Retirement of women born in 1964 under the new law

In 2020, a law raising the retirement age came into force, which primarily affected women born in 1964 . They will be the first to retire under the new law. According to the standards of the old legislation, they were supposed to retire at the age of 55, that is, already in 2020. But taking into account the transitional provisions of the reform, the age value for them increases by 1 year (see Appendix No. 6 to Federal Law No. 400 of December 28 .2013).

However, women born in 1964 are eligible for a benefit that allows them to receive pension payments six months ahead of schedule. This right is granted in accordance with Part 3 of Art. 10 of Law No. 350-FZ of October 3, 2018. This means that their retirement is postponed only for six months .

Thus, women born in 1964 will retire at the age of 55 years 6 months . This will take place according to the following scheme (depending on the month in which they were born):

| Date of Birth | When will they retire |

| January 1964 | July 2019 |

| February 1964 | August 2019 |

| March 1964 | September 2019 |

| April 1964 | October 2019 |

| May 1964 | November 2019 |

| June 1964 | December 2019 |

| July 1964 | January 2020 |

| August 1964 | February 2020 |

| September 1964 | March 2020 |

| October 1964 | April 2020 |

| November 1964 | May 2020 |

| December 1964 | June 2020 |

The pension legislation provides for various benefits, as a result of which the retirement age can be reduced (that is, it will be possible to retire earlier than the period specified in the table).

Conditions of appointment

The procedure for calculating pensions is the same for everyone. In 2020, only women born in 1962 have the right to retire in old age, since men have not reached the required age of 60 years. An exception is persons who, due to their work activity, can apply for early retirement:

| Category of beneficiaries | Age, years |

| Persons who worked on List No. 1 | 50 |

| Persons who worked on List No. 2 | 55 |

- Immunity suspected of accelerating spread of coronavirus

- 5 budget hotels in Sochi for retirees

- Indexation of pensions for working pensioners - procedure and timing

To calculate security, you should contact the Pension Fund, the Multifunctional Center, through the State Services portal or directly to the employer, providing:

- passport;

- SNILS;

- documents confirming unaccounted labor activity (certificates, contracts, extracts, work book).

Retirement age for men born in 1961

According to current standards, men retire at age 60. In accordance with the Government bill on pension reform, adopted by the Duma in the 1st reading and changes proposed by the President of the Russian Federation, the retirement age for men will increase. For those born in 1961, it will be 63 years old, so the expected year of retirement is 2024 (instead of 2021 if they retired under current legislation).

Retirement of a mother of many children born in 1964

Simultaneously with the law on retirement age, new benefits came into force in 2020. One of these benefits is early pension for mothers with many children - with 3 and 4 children (for mothers with five children such a benefit was provided previously).

According to the new law (clauses 1.1 and 1.2, part 1, article 32 of law No. 400-FZ):

- mothers with three children retire at 57;

- and with four - at 56.

Since the law provided for a fixed age, mothers with 3 and 4 children born in 1964 will not be able to take advantage of this benefit. It is more profitable for them to arrange payments according to generally established standards, since they are much lower than those provided for on a preferential basis (at 55 years 6 months). Therefore, the deadlines for processing payments will correspond to the generally established ones (see table).

Let us remind you that for a preferential appointment it is not enough just to reach the established age:

- Children must be raised until their 8th birthday ;

- A woman must have at least 15 years of insurance experience and an IPC of at least 30 points.

In addition, when determining the right to benefits, children in respect of whom the mother was deprived of parental rights or whose adoption was canceled are not taken into account.

Early exit based on length of service (37 years)

If you have a long work history (37 years for women), you can apply for a pension before reaching retirement age. Having developed the required length of service, a woman can become a pensioner 24 months before the statutory period, but not earlier than 55 years .

Since the law sets the retirement age at 55.5 for women born in 1964, the length of service benefit for them will not be provided in full . The reduction will be only six months instead of two, since the law limits the lower age limit. Therefore, women born in 1964 with 37 years of experience they retire at 55 .

Let us remind you that the duration of this length of service includes only periods of working activity and paid sick leave. That is, the time a woman is on maternity leave for up to 1.5 years is not included in it.

Calculation procedure

The accrued pension for women consists of a fixed part and an individual part. The latter is divided into four separate components, each of which has its own calculation method:

- Estimated amount of pension capital until 2002

- Insurance pension from 2002 to 2014.

- Pensions from 2020 to 2020

- Non-insurance periods.

Determination of the estimated amount of pension capital until 2002

- The duration of the insurance period of the future pensioner until 2002 is determined through the “experience coefficient” (SC). The size is calculated using the formula:

| Number of years of experience until 2002 | Size |

| 20 or more | 0.55 + 0.01 × (number of years of experience – 20) |

| Less than 20 | 0,55 |

Please note that the SC cannot exceed the value of 0.75 - this norm is established by law! Even if the resulting figure is greater than this value, 0.75 is taken for calculation.

