Home / Labor Law / Payment and Benefits / Pension

Back

Published: 04/06/2020

Reading time: 3 min

0

282

— Now I’m 25, but I understand that you need to think about your future retirement as early as possible. I constantly come across offers from various non-state pension funds (NPFs). How are they fundamentally different from the Pension Fund and can you trust them with your money?

— In Russia there is only one state pension fund - the Pension Fund. Citizens can make a choice regarding the funded part of their pension, forming it not through the Pension Fund, but through a non-state pension fund. Let’s figure out how reliable it is and how to choose a non-state pension fund with minimal risks for yourself.

- Comparison of Pension Fund and Non-State Pension Fund

- Is it possible to be left without funds by investing money in a non-state pension fund?

Differences between Pension Fund and Non-State Pension Fund

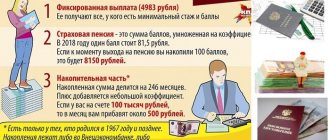

The principles of operation of state and non-state pension funds are the same: the client transfers part of the funds from wages to a personal account to form future pension payments. But then the differences begin.

Let's look at the difference between funds using several specific examples.

1. The State Pension Fund pays the accrued pension regardless of the balance on the personal account. The private entity pays as long as there are funds in the account. If a pensioner is lucky enough to live to be 100 years old, it is not a fact that the NPF will make payments - the money in the personal account may run out. But such a situation occurs extremely rarely. Typically, funds assume that the pensioner will live another 30 years after retirement.

2. In the Pension Fund of the Russian Federation, the size of the pension is in no way linked to the profitability of the funds placed - the size of pension payments is calculated without taking this factor into account. Private foundations count every penny. The movement of funds in the account can be seen through your Personal Account.

3. Funds in the state fund are considered the property of the state - those who die before retirement cannot transfer the accumulated funds to their heirs: there is no normal legal framework. NPFs enter into agreements with their clients, where all issues are thoroughly discussed, including who will receive the rest of their pension savings.

4. The Pension Fund is constrained by instructions on the placement of its capital. Non-state pension funds have the right to invest clients’ money in any operations.

Let's summarize the first results: there is only one state pension fund in the country - the Pension Fund. It is included in the country's budget structure. Therefore, the size of pensions depends entirely on the adopted budget for the reporting year. All the talk about the profitability of funds in this fund is from the evil one - they do not in any way affect the size of the pension you receive. NPFs are non-profit social security organizations operating in the pension sector. Pensions are paid from accumulated funds. Their size has nothing to do with length of service and other government features. Linked only to the amount of accumulated funds.

Cost of purchased diplomas and certificates

Studying on a paid basis costs the student a good amount of money. At the most prestigious faculties of elite universities, tuition fees amount to tens of thousands of dollars. Not every person has the constant ability to pay the required price.

Buying a diploma is much cheaper than paying tuition. Standard prices are 20,000 rubles, prices vary slightly depending on:

- From the level of the educational institution;

- Specialties and specializations;

- Years of admission and graduation;

- Urgency of order fulfillment.

Each client needs to individually choose the terms of cooperation, but we will definitely take the main points into account when completing the order.

Who needs quick diplomas?

Studying at a university or college often has a negative impact on the health of students. We have to expend the strength of a young body:

- To study a large number of non-core subjects;

- Attending boring lectures and mandatory practical classes;

- Passing sessions and defending final works;

- Writing a thesis project and communicating with curators.

You can get a diploma with a minimum of effort. You just need to leave a request on the website and wait for contact with the company manager. Instead of tedious full-time or part-time studies, living expenses, tests and exams, many choose a different path.

The potential buyer gets the opportunity to engage in his own practical self-education. He does not need to study many related disciplines that will never be useful in the future. A failed part-time student is freed from communication with teachers who are not always adequate.

Selling diplomas is carried out without unnecessary complications. Within a couple of days, the customer receives the desired document.

How to verify the authenticity of documents

For most employers, having a diploma when hiring is a formality. It is much more important that a person has solid practical experience and outstanding personal qualities. Many companies specifically require a document from applicants for management positions in order to narrow the pool of potential applicants.

Therefore, verifying the authenticity of the provided diploma or school certificate is usually the responsibility of the personnel department employees. The employee will visually inspect the document, make a copy and attach it to his personal file. This diploma fully meets the necessary criteria of the Russian Ministry of Education.

Serious verification of documents is possible only in some cases. The most common official requests are sent to:

- From law enforcement agencies;

- Large commercial firms;

- Companies working in the financial sector;

- Oil refining industry organizations;

- State medical institutions.

Order a diploma from us - get a prestigious job in commercial structures with minimal risks of detecting a fake

Pros and cons of the state pension fund

Considering the positive and negative aspects of the Pension Fund's activities, experts get off with a couple of sentences, talking about the advantages of the fund, and one about the disadvantages.

We quote them verbatim:

- The advantage of a state fund is its reliability - there is absolutely no risk of losing savings;

- regular indexation linked to inflation.

The disadvantages include the low profitability of funds stored in the Pension Fund.

