Home / Labor Law / Payment and Benefits / Pension

Back

Published: March 24, 2016

Reading time: 7 min

0

900

The issue of increasing pension payments is always relevant for all pensioners. The reform carried out in the pension system allows today to receive a pension formed from two components at once - the insurance and the fixed part.

The fixed part or payment, as it is now called, is a guarantee of receiving the minimum pension payments every month. And insurance savings are a kind of financial instrument for adjusting the amount of capital. The more a person worked and the higher his salary, the greater the insurance portion of his pension payments. Of course, provided that insurance contributions were made by the employer on time and in the amount required by law.

The dimensions of the fixed part are established according to government regulations. And they depend, first of all, on the income of the Pension Fund, as well as the state of the economy in the country. That is, indexation or adjustment of fixed payments is made depending on inflation indicators in the past year. And the insured amounts also depend on pension points. Therefore, the overall increase usually occurs in two stages.

- Situation in 2020

- Increase in payments for different categories

- Basic moments

- Adjustments and indexing - the difference

Social pension in Moscow

For the capital, the cost of living for a pensioner is set at 11,561 rubles. This is the minimum Moscow pension, taking into account social supplements in the region. It is already known that it is proposed to increase the cost of living for people of retirement age, which will increase the pension by 255 rubles, and it will amount to 11,816 rubles. This will be the minimum pension in Moscow in 2020.

This minimum amount is established for all Moscow pensioners, those who are registered at their territorial location or place of residence for a total period of less than 10 years. For the capital's old-timers, there is a specific amount that corresponds to the City Social Standard of Minimum Income.

Residents for less than 10 years at the place of registration

A person who, upon reaching retirement age, has lived in the capital for less than 10 years is considered a visiting pensioner, and he is not entitled to receive a Moscow bonus. For such citizens, pension payments are calculated based on the lowest cost of living in their region. If an elderly person is registered as an official resident of the capital for less than ten years, then he will receive only the approved subsistence minimum.

Registered in Moscow for over 10 years

The minimum old-age pension in Moscow for such a pensioner will apply when he has lived in the main city of Russia for ten or more years. To receive an insurance pension payment, a person must have eight or more years of insurance experience. Temporary registration does not affect changes in the amount of the subsidy; permanent registration is required. The period of Moscow registration with the districts equated to it is summed up.

What changes have occurred with indexing, and what awaits us in the future?

A pension is the funds on which we will have to live in old age for more than a year or two, which is why it is so important to know how the final amount of the pension is formed and what it will be for future retirees. In order to have a clear idea of your own pension, you need to know all the intricacies of how pension funds work and carefully monitor all contributions. In this article we will try to tell you about what has happened to pension payments over the past two years and what changes to expect in the future.

How the minimum pension will change in Moscow from January 2018

According to the latest data, the minimum payment to pensioners in Moscow will increase significantly. When calculating the insurance pension for 2020, total points are taken into account: the amount of the difference for the periods between the onset of retirement age and the actual date of retirement. Late registration of a pension will increase the pension coefficient. The table provides a comparative analysis of income growth:

| Name | 2017 Payment, rub. | 2018 Payment, rub. | Growth, % |

| Lowest GSS indicator | 14500 | 17500 | 21 |

The state will index the value of pension points with fixed bonuses. Main nuances:

- The increase in the minimum pension for Muscovites will begin on January 1, 2018.

- The amount of money paid to a pensioner will increase to 17.5 thousand rubles.

- The difference will be 3 thousand, this is a very noticeable increase in the social supplement for an elderly person.

Reasons for increasing pension payments

The minimum pension in Moscow in 2020 was affected by a decrease in real incomes of low-income citizens, plus there was an increase in prices for essential products due to the current level of inflation. The amount of the minimum payment determined for Muscovites no longer covers the needs of pensioners. The current mayor of the city, S.S., proposed taking action. Sobyanin. For approximately 43 thousand more citizens, new types of additional payments will be established that they have never received before.

