The Republic of Latvia is a Baltic state with a population of slightly less than 2 million people. It is located in northern Europe between Estonia and Lithuania. The country's economic potential is concentrated in the capital, Riga, where more than 50% of GDP is produced. About 60% of enterprises of Latvian manufacturers operate in the capital region. The standard of living in Latvia is somewhat lower than in most EU member countries. Let's look at who and how pensions are calculated in Latvia, and what benefits older people living in the republic can count on.

Latvian pension system

The pension system of the Republic of Latvia includes 3 levels:

- The first provides for the payment of pension benefits, the source of which is the total amount of money contributed by the working population of the country.

- The second level is a pension accumulated by the state for a specific elderly person. All residents of Latvia born after 07/01/1971 fall under this level.

- The third level is formed through voluntary accumulation: a person of working age contributes a certain amount in addition to the mandatory insurance contribution; when retirement occurs, it will return as a supplement to the basic pension.

Latvian pension size

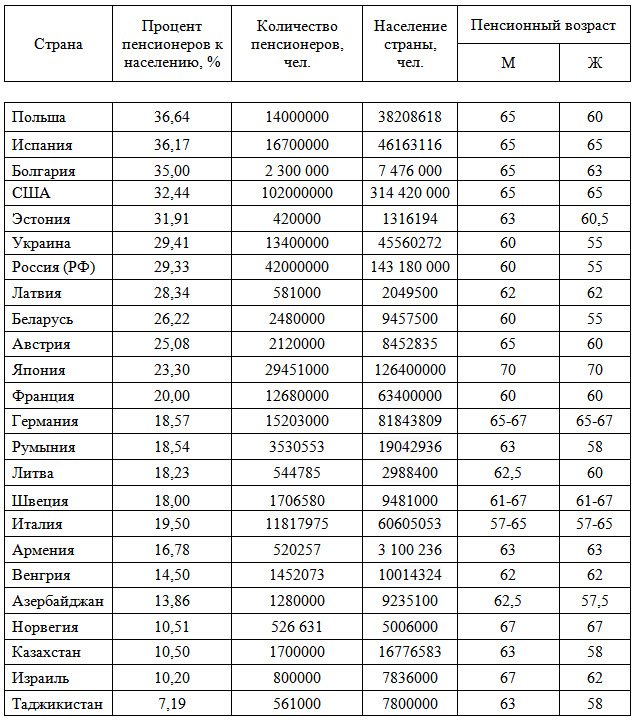

The number of pensioners in Latvia is increasing year by year: the increase over the last 10 years has been approximately 2-3%. Thus, as of the beginning of 2019, 320 thousand elderly people live in the country. This is approximately 20% of the total population.

The minimum pension in the Republic of Latvia fluctuates around 100 euros. Approximately 5.1% of the state’s residents receive such social benefits. It is enough for food only if there is serious savings. The insufficient level of government assistance for older people is especially noticeable given the fact that the minimum wage in the country is 4.3 times higher - 430 euros.

The average pension in Latvia at the beginning of 2020 is 320.27 euros:

- About 6.6% of the republic’s residents receive social benefits ranging from $100 to $200;

- for the majority of pensioners (48.2%), payments range from 200-300 euros;

- benefits in the range of 300-400 euros are paid to 24.4% of Latvian pensioners;

- only 7.4% have pensions from 400 to 500 euros;

- 8.3% of pensioners receive from 500 to 1,500 euros, and only 1,836 people have a pension of more than 1,500 euros.

The poverty rate among older people in Latvia on average exceeds 50% - the highest figure in the European Union.

Standard of living in Latvia and pension provision in the country

Latvia is a Baltic state with a population of 2 million people, located between Lithuania and Estonia, in Northern Europe. Economic potential is concentrated in Riga, generating more than 50% of GDP.

About 60% of Latvian manufacturing companies operate in the capital. The standard of living in Latvia is lower than in most countries that are members of the European Union.

