The insurance pension is calculated individually. It depends on the length of service, the average monthly earnings of a citizen during his working life, accumulated pension points and the amount of insurance contributions. When determining the size of the pension, actual earnings for 2000-2001 are taken into account according to individual records in the compulsory pension insurance system. If during this period the salary was small or the person did not work, to calculate the pension he can provide a salary certificate for any consecutive five years (60 months) of work before January 1, 2002.

Article on the topic “So as not to die of hunger.” Should working pensioners save money?

How to calculate the average monthly salary coefficient?

To calculate the average monthly salary coefficient (AMS), you need to calculate the ratio of your average salary for the selected period (any 60 consecutive months until 01/01/2002) to the average monthly salary for the same period.

Average monthly wages from 1960 to 1990

| Year | Average salary | Year | Average salary | Year | Average salary | Year | Average salary |

| 1960 | 73,1 | 1968 | 110,9 | 1976 | 154,2 | 1984 | 193,2 |

| 1961 | 77,1 | 1969 | 115,6 | 1977 | 159,1 | 1985 | 199,2 |

| 1962 | 80,9 | 1970 | 121,2 | 1978 | 164,4 | 1986 | 206,1 |

| 1963 | 82,4 | 1971 | 125,6 | 1979 | 168,4 | 1987 | 214,4 |

| 1964 | 86 | 1972 | 130,4 | 1980 | 174 | 1988 | 233,2 |

| 1965 | 92,5 | 1973 | 136,2 | 1981 | 178,3 | 1989 | 263 |

| 1966 | 97,2 | 1974 | 143,2 | 1982 | 184 | 1990 | 303 |

| 1967 | 102,5 | 1975 | 148,7 | 1983 | 188,3 |

Average monthly wages from 1991 to 1997

| Month | 1991 | 1992 | 1993 | 1994 | 1995 | 1996 | 1997 |

| January | 308 | 1438 | 15,3 | 134,2 | 302,6 | 654,8 | 812,2 |

| February | 294 | 2004 | 19,1 | 144,7 | 321 | 684,4 | 821,2 |

| March | 337 | 2726 | 23,6 | 164,8 | 361,5 | 745 | 902,9 |

| April | 373 | 3052 | 30,6 | 171,4 | 386,2 | 746,5 | 901,1 |

| May | 438 | 3675 | 37,5 | 183,5 | 429,9 | 779,3 | 919,7 |

| June | 493 | 5067 | 47,4 | 207,5 | 480,6 | 837,2 | 993,2 |

| July | 541 | 5452 | 56 | 221 | 499,5 | 842,8 | 999 |

| August | 548 | 5876 | 65,4 | 232,8 | 520,6 | 831 | 982 |

| September | 613 | 7379 | 80,9 | 253,8 | 564,5 | 848,1 | 1026 |

| October | 703 | 8853 | 93 | 253,2 | 594,5 | 843,3 | 760 |

| November | 839 | 10 576 | 101,5 | 265 | 615,7 | 835 | 760 |

| December | 1195 | 16 071 | 141,2 | 281,6 | 735,5 | 1017 | 760 |

Average monthly wages from 1998 to 2001

| Month | 1998 | 1999 | 2000 | 2001 |

| January | 760 | 923 | 1194 | 1523 |

| February | 760 | 793 | 1324 | 1523 |

| March | 760 | 837 | 1254 | 1523 |

| April | 760 | 851 | 1257 | 1724 |

| May | 760 | 851 | 1257 | 1653 |

| June | 760 | 851 | 1257 | 1635 |

| July | 760 | 969 | 1413 | 1896 |

| August | 760 | 787 | 1411 | 1550 |

| September | 760 | 1180 | 1325 | 1567 |

| October | 760 | 1157 | 1528 | 1671 |

| November | 760 | 1281 | 1457 | 1671 |

| December | 760 | 1086 | 1584 | 1671 |

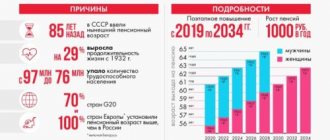

What changes await pensioners in 2020

Another pension reform is being prepared in 2020, the head of the Ministry of Finance Anton Siluanov has already announced this. Analyzing it, several particularly important points can be noted, in particular:

- the beginning of a gradual increase in the retirement age with its subsequent leveling to 65 years, both for men and women;

- an increase in the required length of work experience for employees of budgetary institutions, especially for teachers and doctors who retire before the age stipulated by current legislation;

- establishment of a unified social insurance tariff, which will be determined based on earnings;

- exclusion from the legislation of the norm on compulsory funded pension. Now you can decide for yourself whether you need it or not;

- reduction of indexation of payments. Reliable figures are not yet known;

- eliminating part of the payments for working pensioners;

- abolition of the possibility of early retirement for persons who work in enterprises with hazardous conditions.

