NPF Telecom-Soyuz is a non-state pension fund operating since 1996. At the moment, it is one of the largest organizations in the Russian Federation in its segment.

The structure is controlled by O1 Group; since 2014 it has operated as an OJSC. The personal account of NPF Telecom-Soyuz allows clients to monitor the status of their savings and perform certain operations.

Official website of NPF "Telecom-Soyuz"

As mentioned above, this pension fund is a reliable deposit partner, as it has existed on the financial market for a relatively long time. The fund also has its own website, which provides all the information of interest to investors and more. But the most significant factors of any fund are two points - the fund’s profitability and also the reliability rating.

Each of them plays a key role in the fund and repeatedly influences the entire system of the fund as a whole. Now let's take a closer look at these points regarding him.

Profitability

Profitability - the most important component is that it depends not only on the amount of money that will be received by depositing money, but also on the percentage of withdrawal of funds and income received. According to statistics from 2020, the percentage return on this pension fund is 1.03% . These data are quite good, and also provide an excellent guarantee of earnings from invested funds and an increase in pension.

Reliability rating

The reliability rating is another important fact, which also plays a key role when choosing a pension fund. The reliability rating is a kind of guarantor of the safety of your invested funds. It is very important to thoroughly study this point in particular and familiarize yourself with the statistics, since it is this that acts as a guarantee for receiving income, the savings portion and profit from investments. This pension fund was assigned the highest reliability rating A++ , which means the highest.

It is worth noting once again that when choosing a place for deposits, you need to familiarize yourself in particular with these two points, which have already been mentioned.

Non-state pension fund “Telecom Union”

Whatever changes occur in society and the economy, a reliable and profitable investment, financial security and protection will always be relevant. Non-state pension funds (NPFs) can be considered a proven way to allocate finances.

Operating since 1996, it is a large and popular non-state pension fund.

The license to operate is unlimited, issued in 2009. The company is large, national.

The central office is in Moscow, branches are in seven regions of Russia.

Previously, the majority of Telecom-Soyuz clients were employees of Rostelecom and Russian Post.

Advantages:

- investment activities of the company (the possibility of clients receiving an increased funded pension);

- protection of savings (if the fund is liquidated, the state guarantees the return of funds);

- long life of the fund (more than twenty years);

- convenient functionality (opportunities: choose an accrual scheme, appoint an heir; influence the amount of invested funds; convenience in transferring savings; heirs - receive funds accumulated by the client of the fund).

- good reliability indicators;

- transparency and openness of activities (the ability to obtain any information upon request; read the reports and evaluate the work of the fund)

Flaws:

- high-risk investments.

- recently - low profitability;

- it is difficult to predict the amount of savings;

- the need to pay taxes when receiving savings;

The main performance indicators of non-state pension funds can be considered profitability and reliability.

Subsequently, their share was reduced to half, due to the fund attracting clients from other sectors of the economy. Download for viewing and printing: Knowing the pros and cons of its work will help you evaluate the work of the NPF in order to make a decision on cooperation.

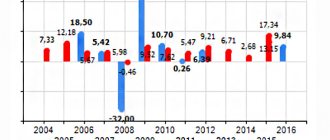

Change in investment income from 2010 to 2017

In the period 2010-2016, the fund provided good returns (from 2 to 14%), thanks to which it became one of the top ten NPFs in Russia.

Interesting! In 2020, revenues fell sharply.

The reason is that Telecom-Soyuz invested in banks that suffered as a result of the program for the rehabilitation of the Russian banking system. According to the reporting for 2020, the fund is restoring economic indicators. Thus, against the backdrop of losses in 2017, in the 1st quarter of last year, income of more than 214 million was received.

rub. Over the years of its existence, the fund has acquired the status of a stable, responsible organization.

Information on reliability ratings in different years:

- 2015, by the Rus-Rating agency - high rating A+ on the national scale, average BB+ on the international scale; NRA - maximum reliability AAA;

- 2013, Expert RA confirmed an exceptionally high A++ rating, the National Rating Agency (NRA) confirmed the most reliable AAA rating;

- 2017, according to the NRA, the AAA rating was confirmed.

