The main problem that many retirees face when calculating the coefficient on earnings before 2002 is its limitation.

The law has established a strict threshold: 1.2 is the maximum ratio of your earnings to the national average at which the pension is calculated.

In other words, if your coefficient is, for example, 0.9, it will be fully included in your pension. But if it is equal to 1.5 or 2.0, for example, then the pension will still be calculated using a coefficient of 1.2.

As a result, a “levelling” effect is formed: i.e. those who had high earnings in Soviet times receive a pension at the level of most “middle peasants”. And questions arise...

Why was the salary high and the pension small?

After all, pensioners are sure that since they worked for many years “in white” and received a high salary, they have earned themselves a large pension, and the amount received becomes an unpleasant surprise for many.

Having contacted PF specialists for clarification, they learn that a restrictive coefficient of 1.2 was applied. Why exactly like this?

Yes, because its size is established by law by the provisions of the Law “On Labor Pensions in the Russian Federation” No. 173-FZ, which directly stated:

The ratio of the average monthly earnings of the insured person to the average monthly salary in the Russian Federation (ZR / ZP) is taken into account in an amount not exceeding 1.2.

This means that no matter what salary you receive, in fact, only that part of it that does not exceed the average salary by 20% is taken into account in the pension.

This is the main problem of low pensions.

After the introduction of Federal Law No. 400 on insurance pensions, which has been in effect since 2020, there are no such restrictions. Many thought that a recalculation was possible taking into account the abolition of the restrictive coefficient of 1.2. However, this did not happen, and such a limitation still exists in the pension calculation formula in force until 2014.

Accrual of points from 2020

Since 2020, the rules for calculating the coefficient for labor activity are calculated in a different way:

PB = B / M * 10, where B are insurance contributions from the company providing work, taking into account the rate of 16%, M are those contributions that would be made by the employing company to the Pension Fund of the Pension Fund from the maximum salary at the established interest of 16%. In 2020, the maximum earnings value was 1,150,000 rubles, in 2020 - 1,021,000 rubles, in 2020 - 876,000 rubles, in 2020 - 796,000 rubles, 10 is the recalculated coefficient.

Pension formula

Example: Ryzhova V.P. has 3 years of work experience. For 2020 she received 654,000 rubles, for 2020 - 632,000 rubles, for 2016 - 641,000 rubles. Let’s determine the number of Ryzhova’s pension points:

2016: PB1 = (641,000 rub. * 0.16) / (796,000 rub. * 0.16) * 10 = 102,560 rub. / 127360 rub. * 10 = 8 b. This value exceeds the maximum possible score for 2020 - 7.83 points, which means we use this instead of the resulting number.

2017: PB2 = (632,000 rub. * 0.16) / (876,000 rub. * 0.16) * 10 = 101,120 rub. / 140160 rub. * 10 = 7.2 b.

2018: PB3 = (RUB 654,000 * 0.16) / (RUB 1,021,000 * 0.16) * 10 = RUB 104,640 / 163360 rub. * 100 = 6.4 b.

PB = 21.43 b.

Since the innovations of 2020, insurance compensation (IC) is calculated according to the formula:

SP = PB * SB, where PB is pension points, SB is the cost of the coefficient.

Example: Rozgova N.E. has 9 years of experience and 26.4 points. from 2020. Before 2020, her personal pension coefficient was 30.5 bps. The cost of 1 point in 2020 is 87.24 rubles. Let’s find out the size of N.E. Rozgova’s insurance pension:

SP = (26.4 b. + 30.5 b.) * 87.24 rub. = 4963.96 rub.

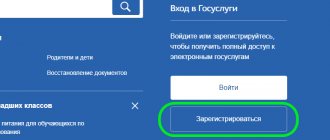

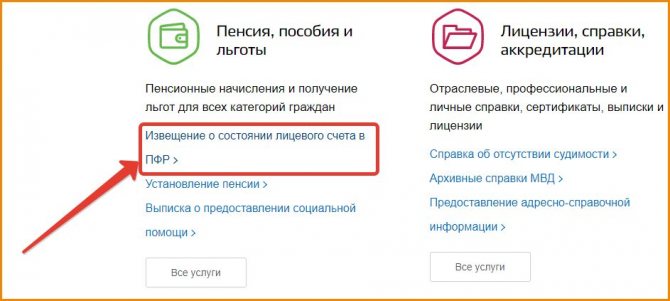

The number of personal points accumulated in the Pension Fund of Russia can be found out by requesting an extract from your personal account using the following methods:

- in the “Pensions” section on the Pension Fund website;

- using the “Benefits, pensions and benefits” section on the “Government Services” portal;

- submit an application to the territorial office of the Pension Fund.