- The average monthly earnings coefficient (AMC) is calculated. For this purpose, the average salary for 2001–2002 is taken. or for any 60 months, after which this value is divided by the average monthly salary in Russia for the same period. The result obtained is limited to a maximum value of 1.2, with the exception of women born in 1964 who worked in the northern regions during this period. The coefficient for them is 1.4–1.9.

- The size of the estimated pension for January 2002 is determined. For this, the following formulas are used depending on the size of the insurance system:

| SK | Formula | Note |

| More than 0.55 | RP = SK × KSZ × 1671 – 450 | Provided that RP = SK × KSZ × 1671 is less than 660, the value of RP is determined to be 210 |

| 0,55 | RP = (SK × KSZ × 1671 – 450) × (number of years of experience before 2002 / 20) | Provided that RP = SK × KSZ × 1671 is less than 660, the value of RP is determined to be equal to 210 × (number of years of experience before 2002/20) |

- The duration of the insurance period until 1991 is determined. In its absence, the pension supplement will be 10% of the determined RP. An additional 1% is added for each full year.

Features of calculating insurance pensions from 2002 to 2014

- Receive notification about the status of your personal account. This can be done at the territorial branch of the Pension Fund or through the government services website.

- The total amount for the years worked must be multiplied by the product of indexation coefficients calculated taking into account inflation. For the period from 2003 to 2020 it is equal to 5.6148:

| Year | Indexation coefficient |

| 2003 | 1,307 |

| 2004 | 1,177 |

| 2005 | 1,114 |

| 2006 | 1,127 |

| 2007 | 1,16 |

| 2008 | 1,204 |

| 2009 | 1,269 |

| 2010 | 1,1427 |

| 2011 | 1,088 |

| 2012 | 1,1065 |

| 2013 | 1,101 |

| 2014 | 1,083 |

- The monthly amount of the insurance pension is divided by the age of survival - 228 months.

- The result obtained is divided by 64.1 - the value of the pension point at the beginning of 2020.

Pension amount from 2020 to 2020

After 2020, each insured person is awarded pension points depending on the amount of insurance premiums. The legislation provides for an increase in the minimum insurance period (by 2025 it will increase to 15 years) and the minimum number of points to 30. Pension rights that a person earned before 2020 do not expire; they are converted into points and taken into account when calculating the pension. More details in the table:

| Year | Minimum insurance period | Minimum number of IPCs |

| 2015 | 6 | 6,6 |

| 2016 | 7 | 9 |

| 2017 | 8 | 11,4 |

| 2018 | 9 | 13,8 |

| 2019 | 10 | 16,2 |

| 2020 | 11 | 18,6 |

| 2021 | 12 | 21 |

| 2022 | 13 | 23,4 |

| 2023 | 14 | 25,8 |

| 2024 | 15 | 28,2 |

| 2025 and later | 15 | 30 |

Non-insurance periods

The calculation of pensions for women born in 1964 is made taking into account “non-insurance periods”, each of which has its own size:

| Non-insurance periods | IPC |

| compulsory military service | 1,8 |

| receiving unemployment benefits | 1,8 |

| being on sick leave subject to receipt of compulsory social insurance payments | 1,8 |

| period of care for a disabled person of group 1, an elderly person over 80 years of age or a disabled child | 1,8 |

| participation in paid public works | 1,8 |

| moving or relocating to a new area for employment in the direction of the state employment service | 1,8 |

| detention if the person was subsequently rehabilitated | 1,8 |

| parental leave from birth to 1.5 years of age (until 2020 - no more than 4.5 years in total, from 2020 - no more than 6) | 1.8 – for the first child |

| 3.6 – for the second | |

| 5.4 – for the third and fourth | |

| the time during which the spouse of a military personnel was unemployed due to the inability to find work in the area where the spouse was sent for service (maximum 5 years) | 1,8 |

| residence abroad of Russia by the spouse of representatives of embassies, diplomatic missions, etc. (maximum 5 years) | 1,8 |

How to calculate a pension for a woman born in 1964

The calculation of the insurance pension (SP), regardless of the citizen’s date of birth, is carried out according to the formula:

SP = PV + ∑IPK × SIPC

Where

- PV – basic part of the pension (fixed payment);

- ∑IPK – total IPC on a citizen’s personal account (SNILS);

- SIPC is the cost of one IPK (or so-called pension point).

The total IPC depends only on the citizen - on the duration of his work, “non-insurance” periods, for which points are also awarded (caring for a child under 1.5 years old, military service), etc. And the values of the fixed payment and the cost of the pension coefficient are established by law and change annually.

Since women born in 1964 retire in 2019 and 2020, the calculation of the payment assigned to them will be different.

- When calculating pensions in 2020, the following values will be used: FV = 5334.19 rubles, SIPC = 87.24 rubles. This applies to women born from January to the end of June 1964.

- When calculated in 2020 : the fixed payment is equal to 5686.25 rubles, the cost of one coefficient is 93 rubles. This applies to women born from July to the end of 1964.

