The state regularly improves the pension system. Now the year of birth is one of the key factors according to which old-age cash benefits will be paid: those born before 1967 receive a pension in three components, and after this year - in two.

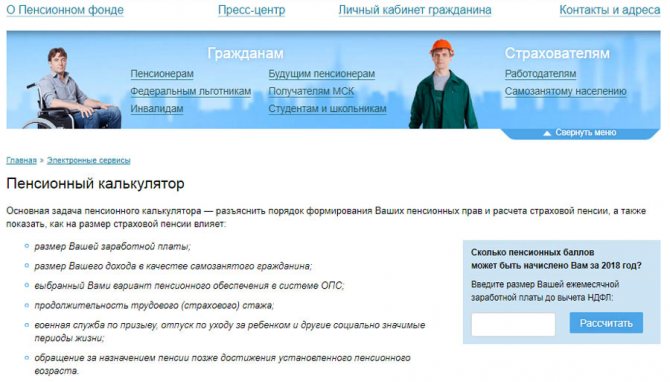

A calculator designed to inform you of its preliminary size will help you calculate the pension for those born after 1967. Algorithms allow you to calculate the amount without leaving your home. The pension calculator will also be relevant for persons born before 1967.

Calculate pensions using an online calculator for citizens born before 1967.

The calculation of pensions for those born before 1967 can be done either through a calculator or by contacting the Russian Pension Fund in person.

Important! The calculation formulas are publicly available, and every citizen is able to independently determine the amount of the future benefit, but this does not exclude the possibility of a gross error. Calculators record some coefficients for ease of calculation. This means that they will also withdraw an approximate amount. Only the Pension Fund can provide accurate information, using all the nuances of legislation and benefits for each individual citizen.

The pension consists of three parts:

- cumulative;

- fixed;

- insurance

Each citizen has his own savings portion. This depends on investing regularly for your future retirement. Please note: the state does not index savings based on inflation.

The second part of the pension is fixed, or otherwise basic. It is established by the state, its size changes annually taking into account inflation. In 2020 it is 5,686.25 rubles, but for a certain category of citizens it changes up or down.

Unlike the funded share, the insurance share is indexed. It is calculated by dividing the size of the Pension Capital (PC) by the estimated number of months during which the benefit will be paid. For PC you need to know:

- Estimated pension payment (RP). It includes:

- Coefficient for length of service. At the moment, it is 0.55 for men with more than 25 years of experience, and for women - 20. If a person has a period longer than this, then 0.1 is added to him for each year. In this case, the total amount does not exceed 0.75.

- Ratio of wages to the national average. Limit for the indicator: no more than 1.2.

- Average salary. The Pension Fund calculates it and charges 1,671 rubles.

The formula is as follows: all three of the above indicators are multiplied.

- Conditional pension capital (CPC). To calculate you will need:

- Settlement payment.

- Fixed share.

- Estimated payment time in months.

Formula: Estimated Payout - (Fixed Proportion / Estimated Time).

Unknown information can be obtained from the Pension Fund.

Pension with option: how to choose pension provision

Until the end of 2020, citizens born in 1967 and younger need to choose one of two pension options: form only the insurance or insurance and funded parts of the pension.

What is the difference?

The insurance part is the basic form of state pension provision. The pension is guaranteed, but its size depends on the situation in the country at the start of payments, first of all, on the ratio of the number of working citizens and pensioners and on the situation with the state budget.

The funded part is a means of mandatory pension savings, which is managed by professional market participants in the interests of the future pensioner.

Components of a future pension

There is a difference between the insurance and funded parts of a pension. Moreover, the difference is expressed in the formation, in the order of indexation and in the right of inheritance of funds.

Options for placing the funded part of the pension

Any citizen has the right to choose a company to which he is willing to entrust his funds.

This can be a state-owned (VEB) or private management company (MC) or a non-state pension fund (NPF).

If a citizen decides to refuse further formation of pension savings, all insurance contributions paid for him by the employer to the Pension Fund of the Russian Federation - in the amount of the individual tariff (16%) - will be directed to the formation of an insurance pension.

If citizens who have never submitted an application to choose a management company, including VEB, or a non-state pension fund for investing their pension savings, the so-called “silent ones”, want that in subsequent years, insurance premiums in the amount of 6% of the tariff continue to be directed to the formation of a funded pensions, they should, before December 31, 2015, submit an application to the Pension Fund to choose the option of pension provision with the formation of a funded pension, or choose a management company or a non-state pension fund.

