Social pension in 2020 in Penza is a type of government provision that every citizen can count on upon reaching a certain age. Currently, 440,115 citizens of retirement age live in the region, of which 245,751 people are already receiving the required payments. Note that the Penza region is not one of the regions with special living conditions, so increasing coefficients do not apply here, but residents can count on other allowances.

Download for viewing and printing:

Federal Law of December 28, 2013 N 400-FZ, as amended. dated 12/19/2016 “On insurance pensions”

Federal Law “On State Social Assistance” dated July 17, 1999 N 178-FZ

Federal Law of December 28, 2013 N 424-FZ, as amended. dated 05/23/2016 “On funded pensions”

Federal Law of December 15, 2001 N 166-FZ, as amended. dated 07/03/2016) “On state pension provision in the Russian Federation”, as amended. and additional, intro. in force from 01/01/2017

General information

The following types of pensions are paid in the region:

1. Old age:

a. insurance is assigned if the criteria for length of service and points are met:

- after 60 years for women;

- after 65 years for men;

- at a different age in the presence of preferential grounds;

- work experience of at least 15 years (this indicator will be relevant by 2024, in 2020 the minimum experience is 11 years, within 4 years it will increase by 1 year annually);

- 30 individual pension coefficients (in 2020, the minimum amount of pension points is 18.6, the required number will increase annually and will reach 30 by 2024)

b. social :

- women who have celebrated their 65th birthday;

- men over 70 years of age;

- foreign citizens and stateless persons permanently residing in the territory of the Russian Federation for at least 15 years and who have reached the specified age;

- state : assigned to citizens affected by radiation or man-made disasters;

- The state pension for long service is assigned to federal civil servants, military personnel, astronauts and flight test personnel.

2. For disability:

- insurance in the presence of disability and at least one day of insurance experience;

- social in the presence of disability and lack of insurance coverage;

- state is assigned to military personnel, citizens who suffered as a result of radiation or man-made disasters, participants in the Great Patriotic War, citizens awarded the “Resident of Siege Leningrad” badge, and cosmonauts;

3. In the event of the loss of a breadwinner, a pension is entitled to:

- insurance is assigned upon the death of the breadwinner, who was dependent on the applicant for pension provision. The main condition is that the deceased breadwinner has an insurance period (at least one day);

- social is assigned to children under the age of 18, as well as over this age, studying full-time in educational organizations, until they complete such training, but no longer than until they reach the age of 23, who have lost one or both parents, and children of a deceased single person mothers;

4. State pension is assigned to disabled family members of fallen (deceased) military personnel; citizens injured as a result of radiation or man-made disasters, astronauts.

5. The funded pension is paid together with the insurance if the applicant has entered into an appropriate agreement with the Non-State Pension Fund. Persons born after 1966 have the right to such rights.

Important! Certain categories of citizens receive the right to reduce their retirement age. This includes teachers and medical workers (25 and 25-30 years of experience), people who have worked in the Far North for more than 15 years, workers employed in hazardous production, hot shops, women who raised three or more children before they reached the age of 8, one of parents of a disabled child, etc.

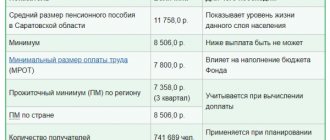

Minimum pension in the Penza region in 2020

In the Penza region in 2020, non-working pensioners are entitled to an additional payment to their pension of up to 8,404

rubles.

The regional subsistence level for a pensioner (RUB 8,404) is greater than the subsistence level for a pensioner in the Russian Federation as a whole ( the subsistence level for a pensioner in the Russian Federation as a whole has not yet been adopted

).

Non-working pensioners whose total amount of material support is less than the regional subsistence level of a pensioner are entitled to a regional social supplement (from the local budget):

Amount of supplement, rub.

= 8404 – Amount of material support for a pensioner The cost of living for a pensioner as a whole in the Russian Federation is established to determine the amount of the federal social supplement to the pension.

The regional cost of living for a pensioner is established in each subject of the Russian Federation in order to determine the social supplement to the pension.

Only non-working pensioners have the right to a social supplement to their pension if the amount of their financial support is lower than the pensioner’s subsistence level established in the region at their place of residence.

Please note that local legislation may provide for certain conditions for receiving a regional social supplement to a pension.

The social supplement to the pension is established from the 1st day of the month following the month of applying for it with the appropriate application and necessary documents.

What amounts are taken into account when calculating the amount of financial support for a pensioner:

- all types of pensions;

- immediate pension payment;

- additional material (social) support;

- monthly cash payment (including the cost of a set of social services);

- other measures of social support (assistance) established by regional legislation in monetary terms (with the exception of measures of social support provided at a time);

- cash equivalents of the social support measures provided to pay for the use of telephones, residential premises and utilities, travel on all types of passenger transport, as well as monetary compensation for the costs of paying for these services.

What amounts are NOT taken into account when calculating

the amount of financial support for a pensioner: social support measures provided in accordance with the law in kind.