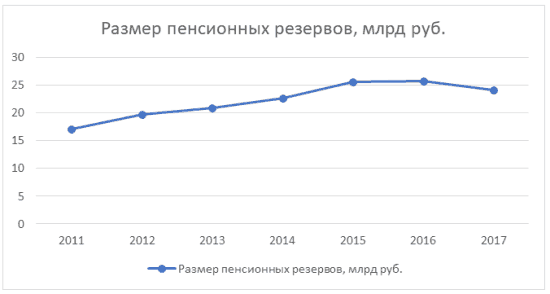

In the period 2011-2016, the volume of the fund’s savings increased (from 16 to almost 24 billion).

rubles), in 2020 there was a slight decrease (to 22 billion).

How to join?

Like any other non-state pension fund, it requires the signing of an agreement or contract on both sides to begin cooperation and start working together. But before signing the contract, you also need to provide the necessary documents that will also be required when the parties agree:

- Passport or photocopy of passport;

- SNILS and its availability.

If one of the documents is missing, it will be impossible to sign the agreement. For this reason, you need to prepare them and then contact the office.

Personal Area

The official website also offers a service called a personal account. A comfortable thing for those who do not like to leave home often, as it allows you to manage funds using your personal account. It is possible to track completed transactions, transfers and investments at home. It is also now possible to check your balance. Your personal account is your personal assistant for managing deposits, investments and payments. And now a little more about some of its capabilities.

Possibilities

Now, in order to invest funds, there is no need to contact the office and personally attend operations. There is a remote control function from home.

How to find out your savings?

To find out the amount of the accumulated portion, you should go to your personal account and check the balance. The history of deposits and transfers will also be available for viewing.

Telecom-Soyuz NPF hotline telephone number

If you still have questions that you have not received an answer to, you can call the hotline 8 800 200 08 09 , which is listed on our official website. Our employees will answer your questions and help resolve controversial situations.

Attention! Due to recent changes in legislation, the legal information in this article may be out of date! Our lawyer can advise you free of charge - write a question in the form below:

NPF "Telecom-Soyuz" is a non-state pension fund formed in 1996.

The organization was the first to provide non-state pension provision. The owner is the investment company O1 Group. Today Telecom-Soyuz is the main industry fund engaged in non-state pension provision for employees in the telecommunications sector. The fund is rated by ten competing companies and is highly reliable. The fund has a developed regional network. Branches are located in seven federal districts. For the convenience of users, a personal account is provided. Through it, pension recipients have the right to the status of pension accruals, receive detailed reporting, and choose the method of transferring funds.

general characteristics

The non-state pension fund "Telecom-Soyuz" (hereinafter referred to as NPF) is one of the industry organizations for pension provision. The owner of the company is an investment organization called O1 Group.

The Foundation has the following contact information:

- Main office – Moscow, Tsvetnoy Boulevard, building 2;

- Telephone: +7(495)9372748, +7(495)9372747;

- Hotline – 8(800)2000809;

- Website – www.npfts.ru;

- License – No. 94/2 dated January 27, 2009. Validity period – unlimited, TIN – 7825349490;

- Constituent documentation – Charter.

The main clients of NPFs are employees of such organizations as Rostelecom and Russian Post. At the same time, the fund operates in seven districts.

In addition, it is worth considering criteria such as:

- Number of clients – 455,000 people.

- Pension reserve – 24 billion.

- Savings -1.5 billion.

- Own property – 31 billion.

- 137,000 people receive a pension.

Features of NPF "Telecom-Soyuz"

Main advantages of the fund

- Long work; High reliability indicator; Possibility to choose the method of receiving money; Selecting an accrual scheme.

- Low profitability indicators; Inability to determine the amount of future payments; Investment risk.

Today, the work of non-state pension funds is an important requirement of the Russian population. Many people want to choose their own retirement savings methods. The modern NFP market is unstable, however, large organizations have an increased likelihood of successfully continuing their work and paying savings to participants.

