Information about the fund

- Full name of the organization (name of NPF): Joint Stock Company Non-State Pension Fund "Alliance"

- Status in 2020: Active - Valid license

- License number: 415

The non-state pension fund Alliance has been operating under this name since 2010. The fund is part of the Allianz group of financial companies, whose history began in 1890 in Germany. The company's many years of activity have allowed it to achieve considerable success in the non-state pension fund market. Among the services provided by PF Alliance are NGOs, OPS, a co-financing program and corporate pension programs.

NPF Alliance acquired by Rostelecom

In 2016, a controlling stake in the Alliance pension fund was purchased by Rostelecom; in 2017 and subsequent years, the fund will be used to provide social programs for retiring Rostelecom employees. The fund's central office is located in the Federation Tower in Moscow City.

Affiliated funds

No affiliated funds

Requisites

View details

INN 7703379402 KPP 771001001 OGRN 1157700006199 OKATO 45286585000 OKTMO 45382000000 OKPO 72095845 OKVED 65.30 OKFS 16 OKOGU 4210014 OKOPF 122 67

Bank details for settlements under OUD Account number 40701810738180000083 in PJSC Sberbank, Moscow Account number 30101810400000000225, BIC 044525225

Bank details for settlements on pension reserves (NPO) Account number 40701810038180000084 in PJSC Sberbank, Moscow Account number 30101810400000000225, BIC 044525225

Bank details for settlements on pension savings (OPS) Account number 40701810526800000088 in VTB (PJSC) Moscow Account number 30101810700000000187, BIC 044525187

Mobile app

To improve the ease of use of the service and to make the Alliance personal account accessible to a wider audience, the company has released a special mobile application. It allows you to access the main functions of your personal account even when away from your computer.

The mobile application allows:

- View the status of accounts under agreements concluded with the pension fund;

- Ask questions to support staff;

- View information about the location of the nearest branches of the Alliance pension fund on the map;

- Request the generation of reports on the status of the pension account (with subsequent automatic sending by email).

The application is available for download in the official AppStore and GooglePlay stores. The application is distributed free of charge; login is also carried out using your SNILS number and password. If you have not yet registered an account on the site, you can do so directly in the application.

Contacts

Official website of NPF Alliance

https://www.npfalliance.ru/

The site itself has been updated and meets modern user expectations, with a mobile version and an easy-to-download desktop version. The pages contain a pension calculator; all other necessary information is available to anyone: documents, reporting, answers to questions, a list of branches.

Email mail

Address

Russia, 125009, Moscow, Nikitsky lane, 7 building 1

Hotline number

Unified information service - 8 800 707 0357

Phone/Fax +7 495 974 0325

How to join?

A pensioner can become a member of a non-state pension fund by contacting the organization’s office or through the official portal. To conclude an agreement through the website, you need a passport and SNILS. The user must fill out a special form using the assistance of a Foundation employee.

The form must provide the following information:

- FULL NAME;

- series and number of the identity document;

- residence address;

- SNILS number;

- contact information: phone number and email.

An individual can open a personal account by providing:

- copies of a document confirming the identity of the applicant;

- SNILS;

- bank account number to which payments will be made.

Important! To enter into an agreement, documents may need to be notarized.

Statistics of NPF Alliance: rating of reliability and profitability

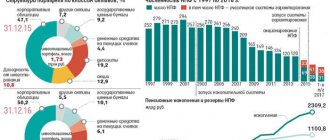

According to the Central Bank of the Russian Federation from the reporting “Main performance indicators of non-state pension funds” as of the date: 01/01/2020

Fund assets (thousand rubles): 7939229.61

Statistics on NPO (non-state pension provision) as of 01/01/2020

- Total volume of pension reserves (thousand rubles): 6839607.40

- Total number of participants (people): 57073

- Participants receiving a pension (persons): 3288

- Total amount of pensions paid under NPO (thousand rubles): 82603.14

Statistics on compulsory pension insurance (compulsory pension insurance) as of 01/01/2020

- Pension savings (thousand rubles, market value): 836086.43

- Number of insured persons (people): 4245

- Participants receiving a pension under compulsory pension insurance (persons): 102

- Amount of pension payments under compulsory pension insurance (thousand rubles): 2733.06

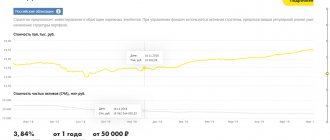

Profitability of pension savings

Current profitability

Minus remuneration for management companies, specialized depository and fund.

