule is practically implemented by providing a social supplement , unofficially called the presidential one. In the Khanty-Mansiysk region, the old-age pension is brought up to the minimum wage for the district. It is paid from the regional budget, since the cost of living established in the region is higher than the federal one. To assign an additional payment, you need to contact the Pension Fund authorities on a territorial basis.

Hint: when calculating the amount of additional payment, benefits and preferences provided to the pensioner from budget funds are taken into account.

Self-study documents

Decree of the Government of the Russian Federation N 975 “On approval of the Rules for determining the cost of living of a pensioner in the constituent entities of the Russian Federation in order to establish a social supplement to pensions” (07/30/2019)

Law of the Khanty-Mansiysk Autonomous Okrug - Ugra N 24-oz “On the consumer basket and the procedure for establishing the cost of living in the Khanty-Mansiysk Autonomous Okrug - Ugra” (04/05/2013)

Federal Law N 178-FZ “On State Social Assistance” (04/24/2020)

Federal Law N 134-FZ “On the subsistence minimum in the Russian Federation” (04/01/2019)

Did you find this information useful?

19 5

Methodology for assigning a pension

The PFR departments deal with issues of determining the right to pension benefits and the amount of payment. These work in every municipality. An applicant for a pension should do the following:

- Wait until you become eligible for a pension.

- Collect documents. The main ones are: passport and SNILS (make copies);

- work record and contracts with employers;

- reference:

- on the assignment of disability;

- about the presence of dependents (accruals increase);

- certificates:

- about the birth of children;

- about the death of the breadwinner;

- on marriage/divorce.

- bring in person;

- through the post office;

Hint: you are allowed to bring a package of documents to the department a month before your eligibility (birthday).

What does the minimum old-age pension consist of?

It happens that a person was assigned an old-age pension, but its amount turned out to be lower than the pensioner’s subsistence level. In this case, he is entitled to an additional payment up to the “minimum wage”. It is correctly called “social supplement to pension” up to the pensioner’s subsistence level. The right to it arises when 2 conditions are simultaneously met:

- absence of work or other activity during which the person is subject to compulsory pension insurance;

- failure to achieve the total amount of material support for a pensioner equal to the minimum subsistence level of a pensioner in the region of his residence.

Keep in mind that in order to calculate the “total amount of material support”, almost everything is taken into account - all cash payments, including pensions and cash equivalents of social support measures to pay for telephones, housing, utilities and travel on all types of passenger transport (urban, suburban and intercity) , as well as monetary compensation for the costs of paying for these services.

The amount of PMP for determining the size of federal and regional social supplements to pensions is established in the whole of the Russian Federation and in each subject of the Russian Federation. So, for 2020 in the Russian Federation it is 8,726 rubles, and, for example, in Moscow – 11,816 rubles.

The pensioner must receive a larger payment (when choosing between federal or regional). Also see “Where to apply for a social supplement to your pension: to the Pension Fund or Social Security?”

Where to contact

Applicants for pension benefits are accepted in the Fund's divisions on a territorial basis. A citizen should go to the government agency operating at his place of registration. The addresses are shown in the table:

| Service region | Address | Telephone | Time of receipt | |

| For citizens | For policyholders | |||

| Khanty-Mansiysk District | Khanty-Mansiysk, st. Mira 34 | 8 (3467) 393-032 | – | 09:00 — 18:00; break: 13:00 – 14:00 |

| Cities | ||||

| Langepas | st. Lenina, 23a | 8 (34669) 5-02-62 | 8 (34669) 5-04-92 | 09.00-17.00; break: 13:00 – 14:00 |

| Wiggle it | st. Komsomolskaya 3 | 8 (34669) 7-42-09 | 8 (34669) 7-09-50 | |

| Surgut | st. Mayskaya, 8/1 | 8 | 8 | |

| Kogalym | st. Mira, 24 | 8 (34667) 2-28-61 | 8 (34667) 2-13-95 | |

| Megion | st. Kuzmina, 4 | 8 (34643) 2-45-55 | 8 (34643) 2-59-49 | |

| Nefteyugansk | st. Neftyanikov, building 16, building 2 | 8 | 8 | |

| Nizhnevartovsk | st. Dzerzhinsky, 17b | 8 | 8 | |

| Nyagan | st. Sibirskaya, 7a | 8 (34672) 5-01-09 | Phone: 8 (34672) 5-01-13, 5-02-05 | |

| Pyt-Yakh | st. Nikolay Samardakov, 7 | 8 | 8 | |

| Rainbow | 2 microdistrict, 25 | 8 (34668) 3-40-91 | 8 (34668) 3-40-91 | |

| Soviet | st. Gastello, 39 | 8 (34675) 3-84-63 | 8 (34675) 3-84-63 | |

| Urai | 2 microdistrict, 27 | 8 (34676) 3-10-64 | 8 (34676) 3-01-22 | |

| Khanty-Mansiysk | st. Doronina, 3 | 8 (3467) 393-112 | 8 (3476) 393-117 | |

| Yugorsk, | st. Tolstoy, 8 | 8 (34675) 7-62-03 | 8 (34675) 7-10-38 | |

| Municipal districts | ||||

| Beloyarsky | Beloyarsky, 7 microdistrict, 5 | 8 (34670) 2-37-83 | 8 (34670) 2-33-10 | |

| Berezovsky | Berezovo, st. Aviatorov, 20, office 1 | 8 (34674) 2-40-60 | 8 (34674) 2-40-60 | |

| October | Oktyabrskoye, st. Sovetskaya, 41 | 8 (34678) 2-13-11 | 8 (34678) 2-12-59 | |

| Kondinsky | Mezhdurechensky, st. Pervomaiskaya, 23 | 8 (34677) 3-45-03 | 8 (34677) 3-20-94 | |

Hint: you can now make an appointment through the State Services portal, and send an appeal with a question on the official website of the Foundation.

Will the pension change after moving to another region?

A pensioner's income consists of several parts. Northern coefficients affect the fixed payment . It changes downwards when moving to regions where there are no northern allowances. A large size of the fixed part is maintained in any situation for persons who have worked:

- 15 years in the Far North;

- 20 - in equal areas.

Hint: the rule applies to persons with a total work experience of at least:

- 20 years for women;

- 25 - for men.