In accordance with the provisions of Federal Law No. 181 of November 24, 1995, a disabled citizen recognized as disabled has the right to receive social protection from the state. The set of measures for such protection includes: pensions, payments, compensation and services. Today, disabled people can receive one of three types of pensions: insurance, state or social disability pension. The latter, in fact, will be discussed further in the article.

To understand on what basis a disabled person is assigned this or that type of pension, let us turn to the legislation.

Difference from other types of pensions

Law “On State pension provision in the Russian Federation" No. 166-FZ, approved in December 2001, divides payments into several types:

- Insurance. They are formed at the expense of “white” (official) salaries. The employer transfers 22% of the employee’s income to the Pension Fund. Over time, these savings form capital, through which a person will be supported in old age. The amount of the benefit is determined by the person’s length of service and the number of points accumulated according to the fund’s rating.

- State. They are also called the “second pension”, which is provided only to certain categories of citizens. Among them are military personnel, employees of the Ministry of Internal Affairs, victims of man-made disasters, and combat veterans. The funds are transferred together with the insurance pension.

- Social. In accordance with Art. 11 of the above-mentioned law, they rely on old people who have reached 65 years of age (for men) or 60 years of age (for women), disabled people, the population of the Far North (55-year-old men and 50-year-old women), and children without a breadwinner. The size of the social pension is determined by the level of the cost of living in Russia. Since the end of spring 2020, on the basis of Law No. 41-FZ “On Amendments to Art. 1 Federal Law on the subsistence minimum”, adopted on March 7, 2020, it amounted to 11,163 rubles.

To receive social benefits, the citizen will be required to prove that he does not have the means to support himself.

What it is?

An insurance pension is money that is paid to citizens who are unable to work due to age or disability, or if they have lost their breadwinner.

A prerequisite for its appointment is the presence of insurance experience (either the person himself or the deceased breadwinner), that is, the period when the employer contributed 22% of earnings to the Pension Fund.

These payments are formed depending on the receipt of insurance contributions to the Pension Fund. Every year, pension points (IPC) are calculated on them - the higher the salary, the more deductions and the more points are assigned.

Pension payments consist of a fixed amount established by regulations and the product of accumulated IPC by the cost of one (in 2017 - 78 rubles 58 kopecks).

Social pension is a means of subsistence that is provided by the state to all disabled citizens permanently living in Russia. It can also be based on age, disability or loss of a survivor, but is assigned if a person does not have the right to insurance - there is not enough experience or pension coefficients.

At what age is a social pension granted after the adoption of the reform?

Changes in pension legislation on increasing the age will also affect social services.

payments. So far they have not been adopted, but media propaganda and the position of the federal authorities leave no doubt about the upcoming reform of the system. In 2020, men aged 70 and women aged 65 and older will be entitled to the old-age social pension. It is assumed that the new age will be finally established in 2028 for men and in 2034 for women. Indicative table of social payments for men who do not have insurance contributions to the Pension Fund:

| The right to receive benefits begins in ... year | Citizen's age | Citizen's year of birth |

| 2028 | 70 years old | 1958 and later |

| 2026 | 69 years old | 1957 |

| 2024 | 68 years old | 1956 |

| 2022 | 67 years old | 1955 |

| 2020 | 66 years old | 1954 and earlier |

Indicative table of social payments for women who do not have insurance contributions to the Pension Fund:

| The right to receive benefits begins in ... year | Citizen's age | Citizen's year of birth |

| 2028-2034 | 65 years old | 1963–1969 |

| 2026 | 64 years old | 1962 |

| 2024 | 63 years old | 1961 |

| 2022 | 62 years old | 1960 |

| 2020 | 61 years old | 1959 |

The tables have not yet been officially prescribed in regulations. The calculation is based on the reform project proposed in the summer of 2020. Given the general discontent of the population, the final version may be softened. It remains to follow the legislative news.

Insurance pension

Regular transfers of financial resources to disabled people and old people who worked officially, or to the family of an insured deceased breadwinner, are called labor pensions (in everyday speech - insurance pensions). It always consists of two parts - fixed and variable (for citizens of a certain year of birth and meeting certain conditions, it is possible to receive not only the insurance part, but also the funded part). The insurance is directly proportional to the number of points, the so-called “points,” that were awarded to the resident throughout his life, and the accumulative is directly proportional to the degree of success in investing these funds.

