General information about Promagrofund

The NPF Promagrofond under consideration has been operating on the market for about 20 years.

During its activities, this organization was able to achieve high results, for example:

- Currently, the NPF has about two million clients;

- on reserve funds – 714 million;

- accumulation of pension value – 53 billion rubles.

The company has 56 billion worth of property and has 70 offices in the country. All crises by this organization were endured without consequences for citizens who invested in the fund, while the level of the organization’s rating was maintained.

Personal account features

The personal account of NPF Promagrofond provides its clients with an expanded range of options and capabilities, the main of which are:

- View information about accounts opened with the Fund.

- Obtaining information about transactions and movements of funds within accounts.

- Review of the volume of pension savings and transferred funds.

Thus, the Promagrofond personal account provides the client with the opportunity to receive complete, prompt and reliable information on the formation of the funded part of the pension, as well as on additional accruals as part of co-financing.

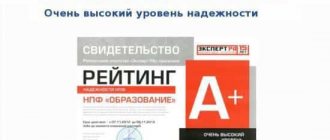

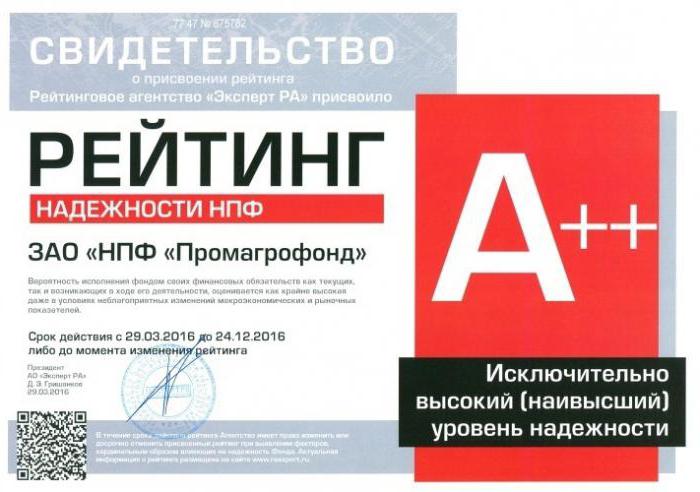

Reliability and profitability rating

It is worth paying attention to the fact that the rating level is set by different agencies, for example, Expert RA, which set the rating “A++” for the fund in question. This rating indicator is the maximum, which indicates that the company provides high quality services and investments in it are protected.

An increased level of reliability is ensured due to the fact that the organization’s activities are ensured through strict control by government agencies.

The work of the fund is subject to licensing, in addition, there is an indicator of the normative contribution of the founders in the aggregate, in addition, the placement of investment funds and reserves from pension savings. Similar rules apply to the formation of a reserve of insurance value.

Important! The funds accumulated in pension accounts cannot be subject to penalties that relate to the debt that is registered with the fund. If there is a negative return, then it can be covered using the funds of the fund.

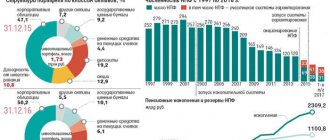

Between 2005 and 2012 there was an increase in funds. Every 1000 in the account became equal to 2002 rubles. Over eight years of operation, the organization’s income was 73% . In this case, the average is 9.1%. In 2020, the profitability of the organization in question exceeded 16%.

It should be pointed out that during the crisis in 2008, the level of profitability of this fund did not fall below 5.2%. If we consider from the same point of view the activities of the official manager of the Pension Fund, then during the specified period of time the indicator had a negative value.

The fund in question has some advantages. Among the main ones, we can highlight the fact that there is transparency and openness in working with clients. For example, this concerns information about the distribution of incoming investments, which is publicly available. This means that every citizen has the right to familiarize himself with this information.

There are several main indicators that characterize the fund’s activities.

Funds are invested in financial instruments:

- government-developed securities;

- bonds issued by companies conducting economic activities;

- deposits in banking organizations;

- shares of enterprises that operate in a strategic direction;

- securities of companies.

In addition, this is documentation of mortgage relations and bonds of the municipality. You can obtain up-to-date information by contacting the fund.

Customer support

There are several ways to contact fund specialists. There is a hotline where you can call an operator free of charge and resolve any issues that may arise. Its number is 8 800 775 90 20. Also, Gazfond (as the successor to NPF Profagrofond) has its own pages on the most popular social networks: Facebook, Odnoklassniki and VKontakte. Therefore, each fund participant can ask a question to the official group, where they will answer it quite quickly. Links to these communities can be found in the upper right corner of the official website.

Official site:

https://www.promagrofond.ru

Personal Area:

https://lk.gazfond-pn.ru/?new

Hotline phone number:

Pension accumulation programs

Currently, the organization in question has developed several programs that focus on pension insurance.

