A pension is a monetary compensation that is the only source of income for some social groups. It is paid every month in case of:

- reaching a specified old age;

- permanent inability to perform vital functions;

- death of a person supporting a dependent;

- established service life of the Russian Federation.

The payment can be made by the state or by a private institution, for example, a non-state pension fund.

Cash provision for needy persons can be of several types.

Pension points

Labor payment

These monetary compensations are regulated by Federal Law No. 400-FZ dated December 28, 2013. Insured citizens of the Russian Federation or foreigners can apply for the benefit. After 2020, each employee has the opportunity to make a choice: invest only in an insurance pension or in an insurance + savings pension. At the same time, there is a different percentage of contributions to the company. 22% is distributed as follows:

| Insurance + savings | Insurance |

| 16% - for insurance, 6% - for savings | 16% - for insurance, 6% - for established compensation in cash |

The first option for registering a pension consists of 2 components, which have their own characteristics:

| Insurance | Cumulative |

| Replenishes the persons mentioned in the law with their earnings due to the current impossibility of carrying out work activities. | Provided to citizens born in 1967 and younger if they decide to choose this pension option |

| Calculated in points | Presented in material form |

| Formed from accruals of citizens currently working | Formed as a result of investment investments by professional managers |

| No inheritance provided | It is possible to inherit before achieving the necessary conditions for receiving |

| Paid by the Pension Fund | It is possible to obtain from the Pension Fund or any other non-governmental institution specializing in deposits |

You can choose the double accrual method for 5 liters. from the time of accrual of insurance contributions. To confirm, you need to decide on the fund that forms the savings part, and then contact the Pension Fund with an appeal.

Federal Law “On Insurance Pensions” N 400-FZ. Chapter 1, Article 4

Pension coefficient norm

In 2020, the IPC standard for pension formation was established at 6.6. But every year the IPC will increase by 2.4 points. Therefore, the calculations will be as follows:

- 2016 - 9;

- 2017 - 11.4;

- 2018 - 13.6.

The increase will be carried out until 2025 to a maximum of 30 points.

When determining the IPC, the maximum scores for the current year will be calculated.

For example, a citizen earned 12.5 in 2020, and the maximum value is 11.4. Consequently, the increase is made by the number of points established by the Government, nothing more!

Payment of the savings portion

The savings part is issued in 3 ways:

- One time . Persons whose accumulative payment is 5% or less of the labor amount can receive it.

- Urgently . Produced for a period of at least 10 liters. for citizens participating in the state project. financing and paying additional contributions to this type of pension, as well as for persons who are owners of family capital, used to form the accumulation of future benefits.

- Indefinitely . The appointment occurs if there are necessary requirements for payment of the age-related subsidy and with savings of 5% per month of the entire amount of labor compensation.

If you want to know the calculation of perpetual funded pension payments, you can follow the link to our article with a calculation calculator by clicking here.

Cumulative compensation can be calculated using the formula:

NK = OH / P , where NK is the accumulative part, OH is the total accumulation, P is the survival period.

| Year | Expected period |

| 2019 | 21 |

| 2018 | 20.5 l. |

| 2017 | 20 l. |

| 2016 | 19.5 l. |

Cumulative compensation calculator

Go to calculations

You can find out more detailed information about the savings part, as well as terms, payments and amounts, from our new article.

Maximum coefficient value

The government of the country sets the maximum parameters for the IPC value. In 2020 it was 7.83. The increase will occur annually as follows, until 2021:

- up to 10 - 1 group of people who do not have a savings part (hereinafter referred to as NP);

- up to 6.25 - for citizens of the second group who form funded contributions.

Currently, the maximum indicators for the first group are 7.39, and for the second - 4.62.

For a more detailed presentation of information, we suggest that each future pensioner study the table below on the maximum IPC indicators:

| Year of retirement | With deductions for low frequency | No deductions for low frequencies |

| 2015 | 4,6 | 7,3 |

| 2016 | 4,8 | 7,8 |

| 2017 | 5,1 | 8,2 |

| 2018 | 5,4 | 8,7 |

| 2019 | 5,7 | 9,1 |

| 2020 | 5,9 | 9,5 |

| 2021 | 6,2 | 10 |

When calculating, only the maximum indicators established by the state are taken into account. For example, a citizen earned 9.9 points in 2017, but government agencies will only take into account 8.2 points (if there were no deductions for low income).