Regulatory framework

Pensioners-Muscovites, along with other constituent entities of the Russian Federation, enjoy benefits based on articles of regulatory documents. Officials rely on regulations when determining the amount of cash payments. The minimum pension for Muscovites in 2020 is based on official government regulations:

- On October 31, 2017, the Government officially reviewed and submitted for implementation No. 805-PP “On establishing the amounts of individual social and other payments for 2020, on amendments to the resolution of November 27, 2007 No. 1005-PP.”

- From 01/01/2018, the coefficient of the city social standard (GSS) increases to determine the size of the regional social supplement to citizens’ pensions to 17,500 rubles, which is higher than 14,500 rubles previously indicated in 2016-2017, the increase will be 21%.

The growth of the city's social supplement for elderly people and the increase in benefits for the low-income population will affect more than 2 million Muscovites. In order to financially protect the population, monthly and one-time social benefits are officially increased for preferential categories, these include families:

- large families;

- low-income people with children;

- raising handicapped children (new benefit - annual compensation of 10,000 rubles for the purchase of children's school uniforms).

Principles of accumulation of labor pension

The generally accepted term “labor pension,” according to Russian legislation, refers to the amount of money allocated monthly to an insured citizen by the state. The formal basis for this is the need to compensate him for his salary or other lost benefits due to incapacity for work:

- old age;

- disability;

- death of the family's sole breadwinner.

General pension rule - two options

Moreover, in the first two cases, it is not necessary to justify the fact of the need to start paying a pension to the citizen, and in the latter, such a right is determined by the responsible service based on legislative norms.

Profile legislative framework

Before moving on to consider what parts and on what principles the amount in the calculation of pension savings is made up, let us define the legislative acts on the basis of which the Russian pension system operates today. Initially, this was one law for citizens of the Russian Federation, but after the reform of the pension system in 2013-15, two more specialized laws were added to it. As a result, the legislative framework includes three laws:

- legislative act N. 173-FZ / December 17, 2001. It regulates the calculation and payment of labor pensions;

- law concerning the insurance part of pensions - N. 400-FZ / 12/28/2013;

- federal legislative act explaining and regulating the calculation of the funded part of pensions - N 424-FZ. / 12/28/2013.

Pension reform and legislation for 2020

Important. For civil servants, law enforcement officers and the Ministry of Emergency Situations, elected deputies of federal legislative bodies, and military personnel and some other categories, pension issues are regulated by a separate act - Fed. Law N. 166-FZ / December 15, 2001

Current principles for calculating pensions

After the specified Federal Laws gained legal force in January 2015, the pension system began to be structured as follows: if the labor pension previously named in the main definition was considered as a single payment, then after the introduction of reform laws it was divided. So the actual labor payment became insurance, that is, guaranteed by the state, subject to the conditions specified in the law.

Important . In addition to it, since 2020, the so-called the savings part, which the future pensioner has the right to form independently, allocating 6% for this as deductions from salary (excluding income tax deductions).

Pension Fund employee calculates pension

If the employee does not share the accumulation, then the employer sends the entire amount of payments required by law (22 percent) to the Pension Fund of Russia. At the same time, 16% is taken into account in the employee’s individual pension account, and the remaining 6 go towards such an indicator as the size of the fixed payment.

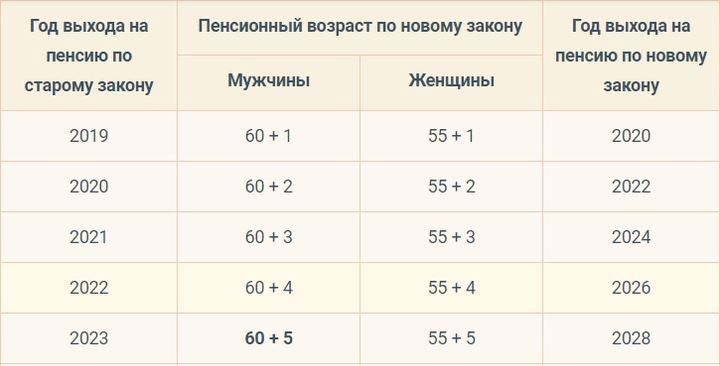

Post-reform increase in retirement age

In order to qualify for pension insurance (employment insurance), the employee must confirm:

