It is worth saying that Rosgosstrakh, founded in 1921, is one of the oldest financial companies in the country, which inspires Russians with great confidence in the activities of the institution.

In the field of pension insurance, the organization offers 2 main services:

- compulsory pension insurance (OPI);

- concluding contracts for voluntary insurance (VPO and NPO).

Rosgosstrakh clients can maintain contact with the organization remotely - for this purpose, the depositor’s personal account is used, which allows, for example, to monitor the accrual of interest and resolve service-related issues online.

NPF Rosgosstrakh: login to your personal account

On August 17, 2020, NPF RGS became part of the consolidated fund of NPF LUKOIL-GARANT.

To authorize in the Internet service, use the password and pension certificate number sent via SMS or e-mail. If the client loses the access code, it will be necessary to click on a special link next to the authorization window and re-request the password. The new ID will be sent to the email address registered in the system.

How to join

The fund works in 2 directions:

- The individual NGO program is a financial instrument for providing an additional pension. The participant independently chooses the size of the contribution, the period of contribution, the size of the pension and the period for receiving it (term or lifelong), as well as the legal successor in the event of death.

- OPS program, in which the employer pays 22% of the wage fund for insurance premiums. The client can choose to form an insurance pension at a rate of 22% or a separate pension - 16% for insurance and 6% for funded. The insurance pension is taken into account in points, is not inherited and goes towards pension payments. Investment income accrues to the split pension; the amount gradually accumulates and can be inherited.

To join a non-state pension fund, you must visit the nearest office of the company and submit the following documents:

- application for membership;

- contract;

- passport;

- insurance certificate.

The signed agreement can be terminated at any time and you can receive the amount specified in the agreement.

As soon as the first contribution is made to a personal account, the citizen becomes a participant in the pension program and a client of the fund.

Pension contributions are paid in cash to the current account of the NPF:

- through any bank;

- from the depositor’s place of work through the accounting department;

- transfer via mail;

- depositing money into the fund's cash register.

Functionality of the personal account of NPF RGS

By creating an account in the personal account, a Rosgosstrakh client will be able to:

- Keep track of your savings. Thanks to the Internet service, a future pensioner can find out the status of the savings account at any time, as well as receive an extract from the history of money transfers to Rosgosstrakh.

- Control the profitability of the deposit. The user can request details of interest accrual for an arbitrary time period: for example, for the previous year.

- Receive an electronic contract. Thanks to your personal account, you can download an electronic version of the contract between the Rosgosstrakh pension fund and an individual, which will be confirmed with a digital signature and seal. The online service also allows you to order additional certificates from NPF Rosgosstrakh and download official forms of the organization.

- Find out the amount of future payments. The online service integrates a special calculator that allows you to get a rough idea of your future pension. It should be noted that to carry out calculations, the user does not need to manually “enter” any information into the fields of the calculator - the system will automatically analyze the terms of the contract and the volume of transfers.

- Stay up to date with the latest changes in pension legislation. In this case, the personal account plays the role of a kind of news feed. You can also get additional information about the activities of Rosgosstrakh in the online system.

The personal account has a pleasant interface with a minimalistic design, thanks to which any user can navigate the system without any problems. It is important that most blocks of text use a large, easy-to-read font.

Terms of cooperation

Today, the company offers clients to join a program called “Pension Plan”. The company’s employees, who actually developed this project, are confident that it will help Russian citizens maintain their usual standard of living after retirement. This is a significant advantage. Because, as you know, pensions in Russia are not as high as citizens would like. And that’s why many of them are delaying their retirement period as much as possible.

However, after concluding an agreement with the company, this problem will lose its relevance. But it must be remembered that the size of the funded part of the pension will depend entirely on the client’s salary. The main advantages of the program are considered to be:

- the ability to top up your account with any amount;

- no restrictions on the number of replenishments during the year;

- after reaching retirement age, the client will begin to receive a guaranteed payment of 2,000 rubles as an insured person;

- Mandatory payments can be received in equal parts over 10 years or for life.

Each client of the company who has entered into an agreement has the right to apply for a tax deduction. The tax deduction amount will be 13% of insurance premiums. However, it must be remembered that the tax base will be precisely the amount of insurance premiums. And therefore it should not be more than 120,000 rubles.

Registration in the personal account of Rosgosstrakh

It will not be possible to create a personal account account on your own: to access the online service, the client will have to submit an application to create a depositor account to the nearest branch of the non-state pension fund. It is important to note that it may take 1 month for your application to be processed. When the application is processed, the company’s client will receive a password from the profile on the Rosgosstrakh website to the mobile phone number (or email address) specified in the application. The depositor can notify the organization of the desire to register in the personal account at the time of opening a savings account.

Information about the fund

OJSC NPF RGS (Open Joint Stock Company Non-State Pension Fund Rosgosstrakh) was registered in 2002 and is a division of the largest insurance network Rosgosstrakh.