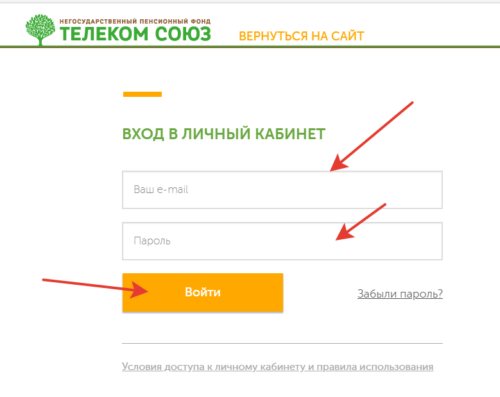

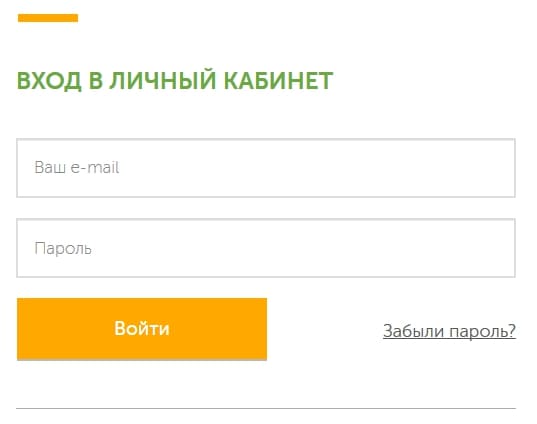

NPF Telecom-Soyuz: login and registration of your personal account

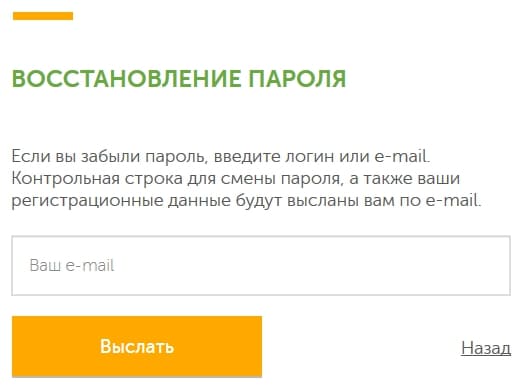

Before using your account, please pre-register. The rules of the Telecom-Soyuz Foundation prohibit remote registration. To create an account, visit the fund's representative office with a Russian passport and SNILS number. Show the required documents to the staff and fill out the application. After successful registration, employees will send an authorization password via email. To log in, visit the organization’s main page, enter your email with a password and click the login button.

If you can't log in, carefully check your IDs. The user may have made a mistake or selected the wrong keyboard layout. In some cases, the password is forgotten. To restore access, click the “Forgot your password” link and enter your login. The system will soon send a new access key by email.

Contacts

[Total: 0 Average: 0/5]

NPF Telecom-Soyuz is a non-state pension fund operating since 1996. At the moment, it is one of the largest organizations in the Russian Federation in its segment.

The structure is controlled by O1 Group; since 2014 it has operated as an OJSC. The personal account of NPF Telecom-Soyuz allows clients to monitor the status of their savings and perform certain operations.

Who is the owner of the fund

The company's shareholders are:

- “Financial Group Future” – 99.86%;

- PJSC Rostelecom – 0.14%.

The beneficial owner of the fund is entrepreneur Boris Mints, who owns a controlling stake of 76.3% (worth 6.1 billion rubles). The businessman acquired NPF Telecom-Soyuz in 2013. The remaining number of securities is distributed among minority shareholders.

Briefly. Control over the company's activities is carried out by the Internal Control Service, the Fund's Board of Trustees, and the Central Bank of the Russian Federation.

General Director of the NPF is Pavel Tkachenko.

More information about another leader of the Russian NPF market in the material: “Review of the non-state pension fund “BLAGOSOSTOYANIE” - NPF Russian Railways.”

Foundation website

Corporate and private clients can use it. All necessary information can be found on the website www.npfts.ru. For companies, it is proposed to develop pension programs taking into account the characteristics of the organization. This approach helps motivate staff and receive tax benefits.

Helpful information! Legal entities interested in cooperation with NPFs must fill out a form. It can be found in the corresponding section of the site along with instructions for filling it out.

Awards and ratings

NPF Telecom-Soyuz became known to the public after major agreements on the launch of a corporate pension program for and Russian Post in 2004 and 2009, respectively. Then the Expert Ra agency assessed the reliability of the fund, rating it as A+ (high).

Since 2020, the rating of this agency has been withdrawn - Telecom-Soyuz has ceased to support Expert Ra, although before this NPF was assigned A++ (the highest reliability rating), the forecast is developing.

For several years, the NRA (National Rating Agency) has assessed the company as a reliable market participant with a high level of service. In 2017, the AAA rating and stable forecast were confirmed again.

