Is the funded part of the deceased’s pension an inheritance?

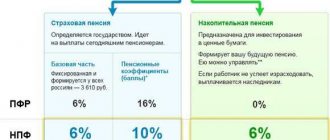

Since 2002, pension provision in Russia has included three components:

- basic;

- insurance;

- cumulative.

Only a third of them are allowed to inherit, and then only if a number of the following conditions are met:

- The deceased individual was a participant in compulsory pension insurance and his account was replenished.

- The death of the testator occurred before the pension payments were issued.

- If the deceased has reached retirement age, but did not apply for payments and never received them.

Thus, the key point is to receive a pension for the deceased at least once. If this happens, then the legal successors will not be able to receive the accumulated portion.

Succession of pension savings after the death of father or mother

Inheritance of property, including pension savings, is carried out in two legal ways:

- in accordance with the last will of the person;

- within the law.

In the absence of a testamentary order, the transfer of property preferences is carried out according to law. In this case, the legal successors are exclusively close relatives of the deceased. Among the priority heirs are children.

Recipients of the inheritance are obliged to independently submit an application to the Pension Fund for receipt of payment. No employee is required to notify potential assignees of the availability of the opportunity to receive.

So, after the death of their father or mother, children have the right to apply to an authorized institution and enter into an inheritance. All accumulated funds will be distributed among applicants in equal shares. Moreover, it should be mentioned that both the natural children of the deceased and those adopted by him have equal opportunities.

An interesting situation arises with the participation of maternity capital funds in the mother’s savings. The following have the prerogative to receive:

- The children's father, who survived his wife. He is considered the primary and prevailing subject.

- If there is no father, then children who have not reached the age of majority or who have already celebrated their 18th birthday but are studying on a full-time basis are allowed to use the funds.

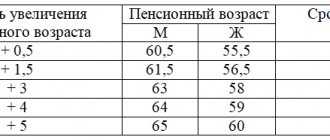

When is it paid?

Pension savings funds can be paid to legal successors if the death of a citizen occurs:

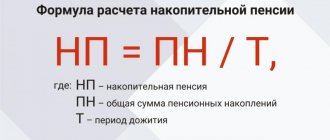

- before a payment is assigned to him from pension savings or before its amount is recalculated taking into account additional pension savings (with the exception of maternal (family) capital funds aimed at forming a future pension);

- after the appointment of an urgent pension payment to him. In this case, the legal successors have the right to receive the unpaid balance of pension savings (with the exception of maternal (family) capital funds aimed at forming a future pension);

- after a lump sum payment of pension savings was assigned but not yet paid to him. It can be received by family members of a deceased pensioner (provided they live together with him), as well as his disabled dependents (regardless of whether they lived with the deceased or not) within 4 months from the date of the citizen’s death. If these persons are absent, the amount of the lump sum payment is included in the inheritance and is inherited on a general basis.

If a citizen has been provided with a funded pension (indefinitely), in the event of his death, pension savings are not paid to his successors.

With regard to funds generated through the payment of additional insurance contributions within the framework of the State Pension Co-financing Program, as well as funds from maternity (family) capital, a different procedure applies: funds are paid to legal successors, regardless of whether payment has been established to the insured person. And if a citizen, before his death, has already received part of his pension savings in the form of payments provided for by law, the remaining amount can still be transferred to his legal successors.