- Profitability of placing funds from pension reserves (NPO): 11.81%

- Return on investment of pension savings (OPS): 10.76%

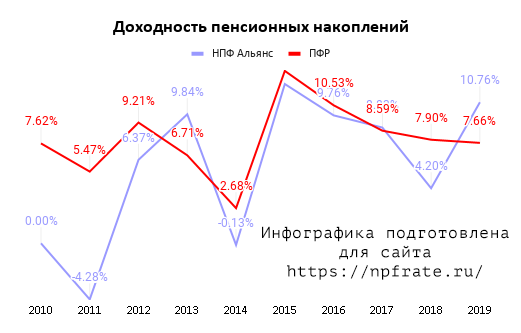

Profitability chart

Data on the profitability of NPF Alliance in 2020 (as of 01/01/2020), including information for the previous 10 years in comparison with the profitability of the Pension Fund of Russia (VEB):

Yield comparison table

| Year | NPF Alliance | Pension Fund |

| 2010 | 0.00% | 7.62% |

| 2011 | -4.28% | 5.47% |

| 2012 | 6.37% | 9.21% |

| 2013 | 9.84% | 6.71% |

| 2014 | -0.1% | 2.68% |

| 2015 | 12.15% | 13.15% |

| 2016 | 9.76% | 10.53% |

| 2017 | 8.83% | 8.59% |

| 2018 | 4.20% | 7.90% |

| 2019 | 10.76% | 7.66% |

Personal account features

Your personal account provides a number of standard features:

- View current information. For example, your personal account will display your name and the status of your current position in the company. You can view the characteristics in the relevant sections.

- Management of functions and tools. Connecting, disabling functions, managing capabilities and much more - all this can be done in your personal account.

- Navigate through sections and receive up-to-date information, possibly news, notifications.

- Replacing data, entering other information for correct display and use of company capabilities.

The capabilities of the personal account of NPF Alliance (Rostelecom) may change periodically - this depends on changes and innovations that periodically occur in the company.

— To ask your question, use the form below.

Official website of NPF "Alliance"

You can open the NPF portal by going to https://npfalliance.ru/.

Personal Area

To authorize the account, the client needs to follow the link https://lk.npfalliance.ru/ and fill out the form by entering the login (SNILS) and password.

Using an account on the website, the client will be able to:

- track the growth of your savings;

- obtain the necessary documents for a certain period;

- request a consultation with a Foundation employee.

Termination of an agreement

The agreement is considered terminated if:

- the fund has fulfilled the obligations assumed in the agreement with the client;

- the citizen died (the company was liquidated), and the heirs received his pension capital;

- the client transferred his savings to another non-state pension fund.

Advantages and disadvantages

To increase the return on savings, the Fund invests available funds in:

- bonds of business companies;

- government securities;

- shares of enterprises and other assets.

It is more profitable for legal entities to cooperate with non-state pension funds, since this allows them to reduce the income tax rate and reduce the amount of payments to the Pension Fund from 30% to 12%.

One of the disadvantages is that the Fund is seriously affected by the general economic situation in the country. Most of the investments go to the purchase of assets owned by the state, which is why profitability directly depends on the stock and securities market.

Random connections with non-state pension funds in Russia

Good afternoon.

Back in 1998, Federal Law No. 75 dated May 7, 1998 “ON NON-STATE PENSION FUNDS” was adopted by the State Duma and approved by the Federation Council. That year, I personally was a cadet at a military school, I studied well and excellently, and this year, for me personally, was remembered by the information about the default at the moment when we were at field training. I remember an ensign from a food warehouse who came from Moscow and was very sad about the sharply increased cost of LM cigarettes.

I also remember this year as the first military contract I concluded...

But I didn’t even think that this year would come back to haunt me many years later, when I, already a certified lawyer in the second higher education, would be faced with that formation in the form of a non-state pension fund, which was born thanks to the law adopted back in 1998, which I remember as a default , ensign and contract.