Receiving insurance compensation

The second option is only an insurance subsidy, issued according to:

- death of the breadwinner;

- establishing disability and, as a result, incapacity for work;

- old age specified by law.

Receiving insurance compensation

Moreover, in any of the listed situations, the person must have worked at least a day before submitting an application for receiving the pension amount.

In the first situation, dependents are relatives:

- not older than 18 years old. or from 60/65 l. (depending on age);

- with children under 14 years old;

- those undergoing full-time education who are not older than 23 years old;

- disabled people of any age who were supported.

They have the right to receive monthly compensation upon provision to the Pension Fund of the Russian Federation:

- passports;

- a document confirming the death of the person holding them;

- necessary information about family ties;

- extracts from the breadwinner's work.

You can apply for monthly compensation at one of the Pension Fund branches

Payment is provided within 10 days. from the date of filing, but only if the necessary documents were provided no later than one year from the death.

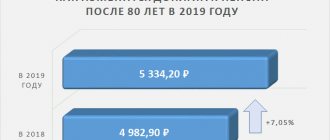

An increase is added to the insurance pension - a cash benefit. For dependents left without support, it is 2667.10 rubles. for everyone (full orphans - 5334.19 rubles).

If a special medical commission assigns a disabled group, such a person also has the right to receive an insurance subsidy. In this case, the condition must be met that the injury was not caused intentionally.

The monetary increase for each disability group is:

| Disability | 2019 |

| 1 gr. (inability to talk, walk, care for oneself, disorientation) | RUB 3,782.94 |

| 2 gr. (ability for self-care, movement, communication, but inability to learn and carry out work activities) | 2701.62 rub. |

| 3 gr. (movement, communication, doing work, but with more time) | 2162.67 rub. |

| Disabled children (inability to live independently acquired before adolescence) | 2701.62 rub. |

The amount of the single benefit includes the NSO (complexity of social services). If a person does not want to use this type of assistance, it is exchanged for compensation in material form. In 2020 it is equal to 1121.42 rubles.

In case of assignment to a disabled group, a person has the right to receive an insurance subsidy

For old age payments, the following points must also be met: age must be at least 60 years old. (women) and 65 l. (men).

Due to the pension reform in 2020, the opportunity to work was increased by 5 years. In this case, the age increase is carried out sequentially according to the following scheme:

| Time | Men | Women |

| 2019 | 60 l. + 1 year | 55 l. + 1 year |

| 2020 | 60 l. + 2 g. | 55 l. + 2 g. |

| 2021 | 60 l. + 3 g. | 55 l. + 3 g. |

| 2022 | 60 l. + 4 g. | 55 l. + 4 g. |

| 2023 | 60 l. + 5 l. | 55 l. + 5 l. |

At the same time, the retirement age for female civil servants has been increased in the same way in stages to 63 years. For men in civil service, the period is equal to the above - 65 years. If such persons have an accumulated experience of 42 years (men) and 37 years. (women) payment can be issued earlier than the specified age for 2 years.

- working experience more than 15 years. Similar to increasing the age category, the increase is 1 year for every 1 year (in 2020 - 10 years);

- Pension points must be equal to a certain minimum value established in the selected year.

The retirement age for female civil servants has been increased in stages

Pension points

So, a pension point is a unit, measured conventionally in a numerical way, accrued for the accumulated term each year and depending on the earnings received. It is also called the personal pension ratio. It was first introduced by the reforms of 2013-2015. and is reflected in the Federal Law dated December 28, 2013 No. 400-FZ and Federal Law dated December 28, 2013 No. 424-FZ.

The minimum size of this number in 2020 was initially 6.6 points and is growing by 2.4 points every year. up to 30 b. ultimately:

| Year | Points |

| 2015 | 6,6 |

| 2016 | 9 |

| 2017 | 11,4 |

| 2018 | 13,8 |

| 2019 | 16,2 |

| 2020 | 18,6 |

| 2021 | 21 |

| 2022 | 23,4 |

| 2023 | 25,8 |

| 2024 | 28,2 |

| 2025 | 30 |

In 2020, the smallest figure for registering a pension is 16.2 bps. If a person has reached the age to receive this benefit, and the points have not been collected to the minimum value, it is necessary to work up to the required number, and only then retire. In addition to the modified coefficient, the citizen will receive additional points for later refusal to work. The increase only applies to those who stop working:

| Additional work time after the established retirement period | Point increase factor | Single benefit increase coefficient |

| Less than a year | 1 | — |

| 2 years | 1,07 | 1,056 |

| 3 years | 1,15 | 1,12 |

| 4 years | 1,24 | 1,19 |

| 5 years | 1,34 | 1,27 |

| 6 years | 1,45 | 1,36 |

| 10 l. | 2,32 | 2,11 |

After 10 l. After reaching the required age, the amount of points and payments will increase by almost 2.5 times.

