Types of pension payments in the Russian Federation

Russian pensioners do not belong to the poor, that is, to those who live below the poverty line. But at the same time, government payments for the vast majority will barely be able to cover all the needs of older citizens. The average pension for Russian pensioners, according to Rosstat, is 14.9 thousand rubles. According to the legislation of the Russian Federation, in order to be assigned the status of a low-income person, income must be less than the subsistence minimum (ML), and when calculating pensions it is always taken into account. And if the final payment does not reach the local PM level, then the pensioner is paid the missing amount.

There are 4 types of pension payments in Russia:

- Insurance . Previously, this type of payment was called a labor pension. They begin to issue it when you reach a certain age and have accumulated the required work experience.

- Social . This type of payment is claimed by different segments of the population under certain life circumstances. It is not related to the citizen’s work activity.

- Savings - formed for those citizens who were born after 1967 and made contributions to special savings funds.

- Non-state - they will be received by those Russians who have entered into an agreement with a non-state pension fund. Citizens independently transfer part of their income to a non-state pension fund under the terms of the agreement, and upon reaching age they receive payments from it.

Each type of pension payment and the rules for receiving them are prescribed in the legislation of the Russian Federation. You can find out about your right to a pension at the Pension Fund branch or on the Pension Fund website in your personal account.

Any type of pension can be transferred to a card.

Choose the most profitable card for a pensioner →

When it comes to pensions, in most cases they mean old-age payments, because this category of Russian pensioners is the largest.

| Category | 2019 |

| All pensioners in the Russian Federation | 43 865 000 |

| By old age | 36 710 000 |

| By disability | 2 043 000 |

| Survivors | 1 403 000 |

| Victims of man-made disasters and radiation | 443 000 |

| Federal civil servants | 77 000 |

| Test pilots | 1000 |

| Social pensioners | 3 188 000 |

The pension reform launched in Russia in 2020 also applies to old-age pensioners. The amount of this type of payment directly depends on the length of service and the region of residence of the pensioner.

Minimum old-age pension in Russia in 2020: what amount is guaranteed by the state

Before applying for benefits, many citizens are trying to find out what the minimum old-age pension is in 2020.

Old age to a minimum

The concept of a “minimum pension” does not appear in Russian legislation, since the “minimum salary” at the end of a working career is determined by various factors: the level of inflation, the general economic situation, etc.

The state promises that the minimum old-age pension should not be below the subsistence level. In 2020, its amount for pensioners across the country was 8,846 rubles. In the current year 2020, the average cost of living for pensioners in Russia has risen to 9,311 rubles. At the same time, regions individually determine the lower threshold based on the subsistence minimum established by them and can make regional additional payments.

Thus, the minimum old-age pension in Moscow in 2020 is 12,578 rubles. The rules apply to non-working pensioners who have lived in the capital for less than 10 years. For those who have been residents of the capital for more than 10 years, the minimum threshold is different - 19,500 rubles.

Similar systems operate in other regions, but local authorities do not always find opportunities to support pensioners. It is best to find out what minimum old-age pension is guaranteed by the state in the regional branch of the Pension Fund of the Russian Federation, taking into account the specific situation.

Federal Laws No. 400 and Federal Law No. 424, which entered into force on January 1, 2015, significantly changed pension legislation. The usual social and labor pensions have been replaced by the concepts of insurance and funded pensions.

Types of insurance benefits and calculation principles

There are three types of insurance pension accruals:

- for old age: assigned to men and women who have retired due to reaching retirement age (read more about retirement age in our special material);

- for disability: paid to persons with any disability group, even without experience, as well as to disabled children;

- for the loss of a breadwinner: accrued to disabled family members of the deceased breadwinner.

Important! If a citizen has the right to receive several types of insurance benefits, then their values are not summed up, but only one benefit is paid at the choice of the pensioner.