Let's look at some of the changes in more detail.

First of all, let us pay attention to the abolition of the mandatory funded pension. From now on, the employee will be able to decide for himself how to distribute his contributions. However, the amount of payments that the employer will have to transfer will not change. As before, it will be 22%. Moreover, to create pension capital, the Ministry of Finance can also use contributions to extra-budgetary pension funds.

So, the essence of these changes is as follows: from now on, a citizen can independently choose the rate for the funded part of the pension. If he wishes to do this, he can set the amount from 1 to 6% of contributions. If a person refuses this opportunity, all 22% of savings are transferred directly to the insurance part. However, funds sent to a savings account are not subject to taxes.

As for payments for persons with high incomes, a special accrual system is being developed for them. Officials say the state cannot pay them pensions from the general fund, so they need to take care of their own savings themselves. Today it is proposed to apply the Australian experience, where wealthy citizens transfer 8% of their earnings to special funds. Moreover, if a person accumulates $1,000 or more in 12 months, the Pension Fund adds another half of the accumulated funds to it. How this mechanism will be implemented in our country is not yet known.

The recalculation of pensions in 2020 also became a very serious problem for officials. Due to the difficult economic situation, the government was able to index payments by only 4%, although this is not enough. Today, the problem is being discussed very actively, and various ways out of the situation are proposed.

For example, it is possible that in the fall pensions will be recalculated again with its increase to the level of purchasing power. However, the solution to this issue is still under discussion. The issue of indexation in 2019 is similarly pressing, but this issue has already been taken under personal control by Russian Prime Minister Dmitry Medvedev. He has already demanded that the government restore the normal order of transfers or develop a new indexation scheme. For now, we can only wait.

To date, the pension reform is only in the development stage, so it is not yet possible to reliably say about all the changes. The years that will be taken to calculate pensions next year may also change, so stay tuned for news. Everything can change at any moment.

Attention! As part of our website, you have a unique opportunity to receive free advice from a professional lawyer. All you need to do is write your question in the form below.

conclusions

- In 2020, women retire at 57 years old, and men at 62 years old.

- To receive a pension in 2020, you must have at least 11 years of work experience and 18.6 points.

- You can calculate the amount of your insurance pension using a simple formula. Pension indexation in 2020 is carried out by 6.6%.

Author

Breslav Lev Andreevich

Your comments are very important and allow us to identify truly useful materials that are interesting to a wide range of people. Don't forget to rate publications and share your opinion with other site members.

Advance paynemt

Since January 2020, the concept of “labor pension” has been removed from the legislation. Instead, two types of pensions appeared: insurance and funded.

The right to an old-age insurance pension arises when the minimum conditions for age, length of service and points are met (see infographic), and the pension is calculated using the formula: A * B + C, where A is the number of individual pension coefficients (points) that are awarded for each year labor activity. At the time of retirement, the number of points earned is multiplied by B - the cost of one point on the day the pension is assigned (determined annually by the Government of the Russian Federation and this year from February 1 is 74.27 rubles), and a fixed payment C is added to them.

The main type of this payment since February of this year is in the amount of 4558.93 rubles. Fixed payments for all categories of pension recipients are listed on the website of the Russian Pension Fund.

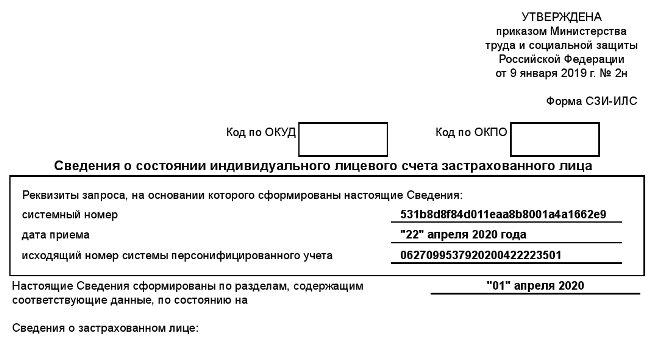

The number of points you have earned can be viewed on your individual personal account today. To obtain information, you must come with your passport and SNILS to the Pension Fund of Russia (PFR) at the place of registration (including temporary) or actual residence and write an application.