A working pensioner is entitled to social compensation

However, with the new calculation of compensation for working citizens of retirement age with the distribution of interest on insurance and funded subsidies, the maximum coefficient is 1.875, and for those who have only the insurance part - no more than 3.

In addition, if there is a lack of personal coefficient, you can choose social compensation, but to obtain it you will need to wait another 5 years after reaching the age of labor payment.

In addition to the minimum amount of points, the maximum coefficient limit for 1 year is also established:

| Year | Maximum score for people who have only received an insurance subsidy | Max.point for persons with insurance and savings benefits |

| 2015 | 7,39 | 4,62 |

| 2016 | 7,83 | 4,89 |

| 2017 | 8,26 | 5,16 |

| 2018 | 8,7 | 5,43 |

| 2019 | 9,13 | 5,71 |

| 2020 | 9,57 | 5,98 |

| 2021 and following years | 10 | 6,25 |

The personal pension coefficient is calculated:

- insured employees;

Personal pension coefficient is calculated for insured persons

- unemployed people performing important roles, but at the same time having work experience.

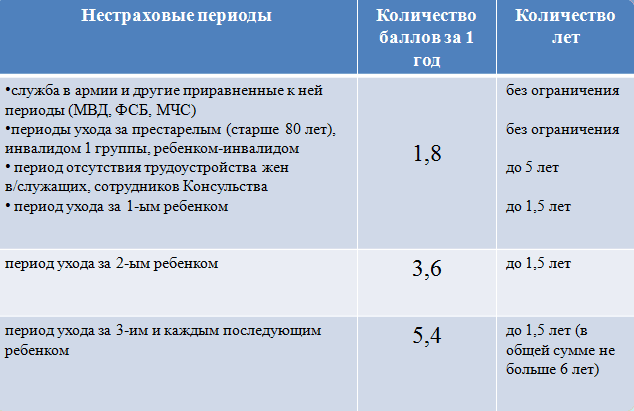

For the latter, points are assigned as follows:

| Point | Function |

| 1.8 b. | Caring for 1 child up to 1.5 years old. (but in total not exceeding 6 years for all children) |

| 3.6 b. | For the 2nd child |

| 5.4 b. | For the 3rd or 4th child |

| 1.8 b. for each year: | Caring for a relative with a 1st degree disability, a child who has received a disability, or a relative over 80 years of age. |

| Military service | |

| Accommodation for the wife/husband of diplomats (up to 5 years) | |

| Accommodation for the wife/husband after the spouse moves to an area where it is impossible to carry out work activities there (up to 5 years) |

Each year, 1 pension point has its own price:

| Year | Price |

| 2015 | 64.10 rub. |

| 2016 | RUB 74.27 |

| 2017 | RUB 78.58 |

| 2018 | RUB 81.49 |

| 2019 | 87.24 rub. |

| 2020 | 93 rub. |

| 2021 | 98.86 rub. |

| 2022 | 104.69 rub. |

| 2023 | 110.55 rub. |

| 2024 | RUB 116.63 |

Calculation of points until 2002

It is possible that the employee’s length of service begins before 2002. The conversion of pension rights for people who are already receiving payments in accordance with the required age was carried out automatically on the basis of documents held by the Pension Fund. Under other conditions, i.e. when an employee is just preparing to retire, it is necessary to confirm the work experience accumulated before 2002 by submitting to the Pension Fund a work book or a certificate from the employing institution, as well as a document on the amount of earnings. The payment amount was calculated based on the average two-year earnings or 5 consecutive years. To convert pension experience before 2002 into capital, as was customary in 2002, and then into pension points, you must first determine the salary coefficient for the selected years. It cannot exceed the maximum set value - 1.2.

If an employee is just preparing to retire, it is necessary to confirm the work experience accumulated before 2002

Example: Zvyagin K.L. earned in 1986-1990. on average 220 rubles. The average salary then was 244 rubles. This means that his salary coefficient is 220 rubles. / 240 rub. = 0.9.