At the same time, you can choose or change a management company or non-state pension fund at the same time as refusing to further form pension savings; To do this, you will need to submit an application to refuse to finance the funded pension and to allocate the entire amount of insurance contributions to finance the insurance pension.

For those who do not submit an application before December 31, 2020 and remain so-called “silent”, pension savings will cease to be formed through the receipt of new insurance contributions from the employer (no earlier than 2020), and all insurance contributions will be used to form an insurance pension.

For citizens who, in previous years, at least once submitted an application to choose a management company, including VEB, or a non-state pension fund, and it was granted, part of the insurance contributions will continue to be transferred to the funded pension, starting in 2020, if the state decides to renew formation of pension savings through mandatory insurance contributions. At the same time, they do not need to submit an additional application to transfer 6% to a funded pension.

Thus, a citizen can either continue to form or refuse further formation of a funded pension in favor of an insurance pension, being both a client of the Pension Fund and a Non-State Pension Fund.

How to place your funds

To implement the decision, you must contact the Pension Fund with an application.

When applying to the Pension Fund, in addition to the application, you will need:

- insurance certificate of compulsory pension insurance (SNILS);

- identification document (passport of a citizen of the Russian Federation);

- statement on the selection of a management company.

Until 2014, all working citizens born in 1967 and younger received both insurance and funded pensions, and citizens born in 1966 and older received only an insurance pension.

The Pension Fund says that the refusal to form a funded pension through new contributions does not mean a reduction in pension rights or a reduction in the future size of the pension. That is, insurance contributions (6% of the insurance premium rate), which could be used to form new pension savings for citizens who have chosen the option of pension provision with the simultaneous formation of both an insurance and funded pension, are directed to the formation of only an insurance pension. Thus, in any case, all insurance contributions participate in the formation of pensions in the compulsory pension insurance system.

In addition, if with the option of forming both funded and insurance pensions, pension points are accrued by 37.5% less than when forming only an insurance pension, then when forming only an insurance pension, citizens are awarded the maximum number of points from the entire amount of insurance contributions, the Pension Fund reminds . However, in this case, the “market mechanism”, which will be discussed below, is absent.

You can submit an application to choose a pension option, transfer to a non-state pension fund, transfer from a non-state pension fund to another non-state pension fund or back to the Pension Fund at any Pension Fund client service and at most MFCs.

However, the application can still be submitted by mail or courier. In this case, identification and verification of the authenticity of the signature of the insured person is carried out by a notary.

You can find out which insurer is currently forming your pension savings, and what type of pension provision you have, by receiving an extract from your individual personal account at the Pension Fund, contacting the Pension Fund client service, the personal account of the insured person on the Pension Fund website, or through the government services portal.

As of December 1, 2020, there is no decision on extending the period for choosing a pension option, that is, the choice must be made before the end of the current year.

At the same time, citizens whose pension savings are already in a non-state pension fund or have ever had a choice of an insurer or management company, in 2016 and beyond, retain the right to refuse further formation of pension savings at the expense of new mandatory insurance contributions to compulsory pension insurance.

To save or not to save?

The most important and unpleasant thing for those who don’t like to think is that everyone makes the decision whether or not to form a funded component of a pension independently.

The combination of the funded and insurance parts allows you to create the most reliable pension option.

Such a “combined” pension consists of at least two elements - budgetary and market, which helps protect potential payments from risks of various natures. This is a plus of the savings component.

In Russia, at the same time, in 2020, insurance contributions for funded pensions will again be sent to the distribution system - they are once again frozen. This is a minus that undermines Russians’ trust in the system.

Some countries have recently begun to consider citizens' funded pensions as a source of financing the budget deficit. In Russia, the pool of funded pensions is approximately 3 trillion rubles, or 4% of GDP. And although experts now doubt that the government is seriously considering this option, it is possible that international experience in support of the nationalization of funded pensions could push Russia towards a similar practice in the future.

By the way, the Central Bank of the Russian Federation sees the risk of freezing pension savings in 2017. Information about this is contained in the document “Main directions for the development and functioning of the financial market of the Russian Federation for the period 2016-2018”, published this week.