The Russian State Insurance Company in 1992 became the successor to the Soviet Gosstrakh of the RSFSR. The state block of shares was transferred in full to the organization’s balance sheet. Therefore, traditionally, October 6, 1921 is considered the founding day. During the period 1992-2010, Rosgosstrakh OJSC successfully purchased the assets of regional and federal insurance companies and became the owner of all rights and obligations to clients and partners.

The fund has a high level of public confidence, characterized by the “A++” indicator in the rating system. In the “Reliability” category of the “Financial Elite of Russia” award in 2020, the NPF was recognized as the best and showed excellent performance results over the previous year. In 2020, he became the winner of the “Fund of the Year in Technology and Innovation” award.

Based on the final performance indicators within the framework of the project “The Future of the Pension Market”, he was awarded the diplomas “For High Reliability” and “Growth Leader in the Pension Market”.

The company's activities are under strict state control, which includes:

- Bank of Russia;

- The Federal Tax Service;

- other government agencies.

Pension savings are guaranteed. The fund is included in the rights guarantee system, which is implemented by the Deposit Insurance Agency. The state of the investment portfolio is monitored every day by a specialized depository.

The company has a high level of profitability, thanks to an excellent marketing strategy, constant monitoring of the financial market and a well-thought-out investment mechanism.

Customer support service

If any problems arise with the deposit or the operation of the personal account, the user can contact technical support by calling a toll-free number or sending an email to the address. Also, a client of the company can order a call back: for this you will need to fill out a special form on the official website of Rosgosstrakh.

Rating formation indicators

To assess how reliable a company is, you need to look at its rating. This company has a fairly high rating. And this means that:

- The company's clients are more than 3 million citizens of the Russian Federation;

- The authorized capital of the organization is 164 billion rubles;

- the company has a wide distribution area throughout the Russian Federation (more than 3,500 branches);