Next, you need to find out the length of service coefficient, which is equal to 0.55 with the shortest accumulated period of 25 years (men), 20 years (women) and increases by adding 0.01 for another year (but cannot exceed 0.2).

Example: Zvyagin’s experience is 27 years, therefore, his experience coefficient will be 0.57. After this, you can calculate the amount of labor benefits using the formula:

TP = KZ * KS * 1671 rubles, where TP is the labor pension, KZ is the salary coefficient, KS is the experience coefficient, 1671 rubles. – average earnings established in the Russian Federation for the 3rd quarter of 2001. If the calculated number exceeds 660 rubles, you need to reduce it by 450 rubles. – the basic amount of labor benefits until 2002.

Example: Let’s calculate Zvyagin’s retirement pension from the available data:

TP = 0.9 * 0.57 * 1671 rub. = 857.22 rub. – the amount received is more than 660 rubles.

RUR 857.22 – 450 rub. = 407.22 rub.

To convert this into pension capital, you need to index the number by 10% and for every 12 months of service before 1991 by another 1%. To convert to pension points accepted from 2020, you need to multiply the result by the indexation number from 2002-2015 - 5.6148, and then divide by the cost of 1 point in 2020 - 64.10 rubles.

Minimum requirements for calculating point growth

Example: As already mentioned, Zvyagin’s experience is 27 years, therefore, his coefficient is 27%.

RUR 407.22 * 0.27 = 110 rub.

RUR 407.22 + 110 rub. = 517.22 rub.

RUB 517.22 * 5.6148 = 2904.08 rub.

2904.08 rub. / 64.10 rub. = 45.3 – Zvyagin’s pension points.

What is IPC?

The IPC is the value that is used to calculate pensions for older people starting in 2020. The IPC is determined for each completed reporting period, taking into account the amount of insurance contributions to the Pension Fund (PFR).

So, to receive a high level of pension payments, young people need to do the following:

- earn at least 10 points by 2021;

- total experience - from 15 years.

The concept of IPC and pension points have the same meaning!

Every year, authorities determine the value of 1 point - changes occur twice a year: February 1 and April 1. On February 1, 2017, they plan to set the price at 77.3 rubles.

If the IPC value does not reach the minimum indicators, the elderly citizen will be paid only a social pension.

Calculation of points until 2020

From 2002 to 2020, there was a different calculation of pension savings, which was formed from contributions made up of accumulated funds. To convert the pension capital that existed before 2020 into pension points, you need to use the formula:

PB = C / SB + NV, where PB are points, C is insurance compensation, SB is the cost of the coefficient in 2020 - 64.10 rubles, NV is uninsured time until 2020.

C = PC / 228, where C is insurance compensation, PC is the pension capital as of 2020, 228 are the months that constituted the intended period of the pension (i.e. 19 years).

PC = ZB * 16% * L, where PC is capital, ZB is annual earnings, 16% is the percentage on pension contributions established by the state, L is the number of years worked.

Algorithm for calculating future pensions

Example: Citizen Epifantsev D.L., who has 7 years of work experience, earned 540,000 rubles in 2014.

- Let's find out the size of Epifantsev's pension capital: PC = 540,000 rubles. * 0.16 * 7 l. = 604800 rub.

- Let's calculate the insurance pension according to the old model: C = 604,800 rubles. / 228 months = 2652.63 rub.

- Let's determine Epifantsev's pension points: PB = 2652.63 rubles. / 64.10 rub. = 41.38 b.

Accrual of points from 2020

Since 2020, the rules for calculating the coefficient for labor activity are calculated in a different way:

PB = B / M * 10, where B are insurance contributions from the company providing work, taking into account the rate of 16%, M are those contributions that would be made by the employing company to the Pension Fund of the Pension Fund from the maximum salary at the established interest of 16%. In 2020, the maximum earnings value was 1,150,000 rubles, in 2020 - 1,021,000 rubles, in 2020 - 876,000 rubles, in 2020 - 796,000 rubles, 10 is the recalculated coefficient.

Pension formula

Example: Ryzhova V.P. has 3 years of work experience. For 2020 she received 654,000 rubles, for 2020 - 632,000 rubles, for 2016 - 641,000 rubles. Let’s determine the number of Ryzhova’s pension points:

2016: PB1 = (641,000 rub. * 0.16) / (796,000 rub. * 0.16) * 10 = 102,560 rub. / 127360 rub. * 10 = 8 b. This value exceeds the maximum possible score for 2020 - 7.83 points, which means we use this instead of the resulting number.