I got acquainted with one of the NPFs, the law on their activities and other federal laws in this area quite normally. Having uploaded in April 2020 on the State Services website information about the status of the individual personal account of the insured person with the Pension Fund of the Russian Federation in paragraph 4, I saw that the insurer of my savings has been, since December 6, 2018, some NPF "Neftegarant" and then the Pension Fund of the Russian Federation in connection with the early transition seized in accordance with Art. 34.1 Federal Law-111 dated July 24, 2002 “On investing funds to finance funded pensions in the Russian Federation” more than 50 thousand rubles of investment funds. I started to figure it out, since I never had any intention of transferring anywhere from my native Pension Fund. One can say that I completely and completely trust him with my future pension and the savings that I, being already the owner of the business, have been sending myself there for many years. My path turned out to be long and thorny, but first things first:

Based on the fact that I am a Muscovite, the first thing I did was go to our territorial district Pension Fund to find out what kind of NPF Neftegarant was and how I ended up there. But I didn’t receive any answers, no one was able to give such information, and I was sent there to the Main Directorate of the Pension Fund of the Russian Federation No. 3 for Moscow and the Moscow Region (on Volgogradsky Prospect), explaining that there I would receive all the answers;

Arriving at the above mentioned GU, I went straight to the manager with questions, but settled on the secretary, who asked me to write a statement addressed to the manager with a request to provide the necessary information. No sooner said than done. I wrote there asking how, when and why the accumulated money from my funded part of my pension ended up in some kind of non-state pension fund. In my application, I asked for a response to be sent to the specified email and registration address. Well done here - the next day I received an answer by email. The answer describes in detail that I entered into an agreement with the NPF Soglasie (another NPF) in 2020 and sent an application to the Pension Fund with a request to transfer my pension savings to this NPF.

It’s good that I’m quite a sociable comrade and in a conversation in Volgogradka with Pension Fund employees I received unofficial information that it turns out that my application for transfer was sent to the Pension Fund for the Republic of Tatarstan and all the information is there. An interesting move: I am a Muscovite, and I am submitting an application to Tatarstan. Naturally, I immediately write a request for information to Kazan and at the same time clarify similar information with a request to provide a contract, duly certified and an application in the Pension Fund of the Russian Federation No. 3 for Moscow and Moscow Region. Plus, I officially request from NPF Neftegarant (as it turns out, this is the legal successor of NPF Soglasie, which merged it as part of the reorganization) for an answer to the questions that concern me and a duly certified copy of the OPS agreement;

The cold summer of 2020 has arrived. I receive answers in about a month:

-PFR in Moscow - go to Kazan,

-NPF "Neftegarant" (with the Rosneft logo on the header of the letter) - a description of how the money ended up with them, that everything is legal, if something doesn’t suit you, then go to court, but know that we are one of the coolest in country, tens of thousands of people (almost hundreds) entrusted us with their money and blah blah further. But well done - they attached a copy of the OPS agreement with an obviously fake signature and not my phone number.

- UPFR for the Republic of Tatarstan - within the framework of a pilot project that operated in 2020, you received a signed enhanced qualified digital signature, which was issued by a certain CA LLC "Aksikom" and attached an download from the program. Request all statements and consents to the processing of personal data from them.

Well, I think we need to move on. I sent a request to this LLC "Aksicom" (by the way, registered and actually located extremely close to the place of registration of the NPF "Neftegarant - Evolution") with a request to provide me with the validity of issuing an electronic digital signature in my name, as well as all the statements and consents necessary for this. I'm waiting for an answer. In order not to waste time, I think I should inform law enforcement agencies and report such a crime. I decided to start with the territorial police department at my place of residence. I wrote a statement about fraud, they accepted it, smiled at the duty desk, gave me a KUS and told me to wait. The answer arrived in about a month along with the answer from Aksicom LLC and, not surprisingly, local law enforcement officers sent the material to the local police officer (who is already responsible for everything), who wrote me a refusal due to the absence of a crime and if you believe that your rights have been violated - go to court. Naturally, I appealed this refusal to the prosecutor’s office, since the police department should have sent him to the Department of Economic Crimes, and not to the Criminal Investigation Department. Of course, the prosecutor’s office wrote to me that the refusal was unfounded, that they would sort it out, that they would restore my violated rights, but then more interesting events began to happen and somehow this restoration of my rights “perished” somewhere in the outskirts of the Ministry of Internal Affairs department.