This does not mean that women born in 1964 who received a pension in 2019 will have lower payments than those who received a pension in 2020. From January 1, 2020, their collateral will be recalculated taking into account the current values of the PV and SIPC (traditional indexation will be carried out).

Final calculation of pension payments

Taking into account the above, the calculation of pensions for those born in 1961 will be carried out according to the following formula:

P = FV × PK1 + (IPK2002 + IPK2002–2014 + IPK2015 + IPKnon-insurance) × SPB × PK2, where:

- P – size of the expected collateral;

- FV – fixed payment;

- PC1 – bonus coefficient to the fixed payment;

- PC2 – premium coefficient for the insurance part;

- IPK2002 – number of PB earned before 2002;

- IPK2002–2014 – number of PB earned from 2002 to 2014. (inclusive);

- IPK2015 – number of PB accrued after 2020.

- IPC non-insurance - the number of PB for non-insurance periods.

- SPB – the value of the point on the date of assignment of the security.

Calculation example

Lyubov Ivanovna Smirnova was born on May 25, 1964. She plans to retire and wants to calculate when she will be able to do this, as well as calculate the amount of payment that will be assigned to her in the Pension Fund.

- According to the table, Lyubov Ivanovna will retire on November 25, 2019, when she turns 55.5 years old .

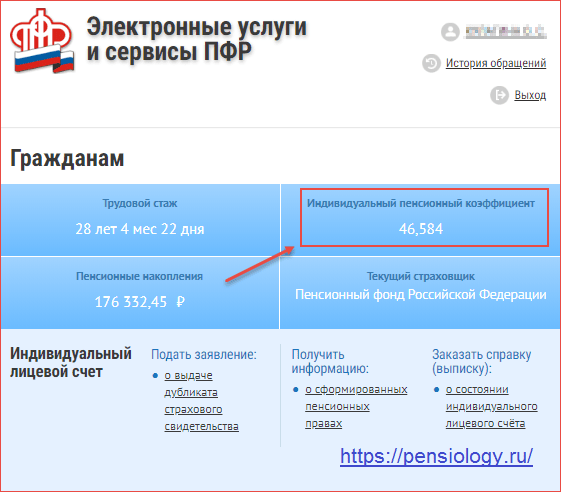

- When calculating her pension payment, the size of the fixed payment and the cost of one point, established for 2019, will be used - 5334.19 and 87.24 rubles, respectively. To find out how many pension points have accumulated on SNILS, Lyubov Ivanovna will use her personal account on the Pension Fund website (picture below) or contact the territorial office of the Pension Fund.

Smirnova has 46.584 points, which means the size of her future pension will be equal to: 46.584 × 87.24 + 5334.19 = 9398.18 rubles .

In addition, from January 1, 2020, indexation will take place for non-working pensioners, and this payment will be recalculated taking into account the new values of the PV and SIPC. The new security amount will be: 46.584 × 93 + 5686.25 = 10018.56 rubles .

Formula for determining the insurance part

Taking into account the above criteria and relying on the provisions of Law No. 400-FZ (December 28, 2013), the insurance pension formula for women born in 1964 can be expressed as follows:

RSP = FV + SPB × KPIK, where:

- RSP – amount of insurance pension;

- FV is a fixed (basic) component, the size of which for 2019 is set at 4,982.90 rubles;

- SPB - the cost of a pension point (in 2020 - 81.49 rubles)

Please note that in addition to the insurance pension, women born in 1964 can also receive a funded pension, but only if it is formed. The size of the payment depends on several factors:

- the amount of contributions to be deducted;

- the number of years during which contributions were made;

- in which fund the savings were placed (each company has its own interest rates).

- 8 reasons why your hip hurts after sleep

- What to do if the price tag of a product does not match the checkout price

- Salad with frozen, marinated or smoked mussels - step-by-step cooking recipes with photos

What factors influence the value of the IPC?

During their working career, women receive a salary, based on the amount of which the employer pays insurance contributions to the Pension Fund. Subsequently, they are converted into pension points, the number of which directly affects the size of the pension payment. For different periods of employment, the IPC is determined taking into account a number of features:

| Calculation time periods | Criteria taken into account when calculating | Peculiarities |

| Until 2002 |

| Due to the fact that the Pension Fund does not have enough information about the length of service and accruals made, the IPC may be reflected erroneously in each individual case. To avoid this, it is recommended to provide all possible evidence of employment at this time and confirm the amount of salary received. |

| 2002–2014 | Funds accumulated in accounts are converted into IPC using a special formula | You can calculate the number of IPCs yourself by using the calculator on the Pension Fund website |

| Since 2015 | Determined by the amount of insurance premiums | Calculation is carried out for each year worked |

| Other periods | The IPC is stipulated by law depending on the reason for lack of employment | The periods during which the woman did not work are taken into account. This includes:

|

The number of pension points can be calculated on the Pension Fund website, using a special calculator, or using the following formula:

IPC = Amount of insurance contributions of a citizen for a specific year / Standard amount of contributions for an insurance pension × 10