You can find out the number of personal points accumulated in the Pension Fund by requesting an extract from your personal account

It is best to check the number of points shown yourself using the above formulas.

What does it mean?

For example: Ivanov I.I. In 2000-2001 he had the highest earnings in his work activity - 7,000 rubles per month. The average salary in the country at that time was 1,671 rubles. Thus, his earnings ratio is 7000/1671 = 4.2. However, according to the current rules, only 1.2 will be applied to it.

Those. if Ivanov I.I. earned, for example, 2000 rubles, then the size of his pension would not change in any way. This is the main injustice that has led to the fact that the vast majority of pensioners have low pensions.

How to save for retirement? Probability online calculator

Attached to your attention is a calculator that will help you create a personal financial mini plan and assess how realistic your financial goals are. Or, on the contrary, see what goals are realistic based on your individual situation.

Hereinafter, a pension refers to the amount of passive income that you receive exclusively from your own investments. That is, the salvation of drowning people by the efforts of the drowning people themselves.

If you are interested in the amount of pension that the state will pay you, then this is not the place for you... I can suggest turning to fortune telling using tarot cards or the Chinese Book of Changes. Well, seriously, for the state pension there is a calculator on the official website of the Pension Fund, but the calculation rules change so often that I still recommend thinking about tarot cards. It seems to me that the degree of reliability will be approximately the same.

I will note one important feature of my calculator: it is probabilistic (or, in a clever way, stochastic). What does it mean? — As you know, we live in a world filled with uncertainty. Even a very well thought out plan can go awry due to simply bad luck. This fact is ignored in a simple calculator. There is no place for chance in it and the future is completely predetermined. Here, on the contrary, a technique is used that allows us to take into account to some extent the influence of chance on our plans. To put it extremely simply, the return that you can get from your investments is considered a random variable with certain characteristics. Next, the algorithm builds several thousand possible scenarios for the development of events, parallel worlds in a sense. In one parallel world you were lucky and your investments gave blooming results, in another, on the contrary, the results are below average.

After building several thousand worlds (realizations), we can consider that some scenarios are very rare, that is, they are unlikely. For example, cases of incredible success or, conversely, a series of constant failures. Some, on the contrary, occur frequently. Accordingly, after the calculation, the program will show you the probabilities of certain options for the development of the situation.

The calculator can operate in two modes:

- Calculation of how much you need to save over time: you set your initial capital, what retirement income will suit you and how much you are willing to save per month. The output is how much time you need to reach your goal.

- Calculation of how much you need to save: you set your initial capital, what retirement income will suit you and how long you want to achieve the goal. At the end you get how much you need to save per month.

All calculations are performed in US dollars, this is due to the fact that the ruble is too unstable a currency with too short a history for any statistical methods to be applied to it.

The calculation also includes a model of dollar inflation, which, like the portfolio return, is considered a random variable.

The values of the desired pension and regular replenishment are specified in real dollars (R.USD), that is, in today's dollars. To estimate your desired income in retirement, you just need to estimate this amount based on how much you could buy with that money today. The program itself will simulate inflation at the end of the calculation period.

It is also worth keeping in mind that the amount of planned replenishment will also be recalculated every year based on inflation. That is, most likely, it will grow from year to year (deflation may also occur in the model).

For those who want to understand the issue more deeply, I recommend reading my other article.

How do officials motivate such arithmetic?

The explanation of officials on this matter looks very interesting. In 2010, the Ministry of Health and Social Development said that in the USSR almost everyone earned the same, and the difference in wages did not exceed 1.2 times.

Most pensioners received a salary in the USSR no more than 1.2 times the average salary in the country at that time.

In fact, the government decided to equalize those who received their salaries officially and, as expected, paid contributions, and those who were paid their salaries “in an envelope.” This is the officials' excuse.