Among the awards are the following:

- diplomas received at the “Financial Elite of Russia 2005-2010” award in the categories “Dynamics of Development” and “Company of the Five Years”;

- “Company of the Year 2010” at the National Business Awards;

- diploma received at the “Financial Elite of Russia-2011” award in the “Impeccable Reputation” category;

- diploma received at the “Financial Elite of Russia-2011” award in the “Company of the Year” category, etc.

Services to clients

NPF offers citizens non-state pension programs with a number of advantages:

- The ability to increase your future pension now;

- Transfer of accumulated funds by inheritance;

- Selecting the amount of contributions and the frequency of their payment;

- Determination of the conditions and period for payment of pensions.

To become a participant in such a program, you must contact one of the Telecom-Soyuz branches and conclude an agreement. For this you will need a passport and SNILS.

Number of clients

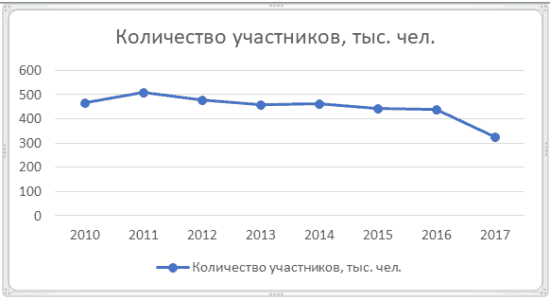

The level of profitability of NPF Telecom-Soyuz, in accordance with the above data, is highly volatile.

Interesting fact! After leading in terms of profitability in 2009-2010. There was an influx of new clients, but subsequent unstable performance results led to a gradual decline in the number of participants.

Table 4. Total number of clients in NPF Telecom-Soyuz in 2010-2017. Source: npf.investfunds.ru

| Year | Number of insured persons, people. | Number of participants, people |

| 2017 | 17.4 thousand | 309.6 thousand |

| 2016 | 18.1 thousand | 423 thousand |

| 2015 | 19.4 thousand | 423.8 thousand |

| 2014 | 20.9 thousand | 443.2 thousand |

| 2013 | 20.9 thousand | 438.6 thousand |

| 2012 | 21.6 thousand | 455.6 thousand |

| 2011 | 21.7 thousand | 489.6 thousand |

| 2010 | 19.7 thousand | 458.4 thousand |

Graph 1. Dynamics of changes in the number of clients of NPF Telecom-Soyuz in 2010-2016.

Judging by the reporting for January-March 2020, the company is restoring its financial activity indicators after last year’s decline - a total income of 212.4 million rubles was received. against a loss of -172 million rubles. for the same period in 2020

Reliability and profitability level

One of the most important characteristics of NPF is its reliability. The most authoritative agencies assess the performance of Telecom-Soyuz very highly. Thus, in 2011, RA Expert raised the fund’s rating to the maximum A++.

The NRA also awarded the organization its highest rating of AAA, with both ratings reaffirmed in 2012. However, the Expert agency subsequently withdrew its rating.

The fund's return for 2007-2012 was 56%. The highest figure was achieved in 1009 -25.74%.

Information disclosure

From 2011 to 2020 The total amount of savings of Telecom-Soyuz has been steadily increasing; in 2017, there was a slight decrease.

Table 2. The size of pension reserves of NPF Telecom-Soyuz in 2011-2017.

Source: npf.investfunds.ru

| Year | Amount of funds under OPS, rub. | Amount of funds for NGOs, rub. |

| 2017 | 1.65 billion | 22.4 billion |

| 2016 | 1.85 billion | 23.9 billion |

| 2015 | 1.88 billion | 23.7 billion |

| 2014 | 1.71 billion | 20.9 billion |

| 2013 | 1.69 billion | 19.2 billion |

| 2012 | 1.45 billion | 18.3 billion |

| 2011 | 1.14 billion | 16 billion |

Chart 1. Dynamics of changes in the size of pension reserves of NPF Telecom-Soyuz in 2010-2016.

In 2010-2016 Telecom-Soyuz provided average returns from investing funds entrusted to clients.

Interesting fact! The situation changed in 2017 - the fund was among the outsiders in terms of profitability - it fell due to the improvement of the Russian banking system - those banks in which the fund held funds fell under it.

As of March 2020, the return was 11.57%.

