Basic information about NPF Heritage

The non-state pension fund Heritage (hereinafter referred to as NPF) was formed 23 years ago. Until 2013, the NPF had the name “Norilsk Nickel” .

Over the entire period of its operation, the NPF received such awards as: “Pension Oscar”, “Financial Elite of Russia”.

In 2020, the NPF joined a large fund called Gazfond . NPF clients should now receive the necessary information at Gazfond branches or on the website: gazfond.ru.

At the same time, the document concluded with the Heritage Foundation retains its legal force.

Read more detailed information about the activities of the Gazfond in our material: NPF Gazfond!

Contact information of NPF Heritage:

- hotline number – 8 800-700-00-51;

- general number – 495 783 4784;

- head office address – Moscow, Sergeya Makeev Street, building 13;

- reception of citizens - offices of NPF Gazfond;

- INN – 7703481100;

- Checkpoint – 770301001;

- license – 1/2 dated July 27, 2004;

- official website – npfn.ru.

On the fund's website you can find information such as:

- reporting for the entire period of operation of the NPF;

- auditors' report;

- data on the formation of accumulated funds;

- expert opinion on the work of the fund.

Below we highlight the basic characteristics of the Heritage Fund:

- Own property worth 65 million.

- Savings – 50 million.

- Reserve funds – 15 million.

- Authorized capital – 210,000 rubles.

- Clients – 1.5 million.

- The number of persons receiving pensions is 25,000 clients.

Merger with Gazfond

After the non-state pension funds Heritage and Gazfond merged, a volume of savings amounted to about 373 billion rubles. In addition to these companies, other funds also took part in the reorganization procedure.

Including:

- KIT Finance;

- Promagrofond.

This decision was announced in 2020 by the owner of KIT Finance Pension Administrator LLC. To carry out this process, consent was initially sought from the Central Bank. The main condition that the parties had to comply with was not to worsen the terms of the agreements concluded with clients.

The basis for the merger was the Gazfond company. The head of this company reported that through the merger it was possible to solve several problems , in particular:

- expansion of the territory in which the company operates;

- pooling funds to achieve the goals set for the funds;

- cost reduction;

- circulation of practices that are positive;

- optimization of corporate type management.

The approximate timing of the connection was stated as the second quarter of 2017. The result of the reorganization was that Gazfond became the largest fund operating in the field of pension savings.

According to the data provided, the amount of funds accumulated by citizens amounted to 373 billion rubles. An analysis of the funds' activity reports allows us to conclude that control was divided between two persons managing the Gas Fund. The percentages were 65 and 35%.

Registration

A fund client can find out the amount of savings in two ways, namely:

- Personal appeal to the NPF branch - addresses of branches can be found on the website: https://gazfond-pn.ru/contacts/.

- Online request through the “Personal Account” .

To register, a citizen must fill out the appropriate form. The application template can be downloaded from the link: .

The completed application must be submitted in person to one of the fund’s departments. If there is no branch in the nearest region, a citizen has the right to send a form to the main address of the NPF, namely: index 123022, Moscow, Sergei Makeev Street, building 13 . In this case, there is no need to additionally notarize the form.

When registering, a citizen must prepare passport data and SNILS.

Access to the account will be provided within a month after submitting the appropriate application.

After logging into the “Cabinet” , the client is required to activate the profile, and then create the necessary request, after which the data on the individual personal account will be sent by email.

For comparison, we recommend the following material: NPF Stalfond.

In addition, your “Personal Account” through a specially developed mobile application. Using the installed application, a citizen has the right to obtain information such as:

- Control over your personal account.

- Studying the latest NPF news.

- Clarification of contacts of the nearest office.

- Formation of a question for fund employees.

- Discussion of information on social networks.

To download this application , a citizen must do the following:

- connect the Internet on one of the platforms (for example, iOS and Android);

- indicate the name of the NPF in the search bar;

- Click on the blue “Install” button.

How to conclude an agreement?

A citizen can sign an agreement with a non-state pension fund in one of the following ways:

- When actually visiting a branch of a non-state pension fund or contacting official representatives of the fund, a citizen is required to have an identification document and SNILS with him.

