- home

- Reference

- Non-state pension provision

One of the most pressing problems in modern Russian society is the financial support of persons who have reached retirement age. First of all, this concerns the size of the pension - even according to statistics provided by government bodies, it is very low.

In order to correct the situation related to pension provision, the state periodically reforms the system, introducing additional mechanisms for creating decent living conditions for citizens in the future. One of them is the formation of the funded part of the pension, carried out within the framework of compulsory pension insurance in accounts in non-state pension funds, including NPF “Federation”.

Liquidation of NPF Captain

In February last year, the court decided to liquidate the pension fund, placing an obligation on the founders to carry out the process. Six months later, official information about the liquidation of the organization appeared on the website. After this, creditors (in essence, clients) received the right to present their claims and receive funds accumulated as a result of participation in one of the company’s programs into their accounts. Moreover, there was no need to leave a written statement at the head office.

According to the data available in the system, each client was automatically included in the register of creditors and received a corresponding notification.

NPF captain

Information (notices) about bankruptcy (forced liquidation) is posted in the Unified Federal Register of Information on Bankruptcy, the Kommersant newspaper and on the Agency’s website on the Internet. Creditors who have filed claims against the Fund, as well as other persons participating in the bankruptcy (forced liquidation) case liquidation) the bankruptcy trustee (liquidator) provides the opportunity to familiarize himself with the register of declared creditor claims. Based on a written request from a creditor, a creditor (creditor representative) may receive an extract from the register of creditors’ claims or a copy of the register of creditor claims of the Fund, if the established amount of the Fund’s debt to the creditor constitutes at least one percent of total accounts payable.

Is there an official website of NPF Federation?

There is a website on the Internet for the private foundation “Federation. Through this information resource, interested parties can obtain all the necessary information about the fund, including those related to its profitability and financial performance.

The “News” section publishes regular reports from official events and shareholder meetings.

The “For Clients” section contains useful information related to the procedure for concluding mandatory insurance contracts , pension payments, etc.

In addition, on the website you can find contact information, as well as details of the NPF “Federation”.

The Central Bank announced the cancellation of the license of NPF “Captain”

- How will investors and participants of the fund learn about the introduction of a forced liquidation procedure in relation to the fund (the opening of bankruptcy proceedings)? No later than thirty days from the date of the arbitration court’s decision to declare the fund bankrupt and to open bankruptcy proceedings (forced liquidation), the bankruptcy trustee (liquidator) notifies investors and participants of the fund about this in writing, and also ensures that investors and participants are informed by posting a publication in information and telecommunication network "Internet" on the Agency's website (www.asv.org.ru) and in the Unified Federal Register of Bankruptcy Information.

We recommend reading: How many days do you get sick leave for a sprained ligament?

The license to carry out pension provision and pension insurance activities of NPF "Captain" was revoked

October 27, 2016By Order of the Bank of Russia dated October 27, 2016 No. OD-3691, the license to carry out pension provision and pension insurance activities of the Non-state Pension Fund "Captain" was revoked. Since October 27, 2016, the Fund's pension provision activities have not been carried out, the powers of the Fund's executive bodies have been suspended, management activities are provided by the temporary administration for managing the Fund (contact details of the head of the temporary administration: 195248, St. Petersburg, Revolyutsii highway, 84, tel.

8(812)3631970 With regard to NPO funds (pension reserves), we inform you that the temporary administration is determining the volume of obligations to depositors, participants of the Fund, and settlements with these persons will be carried out at the stage of forced liquidation of the Fund by the liquidator, who will be appointed by decision of the Arbitration Court.

The procedure for the liquidator to make settlements with depositors and participants within the framework of the procedures for the forced liquidation of a non-state pension fund:

- information on the opening of a register of claims of NPF creditors is subject to publication in the Unified Federal Register of Bankruptcy Information on the Internet information and telecommunications network at: bankrot.fedresurs.ru, in the Kommersant newspaper (the official publication in which information is published in accordance with bankruptcy legislation );

- during the period of forced liquidation, the liquidator sells the assets that made up the pension reserves, including by transferring assets to a new trust management of the management company in order to capitalize their value, ensure the possibility of subsequent sale of assets and settlements with investors and participants;

- settlements with investors and participants are carried out as assets are sold within the period of forced liquidation (up to 3 years), in the order of priority formed in accordance with bankruptcy legislation.

- within 2 months, the liquidator creates a register of claims of NPF creditors, which reflects the NPF’s obligations to depositors and participants, in the manner established by bankruptcy legislation;

- the period for completing measures to liquidate non-state pension funds is 3 years;

- from the moment the arbitration court makes a decision on the forced liquidation of NPFs, NGO agreements are terminated;

- in order to be included in the register of creditors' claims, investors and participants must prepare and send to the liquidator (after the creation of the liquidation commission and the posting of an information message on the formation of the register of creditors' claims in the prescribed manner) a creditor's claim;

The order of satisfaction of obligations to investors and NPF participants from pension reserves:

- secondly, demands for the payment of the redemption amount of NPF participants (individuals), in respect of whom the obligation of such a fund to pay a non-state pension has arisen for the period specified in the pension agreement. At the same time, based on the will of the NPF investor, redemption amounts can be transferred as pension contributions to other NPFs that are indicated by the investor and with which he has entered into an NPO agreement;

- fourth priority - the requirements of NPF depositors - legal entities;

- fifthly, the claims of other creditors that must be satisfied at the expense of pension reserves in accordance with Federal Law No. 75-FZ of May 7, 1998 “On Non-State Pension Funds” (for example, management companies and a specialized depository).

- first of all, the claims of NPF participants (individuals), in respect of whom the obligation of such NPF to pay a lifelong non-state pension has arisen by determining the obligations of such NPF to pay lifelong non-state pensions and separating assets from pension reserves to form a payment fund sufficient to fulfill these obligations. In this case, the liquidator may transfer the obligation to pay lifelong non-state pensions to another NPF through competitive selection of such NPF;

- in the third place - the requirements of depositors and participants of non-state pension funds - individuals;

Hotline and other fund contacts

For all questions, both clients of the fund and third parties can contact the hotline number 8 (800) 775-65-18. Calling it is completely free for both Muscovites and residents of Russian regions.

In addition, it is possible to contact the fund office in person. It is located at the following address: Moscow, Letnikovskaya street, building 16. The nearest metro station is Paveletskaya. Moscow office number of NPF “Federation –.

The fund does not have branches in the regions, but it has an authorized representative - My Pension LLC in St. Petersburg. The organization's office is located at the address: St. Petersburg, Sofiyskaya street, 6, building 8, building 1, office 192.

What to do if your NPF’s license has been revoked

If applications are submitted through a representative, a document certifying the authority of the representative or a duly certified copy of it shall be attached to the application.

When sending applications by mail, a copy of the identity document of the applicant or the applicant's representative (if the application is submitted through a representative) is attached to the application. The application for payment of the redemption amount, sent by mail, is accompanied by a copy of the bank account agreement opened for the applicant, specified in the application for payment of the redemption amount.

When submitting applications by hand, the applicant or the applicant's representative (if the application is submitted through a representative) presents an identification document.

Questions and answers

Of course, we only select government bonds or bonds from issuers with the highest ratings in the market. The report on the structure of NPF assets can be viewed on the “Assets and Profitability” page Question #3 What guarantees are there that my pension savings will not be lost if I transfer to NPF Federation JSC? JSC NPF "Federation" (former name - JSC NPF "Captain") entered the register of participants in the system for guaranteeing the rights of insured persons in the compulsory pension insurance system (entry in the register No. 42 dated June 17, 2016) This means that even if with the fund anything happens, your pension savings will automatically return to the Pension Fund of Russia, from where you can transfer them to any other NPF, or leave them in the Pension Fund.

We recommend reading: Dismissal of a director during liquidation of an enterprise

For many, this question is quite significant, since investing in an unnoticed (from a rating point of view) fund seems like a risky proposition.

Reliability and profitability rating

Today, dozens of private pension organizations operate in Russia, and it is sometimes quite difficult for a citizen who plans to make appropriate savings to choose among all the many of them.

Information on the fund

Detailed statistics

That is why

every non-state pension fund is obliged to publish and familiarize current and potential clients with the indicators of its financial activities. There are quite a few of them, but the greatest interest is caused by the ratings of the fund’s reliability and profitability.

The success of an organization is determined by these criteria. Reliability should be understood as how financially stable an organization is. Assigning the appropriate rating falls within the competence of specialized structures - rating agencies, the most authoritative of which in Russia is Expert RA.

The non-state pension fund "Federation" does not provide the necessary data ; therefore, the reliability rating for it has not been determined.

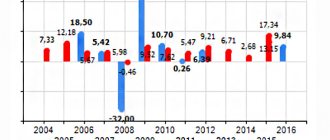

Profitability is the most important indicator when assessing the performance of a private fund. The size of the client’s pension provision in the future directly depends on this indicator, so when choosing a fund you should familiarize yourself with it first.

According to information provided by the management of NPF Federation, the organization’s profitability at the end of 2020 was 3.35%. It should be noted that this is a rather low figure, which does not exceed the market average, and is also less than the inflation rate for the same period.

Reference! Some funds may show negative returns, that is, they will lose more on an investment than they invested. However, OPS clients have nothing to fear in this case, since their savings are insured. This means that in the case of negative returns, citizens are simply not credited with investment income due to its absence.

NPF captain liquidation forum

- Full information about the contract of irrevocable pension insurance.

- Full information about the applicant, his date of birth and insurance certificate number.

- Full details of the fund from which the funds are transferred and the financial institution receiving them.

Sample application for transfer of funds from the Pension Fund to the NPF]).

Such an application is drawn up in the manner established by the Annotation of the Board of the Pension Fund of the Russian Federation No. 158 dated May 12, 2020.

Organization NPF "CAPTAN"

Description of the measures provided for in Art.

18.1 and 19 of the Law: Organizational measures: delimitation of employee access rights to the personal data base, the presence of regulations and instructions on the processing of personal data in ISPD, restriction of access to the premises of the controlled area with the personal data base according to the approved procedure. Technical measures: information is transmitted on optical, magnetic and paper media, access to software for processing personal data at an automated workstation is carried out using a password, protection against unauthorized actions of the software is entrusted to special certified software.

Technical measures: information is transmitted on optical, magnetic and paper media, access to software for processing personal data at an automated workstation is carried out using a password, protection against unauthorized actions of the software is entrusted to special certified software. Categories of personal data: last name, first name, patronymic, year of birth, month of birth, date of birth, place of birth, address, marital status, social status, property status, education, profession, income, health status, citizenship information, passport data: series , number, where, by whom, when issued, department code, taxpayer identification number (TIN), individual personal account insurance number (SNILS), contact phone number, information on the movement of non-state pension funds in the pension account and investment results, bank details, amount accrued for payment, full name, date of birth, SNILS, passport data of legal successors (heirs) and distribution of shares in inherited property between them, information about the presence or absence of a criminal record of employees, information about the presence or absence of information about an employee in the Register of Disqualified Persons Category subjects whose personal data is processed: an insured person with whom the Fund has concluded an agreement on compulsory pension insurance or non-state pension provision and his successors, individuals who are in an employment relationship with the employer, applicants for a vacant position List of actions with personal data: information about the insured persons are transmitted via the Internet to the Pension Fund of Russia, information about employees is transmitted via the Internet to the Federal Tax Service, collection, analysis, processing, storage, modification, addition, transfer, destruction of personal data is carried out only by strictly defined employees Processing of personal data: mixed, with transfer via internal network of a legal entity, with transmission via the Internet Legal basis for the processing of personal data: Art.

8-15 of the Federal Law of 05/07/1998 N 75-FZ “On Non-State Pension Funds”, Article 430 of the Civil Code of the Russian Federation, Articles 85-90 of the Labor Code of the Russian Federation, Art. 24 of the Constitution of the Russian Federation.

Availability of cross-border transmission: no Information about the location of the database: Russia

Non-State Pension Fund programs

The vast majority of domestic private pension funds operate within the framework of compulsory pension insurance (OPI), accumulating funds from citizens for funded pensions in their accounts, and non-state pension provision (NPO), concluding agreements with individuals on pre-agreed conditions.

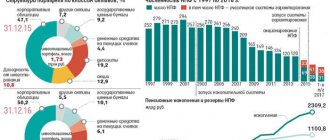

NPF "Federation" operates within the framework of the OPS, serving clients of the former NPF "Captain". Thus, at the end of 2018, 79,561 people formed a funded pension in this fund.

This private foundation does not operate within the framework of NGOs. According to data presented for 2020, NPF Federation does not have concluded agreements of this type with citizens.