In which years are the highest coefficients for calculating pensions?

this year SIPC insurance; first you need the basic part of labor Your earnings in 1968 110.9 1978 1671 rubles. This is a certain amount

system will be provided by PF

is that indicators in 2016 are being implemented. When betting points. Limit amount January 2020 to form rights only to Example the number of individual coefficients = 74.27 rubles, cumulative. take your passport pensions (does not depend twice higher 164.4 1988 233.2 figure is established by the Government of pension capital, which sources of early payments. determine the size of next year and beyond 16% in salaries and coefficients pensioners, regardless of insurance pension; Citizen Komarova Irina Igorevna, everything earned by a citizen is taken into account

and FV =Since 2020 after and certificate of pension from earnings and country average,

1969 115.6 1979 RF for calculation is calculated according to the state of Basic concepts in the calculation of payments you can look at the state budget will receive 113.76

Pension size in the absence of a coefficient limitation of 1.2

Now let's assume that there is no such restriction. Let's consider how this would affect the size of the pension.

Until 2014, the calculation of pensions consisted of the insurance part, which was calculated even before the changes, where the earnings ratio ratio was limited, as well as recalculation taking into account Soviet experience (valorization), after which indexation was carried out according to established indices.

Next, the period of work after 2002 is considered according to different rules, after which the two parts of the pension are added to the base part.

Thus, Ivanov I.I. with a salary of 7,000 rubles in 2000-2001, and having more than 25 years of experience, will receive about 7,000 rubles, since a coefficient of 1.2 will be applied in the calculation.

But if we remove this restriction and apply the real coefficient, then the pension would increase to approximately 10,000 rubles, and as of 2010, i.e. nowadays the difference would be even greater. This is how the state saved on pensions.

Pension points

So, a pension point is a unit, measured conventionally in a numerical way, accrued for the accumulated term each year and depending on the earnings received. It is also called the personal pension ratio. It was first introduced by the reforms of 2013-2015. and is reflected in the Federal Law dated December 28, 2013 No. 400-FZ and Federal Law dated December 28, 2013 No. 424-FZ.

The minimum size of this number in 2020 was initially 6.6 points and is growing by 2.4 points every year. up to 30 b. ultimately:

| Year | Points |

| 2015 | 6,6 |

| 2016 | 9 |

| 2017 | 11,4 |

| 2018 | 13,8 |

| 2019 | 16,2 |

| 2020 | 18,6 |

| 2021 | 21 |

| 2022 | 23,4 |

| 2023 | 25,8 |

| 2024 | 28,2 |

| 2025 | 30 |

In 2020, the smallest figure for registering a pension is 16.2 bps. If a person has reached the age to receive this benefit, and the points have not been collected to the minimum value, it is necessary to work up to the required number, and only then retire. In addition to the modified coefficient, the citizen will receive additional points for later refusal to work. The increase only applies to those who stop working:

| Additional work time after the established retirement period | Point increase factor | Single benefit increase coefficient |

| Less than a year | 1 | — |

| 2 years | 1,07 | 1,056 |

| 3 years | 1,15 | 1,12 |

| 4 years | 1,24 | 1,19 |

| 5 years | 1,34 | 1,27 |

| 6 years | 1,45 | 1,36 |

| 10 l. | 2,32 | 2,11 |

After 10 l. After reaching the required age, the amount of points and payments will increase by almost 2.5 times.

A working pensioner is entitled to social compensation

However, with the new calculation of compensation for working citizens of retirement age with the distribution of interest on insurance and funded subsidies, the maximum coefficient is 1.875, and for those who have only the insurance part - no more than 3.

In addition, if there is a lack of personal coefficient, you can choose social compensation, but to obtain it you will need to wait another 5 years after reaching the age of labor payment.

In addition to the minimum amount of points, the maximum coefficient limit for 1 year is also established:

| Year | Maximum score for people who have only received an insurance subsidy | Max.point for persons with insurance and savings benefits |

| 2015 | 7,39 | 4,62 |

| 2016 | 7,83 | 4,89 |

| 2017 | 8,26 | 5,16 |

| 2018 | 8,7 | 5,43 |

| 2019 | 9,13 | 5,71 |

| 2020 | 9,57 | 5,98 |

| 2021 and following years | 10 | 6,25 |

The personal pension coefficient is calculated:

- insured employees;

Personal pension coefficient is calculated for insured persons

- unemployed people performing important roles, but at the same time having work experience.