If we talk about the advantages, they are stated precisely and even with a strong desire you will not find more. But you need to deal with the disadvantages.

1. When talking about low income, social service workers are either disingenuous or do not understand what they are talking about. After all, the level of profitability of funds set aside in the Pension Fund does not in any way affect the pension of the country’s residents. There is not a single word in the regulatory documents that links the size of pension payments to the profits of the Pension Fund, which circulates the population’s money through VEB.RF.

Profitability affects only the number of fund employees, their salaries and palace buildings. Judging by what is observed on the ground, everything is fine with making a profit: a huge staff, large salaries, buildings better than Gazprom’s.

2. In all developed countries, pension savings belong to the investor. He has the right to bequeath them or withdraw them completely at any time. The amounts there are considerable. For example, in the USA, a worker, not a white collar worker, but a hard worker, upon retirement has about 750.0-1500.0 thousand US dollars in his pension fund account, which allows him to travel around the world without worries or provide financially for his family after of death.

The difference in pension provision is clearly demonstrated by a curious case from US legal practice. The widow of a Navy colonel received a large pension for her husband, even by American standards. At the age of 80, she wanted to marry a 40-year-old illegal Ukrainian immigrant. The marriage was registered. After 5 years the woman dies. After legal proceedings, the United States government was forced to pay a pension for the deceased colonel to the widower.

Is this possible in Russia? Here, even direct heirs cannot receive the rest of the pension savings from the state fund. That's all the difference. This is a minus and a fat one at that.

3. Information about the activities of the fund is completely closed. Under no circumstances will it be possible to find out where and under what conditions the fund’s money is invested.

4. It is also impossible to obtain information about the state of a pensioner’s personal account. Information is provided only when funds are transferred to a non-state fund. There’s no need to even explain anything here. After all, knowing the amounts confirmed by an extract from the fund, the heirs can try to get the unpaid part of the pension savings through the court. And so - no paper, no business.

5. The fund’s huge staff does not correspond to the quality of service. It even seems that the more employees there are, the more difficult it is to achieve your goal.

6. The absence of a formal agreement between the fund and the client puts the latter in a powerless position.

The results of the analysis are impressive: the Pension Fund of Russia has practically no disadvantages.

NPF - definition

A non-state pension fund is an organization authorized by the Central Bank of the Russian Federation to work with pension funds of citizens. Back in the 90s, the first funds of this type began to be created; Sberbank is considered one of the pioneers of NPFs, which began raising capital in 1995. Currently, more than 130 non-state pension funds are registered in Russia. The activities of organizations of this form are regulated by advisory acts of pension legislation. The interaction between the fund and the citizen is carried out in a contractual form; funds received into the accounts of the NPF are insured and guaranteed to be returned to the investor. The fund is a participant in the pension insurance system and works only with the funded part of the pension. Every year, ratings of non-state funds are compiled based on indicators such as profitability, reliability, etc.

Pros and cons of a non-state fund

The population's attitude towards non-state pension funds is more negative than positive, which contradicts common logic. The reason seems to be one thing: poor knowledge of the legislative framework and lack of explanatory work through the media.

But here everything is clear: they cannot spend their own savings on advertising NPFs - it’s expensive, and the state is not ready to cut the branch on which it sits, i.e. is not interested in explaining to the population the pros and cons of non-state structures in the field of pension provision.

Let's try to explain how a non-state pension fund differs from a state one based on the advantages of the first:

- total control by government services. This is, firstly, the fight against a competitor, and secondly, the protection of the interests of the country’s citizens;

- high-quality service - no one will go to employees of a non-state fund who scream or do not notice the client;

- the possibility of transferring unspent amounts to pay pensions to heirs;

- the existence of an agreement between the fund and the client, which transfers all relationships to the legal plane;

- the accumulated amount can be received in full upon retirement;

- high yield, significantly increasing the amount of savings;

- the ability to change the fund once every 5 years;

- protection of deposits in several ways at once;

- transparency of the entire work of the fund - through your personal account you can get all the necessary information: placement of savings, movement of amounts on your personal account, etc.

For some reason, the disadvantages include:

- the possibility of bankruptcy with loss of income received;

- high probability of license revocation.

Let's see how these disadvantages really are the weak side of non-state structures in providing pensions to citizens.

1. There really are risks of going bankrupt or losing your license. But no one says how they affect specific Ivanov, Petrov, Sidorov.

Let's start with the fact that pension savings are protected:

- reserves for compulsory pension insurance (OPI);

- a national guarantee fund, which, by the way, includes the Pension Fund.

This means that in any case, the pensioner will receive the amount transferred to the non-state fund during his work. Only accrued income will be lost.

2. The profitability of the Pension Fund does not in any way affect the final size of the pensions of Ivanov, Petrov, Sidorov. This means that the transfer of pension savings to the Pension Fund in the event of bankruptcy of a non-state pension fund or revocation of a license will not be able to reduce the accrued pension of clients of a non-state structure, i.e. they would receive the same pension if the funds were transferred immediately to the state fund. So what risks are we talking about? About those who could, but did not receive higher pension payments?