2017: PB2 = (632,000 rub. * 0.16) / (876,000 rub. * 0.16) * 10 = 101,120 rub. / 140160 rub. * 10 = 7.2 b.

2018: PB3 = (RUB 654,000 * 0.16) / (RUB 1,021,000 * 0.16) * 10 = RUB 104,640 / 163360 rub. * 100 = 6.4 b.

PB = 21.43 b.

Since the innovations of 2020, insurance compensation (IC) is calculated according to the formula:

SP = PB * SB, where PB is pension points, SB is the cost of the coefficient.

Example: Rozgova N.E. has 9 years of experience and 26.4 points. from 2020. Before 2020, her personal pension coefficient was 30.5 bps. The cost of 1 point in 2020 is 87.24 rubles. Let’s find out the size of N.E. Rozgova’s insurance pension:

SP = (26.4 b. + 30.5 b.) * 87.24 rub. = 4963.96 rub.

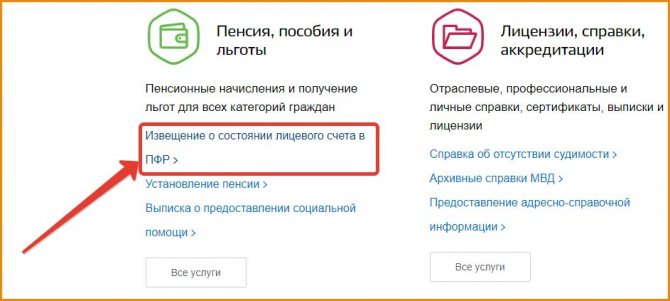

The number of personal points accumulated in the Pension Fund of Russia can be found out by requesting an extract from your personal account using the following methods:

- in the “Pensions” section on the Pension Fund website;

- using the “Benefits, pensions and benefits” section on the “Government Services” portal;

- submit an application to the territorial office of the Pension Fund.

You can find out the number of personal points accumulated in the Pension Fund by requesting an extract from your personal account

It is best to check the number of points shown yourself using the above formulas.

Calculation examples

Expert opinion

Gusev Pyotr Fedorovich

Practicing lawyer with 10 years of experience. Specialization: criminal law. More than 3 years of experience in developing legal documentation.

Before giving a few examples, we note that pension units are accrued not only for work. The law establishes several periods for which contributions are not paid, but are reimbursed by the state in the following amounts.

We saw what the formula for calculating pensions in 2020 for employees looks like using the example of an ordinary Russian engineer. But there are other categories of citizens, they are also interested in knowing what awaits them.

Example 3. Young successful top manager Sergei.

Example 4. Former military man, now an individual entrepreneur Dmitry.

The number of units earned in each period will be different. After all, it depends both on the employee’s personal salary and on the maximum amount for calculating contributions, which changes annually.

Moreover, it is growing noticeably faster than income. Thus, in 2020 it increased by almost 14% compared to the previous one, and the average salary during this period increased by only 9%.

So, even with good earnings, you cannot count on a large pension. Therefore, you need to take care of other ways to accumulate capital for old age.

The 2020 reform introduced new conditions for calculating old-age insurance benefits, which depend on points earned by citizens in the active period of life. To ensure a decent old age, young workers must take care of ensuring it already at the beginning of their working career. To do this, you need to clearly understand how points are calculated for your pension.

Pension rights of the older generation are also converted into points. As retirement age approaches, the question becomes relevant for them: how many points are needed to calculate a pension, and do they have enough rights to receive it? Anyone who has decided to continue working without retiring should understand the procedure for calculating pension points for working pensioners.

- What are pension points

- What are pension points awarded for?

- From what year are pension points accrued?

- How are pension points calculated?

- Accrual system

- Points for Soviet experience

- Points for working pensioners

- Points for temporarily unemployed

- Features of accrual of pension points in 2020

- How much is a pension point worth in 2020?

- How are pension points used to calculate pensions?

- How many points are needed to earn a pension?

From 2020, three conditions govern the receipt of old-age insurance benefits:

- age: 55/60 years;

- length of insurance payments - the number of years when the employee contributed funds from his earnings to the Pension Fund of Russia (PFR). Before the reform, it was only 5 years, from 2020 it began to grow and by the end of the transition period (2025) it will be equal to 15;

- individual pension coefficient (IPK) – the number of pension points (PB). The lowest point total for retirement in 2020 was 6, in 10 years it will be 30.