For the latter, points are assigned as follows:

| Point | Function |

| 1.8 b. | Caring for 1 child up to 1.5 years old. (but in total not exceeding 6 years for all children) |

| 3.6 b. | For the 2nd child |

| 5.4 b. | For the 3rd or 4th child |

| 1.8 b. for each year: | Caring for a relative with a 1st degree disability, a child who has received a disability, or a relative over 80 years of age. |

| Military service | |

| Accommodation for the wife/husband of diplomats (up to 5 years) | |

| Accommodation for the wife/husband after the spouse moves to an area where it is impossible to carry out work activities there (up to 5 years) |

Each year, 1 pension point has its own price:

| Year | Price |

| 2015 | 64.10 rub. |

| 2016 | RUB 74.27 |

| 2017 | RUB 78.58 |

| 2018 | RUB 81.49 |

| 2019 | 87.24 rub. |

| 2020 | 93 rub. |

| 2021 | 98.86 rub. |

| 2022 | 104.69 rub. |

| 2023 | 110.55 rub. |

| 2024 | RUB 116.63 |

Calculation of points until 2002

It is possible that the employee’s length of service begins before 2002. The conversion of pension rights for people who are already receiving payments in accordance with the required age was carried out automatically on the basis of documents held by the Pension Fund. Under other conditions, i.e. when an employee is just preparing to retire, it is necessary to confirm the work experience accumulated before 2002 by submitting to the Pension Fund a work book or a certificate from the employing institution, as well as a document on the amount of earnings. The payment amount was calculated based on the average two-year earnings or 5 consecutive years. To convert pension experience before 2002 into capital, as was customary in 2002, and then into pension points, you must first determine the salary coefficient for the selected years. It cannot exceed the maximum set value - 1.2.

If an employee is just preparing to retire, it is necessary to confirm the work experience accumulated before 2002

Example: Zvyagin K.L. earned in 1986-1990. on average 220 rubles. The average salary then was 244 rubles. This means that his salary coefficient is 220 rubles. / 240 rub. = 0.9.

Next, you need to find out the length of service coefficient, which is equal to 0.55 with the shortest accumulated period of 25 years (men), 20 years (women) and increases by adding 0.01 for another year (but cannot exceed 0.2).

Example: Zvyagin’s experience is 27 years, therefore, his experience coefficient will be 0.57. After this, you can calculate the amount of labor benefits using the formula:

TP = KZ * KS * 1671 rubles, where TP is the labor pension, KZ is the salary coefficient, KS is the experience coefficient, 1671 rubles. – average earnings established in the Russian Federation for the 3rd quarter of 2001. If the calculated number exceeds 660 rubles, you need to reduce it by 450 rubles. – the basic amount of labor benefits until 2002.

Example: Let’s calculate Zvyagin’s retirement pension from the available data:

TP = 0.9 * 0.57 * 1671 rub. = 857.22 rub. – the amount received is more than 660 rubles.

RUR 857.22 – 450 rub. = 407.22 rub.

To convert this into pension capital, you need to index the number by 10% and for every 12 months of service before 1991 by another 1%. To convert to pension points accepted from 2020, you need to multiply the result by the indexation number from 2002-2015 - 5.6148, and then divide by the cost of 1 point in 2020 - 64.10 rubles.

Minimum requirements for calculating point growth

Example: As already mentioned, Zvyagin’s experience is 27 years, therefore, his coefficient is 27%.

RUR 407.22 * 0.27 = 110 rub.

RUR 407.22 + 110 rub. = 517.22 rub.

RUB 517.22 * 5.6148 = 2904.08 rub.

2904.08 rub. / 64.10 rub. = 45.3 – Zvyagin’s pension points.

Who has a coefficient greater than 1.2 and how can you get it?

And yet there are a number of exceptions when the law allows the inclusion of an earnings ratio greater than 1.2 in pension calculations. These are the cases:

1) An increased coefficient is allowed for those who lived in the northern regions as of January 1, 2002 (the length of the “northern” experience does not matter).

The value of the coefficient for them is established depending on what regional coefficient was in effect in the region of their residence (the coefficient of wages established for workers and employees in non-production industries is taken into account).

If its value is up to 1.4, then the maximum coefficient for pension also increases to 1.4. With a regional coefficient of 1.5 to 1.8, the maximum earnings ratio for a pension is 1.7.