Let's summarize: regardless of where pension savings are accumulated, the future pensioner is guaranteed to receive a pension in the amount calculated by the state. But when working with a non-state entity, payments can be significantly higher.

The editors of the site hope that the information provided is enough to understand how the NPF differs from the Pension Fund.

What is a non-state pension fund?

This type of organization solves, in principle, the same social problems as the Pension Fund of Russia, but their property belongs to individuals or corporations. The main activity of NPFs is the implementation of funded pension insurance programs. That is, the work of NPFs is predominantly associated with increasing the volume of pensions of citizens who are under the jurisdiction of the relevant funds.

Non-state funds can thus interact with several management companies and choose from them the one that is capable of ensuring the greatest profitability of pension investments.

NPFs are legally independent from the Pension Fund of the Russian Federation and government authorities, but a controlling stake in them often belongs to state-owned enterprises. In this case, the relationship between non-state pension funds and the state is still present, and it can influence the setting of priorities in the activities of the relevant funds.

What and in what case should you choose?

As can be seen from the general thrust of the material, the author is completely in favor of non-state structures. At the same time, there is no discrediting of government agencies. How can they be discredited if “the state is me, you, all of us together, from Kaliningrad to Kamchatka.” But let’s be objective and consider what to choose, the Pension Fund or the Non-State Pension Fund for the formation of a future pension based on purely mercantile interests.

Let us immediately note that the choice of fund is a personal matter for a citizen of the Russian Federation. Neither the employer nor the banks have the right to require him to work with the Pension Fund or NPF when drawing up lending agreements (VTB and Sberbank have their own NPFs).

From the financial side, in 2020 it is definitely more profitable to deal with a non-state fund. But when choosing a pension savings holder, you need to consider:

- fund rating (updated 2 times a year, you can see it, for example, here). It is advisable to choose the one with the ruAAA index, the highest, indicating the stability and reliability of the NPF. You can also choose one with a lower rating - their position is still stable. Only low scores with one or more B's in the index signal potential instability;

- financial indicators for the reporting period, including the amount of client income, indicate the effectiveness of money supply management;

- the amount of equity - the more capital, the better;

- number of clients – indicates the population’s confidence in the structure, but does not protect against possible risks of losing the accumulated part of pension savings;

- transparency of work;

- level of service;

- reviews from experts and clients.

How to understand which NPF is reliable?

It is important to understand that any investment is a risk. And therefore there are no completely risk-free funds. But several characteristics of NPFs can and should be studied.

- Check if the fund has a license. No scammers masquerading as NPFs have been spotted so far, but it’s better to be on the safe side.

- Pay attention to the life of the NPF (the longer the better), the number of clients and the amount of pension funds managed by the fund. All this data is publicly available on the Bank of Russia website. The logic is simple: the larger the fund, the more expensive and professional team of investment managers it can afford. The level of service in large funds is also usually higher: it will be more convenient and faster to clarify information on your account and receive advice on pension issues.

- Look who owns the fund. If it is owned by large and reliable structures, such as banks or corporations, this gives hope for the stability of the NPF. A good sign is if the fund is managed by people with extensive and successful experience in the financial market. Conversely, if the fund’s website does not contain information about managers, you should be wary.

How to transfer to a non-state pension fund or return to the Pension Fund of Russia

You can switch from one fund to another at any time. However, you need to remember the 5-year rule, according to which a transfer while maintaining the funded part of the pension is possible only once within five years. If the condition is violated, only the part of the money transferred from the salary will be transferred, without income. This is the same as withdrawing your deposit early.

True, it is not clear how the provisions of the law are implemented during the transition from the Pension Fund to the Non-State Pension Fund. In reality, no one there charges interest on amounts stored in a personal account - there is no point. All the same, the pension will be calculated according to different rules.

To transfer, you need to submit a corresponding application to the fund directly or to the MFC. The law allows you to submit documents in person, online or by mail. In the latter case, the application must be notarized. The role of a notary can be performed by law and other representatives of government bodies.

Documents on exit (transition) are accepted from January 1 to December 1. A month is given for the final decision. It's like a divorce - a probationary period. What if he changes his mind?

Leaders of sells

Bachelor's degree from 2014 to 2020 Order RUB 14,950. Typographic form

Order RUB 19,950. Real GOZNAK

Specialist diploma from 2014 to 2020 Order RUB 14,950. Typographic form

Order RUB 19,950. Real GOZNAK

Master's degree from 2009 to 2010 Order RUB 12,950. Typographic form

Order RUB 17,950. Real GOZNAK

Specialist diploma from 2011 to 2013 Order RUB 13,950. Typographic form

Order 18,950 rub. Real GOZNAK

Studying at an institute or college lasts more than one year. A master's degree is usually obtained after 5.5 years of hard study, and a bachelor's degree is obtained only after completing 4 university courses. This is a huge period of time, which a modern business person is always sorely lacking.

The procedure for purchasing a diploma rarely exceeds two days. This is a negligibly short period of time compared to traditional training.