For information

In the Penza region, a subsistence minimum per capita has been adopted for certain socio-demographic groups (pensioners, children, working population). It is used for:

- assessing the standard of living of the population in the Penza region in the development and implementation of regional social programs;

- providing state social assistance to low-income citizens;

- formation of the budget of the Penza region.

The cost of living is calculated once a quarter on the basis of the consumer basket (products, industrial goods, services) adopted in the Penza region. It is not used directly for calculating and calculating pensions.

Minimum pension in the Penza region

Allowances

If the total income of a non-working pensioner is below the established minimum subsistence level, the pensioner becomes entitled to a social supplement.

When recalculating, all types of benefits and income received are taken into account, with the exception of one-time payments. This type of support does not apply to working pensioners. If, after receiving the bonus, a citizen goes to work, he is obliged to notify representatives of the territorial branch of the Pension Fund about this.

In addition, pensioners of the Penza region are entitled to the following payments:

- veterans of labor and military service: 430 rubles. monthly;

- home front workers - 500 rubles. at the same time for the celebration of Victory Day;

- monthly cash payment in the amount of 1720 rubles. each disabled family member of a deceased Hero of Socialist Labor, Hero of Labor of the Russian Federation or full holder of the Order of Labor Glory;

- one-time benefit in the amount of 20,000 rubles. in the event of the death (death) of a Hero of Socialist Labor, a Hero of Labor of the Russian Federation or a full holder of the Order of Labor Glory to each of the following members of his family;

- women awarded the “Maternal Valor” medal - 430 rubles. monthly;

- Rehabilitated persons and persons who suffered from political repression - 480 rubles. monthly;

In addition, single pensioners who have reached the age specified by law pay contributions for major repairs at preferential rates, are exempt from property tax (one property to choose from), and receive a reduced tax base for land plots.

Important! When reaching retirement age, a citizen is not required to immediately process the required payments. He can continue to work, increasing the coefficient and, accordingly, the size of his future pension.

What laws will change the lives of Penza residents in 2020?

Payments for the first child

Every month, young families in the region at the birth of their first child after January 1, 2020 will receive 9,470 rubles until the child reaches one and a half years old. The right to support will be given to those families in which the average per capita income does not exceed 150% of the cost of living in the region - 14,656.5 rubles.

To complete the documents, you need to contact the social security authorities or the MFC.

The minimum wage will increase

The minimum wage (minimum wage) will be 9,489 rubles. The increase in salaries, sick leave and other benefits depends on its size. The law will affect about 4 million Russians, TASS reports.

Pensions will increase

Old-age pensions will increase from January 1, 2020 by 3.7%, the average increase will be 500 rubles. The pension amount will increase to 14.3 thousand rubles.

From January 1, 2020, a new procedure for paying pensions to pensioners who stopped working or other activities during which they were subject to compulsory pension insurance will come into force. Payment of insurance pension amounts, taking into account indexation, will be made from the first day of the month following the month of termination of work or other activity.

The new norm will be implemented by additional payment of insurance pension amounts from the first day of the month following the month of dismissal.

A new form of OSAGO policy will appear

From January 1, 2020, the MTPL form will be supplemented with a QR code in the upper right corner.

By scanning it, you will be able to obtain detailed information online from the website of the Russian Union of Auto Insurers about the owner of the car; persons authorized to manage it; insurance policy; insurance company, etc., reports TASS.

It is assumed that the new measure will help combat counterfeit insurance policies.

Excise taxes on gasoline will increase

From January 1, excise taxes on diesel fuel and gasoline will increase by 50 kopecks per liter.

In addition, excise tax rates for passenger cars will change.

According to TASS, the rate will increase least for cars with engine power from 90 to 150 hp. But excise taxes on powerful cars will increase more significantly. In addition, there will be a new differentiation of excise taxes for powerful cars.

Children will not be able to travel on old buses

From January 1, it will be possible to transport groups of children only on buses that are no more than 10 years old from the year of manufacture. The ban was supposed to come into force in 2017, but its deadline was postponed at the request of carriers, representatives of educational institutions and travel agencies.

It will be prohibited to sell energy drinks with degrees

From January 1, Russia will ban the production and sale of alcoholic beverages containing ethyl alcohol less than 15% of the volume of finished products containing tonic substances, according to Rossiyskaya Gazeta.

Registration procedure

To receive pension benefits, you must contact the Pension Fund branch at your place of actual residence . The following documents are usually required for registration:

- written statement;

- passport;

- employment history;

- SNILS;

- ITU conclusion (for disabled people);

- death certificate (survivor's pension);

- documents confirming the right to early retirement.

The package of papers for military pensioners is slightly different:

- statement;

- passport and military ID;

- prescription;

- employment history;

- clothing and cash certificates;

- SNILS.

If there are awards, award certificates are attached to the general package of documents.

In any case, the decision to assign a pension is made within ten days.

Who will become a pensioner

In 2020, 93,971 working pensioners in the Penza region received a recalculation of their insurance pension, and 144 people were able to retire early, having earned considerable length of service.

