Home > News > Deadlines for recalculating pensions after dismissal

19:22 04 July 2017

3 814

Starting from 2020, in order to reduce budget expenses, it was decided not to index the pensions of working pensioners, but they promised to compensate for the lost indexation in full after they stopped working.

In order to preserve the rights of working pension recipients, members of the State Duma prepared a bill to reduce the time frame for receiving the required pre-indexation to one month , i.e. the entire due amount will be accrued from the first month following the month of official termination of work.

On July 1, 2020, the law was signed by the President of the Russian Federation and posted on the Official Internet Portal of Legal Information. The law will come into force on January 1, 2020 .

For citizens who retired before January 2020, a different procedure will apply for receiving the required increase in the amount of pension benefits, which will be in effect until the adoption of the above federal law.

Indexation of pensions for working pensioners after dismissal

The departure of a citizen from the workplace leads to a recalculation of payments by the Pension Fund. The increase occurs most often. All indexations that began in 2020 are taken into account. Receiving a job again does not imply recalculation in reverse order. Because of this, social benefits are not reduced. But subsequent increases will be stopped until the citizen has a job again.

This is one of the anti-crisis measures. It often leads to people of retirement age agreeing to informal part-time jobs. Repeated dismissals and rehiring are permissible if employers do not object.

But only insurance pensions are subject to the indexation ban. If state support remains the main one, the recalculation is carried out in any case, regardless of the work. The Personal Account on the official website of the Pension Fund of the Russian Federation helps to obtain information regarding benefits intended for a particular person.

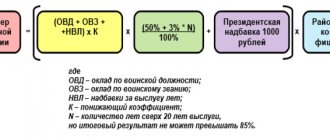

Formula for recalculating pension after dismissal: how much will be added

Representatives of the Pension Fund of the Russian Federation use a special formula for recalculating state pensions after the dismissal of working pensioners:

Pension after recalculation = (IPK1 + IPK2) × costIPK + FD,

Where:

- IPK1 is the number of pension points that were accumulated by a person at the time of assignment of a state insurance pension;

- IPK2 - part of the pension points accumulated by the pensioner during the period of work in retirement;

- CostIPK - the cost of one pension point, established on the date of dismissal from the last place of work of a senior citizen;

- PV is a fixed additional payment to the state pension, established at the time of the recalculation of payments.

According to the regulatory regulations establishing the rules for recalculating state pensions, the maximum increase factor is determined:

- coefficient 3 applies to citizens whose pension savings have been stopped;

- a coefficient of 1.875 is applied to people whose pension savings continued to be formed.

Until 2022, when recalculating the state insurance pension, the maximum IPC value of 3.0 is applied in connection with the suspension of the formation of a funded pension at the expense of insurance contributions for compulsory pension insurance (clause 4, article 33.3 of the law of December 15, 2001 No. 167-FZ; Article 6.1 of the Law of December 4, 2013 No. 351-FZ).

Calculation example.

Bukashka Anna Ivanovna received her pension in May 2020. IPC - 100 points. The state pension is 12,663.11 rubles. (RUB 78.58 × 100 points + RUB 4,805.11 (fixed payment)).

In August 2020, widespread indexation of pension income was carried out, the payment amounted to 13,131.65 rubles. (by 3.7%).

In the period 2017-2019, Bukashka continued to work and quit only in February 2020. During this time, another 15 points were accumulated.

The cost of the IPC 2020 is 87.24 rubles.

Fixed additional payment for 2020 - 5334.19 rubles.

In March 2020, the state pension after dismissal will be:

(100 + 15) × 87.24 + 5334.19 = 10,032.60 + 5334.19 = 15,366.79 rubles.

The procedure for indexing pensions after dismissal from 2018

90 days after termination of the employment contract - no earlier than this time a full recalculation will take place if the employer has no problems with timely sending data to the Pension Fund. Managers must submit reports monthly, in the first half of the current reporting period. Employees make the decision to pay an increased pension in the month following the period of last receipt of information.

The standard recalculation algorithm looks like this:

- An example is taken when a person quit in April.

- According to the text of the reporting for May, the citizen is still counted as working.

- Current data will be in documents issued for June.

- July is the month of pension indexation according to the decision of the Pension Fund.

- Payments are transferred for the first time in August.

Recalculation of pension upon dismissal of a working pensioner

Indexation of old-age benefits for a working citizen is suspended until he is fired. And upon termination of employment, the state is obliged to recalculate the insurance payments of the retired pensioner.

But there is a subtlety here: the recalculation will be done for the entire period of the person’s work (taking into account all indexations), but the new pension will be paid only from the date of dismissal. There is no point in waiting for the indexation payment for all past years to be paid retroactively - it will not happen.

Moreover, in 2020, there was a special procedure for recalculating pensions after the dismissal of a working pensioner: if a citizen quit on December 29, 2016, then he will be assigned an indexed pension only three months later, from March 29, 2017. Such instructions are contained in paragraphs 6 and 7 of Art. 3 of Law No. 358-FZ of December 29, 2015.

But since January 2020, changes have been in effect: a new, more profitable recalculation algorithm. Question: if a working pensioner quits, when will the pension be recalculated in 2020? The bonus, in accordance with Law No. 134-FZ dated July 1, 2017, will be accrued from the day following the date of dismissal. Please note that increased insurance benefits should not be expected in the month of termination of employment. The additional payment will be paid later, but in full.