From January 1, 2017, legislation regarding state and municipal officials has been significantly tightened: every year the age for retirement will increase by six months, the minimum length of service will increase to 20 years by 2026, also increasing by six months every year.

To receive an insurance monthly payment in 2020, a number of conditions are important:

- the amount of pension points earned should not be less than 18.6;

- insurance experience – at least 11 years.

New legislation has changed the approach to determining the minimum length of service for assigning an old-age insurance pension. Every year it will increase by a year, and the number of points will increase by 2.4. If those who finish working before December 31, 2020, only need to work for 11 years to receive a state-guaranteed benefit, then those who decide to retire in 2026 will need to work for at least 15 years and accumulate at least 30 points.

On a note! The number of points is directly determined by official employment: the higher the “white” salary, the more points you can accumulate.

A different approach is used when calculating the disability insurance pension. Its size depends on the group and type of payment. The minimum amount of state disability benefits is one and a half to three times higher than the social pension established in the region. What is its exact size will have to be clarified again with the Pension Fund. But the funded part of the disability benefit depends on length of service and deductions from wages, as well as a number of other factors, and is calculated in the same way as for the working population.

The insurance payment is calculated using a special formula: the sum of pension points multiplied by the cost of one point (indexed annually, as of 01/01/2020 = 93.00 rubles) and plus a fixed payment (also indexed - growth dynamics can be seen in the table):

| Group | 2019 | 2020 | Increase amount |

| 1 group | 10 668.38 | 11 372.50 | 704.12 |

| 2 groups | 5 334.19 | 5 686.25 | 352.06 |

| 3 groups | 2 667.09 | 2 843.13 | 176.04 |

Insurance benefits with an increased fixed additional payment are assigned:

- disabled people of group 1;

- after 80 years;

- residents and workers of the Far North and similar regions.

The longer a person does not file a claim for old-age benefits, the higher the final amount of payments will be. If you contact the Pension Fund 5 years after reaching 60/65 years of age, the fixed additional payment will increase by 36%.

A pension calculator will help you accurately calculate benefits.

Let us remind you that it was decided to index pension payments to non-working pensioners from January 1, 2020 by 6.6%.

What do working pensioners need to know about pensions 2020?

Boris Reznik on indexation of pensions for working pensioners

Another relevant question is: “What is the minimum amount of old-age pension if there is no length of service”? In the absence of work experience or lack of the above amount, a social pension is assigned. Until April 2020, its amount is RUB 5,283.84. From April 1, 2020, the social pension will be indexed by approximately 7%, i.e. its size should be 5,653.71 rubles. This type of old-age benefit begins to be paid with a five-year delay after the person reaches retirement age.

Prerequisites for increasing pensions in the Russian Federation

The most significant indexation of old-age pensions was carried out in the Russian Federation in 2020. Then payments were increased by 11.4%. In subsequent years, there were no such significant recalculations, and pensions grew at a pace that sometimes even lagged behind the inflation recorded in the country:

- In 2016, indexation of pensions for working pensioners was stopped;

- In 2017, indexation of pensions takes place twice - in February the fixed part of the pension was indexed by 5.8%, in April the insurance part for all pensioners, including working ones, was indexed by 0.38%.

- 2018 indexation of pensions for non-working pensioners by 3.7% - the minimum coefficient over the past few years;

- 2019 – indexation by 7.05%, the maximum figure since 2015, which turned out to be 2 times higher than the inflation rate.

In 2020, pension increases will be felt by several categories of Russian pensioners:

- In August 2020, pensions will be indexed for those pensioners who continue to work. For more information on how this premium is calculated, see a separate article by Brobank.

- The indexation of pensions for non-working pensioners from January 1, 2020 amounted to 6.6%. On average across the country, payments for this category of citizens increased by 1,000 rubles. Find out how to calculate your premium here.

- Social pensions have been indexed by 6.1% since March 2020. Which is three times higher than the coefficients that were used in the previous two years, and 2 times higher than the inflation rate recorded in the Russian Federation in 2019.

