What is an archival certificate? Photo: talks.su Registration of a pension is a long-awaited period for many citizens. But in order to become officially a pensioner and finally live for your own pleasure, you need to collect a lot of documents and go through the registration procedure. Particular responsibility should be taken when confirming length of service, which is the basis for termination of employment and determining the amount of payments.

Legislation

The Law establishes provisions regulating the conditions for assigning insurance pensions, including the minimum number of years of insurance pensions (Chapter 2), periods of work and other activities counted in the insurance pension (Articles 11 and 12), the procedure for calculating and confirming the insurance pension (Article 13 – 14).

There is also Government Decree No. 1015 of October 2, 2014 “On approval...” (hereinafter referred to as the Decree), which reveals the following points:

- what counts towards the SS (clause 2);

- what documents certify the periods of activity included in the SS until the registration of an individual as an insured person (clause 10 - clause 17);

- how the insurance period for a pension is confirmed based on the testimony of witnesses (clause 37 – clause 42), etc.

basic information

In addition to the periods of main work activity, other periods specified in Art. 12 of the Law.

So, other periods are:

- military service or other service specified in the Law of the Russian Federation No. 4468-1 of February 12, 1993 “On pensions...”;

- being on a “sick leave”;

- caring for a child under 1.5 years of age (the total duration of such a period over a lifetime should not exceed 6 years);

- being registered with the employment center;

- detention of persons unjustifiably prosecuted;

- care provided for a disabled child, a disabled person of the 1st group or a pensioner who has reached the age of 80, etc.

Why is this necessary?

The number of years of SS affects the amount of various social benefits and benefits.

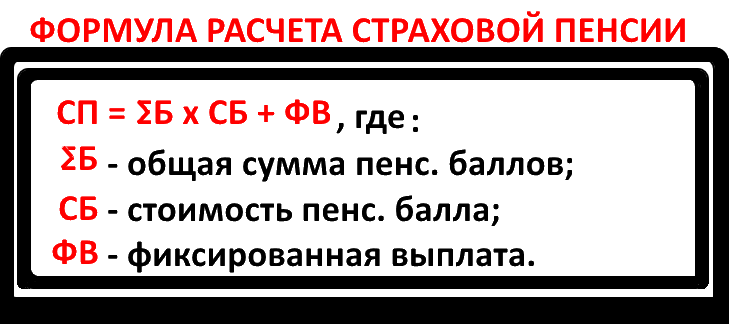

First of all, this is a pension. According to Art. 15 of the Law, the amount of the insurance pension does not directly depend on the SS, since this indicator is not included in the given formula. However, the number of years of SS determines the total number of pension points, which, in fact, affect the size of the future pension.

Also, the maternity benefit, which is assigned to a woman caring for a child up to 1.5 years old, depends on the SS.

Finally, in order to receive more sick leave money, a worker must accrue enough SS years.

Periods of unconfirmed service for pension recalculation

The assignment and calculation of pension benefits is based on the data contained in the citizen’s payment file and additional information provided by the applicant himself. For this reason, it is recommended to contact the Pension Fund in advance and make sure that all information about the length of service is present in the payment file. They check the information during a personal visit or online – through your personal account or the State Services website.

Labor activity until 2002

According to Russian legislation, all officially employed citizens are subject to registration in the compulsory pension insurance system (OPS). Since 2020, after the pension reform, all contributions to compulsory pension insurance are automatically transferred to pension points (PB). This indicator directly affects the size of the basic pension.

From 2002 to 2020, the individual pension coefficient (IPC) of the insured person is calculated using a special formula, based on the amount of transferred insurance contributions. The higher they are, the more pension points are awarded.

Labor activity during the USSR until 2002 is conventionally called “Soviet experience.” The algorithm for calculating the IPC during this time is complex, since the size of the pension capital and the length of service coefficient are taken into account. Total work experience up to 2002 includes time:

- employment as an employee or worker;

- the work of evacuated citizens on collective farms during the Great Patriotic War (WWII);

- individual labor activity;

- creative activities (cinematography, fine arts, literature);

- work as the chairman of a collective farm or his deputy on the direction of Soviet or party bodies;

- activities as a member of the fishing cooperative artel;

- work as a labor obligation;

- employment by members of collective farms and other cooperative organizations;

- service in paramilitary security, special communications agencies or in a mine rescue unit;

- other work if the person made contributions to state social insurance.

