The difference between deposits for pensioners and standard types

For the most part, the contribution for pensioners is similar to the investment of the working population.

But there are still some differences, and for people of retirement age they are of great importance. The main differences that most banks offer:

- There are no restrictions on the minimum size of the deposited amount. In order to attract pensioners (receiving old-age pensions and social pensions), many banks have put forward a program that allows them to make an investment equal to one ruble.

- Possibility of regular replenishment. The deposit can be replenished not only by any amount, but also at any time. Thus, you can, whenever possible, save your funds by depositing them into your account. Some banks may impose a limit on replenishment 1-3 months before account closure.

- Possibility to withdraw part of savings. This condition is not typical for all types of deposits for pension savings, but it does occur.

- Choice of interest accumulation. Pensioners are always offered 2 options for disposing of interest income: accumulation and withdrawal at the end of the deposit agreement, or regular transfer to an additional account or card.

- High profitability. As a rule, the pension type of deposit has higher rates, plus there are special programs for this. Such programs are often used by UralSib Bank and Sberbank.

- Monthly charges. Most often, programs for this type of investment provide for monthly interest accrual.

back to menu ↑

The main advantages of the pension type of deposit

An analysis of such deposits showed that they have a lot of advantages that distinguish them favorably from investments of the standard type:

- the main advantage is more flexible conditions, allowing you to choose the type of deposit for each pensioner;

- increased profitability. Even with standard interest rates, banks attach special programs to such investments that increase the savings part;

- automatic transfer of savings to the specified account;

- deposit account calculation. A bank client can use this service independently or with the help of a consultant;

- information support on saving funds in the account, which is provided at the request of the depositor, both electronically and in writing;

- the possibility of compensation when investing different types of currency. This is relevant during sharp declines in the value of currencies;

- obtaining a universal bank card. The card is issued at the request of the depositor;

- the possibility of premature withdrawal of investments on soft terms with minimal losses of funds remains;

- notarized trust of authority to a third party who can dispose of the deposit in the interests of the bank client.

back to menu ↑

Will interest rates increase in the near future?

Recently, the yield on deposits has fallen sharply. This is due to the reduction of the key rate by the Bank of Russia. Could deposit rates soar again?

“In the current situation, deposit rates will no longer rise,” says Anton Pavlov, . “And it’s not just the recent reduction of the Central Bank’s key rate. Most likely, its decline will continue, which means that a rate correction, even if only insignificant, is possible only within the framework of short shares of individual market players.”

See also:

— Types, interest and cost of Sberbank Pension Cards >>

— Favorable interest on pensions for the Rosselkhozbank Pension Card >>

How to find out if the bank cheated when opening a deposit

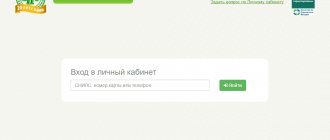

Situations were repeatedly discussed when pensioners opened deposits in a bank, then its license was revoked, and the DIA did not find these deposits on the credit organization’s balance sheet. This means that it will not be superfluous to additionally make sure that the deposit has actually been placed.

You can check this, for example, through online banking. If you see your deposit there and can make transactions on it (if they are provided for by the conditions), then the bank has not hidden anything from you.

The information is not a public offer. Find out more about interest rates and conditions of favorable deposits for pensioners today from the relevant banks.

Documents required for registration of pension investments

The set of documents presented for registration of any deposit is standard. As a rule, it includes documents confirming the depositor’s identity (passport, which should not be expired) and a bank service agreement.

But when pensioners register a deposit, they will need a number of other documents. Let's take a closer look at the entire package of documents:

- Passport or military ID to verify your identity.

- Pensioner's ID.

- Standard application form for the Pension Fund. In case the investor wishes to replenish the account directly by transferring a pension.

- Certificate from the Pension Fund. Most often, such a certificate is not required, since information automation allows the bank to independently request information. But, in some cases, this can take a long time, so having such a certificate will significantly speed up the process and eliminate possible errors.

- An agreement from the bank for servicing an individual and opening an account. The agreement is issued for signature in two copies, one of which remains with the client. This document must be retained until the expiration date.

