Information about the fund

- Full name of the organization (name of NPF): Joint Stock Company “Non-State Pension Fund “Vnesheconomfond”

- Status in 2020: Active - Valid license

- License number: 350/2

The non-profit organization was reorganized into the Joint Stock Company “Non-State Pension Fund “Vnesheconomfond” in 2016.

NPF Vnesheconomfond does not carry out compulsory pension insurance activities.

The Fund has a license issued by the Federal Service for Financial Markets (N 350/2 dated June 30, 2009) to carry out pension provision and pension insurance activities.

Affiliated funds

No affiliated funds

Requisites

View details

OGRN 1167700051727 dated February 4, 2020

INN/KPP 7728329636 773001001

OKPO 54923741 OKATO 45268554000 OKOGU 4210014 OKTMO 45318000000

In February 2020, the Non-State Pension Fund of Vnesheconombank "Vnesheconomfond" was reorganized into the Joint Stock Company "Non-State Pension Fund "Vnesheconomfond", abbreviated name - JSC NPF "Vnesheconomfond". JSC NPF Vnesheconomfond is registered by the Department of the Federal Tax Service for the city of Moscow, registration certificate series 77 N 016522420 dated February 4, 2020 (OGRN No. 1167700051727, INN/KPP 7728329636/773001001). The Fund has a license issued by the Federal Service for Financial Markets (N 350/2 dated June 30, 2009) to carry out pension provision and pension insurance activities.Please note that currently JSC

NPF Vnesheconomfond does not carry out compulsory pension insurance activities.

Branches of JSC NPF Vnesheconomfond operate at the following addresses: Samara region, Tolyatti, st. Gorky, 96. Chelyabinsk region, Chelyabinsk, Vorovskogo st., 23, building A, room 40

Dear Investors and Participants!

We draw your attention to the fact that on the basis of Article 14 of Federal Law No. 75-FZ of May 17, 1998 and in accordance with clause 5.6 of the Fund’s Pension Rules, information on the status of pension accounts is provided free of charge once a year upon the Depositor’s request ( Participant).

The Fund informs all interested parties about the following: – it is possible to increase or decrease income from the placement of pension reserves; past investment results do not determine future returns; – the state does not guarantee the profitability of placing pension reserves; – before concluding a pension agreement, you must carefully read the Charter and Pension Rules of the Fund.

Information subject to disclosure by the Fund in accordance with Article 35.1 of the Federal Law of May 7, 1998 No. 75-FZ “On Non-State Pension Funds” and Directive of the Bank of Russia dated June 18, 2020 No. 5175-U “On information to be disclosed by a non-state pension fund” as well as the procedure and timing of its disclosure«

Key information document on non-state pension provision

JSC NPF Vnesheconomfond informs the Fund's participants that in order to comply with the requirements of the Federal Law of August 7, 2001 No. 115-FZ “On Combating the Legalization (Laundering) of Proceeds from Crime and the Financing of Terrorism” in the event of a change in the registration address, actual address residence, passport details and other personal data, the Fund participant must immediately notify the Fund about this by sending to his address a completed and personally signed Participant Questionnaire with copies of supporting documents attached.

(More details…) — Fund participant questionnaire. — Consent to the processing of personal data. — Questionnaire of a legal entity - a contributor to the Fund.

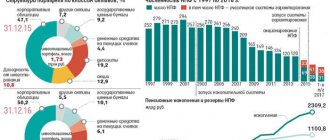

Statistics of NPF Vnesheconomfond: rating of reliability and profitability

According to the Central Bank of the Russian Federation from the reporting “Main performance indicators of non-state pension funds” as of the date: 01/01/2020

Fund assets (thousand rubles): 6005803.78

Statistics on NPO (non-state pension provision) as of 01/01/2020

- Total volume of pension reserves (thousand rubles): 5218626.42

- Total number of participants (people): 19474

- Participants receiving a pension (persons): 14419

- Total amount of pensions paid under NPO (thousand rubles): 249886.97

Statistics on compulsory pension insurance (compulsory pension insurance) as of 01/01/2020

- Pension savings (thousand rubles, market value): 0

- Number of insured persons (people): 0

- Participants receiving a pension under compulsory pension insurance (persons): 0

- Amount of pension payments under compulsory pension insurance (thousand rubles): 0

Profitability of pension savings

Current profitability

Minus remuneration for management companies, specialized depository and fund.

- Profitability of placing funds from pension reserves (NPO): 5.63%

- Return on investment of pension savings (OPS): 5.70%

Profitability chart

Data on the profitability of NPF Vnesheconomfond in 2020 (as of 01/01/2020), including information for the previous 10 years in comparison with the profitability of the Pension Fund (VEB):

Yield comparison table

| Year | NPF Vnesheconomfond | Pension Fund |

| 2010 | 0.00% | 7.62% |

| 2011 | 0.00% | 5.47% |

| 2012 | 0.00% | 9.21% |

| 2013 | 8.64% | 6.71% |

| 2014 | 1.53% | 2.68% |

| 2015 | 14.72% | 13.15% |

| 2016 | 11.23% | 10.53% |

| 2017 | 11.03% | 8.59% |

| 2018 | 0.00% | 7.90% |

| 2019 | 5.70% | 7.66% |

Documentation

| № | Name | Open/Download |

| 1 | License | |

| 2 | Charter | |

| 2.1 | Changes to the Charter dated February 22, 2019 | |

| 2.2 | Changes to the Charter dated July 30, 2019 | |

| 2.3 | Changes to the Charter dated November 6, 2019 | |

| 3 | Certificate of state registration of a legal entity | |

| 4 | Certificate of registration of a Russian organization with the tax authority at its location | |

| 5 | Certificate of entry into the register of members of the Self-regulatory organization National Association of Non-State Pension Funds (NAPF) - exception 04/07/2017 | |

| 6 | Certificate of entry into the register of members of the Self-Regulatory Organization - Association of Non-State Pension Funds (ANPF) - entry 04/25/2017 | |

| 7 | Pension rules | |

| Edition 2020 | ||

| Edition 2010 | ||

| Edition 2009 | ||

| Edition 2003 | ||

| Edition 2000 | ||

| 8 | Regulations on the procedure for choosing and refusing the services of management companies | |

| 9 | Regulations on the procedure for choosing and refusing the services of a specialized depository | |

| 10 | Policy regarding the processing and protection of personal data | |

| 11 | Rules for determining the value of net assets in which funds from the pension reserves of JSC NPF Vnesheconomfond are placed (version No. 2) | |

| 12 | Rules for determining the value of net assets in which funds from the pension reserves of JSC NPF Vnesheconomfond are placed | |

| 13 | Rules for determining the value of net assets in which funds from the pension reserves of JSC NPF Vnesheconomfond are placed (revision No. 3) | |

| 14 | Rules for calculating the value of assets that make up pension reserves and the total value of pension reserves of JSC NPF Vnesheconomfond (revision No. 4) | |

| 15 | Rules for calculating the value of assets that make up pension reserves and the total value of pension reserves of JSC NPF Vnesheconomfond (revision No. 5) | |

| 16 | Rules for determining the value of net assets constituting pension reserves, JSC NPF Vnesheconomfond (revision No. 6) | |

| 17 | Rules for determining the value of net assets constituting pension reserves, JSC NPF Vnesheconomfond (revision No. 7) | |

| 18 | Criteria for classifying clients of NPF Vnesheconomfond JSC as a client - a foreign taxpayer and methods of obtaining information in order to comply with the requirements of 173-FZ of June 28, 2014 |

Foundation programs

The investment portfolio registered in the organization in question includes funds that were received by a citizen upon transfer to a non-state pension fund from the Pension Fund. In addition, the formation is implemented through the citizen’s constant deposit of funds into an account opened with the company. Several programs can be used for this.

The development is carried out by representatives of the fund, depending on the level of income the citizen receives per month.

The programs have the following expression:

- Payment of money is required every month in a certain amount. When contacting the organization in question, the employee helps the citizen select the right program depending on financial capabilities;

- funds can be received at any time and in any amount.

At the same time, it is important to point out that the programs provide for urgent or indefinite payments. In addition, the differences between them lie in whether a citizen’s savings can be transferred to his heirs. This measure is used only for urgent payments.