Table 3. Change in profitability from investing savings of NPF “Telecom-Soyuz” in 2010-2017. Source: npf.investfunds.ru

| Year | Profitability |

| 2017 | 0,12% |

| 2016 | 9,05% |

| 2015 | 8,42% |

| 2014 | 2,29% |

| 2013 | 5,6% |

| 2012 | 8,45% |

| 2011 | 2,25% |

| 2010 | 14,91% |

Graph 2. Dynamics of changes in profitability from investing savings of NPF “Telecom-Soyuz” in 2010-2017.

User account

On the official website of NPF Telecom-Soyuz, your personal account can be found via the link on the right on the main page or at lk.npfts.ru. For registered users, login is carried out in the traditional way: by entering a login and password.

Important! You can gain access to your personal account only after contacting a branch of the organization or one of its representatives. You must have an identification document with you. The access password is sent to your email.

About the fund

NPF Telecom-Soyuz, registered in 1996, was considered an industry fund for communications workers.

That's why some consider it a pocket fund of Soyuztelecom, the communications company. However, the non-state pension fund is the property of Boris Mints’ group (FG “Future”). The purchase took place in 2013. NPF Telecom-Soyuz was considered the largest fund in terms of the size of its own assets. But the money was invested in illiquid securities. At the same time, the fund managed to pass the inspection of the regulator (Central Bank of the Russian Federation) and was officially accepted into the guarantee system.

In 2020, the Future Financial Group experienced financial problems. Since pension funds have always been viewed as a source of “long-term” (and sometimes free) money, the funds of NPF Telecom-Soyuz investors were directed to risky financial transactions (or fraud).

For almost 3 years there has been talk that the fund’s license will be revoked, but... NPF Telecom-Soyuz works, continuing to distribute losses to depositors’ accounts.

By the way, do not look for this information on the official website: in the “News” section there are standard holiday greetings (sounds like mockery).

Information

| Full title | JSC NPF Telecom-Soyuz | ||

| License | № 94/2 | ||

| head office | Moscow, Tsvetnoy Boulevard, 2 | ||

| Official site | https://www.npfts.ru | ||

| Contacts | Hotline phone number E-mail | ||

| Founders | OJSC Svyazinvest, PJSC Rostelecom, CJSC Telecominvest, OJSC RTK-Leasing, CJSC Gamma Capital, JSC KFP Finance | ||

| Shareholders | PJSC FG Future (99.8591% of shares), PJSC Rostelecom (0.1409%) | ||

| Legal entity | Pension savings | "REGION Trust" | |

| Pension reserves | "REGION Trust", "Agana". | ||

| Depository | JSC "Independent Specialized Depository" | ||

| Managers, "Agana". | |||

| Branches and regional offices |

| ||

| What services does it provide? |

| ||

Statistics

| Volume of pension savings/reserves, thousand rubles. | 1 405 184,00279/20 192 063,13936 |

| Amount of pensions paid, compulsory pensions/NPO thousand rubles. | 4522,83108/785 130,8317 |

| Number of clients | 15 719 |

| Profitability | (-13.05) minus all remunerations (Central Bank data for the 2nd quarter of 2019) |

| Reliability rating | Not ordered |

| Awards mentioned on the official website | From the “Financial Elite of Russia”:

From Expert Ra (2013):

National Business Award “Company of the Year 2010” |

Terms and service

| fund programs | OPS and NGOs are offered for individuals; for individual programs on the official website they are sent to one of the branches. |

| entry conditions | Consent to automated data processing |

| types of payments | Lifetime, fixed-term, to legal successors |

| user's personal account on the official website | https://lk.npfts.ru/auth/ |

| mobile app | Not developed, but the official website template is adapted for smartphones |

How to enter into and formalize an agreement with the fund: application form

Despite the losses resulting from the work of NPF Telecom-Soyuz, work to attract new clients continues.

An agreement with a non-state pension fund is concluded in one of the branches (a passport and SNILS are required). On the official website of NPF Telecom-Soyuz you are invited to use the feedback form (at the very bottom of the page):

- for NGOs;

- for OPS.

TO

Unfortunately, the application form and sample contract are not posted on the official website. You can try contacting the hotline with a request to send sample documents by email. Or take a walk to the nearest branch.

How to transfer pension

Transferring a pension from fund to fund is the same for any NPF.

- You enter into an agreement with NPF Telecom-Soyuz.

- Terminate the agreement with the previous non-state pension fund. Important: read the contract carefully so as not to lose your savings!