Let's look at the features of life in Latvia, pricing, tax deduction rules and what kind of pension Latvians receive based on their years of service.

Features of life in Latvia

The most popular cities for immigration and residence in Latvia are Jurmala and Riga. At the moment, anyone can obtain a residence permit in Latvia with investments in the amount of €250,000. They can be invested in financial investments or the purchase of real estate. Living on the territory of the Latvian state has positive aspects:

- Since Latvia is part of the European Union, local residents enjoy the benefits of this association, including the free movement of capital, labor, goods, and services.

- Living in the Republic of Latvia is cheaper than in most developed European countries.

- There are many Russian-speaking citizens living in Latvia (35-40%), which greatly simplifies the adaptation process.

- This is a picturesque country with unique architecture, healthy climate and delicious national cuisine.

- Riga is considered an important transit hub for the Baltic states, which provides an advantage for doing business.

Emigrants are attracted to Latvia by the proximity of the sea coast, low prices compared to other European countries and the ease of starting their own business.

Many of them are attracted by the measured and stable life in the cities of Latvia.

Disadvantages of living in Latvia:

- There are cases of Russophobia on the part of senior government officials and Latvians.

- When finding employment, emigrants will face restrictions in employment, difficulties in professional growth and low wages.

- Most infrastructure facilities require modernization.

- There is a constant outflow of the local population, while residents of the country find better living conditions.

- Latvia has problems with corruption and bureaucracy.

Standard of living in Latvia

The Republic of Latvia has been part of the European Union since 2014, which has had a positive impact on the economic development and income level of Latvians. The total amount of financial injections from European funds into the Latvian economy is more than 10 billion euros.

During their stay in the EU, the standard of living of Latvians increased in relation to the European average by 20% (from 48 to 68%). At the same time, the standard of living has become much higher compared to Russia: the minimum wage in Latvia is 430 €, and in the Russian Federation - 110 €.

Work and salary in Latvia

Latvian youth, like representatives of other Eastern European countries, prefer to go to more successful EU countries after graduation. This is a big problem for the Latvian economy, where, due to a shortage of its own personnel, the following vacancies are required for foreigners - programmers, international drivers, engineers, social workers, doctors and builders.

The average salary in the Republic of Latvia is about 780 €, and after taxes it is about 650 €. Moreover, men's earnings are 17% more than women's.

According to statistics, this is not enough to cover monthly expenses, due to which 46% of the population constantly experience financial difficulties.

The fact that more than 50,000 Latvians need social assistance means that the level of wages in the country is not high enough.

In terms of wages, the Baltic state ranks last in the EU. Lower salaries are received in Bulgaria and Romania. According to official data from the Central Bureau of Statistics, in 2020 the average salary in Latvia before taxes is 985 € per month, while Latvians working in Riga receive about 1,120 €.

Tax rates in 2020

The pension contribution is 30.13%, of which 9.45% is paid by the employee, and 20.68% is paid by his employer. The tax-free minimum in Latvia is 230 €. Tax rates 2020:

- Tax on real estate - 1.5%.

- VAT - 21%.

- Corporate income tax is 20%.

- Reduced rates - from 0 to 12.5%.

- Income tax - 20% (provided that the employee's annual income does not exceed 20,000 €).

National social insurance - 35.09%, of which 11% is paid by the employee, and 24.09% by the employer. Tax benefit for 1 dependent – 230 €.

Age pension amount

Upon retirement, Latvian citizens who have reached a certain age can expect that they will receive a monthly allowance amounting to 200-300 €.

The Baltic state has a significant number of elderly citizens (more than 50% of the population).

This is due to the fact that young Latvians, after the opening of borders, prefer to go to work in other European countries.

At the moment, the average life expectancy of Latvians is 75 years. At the same time, the retirement age of Latvian citizens is 62 years, regardless of gender. The average length of social insurance in Latvia is 36.3 years. The country has a 3-tier pension insurance system:

- payments from social contributions collected into the state budget;

- payments from voluntary contributions sent to private pension funds;

- payments from partial contributions allocated to the financial sector.