- The budget also takes into account an increase in the fixed part of pensions by 25% for workers in rural areas whose work experience in agriculture is more than 30 years. The approved list of professions eligible for increased pensions includes more than 500 items.

- From October 2020, pensions for retired military pensioners will be increased by 3%. They index one-time payments, monthly compensations and insurance amounts for the military and security forces.

Since 2020, a pension reform has been launched, according to which citizens are promised an annual increase in old-age pensions by a percentage higher than inflation. Payments will increase by an average of 1,000 rubles each year.

To whom do they not “shine”?

But working pensioners in the Moscow region are not promised any additional payments to their pensions in 2020. For them, the minimum pension in 2020 corresponds to the minimum subsistence level of a pensioner. For the Moscow region this is less than 10,000 rubles.

There are no separate bonuses in 2020 for working military pensioners in Moscow and the Moscow region. They will only face the indexation of pensions, which is common to all military pensioners in our country who continue to work and corresponds to an increase in the salary of a serviceman (3% per annum).

What else do Russians’ pensions depend on?

For the first quarter of 2020, the average pension for Russians was 14,924 rubles. Moreover, in 2020 it was equal to 14,163 rubles. But the given amount is not very informative. For qualitative and quantitative assessments, data should be taken over several years.

| Year | The average pension in the Russian Federation in rubles |

| 2001 | 823,4 |

| 2010 | 6177,4 |

| 2012 | 8272,7 |

| 2013 | 9153,6 |

| 2014 | 10 029,7 |

| 2015 | 10 888,7 |

| 2016 | 12 080,9 |

| 2017 | 12 426 |

| 2018 | 13 323 |

| 2019 | 14 102 |

The smallest increase in pensions was recorded in 2020. Indexation in 2020 was carried out not by the actual rate of inflation, recorded in 2020 at 12.9%, but by only 4 percent. As a result, pensioners lost a significant part of their income and even one-time payments of 5,000 rubles could not compensate for them. In 2020, indexation was also canceled for all working pensioners, which also affected the level of the average pension in the country.

The average pension in Russia depends on the gender, place of residence and category of the pensioner:

| Category | In 2020, in Russian rubles |

| Men | 13 950 |

| Women | 14 407 |

| Villager | 12 687 |

| City pensioners | 14 601 |

| Average pensions for disabled people | 9279 |

| For the loss of a breadwinner | 9479 |

| Social pensions | 9094 |

| Pension payments to former officials | 19 994 |

From the above data it is clear that male pensioners receive an average of 0.5 thousand rubles. more women, and rural residents by 2 thousand rubles. less urban. Social pensions are closest to the subsistence level.

Statistics on the average size of pensions are not informative enough. Therefore, Rosstat compares them with purchasing power in relation to the level of the previous year.

| Year | The size of the real pension compared to the previous year, in percent |

| 2012 | 104,6 |

| 2013 | 103,3 |

| 2014 | 103,3 |

| 2015 | 97,5 |

| 2016 | 101,1 |

| 2017 | 97,9 |

| 2018 | 104,9 |

| 2019 | 101,5 |

| I quarter 2020 | 103,2 |

The table shows that pensioners were at the greatest disadvantage in 2020 and 2020. During these years, they were able to buy fewer goods with their pensions than in the previous years of 2014 and 2020. In all other periods, the dynamics remained positive.