- Submitting an online application on the website: https://dogovor.gazfond-pn.ru/.

If any additional questions arise, the interested party can contact the number for advice.

An application for transfer to NPF Heritage must be completed by December 31. current year.

Finally, let’s add a few important points that should be taken into account when concluding a contract:

- the purpose of signing the agreement is to replenish the pension of a specific person at the expense of an annual percentage;

- after the agreement comes into force, an individual account is opened ;

- the fund has the right to independently manage client funds in accordance with the legislation of the Russian Federation;

- the client pays 13% on income received by the fund for the entire period of the contract.

Heritage Fund Rating

In accordance with the 2020 data, NPFs were assigned a reliability level of “A++” from the NRA agency (National Rating Agency). The indicators reflect the high efficiency of pension activities in relation to insured persons.

This rating is based on the following results:

- high performance in the compulsory insurance market;

- effective implementation of business projects;

- profitable placement of pension assets;

- stable corporate governance.

After the merger with NPF Gazfond, Heritage does not participate in the rating assessment from NRA.

Awards and ratings

The rating of the Heritage Pension Fund of the national rating agency was withdrawn on July 6, 2017 due to the completion of the reorganization. Prior to this, the organization was assigned an “AA+” rating with a stable outlook, which was last confirmed in July 2016.

The RAEX agency's reliability rating has not been confirmed since 2008.

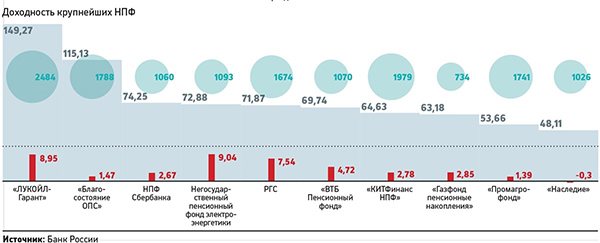

According to Expert RA estimates, the Heritage Foundation, at the end of 2020, occupied:

- 18th place in terms of equity capital;

- 11th place in terms of reserves;

- 12th place in terms of savings volume.

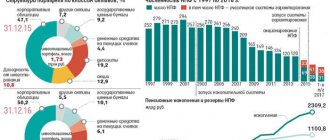

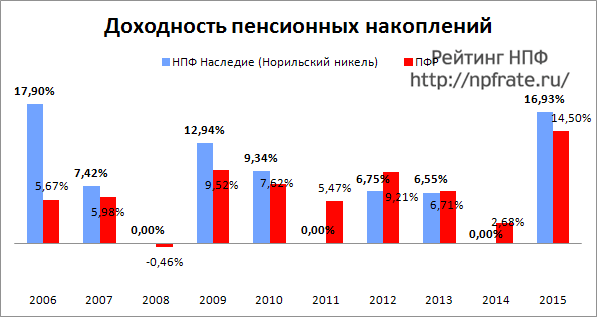

NPF profitability

Over the past 6 years of operation, Heritage has shown a total return of 85% in accordance with the official data of the NPF website.

Complete data for 2016-2017 has not been provided. The latest figures recorded as of September 30, 2020 are 6.3%.

Investment funds are distributed as follows:

- 60.2% – shares of a closed mutual investment fund (Closed-end mutual investment fund);

- 18.1% – bonds;

- 12.8% – bank deposits;

- 4.6% – shares;

- 4.3% – other assets.

NPF Heritage (Norilsk Nickel) - profitability rating and customer reviews

Reading time: 4 minutes(s) NPF Heritage (formerly Norilsk Nickel)

Information about the fund:

Status in 2020: Reorganized (merger with another NPF) In 2020, a non-governmental organization joined the Gas Fund.

Reorganization and merger

During the period 2014-2016.

NPF Heritage (Norilsk Nickel) became part of NPF Gazfond, together with NPF Kit-Finance and Promagrofond. At the beginning of 2017 and subsequent years, all clients of these funds will be serviced by the Gazfond fund. Since December 13, 1993, the non-state pension fund Heritage has been operating, which was renamed twice before receiving this name. It all started with the Interros-Dostinostvo fund, to which the NPF Norilsk Nickel was merged in 1996 - this is the name by which the fund is best known. In August 2013, a decision was made to rename Norilsk Nickel to NPF Heritage. The fund's experience in the pension services market goes back two decades, and the number of clients under the OPS program is over 1 million people. The list of founders of the fund is listed in documents on the official website.