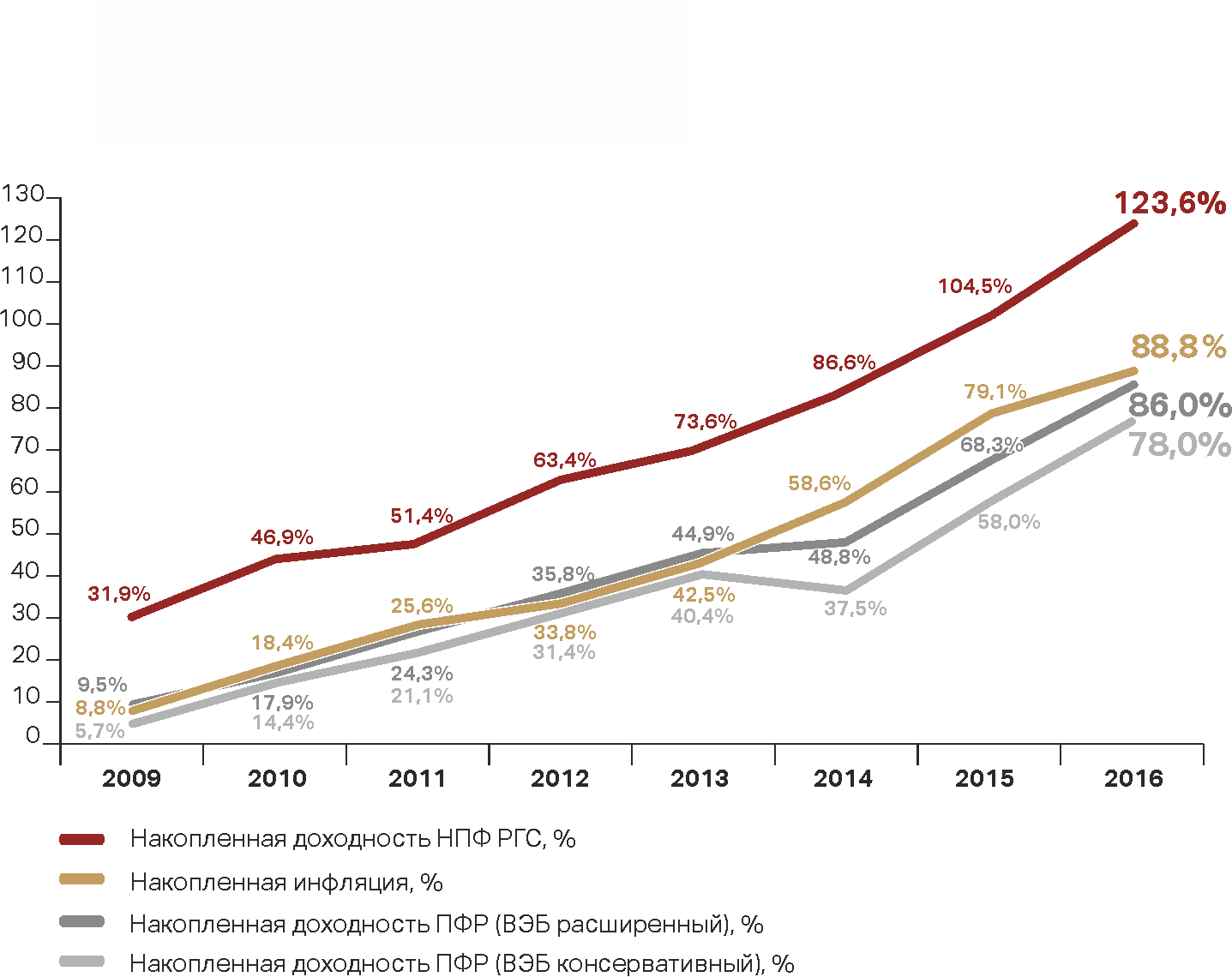

- the organization has a high level of profitability (more than 86% for the entire period).

Having studied the rating indicators, it becomes clear that this organization can really guarantee the safety of savings and a high percentage of profitability. In addition, the reliability of the company is also shown by the method of distribution of investment capital. Because only if there is a profitable and correct distribution of investment capital does it become possible to significantly increase income.

When considering the Rosgosstrakh company, it should be mentioned that its specialists have chosen the right tactics for distributing investments. Since more than half of the investments received were directed to bank deposits, and the rest are bonds. In addition, about 22% of funds are kept in a bank account.

Under what conditions is the funded part of the pension issued at Rosgosstrakh?

NPF “Rosgosstrakh” received permission from the Central Bank of Russia to accept deposits towards the formation of funded pensions for citizens. It belongs to the compulsory insurance system, and therefore future pensioners are guaranteed the right to receive a pension benefit upon reaching the legal age of 55 and 60 years for the female and male population, respectively. Payments made by the fund always arrive at the account of the insured persons in a timely manner.

Currently, it is assumed that the compulsory pension system in Russia will pay pensions in 2 ways:

- only insurance pension;

- insurance and funded pension (from 2020 these are two separate payments, and not components of one benefit).

The main advantage of joining the state program. Co-financing of pensions through the NPF “Rosgosstrakh” is an increase in cash investments. The depositor's funds are invested in some area of the economy, and the organization's financiers form an investment portfolio. This makes money “work” instead of just accumulating. As a result, the future pension will be formed not only from the investor’s insurance premiums, but also from investment income.

The pension savings program allows you to form savings through insurance payments in the amount of 6% of the investor’s total income and receive profit from investing funds. The conditions for participation in the program are as follows:

- You can start using services for forming a funded pension from the age of 14;

- independent choice of the term for depositing funds into the deposit account (duration – 10 years);

- free registration in the pension co-financing program.

If a person participating in the pension co-financing program has reached retirement age, but continues to work, for every 1 thousand rubles invested, the state will add 4 thousand rubles. The annual payment from the state cannot exceed 48 thousand rubles.

When a citizen invests an amount from 2 to 12 thousand rubles per year, the state doubles the money. Despite the small amounts, there are still benefits from participating in the program.

Advantages and disadvantages

Advantages of transferring funds to NPF Rosgosstrakh:

- the pension savings of the insured persons are protected - the policyholder, in the event of liquidation of the fund, will be reimbursed for all contributions and funds reflected in the NP account (including investment income);

- the profitability of the RGS significantly exceeds inflation (123.61% - the profitability of the NPF RGS, 88.8% - inflation - for the period from 2009 to 2016);

- the most convenient service - through your personal account you can download all necessary application forms and track the current status of your savings account online.

Flaws:

- according to the Expert RA rating agency, NPF RGS ranks 18th with a rating of ruBBB+ (stable forecast), which is not a very high figure;

- According to some information, employees of NPF RGS often enter into OPS agreements without the consent of clients.

So, NPF Rosgosstrakh is reliable and invests only in highly profitable sources. Clients do not have to worry about the safety of their savings - after all, the fund is a participant in the system of guaranteeing the rights of insured persons.

What is an insurance pension?

An insurance pension will be assigned to every citizen of the country, regardless of the length of the insurance period (and its presence as such) and the individual pension coefficients (IPC, “pension points”) accumulated over the cumulative periods of work. The funded pension depends on these two indicators. This type of pension is assigned:

- citizens who have reached retirement age (age pension);

- persons who were recognized as disabled by any of the three existing groups during a medical and social examination (disability pension);

- family members who have lost their breadwinner (survivor pension).

However, it is impossible to be calm about your financial situation in the future, knowing about a guaranteed insurance pension. Its amount is approved annually based on the regional subsistence level. In 2020, the amount of the insurance pension does not exceed 5 thousand rubles.