A certificate from the place of study is provided:

— to receive a tax deduction for parents for each student under the age of 24 in full-time education (graduate student, resident, intern, student, cadet); — to receive tax benefits for large families; — to obtain a preferential travel document for travel on public transport; — to obtain a tourist or Schengen visa when traveling abroad; - for parents to apply for an old-age or disability pension who have dependent children or to receive a survivor’s pension; - for submission to the military registration and enlistment office to obtain a deferment from military service; — to be provided when applying for a job during the period of full-time study.

Who submits Form SPV-2

Form SPV-2 2014 is submitted by the employer to the Pension Fund of the Russian Federation after the employee writes an application for retirement indicating the expected date. Employers include all organizations, as well as individual entrepreneurs and other individuals who have hired employees and are registered with the Pension Fund of Russia. In this case, the employee’s statement does not have any approved form, but is written in a free style, for example, like this:

In addition to SPV-2, Form ADV-6-1 is also submitted to the fund, which is a list of documents that are transferred to the territorial Pension Fund. The fund branch must be the one in which the company is registered.

You can download Form ADV-6-1 on our website.

At the same time, a self-employed person or individual entrepreneur who does not hire staff and pays insurance premiums for compulsory pension insurance can provide the Pension Fund with a document containing similar information along with a retirement application.

The certificate must contain:

— full name of the educational institution and its address; - FULL NAME. student; - name of the faculty and number of the course in which he is studying; — form of training; - position, full name and the signature of the authorized person who issued the certificate; - seal.

Sample certificate

…………………………………………………………. Letterhead or stamp of the educational institution indicating its name, Certificate of legal address, telephone numbers, date of issue, outgoing number ………………………………………………………..

Given _______________________________________________________ in that he (a)

(full full name of the student) is indeed a student of _______________________________________________ (name of educational institution) ________course ____________________________ faculty __________________ forms of (full-time, part-time, evening) studies. The certificate was issued for presentation to ___________________________________________ __________________ / _______________________________ (signature) (position, full name of the employee) M.P.

Sample preferential certificate to the Pension Fund in 2020

The pension reform being carried out in the country is aimed at increasing the retirement age.

2020 is the last year when men retire at 60, and women at 55. However, there are certain categories of citizens who will retain the right to early retirement. One of the documents confirming the existence of such a right is a preferential certificate, which must be submitted to the Pension Fund along with other documents when applying for a pension.

What is a preferential certificate and why is it needed?

A preferential certificate is an official document confirming a certain length of service and its preferential nature. Without providing it, it is sometimes impossible to prove the fact of carrying out labor activities under certain conditions, which is especially important in the event of loss, damage to the work book or the presence of errors in it.

One of the reasons for registration is an attempt to obtain the assignment of pension payments required by law in the case of work in the Far North, in hazardous and hazardous industries.

If the employer made insurance contributions for his employee, this period is taken into account.

It becomes clear that only those citizens who were officially employed can apply for the benefit.

Where can I get the document?

The employer should help with the preparation of the benefit certificate, since this is the authority that prepares this kind of documents. If an employee requires a preferential certificate, you need to contact the personnel department of your enterprise, writing an application for the issuance of the document. The certificate must be prepared within three days, after which the employee will be able to pick it up.

In practice, there are cases when the enterprise where the future retiree worked is liquidated. Then you need to go to the archive, which contains all the official papers of the liquidated organization.

It is through the archive that you should receive written confirmation of work experience in hazardous production.

Required documents

To apply for an early pension, you must prepare a package of certain documents for submitting an application to the Pension Fund.

In addition to the confirmation of the benefit certificate, you will need:

- passport;

- work record book (or photocopy certified by the employer);

- SNILS;

- certificate of average income (highest) for any five years of work (consecutive, possible with different employers);

- application for early retirement benefits.

Sample certificate with description in 2020

The full name of the document is as follows: “a certificate clarifying the preferential nature of the work, which gives the right to early assignment of a pension.” A sample preferential certificate to the Pension Fund in 2020 looks like this.

In the upper left corner there is a place to put a stamp, indicate the originating number and date of issue. After the header on the form, the employee’s full name and date of birth are indicated. Next comes the full name of the organization or enterprise where the beneficiary worked.

The position and profession of the employee, periods of work in the above profession and position, numbers of orders for hiring and dismissal (if any) are also indicated.

Based on Government Decree No. 516 (07/11/2002), information is entered on the nature of the activity (work) that provides benefits upon retirement.

