NPF "Diamond Autumn" began its activities in 1995. The initiative to create this non-state fund was taken by the joint-stock company ALROSA, within the framework of which this non-state fund was created. The co-founders of the fund were the trade union of interregional importance "Profalmaz" and the Moscow bank "Derzhava".

A special pension program was developed, in which company veterans with at least 15 years of work experience automatically became participants. They were the first to acquire the right and opportunity to receive corporate pension payments. The website and personal account of the NPF Diamond Autumn began operating.

Pension payments were indexed annually: in 2020, the amount of corporate pension payments was about 4,900 rubles. Thanks to such achievements, the non-state pension fund received a license to work in the field of pension provision for an indefinite period, and in 2020 it was included in the register of non-state funds participating in the guarantee system for insured citizens.

Information about the Diamond Autumn Foundation

Diamond Autumn NPF year. The name comes from the main shareholder of the non-state pension fund of the ALROSA enterprise. In 2020, the fund was reorganized into a joint-stock company, and then the organization took part in the system of guaranteeing the rights of insured citizens. The Foundation is engaged in carrying out activities on NGOs and OPS.

The fund's investors include more than 20 enterprises operating in various fields and forms of ownership.

More than 45 thousand employees work under a corporate pension form, among them there are diamond miners, bank employees, scientists, municipal employees, doctors and teachers, and agricultural workers.

ALROSA was unable to sell its non-state pension fund

The auction for the sale of the non-state pension fund (NPF) “Diamond Autumn”, owned by ALROSA, did not take place. Only one buyer took part in the closed competition. According to Kommersant's sources, it was the NPF Gazfond Pension Savings. Other contenders - VTB and Sberbank - were not satisfied with the minimum price for NPFs, as well as some requirements for the buyer. The supervisory board of the diamond monopoly will consider the possibility of selling the NPF to a single bidder. If the requirements are relaxed, a second round of the auction may be held, experts believe.

The closed auction for the sale of NPF Almaznaya Osen, for which applications were accepted until February 17, was declared invalid, the ALROSA company said. The reason was the only application submitted. “Several bidders were invited to participate in the closed auction,” ALROSA previously said. At the same time, the circle of potential buyers of Diamond Autumn shares was limited to pension funds “with the highest reliability rating, a significant volume of assets, consistently high profitability and experience in the areas of the fund’s activities,” the company noted.

The Sberbank and VTB groups, as well as Gazfond Pension Savings, were invited to participate in the auction, sources close to those interested in the Diamond Autumn told Kommersant. However, in the end, neither Sberbank nor VTB submitted applications, and the only contender was Gazfond PN, Kommersant’s interlocutors note. “VTB Pension Fund did not take part in this auction, since the proposed conditions did not interest us,” said a representative of the VTB Group. Sberbank and its NPF declined to comment; Gazfond PN did not respond to Kommersant’s request.

of the NPF “Almaznaya Osen” created in 1995

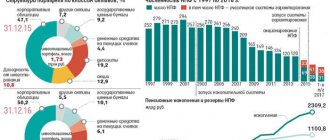

is ALROSA with a share of 99.92% of shares, another 0.08% from the trade union of the company's employees. The diamond miner’s corporate program is being formed on the basis of the fund. Liabilities for non-state pension provision (NPO) of the fund at the beginning of the year amounted to 26.8 billion rubles, for compulsory pension insurance (OPI) - 3.4 billion rubles. The number of fund participants in NGOs was 28.9 thousand, clients in OPS - 33.8 thousand.

ALROSA has long been thinking about selling NPFs. At that time, the same players to whom invitations were ultimately sent were also named as the main contenders for the asset (see “Kommersant” dated September 17, 2018). In December last year, the ALROSA Supervisory Board decided to sell its assets in the form of a closed auction. A shareholder agreement was to be concluded with the winner of the auction, according to which the NPF could not be liquidated or reorganized, nor could its shares be sold to third parties, ALROSA said in a statement. Sources told Kommersant that, under the terms of the Diamond Autumn shareholder agreement, it was impossible for several years to add a buyer to the NPF. Also, the diamond miner had to “retain control when making the most important decisions for the fund’s activities and representation on the board of directors of the NPF,” ALROSA said in a statement.