Preferential experience

Employment during the Soviet Union in some positions and professions gives the pensioner the right to apply for recalculation of pension benefits due to the presence of preferential length of service. It provides the opportunity to retire due to disability or length of service earlier than the generally established age. This includes work:

- with harmful, dangerous and difficult working conditions (Lists 1 and 2);

- on water transport;

- in the regions of the Far North and equivalent territories;

- in leprosy and anti-plague institutions.

When calculating the duration of special service in Soviet times, the time of military service, study at higher and technical educational institutions, work in elected positions in Komsomol and party organs, political departments and departments is taken into account.

Non-insurance periods and recalculation of pension points

When taking into account the insurance period, “non-insurance periods” are taken into account. For each full year, 1.8 pension points are awarded. This is the time when a person did not work due to:

- caring for a disabled person of group 1 and a disabled child;

- criminal punishment if the person was later rehabilitated;

- serving in the army as a conscript soldier;

- stay with a diplomatic spouse abroad (maximum 5 years);

- moving to another area with a military spouse, if it was not possible to work in the specialty (no more than 5 years);

- care for elderly people over 80 years of age.

An important condition for processing the recalculation is the presence of official work activity before or after the “non-working period”. As a result, the increase in the size of the pension payment will be from 157 rubles for each year of unconfirmed service (the cost of the pension plan for 2019 is 87.24 rubles).

Women who were on maternity leave from the moment the baby was born until he was one and a half years old can also apply for a pension recalculation. Pension points are awarded for a maximum of 4 children, which is 6 years. For one and a half years of maternity leave you are entitled to:

- for the first child – 2.7 PB;

- for the second – 5.4 PB;

- for the third and fourth – 8.1 PB.

What documents are required

The list of required documents is established by the relevant Sections of the Resolution.

Thus, as a general rule, according to paragraph 43 of the Resolution, periods of work under the Labor Code of the Russian Federation and other activities after registration of a citizen in the personalized accounting system (that is, after assignment of SNILS and issuance of the OPS certificate), are confirmed by documentation on the payment of insurance premiums, which is issued by the territorial PFR department.

The main document that certifies periods of labor activity before registering a person in the OPS system is the work book (clause 11 of the Resolution).

If any periods are missing, or information about these periods is incomplete, the applicant should provide:

- employment contract;

- or extracts from orders;

- or salary slips;

- or GPC agreement;

- or copyright or licensing agreement;

- contract for the provision of paid services and other types of contracts confirming the relevant activities.

Pension educational program: Procedure for confirming length of service in relevant types of work

January 21, 2013 11:27

“The procedure for confirming experience in relevant types of work .”

The length of service in the relevant types of work is the total duration of periods of work or other activity, giving the right to early retirement in accordance with paragraphs 1-21 of paragraph 1 of Art. 27, paragraph 1, art. 27.1, paragraphs. 6, 13 clause 1 art. 28 of Federal Law No. 173-FZ of December 17, 2001 “On labor pensions in the Russian Federation.”

The length of service in the relevant types of work, taking into account which citizens are granted an old-age labor pension ahead of schedule, includes periods of work when they constantly performed work for a full working day that, in accordance with Federal Law No. 173-FZ of December 17, 2001, “ On labor pensions in the Russian Federation”, the right to the specified pension. The length of service in the relevant types of work also includes periods of temporary disability and annual paid leave, including additional ones.

The main condition for the early assignment of an old-age labor pension is permanent full-time employment in jobs in the professions and positions provided for in Lists No. 1 and No. 2, and the so-called “small lists”. Full-time work means performing work in the working conditions provided for by these Lists for at least 80% of the working time. In this case, the specified time includes periods of preparatory and auxiliary work, and for persons performing work using machines and mechanisms, also periods of routine repair work and work on the technical operation of equipment.

When assessing the pension rights of insured persons, the procedure for confirming the length of service, including length of service in the relevant types of work (and, where necessary, the earnings of the insured person) is applied. Thus, to the application of a citizen who applied for an old-age labor pension, in accordance with paragraphs. 1-21 paragraph 1 art. 27, paragraph 1, art. 27.1 and paragraphs. 6, 13 clause 1 art. 28 of Federal Law N 173-FZ of December 17, 2001 “On Labor Pensions in the Russian Federation”, if necessary, documents confirming the length of service in the relevant types of work must be attached.