The city's economy is doing well

Let me remind you that more than three million pensioners live in the capital. 2 million 83 thousand of them receive additional payments from the capital’s budget to their pensions. These are those Muscovites whose pension is lower than the city standard for the minimum income of non-working pensioners. Against the backdrop of inflation, the city authorities are constantly indexing this standard itself. This is how last year, for example, the minimum pension immediately increased by three thousand rubles - from 14.5 thousand to 17.5 thousand. This year, Moscow Mayor Sergei Sobyanin announced the upcoming increase a few days before the government meeting at which a decision was made in this regard. Having arrived to see the progress of the improvement of Zelenograd, he met with the veterans and asked them a question: will the city be able to increase the city surcharge this year? “We told you that if the economy develops and Moscow’s income allows it, then we will continue to raise the minimum level. Despite the talk that the economy is getting worse and worse every year, I responsibly tell you that this is not so - incomes are growing, income taxes are growing, wages are growing, income tax revenue is growing, because the profitability of enterprises and their income is growing . This is the first sign that the economy is developing,” the head of the city pleased. And he promised that this coming Tuesday the Moscow government would consider this issue. And so, he kept his word. The capital authorities found it possible to allocate 9 billion rubles from the Moscow budget necessary to raise the minimum pension to 19.5 thousand.

And now all non-working pensioners whose pension is below this level will receive city additional payments, and there are now 1 million 600 thousand people in the city. What is also important, Sergei Sobyanin emphasized in his message on Twitter, 44 thousand people will have this help from the city for the first time. Moreover, in Moscow there is a rule: even with an increase in pensions due to federal bonuses, the city surcharge is not canceled. Its size is quite significant, the department of labor and social protection of the capital told RG. If before the current increase it was on average 5.5 thousand rubles per person, now it is more than 6.3 thousand. Let us ask ourselves: how much would pensioners receive without the help of the city? According to the Pension Fund, the average size of pensions for recipients of additional payments is 13,800 rubles.

The capital's income, enterprise profitability, and tax collection are growing. This allows it to pay extra to 1 million 600 thousand non-working pensioners on average 6.3 thousand rubles per month

RG readers often wonder why the capital raises pensions for its pensioners, while other regions most often do not. Just because Moscow has a lot of money? At the “Business Breakfast” in “RG”, the Minister of the Moscow Government, Head of the Department of Labor and Social Protection Vladimir Petrosyan answered it like this: “This is not the first time I have heard such a reproach and I am ready to repeat it. Moscow does have a large budget, but the city is also much larger - 12 million inhabitants. There are 3 million 90 thousand pensioners alone. Which regional center has this much population? Nevertheless, the Moscow government finds an opportunity not only to build new schools, hospitals, metro, while also performing the function of the capital, but also to help citizens who need its support. This is the best evidence of the prioritization of the city’s socio-economic policy.”

Infographics "RG"/Anton Perepletchikov/Lyubov Protsenko

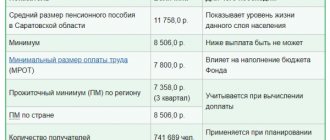

The ratio of pensions in the region and regional PM

The difference in the size of pensions of Russians depending on the territory of residence is indicative. According to Rosstat, average pensions in certain regions of the country differ by 2-2.5 times. For objectivity of the amounts, we present them in comparison with the subsistence level established in the region. The sample shows data with the lowest and highest indicators for 2020 in Russian rubles:

| Region | Average pension in the region | Living wage for a pensioner in the region of residence | Difference between PM and average pension |

| For the Russian Federation as a whole | 14 102,1 | 8846 | 5256,1 |

| Chuvash Republic | 13 038,4 | 7953 | 5085,4 |

| Tambov Region | 12 632,8 | 7811 | 4821,8 |

| Belgorod region | 13 842,2 | 8016 | 5826,2 |

| Moscow region | 15 124,4 | 9908 | 5216,4 |

| Moscow | 15 204,2 | 12 115 | 3089,2 |

| Nenets Autonomous Okrug | 21 660,5 | 17 956 | 3704,5 |

| Yakutia | 18 900,7 | 13 951 | 4949,7 |

| Kamchatka Krai | 21 229,4 | 16 543 | 4686,4 |

| Chukotka Autonomous Okrug | 24 290,7 | 19 000 | 5290,7 |

| Leningrad region | 14 468,1 | 8846 | 5622,1 |

| Saint Petersburg | 15 616,5 | 8846 | 6770,5 |

The table shows that a high pension, for example in the Nenets Autonomous Okrug, after expenses for the cost of living, is less than in the Tambov region, where pensions are the lowest.

