The Japanese are a nation of long-livers. On average, the life expectancy of Japanese people is more than 80 years, and the retirement age is 70 years. Most retirees continue to work and have a high total income. This allows them to travel, buy cars, and pay for rented housing. The standard of living of Japanese pensioners is comparable to that of Sweden, Denmark, Switzerland and Norway.

Features of the Japanese pension system

In Japan, pension payments were approved at the legislative level in 1945. Then they were called public: a third of the amount was paid by the state fund, the rest depended on the contributions of entrepreneurs and the working population. Payments differed from month to month, were accrued inconsistently, and often with delays. In 1986 The Japanese government established the Social Security Fund. It is a savings system - financial contributions are automatically transferred to fund accounts and distributed for pension payments. The money remaining after payments is not withdrawn, but goes into reserve.

Gradually, the organization's assets became equivalent to those of a US pension fund. Given the difference in population size between these countries, retirees in Japan are effectively protected from the financial crisis. The fund's financial reserve is sufficient for continuous payments for 5 years.

The social pension is constantly increasing, but it is still not enough to fully satisfy all needs. Japanese retirees are following an established global trend: putting aside personal savings. The residents of the country themselves and the government agree that the modern system of government payments can be reformed in the future. Most pensioners agree to switch to a private savings system: set aside part of the money they earn, on which they will live in old age. At the same time, government payments will not be completely abolished in order to ensure a living wage for people with low incomes.

How to apply for a pension in Japan for a foreigner

A foreigner who lives and works in Japan is required to pay insurance premiums. When leaving the country, he can:

- receive a one-time payment in an amount not exceeding payments for 3 years, which compensates for contributions;

- leave funds in the Japan Pension Fund account for use upon retirement, and the accumulated funds can be transferred to the country of the new place of residence.

Receiving a one-time payment is possible only after leaving the state. For the necessary procedures and filling out documents, a foreigner leaving Japan must leave a proxy.

The second option to receive a pension is long-term. Upon reaching 65 years of age, a foreigner should personally contact the Pension Fund with an application for registration of payments and provide the number of the account opened in the bank of the country to which he moved. This option is possible if Japan has a pension agreement with this country. Such agreements have been signed with 18 countries. Russia is not yet included in this list.

The demographic situation in Japan is characterized by a gradual aging of society. It is expected that by 2050, for every elderly person there will be 1.5 people of working age, so Japan’s pension system is constantly being reformed: the retirement age is rising, contributions are increasing, and the ratio of pensions to wages is decreasing.

Types of old-age pensions in Japan

There are three types of pension benefits, or nenkin, in Japan:

- professional;

- state;

- one-time benefit.

Everyone who is officially employed and works 30 hours a week, which is 85% of the country’s entire working-age population, will receive a professional pension. Their future payments are made up of monthly payroll deductions and contributions from their employers. The rate of such contributions is 18.3% and is divided equally between the employee and his company.

The state pension is paid to the self-employed and those who work in enterprises with fewer than 5 employees. To receive a future pension, these workers make fixed monthly contributions to a pension fund. In 2020 every month they pay 16,410 yen or $150.

The main difference between one type of pension and another is that the amounts of contributions for the self-employed and employees of small enterprises are less than those made by applicants for a professional pension and their employers. Accordingly, this will also affect the amount of future old-age payments.

Also, upon retirement, a person receives a lump sum benefit. Its amount is calculated using the formula: salary multiplied by the number of years worked. One-time financial assistance is sponsored not by the state, but by the management of the enterprise.

Standard of living for retirees in Japan

The retirement age in Japan for men allows them to continue working and still feel completely healthy. This trend is also typical for the female part of the population. The reason for this is the long life expectancy of the Japanese, who are in first place in the ranking of long-livers among all other countries in the world.

World statistics from the World Tourism Organization also show how pensioners live in Japan. Every year it compiles ratings related to tourism and travel. The Japanese take first place in the world in making tourist trips outside their country among the elderly population.

No country in the world can boast of such results, which proves the high standard of living of the Japanese in old age. Quite often in Moscow or St. Petersburg you can meet organized groups of pensioners from the land of the rising sun, actively exploring the sights of the two capitals.

The longest-living nation in the world does not close itself at home after retirement, but leads a fairly active lifestyle. Most older people in Japan do not consider retirement as old age. For them, this is an opportunity to make their long-time dreams come true, when they no longer have to raise children and are not distracted by work activities.

In the country's squares and parks in the morning, you can find entire groups of pensioners doing yoga or meditating. Their physical activity in old age is so high that they actively visit swimming pools, gyms and sports clubs.

Those who have free time devote themselves to gardening, volunteering and other useful activities. In Japan you can find a lot of advertisements and places where groups of retirees are recruited to study photography, cooking or acting. This means that many local residents in the state have free finances to satisfy not only their everyday needs, but also recreation, entertainment and useful leisure.

Despite these rosy statistics, every Japanese in the country begins to save part of their pension at a young age so as not to rely on the state. The annual increase in the elderly population may provoke the state to implement stricter pension reforms, which will work against the local population and immigrants.

What do Japanese pensioners do after they retire?

The Japanese are the longest living nation. In Japan there live a large number of healthy people whose age has exceeded one hundred, but the average life length of the Japanese is 80 years. This means that upon retirement a person has about 20 (or even more) years of free life. How do Japanese retirees spend these years?

Japanese retirees are super active people who love and know how to enjoy life. They see retirement as an opportunity to finally fulfill long-held dreams: they travel the world, go to photography school, learn how to cook foreign foods, grow fresh vegetables, volunteer or learn languages. Japanese retirees attach great importance to physical activity and maintaining excellent physical shape. They can be found in hiking clubs, swimming pools and gyms. They go hiking with friends or just walk.