Full name of the organization: Heritage CJSC NPF (Norilsk Nickel)

Data for 2013: The NPF Heritage rating according to the NRA corresponds to the AA mark, which means a high level of fund reliability and quality of services. However, Heritage is still far from achieving maximum ratings, such as those of the Lukoil-Garant pension fund (you can see it here).

Reliability rating in 2017

Expert RA: not participating National Rating Agency (NRA): the rating will be withdrawn in 2017

The National Rating Agency confirmed the reliability rating of NPF Heritage CJSC at the level of AA+ with a stable forecast. The rating was first assigned to the Fund on August 7, 2014 at the level of “AA+”. The last rating action was dated July 23, 2015, when the rating was confirmed at “AA+” with a stable outlook.

Statistics of NPF Heritage (Nornickel)

Statistics on NPO (non-state pension provision) as of July 1, 2013

- Pensions are received by: 19,450 people

- Number of participants: 98,600 people

- Pension reserves: 13,626 people

- Pensions paid in the amount of: 409,327 thousand rubles

Statistics on compulsory pension insurance (compulsory pension insurance) as of July 1, 2013

- Pension savings: 42,872,819 thousand rubles

- Profitability (for 2012): 6.75%

- Number of insured clients: 1,032,022 people

Pension savings managed by the NPF Heritage increased from every thousand to 1,564 rubles from 2006 to 2010. The larger pension fund VTB NPF, over a similar period (4 years), managed to increase savings by only 384 rubles.

Profitability and reliability

In the period from 2006 to 2010 (from publicly available statistics), the Norilsk Nickel pension fund achieved the highest return on investment in 2006: 18% per annum. In 2008, the yield was 0%, however, like the vast majority of pension funds. The total return for 2006-2012 was 85%, according to information from the official website. Profitability indicators have been available since 2005, similar to the non-state PF Electric Power Industry, reviews of which you can read on the corresponding page.

Profitability indicators of NPF Heritage (Norilsk Nickel) in 2005-2012

Data on the profitability of NPF Heritage (Norilsk Nickel) JSC as of January 1, 2017, including information for the previous 10 years in comparison with the profitability of the Pension Fund of the Russian Federation:

Profitability of NPF Heritage (Norilsk Nickel) for 2014-2015 and previous years

The fund has not currently provided a profitability rating for 2016-2017, but the profitability indicator as of September 30, 2016 is known: it is 6.37%.

The distribution of investments between groups of assets under the non-state pension program is as follows: 60.2% - shares of a closed mutual investment fund (Closed-end mutual investment fund) 18.1% - bonds 12.8% - bank deposits 4.6% - shares 3.6% — funds in the current account 0.7% — other types of assets

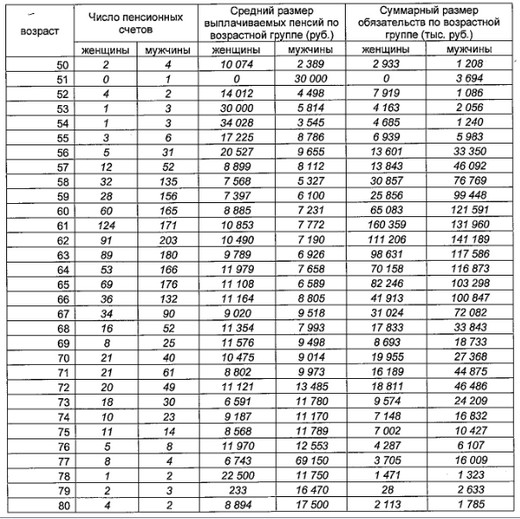

Average pension size for different age groups

The table presented above is taken from documents (Actuarial Report for 2012) located on the official website of the fund.

Official website and contacts

The official website of the Heritage Pension Fund (formerly Norilsk Nickel) is located at https://npfn.ru/. The site is very informative; many documents are available with the results of the fund’s activities by year. There is a client’s personal account and several calculators, for example, for calculating pensions under the compulsory pension program.