A response came from Aksicom LLC, in which it was written that yes, it was one of our full-time employees who prepared the digital signature for you, but we had an agreement with a certain trusted representative of Orlan Pension Broker LLC (TIN 7722386130), he was the source of the provision personal information about you and should have provided documents (applications and consent to the processing of personal data), but in violation of the terms of the contract, he did not. All our efforts and repeated appeals to them did not lead to results. Moreover, we also gave him access to filling out forms for citizens and interacting with Pension Fund authorities as part of a pilot project about which they wrote to me from Kazan. Yes...moreover, according to the data on the website of the Federal Tax Service (as of July 4, 2019), Pension Broker Orlan LLC was liquidated for more than a year (record dated April 10, 2018), and this broker was registered on December 19, 2016. Those. It flew for less than a year and a half and perhaps did not even submit reports for 2017. Moreover, the documents I requested on the basis of which the digital signature was issued were not even sent to me in copies. They didn’t send anything at all in the first response, they only wrote information from which only one thing is clear: it’s not us, but them - go to them, but they’re no longer there. Moreover, I looked on the website of the Arbitration Court for this Orlan - it turned out that at the end of 2020 he recovered from a certain individual entrepreneur O.V. Charkin. (TIN 501905441423) almost 550 thousand in unjust enrichment. And most importantly for what - for the obligations of O.V. Charkin. for a fee (1.8 million rubles for 600 sets of OPS contracts) to carry out the Customer’s instructions to attract individuals on a voluntary basis as insured persons in the Joint Stock Company “Non-State Pension Fund Soglasie” (this is the legal predecessor of the fund in which I found myself at the time I found out about this in the spring of 2020), but Charkin took 550 thousand and almost did not work, presenting only 420 sets... did not attract citizens on a voluntary basis... Moreover, this comrade Charkin O.V. is alive and well at the moment with its own individual entrepreneur, although the LLC with similar OKVED registrations had to be liquidated at the beginning of 2020. The broken chain has been restored. There is a specific perpetrator from whom our law enforcement officers can unravel this case.

Well, I think... that's it.. Gotcha. Now I will write to our highest law enforcement officers that I am so handsome, I have done a huge amount of operational work, exposed the scammers and began to follow the intended path:

- wrote a second clarifying request to the Aksicom LLC UC with a request to still provide me with the requested documents, since if you write that your full-time employee issued an electronic digital signature, he didn’t take my personal data out of thin air, send me an agreement with Orlan and other documents , which they referred to in the first response for the study;

- wrote a complaint to the Central Bank of the Russian Federation against the NPF with a request to bring them to administrative responsibility;

- wrote a complaint to the Ministry of Internal Affairs of the Russian Federation addressed to Kolokoltsev, describing the entire situation and providing copies of responses and downloads;

- wrote a complaint to the Investigative Committee of the Russian Federation addressed to Bastrykin, describing the entire situation and providing copies of responses and downloads;

- wrote a complaint to the FSB of the Russian Federation addressed to Bortnikov, describing the entire situation and providing copies of responses and downloads;

- wrote a complaint to the Prosecutor General's Office of the Russian Federation addressed to Chaika, describing the entire situation and providing copies of responses and downloads;

- wrote an appeal to the Ministry of Digital Development and Mass Communications addressed to the Minister with a request to deal with the TC Aksikom LLC in connection with obvious violations.

And I expect that soon the king’s musketeers or the cardinal’s guards will smash both the NPF and all the participants in these events to smithereens.

The last month of summer 2020 has arrived and the answers have begun to arrive. Moreover, the content of these answers extremely disappointed me. The bottom line: we’ll figure it out, but if you think that your rights have been violated and you didn’t enter into this OPS agreement, go to court and challenge it. Regarding even administrative penalties: this is not a lasting offense, the statute of limitations is 1 year and has long expired.

Aksicom LLC again did not send me any statements or consent to process my personal data, but their general director, after my third request, called me and asked for a meeting. I agreed. The meeting was not productive, he didn’t tell me anything new, but he confirmed all my conclusions and collected facts.

In general, law enforcement and other authorities did not need information from me, or they already knew everything about it.