- Apply for transfer to the Pension Fund of the Russian Federation at your place of residence.

How to find out your savings

Choose one of the available options:

- register on the official website, track savings in your personal account;

- register on the State Services website and track your future pension there;

- contact the central office of NPF Telecom-Soyuz with a written application to provide an extract from an individual pension account.

How to terminate an agreement with a non-state pension fund

Details about the termination of the contract with NPF Telecom-Soyuz can be found on the official website.

Personal income tax refund

The official website of NPF Telecom-Soyuz published a large amount of information on tax deductions, but forgot to consider the issues of personal income tax refund.

To return part of your hard-earned money, you will have to contact the tax office at your place of residence. It’s easier and faster to register on the official website of the tax office.

Then download the document forms from there, fill them out and send them, attaching the necessary scanned photocopies.

Early retirement

Did you manage to retire early? Congratulations. You will receive a social benefit pension. But the funded one will have to wait until retirement age (unless otherwise specifically agreed upon in the agreement with NPF Telecom-Soyuz).

Payment of fees

Clients of NPF Telecom-Soyuz are required to regularly pay no less than the minimum amount specified in the agreement. If it is possible to increase the payment, you need to apply to the accounting department at your place of work (if the transfers are carried out by the salary department). Or continue to pay yourself through the bank.

Before transferring, I recommend checking the details on the page.

Termination of an agreement

To terminate an agreement with a non-state pension fund, the standard procedure applies:

- Choosing the direction of transfer of savings (another non-state fund or Pension Fund);

- Filling out an application in a new organization;

- Notification of the Pension Fund about the transition;

- Signing an agreement indicating the heirs.

The former fund does not have to be notified of its decision; this function is performed by the Pension Fund.

Reviews and contact information

Despite rumors that periodically appear on the Internet about the revocation of the fund’s license, it still operates legally. The fund is not very popular among insured persons, so there are few reviews about it.

All necessary information about the fund’s services can be obtained from the hotline number. The head office is located in Moscow on Tsvetnoy Boulevard, 2, with branches in several cities.

Free help from a Pension Lawyer Legal advice

on deprivation of rights, road accidents, insurance compensation, driving into the oncoming lane, and other automotive issues.

Daily from 9.00 to 21.00

Moscow and Moscow region +7 (499) 653-60-72 ext. 945 St. Petersburg and LO+7 ext. 644 Free call within Russia8-800-511-20-36 —> Sources used:

- https://pfrf-kabinet.ru/lk/npf-telekom-soyuz.html

- https://lichniy-kabinet.info/telekom-soyuz/

- https://ru-npf.ru/telekom-soyuz-lichnyy-kabinet/

alishavalenko.ru

Moscow, Tsvetnoy Boulevard, no.

We recommend reading: Application for employment of a pensioner under a fixed-term employment contract

Important Cherepovets, Lunacharsky Ave., 53A. Joint Stock Company Non-State Pension Fund Telecom-Soyuz is a participant in the system of guaranteeing the rights of insured persons.

2., by phone and on the website www.npfts.ru.

Important It is possible to increase or decrease income from placing pension reserves and investing pension savings.

Past investment performance does not determine future returns. Info The state does not guarantee the profitability of placing pension reserves and investing pension savings.

It is necessary to carefully read the fund's charter, its pension and insurance rules before concluding a pension agreement or transferring pension savings to the fund.

- Find out about NGOs

For individuals who wish to conclude an agreement

- Non-state pension provision

- Mandatory pension insurance

For companies wishing to conclude an agreement

- Corporate pension programs

- Non-state pension provision

NPF "Telecom-Soyuz"

rubles; non-state pension support was provided to almost 500 thousand.

Human; pension reserves amounted to 19 billion rubles; the amount of pension savings is 21 thousand.

depositors - 1.7 million rubles.

Investments of NPF funds are carried out in accordance with the current legislation of the Russian Federation under the control of supervisory authorities.

A well-thought-out investment strategy is aimed at increasing pension reserves and savings through investments in various assets. Risk minimization is achieved by working with reliable partners.

Pension reserves as of the beginning of 2014 were distributed mainly for the purchase of corporate bonds - 79.12%, 7.29% were invested in mutual funds, 7.07% were placed on bank deposits, the rest of the funds went to purchase bonds: state, subfederal and municipal . The profitability of pension reserves for 2009–2013 increased