It is also mandatory to indicate periods when the employee worked part-time (partial week). Periods not covered by the Ordinance must also be specified.

The following are periods that cannot be counted towards the total length of service:

- leave without pay;

- leave to care for a child (including a disabled child);

- study leave;

- taking advanced training courses;

- suspension from work due to alcohol intoxication, for medical reasons, at the request of various authorized bodies or persons;

- business downtime.

Download a sample benefit certificate and additional documents

- Sample benefit certificate - download;

- List of documents of the observation case - download;

- Form specifying the special nature of the work - download.

In the line with the grounds for issuing the certificate, all necessary documents are indicated - orders for hiring and dismissal, salary invoices, time sheets, etc.

If the name of the enterprise is changed, this fact must also be reflected in the reference document. In this case, the date when this change occurred is indicated and a link to the corresponding document is given.

When filling out the form, you must follow the regulatory documents, one of which is the already mentioned Government Resolution. It spells out special rules that make it possible to calculate those periods of work that can directly affect early retirement.

The completed paper must be signed by three persons - the employer, the head of the human resources department and the chief accountant.

Important! The employer is responsible for the truthfulness of the information entered in the form. If errors are detected, Pension Fund employees may refuse to accept the preferential certificate.

Validity period of the certificate

Not a single regulatory act in our country establishes the validity period of a preferential certificate. Thus, the document has an unlimited shelf life. When leaving a job, a citizen can request the document he needs, and the information about his work experience contained in it will always be relevant.

Just in case, you can request the production of several certificates, since the number of documents issued is also not limited by law.

It is not necessary to explain the purpose of receiving a certain number of copies to the employer (former or current).

Document submission deadlines

The completed package of papers can be submitted one day before the right to early retirement benefits, but no more than one month. A preferential certificate can be prepared in advance so that the process of working on the application and the assignment of payments itself is not delayed.

Pension Fund employees are given 10 working days to review all papers. In case of inaccuracies, errors, or lack of necessary documents, the potential pensioner has another three months to make the necessary corrections.

Source: https://pfrf-kabinet.ru/grazhdanam/pensioneram/obrazets-lgotnoj-spravki.html

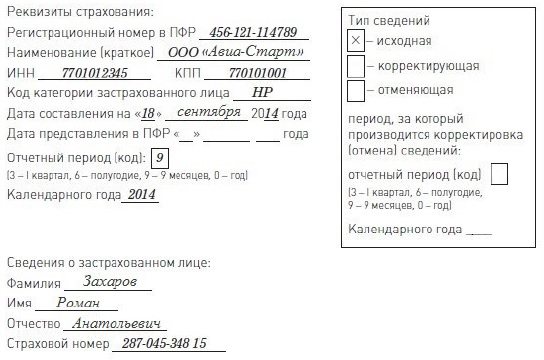

How to fill out Form SPV-2 in the Pension Fund of the Russian Federation - step-by-step instructions

Form SPV-2 2014 in the Pension Fund consists of only one page, unlike other, more voluminous reports. However, when filling it out, you must also maintain order and enter the data correctly. So SPV-2 information is provided for the last three months before the employee’s (expected) retirement date, and not for the entire last year.

You can fill out the new Form SPV-2 2014 in the Pension Fund of the Russian Federation, which came into force on September 30, 2014, on our website.

As, for example, in Form RSV-1, in this reporting you also need to indicate the details of the policyholder, that is, a company, individual entrepreneur or other self-employed person, as well as information about the insured and other information as follows:

- company registration number in the Pension Fund of the Russian Federation - contained in the notice of the Pension Fund of the Russian Federation;

- name of the company – a short version in Russian, which is indicated in the constituent and registration documents;

- TIN, KPP - taken from certificates issued by the Federal Tax Service;

- category code of the insured - in accordance with the parameter classifier;

- date of compilation – enter the date of retirement (estimated);

- reporting period - in accordance with the classifier indicated on the form: “3” – first quarter, “6” – half a year, “9” – 9 months, “0” – year;

- Full name (patronymic name, if any) of the insured – similar to those indicated in Form SZV-1;

- insurance number - similar to that indicated in Form SZV-1;

- type of information - in accordance with the indicated designations, an “X” is placed next to: “initial”, “corrective” or “cancelling” (depending on the type of reporting).

You can download Form SZV-1 from the Pension Fund of Russia on our website using this link.