But still, apparently, there was some effect from all this, since on August 22, 2020, NPF Neftegarant took over and renamed NPF Evolution (an interesting evolution and apparently they already knew everything), and on September 13, 2020 ... they call me on my personal phone (interesting!) from the Ren TV channel and ask me to give an interview about everything described above. I agree, bring to the meeting my already quite complete folder with all the materials on the case (requests, answers, correspondence) and tell everything. In the evening, a report comes out about massive illegal transfers of funds from the funded part of the pension (https://m.ren.tv/novosti/2019-09-13/v-sk-prokommentirovali-rassledovanie-massovogo-hishcheniya-pensiy), information about that the Investigative Committee in Moscow opened a criminal case under Part 3 of Art. 30 of the Criminal Code of the Russian Federation (attempted crime), and even the numbers were mentioned about the number of victims (at least 500 thousand people), but then (as with my complaints about which I wrote above) - everything “perished” and on other federal channels no more words.

Naturally, I went to a court of general jurisdiction, won the trial (though taking into account the pandemic and more than 8 months passed before the decision entered into legal force), returned the money to the Pension Fund (though not without difficulty, since a month and a half after the entry into legal force) The NPF informed me of the validity of the decision that they had not received a decision, although they were a party to the case. And the law on NPF says exactly this: if an agreement is declared invalid, the fund is obliged no later than 30 days from the date the fund receives the corresponding court decision (p 5.3. Article 36.6 of the Federal Law on Non-State Pension Funds). And I had to receive a decision with a mark of entry into legal force and a writ of execution, send them to the Non-State Pension Fund "Evolution" and the bailiffs. As a result, the money was returned back to the Pension Fund 10 months after registration statements in court.

Conclusions and conclusions:

1. Once again, the Russian Pension Fund turned out to be “leaky” and made it possible for fraudsters to steal a huge amount of money through schemes. I proceeded from the fact that when I was unraveling this whole tangle and suing for my money (which in fact returned back to the Pension Fund), that in choosing between the NPF and the Pension Fund, one chooses the lesser of two evils;

2. Unfortunately, absolutely all of our law enforcement agencies do not care (accidentally or intentionally) about the rights of ordinary citizens. And as a result, a person who has suffered from the actions of scammers, when he finds out, will go through this closed “circle” that I described, will spend his time, money and nerves on our courts of general jurisdiction, in the end, even if he achieves his goal, the money will come back to the Pension Fund, which may lose them again next time;

3. A huge number of citizens whose funds from the funded part of their pension accidentally or intentionally ended up in one or another NPF (Soglasie - Neftegarant - Evolution is not the only example of active accumulation of assets in the period 2016-2018) do not know about this. And they will find out when they go to apply for a pension (if they survive). 2-4 years (like me) after I found out it is difficult to find the truth and restore, at least partially, justice, but in 20-30 years it will be even more difficult. And a person can receive a simple and unemotional answer from a Pension Fund employee from the window (or whatever will be there by this time): “Sorry, but 20 years ago you transferred funds to such a non-state pension fund, and, unfortunately, all the years it showed negative indicators for invest money and here’s a social pension for you, three kopecks and survive.”

4. Saving for your future pension (despite the low interest on investment) was a good idea, as it allowed the employee to strive for a job with a high and white salary. As a result, you can generate more money for your retirement. Even if it was small, but at least within the limits of inflation when you were in the Pension Fund, you were guaranteed investment income;

5. I also noticed that some large companies with many employees now have their own NPFs (the same NPF Neftegarant, which was part of the Rosneft structure and has their logo, NPF Magnit - the Magnit chain of stores, NPF Transneft, etc. .d.). It would seem: why? But it’s simple, it seems to me: you transfer all your employees (most likely ahead of schedule, since no one is going to wait 5 years) upon registration (with the conclusion of a mandatory pension agreement and writing an application) or work to your non-state pension fund, all funds (the funded part ) goes into your non-state pension fund, you form a certain amount (depending on the number of employees) that you invest in the projects of the parent company. After all, why go to the bank for a loan if you can use this resource. Moreover, the NPF does not guarantee good investment income from investments.

6. In case of mass early transfer of citizens (legal or illegal) in the period from 2020 to 2020. The Pension Fund also remained in the black. After all, in case of early transfer, according to the law, the investment funds for the entire period remain in the previous fund. If we take me as an example, this is approximately 20% of the funded pension. Here is the article https://www.banki.ru/news/lenta/?id=10333735

Judging by this article, citizens lost 55 billion in 2017 (when I was actually transferred illegally). Those. These are funds remaining in the Pension Fund due to the early transfer. If you multiply this by at least 5 (again, based on my numbers), you will get approximately the amount that flowed into the NPF for 2020. Even if half of them signed contracts and statements themselves - 137.5 billion is quite an impressive amount that was transferred under fake contracts and statements

But there are those whose funded part and, accordingly, their withdrawn income is greater than mine.