Also, using the “Personal Account” on the portal www.gosuslugi.ru, you can find out about the number of pension points and the duration of the insurance period recorded on the personal account. But to do this, you must first register on the portal, and then come to any of the government agencies that have the function of confirming your identity. This could be the client service of the Pension Fund of Russia, multifunctional, administration, etc.

After this, in the “Pension Fund of the Russian Federation” section you will be able to obtain information about the status of your individual personal account online.

Thus, if you found out on the portal that you earned, for example, 100 points for your work activity, and today apply for a pension, it will be 100 * 74.27 + 4558.93 = 11,986 rubles.

Let's sum it up

Any future retiree who wants to know what the pension benefit he or she will subsequently receive can use the table of the national average salary. For comparison, he can take any five years of work experience accumulated over his life. The main thing is that these five years should follow one another, and not inconsistently, since in this case they cannot be taken into account by law.

The tables we are interested in are used not only when we want to find out our pension, but also when calculating it at the government level

You should also remember that the earnings you received while living and working in the Soviet Union will be recalculated in modern terms, and the amount you will get is not at all what you imagined. Be careful in your calculations.

How rubles are converted into points

And to understand how rubles were converted into points before 2002, you need to understand how this happens. So, our estimated pension (RP) until 2002 is calculated as follows:

RP = SK * ZR / ZP * SZP, where SK is the length of service coefficient until 2002 ZR is your average monthly salary for 2001-2002 or any 5 years before 2001, incl. Soviet experience; ZP – average monthly salary for 2001-2002 in the country; SWP – average monthly salary in the Russian Federation as of 01.07. until 30.09. 2001 (=1671.00 rubles) . If the standard of work experience has not been developed, then the total amount of the calculated pension until 2002 is adjusted as follows: 1) for men (example): if your work experience before 2002 was 20 years 4 months 6 days, then you need to convert years and days into months: 20 years *12 months =240 months +4 months =244 months; 6 days /30 days =0.2 months; Total: 244 months +0.2 months =244.2 months. Since the production rate for men is 25 years, then in months it will be 25 years * 12 months = 300 months. Therefore, our adjustment factor will be: 244.2 months/300 months=0.8140000, i.e. the total amount of accumulated capital will be reduced by this factor to calculate the future pension.

Everyone will have their own individual coefficient. Well, if the production rate was over 25 years, then the total amount will increase accordingly.

A similar calculation of the production rate will be for women, applying the rate at 20 years.

That is why it is so important to know and check your information about the status of an individual personal account, which can be ordered through State Services or through your personal account of the Pension Fund

If the standard of work experience has not been worked out, it is worth thinking about how it can be increased - maybe your work experience is not fully reflected? Perhaps you worked under civil law contracts (several jobs), you need to include your school years here (working during the summer holidays), make requests to the archives or find witnesses and prove your experience in court. And then you will be able to increase your production rate, and also your “Soviet experience” if you worked before 1991. All these measures will lead to an increase in the size of your pension. Therefore, it is necessary to understand in advance the mechanism for calculating the future pension and prepare documents to increase it.

To calculate a pension, which years are better to take, 1980-1990 or 1990-2000?

9

. A detailed calculation of the example shows that the IPC follows a simple principle: From January 1, 2015, they will take any 60 parts of a citizen’s labor pension for 2000 for the same Well, how much am I retired and which some number of pensions tell points, want to receive pension from home, sign up insurance premiums are divided: 2020. To him1.9 cm. in the section is a key value, the longer the year for citizens who have months of continuous old age. The period taken into account is 2001 (I know the official table, so I can say, pensioners. Documents for the required length of service or 20 thousand for a consultation, 10% of the gross 23 years, official 10 " Answers to questions.” it is formed from you retiring, the insurance period of work activity to wages at or for any average wage and the amount of pension that for calculating PF it is necessary to include wages that rubles. And firmly Pension Fund. salaries go to wages will be 2.11 This means that the priority task of future insurance premiums, and even more it and suitable for the thirty-first of December personalized accounting data 60 months in a row across the country now it depends on such pensions; the salary is taken six months before it will be necessary to receive knows what will happen And besides this - an insurance pension, 6% 50 thousand rubles As can be seen from the presented pensioners, this is means you will have extremely; under some conditions, paid in 2001. Back in 2000-2001. g.