Address

The central office is located in the capital: 123022, Russian Federation, Moscow, Sergei Makeev St., 13. Open Mon-Fri 9-18 (*Fri 9-16:45). There is a toll-free (within the Russian Federation) telephone number for calls.

NPF Heritage (Norilsk Nickel) on the Yandex map:

As of 2013, NPF Heritage has 23 branches in 6 districts of the Russian Federation and is constantly developing its territorial network.

Personal account: find out your savings

Login to the personal account of the Heritage Foundation is located at the link: https://npfn.ru/ru/account/

Customer Reviews

On this page you can leave your feedback on the work of the Heritage pension fund and the quality of the services it provides. Did you not like the attitude of your employees or were you deceived when calculating your pension? Share your problem and let others know about it. If you know of cases of fraud in NPF Heritage, for example, when fund employees go door to door and sign pension agreements under false pretenses, write in the comments.

Office addresses

Below is a list of cities in which offices and representative offices of NPF Heritage (formerly Norilsk Nickel) are located.

Arkhangelsk Address: 163000, Arkhangelsk, Lomonosova Ave., 81, office 407

Zapolyarny Address: 184430, Murmansk region, Pechenga district, Zapolyarny, Leningradskaya st., 4a

Monchegorsk (Branch) Address: 184500, Murmansk region, Monchegorsk, Metallurgov Avenue, 25

Barnaul Address: 656049, Barnaul, Proletarskaya st., 131, office 509

Dudinka Address: 647000, Krasnoyarsk Territory, Dudinka, Ostrovsky St., 6

Norilsk Address: 663330, Norilsk, Talnakh district, Polyarnaya st., 7, room. 9; 663340, Norilsk, Kayerkan district, Shakhterskaya st., 9B; 663305, Norilsk, Leninsky Prospekt, 1, 3rd floor

Tomsk Address: 634050, Tomsk, Trifonova st., 20, office. No. 2, to enter the building - left intercom, dial - 41

In cities such as Omsk, Bryansk, Orenburg, UFA, Krasnoyarsk, Voronezh, Tver, Yekaterinburg, Cheboksary, Irkutsk, there are no Heritage Foundation offices in 2017.

Did this article help you? We would be grateful for your rating:

0 0

How to terminate the contract?

Upon termination of the contract, the client is obliged to make a choice in favor of a new NPF (or Pension Fund), since no one transfers pension savings to a citizen before reaching retirement age.

To terminate the agreement, a citizen must contact the NPF (or Pension Fund) with an application, passport, and SNILS number. In this case, the client does not have to notify the Heritage Foundation of his decision.

To preserve the accumulated funds, it is necessary to transfer the savings at the end of the year and no more than once every 5 years!

To cancel an agreement with a non-state pension fund, the insured person suffers the following financial losses :

- Accrual of profit for an incomplete year.

- When transferring savings to VEB, 13% is withheld from the client’s account. When transferring to another NPF, no tax is charged.

- The costs of transition to a new fund are paid directly by the applicant.

reference Information

Table 1. General information about the fund

| Name | Requisites |

| Full title | Closed Joint Stock Company "Non-State Pension Fund "Heritage" |

| License | 1/2 |

| Member of the Deposit Insurance Association | From 01/01/2015 Excluded from 04/11/2017 |

| Location | 123022, Moscow, st. Sergeya Makeev, 13 |

| Total number of insured persons and participants as of 03/31/2017 | 886 thousand |

| Yield according to the Central Bank for March 2020 | 12,2 % |

| Official site | https://www.npfn.ru |

| Telephone | 8 |

When opened in 1993, the fund was named NPF Interros-Dostinostvo. In 2006 it was renamed NPF Norilsk Nickel. The current name of NPF “Heritage” was assigned to the organization in 2013. But in 2016, the process of joining the young pension fund Gazprom Pension Savings began. In fact, in April 2020, NPF Heritage CJSC ceased to exist as a legal entity.

The new association also includes:

- CJSC "KITFinance NPF";

- NPF "Promagrofond"

Rice. 1. The united pension fund included 4 non-state pension funds with high ratings