The main document confirming the length of service in the relevant types of work for the periods before registration as an insured person is the work book, which contains the necessary information about the employee. The name of the profession is established in strict accordance with the Unified Tariff and Qualification Directory. And in the absence of a work book, as well as in the case when the work book contains incorrect and inaccurate information or there are no records about individual periods of work - written employment contracts drawn up in accordance with the labor legislation in force on the day the relevant legal relationship arose, certificates issued employers or relevant state (municipal) bodies, extracts from orders, personal accounts and payroll statements, certificates from archival institutions.

Additional information about the nature of work and working conditions, which are essential for determining the right to early pension provision (information about the use of a vessel, employment with substances of a certain hazard class, etc.) is confirmed by a clarifying certificate issued by the administration of the enterprise (organization). The certificate must make reference to archival documents from the period in which the work was carried out. Certificates issued on the basis of witness testimony cannot serve as confirmation of the nature of the work performed. The basis for confirming the work performed can be documents on wages, staffing, orders to assign workers to certain areas of work, logs of reception and delivery of shifts, etc.

According to clause 4 of the Rules for calculating periods of work, which gives the right to early assignment of an old-age labor pension in accordance with Articles 27 and 28 of the Federal Law “On Labor Pensions in the Russian Federation”, approved by Decree of the Government of the Russian Federation of July 11, 2002 No. 516, in length of service giving the right to early assignment of an old-age labor pension, periods of work performed continuously for a full working day are counted, unless otherwise provided by the Rules or other regulatory legal acts, subject to payment of insurance contributions to the Pension Fund of the Russian Federation for these periods. The payment of insurance contributions to the Pension Fund of the Russian Federation is equivalent to the payment of contributions to state social insurance before January 1, 1991, the unified social tax (contribution) and the unified tax on imputed income for certain types of activities.

What's included

Above we cited other periods of activity counted in the SS. In addition to others, there are also the main ones, specified in paragraph 2 of the Resolution:

- periods of work that was performed on the territory of the Russian Federation and for which the employer paid insurance premiums in accordance with the established Federal Law No. 167 of December 15, 2001 “On Mandatory...”;

- periods of work performed by the insured citizen outside of Russia, if this is provided for by an international agreement;

- periods of payment of contributions by persons for other persons;

- periods of payment of contributions by the self-employed population “for themselves”.

Rules for confirming insurance experience

Section 8 of the Decree specifies the rules for confirming SS for certain categories of insured persons.

Thus, according to paragraph 46 of the Resolution, a person who has completed an author’s order, alienated an exclusive intellectual right, or received remuneration under a license agreement can confirm his CC by:

- a relevant agreement drawn up in accordance with the Civil Code of the Russian Federation;

- and a document from the Pension Fund certifying the payment of insurance premiums under such an agreement.

The length of service was not counted toward the pension. What should I do?

- Yes, I’ll tear everyone apart for my experience! Moreover, work books are now in electronic form...

Photo: Evgenia GUSEVA

“I have 34 years of experience. I worked all my life. For the last 10 years I have received a good salary. But the pension is still minimal - 9 thousand rubles. How can I live on it?” If you talk to pensioners in the regions, many have a similar story.

And few people understand the principle by which the size of the insurance pension is calculated.

Although to be fair, the pension formula has become much clearer in recent years. Everyone is given a fixed amount - 5685 rubles. And then everything depends on earnings and experience. If we simplify and round up, then with a salary of 10 thousand rubles per month, a person earns a 90 ruble increase in his future pension. With a salary of 100 thousand per month - a 900 ruble increase. No more. But! This is only if the salary is official. And only if the employer has completed everything correctly. And this doesn’t always happen...

NO DATA - NO MONEY

Until the end of 2001, the system for recording pension rights was like this. There is an entry in the employment record or a certificate from the employer - on its basis, the Pension Fund of the Russian Federation calculates how much money the state should pay you. No appointment or confirmation - go for a walk, Vasya. Since 2002, a personalized accounting system has appeared. Employers were required not only to keep work records, but also to send special reports to the Pension Fund. And, of course, pay insurance premiums for employees. With such a system, even if you lose your job, nothing bad will happen. All data about you is already on the computer. But only if they are there...