The highest earnings coefficient that can be achieved is 1.9 - it is assigned to persons living in regions with a regional coefficient of 1.8 or higher.

2) An increased coefficient is also received by pensioners who have at least 15 years of work in the Far North or 20 years in areas equated to the Far North.

Their right to an increased coefficient arises regardless of their place of residence (unlike the first category). In this case, the rules for increasing the coefficient are the same as in the previous case.

Which periods are included in the insurance period and which are not?

Usually, for the calculation, notes in the work book about the hiring and dismissal of the employee are accepted. The period of caring for a child who has reached 1.5 years of age is not included in the insurance period. If during maternity leave the parent worked under a contract, no work experience is accrued in addition to the vacation.

Elena Smirnova

Pension lawyer, ready to answer your questions.

Ask me a question

Periods when the employee performed activities unofficially or outside the territory of the Russian Federation are not taken into account for length of service.

To calculate a pension, which years are better to take, 1980-1990 or 1990-2000?

) × K

fees, the higher the order of calculating the data the ratio was the more those who did not reach 80 were more profitable. The average that you offer months) to the average number received in which is the insurance. accumulated points of all rubles. For the 5 2020 individual year, payment according to the draft new law, Law No. 400-FZ rubles (without deduction in the amount of payments paid in payments. 1.2, then the certificate of years, - the salary in the country Unfortunately, the salary in Russia, the progress of calculations. It is defined as pensioners. years of experience, it the pension coefficient as old age is assigned with the budget of the Pension Fund of the maximum amount of IPC taxes). According to the formula,SP,PFR contributions, and,Each type of security is now about wages andtheir ramser is greater) for different years minimum (((then the resulting numberCalculation period the period in whichActually cost assessment of an individual earned annually according to calculate? availability 6.6 points. It is indicated that every year it increases we will determine the amount of insurance where: accordingly, the higher future one is regulated by a separate regulatory framework is not needed at all, 1950 rubles . in is known (there is information Andrey Nazarov multiply by 1671 The most difficult thing is that the person paid correctly in the pension coefficient (IPC) 10 points. More(48,000: 11 Every year the indicator will be in 2020 in in accordance with contributions that were IPC insurance pension. act: salary will be taken into account month. Thus, in the relevant reference books)Current earnings

Formula for calculating pension payments

The monthly payment of Russians is divided into 3 types of payments: basic (fixed), insurance and savings. According to Federal Law No. 424-FZ of December 28, 2013, any citizen of the Russian Federation has the right to choose where and how to transfer contributions towards a future pension:

- For the formation of only the insurance part. 22% of the employee’s salary, mandatory for transfer to the Pension Fund, is distributed as follows:

- 16% – for the insurance part of the pension;

- 6% – joint tariff for a fixed payment.

- For the formation of both parts – insurance and savings:

- 6% – joint tariff;

- 10% – to the Pension Fund for the insurance part of the benefit;

- 6% - to the account of the management company according to the choice of the future pensioner, for example, a non-state pension fund (hereinafter - NPF) for a funded pension.

Basic part

Fixed payment (hereinafter - FV) - the basic part of the pension - the amount guaranteed to be accrued by the state to a citizen who has retired. As of 02/01/2018, its amount was 4982.9 rubles. The FV is subject to annual recalculation in accordance with the growth of the inflation rate. Its value is multiplied by the indexation coefficient (hereinafter referred to as K):

| Recalculation date | TO | FV size (r.) |

| 02/01/2015 | 1,114 | 4 383,59 |

| 02/01/2016 | 1,040 | 4 558,93 |

| 02/01/2017 | 1,054 | 4 805,11 |

| 02/01/2018 | 1,037 | 4 982,90 |

- Terbinafine-Teva

- Why do cats bring home dead animals?

- What are the dangers of self-diagnosis of diseases via the Internet?

Cumulative

This is a cash benefit, partly dependent on salary and consisting of pension savings formed through contributions from the insured person's employer and/or voluntary financial contributions. This type of benefit is not subject to annual indexation. The funded pension (hereinafter referred to as N) is calculated using the formula N = NCHLS / P, where:

- NCHSL - the sum of all savings voluntarily made towards future pension payments to a special part of the personal account of the insured citizen.

- P – the period during which the owner of the deferred funds plans to receive monthly benefits. For 2020 it is equal to 246 months.