- having a work experience of at least nine years, during which the employing company transferred an insurance contribution (contribution) to the accounts of the Pension Fund for the employee;

- a volume of accumulated pension fund points sufficient to pay a pension. Moreover, for 2020 the overall indicator should have been at least 13.8, and by 2025 it would increase to 30;

- for employees retiring after reaching retirement age, it is provided that for each year of work after reaching retirement age, bonus points will be awarded to him, which will also be reflected in the amount of the fixed part;

- the arrival of the statutory retirement age. Let us recall that in 2020 the President approved a bill stating that the age will be raised “every year, but gradually.” The following calculation is given for the coming period.

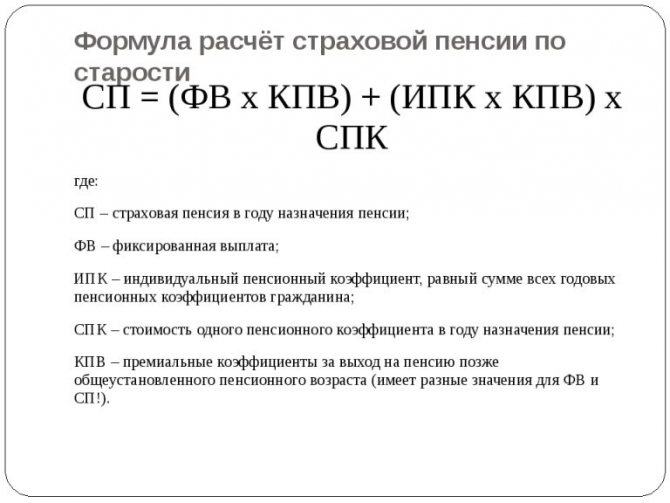

As a general rule, the calculation of the primary amount paid to a citizen as a pension is calculated using the formula:

Formula for calculating pension payments

At the same time, since points are awarded based on length of service, it is important to note that they mean not only the time the citizen worked, but also:

- period of service in the Armed Forces or internal troops (police, Ministry of Emergency Situations, customs);

- sick periods during work;

- decree. However, for this category there is a condition - the total period should not exceed six years;

- temporary downtime or unemployment due to legal re-registration or relocation of the employer's office;

- participation in public or social-labor activities;

- the period when the employee was subjected to illegal arrest or repression;

- the period of care and concern for citizens/citizens with disabilities due to disability or old age, after 80 years, as well as for disabled children;

- for wives of military personnel - time (up to 5 years) of garrison residence with their husband, without the possibility of getting a job;

- for wives and children of employees of diplomatic and consular missions during their stay abroad. Also up to 5 years.

Important. These periods can be included in the length of service only if the citizen presents the fact of employment before and after the specified period.

Minimum pension amount

In the capital, for elderly people, in addition to the social part established by the federal authorities, there are regional maximum increases. The final amount of the smallest additional payment is determined by the length of the pensioner’s stay in the capital. If you have 10 years of official registration, you can count on additional payment according to Moscow indicators. For the country, the basic indicator is 8,540 rubles, while for the capital it corresponds to the monetary equivalent of 11,561 rubles.

Non-working pensioners

The minimum social pension in 2020 for non-working Muscovites will increase by 7%. According to representatives of the Russian Pension Fund, such compensation will not cover the cost of living of an elderly person. It is expected that the social pension will be 9156 rubles, with an expected cost of living of 9364 rubles.

Working pensioners

Working pensioners have been waiting for indexation of pensions for a very long time. The hopeful summer 2020 increase did not materialize. For the coming period, nothing is known yet about indexation for older workers. One thing is clear: if you stop working, your payments will be indexed.

Examples of calculations

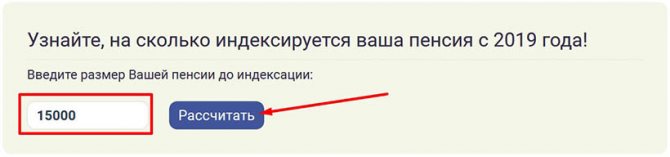

To understand how insurance payments with coefficients are calculated, you can see an example of calculating pension indexation. In the calculator, you should enter in numbers the payment that was accrued to the pensioner.

Then click the “Calculate” button. At the bottom of the “Calculation Results” window, a figure will be displayed - the amount of indexation (coefficient) and even lower - the amount will already be indexed.

The amount of the supplement is not indicated separately, although you may also find a form of calculator where they will separately write down the figure of how much is added to the pension. Payments can be made from anywhere in the country (Central Federal District, North-West Federal District, Volga Federal District, Ural Federal District, Southern Federal District, North-Kazakh Federal District, etc.). The service on the portal is provided completely free of charge and can be used at any time of the day.

What additional payments will pensioners receive in 2020?

The economic situation in the Russian capital is improving slightly, but this is least affecting low-income pensioners and families. For this reason, a decision was made on the necessary increase in social cash subsidies. Already from the beginning of the new year 2018, from the first day of January, all Muscovite pensioners will begin to receive the assigned new compensations. According to average indicators, they will grow up to 5 times. For these purposes, 47 billion rubles are allocated from the budget.

Certain categories of citizens

New amounts for certain categories of citizens will be paid every month; recipients’ cash accruals look like this:

- Faces of Moscow defense – 8000 rub.

- Veterans of labor and military service - 1000 rubles, home front workers - 1500 rubles, rehabilitated persons - 2000 rubles.

- Participants of the Patriotic War (1941-1945), disabled people of the Second World War 1941-1945. – partial compensation for food products from the basic necessary list – up to 2000 rubles.

- Persons who suffered from political repression and are rehabilitated will increase by double or more times the amount of compensation provided now.

- Heroic figures of the Russian Federation, USSR, Labor of the Russian Federation, Socialist Labor, full gentlemen with the Order of Glory and Labor Glory - 25,000 rubles.

- Widows (widowers) of heroes of the USSR, Russia, Labor of the Russian Federation, Socialist Labor, full gentlemen with the Order of Glory and the Order of Labor Glory - who have not entered into a subsequent marriage - 15,000 rubles.

- Additional lifetime financial remuneration for persons of retirement age with the title “Honorary Citizen of Moscow” - monthly 50,000 rubles.

- Persons of retirement age with the titles “People’s Artist of the Soviet Union”; “Honored Artist of the Russian Federation”; “Artist of the People of the RSFSR”; "People's Artist of the Russian Federation"; “Honored Artist of the RSFSR” – 30,000 rubles. - this is the new benefit.

For long-livers of the capital

Financial compensation is provided for long-livers of the Russian capital. Additional cash rewards await Moscow residents who are 101 years old or older. They will immediately receive from the state, on the occasion of their own birthday, a one-time gift income that will amount to 15,000 rubles.

One-time payment to families of marital anniversaries

The one-time compensation for celebrants will also increase due to their strong family life together. More than 15 thousand Moscow families will receive such a reward for love. Based on 2020, we can see that the growth of the gift amount will increase significantly. The comparison is shown in the table:

| Family one-time compensation for spouses celebrating anniversaries, years | Remuneration, rub. for 2020 | Remuneration, rub. for 2020 | Magnification factor |

| 50 | 10000 | 20000 | 2 |

| 55 | 11000 | 25000 | 2,3 |

| 60 | 12000 | 25000 | 2,1 |

| 65 | 13000 | 30000 | 2,3 |

| 70 | 15000 | 30000 | 2 |