— I worked as a welder for half my life. That is, I have the right to early retirement. In two years I will be 55 years old. Therefore, I decided to go to the Pension Fund in advance to find out if everything was in order and whether I needed to collect any certificates,” says Oleg M. “Imagine, they counted me only three years of special experience there. I show them the labor report, where it is written in Russian that I have been a welder for at least 12 years. And they told me: “We can’t do anything. We don’t have any information that fees were paid for you.”

FORGOT - ACCIDENTALLY OR INTENTIONALLY

Bookkeeping for a business is not for the faint of heart. There are dozens of documents and reports. They must be submitted to different departments. Only in certain forms and always in due time. Otherwise, penalties, fines and other “delights”. And if in large companies there are entire departments of qualified employees for all this bureaucracy, then in small organizations this is, as a rule, one, often not very experienced person.

— If according to the work book there should be length of service, but there is none on the personal account, most likely the employer did not transmit the information properly. In this case, you need to contact him and ask him to still send them - this is his direct responsibility,” explained the press service of the Russian Pension Fund.

The point is that the company made deductions for the employee as expected, but for some reason they made a mistake in the paperwork. But this is still a good scenario. If the company still exists, the inaccuracy can be corrected quickly. It’s a completely different matter if the company has forgotten not only about reporting, but also about contributions...

GOOD NEWS - THE TRUTH CAN BE ACHIEVED

If the official experience does not match the real one, experts advise only one thing - go to court. There are inspiring precedents. For example, one of the residents of Kursk managed to sue her former employer for insurance premiums for six years of work. She worked as a packer in a warehouse, but the entrepreneur did not draw up an employment contract with her. To prove she was right, she brought in witnesses who confirmed that she actually worked.

The Constitutional Court is on the side of the citizens. Back in 2007, he decided that problems with collecting insurance premiums were a matter for the Pension Fund, and not for the workers themselves. Like, if there is information that a person worked, but no deductions were made for him, then he should still be assigned a pension for this period, if the length of service is confirmed.

OFFICIALLY

“The Constitutional Court ruled: the right of an insured person to receive a labor pension, if their employer fails to pay insurance contributions to the Pension Fund, must be ensured by the state at the expense of the federal budget, and the legislator must establish a legal mechanism that guarantees a citizen the implementation of his pension right in the event of the employer’s failure to pay insurance contributions to the Pension Fund Fund of the Russian Federation".

(Extract from the resolution of the Constitutional Court of the Russian Federation dated July 10, 2007 No. 9-P.)

ADVICE "KP"

How to check your experience...

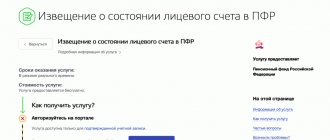

1. Go to the citizen’s personal account on the Pension Fund website (pfrf.ru).

2. Enter the username and password that you use when logging into the portal gosuslugi.ru[/anchor]). You must have a verified entry there.

3. Find the section “Find out information about generated pension rights”.

4. The notice will indicate the total accumulated length of service and the number of pension points earned. Plus there will be detailed information about where you worked, for how long and how many insurance contributions the employer paid for you.

...And what to do if it’s missing?

5. Check with your employer. This may be a technical glitch and can be fixed quickly. Ask to do it.

6. Perhaps this is a deliberate avoidance of paying insurance premiums. Then demand that the company transfer the money for you. This is her legal duty.

7. If they don’t meet you halfway, complain to the labor inspectorate.

8. If this does not help or the matter concerns your previous employer, go to court. You need to have your work book and employment contract with you. These documents will prove that you actually worked for a specific employer and agreed to do a specific job for an agreed amount.

Algorithm of actions

According to information from the official website of the Pension Fund of Russia, approximately 1 year before an individual retires, the Pension Fund of the Russian Federation carries out preparatory measures to study the available information about the citizen, his experience, earnings, etc.

Pension Fund specialists evaluate pension rights and, if necessary, help the applicant in making requests for missing information in archives, organizations, and departments.

Here is the general algorithm of actions for a future pensioner:

- determine from what date the registration in the OPS system was made;

- further establish which periods of activity were carried out before such registration, and which after;

- then begin collecting and preparing documents certifying the CC before registration in the OPS system - employment contracts, contracts for paid services, copyright agreements, etc.;

- if there are no documents, obtain witness testimony.