Market position

According to Sergei Suverov, senior analyst at BCS Premier, the purchase of a stake in NPF Blagosostoyanie will allow the state corporation VEB.RF to strengthen its position in the market of non-state pension funds. “For the NPF market, the changes will be insignificant, since in Blagosostoyanie there was a change of one state owner to another, although a possible “side effect” will be the flow of a number of clients from private NPFs to Blagosostoyanie, including due to VEB’s strong brand,” he said TASS Suverov.

Managing Director for Corporate and Sovereign Ratings at Expert RA Pavel Mitrofanov also expressed the opinion that with the arrival of VEB.RF among the shareholders of Blagosostoyanie, one should not expect any serious changes in the non-state pension fund market. “This is not a fund into which you need to pour money and it will begin to grow explosively. This is already a large established fund. The fact that even a large and important shareholder has joined it will not change anything in the short term,” he told TASS.

At the same time, according to the expert, the “Welfare” strategy will most likely undergo adjustments. “Life shows that the arrival of any major shareholder in any company or fund leads, at a minimum, to a change in the composition of the board and adjustments or a complete update of the strategy. It is obvious that, entering as a major shareholder in such a large fund, VEB has a view on how the fund should work, and this may affect the strategy,” Mitrofanov noted. However, one should not expect any radical changes in the Welfare strategy in the short term, the expert believes.

The president of the self-regulatory organization "Association of Non-State Pension Funds" Sergei Belyakov, commenting on the deal, told TASS that the main thing for the association is the work of the participants according to uniform regulatory rules. “A change in the ownership of the fund will not change these rules,” he added.

Statistics on NPF Vnesheconomfond

Information on the fund

Detailed statistics

The company was registered in 2000 by the Moscow Registration Chamber of the Moscow Government. This fact can be confirmed by using the corresponding certificate No. 350/2. The company received a license to carry out activities in the field of pension accumulation.

According to data for 2014, the level of profitability from placing funds in the company amounted to 12,796,178.60 rubles. It can also be noted that to form property that is used to ensure the purposes specified in the charter, 2,416,514.81 rubles were placed on the accounts.

Attention! In addition, the fund has created a pension reserve, the size of which is currently 668,125.82.

About the deal

At the end of August, the head of VEB.RF, Igor Shuvalov, announced the state corporation’s plans to acquire a blocking stake in NPF Blagosostoyanie. Shuvalov did not specify the terms of the deal. He later noted that the deal could be closed before the end of 2020.

Before VEB.RF entered the NPF Blagosostoyanie, the composition of shareholders was as follows: the share of Russian Railways was 25% + one share, the share of Gazprombank was 50% minus one share, the share of RSHB Asset Management was 19.5%, another 5.5 % belonged to minority shareholders of the fund.

Changes have been made to the news (17:50 Moscow time on December 26) - the headline is given in a new edition, a comment from a VEB.RF representative has been added

Foundation contacts

The name of the company currently remains as JSC Vnesheconomfond. To send requests, you need to use the address: Moscow, Profsoyuznaya str., 57

In addition, a person has the opportunity to ask questions that interest him when using the hotline; to do this, he will need to call the following numbers:

- +7 – applied in the capital;

- +7 – used by residents of St. Petersburg;

- +7 – for the rest of the country’s population.

An important point is that the operation of these services is 24/7. The organization also has an official portal.

Attention! License number - 350/2. Currently, the fund's clients are 1.4 thousand citizens.

OKVED codes

JSC NPF VNESHEKONOMFOND has the right to engage in 3 types of activities. Main type of activity

| Code | Name |

| 65.30 | Activities of non-state pension funds |

Additional activities

| Code | Name |

| 65.12.3 | Civil liability insurance |

| 65.12.9 | Other types of insurance not included in other groups |

Who and how can enter into an agreement with the fund

The insurer of the company in question is the country's Pension Fund. This means that in order to formalize an agreement with the NPF, you will need to submit an application to the NPF. A citizen should have a certain list of documentation with him.

In addition, you can use the services of this fund when using the Internet. It is envisaged that a citizen registers in the system through an application certified in advance by a notary office.

In addition to the application, you will need to use:

- a document by which the identity of a citizen is verified;

- SNILS.

It is also possible to submit documentation by contacting an authorized representative. To do this, you will need to form a power of attorney at a notary office.