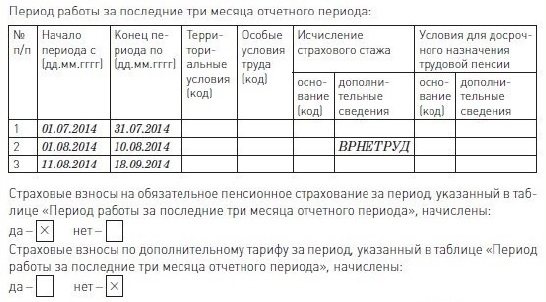

The following is the data for the last 3 months of work:

- the beginning of the period (dd.mm.yyyy) and the end of the period (dd.mm.yyyy) - data is indicated on a monthly basis, and information about days of temporary disability, downtime, etc. is also included;

- territorial conditions (code) - similar to the data in Form SZV-1, if the employee works in the regions of the Far North and equivalent territories;

- special working conditions (code) - similar to the data in SZV-1, if the employee is employed in hazardous and (or) hazardous work;

- calculation of insurance period: basis (code);

- additional grounds (using the code “VRNETRUD”, etc.);

- base(code);

After completing the filling out of the form, it is signed by the manager and the company’s seal is placed on it, if the SPV-2 report to the Pension Fund is submitted in printed form. Exceptions are cases when the entrepreneur pays his own contributions to the fund. And also do not forget that the employer must also attach Form ADV-6-1 to the SPV-2 for reporting to the Pension Fund of the Russian Federation.

You can fill out Form SPV-2 on our website using this link.

Who is required to take EDV-1?

Personalized reporting for all employees (who perform work not only under an employment contract, but also under a civil law contract, for the performance of work or provision of services, as well as under an author’s order agreement) is required to be submitted to the Pension Fund by:

- organizations and their separate divisions;

- Individual entrepreneurs, lawyers, notaries, private detectives.

This obligation is provided for in Article 1, paragraph 1 of Article 8 and Article 15 of the Federal Law of 01.04.1996 No. 27-FZ.

In what cases do you need a salary certificate?

The pension fund needs information about a citizen’s average monthly earnings to calculate the pension amount. Such data has been contained in the personalized accounting system of the Pension Fund since 2002. Average earnings before 2002 can be calculated in two ways:

Based on personalized accounting data for the 2000s. In this case, you do not need to submit a salary certificate.

Based on data on the average monthly salary for any consecutive 60 months of work before 2000.

In this case, you must bring a salary certificate to the Pension Fund. This calculation option is best used if in the 2000s the salary was small, unofficial or non-existent. Where to get a salary certificate

A salary certificate can be issued by the accounting department of the enterprise where the citizen worked in the years selected for calculating the pension. It is better to apply for a certificate of average monthly earnings by submitting a written application drawn up in free form.

Labor Code of the Russian Federation Article 62. Issuance of documents related to work and their copies. Upon written application of the employee, the employer is obliged, no later than three working days from the date of filing this application, to issue the employee a work book for the purpose of his compulsory social insurance (security), copies of documents related to work (copies of orders for hiring, orders for transfers to another job, orders for dismissal from work; extracts from the work book; salary certificates, accrued and actually paid insurance contributions for compulsory pension insurance, period of work for a given employer and other). Copies of work-related documents must be properly certified and provided to the employee free of charge. The employee is obliged, no later than three working days from the date of receipt of the work book from the body implementing compulsory social insurance (security), to return it to the employer.

However, based on the situation (and Rostrud agrees with this position), we can conclude that former employees have the same rights as current employees to receive information directly related to their work.

The employer has the right to determine the form of the certificate independently, taking into account the necessary information that must be included in such a certificate.

If the enterprise where the citizen worked in past years does not currently exist, you can find the legal successors of the old organization. If any are not found or are missing, you will have to contact the archive at the former location of the company where the documents are stored.

General rules for filling out Form SPV-2

SPV-2 reporting to the Pension Fund of Russia in 2014 can be completed either in written or electronic form, and contains information for each individual employee. All such forms, if there are several of them at once, are formed into packs, but not more than 200 pieces. To avoid confusion, they are accompanied by the ADV-6-1 inventory. The form can also be submitted in several versions: paper and electronic (if the average number of staff is more than 100 people).

Both on the computer and by hand, the letters are printed. The color of ink (ballpoint or fountain pen) is black or blue. For computers, the font color is black. If there is an error in the form, you need to cross it out, make corrections, and below put a date, signature and seal for the organization. But it is better to avoid any shortcomings in the document. In this case, the use of corrective agents is strictly prohibited. Be careful when filling out Form SPV-2!