- A savings book or bank card, which is issued directly upon registration.

back to menu ↑

Is it canceled at a certain age?

Disability pensions are paid until the day the old-age pension is assigned. After reaching a certain age, one benefit is automatically replaced by another. Moreover, for these changes to enter into legal force, no statements are required from the person himself.

Russian laws do not allow the simultaneous payment of two benefits. An exception is made for several categories (in accordance with clause 3 of Article 3 No. 166-FZ):

- Disabled persons who received their status during military service have the right to simultaneous payment of a state pension assigned in connection with loss of health, as well as payments due due to age.

- War veterans can receive both pensions.

REFERENCE. If for some reason a citizen expresses a desire to replace one type of pension with another, believing that this is better for him, the legislation of the Russian Federation does not limit him in this way.

In order to do this, all you need to do is write an application to the Pension Fund of the Russian Federation. The changes will take effect at the beginning of the next month after application is submitted.

The video tells the story of a woman who was faced with the replacement of her disability pension with another - for old age.

Read about the transition from disability pension to old age benefits here.

How not to make a mistake with your choice?

The correct choice of deposit determines its ease of use, premature withdrawal of funds and, most importantly, profitability.

Very often, having a large amount of information, people get lost and, not understanding all the conditions, decide on the first bank they like.

Only when the time comes to calculate the income from the investment do they realize their mistake.

In order to avoid such situations, experts have identified the following criteria for the profitable selection of a pension type of deposit:

- investment size. First you need to decide on the size of your funds. Please note that some banks increase the interest rate only in proportion to the deposit amount. By saving a large amount in such an account, you increase interest opportunities;

- interest rate. You should not opt for the largest banks, believing that only they have a guaranteed high percentage of income. Many banks, wanting to attract customers, increase the interest rate for people with a stable income, and therefore for pensioners. One such example is UralSib Bank, which offers a high interest rate for a short period of time;

- investment currency. The banking system of the Russian Federation is designed to maintain its own currency, so the most profitable bank investments for pensioners will be in rubles. But it is worth noting that savings investments in foreign currency, despite the low interest rate, are more stable;

- duration of the program. There is a simple rule: the longer the period of storage of your funds in the account, the higher the income from it will be. I would like to note that this condition mainly applies to a fixed-term deposit;

- conditions. Decide on the conditions that are convenient for you that the pension type of deposit has: type of investment, currency and other options. Keep in mind that a program that has a large number of convenient options for you is usually low-income.

Important: in order for pension types of deposits to be profitable, choose an investment in rubles and for a long period of time.

back to menu ↑

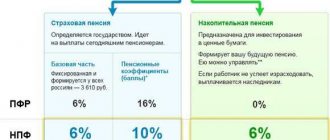

Types of pension investments

Different banks most often offer several types of deposits for pensioners, which have different terms and interest rates. But, despite this difference, all such deposits can be divided into two types according to the conditions provided:

- Deposit on demand. This savings deposit is intended for servicing savings in a non-cash manner, receiving and calculating services and making certain payments. This type of pension investment allows you to withdraw part or all of your savings at any time. The difference between this program is its high interest rate.

- Term deposit type. Intended for interest accumulation and passive preservation of income. A distinctive condition of this type of investment is that withdrawal of money is possible only at a certain time specified in the agreement. As a standard, one of several options is selected for this: month, quarter, year, end of the contract. A time deposit is characterized by the possibility of early partial withdrawal of cash. This type of deposit is offered by a variety of banks: Sberbank, UralSib, Home Credit Bank

Important: regardless of what type of deposit a pensioner has chosen, he always has guaranteed insurance of his investments. Thanks to this, in the event of an insured event, the account will not be frozen, and the investor will be able to withdraw the money on it.

back to menu ↑

Raiffeisenbank offers

Apply for a Raiffeisenbank card

When choosing which bank's pension card is better, you cannot ignore Raiffeisenbank.