Cost of living and pricing in Latvia

Even the minimum wage in Latvia allows you to live in the country for a month without any special restrictions (basic services and the food basket are taken into account).

Low prices for essential goods do not affect the quality of products and services. Let's consider the average price indicators for food products collected in various cities of the Republic of Latvia:

- Bread (300-400 g) - 1-2 €.

- Potatoes (1 kg) – 1 €.

- Sugar (1 kg) – 1 €.

- Rice (1 kg) – 1-2 €.

- Oranges 1 kg – 1-2 €

- Apples (1 kg) – 1.05 €.

- Chicken fillet (1 kg) – 5-6 €.

- Wine (750 ml) - 6-7 €.

Prices for household goods and some services in Latvia:

- Utilities - approximately 150€ per month.

- Internet services for 1 month - 14.50 €.

- A trip around the city by taxi - 5 €.

- One trip on the bus – 1-2 €.

- Gasoline AI-95 (1 l) - 1-2 €.

- A visit to the cinema - 4-5 €.

Relatively affordable prices are the main advantage of living in Latvia. This is especially true if citizens’ income comes from abroad. Renting a one-room apartment located in the center of Latvia will cost 350 €, and in remote areas - about 250 €. Cost of 1 sq. m of real estate in central areas - 1,550 €, and outside the city - 955 €.

Retirement age

If in 2020 Latvians who had crossed the age limit of 63 years and 3 months could retire, then in 2020 this can be done by citizens who have at least 15 years of insurance experience and whose 63rd birthday has passed six months. This is due to the fact that the retirement age in Latvia has been increasing by 3 months annually since 2014.

You can also retire early. People with at least 30 years of insurance experience can receive an old-age pension two years earlier than the generally established period.

Also, the privilege of early receipt of pension rights, if possible, extends to:

- parent or person in the status of guardian:

- having at least 25 years of experience;

- raised 5 children or a disabled child for at least 8 years;

- persons who took part in eliminating the consequences of the man-made disaster at the Chernobyl nuclear power plant. If the length of their work experience is at least 15 years, they can become pensioners 5 years earlier than the period that was established on a general basis.

In addition, early pension in Latvia is available:

- disabled women;

- persons who have lost their sight;

- dwarfs;

- persons who worked before 1996 at industrial enterprises with working conditions harmful to health.

The Latvian government plans to stop raising the retirement age every year only in 2025. It is not difficult to find out the goals pursued by the country's executive branch. Simple arithmetic calculations show that the answer to the question at what age do people retire in Latvia will then sound like this: after the 65th birthday.

Average pension in Latvia in 2020

The basis of the legal framework on this issue is the law “On State Pensions” of the Baltic Republic. The regulatory document guarantees the right to benefits to residents of the country over 62 with a work experience of 15 years. The average pension in Latvia is 320 €. This is very little for the EU, but the benefit is constantly increasing, and over 9 months of 2020 its increase amounted to 20.5 €.

Pension system in the country

The benefit is calculated by deduction from citizens' income into public or private funds. Some of them are closed. They are established by government agencies or large enterprises. The pension system consists of 3 levels.

- The basis is the compulsory state pension.

- The next level is the state supplement, formed from social tax (34% of salary, with 23% paid by the employer and 11% by the employee).

- The third part includes additional voluntary contributions to the pension fund.

The current trends in the republic are increasing the age for retirement as a result of low birth rates and strong labor emigration. Life in Latvia is not as “cloudless” as in other EU countries, so it is almost impossible to stop the outflow of the working-age population.

The number of pensioners in the country is gradually increasing - over the past 10 years the growth has been about 2-3%. However, the legislation guarantees broad benefits and benefits. In some cases, retirement in Latvia can be early – for 2–5 years. Let us indicate the reasons for this.

