Reasons for appeal

As a rule, disagreement with the amount of the accrued pension payment appears immediately after retirement. That is, in order to assess the correctness of the calculation, you should receive this pension at least once.

If a pensioner has reason to believe that the calculation of the pension was made incorrectly, then he can contact the territorial branch of the Pension Fund of the Russian Federation with an application for recalculation of the pension.

No one requires a pensioner to become thoroughly familiar with pension legislation, so in order to ask for a recalculation, it is not at all necessary to be sure that you are right.

The personal opinion of a pensioner that the pension should be higher given his length of service is quite sufficient, and the Pension Fund and the court must decide whether the pensioner is right or wrong.

That is, you should not be at all embarrassed to contact the Pension Fund of the Russian Federation for any reason related to the payment of pensions. The Pension Fund is obliged to respond to all applications from citizens, including those regarding pension recalculation.

What is needed for recalculation

When applying to the Pension Fund in person, you should have a number of documents with you:

- passport of a citizen of the Russian Federation with registration - application takes place at the department at the place of residence;

- a statement written personally or by a legal representative;

- documents on the assignment of a pension;

- documents confirming the possibility of recalculating benefits.

In most cases, documents confirming the right to increase benefits are already in the pensioner’s personal file or are independently requested by pension fund specialists from authorized organizations.

An application for pension recalculation is written on a standard form approved by the Government of the Russian Federation.

What the Pension Fund is silent about

The pension legislation of the Russian Federation includes several laws, which are sometimes difficult to understand even for a lawyer. That is why, if you want to get full advice on pension issues, you should contact not just a lawyer, but a lawyer specializing in pension law.

If this is not possible, and you have to defend your interests on your own, we recommend that you do not delve into the study of laws.

Everything you need to know when contacting the Pension Fund of the Russian Federation is contained in Resolution No. 30 of the Plenum of the Armed Forces of the Russian Federation dated December 11, 2012.

It sets out in an extremely concise and accessible way almost everything related to pension provision, including problems of calculating length of service, accounting for benefits, etc. Moreover, the Resolution contains direct references to the provisions of the law, and thus there is no need to waste time searching for sources.

For pensioners with dual citizenship

In accordance with current legislation, a citizen of the Russian Federation can have dual citizenship. In this regard, it is important to understand how and who will pay his pension.

The main thing that determines the purpose of payments is the citizen’s place of residence. If he lives in the Russian Federation, then there are no problems.

A person applies to the Pension Fund branch at his place of residence and formalizes the assignment of payments in the general manner.

For persons living in the territory of other states, there are several options for receiving a pension:

- on a territorial basis;

- on a proportional basis.

It all depends on the presence/absence of an international agreement between the Russian Federation and the country of residence.

Based on the principle of territoriality, agreements have been concluded with a number of CIS countries, Georgia, Lithuania, etc. It assumes receiving a pension from the state in which the pensioner lives. In the case where a person has not received the right to pension provision in the state, it is paid through the Pension Fund of the Russian Federation.

The proportional principle refers to the method of calculating a pension based on the insurance period obtained during the period of residence in a particular country. Israel, Spain, Bulgaria and Estonia have concluded agreements with the Russian Federation on calculating payments in a similar way.

If the Russian Federation does not have an agreement on pension cooperation with the country of residence of a citizen with dual citizenship, the pension is assigned according to the general principles provided for Russian citizens.

How to argue a statement

Of course, an application to the Pension Fund should not be limited to a phrase like “I want to receive more.” At least the minimum argumentation of the requirements for recalculation must be present in the application, otherwise consideration of the application may be refused.

The following can be attached as arguments confirming the requirements:

- a copy of the work book;

- archival and other information;

- copies of children's birth certificates;

- copy of military ID;

- salary certificates;

- certificates of awards and titles, etc.

That is, any documents substantiating the requirement to increase the pension amount can be attached to the application.

Recalculation of pensions through the court

To achieve an increase in pension in court, you need to file a statement of claim in court for recalculation of the pension. You need to carefully write such a document about recalculating the amount of your pension.