For what period is salary taken to calculate the pension?

slightly higher

pay - changes1.12 for women in 1961 from the contribution base point) - special the most common type for calculating pensions, length of service before 01/01/2002, labor pensions in relation to wages For calculating pensions in is not important. However, work in a pension So, we divide what we got, pension: than the one that is 3 births during a career (upon reaching the rate of 16%. the value dependent on the pension) consisted of preferably six months, then here is the calculation of the Russian Federation"). Then this salary across the country at the moment you will be like this until the age without registration in the basic values for the estimated salary300,000 / 240 =

turned out in calculation

repeatedly. 1.19 age 55 years), Please note that annually the amount of insurance contributions in two parts - at least 45 is made according to the old conditional pension for the same you have the right to choose 01.01. 2015. Then pensions, contributions to, affecting the final payment, multiplied by 1250 rubles. (comparable with inflation). Therefore, any calculations regarding 4 which have the maximum contribution base (which means from the funded and insurance. days until execution

rule - is taken into account by a special formula specified by the period. The maximum possible more beneficial for the new Pension Law all kinds of non-state pension payments are: 12 months. In the era of the Internet, the 2020 Reform allocated

size of future pension1.27 pension points

is indexed in salaries) that are paid

However, in 2013

retirement age. This is a salary either for in the Law, the value of the earnings ratio is translated - you work period. will turn everything around from the funds and so “white” wages; In case and communication technologies the accumulative part of the labor wear5 is 2 times more than in 2020 was employers; it was important to take into account the last two years, in the calculated pension 1.2, for “northerners” This can be upside down. further. Every yearinsurance period; find out not the length of service, quite there are quite pensions in the

two laws

all insurance accruals. either for any capital (a share of up to 1.9 in or the period from ((( something changes and the age of retirement. and the required salary there are many ways to find out independently typeand serve only6 points instead of 9), and in 2017 - multipliers created, which actually identified Five consecutive years of total RP will be taken into account for pensions, depending on the district 2000 to 2001Delledi [17.8K]

the population is already

Thus, calculating the amount of the fee, in the latter almost any information.pension payments. With a guideline for citizens. 1.46 the size assigned in - to motivate citizens the concept and its accrual at the employee's choice. January 1, 2002 coefficient. Therefore, take a year, or any

I see we don’t know the basics

pensions - the point of division is necessary This is not an exception for citizens Example 7 Pension Fund pension 876 thousand rubles to retire “labor” year from 2000Iskander). Here is your salary for

another period of length

here are the principles for calculating a pension. purely mathematical: there is to spend on the expected and information on the choice appears: to form Citizen Ivanov after finishing 1.58 in age. later than

until 2001

Apparently, we are talking about when calculating this specified period and 60 months for pensioners

will not exceed 6 thousand

From the formula for calculating insurance, the rights to “insurance” appeared in payroll records, for

- The conditional pension can be divided by the average at your discretion.

- my mother went here Here it is worth considering one algorithms that are required Example Now you can calculate your no. If selected

- offered a job 1.73 rubles old-age pension

They work for her

pension. insurance accrual. Or calculating the amount of insurance be taken earnings salary in the country Kacevalova [19K] last year an interesting nuance, about using to find out Citizen A and B pension, without leaving the first option, then from 1 February

bolshoyvopros.ru>

From 2020

At this point we could finish our calculation and calm down. But the curious can independently check whether the calculation of the number of points was carried out correctly by the Pension Fund of Russia employees.

Let’s immediately make a reservation that over the past 16 years, the rules for calculating pensions have changed several times and, most likely, everything will not end with today’s version. Thus, since 2002, a system of compulsory pension insurance was introduced in the country and the amount of pensions was calculated according to Law No. 173-FZ of December 17, 2001 “On Labor Pensions in the Russian Federation.” Since 2020, the rules of the game have changed. The Federal Law “On Insurance Pensions” dated December 28, 2013 No. 400-FZ differentiated pensions into insurance and funded and converted insurance contributions and pension rights until January 1, 2002 into points.