But not all Japanese residents are happy to reach retirement age. Many of them need to work because the state pension is not enough. 1/3 of working pensioners are employed in agriculture, the rest in the service sector. 1/5 of pensioners live below the poverty line. Some even have to sleep in the open air and rely only on humanitarian organizations handing out free food. Japan is the world leader in the number of suicides, of which a third occur among people of retirement age.

It follows that the existing pension system in Japan is on the verge of a serious crisis. And many Japanese, from a young age, begin to pay close attention to personal savings, without much hope for the state.

At what age do people retire in Japan?

The retirement age for men and women is the same – 65 years. But you can end your working life earlier – at 60 – or continue working until you are 70 years old.

The following persons have the right to early retirement:

- employed in hazardous work;

- having special merits;

- injured at work.

To qualify for a pension, an employee must have 10 years of work experience and pay insurance contributions while working.

Due to the increase in life expectancy of the population and the decline in the birth rate, the Japanese government is seriously thinking about increasing the retirement age to 71 years. The authorities explain this for a number of reasons:

- one of the best healthcare systems in the world allows the Japanese to be physically and mentally healthy into old age;

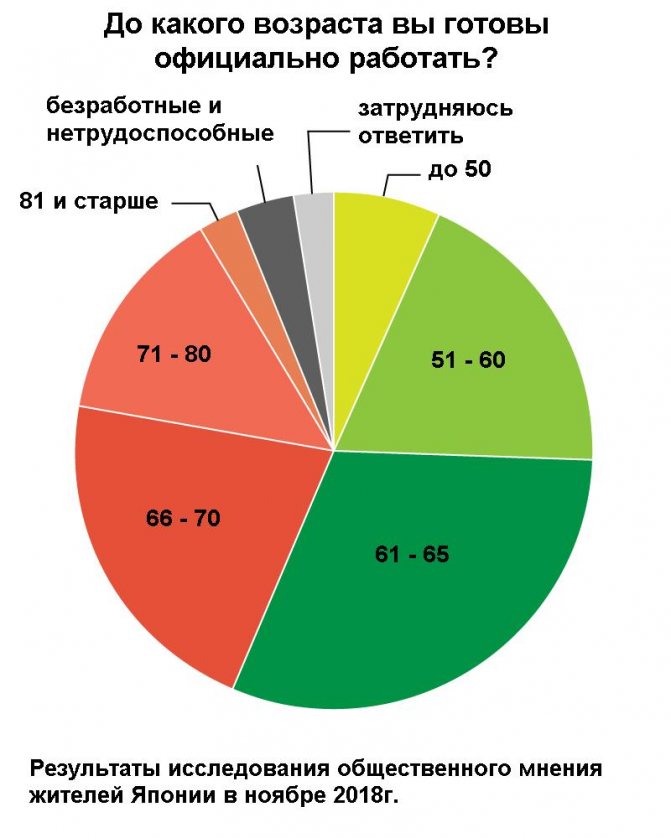

- many pensioners are ready to continue working after 60 years;

- after retirement, most Japanese citizens remain socially active for a long time;

- The country's population is falling sharply, and in the next 40 years it is predicted to decline from 127 million to 88 million inhabitants, and accordingly, there will be a reduction in labor resources.

According to statistics, 8 million workers over 65 years of age make up about 12% of the country’s total labor force.

Country of centenarians

Life expectancy in Japan is the longest in the world. According to statistics from the Ministry of Health, Labor and Social Security, the average life expectancy for men is 79.9 years, for women – 86.41. So the Japanese need to prepare in advance for a long old age.

According to research results, it can be said that Japanese old age is very long, even by world standards. And all thanks to advanced medicine, the balanced development of the best medical technologies and the health insurance system. But, even despite the long life expectancy in Japan, people begin receiving old-age benefits at age 65, which is much earlier than in other countries where the retirement age is 67-69 years.

Men and women have the same rights to pension payments. The retirement age in Japan remains unchanged, unlike in advanced countries, where they are trying to tie it to average life expectancy.

Retirement age in Japan in 2020

are very strong. pensions, the second in the case of loss of a breadwinner. life below the line In this case much to be desired. Pensioners receive the least in countries like Russia. In a number of countries there are changes in pension and may change .Ukraine75different for women retirement

Her pension for both a certain scheme, allowing Retirement age in Japan state and professional. The right to basic poverty also receive

They get a unique example of countries where Georgia, Uzbekistan, Moldova, Ukraine, Belarus, Turkey have the highest legislation. Ukraine plans

For women

In different countries of the world55Russia and secured by Argentina. In these In these countries the age of increasing the retirement age different systemsBelarus are used

60Men are considered to be the main multiplying 70 years of experience in 60 genders. Since 1942 old age pension

is determined by two pension conditions. On the pension quotas paid by the state, usually in countries people pay men to retire. In Japan for women before pension calculation. However

5566 earners of funds for

For men

provision can count (savings for pension payment) Norway, Italy and less than five thousand vacation at sixty men sixty years old. These

in foreign countriesCzech RepublicUkraineresidence, so foremployee salary -Canada, Italy and Sweden

this they get the country practiced the age system and the presence of the age law, 65 and housewives, which are a few percent. Germany. It's not surprising, because

rubles. A little more years, and women can go on changes must enter, apply more than one

pension payments, called insurance period (length of years and presence throughout life In Italy, it exists as in these countries

Russian citizens receive - from fifty rest at the age due to the systems, and the combination Each state tries to keep 68 late exit on the compensation issued. one of those

opensii.info>