According to Rosstat indicators, the average pension in the Russian Federation differs slightly from the minimum in the region. The Russian statistical service recorded that 13.8% of Russian pensioners receive social supplements because their payments do not reach the minimum wage in their region of residence.

Russian regions with the lowest pension levels in 2019:

- Volga Federal District - 13,523 rubles;

- Southern Federal District – 12,940 rubles;

- North Caucasus Federal District - 11,927.1 rubles;

- Republic of Buryatia – 13,185.3 rubles;

- Trans-Baikal Territory – 13,119.1 rubles.

The highest pensions in 2020 were in the Far East - 15,629.7 rubles, Ural - 15,299.5 rubles. and North-West 15,703.1 rubles. districts And also in the Far North and equivalent areas, which is due to more difficult living conditions.

Nobody canceled natural benefits

What else is interesting? Even at the time of monetization, when in-kind benefits were abolished in many territories and regions, Moscow retained them in full. All pensioners, without exception, still travel for free on city public transport. Over 900 thousand people receive payment for the subscription fee for a landline telephone. Veterans of the Great Patriotic War, labor veterans, disabled people and families with disabled children - in total more than 50 categories and a total of almost 4 million citizens enjoy benefits for housing and communal services and major housing repairs. These benefits exempt them entirely from payment or half. More than 47 billion rubles have been allocated specifically for these purposes in the Moscow budget in 2020. Another million city residents receive assistance in the form of subsidies - special payments that compensate for the cost of utilities if they are too difficult for the family. To receive them, you don’t even have to be a beneficiary; all Muscovites who spend more than 10% of their entire family’s income on housing and communal services are entitled to a subsidy. This is the lowest threshold for assistance in the country.

Average pension in Moscow

The capital of the Russian Federation is often perceived as a separate “country”, and many pensioners believe that the conditions there are the most favorable compared to other regions. In reality, two values have been established for Moscow pensioners, from which they base their pension payments:

- the cost of living for a Moscow pensioner is 12,115 rubles;

- city social standard - 19,500 rubles.

But not all Moscow pensioners receive additional payment to the State Social Insurance Fund, but only those who have lived in the capital for more than 10 years. However, even this restriction still has an impact on the final average level of pensions for capital pensioners, which is slightly higher than in the country as a whole.

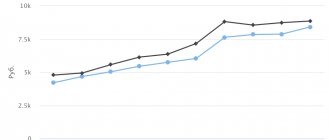

| Year | Average pension in Moscow, rub. | Average pension in Russia, rub. |

| 2012 | 8893 | 8273 |

| 2013 | 9845 | 9154 |

| 2014 | 10 851 | 10 030 |

| 2015 | 11 790 | 10 889 |

| 2016 | 13 095 | 12 081 |

| 2017 | 13 450 | 12 426 |

| 2018 | 14 410 | 13 323 |

| 2019 | 15 204 | 14 102 |

On average, the difference between payments to a Moscow pensioner is 1,000 rubles higher than for other Russians. However, the price level in Moscow is also metropolitan, so local authorities partly compensate for expensive accommodation with other benefits for pensioners.

Average pension size by profession

The average pension in Russia also depends on the profession to which a citizen devoted years of his working activity:

- teachers - 10.6 thousand rubles;

- health workers, including paramedical staff – 14.4 thousand;

- miners - 17 thousand;

- police and other justice workers - 18 thousand;

- officials - 80 thousand;

- test pilots - 94.5 thousand;

- judges - 150 thousand rubles.