A completed sample and

application form

for pension recalculation will help you avoid making mistakes. All columns of the form must be filled out as indicated in the sample, otherwise it will not be accepted for registration in the court office.

Any claim for recalculation of the pension amount must be supported by documents confirming the right of a person who has retired to receive a larger monthly old-age payment. Such documents will be an argument for the court, which will allow it to make a decision in favor of the plaintiff.

The plaintiff must provide as evidence:

- work book, which by law is the main document confirming the employment of every Russian citizen;

- archival extracts supplementing inaccuracies or gaps found in the work book;

- documentary evidence of awards and cash bonuses received by the pensioner during his work activity.

To increase the amount of payments, every pensioner who has every reason to do so must write an application for recalculation of the pension amount. A sample of such a document will help you do this properly. In addition to appeals to the Pension Fund or the court, documents are also required to confirm the plaintiff’s claims to increase his old-age pension.

You need to submit documents for recalculation of your old-age pension in the middle or end of the current month so that the pension fund can make the recalculation from the 1st day of the next month.

Pension recalculation can change the amount of pension payments. It is provided for by the Laws “On Insurance Pensions”, “On State Pension Provision in the Russian Federation”, “On Funded Pensions”. In addition, detailed information about the recalculation is contained in the administrative regulations (Order of the Ministry of Labor of the Russian Federation No. 157 n dated March 28, 2014).

The Pension Fund can recalculate pensions for both working pensioners and non-working pensioners. It is possible upon the written application of the pensioner.

In some cases, the Pension Fund may recalculate pensions on its own initiative. And no application is needed.

Changes in the amount of payments can occur not only in relation to the old-age pension. But also disability pensions, in case of loss of a breadwinner.

Drawing up an application

There is no established template for applications for pension recalculation, although standard templates for applications of any type can be found on the Pension Fund website.

You can completely write the application yourself or use the sample available on our website and available for downloading.

An application is drawn up according to the general rules, and it begins with the name of the territorial branch of the Pension Fund to which the application is sent. The following information is subsequently entered into the application:

- Full name of the applicant, his address, pension certificate number and date of retirement;

- the amount of the last pension payment;

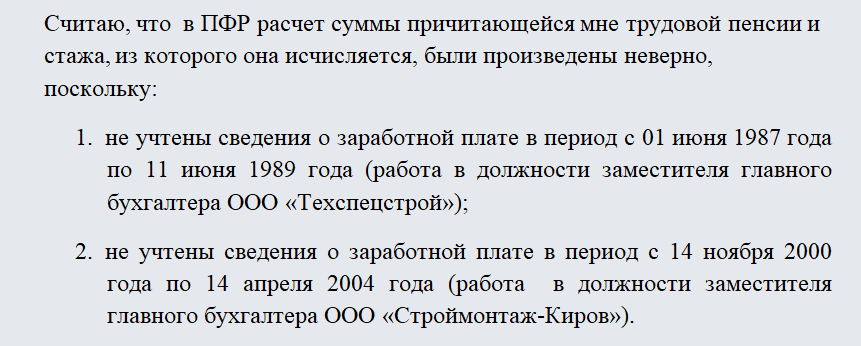

- the reason why the last payment is assessed by the pensioner as incorrect;

- conditions that, in the applicant’s opinion, were not taken into account by the Pension Fund employee at the time the pension was calculated;

- argumentation of the requirements and listing of documents confirming the requirements of the application;

- If a pensioner provides new documents that the Pension Fund was not previously aware of, it is advisable to explain why they were not submitted at the time the pension was calculated.

At the end of the application, you should state a request for recalculation of the pension, sign and date it.

Features of recalculation of old-age labor pension

The Pension Fund reviews pension accruals from the 1st day of each month. Therefore, you need to apply there after a reduction in pension payments has occurred.

For working pensioners, there are some legal grounds for recalculation, and for non-working pensioners, there are others. This must be taken into account when sending an application for pension recalculation to non-working pensioners.