It is not difficult to determine the age and length of service of an employee; it is more difficult to understand how pension points are calculated.

Points are an expression of the employee’s pension rights, the amount of deductions from earnings that he made to the PRF. The employee’s personal account is the source of the insurance portion of the old-age benefit.

A large number of PB guarantees decent benefits. And if the employee has not reached the required minimum, then he will be denied an insurance pension.

Social pension

People who do not have an accumulated period of time or have reached the old age specified in the law, but have not scored the required number of points, have the right to social compensation. According to Federal Law No. 166-FZ dated December 15, 2001, this is:

- citizens of 70 years of age (men) and 65 years of age (women), as well as people from other countries of this age living in the Russian Federation from 15 years of age;

- people under the age of majority or under 23 years of age who have not completed full-time education and who have experienced the death of 1 or 2 breadwinners;

- a few inhabitants of the North aged 55 (male) and 50 (female);

- disabled children;

- persons with any category of disability, and persons limited in their life activities from birth.

This benefit is paid monthly by the state upon provision of a passport, the necessary information about the possibility of receiving this subsidy and an application to the Pension Fund. You can contact them by scheduling an individual conversation with a representative of the Pension Fund, at the MFC, by letter via mail or on the State Services website. Compensation is assigned from the new month upon submission of the necessary documents.

The benefit is paid monthly by the state upon provision of a passport, the necessary information about the possibility of receiving this subsidy and an application to the Pension Fund

| Reason for receiving benefits | Size in 2020 |

| Disability from birth 1 gr.; children who became disabled during their lifetime | 12432,44 |

| Death of 2 breadwinners; 1 tbsp. disability; disability from birth 2 gr. | 10360,52 |

| 70 l./65 l.; death of the breadwinner; disability 2 degrees; inhabitants of the North 55 l./50 l. | 5180.24 rub. |

| 3rd degree disability | 4403,24 |

State compensation

Intended for persons who have distinguished themselves before the state and have a certain work experience. According to Federal Law No. 166-FZ dated December 15, 2001, both citizens of the Russian Federation and foreigners who have a permanent place of residence here have the right to it:

- victims of an accident resulting from an industrial error or radiation disaster;

- participants of the Second World War, as well as residents of Leningrad, which was blocked during the Second World War;

- persons performing military service;

- pilots flying into space, as well as flight crew of the test team with 20 years of experience. (women) and 25 l. (men);

- persons who, according to a medical certificate, are not capable of working;

- civil servants upon reaching 15 years of age at their place of work.

The size of this payment depends on the reason for receipt, and then on the social subsidy or allowance paid. For example, a citizen with a 1st group disability who became incapacitated due to a combat injury during military service receives 300% of the social pension, and an astronaut with 1st degree of disability acquired during a flight or performing a work assignment receives 85% of the allowance.

The amount of state compensation payment depends on the reason for receiving the disability group

So, a pension is a payment received every month by a person entitled to it by law. In Russia, the system of pension subsidies includes labor, social and state. In the first case, the possible amount is calculated depending on the choice made by the working citizen himself: receiving insurance or insurance and funded compensation. Cumulative is calculated according to the principle that existed before 2020, that is, in material equivalent. Insurance is calculated in points, which directly depend on the person’s own earnings for each year.

There are several cases in which the coefficient is added for non-working time: for example, for caring for 1 child under 1.5 years old. You should also pay attention to the minimum points required to receive a pension benefit: without it, you must continue to work after reaching the age of 65 years. for men and 60 l. for women. As you continue to work, the percentage when calculating future compensation also increases.

There are several cases in which the coefficient is added for non-working time, for example, caring for 1 child under 1.5 years old

To determine the size of the pension, a certain coefficient is used every year: in 2020 it is 87.24 rubles. Due to the presence of work experience before 2020 or before 2002, you should use the necessary formulas to convert the accumulated pension benefits into points.

People who do not have work experience or have not accumulated the personal coefficient necessary for labor payments can apply for social benefits, but under certain conditions: their age must be at least 70 years. (men) and 65 l. (women). Also, this subsidy can be applied for by disabled people, residents of the North and dependents who have lost their breadwinner. Government compensation is intended for persons who are injured or ill during service or work of public importance.