Non-state pension provision in the Russian Federation – who provides it in 2020

- An enterprise that has concluded a non-state pension agreement for its employees receives tax benefits;

- Employee loyalty and incentive to work more productively are demonstrated;

- The level of working conditions is increasing, which attracts more qualified and younger personnel.

The main disadvantage is that this type of pension is not supported by a government agency, but by commercial companies, which, as we know, tend to close due to bankruptcy. It is likely that by the time the pension is due, the non-state pension fund with which the agreement was signed will go bankrupt. In addition, a non-state pension has the following disadvantages:

- Very low profitability. The percentage of return is less than that of bank deposits;

- In most cases, it is impossible to receive the accumulated money ahead of schedule;

- All pension savings are made only in rubles;

- A fine may be imposed for late payments;

- The presence of a commission charged by a non-state pension fund for its work;

- Investments are taxable;

- The fund independently decides where the investor’s money will be invested;

- Constantly changing legislation can significantly affect the activities of non-state funds for the worse.

Non-state pension agreement - what is it, with whom is it concluded?

The main condition for participation in the non-state pension system is the conclusion of an appropriate agreement with the selected fund. Its parties are:

- Non-state pension fund operating on the basis of an obtained license;

- The depositor making payments;

- A person who has already been paid or will be paid a non-state pension.

According to the law, investors can be both individuals and legal entities. In the first case, citizens personally pay contributions and at the same time are parties to the agreement. In the second case, contributions are paid by organizations in favor of employees.

What is she like?

In simple terms, this is the money that a citizen exclusively voluntarily puts aside for his old age.

At the same time, a non-state pension is not an alternative to benefits already provided for by law. It is paid in addition to them. Moreover, the earlier savings are made, the larger the monthly payment in old age will be.

By its legal nature, a non-state pension has much in common with a bank deposit. Only it is returned to the person along with interest upon reaching a certain age.

A non-state pension fund (NPF) is responsible for accumulating and managing a citizen’s savings. To do this, an agreement is concluded with him, fixing all essential conditions.

Payment procedure and amount of non-state pension provision

The amount of payments that will be accrued to a citizen in the future depends on the following factors:

Specific features of a particular non-state pension fund;- Pension program described in the contract;

- The amount of contributions at the time the client enters retirement age.

It should be noted that the size of the non-state pension can be increased in connection with the receipt of income from investing funds at the end of the calendar year.

After establishing pension payments, the fund sends a notification to the applicant about the assignment of a pension, indicating the accrued amount and the period during which the funds will be paid.

There are several ways for a participant in the system under consideration to receive a pension: to a bank account, to a card or by postal transfer. At the same time, the pensioner chooses the method of delivery of funds independently.

State and non-state pension: what are the differences?

The main difference is that the activities of OPS funds are strictly regulated by the Central Bank, while NGOs are a little more free from restrictions.

Let's start with the fact that the size of the state pension now largely depends on the official length of service and decisions of the government, and payments under NPO are more likely to depend on the size and frequency of independent contributions of the citizen, as well as on the composition of the investment portfolio and market conditions.

When drawing up an NPO agreement, you can choose the conditions that are convenient for yourself: independently determine the comfortable amount and frequency of contributions, the type of pension payment, the rules for transferring pension savings to another fund and the procedure for transferring savings by inheritance. For OPS, all these rules are predetermined by the state, and the fund’s client cannot influence them in any way.

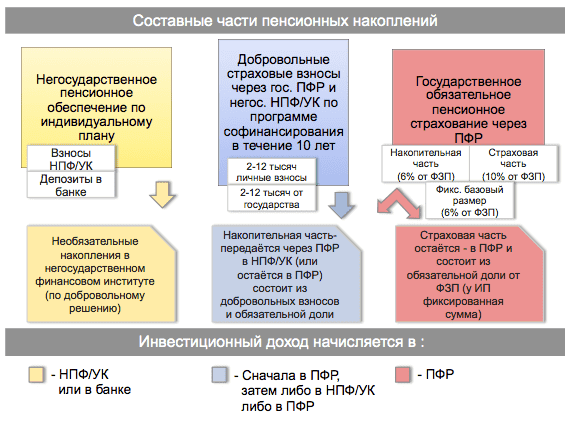

Due to the freezing of funded pensions, funds for compulsory pension insurance will now grow only at the expense of investment income. And you can add as much money to NGOs as you like and, in addition, receive a tax deduction.

Investment strategies for OPS and NPO are also usually different, because the Central Bank has set different restrictions on the investment portfolio. Profitability, accordingly, also varies.

The funds are required to invest at least 90% of pension savings in financial instruments with minimal risk, the return of which is relatively low. And NPFs can offer a choice of both conservative and aggressive investment strategies - more risky, but in the long term bringing greater income.

The pension savings with which the client entered the fund are guaranteed by law. Let’s say that the insurer, based on investment results over the 5 years of the contract, reduced these savings or lost its license. In this case, during an urgent transition (after five years), according to the law, the funds will be replenished from pension reserves up to the guaranteed amount.

Voluntary contributions are not yet insured by the state (industry associations of non-state pension funds are currently conducting relevant negotiations with the Central Bank). If the fund fails, there is no guarantee that you will get your savings back.