The manager of the PFR branch for the Penza region, Mikhail Budanov, spoke about pension provision for residents of the “ML” region.

— Mikhail Yuryevich, in 2020, several categories of citizens for the first time had the opportunity to retire early. Has anyone already taken advantage of this right?

— From January 1, 2020, for the first time, those who have significant work experience received the right to early retirement. For women it is 37 years old, for men it is 42 years old. They can retire 2 years earlier than the new retirement age stipulated by law - 60 years for women and 65 for men, but not earlier than 55 and 60 years, respectively.

When calculating such length of service, only those periods of work for which insurance contributions were paid to the Pension Fund and periods of temporary disability (sick leave) are taken into account. Please note that study, military service, child care and other non-insurance periods are not included in the length of service for such early retirement!

From January to December 2020, 144 people were able to apply for a preferential pension for long service. According to our preliminary estimates, 153 residents of the Penza region will receive this right next year.

— Until 2020, mothers with five or more children had the right to early retirement. From 2020 - those with three and four children. It turns out that now all women with many children can retire early?

— In 2020, women who gave birth and raised five or more children before they reach the age of 8 will continue to have the right to early retirement from the age of 50. Moreover, they must have at least 15 years of experience and at least 18.6 pension points.

Four years earlier than the new retirement age - at 56 years old (60 - 4 = 56) - a woman who gave birth and raised four children before they reached the age of 8 can retire. The requirements for granting a preferential pension are the same - at least 15 years of experience and 18.6 points. Mothers who have given birth and raised three children will retire at 57, three years earlier than the generally established retirement age.

Mothers of large families with four children will begin early retirement in 2021, and those with three - in 2023. Before this, it will be more profitable for them to retire on a general basis while the transition period is in effect.

— What is this transition period and who does it apply to?

— In Russia, a new retirement age was established: 60 years for women and 65 for men. But those who turn 55 and 60 years old in 2020, 2020, 2021 and 2022, respectively, will be able to retire a little earlier.

Thus, the right to a pension in 2020 will be acquired by citizens who reached the age of 55/60 in the second half of 2020. These are women born in 1964 and men born in 1959. The former will retire at 55.5 years, the latter at 60.5. The main condition is that you must have at least 11 years of insurance experience and at least 18.6 individual pension points.

Women born in 1965 and men born in 1960 will retire in the second half of 2021 and the first half of 2022 at 56.5 and 61.5 years, respectively (see table).

— Parents raising disabled children often forget about their right to early retirement. Especially if this disability is removed from the child after a course of treatment and rehabilitation. Under what conditions will such an early pension be granted in 2020?

— One of the parents of a disabled child or a person disabled since childhood, regardless of whether his disability has been removed or not, has the right to early retirement. The mother of such a child can retire at 50 years old, and the father at 55, if they raised the child until he reached the age of 8 years.

But, let me emphasize, one of the parents! If mom takes advantage of her right to a preferential pension, then dad will no longer be able to do this, and vice versa.

The conditions for receiving such a pension are at least 15 years of service and at least 18.6 pension points.

— How many pensioners are there in the Penza region and what kind of pension do they receive?

- 447.1 thousand people. This takes into account military personnel who receive an old-age insurance pension. 33.9 percent of the permanent population of the Penza region are pensioners.

Of these, 393.6 thousand people (89.3 percent) receive insurance pensions, 47.1 thousand (10.7 percent) receive social pensions and state pensions.

Last year there were more pension recalculations than in previous years. This is due to changes in pension legislation, federal laws “On State Social Assistance” and “On the Living Wage in the Russian Federation”.

Thus, in January 2020, insurance pensions were indexed by 7.05 percent, in April state and social pensions - by 2 percent. As a result, the average pension in the region increased by 6.7 percent and today is 13,071 rubles 10 kopecks. If we take the average size of only the old-age insurance pension in the region, then it amounted to 13,799 rubles. It increased by 898 rubles 24 kopecks.

In January 2020, almost 406 thousand non-working pensioners will receive an increase in their insurance pension. Indexation will be 6.6 percent. This is higher than the 2020 inflation rate. As a result, the average insurance pension in the Penza region will be 14,374 rubles 52 kopecks.

The size of the fixed payment has increased to 5,686 rubles 25 kopecks since the new year. For disabled people of the first group and citizens over 80 years old, it will be 11,372 rubles 50 kopecks.

— There are statistics: residents of the Penza region began to apply to the Pension Fund more often. Why?

— Indeed, the number of citizens’ appeals to the Pension Fund of Russia is growing. Thus, in 2020, the number of written requests received by the regional department and its territorial bodies increased by 23 percent compared to 2020.

This suggests that people want to know their pension rights and are interested in the changes that are taking place in pension legislation.

The most common questions we get asked are about pensions. They relate to a low pension, the right to early retirement, and bonuses for work in agriculture.

The number of requests regarding information about individual personal accounts has tripled. Citizens are actively interested in this data, because the right to receive a pension and its size depend on it.

Yulia Izmailova