7. It is still very unclear how the UPFR in the Republic of Tatarstan accepted from a Muscovite an application signed with an electronic digital signature issued in Moscow and transferred the funded part of the pension. If you think about it sensibly, then this is not logical, since my territorial fund is the UPFR in Moscow, so why should I, even through the Internet, contact Kazan and why does Kazan accept an application from a Muscovite and transfer funds. Intent? Or a gap in legislation skillfully exploited by scammers?

8. While looking into it, I realized one more point, but this is already a kind of “gift” from the state. It turned out that since 2020, all citizens who did not choose the option of forming future savings by default began to direct only to the insurance company (https://www.pfrf.ru/knopki/zhizn~4406) and they received “points” (instead of real funds).

Plus, the funded part has been frozen since 2014, using all funds for the needs of the Pension Fund in fact to close the deficit. This article describes it in detail (https://www.9111.ru/questions/777777777255099/)

PS At the moment, I myself have won my case against the NPF “Evolution” and have returned my pension savings, legal costs and interest for using other people’s money.

I recently filed a lawsuit against Aksicom LLC in order to oblige them to delete my personal data that they illegally obtained (case No. M-10621/2020 in the Zamoskvoretsky Court of Moscow).

From my circle of acquaintances there were several people whom I also help to do this, plus I recover moral damages from the NPF.

To everyone who asks for such help, but wants to go to court themselves: I give the optimal, in my opinion, algorithm of actions to reduce the time and money for returning funds from the NPF.

My goal is simple: to reduce the number of people who, upon retirement, find out that their funds are somewhere in a non-state pension fund (most likely already reorganized, renamed, and possibly liquidated several times) and so that now, after assessing the situation, they make a decision on this issue.

Good luck to all. Be sure to check your pension savings from the point of view of who is the insurer. And if this is some kind of non-state pension fund with which you did not enter into an agreement on compulsory pension insurance and did not send an application to the Pension Fund of the Russian Federation, urgently take measures to return the funds.

Sincerely,

Vinokurov Dmitry Vyacheslavovich

Profitability and reliability

Based on information obtained from special portals, profitability for 2011 was 6.5% per annum, in 2012 – 7.3%. The overall profitability for 2016-2017 has not been published at this time. As of September 30, 2016, it is known that this figure does not exceed 12.01%.

IMPORTANT! Rating agency specialists rated the reliability of NPF Alliance at A++ - the maximum mark.

Alliance Foundation programs

There are different offers for individuals and legal entities.

To sign an agreement with the Fund, legal entities must submit:

- certificate of entry into the Unified State Register of Legal Entities;

- an extract confirming registration with the Federal Tax Service;

- protocol indicating the company's management;

- passport details of the head of the organization and the chief accountant;

- account details;

- information about the person who entered into the transaction on behalf of the company (power of attorney, passport details, position, etc.).

To open a personal account, a citizen must provide:

- SNILS;

- personal account details;

- copy of passport.

For private clients

Ordinary citizens will be able to increase their pension by:

- transfer of the funded part of the pension according to compulsory pension insurance;

- accumulation of an additional part of the pension under NPO.

The first program assumes that:

- income comes from investing funds and depends on the person’s investment portfolio;

- contributions under compulsory pension agreements concluded before the beginning of 2020 can be made by the employer;

- the client can pass on his savings by inheritance.

The second program has the following advantages;

- the client can choose exactly when to deposit funds;

- it is possible to request urgent and unlimited payments;

- the accumulated amount can be transferred to the heirs, assigning each a share;

- You can terminate the agreement with the fund before the pension is assigned.

to corporative clients

Legal entities will be able to take advantage of corporate pension programs, with the help of which they can form pension savings for employees.

To participate in the program, the client must open a joint account (an individual entrepreneur registers a personal account). The contract period ranges from 1 year to 25 years. After retirement, employees can transfer money for life.

You can replenish the savings of each employee from the accrued wages and various remunerations. The idea is that staff will have a stake in the outcome of their work as it directly impacts future pensions.