This is the first Austrian credit organization in Russia to join the MIR payment system. Bank card holders receive high-quality service, prompt resolution of all emerging issues, as well as:

- free release and maintenance;

- the opportunity to participate in the loyalty program (more than 4,000 partners, discounts on goods and services up to 25%, bonuses and privileges);

- payment of utility bills, communication services - without commission at ATMs of the issuing bank;

- interest-free cash withdrawals from more than 21,000 self-service devices of Raiffeisenbank and partner banks.

For cash withdrawals from ATMs of third-party banks, a commission of 1% (but not less than 150 rubles) of the amount is charged. The daily limit is 200,000 rubles.

You can fill out an application for a debit card on the official website of Raiffeisenbank. To do this, it is enough to indicate your personal data, the method of receiving the plastic (post office or courier delivery) and indicate contacts for feedback.

Online banking options:

- 24/7 access to account information;

- payment for services (housing and communal services, cellular communications, Internet) without commission with a maximum limit of 15,000 rubles;

- the ability to set up automatic payments;

- saving templates for quick payment;

- fast transfers by phone number.

The service can be activated free of charge on the bank’s website. It is also possible to activate SMS notifications. The cost of the service is 60 rubles per month. It is worth considering that reissue, including planned reissue, is a paid service. If you issue a card for the previous validity period, you will have to pay 300 rubles.

Rating of banks with profitable deposits for pensioners

Let's consider the rating of banks that provide the greatest benefits for this type of deposit. As a basis, we will take a short investment period - from 3 months, an affordable amount of starting capital - from 100 rubles, and the maximum permissible interest rate. Let's distribute the banks in descending order:

- InvestTorgBank came in first place. Here they offer the “Pension Capital Plus” program at an interest rate of 11.50%, with an estimated amount of 3 thousand rubles for one year.

- Trust Bank also holds a leading position with its Pension Income deposit at 11.20% for a period of 180 days, with an initial amount of 5 thousand rubles.

- In third place is the popular Home Credit Bank. This bank offers to make investments for 18 months at 11%, with primary funds - 1000 rubles.

- The savings deposit of the Russian Capital Bank differs in the amount of the first investment. It is equal to 10,000 rubles. Deposit period – from 35 days. Interest, just like the previous bank, is 11.

- The pension deposit program of UralSib Bank has the shortest investment period - 90 days. At the same time, the rate is quite high - 10.10%, as well as the amount of the down payment. UralSib offers to open an account with an amount that should not be less than 5,000 rubles.

- An honorable sixth place, after UralSib Bank, is occupied by the main bank of the Russian Federation - Sberbank, with the Pension Account Plus program. Despite the statements of this bank that all programs are created for the maximum benefit of their clients, the interest rate is still lower than that of the listed banks and is equal to 10%. Although a small initial amount of 1000 rubles and a short investment period, designed for 3 months or more, compensate for the profitability.

- MTS Bank offers a deposit at 9.9% for six months with a minimum investment of at least 5,000 rubles.

- The last three of this rating included the Bank of Moscow with a small deposit of 1000 rubles at 9.8% for 3 months.

- Bank YUGRA also decided to distinguish itself by creating the Social Choice pension investment program. The income in this case is based on 9.7% and is calculated for six months or more. The down payment is quite an impressive amount - 10 thousand rubles.

- The top ten best banks in terms of investment terms are closed by Promsvyazbank, which offers pension savings in the amount of 3,000 rubles for 6 months at 9.5%.

A pension type of deposit is a publicly available method of preserving and increasing your income over a short or long period. Even with small bets, you can choose a program that allows you to effectively increase your cash savings.

back to menu ↑

Types of bank deposits

Sberbank

The bank offers services to pensioners under the following conditions:

- the issue is free, no service fee is charged;

- 3.5% per annum is charged monthly on the balance;

- connection to the THANKS program (up to 0.5% of bonuses are awarded by the bank, up to 30% are given by partner companies);

- SMS notifications are free for the first 2 months, then 30 rubles per month.

Every month the client can withdraw up to 50,000 rubles without commission. If the limit is exceeded, the operation can be performed at the bank's cash desk by paying 0.5% of the amount over 50,000. You can withdraw up to 350,000 rubles per month.