These include:

- The classic program is used to subsequently receive pension payments on a lifetime basis. In this case, it is not provided that funds can be transferred on the basis of relations of hereditary significance. In order to calculate the redemption amount, you need to use the minimum period, which is represented by two years. You will need to deposit a minimum of 2000 rubles. Receipts must be monthly;

- free program. It is used to receive an urgent payment. A special feature of the program is that the schedule for depositing funds has an arbitrary value, that is, the citizen decides on his own how often the money should be credited to the account. The balance of funds in the account is transferred to legal successors upon the death of the owner. The accumulation period is 2 years and the minimum contribution is 500 rubles;

- guaranteed. It is also used to receive an urgent type of payment, while funds are deposited randomly. A citizen has the opportunity to independently determine the frequency of payment; this time cannot be less than a year. The minimum contribution is a couple of thousand rubles and a period of 2 years. The remainder is inherited;

- confident "S". In this case, the amount of contributions is agreed upon by the fund. The payment is made over an annual period and the entire account balance can be transferred to the heirs. The person independently decides how often to deposit funds;

- confident "P". A fixed lifetime payment is provided. It will not be possible to inherit funds; the savings period is a couple of years;

- caring. In this situation, the program makes it possible to transfer pension rights to a third party. You can use any periodicity, but not less than 12 months, with a minimum of 2 years. Every month you need to deposit at least a couple of thousand into your account;

- pension annuity. The citizen receives a pension and the period of contributions is not limited. Payment is made within a year, the remainder is inherited. Every month you need to deposit five thousand rubles.

Due to the fact that funds received from citizens are subject to investment, citizens receive profit. It is transferred to the account. You need to open a separate account for the program. Many of these programs provide a social deduction, which entitles you to a refund of 13% of transfers to NPFs.

Description

To begin with, what exactly is Promagrofond? After realizing this fact, it will be possible to say whether the corporation is really conducting normal activities. Or does she have some kind of shadow politics?

Not at all. Promagrofond is a non-state pension fund. Reviews, ratings, level of public trust - all this is important for this organization. It has existed since 1994. Serves for the formation of pension payments to the population. There is nothing difficult to understand.

The organization receives mostly positive reviews for its activities. It is clear what Promagrofond does. No shadow politics, extremely useful and clear work. But what other aspects of a corporation should you look at before deciding how good it is?

Personal account on the fund website

Each client of the organization in question has the right to register a personal account on the official website of the non-state pension fund "Promagrofond". If, before the merger of Promagrofond CJSC with Gazfond, a person used the capabilities of a personal account, then after that there will be no need to register on the site again.

Algorithm of actions for registration

Using a personal account brings many positive aspects for a citizen. In particular, it is possible to control accumulated funds online.

Registration is done as follows:

- make a scanned passport and SNILS, a statement regarding joining a specific program (it can be drawn up during registration;

- click on the link with the name of the fund’s website;

- reflect SNILS and telephone number, email, residential address;

- attach scanned documents.

Then the citizen receives an identifier on his phone. 10 days are allotted for this. Next, the person will be able to log into his personal account. You will need to change the temporary password and set a permanent one.

What opportunities does LC provide?

The account can be used:

- to check pension savings;

- filling out an application for copies of papers;

- change of personal information.

Also, through your personal account, you will be able to analyze your personal savings and pay the contribution online.

About NPF "Promagrofond"

The organization we are considering is a non-profit pension fund. It was recently merged with NPF Gazfond. All clients automatically came under the management of the partner fund.

Clients of the non-profit pension fund can use their personal account via their computer by visiting the official website. To authorize, just specify your login and password. This is a convenient opportunity - now you don’t need to visit the organization’s representative offices to view your account.

Profitability

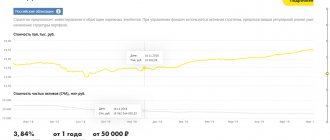

But many potential investors pay attention to the next component. It's about profitability. Non-state pension funds are in demand not only because they offer the preservation of pension savings. They are actively used precisely because of the offers to increase funds in the account.

What is the rating of NPF Promagrofond in terms of profitability? The organization does not show very good performance in this area. The thing is that initially the company offers very good returns. About 15% per annum. That is, the money stored in the account will increase annually by the specified percentage. And that’s why you can find Promagrofond among the top 5 NPF leaders in terms of profitability.

In practice, the picture is somewhat different. Clients indicate that real returns have been significantly reduced. At the moment it is about 5-7%. But some sources indicate that the return is at the level of 17-18%. In reality, it is the first option that takes place.

Due to such inconsistencies, Promagrofond (NPF) receives mixed reviews from clients. Potential investors don't know what to trust. Some feel cheated. In practice, such discrepancies in promises and the actual situation with profitability are a normal phenomenon. It turns out this way because of the crisis and inflation.

In any case, even taking into account the yield of up to 7%, Promagrofond is in demand among the population. Some point out that this organization is not ideal for increasing retirement savings. But it offers a stable increase in deposits. A small percentage will still be due.

Search for clients

Finding clients for a pension fund deserves special attention. It is this nuance that is emphasized in most reviews about the organization. Promagrofond (a non-state pension fund whose rating is already known) is trying, like its competitors, to attract more clients. And the organization uses a variety of methods.

Some potential investors are not happy with the fact that Promagrofond goes door to door. That is, specially hired representatives go door to door looking for new clients. It is noted that scammers often act this way. And therefore, clients often feel deceived.

Promagrofond recommends not contacting representatives who “go door to door.” After all, there are really a lot of scammers who allegedly act in the interests of this non-state fund in Russia. For all information about the work of the organization, it is better to contact the branches directly.