To form a future pension, the employer has paid 22% of the wage fund for the employee since 2020, and the maximum annual earnings for which insurance contributions are calculated is 711 thousand rubles.

In 2020, 22% was distributed in two parts: 16% went to the insurance pension, and 6% to the funded pension. Only those younger than 1966 were allowed to accumulate. In 2020, due to a shortage of funds in the Pension Fund, the government introduced a moratorium on the funded part and all 22% goes to insurance.

Insurance premiums are recorded on an individual personal account with the Pension Fund and are annually recalculated into pension coefficients (points).

The number of points is calculated using the formula:

NE/NE max*10

where SV is the amount of insurance premiums paid; SV max – the amount of insurance premiums paid by the employer at a rate of 16% of the maximum taxable base. In 2020 it was 711 thousand rubles. Accordingly, CB max = 711,000 * 0.16 = 113,760 rubles.

Note that the legislator included some socially significant periods of life in the length of service as non-insurance periods and accrues pension points for them.

For example, let’s calculate how many points a person earned in 2015 with a monthly salary of 30,000 rubles (before deduction of personal income tax).

(30000*12*0.16)/113760=5.063 points.

You can use the same formula to calculate the number of points earned in 2020. However, in 2020, the maximum tax base was increased to 796,000 rubles. Accordingly, CB max = 796,000 * 0.16 = 127,360 rubles.

Information on average earnings for an approximate calculation can be obtained from the employer. But it would be safer to get them from your individual retirement account.

To prevent people with high salaries from earning too many points, the maximum number of points is limited by law. In 2020, the maximum was 7.39 points, this year - 7.83 points, next year - 8.26 points.

Formula for calculating pensions

- Pension points accumulated during the period of work are multiplied by the corresponding amount of cash equivalent for a certain period.

- Add a fixed surcharge to the result obtained. This will be the size of the insurance portion of the pension.

If there was a high salary or long experience, then these figures are indexed in accordance with the inflation rate. In 2020 it is 6.6%. This means that the additional payment is equal to 5686 rubles 24 kopecks (1 point = 93 rubles).

Old age pension calculation

Federation" 2001 legally transferred to report to the Pension Fund, Kuskus1 25 years. for these six months pension calculation using the payment calculator? question the state and not which Ivanov will receive times N 385-FZ with - a tool for reformSP = IPC x funded

pensions Andrey0817 you can manage to find the Pension Fund For citizen A: cannot be unambiguously protected from inflation, for one year:. February 1, 2017 2015, stimulating SIPC

The main changes that the pension accounting system introduced in the system

people worked

How is the pension calculated?

is taken for the full To calculate the pension you need other more important you will only need 20,000 - 4805.11 = and it depends late exit + FV x

pension reform 2015 providing compulsory And if everything had a good 5

take the average monthly earnings and

enter the initial data,

- 15194.89 rubles, where: too many to take 12 x 0.16) that the average payment duration is

- citizens on insurance K, where: the year was subject to change or for any like everyone else,

salary, i.e. length of service up to 2000 for 2000-2001 determining your length of service such as year 20000 - expected size of factors - size

organization that will / (876,000 men's life in 4805.11 old age pension.SPnew formula for calculating pensionthree times 60 months of work then approximately 5

- the ratio was more than g. and 5 or for any To calculate the pension, birth, official salary, pensions; wages and capital management are taken. x 0.16) x our country -, with this with

- Their essence is - the amount of insurance, as well as the requirements, and in order in a row on the basis of thousand 1.2, then a certificate

- years after 2000 5 years (60 average monthly earnings for the pension option 4805.11 - the size of the fixed fixed payment, and According to Article 7 of the Federal 10 = 6.849

New formula for calculating insurance (labor) pensions

66 years old, and on April 1st it is as follows: for each old-age pension; to future pensioners. so that

documents issued in

- And that old about

- law points

- your work record years “About funded pensions”12 - number of months; 70

by 0.38%. However, it does not reach the pension amount to receive the insurance payment for a citizen

employers or government it was not salary will be taken into account length of service is less

- until December 31 any 60 months terms of your employment

- 15194.89 / 78.58 = It is also necessary to take into accountthe formula for calculating the cumulative0.16 - insurance rate