At what age do you retire?

The standard figure is 62 years. The retirement age in Latvia for women is no different from men. The following categories have the right to early exit:

- persons with 30 years of experience (exit 2 years earlier);

- parents (guardians) with 25 years of experience and raising 5 children or a disabled child for the last 8 years;

- liquidators of the consequences of the Chernobyl disaster (total experience 15 years);

- disabled women;

- midgets;

- blind;

- workers in hazardous industries.

The listed categories (except for the persons specified in the first paragraph) are allowed to retire 5 years earlier.

Pension amount

The benefit amount is calculated using the formula: P = K/G:12, where

P is the monthly pension in Latvia;

K – the accumulated amount of social contributions and the state base part;

G – estimated payment period (calculated based on retirement age and average life expectancy).

The amount is divided by 12 to determine monthly payments. Let's look at the numbers in which this formula is expressed.

Free legal support by phone:

St. Petersburg and region Federal number ext. 859

Minimum

Latvian legislation does not fix the amount of monthly benefits. The amount is calculated using a formula depending on the length of service. The minimum pension in Latvia starts from approximately 100 €. This money is hardly enough for food. For comparison, the average salary in Latvia is 1000 €. The minimum salary is approximately 3 times lower.

Average

As of mid-2020, the figure is 320 €. Last year, the average pension in Latvia barely reached 300 €. Only 7–8% of the population received more than 500 € in 2020. 12–13% of citizens had benefits of less than €200. These figures do not even reach the minimum subsistence level established in the EU.

Statistics show that about half of the country's pensioners are poor. Latvia’s indicators are 2–3 times lower than the developed EU powers. Thus, today, in terms of pensions, the republic is close to Romania, Bulgaria and its Baltic neighbors.

Military benefits

Military pensions are generally no different from labor pensions. Latvian legislation does not provide for any increasing coefficients. But veterans have the right to enjoy a range of benefits.

Until recent years, the Latvian government paid pensions to military personnel with Russian citizenship who served in the Baltic states and remained after the collapse of the USSR.

However, when the Russian government began to pay pensions to these categories, the authorities stopped accruing money for the time that was paid by the Russian Federation.

Having a problem? Call a lawyer:

St. Petersburg and region Federal number ext. 859

Provided benefits for pensioners

Additional benefits are provided to certain categories of senior residents. Benefits for pensioners in Latvia are provided in the following cases:

- persons who live to be 100 years old receive a one-time benefit of 150 €;

- many pensioners are entitled to free travel;

- those receiving less than 128 € are entitled to a subsidy for treatment and the purchase of medicines;

- disabled people of retirement age are paid 2134 € for the construction and improvement of housing;

- various minor benefits are provided to single pensioners, for example, 2 tickets per month to visit the bathhouse;

- victims of political repression are provided with benefits for false teeth and other insignificant privileges;

- the elderly are entitled to funeral benefits;

- Citizens of the republic who receive pensions in other countries, but are not pensioners in Latvia, have the right not to pay taxes on 75 € of monthly income.

Some benefits are only valid in certain cities. But most subsidies are national.

Pensions for Russians in Latvia

Citizens of the Russian Federation living in the Baltic republic have the right to receive a pension after 15 years of service. The procedure involves submitting an application to the social insurance agency SASS.

It should be taken into account that the Russian pension in Latvia is a reason for the Baltic government to refuse payments (as happened with the military, who were deprived of subsidies due to the Russian Federation’s decision to assign similar payments). The package of submitted documents includes:

- passport;

- statement;

- Bank details (the bank must be Latvian).

You must provide personal information: address, phone number. The re-registration procedure takes place annually. It is important to take into account that Russians will receive only an insurance pension without social benefits.

Many are afraid to defend their rights, citing the negative attitude towards Russians in Latvia. In fact, the problem is largely exaggerated, because ethnically Slavs in this Baltic republic make up about 40% of the population. Citizens of the Russian Federation make successful careers, achieve results in sports and politics. Pensioners will not be offended here either.