34.9 billion rubles

was the value of the assets of the NPF “Almaznaya Osen” at the beginning of 2020.

Kommersant’s interlocutors say that neither VTB nor Sberbank were satisfied with the high starting price of the auction. “In this case, you are buying a good corporate program,” says a person close to one of the contenders. And it is not a fact that in the future this corporate program will not be transferred to another market participant. “The program is designed for several years, but it may not be continued,” notes another Kommersant interlocutor. Difficulties were caused by the condition that the fund was not affiliated with the supporting NPF. According to two Kommersant sources, VTB and Sberbank were not ready to give more than 5-6% of assets (1.7-2 billion rubles) for “Diamond Autumn”. A person close to Gazfond PN claimed that the fund assessed the risk of transferring the corporate program to another fund as minimal and was ready to buy it out at a price of up to 10% of assets.

“The possibility of selling the asset to the only applicant will be considered by the supervisory board,” says an ALROSA representative. The possibility of a second round of the auction cannot be ruled out, suggests Sergei Okolesnov, CEO of the consulting company. “Taking into account that the potential list of interested parties may be wider than those to whom, due to the strictness of the requirements, invitations were sent to participate in the closed auction, provided that these requirements are relaxed by ALROSA, a second round cannot be ruled out, in which more a wide range of potential buyers,” he says.

Ilya Usov, Daria Andrianova

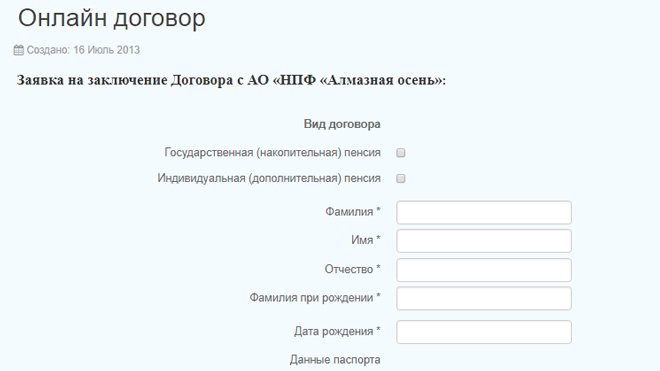

Procedure for registration and termination of an agreement with the fund

In order to conclude an agreement with the fund, you should go to the NPF Diamond Autumn official website and contact specialists. Citizens can connect to a personal plan and create pension capital in additional accounts. After the agreement is concluded, additional payments to pension accruals begin to be made.

List of documents

In order to register a pension with the fund, citizens will need to collect certain documents. The application is written in free form, but it must include personal information and account details for transfers. List of documents:

- statement;

- application for transfer from the Pension Fund to the Non-State Pension Fund;

- certificate 3-NDFL;

- NPF certificate;

- payment details;

- certificate 2-NDFL;

- copy of TIN;

- copy of the passport;

- certificate of funds transfer;

- pension agreement.

Potential buyers are eyeing the ALROSA pension fund

The diamond holding ALROSA is going to sell a non-core asset - the non-state pension fund (NPF) “Diamond Autumn”. Purchase offers were made to Sberbank, VTB, which have their own non-state pension funds, as well as Gazfond Pension Savings, negotiations with which are at the most advanced stage. According to experts, the departure of regional players from the pension market fits into the trend of transition from a captive business model to the concentration of pension assets in the hands of financiers.

The Russian diamond mining company ALROSA has intensified negotiations on the sale of NPF Almaznaya Osen. “The company already has an internal decision to sell its fund,” says a Kommersant source close to the potential buyer. “Requests have come to both VTB and Sberbank, but so far there has been no movement in these banks on this matter,” says one of Kommersant’s sources. According to him, he is most interested in acquiring Gazfond PN. “Indeed, the shareholders of this non-state pension fund have already carried out due diligence and an assessment of Diamond Autumn,” say two more Kommersant sources close to potential buyers. Moreover, one of them does not rule out a deal as early as next year. “ALROSA purposefully negotiates with government and near-government structures. The company wants to transfer the NPF into reliable hands, because it values its obligations,” another Kommersant interlocutor clarifies.