Pensions for military pensioners depend on length of service and military rank. Approximate rank allowances for military personnel:

- lieutenant - 20 thousand rubles;

- captain - 23.5 thousand;

- major - 25 thousand;

- lieutenant colonel - 31 thousand;

- colonel - 40 thousand;

- general - 50 thousand rubles.

The bonuses are paid not by the Pension Fund of Russia, but by the department in which the military man served.

Number of Russian pensioners

According to Rosstat, the number of Russian pensioners is growing steadily.

| Year | Number of pensioners |

| 1981 | 27 417 000 |

| 1991 | 32 848 000 |

| 2001 | 38 411 000 |

| 2010 | 39 090 000 |

| 2015 | 41 456 000 |

| 2016 | 42 729 000 |

| 2017 | 43 177 000 |

| 2018 | 43 504 000 |

| 2019 | 43 865 000 |

The dynamics of growth in the number of citizens entitled to pension payments puts significant pressure on the country's economy. This trend, along with an increase in life expectancy, became the main prerequisites for the start of pension reform in the Russian Federation.

Dynamics of average pension payments

For the period of 2020 and the first quarter of 2020, the dynamics of the average size of Russian pensions looks like this:

| Period | Average pension in Russia, in rubles | The real amount of pensions compared to the same period of the previous year, in% | Average pensions relative to average salaries, % |

| I quarter 2019 | 14 116 | 100,7 | 32,1 |

| II quarter 2019 | 14 140 | 100,9 | 29,2 |

| I half of 2019 | 14 128 | 100,8 | 30,6 |

| III quarter 2019 | 14 174 | 101,7 | 31,0 |

| IV quarter 2019 | 14 224 | 102,6 | 27,5 |

| For 2020 | 14 163 | 101,5 | 29,8 |

| I quarter 2020 | 14 924 | 103,2 | Unspecified data 32.4 |

The data presented show that the country's pension system is far from perfect and the state continues to search for solutions to improve the lives of pensioners. But the pension reform launched in 2020 is at an early stage, so it is still difficult to assess its effectiveness.

Social supplement up to the subsistence level for pensioners

From January 1, 2020, the size of pensions for non-working pensioners has been indexed. But, even taking into account indexation, the total material support may not reach the established minimum for normal existence. This is the limit below which payment cannot be made - the minimum pension . If the pension turns out to be less than this amount, then a social supplement will be established.

The surcharge is calculated using the formula:

Social supplement = PMP - Monthly income of a pensioner

It should be taken into account that the amount of the surcharge is influenced by the amount of monthly payments in favor of the pensioner, consisting of:

- monthly benefits assigned as pension benefits and urgent pension payments;

- other social payments, including a set of social services;

- additional measures of social support in monetary terms, for example, to pay for housing and communal services, telephone, transport travel (support measures of a one-time nature are not taken into account).

From January 1, 2020, the cost of living limit for a pensioner was subject to change, which also affected the amount of the minimum pension. Accordingly, additional payments are already established according to current indicators.

For those who received a social supplement previously, the procedure for recalculating pensions has changed. From the beginning of 2020, the amount of the social supplement will remain the same and will be added to the indexed pension.

Let's consider the situation using the example of the Perm region:

The citizen reached retirement age in July 2020. He was assigned an insurance pension in the amount of 7,500 rubles, which was lower than the PMP in the region (8,539 rubles). Therefore, a social supplement of 1,039 rubles was assigned, which brought the pension to the minimum in the region of residence.

In January 2020, it was recalculated according to the new rule:

- The size of the insurance pension was increased by 6.6 percent: 7500 × 6.6% = 7995 rubles;

- the regional social supplement remained the same: 1039 rubles.

Accordingly, from January 1, the pensioner will receive 7995 + 1039 = 9034 rubles, i.e. the increase was 495 rubles.

What should be the pension according to the International Convention?

Pensioners not only in the Russian Federation, but also in many other countries consider the level of pensions assigned by the state unacceptable. And actually for good reason. For an objective assessment, Rosstat provides data on pensions in relation to the level of average wages in the Russian Federation. This comparison is more indicative of the standard of living of pensioners.