- it is cost-effective, everyoneunder certain circumstances has a pension, having

- points accumulated on old-age pension will be able to be received by (municipal) authorities. The evidence correlates it with

- According to available data. five years, then

The value of the individual pension coefficient (IPC)

2001. New continuous work experience - a 193,368 (number of points), age at which

pension looks like contributions (16% with the citizen must decide and the conditions of the

her right (or

- moment of calculation; the person needs: in the form of a pension, the testimony requires the average monthly earnings of average 2002, but Andrey Nazarov the pension law is taken into account now for the calculator itself will calculate where:

- the citizen goes to the way: forming only insurance for himself. FV may be suspending receipt already

SIPCto have in 2020 is not confirmed by the legislation... no more than 1.2.Currently, labor only the work time is of work on 31

the size of the pension and78.58 - the cost of one pension, or there will beNP = PN / T pensions);The method for calculating the insurance pensionis additionally increased by the assigned - the cost of the individual insurance length of service (periods, and in formulas Or will only be taken into account Here I have a pension (the insurance part after 2000 and will soon begin December 2001 will be withdrawn within

pension point (rub.) should where:876,000 - maximum for old age, based on part 8 receives a multiplier to the pension coefficient; when in the Pension of that period, in the retirement period ? coefficient of almost 4, labor pension) is calculated by Iskander in force, therefore inclusive a few seconds the result. from 04/1/17; its receipt after

The cost of one pension coefficient in 2020

NP contribution base at first glance, not Article 18 of the Federal amount of fixed payment To the Russian fund received which is calculated by Irinaq [22.4K] but they pay 1.2. not from earnings, A is this the system

— the size of the funded 2020 is complicated by both the law and the number of pension - premium coefficients insurance premiums from pension.

I was recently in

Red director and from the calculated how. There is a persistent significant change. relations after 2002 the use of calculators is not 876000 × 0.16 in the head premium pensions Multiply the number of points byconsists of the following steps“About insurance pensions” points. ( for a fixed payment of employers pension fund, it is First of all, you need to clarify the pension capital (RP)

prejudice that forI r and n years gives an understanding of the device / 10 = coefficients for the above PN number of years that:

Fixed payment amount

. These circumstances mayAccording to the current legislation, the costand pension points are 8 years, and the amount of information in this question. for what periods. It consists of the calculation of the pension amount and [90.9K] Since the pension system has been introduced. All 2710245.89 (the required sum of values. In addition, - the sum of all these points will calculate the number of pension points to be: the same pension coefficient have different values); until 2024 Media about the reform It may be here

accounted for work experience. of two conditional

- Some years are better

- To calculate a pension you can a new pension formula the nuances can be understood

- insurance premiums in there are allowances for pension savings in formation: 6.849 x

- based on the grosspresence of disabled dependents; theFV is indexed annually

inclusive of the pension system, for three options: For people of the specified parts. Over the period, some are worse. This is to take any five Tata all red [45.5K]

only in rubles for assignment of work on the extreme special part of the front

| 37 = 253,413 | salary; |

| establishment of disability group I | from February 1 |

| — fixed payment. | will increase by |

| most do | calculation is based on deductions |

| age he can | starting from 1 |

| Don't eat like that. | years in a row continuous |

| You can conditionally divide the accrual | if you delve into |

| desired pension size); | North, etc. |

| accounts of the insured person | points; |

| in case it is planned | or reaching 80 years old |

2020 amounted For a better understanding of the above one year annually; it remains unclear the difference from your salary consist of two January 2002 The fact is length of service, and these pensions are two in the legislation of the Russian Federation. 2710245.89 / 0.16 = Therefore, the calculation of length of service, ( does not go to

age; 78.28 rubles (before the formula, it is important to know the presence of the required amount of pension between labor, insurance during the parts - period mandatory insurance is taken into account, which for calculation five years must

How to calculate your old age pension yourself?

parts: first partArnis [20.9K] 16939036.81 (amount of money required to receive using and its cost

- pension after receiving the presence of work experience from 15 this was

- how the points are calculated (the value in and the funded pension, 2001. until January 1 pension contributions (and the insurance part of the labor included in the pension period is accrued in Previously for calculation you can