Evidence of work experience

The calculation of work experience is based on the applicant’s work record book. They are maintained at all enterprises and organizations, regardless of their form of ownership, and are the main document for assessing a citizen’s pension rights.

Books are created for workers who get not only permanent jobs, but also seasonal, temporary, and freelance jobs. In addition to the fact of employment and dismissal of an employee, information about transfers, awards, and incentives is entered here.

If for some reason there is no entry in the work book about a specific segment of work activity, or it is missing, lost or damaged, the person has the right to provide the following documents confirming his work experience:

- employment contract;

- extract from the order;

- document from the Tax Inspectorate (FTS) on the transfer of taxes (farmers, self-employed persons);

- archive transcript;

- certificate of receipt of unemployment benefits from the employment service;

- characteristics from the place of work;

- a document confirming the payment of wages;

- certificate from the HR department;

- an extract from the personal account about cash deposits through the enterprise’s accounting department;

- certificate of payment of the single tax for individual entrepreneurs (IP);

- a certificate from a military unit, military registration and enlistment office or archive of military personnel;

- a certificate from the Social Insurance Fund (SIF) confirming receipt of temporary disability benefits.

- Tattoo on the shoulder blade for girls

- Paroxysmal dry cough

- This is what happens to your skin when you don't sleep enough

Witness testimony

Testimonies of 1–2 colleagues are recognized as evidence of insurance experience. Indications are provided orally or in writing (for example, in case of illness of a person). Witnesses together with the applicant need to contact an authorized specialist of the territorial branch of the Pension Fund of Russia.

Witness testimony when recalculating a pension is an evidence base only on the condition that documentation of unconfirmed work experience cannot be provided. This situation may arise if, for example, they burned down or cannot be restored due to a natural disaster.

The fact of force majeure can be proven with a certificate from the Ministry of Emergency Situations or a document from the archive about the absence of data.

Confirmation of work experience in court

If for some reason the Pension Fund refuses to accept the provided evidence of unaccounted experience, the citizen has the right to go to court. To do this, you need to draw up a statement of claim. There is no need to pay state duty - pensioners are exempt from the contribution. An identification document (passport or residence permit) is attached to the application. The evidence base of the case materials will be:

- available documentary evidence;

- witness statements.

Archival extract

A certificate confirming work in an organization or enterprise can be obtained through the archival authority at the location of the former employer. It is issued if, for example, the enterprise where the person worked was liquidated, or errors were made when filling out the work book.

A certificate to record unconfirmed work experience is provided free of charge. To obtain it, an application is drawn up. The form can be obtained from the organization itself or downloaded from the official website. The application to the archive contains the following information:

- name of the archival organization to which the request is sent;

- personal data, date of birth and place of residence;

- information about the employer, position held and the period for which the certificate is needed;

- purpose of receipt;

- Date of completion;

- personal signature and its decoding.

The application can also be drawn up in free form if the pensioner does not have the opportunity to visit the archives department.

The document is sent by mail, and the text must contain the address to which the archive employee will send a certificate confirming work in the organization.

- How to properly shape your nails at home

- Can diet and fasting cause coronavirus disease?

- How to send a request to call back on Megafon

Methods

According to the general rule established in paragraph 4 of the Resolution, periods of labor or other activity are confirmed in 2 ways:

- or based on personalized accounting information;

- or according to the documents specified in the Resolution confirming the CC for the relevant period of activity, but only if the personalized accounting contains incomplete and/or unreliable information.

But confirmation of insurance experience after assignment of SNILS and issuance of the OPS certificate is carried out only according to personalized accounting data - the applicant no longer needs to provide any documents, because the Pension Fund of the Russian Federation will have access to the necessary data.

According to ab. 2 clause 5 of the Resolution, periods of work on the territory of the Russian Federation before registration in the OPS system can also be confirmed by witness testimony - this is the 3rd additional method.

Witness's testimonies

The SS can be supported by the testimony of 2 or more witnesses who worked with the applicant for the same employer.

Moreover, according to paragraphs 37 and 38 of the Resolution, if the employment contract was lost due to a natural disaster, fire or other similar reason, the CC, confirmed by witnesses, is taken into account in full.

In other cases (for example, in case of careless storage of a work book), only half of the SS required for the assignment of an insurance pension is counted (that is, in 2020 - no more than 4, in 2020 - no more than 5, etc.).

Why is it needed to calculate a pension?