“The introduction of a moratorium on the transfer of pension savings funds in the period 2014-2015 and its extension to 2020 against the backdrop of insufficient understanding by the population of the “freezing” mechanism create conditions for reducing public confidence in the funded element of the pension system.

At the same time, there is a risk of extending the moratorium on the transfer of pension savings to NPFs in 2020 and subsequent years, which will negatively affect the population’s confidence in the savings element of the pension system and, as a result, will help reduce the growth of long-term investments.”

TO THE POINT:

“Unpopular decisions, like a pendulum, will be harmful to the budget”

On the Russian budget 2020: “Too tough to be realistic”

“Silent people” and pensions: how to switch to a non-state pension fund?

Based on materials from VEB, Pension Fund of the Russian Federation, TatCenter.ru

Rules for calculating and procedure for registering pensions for those born before 1967.

Calculation of the exact amount of payments to a pensioner begins on the day of submission of a fully completed package of documents. You need to collect it in advance. You can apply at any time after reaching retirement age.

List of required papers:

- Application for a pension.

- Russian passport (for foreigners - residence permit).

- SNILS.

- TIN.

- Marriage certificate.

- Certificates, diplomas - all documents related to studies.

- Certificate of family composition.

- Work book: original and copies.

Important: if there is no work record book, then written employment contracts, which are drawn up in strict accordance with the law, are presented as documents confirming work experience. Employers and municipal authorities issue certificates. A citizen can also provide extracts from orders, statements for the issuance of salary, and a military ID.

Important: the papers must indicate the full name and full date of birth of the citizen, number and date of issue, place and period of work, profession and grounds for issue, for example, orders.

- Copies of identification documents of dependents.

- Details of the bank that will make payments.

- Certificate of average monthly salary until January 1, 2002 for 60 consecutive months.

- A certificate confirming the absence of other payments.

For additional circumstances, supporting documents will be needed:

- about changing your full name;

- about the average monthly salary of the deceased breadwinner;

- about disabled family members;

- about the birth of a child;

- on recognition of a child as disabled;

- and others.

You can submit your application no more than 30 days before reaching retirement age. The employee makes the necessary photocopies and scans the documents, after which he returns the originals. Even if there are suspicions of incorrect registration, they have no right to refuse to accept the application and must issue a receipt.

If a citizen provides an incomplete set, then within 3 months he must submit the missing papers, otherwise he will have to submit everything again. The Pension Fund considers applications no more than 10 days. If the details are provided immediately, the payment will take place on the tenth day. For postal transfers there may be a delay of one to three days due to processing.

Important! The pension must exceed the subsistence level, otherwise you need to contact the Pension Fund.

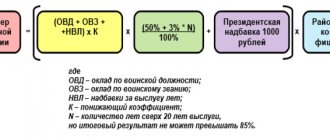

Formulas for calculations

The pensioner's benefit is calculated using the formula:

PP = FS + LF + SD, where:

- PP – pension benefit;

- FS is a fixed rate provided by the state to every Russian upon reaching retirement age;

- LF – storage part;

- SD – insurance share.

Persons born before 1967 The stage of accruals before 2002 is especially important. This period is especially complex, and therefore the calculation procedure needs to be considered in as much detail as possible.

Earnings and years of service are counted in the form of two units: salary and length of service coefficient.

- The salary indicator is determined by the average earnings for a specific period, in relation to the average salary for those years. The maximum indicator here is 1.2.

- The seniority coefficient is more difficult to determine. If a pensioner has worked less than 24 years, then the coefficient for a man will be 0.55. After 25 years of work, the experience coefficient increases by 0.01 for each year. For ladies with less than 19 years of experience, the experience coefficient will also be 0.55, and from 20 years of service this indicator will increase by 0.01 annually.

These indicators are multiplied with each other, then by a fixed amount of 1671 rubles. This is the average monthly earnings for the period 01/07-30/09 2001, which is used in the calculations.

The next step is the deduction of 450 rubles (basic benefit for 2002) and an increase in the form of valorization, regardless of length of service. Valorization is a one-time increase in the pension content of citizens with length of service before 2002. Valorization involves an increase of 10%. Additionally, the amount is increased by 1% for each year worked until 2002.

The resulting amount is multiplied by 5.6148 - the growth coefficient of the pension capital, taking into account the indexations carried out since 2002. If after this year the citizen continued to work, while contributions to the Pension Fund were received for him, then these funds are also taken into account in the insurance part.