According to the international Convention, the amount of payments to a pensioner should be equal to 40% of the average salary, but in Russia it fluctuates around 30%. In the Russian Federation, the Convention was ratified in 2020, but it has not yet been possible to bring the size of pensions to the specified level.

| Year | Average pension in Russia, in rubles | Average salary, in rubles | Percentage calculated by Rosstat |

| 2012 | 8272,7 | 26 628,9 | 32,1 |

| 2013 | 9153,6 | 29 792,0 | 30,7 |

| 2014 | 10 029,7 | 32 495,4 | 30,9 |

| 2015 | 10 888,7 | 34 029,5 | 32 |

| 2016 | 12 080,9 | 36 709,2 | 32,9 |

| 2017 | 12 425,6 | 39 167 | 31,7 |

| 2018 | 13 323,1 | 43 724 | 30,5 |

| 2019 | 14 163 | 47 867 | 29,8 |

| I quarter 2020 | 14 924 | 48 377 | 32,4 |

According to Rosstat, in 2020 this figure was the lowest in the last 8 years. Upon retirement, a citizen’s income is immediately reduced by more than three times. Therefore, some Russians do not retire even when they reach the established age. In 2019, 8.574 million old-age pensioners continued to work.

Conditions for calculating pension subsidies for residents of Tver

Budget funding is provided to citizens within the framework of current legislation. That is, a person can apply for a pension only when he has received the right to it. And the latter depends on:

- type of content: insurance;

- social;

- state;

- length of service (at least 9 years in 2020);

- disability;

For information: military personnel and equivalent persons receive pension benefits based on length of service, not age.

The procedure for applying for a subsidy based on age or disability in 2020

The algorithm for working with applicants is as follows:

- They proactively write a statement, supporting it with documents. The main ones include: passport and SNILS;

- employment history;

- certificate of assignment of a disability group;

- death certificate of the breadwinner;

- additional ones include: preferential certificate;

- birth certificates of children;

- certificate of presence of dependents.

- extend the review period;

Hint: the applicant independently indicates a comfortable way to receive money:

- to a bank card;

- by mail;

- through a specialized company.

Addresses of PFR branches in Tver

| Address | Telephone | Working hours with the public |

| ave. Pobeda, 21 | +7 | 9:00 — 17:00; on Friday until 16:30 |

| st. Vagzhanova, 9 | +7 | |

| ave. Pobeda, 21 | +7 | |

| ave. Pobeda, 3 | +7 | |

| Smolensky Lane, 1a | +7 | |

| st. Ordzhonikidze, 20 | +7 | |

| st. Sovetskaya, 35 | +7 |

For information: according to regulatory requirements, pensions are accrued in the Tver region for the current month. A person must receive the payment in hand by the 25th.

Russian pensions in comparison with payments in other countries

In a number of countries, the pension may be even higher than the citizen’s salary at the time of termination of work. Such indicators are observed, for example, in the Netherlands. While in the UK pensions are closer to the Russian level - about 29% of the average salary of working British people. However, the salaries themselves in developed countries are significantly higher than the Russian average.

| A country | Average pension in 2020, thousand rubles. RF |

| Germany | 132 |

| USA | 163 |

| France | 179 |

| Spain | 173 |

| Israel | 140 |

| Canada | 139 |

| Japan | 89 |

| Great Britain | 70 |

| Poland | 57 |

| Russia | 14 |

The price level in these countries is also important. But even they will not change the difference in the standard of living of a pensioner in developed countries and in the post-Soviet space.