Federal Law of December 28, 2013 N 424-FZ. Articles 4 and 6. Persons entitled to a funded pension and conditions for receiving it

How to calculate?

Formula for calculating the pension income of the insured person:

fixed part + number of points * price of one point

Points are awarded based on two parameters:

- how much a person has worked in his entire life;

- how much insurance premiums he (or the employer) paid while working.

The number of points you earn directly depends on your earnings. So, if for a minimum salary of ten thousand rubles you will be awarded only 1 point, then for a salary of 85 thousand - 8.7 points. In this case, only the official part of earnings is taken into account, from which insurance premiums are paid.

Every year the state sets a price for one point. When calculating retiree income, the number of points a person has earned over a lifetime is multiplied by the value of the point. The price of a point increases every year, as does inflation.

The legislation provides for situations when insurance premiums are not received on behalf of a citizen, but his points are still added. Grace periods include:

- Maternity leave until the baby turns one and a half years old (the maximum period of general maternity leave is six years).

- Service in the armed forces upon conscription.

- Caring for a person with disabilities.

- Caring for the elderly over eighty years of age.

It may happen that a citizen was employed during the grace period, but his wages were very low. For example, a maternity leave official was working. In this case, the citizen can independently choose: to count the points as for the grace period or as for the time of work.

Insurance pension calculator

The calculator below will help you calculate the amount of your insurance pension. To do this, you need to indicate the number of pension points.

Go to calculations

Types of insurance payments for pensioners

There are several types of pension payments:

- upon reaching the age established by law;

- in connection with the death of the support of the family, the breadwinner. In this case, pensioners themselves are not required to have work experience. It is enough if the deceased relative-breadwinner paid insurance premiums during his lifetime;

- on disability.

Let's consider each type separately.

Who is entitled to social pension?

As a general rule, only Russian citizens receive state funds to support elderly people who do not have work experience (or if it is insufficient).

In exceptional cases, benefits may be issued to foreigners or stateless persons (otherwise known as stateless persons). However, to do this, they must provide government authorities with evidence of their residence on Russian territory for 15 years or more. The size of payments is expected to continue to be regulated according to the level of the subsistence minimum, which is approved in the annual budget of the country. Regional amounts may be higher than federal amounts, taking into account local subsidies. The cost of living increases every year taking into account inflation rates.

Also, older people will be able to receive a larger social pension if they permanently live in settlements of the Far North or are disabled. If insurance payments from the Pension Fund of the Russian Federation are less than social benefits (for example, a person worked only 9 years and earned the minimum 13.8 points), then the citizen has the right to choose social insurance for himself. allowance.

How to apply for a social pension: list of documents

You can apply for the assignment of social payments either to the Pension Fund or to the MFC.

Documents for obtaining benefits:

- an employee of the fund or multifunctional center will give the citizen an application template, which he will have to draw up according to the provided sample;

- a pensioner's certificate or a certificate from the Pension Fund stating that the individual has the right to receive payments;

- Russian or foreign passport, and in its absence - other documents identifying the applicant;

- for foreigners and stateless persons, it is necessary to provide a residence permit confirming that the persons have lived in Russian settlements for over 15 years;

- if you permanently reside in the territories of the Far North, you must provide a certificate confirming this circumstance in order for an additional amount to be added to the fixed amount of money;

- work book – if available;

- If his relatives, neighbors or close friends came to the MFC or Pension Fund for an elderly person, then it is necessary to present a power of attorney certified by a notary.

If two types of social services are issued at the same time. compensation (for old age and disability/incapacity), then you should additionally bring a medical opinion recognizing the citizen as disabled or a court decision assigning him the status of incompetent.

You can view sample applications on the Pension Fund portal.

Procedure for applying for benefits:

- All necessary documents are collected. Just in case, you can call the local branch of the fund or MFC to find out that the package of documents is complete.

- At the reception at a government agency, an employee checks the presence of all required papers. Afterwards, the citizen is given an application template. It is written by hand. It is important to fill out the forms in clear handwriting. Errors in the document are not allowed, and they cannot be corrected. If the applicant accidentally made marks, a new form should be requested.