In this situation, a calculation of 228 months is used. This is the approximate period during which the earned funds will be transferred to the citizen. First, the size of the pension capital is determined, after which the result is divided by 228.

The resulting amount is converted into points, taking into account their value for 2014. The result is the number of points for January 2020. Further calculations of pension benefits are carried out by year.

Examples

Let's look at a simple example for a woman. Let’s say she retires in 2020.

- Total length of service as of 01/01/02 – 22 years, including 12 years before 1990.

- The insurance period exceeds 20 years, and therefore a coefficient of 0.55 is used

- Add 0.01 * 2 = 0.02 for each year additionally - 0.55 + 0.02 = 0.57 - the general coefficient.

- If a woman’s average earnings were 250 rubles, and in the country it was 210 rubles, then the salary coefficient will be 250/210 = 1.19.

- We multiply the coefficients and the fixed amount, we get 1.19 * 0.57 * 1671 = 1136.28 rubles.

- We subtract 450 rubles, it turns out 686.28 rubles.

- Since the employee had length of service before 2002, a 10% valorization is applied, plus 1% for each year of service until 1990. In our example, this is 12 years.

- It turns out that we need to increase 686.28 rubles. by 22%, we get 837.26 rubles.

- We multiply this amount by 5.6148, it turns out 4701.05 - this is the calculated pension.

- A fixed part of the pension provision is added to the result obtained, which amounts to 4383.59 rubles. As a result, the amount of the monthly benefit will be 9084.64 rubles.

It is not difficult to calculate the estimated monthly pension amount using this formula.

Video on the topic:

Calculate pensions using an online calculator for citizens born after 1967.

The calculator also allows you to calculate pensions after birth in 1967. In this case, it only takes into account two parts:

- cumulative;

- insurance

Formula for calculating the insurance pension: Pension coefficient x Cost of one pension point + Fixed payment.

In 2020:

- The cost of one pension point is 93.00. For working pensioners, the sum of the maximum 3 points is 261.72 rubles.

- The fixed payment from the state is 5,686.25 rubles. with the exception of a certain category of citizens.

Minimum requirements:

- Retirement age.

- Experience in paying insurance premiums.

- Minimum threshold for pension points

To calculate, the calculator will ask you to enter information that also affects the Individual Pension Coefficient (IPC). After filling out the form, you need to click on the “Calculate” button.

What is a pension point

In the system of compulsory pension insurance, insurance pensions and pension savings are formed for working citizens. Insurance pensions are divided into three types: old age, disability and survivors. Since 2020, the pension rights of citizens are formed in individual pension coefficients, or pension points. All pension rights previously formed in rubles were converted without reduction into pension points and are taken into account when assigning an insurance pension. An old-age insurance pension is assigned upon reaching retirement age: 60 years for men, 55 for women. Some categories of workers are entitled to early retirement. But age is not the only condition for granting a pension. During your working life, you must also accumulate experience of a certain duration. For those retiring now, in 2020, 7 years is enough, but the minimum required length of service is increasing every year. By 2024, it will reach 15 years, in accordance with the law “On Insurance Pensions”. And the third condition is the presence of a minimum amount of pension points. From 2025, every citizen retiring will have to “show” at least 30 points.

Rules for calculating and procedure for registering pensions for those born after 1967.

You can apply for a pension in different ways, one of which is in your personal account on the State Services website. The citizen fills out an application and provides scanned documents. The main advantage: the possibility of submitting the wrong set of papers is eliminated. The system will tell you what else needs to be added.

Other methods: contacting municipal service departments or providing documents by mail.

List of required papers:

- application for a pension;

- Russian passport or residence permit for foreign citizens;

- employment history.

Important! A citizen must check the pension book so that there are no corrections in it, and in case of a name change there is a stamp.

The list of documents confirming work experience is the same for persons born before and after 1967.

The procedure for admission and consideration is similar. The employee must accept the entire package; if there are no errors, payment will take place on the 10th day after submission. Otherwise, you need to submit the papers within 3 months so as not to have to fill out everything all over again.

Let's sum it up

Date of birth is of great importance in determining the amount of future old age benefits. The pension calculation calculator for those born before and after 1967 allows you to take into account the characteristics for each category of citizens and calculate the approximate amount using special algorithms.

Attention! Due to recent changes in legislation, the legal information in this article may be out of date!

Our lawyer can advise you free of charge - write your question in the form below: