Increase in pensions for pensioners of the Ministry of Internal Affairs

Disabled people who have the right to receive a pension can count on an increase in the amount of their pension. The size of the increase is directly related to the disability group that was assigned to the citizen who served in the Ministry of Internal Affairs. In addition, the cause of the disability is taken into account.

At the legislative level, the main reasons for assigning a disability group are highlighted:

- Getting a general illness

- Acquiring a work injury

- Sustaining a war injury

There is a main rule according to which pension benefits for disabled people are increased. This is a legislative norm, according to which disability cannot be assigned to a citizen as a result of his committing actions of an illegal nature.

Employees of the Ministry of Internal Affairs who participated in the Second World War and became disabled also have the legal right to increase the interest rate for calculating pensions for employees of the Ministry of Internal Affairs.

Insurance pension

Often pensioners, former police officers, continue to work in civilian structures. Having reached the generally established age limit for an old-age pension, under certain conditions they can exercise their right and receive an insurance pension on the basis of “old age” simultaneously with the previously assigned departmental support through law enforcement agencies. Payment from the law enforcement department is determined by Law No. 4468-1 and is carried out in full, regardless of the continuation of the pensioner’s work activity.

If a former employee of the Ministry of Internal Affairs already has two pensions and is working, then the provision of both military personnel and insurance pension payments occurs in full, and according to Law No. 385-FZ, the indexation of payments from the Pension Fund is suspended for the duration of the pensioner’s work. The opportunity to receive an insurance pension for a pensioner of the Ministry of Internal Affairs is given upon reaching the general civil retirement age (in 2020, 60 years for men, 55 years for women). The IPC in 2018 must be ≥ 13.8 points, and for insurance coverage you must work for at least 9 years.

In accordance with the transitional legal provisions on insurance pensions, the IPC, necessary for military pensioners to form the insurance part of the old-age pension, annually adds 2.4 units, and by 2025 it will reach thirty points. The insurance period required for this case increases by one year each financial period to a value of 15 years by 2024.

Special allowances for pensioners of the Ministry of Internal Affairs

The percentage of the bonus that will be paid from the amount of the calculated pension to employees of the Ministry of Internal Affairs is directly related to the following factors:

- Recipient's age

- His marital status

- Recipient status

Citizens who receive cash payments for long service are entitled to the following additional allowances:

- Pensioners of the Ministry of Internal Affairs who participated in the Great Patriotic War are provided with a bonus - its amount is 32%. If the pensioner has reached the age of 80, the size of the supplement doubles and reaches 64%.

- Pensioners who have Group 1 disability and whose age has reached 80 will receive an increase. Its size is 100%.

- If a pensioner does not work, but has disabled relatives on his shoulders (that is, he supports them), he is awarded an appropriate allowance. Its size is: - In the case of 1 dependent - 32%; — In the case of two dependents – 64%; — If a pensioner is supported by three or more dependents, then the amount of the supplement is 100%. If these family members receive pension benefits, the bonus will not apply.

Second pension for law enforcement officers

Former police officers are entitled to receive a second pension from the Pension Fund.

For its registration, the following conditions must be met:

- reaching retirement age;

- accumulation of a certain amount of points;

- having sufficient experience;

- making regular contributions to the state budget by the Ministry of Defense during the service of the pension applicant.

Men acquire the right to this benefit from the age of 61.5 years, and women from the age of 56.5 years. They must accumulate at least 13.8 pension points and have at least 9 years of work experience.

Calculation of the Ministry of Internal Affairs pension for disability

Citizens who received disability status during the period of service or during the three-month period following dismissal can apply for this type of pension. Disability occurring later than this period must be caused by the following reasons:

- Injury received during years of service

- Injured during service

- A disease that a citizen received while serving in the Ministry of Internal Affairs

- Concussion received during service in the Ministry of Internal Affairs

The amount of the pension is directly related to the disability group - it will be established by a medical and social examination, which will draw up a conclusion on this issue. There are a number of citizens who may qualify for additional allowances:

- Persons of retirement age who have reached 80 years of age

- Citizens who are dependent on disabled family members

- Citizens who participated in the Second World War and receive a pension from the Ministry of Internal Affairs

Types of pensions in the Ministry of Internal Affairs

The purpose of a pension depends on its type and basis. Currently there are pensions for long service, disability and loss of a breadwinner. In addition, those who continue to work have the opportunity to earn an insurance type of pension. Injuries and illnesses acquired during service are grounds for receiving disability pension guarantees, regardless of length of service.

The amount of pension payments is calculated based on the disability group determined by a medical and social special examination. Persons who received disability while working in the Ministry of Internal Affairs, or within three months after dismissal, can count on this. For such a pension, disability that occurs later must be due to circumstances that occurred during the period of service in the internal bodies of the Russian Federation. Taken into account:

- wound, trauma;

- contusion;

- injury, damage;

- disease.

Pension payments based on the loss of a survivor are provided to the families of employees who died/died during the period of service (within three months after dismissal). If the breadwinner died after three months, the payment is given due to the cause of death - injury, illness received while in service. Most former police officers, having received a departmental pension, now work in civilian jobs or as civilian employees in their own department.

In this case, the employer pays pension insurance contributions for them and, in accordance with Law No. 400-FZ, these persons acquire the right to an insurance pension with continued pension payments from the Ministry of Internal Affairs, subject to the following conditions in 2020:

- reaching 60 years old (men), 55 years old (women);

- the value of the individual pension coefficient (IPC) equal to 13.8 points or more;

- duration of insurance period is 9 years or more.

Conditions of appointment

The regulatory legal act stipulating the conditions for the right to pension payments based on length of service (experience) is Law No. 4468-1. This type of payment is assigned under the following conditions:

- Sufficient length of service. To receive a pension according to length of service (required length of service), you must work in law enforcement agencies for at least 20 years.

- The maximum age is 45 years for a person/inability to work due to health. If an employee was dismissed/reduced before twenty years of service, his pension right is retained when his duration of employment is 25 years or more, and the period of employment in the Ministry of Internal Affairs is no less than 12.5 years. It is important to take into account that the period of study at a university is included in the calculation of the indicated 12.5 years if a special/military rank was awarded at that time.

Formula for calculating a police officer's pension

When calculating the amount of pension for employees of the Ministry of Internal Affairs, the following will be taken into account:

- Cool qualification

- Salary by position

- Military rank

- Length of work experience

- Long service bonus

Allowed allowances and salary will be summed up. Then the resulting amount is multiplied by a percentage of the existing monetary allowance.

Let's look at the calculation of a pension using a specific example under the following conditions:

- A citizen whose length of service in the Ministry of Internal Affairs is 22 years

- The salary according to rank is 8,500 rubles

- The bonus percentage is 30%, which totals 6,300 rubles

According to the Constitution of the Russian Federation, employees of the Ministry of Internal Affairs are classified as military personnel. They are entitled to a pension in accordance with the calculated standards for military pension payments. In 2017, the same rules and bases for calculating pensions apply as in previous years.

In 2018, pension changes will be affected in terms of indexation and receiving the “13th payment”.

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique.

What pension is due to employees of the Ministry of Internal Affairs?

The calculation process is regulated by the following laws:

- For years of service. Federal Law No. 400 and Federal Law No. 424 stipulate payments due to citizens. They consist of a basic (insurance) and funded part. The insurance payment is formed from points accumulated during service, and the cumulative payment is valid for citizens born in 1967 and later.

- Survivor's pension. Paid to family members in the event of the death of the breadwinner while performing his official functions.

- Disability pension. Assigned to citizens who were injured while serving in the authorities or in case of deterioration of health after 3 months after dismissal. The amount of pension accruals depends on the assigned disability group.

In addition, persons with dependents, WWII participants and persons who have reached the age of 80 can count on additional allowances.

To obtain it, a number of conditions must be met:

- total experience of at least 25 years;

- service experience in the Ministry of Internal Affairs of at least 12 years and 5 months;

- age from 45 years;

- dismissal due to deterioration of health during the performance of official duties, reaching retirement age, or taking measures to reduce the number of employees in the Ministry of Internal Affairs.

If at least one of the above conditions is not met, then the former employee of the Ministry of Internal Affairs will receive a pension on a general basis when he reaches the age of 60.

Expert opinion

Polyakov Kirill Yaroslavovich

Lawyer with 7 years of experience. Specialization: criminal law. Extensive experience in drafting contracts.

Government Decree No. 941 provides for one-time payments. They are calculated in the following cases:

- upon completion of 20 years of service, the employee is entitled to a one-time payment of 7 salaries;

- with less than 20 years of experience – 2 salaries;

- 1 salary is provided as an incentive for receiving a state award or honorary title.

In addition, preferential rates in the form of surcharges can be used by:

- disabled people of group 1 – 100% increase;

- citizens who have reached the age of 80 – 100%;

- disabled citizens of retirement age with one dependent – 32%, with two – 64%, more than two – 100%;

- WWII participants - 32%; when they reach 80 years of age, the premium increases to 64%.

to contents

Features of pension provision for employees of the Ministry of Internal Affairs

The calculation of pensions at the Ministry of Internal Affairs occurs in accordance with current legislation, namely the following acts and laws:

- Federal Law No. 4468 of February 1993;

- Government Decree No. 941 of September 1993;

- Federal Law No. 166 of December 2001;

- Federal Law No. 247, 173 and 283;

- other regulations, decrees and regulations.

The presented legislation indicates the main points of retirement of citizens who are employees of the Russian Ministry of Internal Affairs.

People working in the Ministry of Internal Affairs are divided into two types:

- Civil servants do not have any special benefits.

- Military personnel of a departmental unit have a certain rank and can qualify for preferential pensions.

Pension payments for civilians are assigned at the age of 55 for women and 60 for men. Let us remind you that the increase in the retirement age did not affect employees of the Ministry of Internal Affairs. A police officer or other employee of the Ministry of Internal Affairs with a rank can retire if they have 20 years of experience. In this case, it does not matter how old the applicant is at that time.

You can receive a Ministry of Internal Affairs pension in four types:

- for disability (a pensioner was injured while performing his duty);

- for the loss of a breadwinner (paid to relatives whose breadwinner died during service);

- by length of service (having a long length of service makes it possible to receive increased payments);

- by mixed length of service (taken into account if an employee of the Ministry of Internal Affairs previously worked in other government agencies).

The Ministry of Internal Affairs of Russia includes the following organizations and government agencies:

- police (central office, territorial bodies, educational institutions, research and medical systems and other departments of the Internal Affairs Directorate);

- Main Directorate for Drug Control;

- Main Directorate for Migration Issues;

- other organizations and divisions that are created to perform the duties and powers that apply to the Ministry of Internal Affairs.

Financing of pensions for employees of the Ministry of Internal Affairs comes from the state budget, but the calculation is made by the Russian Pension Fund .

To receive pension payments you need:

- Collect the necessary documents for subsequent pension provision.

- Submit an application with a package of documents to the Pension Fund - to do this, you can contact the branch at the place of registration yourself, submit an application through the MFC, send the application and copies certified by a notary via Russian Post or through the official website of the Pension Fund.

- Wait 10 days from the date of application for government agency employees to check all the data and calculate pension payments.

Upon completion of the inspection, a decision will be made, of which the applicant will be notified in writing by mail.

To submit documents to the Pension Fund you must collect:

- an application that can be taken from the government agency itself or downloaded from the official website of the Pension Fund;

- a payslip with data on years of service - this is taken from the accounting department at the place of work;

- certificate of salary received - also ordered from the accounting department at the place of work;

- any documents confirming your rights to benefits.

Upon submission of documents, Pension Fund employees will issue the applicant a form with consent to data processing, which he will have to sign for further calculation of pension payments.

If pensions are issued based on old age and the presence of the necessary length of service, additional documents should be prepared to obtain the right to security for a well-deserved rest:

- ID of an employee of the Ministry of Internal Affairs;

- passport and copies of pages;

- work book or certificates that can confirm the existence of insurance experience;

- SNILS;

- a certificate of income received before 2002 for 5 years of work in units of the Ministry of Internal Affairs;

- the child’s birth certificate or passport when he or she reaches 14 years of age;

- various documents confirming the availability of awards and titles are necessary to receive the allowances required in accordance with the law.

To avoid problems with the registration of pension payments, it is better to find out the exact list of required documents in your Pension Fund branch.

Calculation of length of service for granting benefits

So how to calculate? When calculating the length of service of a citizen who has retired, the time spent studying at universities in the country and periods of work in various law enforcement agencies of the Russian Federation are taken into account.

The calculation of the long-service pension begins when the employee has worked for 20 years in the authorities. If an employee has reached the service age required for length of service, but has not exceeded the working threshold of 20 years, then such an employee is entitled to a pension in the following cases:

- reaching 45 years of age or having a disease that prevents the employee from performing his job functions;

- total experience of 25 years or more, of which 12 years and 5 months. must serve in the bodies of the Ministry or military service with the assignment of a military rank.

If during the period of service you were injured or acquired a disease, then length of service does not affect the receipt of a disability pension.

Long service payments are calculated at 50% of the corresponding cash payments for 20 years of service. For each subsequent year worked, the employee is assigned 3% of the corresponding amounts, but not more than 85% (what is the minimum and maximum pension for employees of the Ministry of Internal Affairs?).

The long-service pension, taking into account work experience, is calculated at 50% for 25 years of total work experience , and for each subsequent year - 1%.

Official retirement age

The change in 2020 affected not only the size of pension payments, but also age. Thus, from 2020, increased work experience is required to receive a long-service insurance pension.

There is no actual length of service at the moment; 20 years of experience is enough. If the State Duma signs the proposed bill, the retirement age will be increased, but will also depend on length of service. According to the proposed project, by 2024 the minimum length of service should be increased to 30 years.

How to calculate?

- monthly earnings (salary);

- the amount of time worked in the structure of the Ministry of Internal Affairs (experience);

- assigned title;

- long service bonus;

- reduction factor as a percentage.

All this data must be substituted into the formula below -

- R – salary according to law and salary for rank.

- B – basic pension amount, deducted using the formula (salary*%)/100.

A good example

- B = (26500*30)/100 = 7950 rub.

- Longevity factor = 50% + 3% + 3% = 56%.

- The pension amount taking into account the reduction factor = (19292*72.23)/100 = 13934.61 rubles.

How is recalculation done?

The size of the pension depends on the total payments accrued during the period of service. If the size of these payments increases, recalculation becomes possible and rational. But due to the difficult economic situation in the country and the decrease in contributions to the budget revenues, the Government is discussing the possible abolition of indexation, various payments and allowances.

Last year, indexation was not carried out in full. At the beginning of 2020, a reform to increase the length of service for the possibility of retirement was considered and is still in progress. The deadline for completing this reform was set until October of this year.

- February 1 on the inflation rate;

- April 1 at the discretion of the Pension Fund of the Russian Federation.

Thus, in 2018, pension contributions are expected to increase in proportion to inflation rates.

Indexation of pensions of the Ministry of Internal Affairs in 2020

Significant changes are not expected, but positive aspects did appear with the advent of the year. The total amount of pension accruals is increasing, pensions of the Ministry of Internal Affairs will increase from January 1, 2020 due to a 4% increase in the amount of monetary allowance (Resolution of the Government of the Russian Federation of December 21, 2017 No. 1598). Money allowances have not been indexed for 5 years due to inflationary processes. The decision to increase it by 4% results in an increase in pension assistance by 1.04 times.

In addition, the base pay for police officers has been changed, official payments will increase, equal to half the annual indexation, which will amount to 7-8% growth. The second (civilian) pension has been increasing by 3.7% since January (Law No. 400-FZ), which is higher than the planned inflation threshold. The table shows the final changes compared to previous indicators:

| Indicators | 2017 | 2018 |

| Indexing | 5,8% | 4% |

| Reduction factor | 72,23% | 72,23% |

| One-time payments | 5000 | No |

One-time payments

The one-time payment made in the last financial period did not initially include such a category as pensioners of the Ministry of Internal Affairs, but by order of the President, these pensioners also received a one-time social payment of 5,000 rubles. This was supposed to compensate for the slight inflation indexation given the deteriorating economic situation. The decline in consumer price growth was a factor that made it possible not to make similar one-time payments, as was the case last year. No one-time assistance to pensioners is planned in 2020.

How to count?

We provide a convenient calculator especially for retired employees of the Ministry of Internal Affairs of the Russian Federation. The pension of police officers is calculated differently than that of ordinary citizens. So, in order not to get confused in these complex operations, we offer our own calculator for calculations. Below there will be a description in full detail of how to use it.

It is worth understanding that laws do not stand still, and perhaps we made a little mistake somewhere. This calculator should be used to roughly estimate the size of your future pension - the calculator will definitely not go wrong with this.

Attention! Dear reader, if you notice any inaccuracy, have a question or addition, feel free to write a comment. We will help as much as we can. Let us not refuse gratitude either. Thank you!

In the meantime, let's look at all the mechanics of use.

Formula

Here we have already written about the features of pensions for employees of the Ministry of Internal Affairs - CLICK.

Formula used when calculating for the current year:

RPO = 1/2 × (OD + OSZ + NVL) × 72.23%

where RPO is the amount of the pension, OD is the official salary, OSZ is the salary for a special rank, NVL is the award for long service. About the coefficients 1/ and 72.23 will be a little lower; they also change in the calculator. The expression OD+OSZ+NVL is also called “cash allowance.”

For simplicity, the calculation in our calculator is divided into 2 phases:

- Calculation of monetary allowance.

- Calculation, directly, of the pension amount.

The pension itself is calculated based on the first point, so just fill out all the fields one by one, and the result will appear at the very bottom of the form. Below is more detail on each point on how to calculate the pension of an employee of the Ministry of Internal Affairs of the Russian Federation, in case you get confused.

Calculation of monetary allowance

Salary by position

The main thing here is to indicate your latest salary for the position of a police officer. The list already contains positions held, if you don’t remember, you can choose an approximate salary that suits you. There is also an item “Indicate your salary yourself.” By selecting it, a field will appear below for manually entering your exact salary.

Promotion for flight crew class

Pilots' salaries are slightly higher. This list provides possible adjustments for increases. If you haven’t flown, feel free to skip it.

Salary by rank

The pension of police officers also depends on their rank. Similar to the first point - titles are also presented.

Establishing a bonus for length of service in the Ministry of Internal Affairs - all points are in place. All that remains is to count.

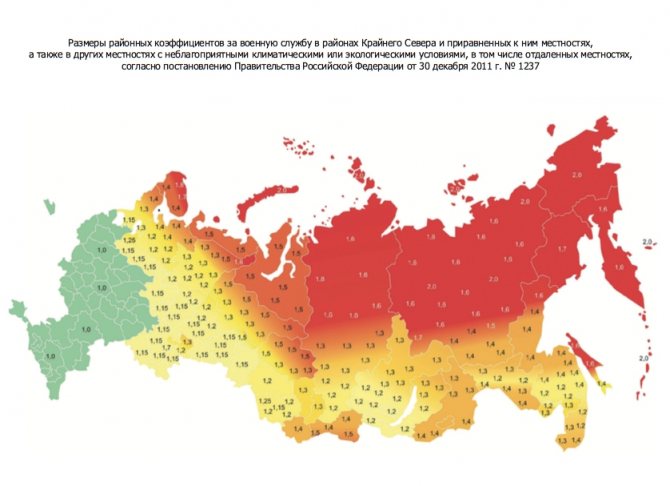

Regional coefficient

Depending on the place of service, it affects the amount of allowance. Feel free to search for your region on the Internet. If it is very difficult, we will specifically insert your region into the table.

Pension calculation

Here we have 2 main influencing coefficients - dependence on length of service and a reduction coefficient.

Seniority

To calculate your pension you must have:

- From 20 years of pure experience.

- or 25 years of mixed experience.

For this, the coefficient of 50% begins to work (the same ½ in the formula). At the same time, for each year of service over 20 years, 3% is added, and for mixed service, for each year over 25% - 1%. All this is reflected in the list. The maximum percentage is 85.

Reduction factor

Another constant value established by law for government employees. The reduction factor is gradually decreasing, now it is 72.23%, and in 2035 it will completely disappear. This coefficient is indicated for edits for early exit. If you don't know, don't touch it.

That’s all, below in the column “Final amount of pension” the approximate value of the pension of employees of the Ministry of Internal Affairs will be calculated. Take it for comparison. That's all, use our online pension calculator. Any questions - ask below.

Benefits for pensioners of the Ministry of Internal Affairs

Special benefits provided for by Federal Law No. 247-FZ dated July 19, 2011 for pensioners who served in the Ministry of Internal Affairs provide for the possibility of them receiving: a one-time benefit for employees with over 20 years of experience in the amount of 7 monthly salaries; a one-time benefit for employees with less than 20 years of experience in the amount of 2 monthly salaries.

If an employee received a state award or honorary title during his service, the benefit increases by 1 salary.

Citizens dismissed without the right to a pension and with at least 20 years of experience receive benefits every month for 1 year. The amount of the benefit is determined by the salary indicator by rank. How to calculate long service pension? 1. 20 years of service

To find out how to calculate the Ministry of Internal Affairs pension, a citizen should determine his work experience. The amount of the service pension depends on the status of the recipient.

Thus, the legislator establishes that persons entitled to receive a pension from the Ministry of Internal Affairs, with 20 years of service, receive a pension in the amount of 50% of the amount of their salary.

If the employee has more than 20 years of service, the pension will be calculated at the rate of 3% of the amount of allowance for each year of service. At the same time, the maximum pension for a person with more than 20 years of service is 85% of the citizen’s allowance. 2. Length of service from 25 years

Expert opinion

Polyakov Kirill Yaroslavovich

Lawyer with 7 years of experience. Specialization: criminal law. Extensive experience in drafting contracts.

If the employee’s work experience is 25 calendar years, then he receives 50% of the allowance. The pension of persons with such experience is calculated according to the rule established by Art. 14 of the Law of the Russian Federation of February 12, 1993 No. 4468-I.

In this case, accrual is made at the rate of 1% of the amount of allowance for each year of service. The size of the pension is not limited by law, but the law contains a clause according to which a work experience of 25 years must include at least 12 years and 6 months spent by a citizen in military service in certain government bodies. 3.

Minimum cash payout

The long service pension cannot be less than 100% of the pensions established in Federal Law No. 166-FZ dated December 15, 2001. At the same time, the authorities calculating the size of the pension should take into account the regular indexation of its size. 4. Increase in pension amount

Disabled people eligible to receive a pension can expect its amount to be increased. The increase in the amount depends on the disability group assigned to the citizen who served in the Ministry of Internal Affairs. In addition, the reason why the citizen became disabled is taken into account.

Among the main reasons for assigning a disability group, the law indicates: receipt of a military injury; getting a general illness; acquisition of a work injury.

The main rule for increasing a pension for a disabled person is the rule according to which disability should not be assigned to a person as a result of his committing unlawful acts.

Employees of the Ministry of Internal Affairs who were participants in the Second World War and recognized as disabled can also count on an increase in the interest rate for calculating pensions. 5. Special allowances

The percentage of the supplement paid from the amount of the calculated amount of pension transfers depends on the status of the recipient, his age and marital status.

Thus, persons receiving payments for long service are entitled to the following additional allowances: Citizens with pensioner status and group 1 disability who have reached the age of 80 years are awarded a 100% allowance. Pensioners who do not have a place of employment and who support disabled relatives are awarded a supplement in the amount of: 32% - for one dependent; 64% - for two; 100% - for 3 or more (if these family members receive a pension, the supplement does not apply). Pensioners who participated in the Great Patriotic War are given a bonus of 32%, but if they have reached 80 years of age, the bonus increases to 64%. Disability pension

This pension is received by persons who become disabled during the period of service or within 3 months from the date of dismissal. If disability occurs later, it must be caused by: injury during service; shell shock while working in the Ministry of Internal Affairs; injury during service; a disease acquired during service in the Ministry of Internal Affairs.

The amount of pension payments depends on the disability group, which is determined in accordance with the conclusion of a medical and social examination. Additional allowances can be received by: persons with dependent family members; pensioners over 80 years of age; WWII participants receiving a pension from the Ministry of Internal Affairs. Survivor benefits

Such a pension is accrued in the event of the death of the breadwinner to the families of employees of the Ministry of Internal Affairs who died/died during the period of service or no later than 3 months from the date of dismissal. It is also possible to pay a pension if the breadwinner died later than the specified period, if the cause of death was an injury or illness received during the period of service. Pension calculation formula

When calculating the pension amount, the following is taken into account: Salary by position. Length of work experience. Rank. Great qualifications. Long service bonus.

The salary and bonus amounts must be summed up. After this, the amount is multiplied by a percentage of the monetary allowance. If necessary, a regional coefficient is added to the result.

Expert opinion

Polyakov Kirill Yaroslavovich

Lawyer with 7 years of experience. Specialization: criminal law. Extensive experience in drafting contracts.

The calculation of the Ministry of Internal Affairs pension differs from how pension benefits are calculated for other citizens. Therefore, a special program has been developed that helps to find out the future pension of a police officer.

How to calculate your pension?

You can calculate the Ministry of Internal Affairs pension if you have the necessary parameters and know the formula for the calculation.

Please note that neither awards nor special merits are taken into account when calculating, although this cannot be said that they do not affect payments. The influence of awards is expressed in the fact that they increase the indicators of monetary compensation, and it is from this that the pension benefit of an employee of the Ministry of Internal Affairs is calculated.

To independently calculate Ministry of Internal Affairs pensions, it is best for an employee to resort to automatic calculation systems. There are many services on the Internet that offer benefit calculators. In particular, there are separate websites that offer the use of specialized MIA pension calculators. These resources have been developed taking into account all the latest legislative requirements in this labor sector and allow you to calculate benefits with one button.

To use the pension calculator, you must have all the current source data at hand.

Parameters for calculation

Future pension benefits are directly or indirectly affected by many factors, including:

- How many years have you served in the Ministry of Internal Affairs and in other structures, in general?

- Amount of monetary allowance.

- The title of a pensioner.

- Skill level.

- Availability of additional payments for length of service.

- Preferential bonus payments.

To use the calculation formula or online calculator, you will need the following information:

- About the total amount of experience expressed in complete years.

- The amount of cash allowance at the time of registration of the pension.

Those who have worked for 20 years or more are entitled to:

- If the minimum worked, that is, 20 years, the resigning person has the right to receive additional allowances in the form of 50% of the calculated pension amount.

- For each year worked over 20 years, another 3% is added.

- The allowed maximum allowance is 85%; no excess is assigned above this amount.

For mixed service:

- Having 25 years of total experience and 12.5 years in the authorities, you can count on the same 50% bonus.

- For each additional year served, 1% is added in excess of the required amounts.

- There is no set maximum size.

When receiving a disability of any category, an increase of 75% is assigned, and if we are talking about injuries resulting from the performance of official duty, then the increase increases to 85%.

In addition, regional coefficients should also be taken into account, as well as those bonuses that are assigned by local budgets.

Calculation formula

How to calculate your pension yourself? To do this, you need to know the formula for calculating the minimum amount and the applicable allowances.

Peculiarities of assigning pension payments in the Ministry of Internal Affairs system

The retirement of a police officer is subject to certain conditions.

These include;

- having 20 years of service;

- total output for at least 25 years;

- reaching the age category of 45 years;

- long service in the law enforcement department.

If a citizen is fired from the structure in question, then the reason that was taken into account when terminating the employment relationship is taken into account. For example, if the reason was a reduction in staffing levels, then the policeman is awarded a pension.

Factors influencing the amount of pension payments to employees of the Ministry of Internal Affairs

When talking about how to calculate the Ministry of Internal Affairs pension in 2020, it is worth considering certain provisions.

The list includes:

- length of service in the system;

- total output.

In addition, calculating a pension involves taking into account whether the citizen has dependents and whether he received the status of a disabled person while performing his job duties. The amount of the pension is affected by the coefficient established in the area where the policeman worked. If the listed criteria are met, then payments increase.

How pensions are calculated for employees of the Ministry of Internal Affairs in 2020

Police superannuation depends on a number of factors.

These include:

- general experience;

- salary amount;

- rank;

- qualifications;

- bonuses due for additional years of work.

Law enforcement officers are entitled to a pension if they have at least 20 years of experience.

The basic conditions that must be met when police officers retire, if they do not have two decades of work in the Ministry of Internal Affairs, are as follows:

- minimum age limit – 45 years;

- length of total work experience – from 25 years;

- The minimum time of work in law enforcement agencies is 12.5 years.

It is planned, starting in 2020, to gradually increase the length of service in the Ministry of Internal Affairs for retirement to 25 years.

Increasing pension benefits for police officers

When calculating police payments in 2020, indexation must be taken into account. This procedure is implemented every year. This applies to the entire population of the country, including retired police officers.

The calculation of the pension of an employee of the Ministry of Internal Affairs indicates the dependence of the amount on the type of social benefit.

It could be:

- payment related to length of service (the increase will occur from October 2020, the salary will increase by 4.3%, in addition, pension accruals will be indexed by 2%);

- benefits assigned to employees who have received disabled status (increased from April 2020);

- for non-working pensioners, the insurance component of the benefit has been increased by 6% since the beginning of the year.

For a working police officer, 2020 does not provide for an increase in the amount of payments.

Additional payments to employees of the Ministry of Internal Affairs in the amount of 2,500 rubles

In order to implement Decree of the President of the Russian Federation No. 604 of 2012 “On further improvement of military service in Russia,” citizens serving in the Ministry of Internal Affairs are assigned an allowance of 2,500 rubles .

This payment became effective in February 2020. The right to receive it is given to persons who have retired through the Ministry of Internal Affairs.

The legislative framework

The calculation of pensions and the grounds for payments to employees are regulated by the following regulatory legal acts of the Russian Federation:

- Federal Law No. 247 of July 19, 2011 (latest edition) “On social guarantees for law enforcement officers in Russia”;

- Decree from the Government of Russia No. 878 of November 3, 2011 “On establishing the amount of salaries for employees of the Ministry of Internal Affairs”;

- Decree from the Government of Russia No. 1237 of December 30, 2011 “On the introduction of increasing coefficients and other additional allowances”;

- Order of the Ministry of Internal Affairs of the Russian Federation No. 627 of July 12, 2007 (as amended on December 25, 2012) “On measures to carry out work to determine the qualifications of flight personnel.”

Additionally, some provisions of additional Federal laws adopted as an application of certain changes to the current regulatory legal acts in the Russian Federation may be applied.

On the basis of all this legislation, the amount of monetary allowance is established, as well as the procedure for calculating it.

Example of calculating pension benefits for a police officer

To better understand payment calculation schemes, it is necessary to provide examples of calculation of pensions for military personnel of the Ministry of Internal Affairs of the Russian Federation.

The source data includes:

- according to the length of service of the Ministry of Internal Affairs, he has 24 years (in this case, the bonus will be 1.3 points).

After this, a formula is applied to calculate the allowance paid each month.

- D – amount of allowance;

- Od – salary amount for the position;

- Oz – salary for rank;

- B – length of service.

If the police officer has civilian experience

When a person has a civilian income, a different formula is used for calculation. For example, you can take 27 years of experience.

(0.5 * D) + (0.01 * (OVS – 25) * D) * 0.7368, where:

- D – amount of allowance;

- O – total experience.

Calculations based on the length of service of the Russian Guard

If a citizen has worked in the Russian Guard for 24 years, then for each year he adds 3%. In this case the calculation looks like this:

21970*0.03*4 = 2626.4 rubles.

The National Guard pension calculator in 2020 can only be found on unofficial resources.

The official website does not contain calculation programs.