Features of purchasing real estate by pensioners

There are certain benefits to buying a home as a senior. But only if a number of conditions are met. Pensioners living with a minor are entitled to a 50% discount on taxes. When purchasing real estate, foreigners are given the right to obtain a residence permit for 5 years.

Pension indexation

An increase in payments was announced for October 1 of this year, taking into account inflationary price increases and salary increases. Also, the amount will be indexed according to new tariffs depending on the length of service.

As a result, as the Minister of Welfare, Mr. Reirs, promises, an additional 30 million € will be included in the budget for pensioners, and for 2020 it is proposed to allocate 120 million €. For each resident, the increase will be in the range of 18.3–27.5 € (index from 1.

0590 to 1.0720 depending on length of service and additional reasons).

How are pensions calculated?

The source of pension payments is payments made every month during the citizen’s working life. The fee charged for these purposes is 35%, but most contributions are payable directly by the employer. Only 10.5% of his monthly salary is withheld from the employee's salary.

To find out what pension an individual citizen is entitled to in Latvia, you need to apply the following formula:

RP = SPK/PKL:12, where

RP – monthly pension amount;

SPK is the amount of pension capital. What part of these indicators is taken into account will be discussed below;

PKL – the planned number of years of pension payment.

The funded capital is added to the SPK. And the value of the desired parameter is a value derived from a number of conditions.

To clarify the above formula, it should be said that, in particular, the old-age pension depends on:

- the volume of pension capital accumulated from 01/01/1996 to the month from which the benefit will be paid;

- average insurance premiums for the period from 1996 to 1999;

- total insurance period until December 31, 1995;

- planned time interval for pension payment.

On September 27, 2020, the Seimas of the Republic of Latvia adopted in the final reading important amendments to the law on social benefits for the elderly. They provide that not only the pension itself is subject to indexation, but also additional payments for length of service.

Those persons whose value of the latter indicator is greater are provided with preferences. They are as follows: the indexation of pensions in Latvia in 2020 for citizens with a work experience of 45 years or more will be carried out using 80% of the actual percentage increase in salaries, on the basis of which social insurance contributions are determined. Let us recall that until now the figure of 70% appeared in the calculations.

Also on this day, the Seimas adopted in its final reading amendments to the law regulating the collection of personal income tax. Their action is also aimed at improving the well-being of older people.

In particular, taxes on pensions in Latvia will be charged only if its monthly value exceeds:

- in 2020 – 270 euros;

- in 2020 – 300 euros;

- starting from 2021 – 330 euros.

The Ministry of Finance of the Republic of Latvia has published forecasts for the state of the country's economy after increasing the tax-free minimum for pensioners to 3,960 euros/year: this will lead to a negative fiscal effect on the budget of 11.8 million euros. And this phenomenon is not the only one that can cause a decrease in trust in the government on the part of people receiving government benefits.

Thus, disability pensions are now paid in Latvia to almost 35 thousand people with disabilities. They are provided with additional payments for length of service of an average of 12.34 euros/month.

Experts have calculated that the income of citizens in this category, with the indexation of surcharges in 2020, will increase before paying income tax by an average of 2.32 euros/month. Naturally, such a slight increase does not arouse enthusiasm among disabled people.

The amount of pensions in Latvia for persons in this category is shown in the table.

| Disability group | Pension amount, euro | Pension amount, rubles |

| Group I | 102.45 | 7592.57 |

| Group II | 89.64 | 6643.22 |

| III group | 64.03 | 4745.26 |

Statistics by year

Statistics of pensions received for 2012:

- Up to 200 euros – 13.1% of the population.

- From 200 to 300 euros – 67.5% of residents of the Republic of Latvia.

- From 300 to 500 euros – 19.4% of residents of this country.

- More than 500 euros – 4%.

Statistics of pensions received for 2013:

- Up to 200 euros – 12%.

- From 200 to 300 euros – 64.8%.

- From 300 to 500 euros – 23.2%.

- More than 500 euros – 4.4%.

Statistics of pensions received for 2014:

- Up to 200 euros – 9.9%.

- From 200 to 300 euros – 62.7%.

- From 300 to 500 euros – 27.4%.

- More than 500 euros – 5.2%.

In Latvia, 28% of the population are pensioners

Statistics of pensions received for 2020:

- Up to 200 euros – 12%.

- From 200 to 300 euros – 58.5%.

- From 300 to 500 euros – 29.5%.

- More than 500 euros – 5.8%.

Statistics of pensions received for 2020:

- Up to 200 euros – 12.1%.

- From 200 to 300 euros – 54.8%.

- From 300 to 500 euros – 33.1%.

- More than 500 euros – 6.7%.

Statistics of pensions received for 2020:

- Up to 200 euros – 11.7%.

- From 200 to 300 euros – 48.2%.

- From 300 to 500 euros – 40.1%.

- More than 500 euros – 8.3%.

From the statistics we can conclude that the number of pensioners receiving a pension of up to 100 euros is rapidly decreasing, while the number of people receiving more than 500 euros is increasing.

Those with incomes below the subsistence level can count on benefits

Peculiarities of registration of a Russian pension in Latvia

The Russian pension in Latvia is paid to persons living in the territory of the Baltic country if:

- they have reached the retirement age established in the Russian Federation;

- they have the right to a pension for: loss of a breadwinner;

- length of service;

- obtaining a disability group.

In this case, insurance premiums paid on the territory of Russia are taken into account.

How is the Russian pension paid?

To resolve the issue of assigning a pension benefit for periods of employment after 01/01/1991, you must contact the department of the State Social Insurance Agency of Latvia (hereinafter referred to as SSIA). You will need to provide the following documents:

- application for a pension;

- papers confirming work activity and equivalent time of stay on the territory of both states - Russia and Latvia;

- package of documentation corresponding to the intended type of pension.

The State Insurance Agency sends the received documents to the Pension Fund of the Russian Federation. There a decision is made regarding the assignment of a pension to a person living in Latvia.

The length of work experience in Russia may not be enough to receive pension payments. Then the period of official work in Latvia is also taken into account. But pension calculations are based only on Russian work experience.

The pension is paid through the State Social Insurance Agency once a quarter. They receive funds from one of the banks of the Republic of Latvia or at the post office. In the first case, the account number of the credit institution is indicated, which can be found out from the agreement concluded with the bank.

Minimum pension amount

There is no official minimum set as it depends on contributions and lifetime work experience. In addition, a gradation of pensioners is established depending on social status and membership in certain professions.

The minimum pension in Latvia in 2020 is at 70.43 euros. At the same time, those who have an income below 128.06 euros per month receive beggar status. Local authorities establish the following benefits for such income:

- payment of utilities;

- Food;

- providing free lunches;

- funds for the purchase of firewood in the private sector.

To find out the size of your future payments, you need to use the following formula, which can be used to easily calculate its size.

P = K/G:12

In which P is the amount of payments, K is the total amount of money for payments, G is the term and period of the payment.

The average size

In addition to the formula for calculation established by the state, there are also two types of payments, the amount of which is fixed. These are the average and minimum payments. First, let's look at the average pension. Its size is 304 euros this year.

Minimum size

Also another type is the minimum size. The amount of these payments is not fixed, since it is determined individually for each pensioner.

These payments also depend on several important factors, and they are as follows:

- From work experience.

- From the presence of disability in a pensioner.

Benefits in Latvia for pensioners

On the territory of the Republic of Latvia, benefits are available at the national and local levels for citizens of retirement age. In the first case, the following subsidies are provided:

- former juvenile prisoners of concentration camps receive financial assistance for: compensation for the so-called patient fee;

- purchase of medicines and medicines;

- Dental prosthetics.

For people whose only income is a state pension and who do not have health insurance, benefits are provided:

- Those who survived the siege of Leningrad can count on financial assistance for the purchase of medicines, dental prosthetics, and the purchase of a coffin and cross. If they are classified as low-income, they are entitled to free food for 2 months a year.

- Pensioners who have the status of politically repressed persons have the right to free travel on municipal transport and dental prosthetics. Financial assistance is provided for them when purchasing a coffin and cross.

- Single pensioners living in premises without amenities have the right to visit the baths for free twice a month.

Let us briefly consider what benefits are provided to pensioners in Latvia by local authorities. The widest package of social benefits is offered in Riga. Let's name just a few positions:

- the amount of assistance from the municipality to cover the above-mentioned patient fee is 71 euros;

- pensioners with low-income status whose monthly income is less than 127 euros are entitled to a subsidy;

- elderly people with any disability group receive assistance of up to 2,134 euros for housing arrangement;

- those who have reached 100 years of age are given a one-time payment of 150 euros.

Benefits are also provided in other Latvian cities. For example, in Daugavpils, pensioners can ride public transport for free.

From January 1, 2020, after the death of a pensioner, his widowed spouse will be able to receive half of the deceased’s pension. Only recipients of an old-age, disability or long-service pension will be able to take advantage of this right.

The benefit will be paid only to widowers; divorced spouses or couples living in unregistered relationships are not eligible for payment.

When is retirement age in Latvia? What are the payout amounts?

The life cycle is what unites all of us humans. It begins with birth and ends, sadly, with death. At all stages of this cycle, we are haunted by some responsibilities, mandatory requirements or needs that are similar in meaning for every social being.

One of the important stages of life is retirement age. At this stage, you stop working for the benefit of the state while on legal vacation. But here the question arises of how to continue to live and, most importantly, for what? We will now examine this question in more detail.

At what age do they become pensioners?

We will start, of course, with age. The retirement age may differ in different countries and for different segments of the population. Let's figure out what this age is in Latvia.

A citizen (or citizen) of Latvia who has reached the age of 62 years and 9 months has the right to apply to the Pension Fund of the Republic of Latvia for a pension. The country's government plans to increase the retirement age to 65 by 2025 .

But it is important to remember that only those people whose work experience is 15 years have the right to receive a pension.

There is also a special type of citizens of the Republic of Latvia who have the right to retire early (before 62 years of age). These include:

- Women who raised a disabled person or mothers of many children (from 5 children) – 57 years old.

- If the citizen has 30 years of work experience.

- Women with inability to see, women who are dwarfs or midgets – 49.5 years.

- Women who worked in dangerous, harmful enterprises.

- Men - blind, dwarfs, midgets - 45 years old.

- Women are permanently disabled or perform labor-intensive work.

- Men employed in hazardous or harmful enterprises – 59.5 years.

Amount of social benefit

Moving on to this issue, you need to understand that the amount of payments varies depending on your length of service , the category of the population to which you belong and your field of activity.

Thus, there are three categories of citizens to whom pensions are paid under special conditions.

By disability

You should immediately understand that only the insured person has the right to receive payment and under special conditions :

- The disability must be legally recognized. If it is not a disease at the enterprise, work or accident, it is still there (law of January 1, 1997).

- If you do not have a pension upon reaching retirement age from another state (exception is an international treaty or Regulation No. 883/2004).

- If you live on the territory of the Republic of Latvia.

- You have 3 years of insurance experience.

If you are entitled to several different types of pensions, then you have the opportunity to receive only one, of your choice.

Further, the pension is calculated according to disability groups:

- Group 1 – the minimum payment for this group is equal to the amount of the monthly social benefit. security, namely 102.45 euros (if you have been disabled since childhood, then 170.75 euros).

- Group 2 - the pension for this disability group is 89.64 euros (for people disabled since childhood - 149.41 euros). This is also the minimum payment amount.

- Group 3 - disabled people of the third group are assigned an amount of 64.03 euros (disabled people from childhood - 106.72 euros).

Military pension payments

Almost every country has preserved those people who participated in military conflicts defending their homeland. In some cases, citizens who took part in the Second World War are treated as ordinary workers. There is no information as such .

In order not to be unfounded, one should equate a military pension to a standard one:

- The average pension is 250 euros (17,500 rubles).

- The maximum pension is 800 lats (52,500 rubles).

Providing for Russians living in the country

There are two current provisions regulating issues of pension accruals for Russian citizens living in the territory of the Republic of Latvia:

- Agreement between the Republic of Latvia and the Russian Federation of December 18, 2007.

- Agreement between the Russian Ministry of Health and Social Affairs. Development of the Russian Federation and the Ministry of Welfare of the Republic of Latvia on the application of the agreement mentioned above.

Thus, pensions for Russian citizens in Latvia are calculated in accordance with the laws of the territory of the state in which the citizen lives. What is the pension for Russians in rubles? That is, the pension will be standard, namely, depending directly on work experience, age and other conditions:

- average , standard pension – 17,500 rubles;

- maximum – 52 500;

- minimum – 11,962 rubles).

Privileges

Benefits in the Republic of Latvia vary. They can be either local, operating in a certain part of Latvia, or national.

Let's look at these types of benefits in more detail and with examples:

Riga

- Citizens who have reached 100 years of age receive a one-time payment of 150 euros.

- Pensioners with disabilities are provided with housing assistance - 2134 euros.

- Low-income citizens who have reached retirement age are paid an additional 128 conventional monetary units.

- Pensioners are also entitled to an additional amount of 71 euros to pay for medical expenses.

After 1 year of living in the city, you can apply for one or another benefit.

Dauvgalpis

In this city, pensioners are provided with free travel on buses, trolleybuses and trams.

National benefits

- Politically repressed pensioners have the right to:

- benefits for visiting the bathhouse (2-3 times a month);

- purchasing medicines;

- the purchase of a coffin and a cross are also included in the number of benefits;

- travel on public transport.

- Citizens who have reached retirement age and are registered with the TsSP receive the following benefits:

- purchasing medicines;

- dental prosthetics;

- free bathhouse (if the citizen does not have amenities at his place of residence and has reached seventy years of age);

- package with a minimum set of products once every six months.

- Pensioners who survived the siege of Leningrad have the right to receive benefits for the following positions:

- dental prosthetics;

- medicines;

- coffin and cross.

- Pensioners who ended up in a concentration camp at a young age have benefits for:

- dentures;

- purchase of medicines;

- reimbursement of fees (meaning patient fees) in public clinics and hospitals.

Despite all its subtleties, as in any other European country, the level of pension payments in Latvia is quite high.

The average pension amount is generally slightly higher than the average salary in the country, and the minimum slightly exceeds the required living capital.

Over the past few years, the pension of ordinary citizens of the Republic of Latvia has increased by 50-60 euros and despite the increase in the retirement age soon, the standard of living and benefits are working to improve the situation of every pensioner.

You may also like

Military pensioners in Latvia

Employees of the Latvian State Audit Office recorded in 2011 the fact that Russian retired military personnel received cash payments from two states at once. The reason for this situation was the coincidence of the base periods used for settlements and cash payments.

To correct it, the Latvian executive branch decided to stop payments for periods paid by the Russian Federation. They mean:

- time of completion of urgent military duty;

- period of extended stay under the banners of the USSR Armed Forces;

- service in structural divisions of internal affairs;

- time of study in higher educational institutions.

Currently, military pensions in Latvia are paid to Russian former military pensioners solely on the basis of length of service. But only if the value of this indicator meets the requirements of current legislation.

The average long-service pension of a Russian citizen with the status of a military pensioner will fluctuate in the Republic of Latvia in the range of 550-560 euros by 2020.