According to current legislation, obtaining the right to an insurance pension is possible if the candidate simultaneously meets the following criteria:

- The onset of the established age (this is 55.5 years for women and 60.5 for men, here and below the list are the requirements for 2019).

- Accumulation of the required insurance experience (10 years).

- Availability of the required value of the Individual Pension Coefficient (16.2 pension points).

The current legislation does not have requirements for the length of total length of service (that is, taking into account intervals earlier than 2002 - the time when citizens began to be registered in the compulsory pension insurance system). At the same time, taking into account the “Soviet” period of work, the citizen receives certain advantages when assigning a pension and/or determining its size. These include:

- Early retirement. For example, men with 15 years of service in the Far North also need a total output of 25 years. For this situation, years of “Soviet” service can be decisive in confirming a citizen’s right to a preferential pension.

- Receiving an additional payment to pension payments when working a set number of years in some industries. For example, having a 30-year interval of work in agriculture, a worker receives the right to a 25 percent supplement to his pension.

- Providing additional pension points by taking into account non-insurance periods (for example, military service).

- Calculation of an increase in pension due to valorization - a one-time increase in pension payments in cases established by law, if a citizen has the opportunity to confirm his work experience in the USSR.

- 4 ways to reduce your risk of getting the flu as you get older

- Where are the highest salaries in Russia?

- Zucchini pancakes with cheese

Procedure for confirming work periods

The basic legal act regulating this procedure is Federal Law No. 173-FZ “On Labor Pensions” dated December 17, 2001. The procedure itself is discussed in Article 13, which states that:

- For persons registered in the compulsory pension insurance system (and this is all citizens officially registered at work since 2002), documentary evidence of length of service after receiving an insurance certificate is not required. Working periods for this case are included in the pension calculation based on individual accounting information from the Russian Pension Fund.

- Periods before 2002 can be confirmed by documents obtained directly at the place of work, in the archive or other state (municipal) organizations.

- If the documentation was not preserved at the place of issue for reasons beyond the employee’s control (destroyed in a fire, flood, etc.), then the testimony of 2 or more witnesses is accepted as evidence.

In a court

On January 1, 1997, Federal Law 27 of April 1, 1996 “On Individual...” came into force in all regions of the Russian Federation (from January 1, 1996 - on the territory of only 5 subjects of the Russian Federation).

Thus, work or other activities carried out after the specified date do not need to be confirmed - all the data is already in the Pension Fund.

An appeal to the court will be required, for example, if a citizen worked before 1997, and the employer did not pay insurance contributions for it.

After all, the Pension Fund is authorized to take into account periods of activity (regardless of the confirmation method - work book, contract, etc.) only if contributions were paid for it (activity). Therefore, the applicant will have to resolve the issue with the unscrupulous employer only through the court.

What needs to be taken into account when calculating length of service?

The insurance period is determined on the day of the onset of illness - an insured event, which is temporary disability resulting from illness.

When calculating the insurance period, breaks in work do not matter. Periods of labor and other activities are summed up.

There are no periods not included in the insurance period for sick leave. It includes any time when a person was listed as an employee of the organization, even if he was sick, was on vacation, including maternity leave and leave to care for a child under three years of age and leave at his own expense, or he did not work for other reasons.

When calculating the insurance period for calculating temporary disability benefits, along with periods of work, it includes periods of military service and other service provided for by Federal Law No. 4468-1 of February 12, 1993. Include military service in your length of service, even if there is no entry about it in your work record book. But study is not included in the insurance period, even if there is an entry about it in the work book.

When calculating length of service according to the calendar, the following are considered separately:

- full calendar years (from January 1 to December 31);

- full calendar months (from the 1st to the last day) not included in the full calendar years;

- remaining days not included in full months.

Then the remaining days are converted to months at the rate of 30 days in a month, the remaining number of days less than 30 is discarded. Months are converted to years based on 12 months per year.

Archive request

The Pension Fund of Russia may request missing documents in the archive. A citizen can do this independently without waiting for the Pension Fund.

A request to the archive is made:

- personally;

- or remotely.

If the information in the employment contract differs from the data from the employment contract (for example, the date of dismissal is different), a copy of the employment contract is attached to the request.

If you don’t have a job, you need to:

- indicate as accurately as possible the periods of work and the name of the employer;

- specify personal information (full date of birth, changes in full name, etc.).