“VTB Pension Fund is considering the possibility of purchasing various pension funds that could help us strengthen our position in the market,” said its representative, but refused to disclose details of specific negotiations. “Currently we have no transactions to implement,” noted Sberbank Senior Vice President Alexander Bondarenko. Gazfond PN did not respond to Kommersant’s request. NPF “Diamond Autumn” declined to comment.

At the moment, NPF “Almaznaya Osen” is not included in the list of non-core assets subject to sale, the ALROSA press service reported. “Nevertheless, in connection with the upcoming pension reform and changes in regulation, we are exploring options for further work, including the possibility of partnership with the largest non-state pension funds that have proven their reliability,” they noted. ALROSA is one of the few companies that still has its own captive non-state pension fund.

Diamond Autumn Foundation

created in 1995. The main shareholder is ALROSA (over 99.9%), another 0.08% is owned by the company's workers' union. As of mid-2020, the fund’s assets exceeded 25.9 billion rubles, of which 21.7 billion rubles were pension reserves. The number of fund participants is almost 25 thousand people. The largest investor is ALROSA, whose contributions for the first half of the year amounted to 3.2 billion rubles. (more than 99% of the total amount). Pension savings amounted to 3.7 billion rubles, the number of insured persons was 33.6 thousand people.

However, according to Kommersant’s sources, there is no need to expect a quick sale of the fund. “Until the end of this year, by decision of the supervisory board of ALROSA, NPF, like a number of other non-core assets, cannot be sold. The next supervisory board, which could change the situation, will take place after March 2020,” says one of them.

According to the counterparty of several funds, a potential buyer may be stopped by the fact that the asset is located very far from the central offices of the largest non-state pension funds and will be too difficult to manage. “For VTB Pension Fund and NPF Sberbank it would be more difficult to manage ALROSA’s large corporate program in a distant region, but Gazfond PN has a competitive advantage here, it is one of the few who have not abandoned the system of regional branches,” says the CEO of the consulting company Sergey Okolesnov. “Regional representative offices still lose out to central offices - the service there is worse. However, “Gafzond PN” looks better here than many other large NPFs,” says Alexey Morozov, head of the ANPF Committee for Small and Regional Funds. “The possible sale of Diamond Autumn is a continuation of the long-established trend of transition from a captive model of running a pension business to a model where non-state pension funds are managed by professional financiers,” summarized Sergei Okolesnov.

Ilya Usov, Anatoly Dzhumailo

Payment of fees

There are several different ways to claim contribution deductions. All this depends on the situation of the citizen.

The payment of contributions is directly dependent on the financial capabilities of the citizen who is creating pension savings. A flexible replenishment schedule is very beneficial for customers.

If a citizen is going to terminate the contract with NPF Almaz, then he should write instructions on withdrawing funds from the account. Funds can be transferred to another NPF or capital transferred to a bank account.

The application must indicate information about the NPF or bank details for transferring contributions. You can return the money within three months from the date of application. In this case, the investor will have to suffer losses:

- partial profit from the deposit;

- withholding tax 13 transfer costs are paid by the depositor.

Advantages and disadvantages

The strengths of the Diamond Autumn Fund are:

- receipt of a larger amount of money by citizens after investment operations; it is also possible to independently determine the amount of investments and periods;

- the possibility of receiving a pension from the fund;

- insurance against pension reduction;

- preferential tax rate;

- control over funds;

- effective investment;

- transfer of pension savings by inheritance;

- transfer funds to any account.

The fund also has a number of disadvantages:

- problems with the economic situation;

- inability to withdraw funds when starting investment projects;

- savings can only be in one selected currency;

- payment of commission to the fund.

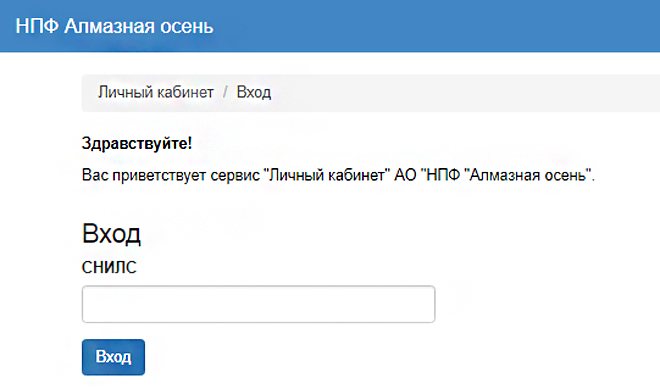

Personal account of NPF Diamond Autumn

In order to get to your personal account, you need to enter the official website of JSC NPF Almaznaya Osen in the search engine. It will help you quickly find information about the status of your accounts.

Personal account features

The personal account is available to participants of the fund’s insurance program, where you can view the availability of funds and their increase, transactions and transfers, and receive news from the Diamond Autumn Non-State Pension Fund.

Registration and login to your personal account

All information for logging into your personal account will be provided by fund employees when completing an agreement and application; you can also register from the official website.

To enter you will need:

- SNILS number;

- phone number.

A message with a one-time code will be sent to the subscriber number to access your personal account.

Share share by e-mail Twitter Facebook

Print Print

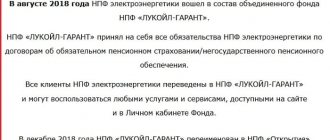

July 24, 2020 - The Republican specialized registrar "Yakut Stock Center" on July 20, 2020 registered the transfer of ownership of the shares of JSC NPF Almaznaya Osen from AK ALROSA (PJSC) to JSC NPF GAZFOND Pension Savings.

As a result of the transaction, 99.75% of the shares of NPF Almaznaya Osen became the property of NPF GAZFOND Pension Savings. After the transaction was closed, a shareholder agreement was concluded between the shareholders. It provides, for three years from the date of its signing, a ban on the takeover or merger of the Fund without the consent of all shareholders, as well as the right of the shareholder owning the remaining 0.25% of shares to participate in the work of the Fund’s Board of Directors. At the end of the specified period, the main shareholder redeems the remaining shares and becomes the sole shareholder of the Fund.

A special condition has been introduced into the competence of the Fund’s Board of Directors, according to which the investment policy, investment strategy, and investment declaration of the Fund are determined only by a unanimous decision of all its members.

In December 2020, the ALROSA Supervisory Board decided to sell the shares of the non-state pension fund Almaznaya Osen owned by the company. The sale of a non-core asset for a diamond mining company to a professional market participant is intended to contribute to the further development of the fund for the benefit of its clients, the majority of whom are employees and veterans of the company, and to provide ALROSA itself with a positive economic effect.

For Diamond Autumn clients, a change in the majority shareholder does not change anything. “The Fund, as before, will continue close cooperation with ALROSA Group enterprises. The sale of the Fund's shares owned by ALROSA does not affect the fulfillment of obligations to clients, the vast majority of whom are former and current employees of the diamond mining company. All contracts of compulsory pension insurance and non-state pension provision, in accordance with the law, will be valid in full. This applies to all contracts without exception – both previously signed and those that will be concluded in the future. Personally, I will keep my pension savings in the Diamond Autumn, as before,” said Sergei Ivanov, CEO of ALROSA.

The page was last updated on July 24, 2020 at 1:07 p.m.

Contact Information

Head office: 678170, Republic of Sakha (Yakutia), Mirny, Komsomolskaya str., 16

Reception: (411-36) 3-27-58

Opening hours: daily, except weekends, from 8.30 to 18.00 (lunch from 12.30 to 14.00)

The last Saturday of the month is working, from 10.00 to 15.00

Official website: https://npfao.ru

Personal account: https://lk.npfao.ru

Hotline number