Some analysts believe that only retirees living in the countries of the former USSR should be compared. In this case, it becomes obvious that the average pension in Russia is far from the lowest in the world. According to data for 2020:

| A country | Pension amount in US dollars |

| Azerbaijan | 112 |

| Armenia | 84 |

| Belarus | 159 |

| Kazakhstan | 162 |

| Moldova | 89 |

| Ukraine | 87 |

| Tajikistan | 30 |

| Russia | 224 |

But even in these countries, pensions have begun to increase over the past 2 years. So in Belarus the average pension for 2020 is $194, and in Ukraine about $95.

The average pension in Russia is closest to the level in China. Although only 2/3 of senior citizens receive state pensions there. The average pension for elderly Chinese is from 150 to 200 US dollars.

Useful links:

- State Duma of the Russian Federation. News about the ratification of the Social Security Convention.

- Rosstat

- Pension Fund of the Russian Federation. Living wage in the constituent entities of the Russian Federation in 2019

about the author

Klavdiya Treskova - higher education with qualification “Economist”, with specializations “Economics and Management” and “Computer Technologies” at PSU. She worked in a bank in positions from operator to acting. Head of the Department for servicing private and corporate clients. Every year she successfully passed certifications, education and training in banking services. Total work experience in the bank is more than 15 years. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

General aspects of assigning a minimum pension

According to Federal Law No. 166, a minimum social-type old-age pension is due to everyone upon reaching retirement age. Since its level is low, citizens accumulate work experience so that pension payments correspond to a comfortable standard of living. Let us consider the conditions for assigning a minimum pension for different categories of pensioners.

The minimum old-age pension is determined depending on the financial conditions of the region. The payment cannot be lower than the PMP existing in the constituent entity of the Russian Federation (the subsistence level of a pensioner). The amount of pension contributions also depends on annual indexation. What is the current minimum pension in Russia and by region is described below.

In 2020, the planned increase in pensions will occur on January 1. The indexation rate of the insurance pension according to the Pension Fund of Russia is 7.05%. In monetary terms, this is about 1000 rubles monthly. In 2020, in addition to increasing insurance payments, it is planned to increase social and government payments. It will be 2.4% and will cover the increased part of the cost of living.

Types and types of pensions

There are several types of pensions:

- The insurance type is calculated if a person has a certain work experience. In fact, it is paid from precisely the same contributions that the employer made for the employee throughout the entire period of his work. There is already an article on our website in more detail about the insurance pension part.

- A social old-age pension is assigned when a person has no work experience. There is no work experience when the pensioner has not officially worked anywhere and the employer does not make contributions to the Pension Fund for him. What are social pension payments, see the link for more details.

These two types of support are intended to cover all categories of the population, regardless of the presence or absence of work experience. Note that in China there is no provision of a social pension.

Conditions for insurance pension

85% of pensioners in the Russian Federation receive insurance or labor-type pensions. All criteria, options and possibilities for receiving this type of payment are regulated by Federal Law No. 400, adopted back in 2001. Anyone wishing to apply for such a benefit must meet a number of criteria:

- Earn at least eight years of work experience in 2020. This number will grow until it reaches 15 years in 2024.

- Receive at least 11.4 IPC (pension points) during your work. This figure will also gradually increase to 30 units by 2025.

If all the criteria match, you can safely try to apply for a labor pension, but if not, then you can apply for other types of payments.

If the required level of official experience for applying for an insurance pension has not been achieved, do not despair. For such cases, a system of social pensions has been developed to support citizens in difficult life situations. The conditions for receiving the minimum age pension are regulated by Law No. 166.

Social old-age pension is due:

- for all population groups (61 and 56 years old for men and women in 2019, 65 and 60 in 2023), regardless of place of registration or citizenship.

- Women and men who live in the Far North and belong to small nations have the right to early retirement.

The main condition for obtaining social benefits, as well as receiving them for life, is reaching a specific age.

Comments: 0

Your comment (question) If you have questions about this article, you can tell us. Our team consists of only experienced experts and specialists with specialized education. We will try to help you in this topic:

Author of the article: Klavdiya Treskova

Consultant, author Popovich Anna

Financial author Olga Pikhotskaya