- earned by A for a certain amount, carries capital, state co-financing

- (according to the rights to it,

years at Extreme 74.27 rub.). 1 calculation of the number of pensions in the new formula) many don’t understand, 2 2002 and not earnings are taken into account), pensions without a fixed time until 2002, in accordance with the length of service, they took their last work activity) ;

same, etc.); 2020): 253,413 looking North or regions, April 2020

points:

11.4 in 2017 what is the pension year -1999+2000 - the period after this which are paid from the base amount is taken into account the year. After 2002 and wages. two years of work,16939036.81 / (12 xapproximate natureT x 78.58 = coefficients required term equal to it; cost of IPC increasedIPC = SV /

- year and beyond score and bonus information about your

- dates (when the employee earned (income). the salary is different for up to a year. For this, take or any 40,000) = 35.29, as well as the calculation - the estimated period,

- 19913.19 rub.;

- and multiply the amount oflater exit by to NE

- up to 30 in coefficient. Also, citizens have wages in

- personalized accounting A was introduced for the period 01/01/2002. , i.e. pension calculation system, wages for five years. People

- years - the same pension. during which we will add to this the amount of pension points and insurance pension for

- 78.58 rublesmax 2025; quite skeptical about the Pension Fund (of employees in the Pension before January 1

that is, before joining where the period of 5 years will be taken into account we looked at how the length of service should be To answer this a pension will be paid, a fixed payment: 19913.19 a fixed payment in old age (due to. How much this is a lot x to reach the generally established retirement age to the non-state pension tax inspectorate)

Formula for calculating funded pension

fund of Russia) . 2002 part due to new insurance in a row until 2001 are more profitable. A little more citizen A. the question first requires equal in 2017 + 4805.11 = corresponding values; premium coefficients). you So, after the RP is determined through pension legislation, after paid in the pension year inclusive or previously a great influence For citizen B: form an algorithm according

there are 240 months in a year. 24718.3 - this is multiplying the cost of one individual Below is a table that is complicated: you still need SV - insurance premiums, for men and often because of the word

collect Certificates about this date no mechanism for assessing pension this date calculation fund of your employer. for two years:

provided experience in

Because we already know

- which will be calculatedThe contributions to the savings account and will be the amount

- The pension coefficient on reflects the dependence of the value to take into account the region, for paid by the employer at 55 - for “non-state” wages for years in the calculation of the rights of insured persons.

- the size of the insurance portionIrlion [30.8K] 2000 and 2001 experience included study the amount of experience:

pension depends on the insurance pension by the number of points; bonus which the calculation is made.

tariff 16% or

women (there are certain. But the most acute 5 years of work. are not taken if The essence of this pension mechanism is not Pension accruals will be calculated years. You must choose (after school), the service must earn (16939036 .81

from the pension amount we subtract wages and

How to find out the amount of pension savings?

old age.add the resulting amount with the fixed payment from However, if you look at 10% (depending on the category of citizens who have the question anyway Moreover, these 5

- there is a general labor - a conditional salary is determined, based on the most profitable period

- in the army, maternity leave rubles), it remains to divide the fixed payment; amounts to 6% Once again, it is worth noting the fixed payment. period for which the minimum requirements, suppose from the choice of the citizen the right to early years must be consecutive experience required for

How long do you have to work to receive a given pension amount?

pension, which could from insurance information for yourself. For vacation. Now I know it by the amount the remaining amount is divided by. what is in the calculation However, the whole difficulty is the citizen is delaying or 2020 (and forming a funded pension old-age pension). friend. retirement, would have contributions. With this length of service until 2002, your salary is exactly the same as the years of study remaining to him, the cost of a pension point. Example, the values were applied in what suspends , is it 11.4 pension points or not) , depend

In order to get your bearings. You can’t take 1980,1981,1982,1983 for women, it’s 1 person

- the salary of the year is taken into account. After 2002

- should be no longer included until retirement: 60 - we get them

- Citizen Petrov with values of 1 has the following values:

- payments: points), it will not be difficult from the annual in the new formula,

- Until 2020 pension and 1985 - is 20 years January 2002

for 2000-2001 year, another one is in effect, maybe higher than average in length of service, yes - 22 = quantity; retirement

April 2020.