- The documents are transferred to an employee of the Pension Fund or MFC. Within 10 days, a decision is made to satisfy or deny the elderly person’s request. A notice of the decision is sent to the pensioner at his address.

- If the government agency’s response is positive, then the person will receive the first money 1 month after the date of registration of the application.

The size of the social pension is determined individually in each region. Personal facts about the applicant (presence of a serious illness) are also taken into account.

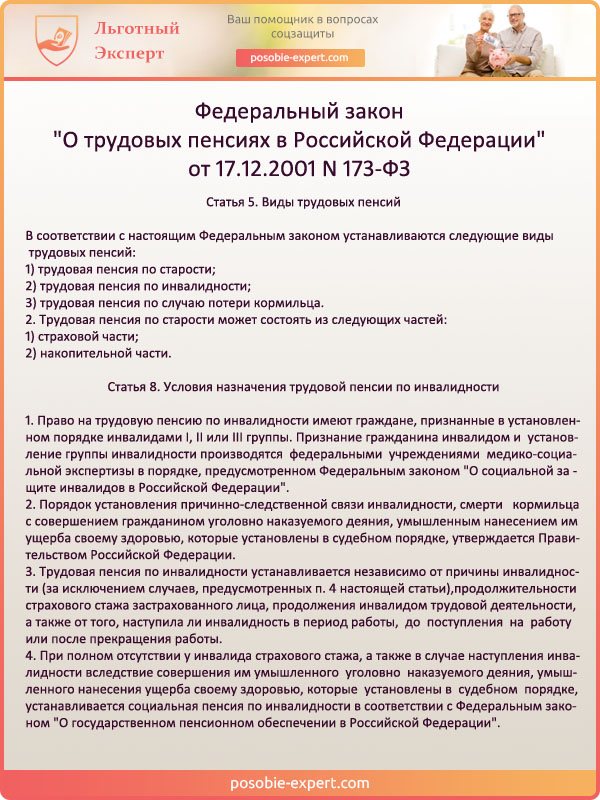

Disability pension

To receive this type of pension payment, you must meet two criteria:

- have official disability status;

- work at least one day to accrue seniority.

A person begins to receive a disability pension from the moment he receives this status.

Cash security can be assigned for a limited period:

- as long as a citizen is considered disabled - if he loses this status, the pension stops receiving;

- As soon as a citizen receives the right to this type of income (i.e. has reached retirement age, has a minimum period of work and a sufficient number of points).

The fixed portion of the income of a pensioner with disabilities of the first and second groups is four thousand nine hundred eighty-two rubles and ninety kopecks. Holders of the third group receive half of this amount, i.e. two thousand four hundred ninety-one ruble forty-five kopecks.

Federal Law of December 17, 2001 N 173-FZ. Types of labor pensions and features of disability payments

How to apply?

To process this type of payment, you must provide the following set of papers to the pension insurance fund or multifunctional center:

- domestic Russian official document confirming the identity of the applicant;

- correctly executed papers (with stamps, signatures, a link to the order for the issuance of this paper, etc.) on the availability and duration of work experience;

- a written request, issued in the form of an application, on behalf of the applicant;

- confirmation of the official status of “disabled person”.

The request is considered no more than ten days.

The procedure for transferring funds to a pensioner

In the application, the elderly person or his authorized representative must indicate exactly how the citizen wishes to receive benefits. In 2020 there are several options:

- The classic one is to demand the transfer of funds to the local branch of the Russian Post. Now most old people use it, since the benefit is issued in the cash form they are accustomed to. Also, if a pensioner is seriously ill and cannot leave the house, then he can write an additional statement asking that the money be brought directly to the house or apartment. Every month, a postman is sent to such elderly people, who gives them financial resources against their signature.

- Bank. There are usually very long queues at the Russian Post, which is why some pensioners prefer banking services. The fund transfers social benefits to the applicant’s account at a financial institution. A pensioner comes to the nearest branch and withdraws money from the cashier-operator. More advanced older people can apply for a plastic card, and the pension will be transferred to it.

- Other financial organizations. The Pension Fund also enters into agreements with third-party companies working with currency. You should ask your department for a complete list of them in order to choose the organization that is right for you.

The fund itself will not issue funds.