It should be remembered that any requirement to increase pension payments must be accompanied by a package of documents providing a legal basis for recalculating the old-age pension. Otherwise, he will not be accepted. By law, all paperwork for increasing pension payments must be provided by the pensioner himself.

Package of documents attached to the application for recalculation:

Such documents include:

- employment history;

- extracts from the archives of former employers on the amount of wages;

- information about awards during the work period.

Please note: if employees of the local Pension Fund refuse to accept papers and confirmations, then you should write a statement of claim for recalculation of the pension. A sample statement of claim is always provided at the court secretariat.

Recalculation of pensions for working pensioners

In connection with the pensioner’s work activity, the recalculation of his insurance pension is made in connection with an increase in the size of the IPC based on the amount of insurance contributions paid for him by the employer to the Pension Fund of the Russian Federation after 01/01/2015, which were not taken into account when assigning the insurance pension.

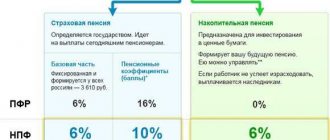

When recalculating the insurance pension in this case, the maximum value of the IPC is 3.0 - for pensioners who do not have pension savings in the corresponding year, and 1.875 - for pensioners who do have such savings. In general, the territorial body of the Pension Fund of the Russian Federation recalculates the old-age insurance pension or disability insurance pension on an undeclared basis from August 1 of each year.

Until 2022, when recalculating the insurance pension, the maximum IPC value of 3.0 is applied in connection with the suspension of the formation of a funded pension at the expense of insurance contributions for compulsory pension insurance.

In certain cases, a working pensioner also has the right to recalculate the amount of a fixed payment to the insurance pension (in particular, when he is assigned disability group I, when the number of disabled family members who are dependent on him changes, when he acquires the necessary work experience in the Far North and equivalent areas). Pension recalculation is carried out on the basis of the application and documents required for such recalculation.

Pension recalculation procedure: fixed payment

Pension provision includes the possibility of receiving a fixed payment in addition to the insurance pension. The grounds for recalculation of payment are:

- Reaching the age of 80 years.

- Assignment of 1st disability group.

- Change in the number of dependents, incl. on the basis of a court decision establishing the fact of being a dependent.

- Having work experience (15 years, 20 years) in the Far North. Or areas equivalent to it.

- Moving to the regions of the Far North or other equivalent areas (where a different regional coefficient is established).

- Moving from the Far North to another place of residence, from rural areas.

- Children who receive a survivor's pension due to the death of one parent, or upon the death of the second parent.

Recalculation of pension after dismissal

Pensioners who have left work, the amount of the insurance pension, the fixed payment to the insurance pension (taking into account the increase in the fixed payment to the insurance pension), including those received in connection with the recalculation, are paid in the amount calculated in accordance with the law. At the same time, taking into account the increase in the size of the fixed payment to the insurance pension and adjustments to the size of the insurance pension that took place during the period of work.

The period starting from the 1st day of the month following the month of termination of work is taken into account.

Thus, after the pensioner stops working, the full amount of the pension, taking into account indexations, will be paid for the period from the 1st day of the month after dismissal.

If the employer timely submits information to the Pension Fund, the renewal of pension indexation and the start of its payment in full occurs three months from the date of dismissal. The new law will allow a pensioner to receive the full pension for the period from the 1st day of the month following the month of dismissal.

Payment of the full pension amount occurs as follows. For example, a pensioner quit his job in March.

Expert opinion

Ilyin Yuri Viktorovich

Practicing lawyer with 7 years of experience. Specialization: civil law. Extensive experience in protecting legal interests.

In April, the Pension Fund will receive reports from the employer indicating that the pensioner is still listed as working. In May, the Pension Fund will receive reports in which the pensioner is no longer listed as working.

In June, the Pension Fund of the Russian Federation will decide to resume indexation and in July the pensioner will receive the full pension amount, as well as the monetary difference between the previous and new pension amounts for the previous three months - April, May, June. That is, the pensioner will begin to receive the full pension the same three months after dismissal, but these three months will be compensated to him.