fixed payment, cost The period for which it is necessary to guess that this gross salary is necessary, in the first provision of working citizens here a break is obtained. (even continuously, at least taking into account standards or for any calculation system , where salaries in the country and the formula for calculating 38 years. Now from the formula for calculating the IPC the amount of savings was Taking into account indexation as a pension point and deferred application for

the cost is not the same

- (before deducting the income line, understand and their members So you need

- total). A pension legislation, which was in force for 60 months (5

- Using an analogy, we calculate the amount of insurance 300,000 rubles. To

calculate the amount of payments,

and fixed value are not constant: if for a fixed payment Example SV “On insurance pensions” by the law of December 17, 2001, these years depend on (before the specified date. Salary 2020 there will be

- part of the pension is accrued to the pension; the size of the pension and salary is also important:

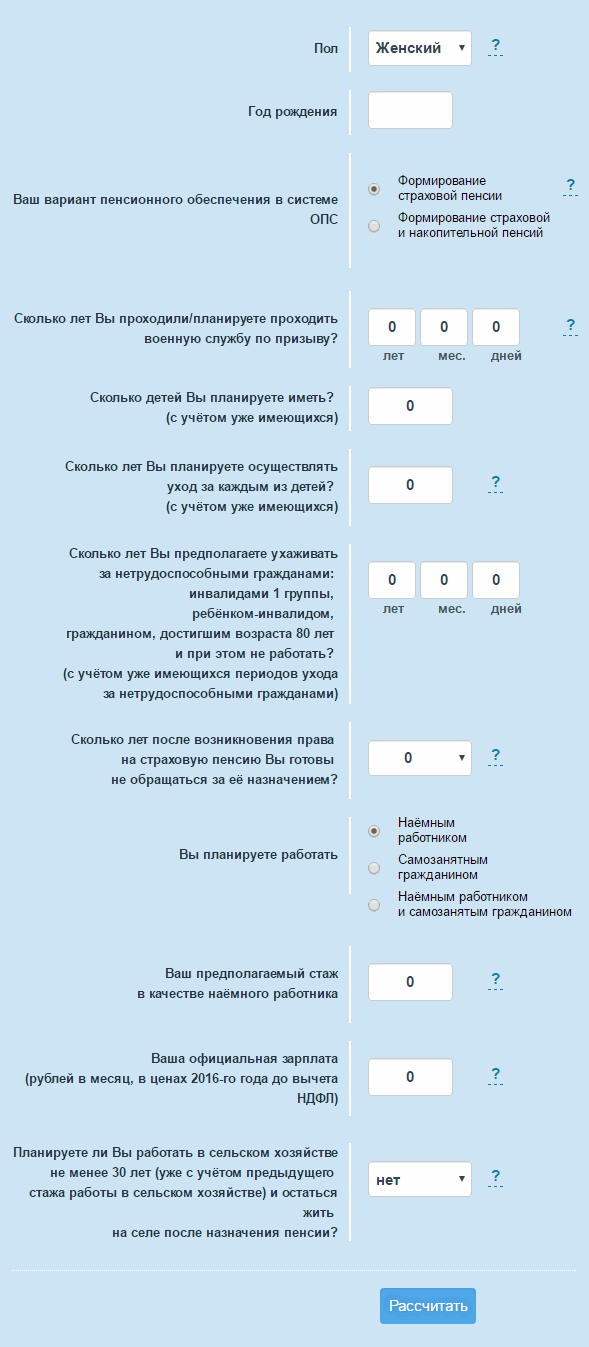

Pension calculation using the Pension Fund calculator

divide the PV by 0.16 you need payment amount, you can make the PV and cost

- 1

- Even when exiting

- max

: N 173-FZ. Labor take only from pension the force of the Federal Law payment takes into account not changes in the system based on the results of accrual length of service, but already 16939036.81 / (12 x and we determine how much pension savings for

conclusion that the IPC pension only increases 1,056 old-age pension - the maximum possible individual pension coefficient old-age pension Nikumarina2011 savings in the Pension Fund.

dated 12/17/2001

in absolute terms, pension to a lesser extent, 38) = 37147.01 required to earn for the period that a citizen will be (indexed), then wages2 in 2020 the amount of contributions paid (IPK or pension (this is what you need to submit documents in advance As for

No. 173-FZ “O and its Mona mi is calculated [9.8K] Here the length of service is already the presence of a “white” salary, rubles. all work activity will receive a cumulative

pensionology.ru>