But if you want to withdraw the money accumulated in NPO before retirement, there is such an opportunity, unlike OPS. The agreement with the NPF will necessarily indicate the procedure for calculating the redemption amount, that is, the money that will be returned to you if you want to terminate the agreement with the fund.

How to transfer to a non-state pension fund or return to the Pension Fund of Russia

You can switch from one fund to another at any time. However, you need to remember the 5-year rule, according to which a transfer while maintaining the funded part of the pension is possible only once within five years. If the condition is violated, only the part of the money transferred from the salary will be transferred, without income. This is the same as withdrawing your deposit early.

True, it is not clear how the provisions of the law are implemented during the transition from the Pension Fund to the Non-State Pension Fund. In reality, no one there charges interest on amounts stored in a personal account - there is no point. All the same, the pension will be calculated according to different rules.

To transfer, you need to submit a corresponding application to the fund directly or to the MFC. The law allows you to submit documents in person, online or by mail. In the latter case, the application must be notarized. The role of a notary can be performed by law and other representatives of government bodies.

Documents on exit (transition) are accepted from January 1 to December 1. A month is given for the final decision. It's like a divorce - a probationary period. What if he changes his mind?

What is an individual NGO plan?

The country annually indexes pensions, but these amounts are so small that it is almost impossible to live normally on a state pension. Therefore, many able-bodied citizens, who are still many years away from retirement, plan to independently create a material base for the future. A convenient tool for this purpose is an individual pension plan.

An individual pension plan in an NGO is drawn up in accordance with the personal interests of the investor and takes into account the frequency of payments, the minimum allowable contribution amount, the possibility of early withdrawal of funds and some other aspects.

Typically, NPF clients choose an individual program with a set contribution amount. This program provides a flexible schedule, but the contribution amount remains unchanged. The individual plan stipulates all possibilities for early withdrawal of invested funds. This may be due to a transfer of funds to another fund, a serious illness of the investor requiring expensive treatment, or other valid reasons.

NGO principles

A non-state fund is a non-profit organization and its main goal is social functions to provide financial support to the fund’s participants. Relations between the fund and its participants are regulated by an agreement, which details the rights and obligations of both the fund’s founders and investors. The contract may be indefinite or have a limited duration. It may be terminated at the request of the investor, by a decision of the judicial authorities, or as a result of the liquidation of the fund. In this case, the funds may be transferred to another financial institution.

Pros and cons of a non-state pension

The main advantage is additional income in old age. If savings began long enough, you can count on a significant increase in basic pension payments.

People without official employment can rely on a non-state pension. This category includes foreigners, individual entrepreneurs, and self-employed people.

Among the disadvantages can be considered an element of psychology. After all, many people, remembering the 90s, do not have confidence in structures like NPFs. Therefore there is no feeling of stability.

In addition, not everyone wants to sacrifice part of their earnings for the sake of probable future income. And legislators are also trying to take this point into account.

Where to apply

In order to save pension savings for old age, you need to choose a suitable non-state pension fund for yourself. Such structures are created at banks and large companies.

It is important to first find out as much information as possible about the selected pension fund and its reliability. Reviews from the Internet will also help.

When the choice is made, it is time to conclude a contract. And here it is important to pay attention to the following main points:

- monthly amount for accumulation, procedure for its payment;

- interest rate;

- the age at which payments begin;

The procedure for receiving a pension deserves a separate discussion. And here two main schemes are possible:

- The size and frequency of payments is determined by the Non-State Pension Fund. For example, contracts often stipulate that money is transferred before the death of the pensioner. By the way, the heirs have the right to the unreceived part.

- In the second option, the initiative belongs to the citizen. He can determine both the time period for receiving an additional pension (for example, several years) and the frequency of payments (quarterly, every six months, and so on). Naturally, the size of the amount received in hand will depend on this.

At what age can you retire?

The new amendments were discussed above. However, until they come into force, one should proceed from the provisions of the current legislation. It says that the right to a non-state pension arises upon reaching the age agreed upon in the contract.

In 2020, the maximum age for men is 65 years, and for women - 60. There are also certain preferential categories. These include disabled people, teaching staff, and citizens who were involved in the Far North.

What else might change with a private pension?

In the same bill, deputies proposed to exclude from the list of pension grounds for receiving payments from non-state pension funds the condition of having an insurance record. According to legislators, this will create an incentive to accumulate future pensions for self-employed citizens and those with dependents and employees.

The draft law also guarantees the assignment of a non-state pension at an even earlier age to disabled people, workers of the Far North and other persons entitled to early receipt of insurance pensions from the Pension Fund.

Question answer

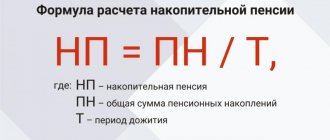

How can funded pension payments change?

Earlier it became known that the Pension Fund is discussing with other departments the possibility of increasing the size of the funded pension by 2.4 times, below which monthly payments will not be assigned. This will lead to more elderly Russians receiving this payment as a lump sum upon retirement. Now, when citizens retire, they receive pension savings in a lump sum if the amount accumulated in a person’s personal savings account at the time of payment is less than 5% of the total pension amount.