IMPORTANT!

In August last year, representatives of the Pension Fund of the Russian Federation carried out an undeclared adjustment of payments to retired elderly people. The reform standard is determined by clause 3, part 2, part 4 of art. 18 of Law No. 400-FZ; clause 56 of the Rules, approved. By Order of the Ministry of Labor of Russia dated November 17, 2014 No. 884n. This means that a similar recalculation of pensions will be carried out in August 2020. Moreover, there is no need to submit any applications for increased payments to the Pension Fund.

Please note: if lawyers offer to help you recalculate your pension for a fee, they are most likely scammers! More details

Regardless of the date of retirement, a citizen does not need to contact the territorial fund with an application. As of April 2020, personal application is no longer required. The employer independently reports to the Pension Fund about the insured persons using the unified form SZV-M.

For what types of pensions is indexation prohibited?

The new rules do not apply to the following types of payments:

- Insurance pension.

- Fixed part.

When continuing to work, indexation is not applied to pensioners. They are not affected by the increase in security that occurs annually. The indexation coefficient itself was no exception. All payments of fixed types are subject to increase. Any citizen has the right to compensation with a larger amount as soon as his work activity ceases.

I am a working pensioner, I decided to quit on August 18, 2020.

Regarding compensation upon your dismissal, I would like to note here that neither federal laws nor the laws of your autonomous region provide for the payment of compensation to working pensioners.

You compensation payment can only be provided for by internal documents of the organization Article 8 of the Labor Code of the Russian Federation where you work. Therefore, regarding compensation, you need to find out from your HR department whether it is provided for in your organization. What kind of payments from the employer are 36 thousand rubles? This is exactly the compensation provided for in your organization. You need to write an application to receive this money addressed to the head of your organization

As for the size of the pension after dismissal, recalculation is possible on the basis of Article 23 of this law. You need to know the amount of your earnings to answer your question about the size of the pension

Federal Law of December 28, 2013 N 400-FZ (as amended on October 1, 2019, as amended on April 22, 2020) “On insurance pensions”

Article 23. Terms for recalculating the amount of the insurance pension, fixed payment to the insurance pension

1. Recalculation of the amount of the insurance pension, fixed payment to the insurance pension, except for the cases provided for in parts 4 and 5 of this article, is carried out:

1) from the 1st day of the month following the month in which circumstances occurred that entailed a recalculation of the amount of the insurance pension, a fixed payment to the insurance pension downwards;

2) from the 1st day of the month following the month in which the pensioner’s application to recalculate the amount of the insurance pension, the fixed payment to the insurance pension upwards was accepted.

2. A pensioner’s application for recalculation of the amount of the insurance pension is accepted subject to the simultaneous submission by him of the documents necessary for such recalculation, which must be submitted by the applicant taking into account the provisions of Part 7 of Article 21 of this Federal Law.

3. The body providing pension provision, when accepting an application for recalculation of the amount of the insurance pension, provides the person who applied for recalculation of the amount of the insurance pension with an explanation of what documents are at the disposal of other state bodies, local government bodies or organizations subordinate to state bodies or local self-government bodies , he has the right to submit on his own initiative.

4. The amount of the fixed payment to the insurance pension is recalculated in the following order:

1) when establishing a disability group that gives the right to a higher fixed payment to the old-age insurance pension or to the disability insurance pension, an increase in the fixed payment to the old-age insurance pension or to the disability insurance pension - from the date the federal institution establishes the medical social examination of the corresponding disability group without requesting from the pensioner an application for recalculation of the amount of a fixed payment to an old-age insurance pension or to a disability insurance pension on the basis of information contained in the federal register of disabled people or documents received from federal medical and social examination institutions;

(as amended by Federal Law dated October 3, 2018 N 350-FZ)

(see text in the previous edition)

2) when establishing a disability group, entailing a recalculation of the amount of a fixed payment to the old-age insurance pension or to the disability insurance pension downwards - from the 1st day of the month following the month for which the previous disability group was established.

5. Recalculation of the amount of the fixed payment to the old-age insurance pension in connection with the pensioner reaching the age of 80 years is carried out from the day the pensioner reaches the specified age without requiring an application from him to recalculate the amount of the fixed payment to the old-age insurance pension on the basis of data available to the body, providing pensions.

6. An application for recalculation of the amount of the insurance pension is considered no later than five working days from the date of receipt of the said application with all the necessary documents to be submitted by the applicant taking into account the provisions of Part 7 of Article 21 of this Federal Law, which he has the right to submit on his own initiative, or with the day of receipt of documents requested by the body providing pensions to other state bodies, local government bodies or organizations subordinate to state bodies or local government bodies.

7. In the event of an audit of the accuracy of the documents required for recalculation of the amount of the insurance pension, the failure of state bodies, local self-government bodies or organizations subordinate to state bodies or local self-government bodies to submit documents within the established period of time, the body providing pension provision has the right to suspend the period for consideration of the application until the completion of the verification , submission of documents requested from the specified bodies and organizations, but not more than three months.

8. In the event of a refusal to satisfy an application for recalculation of the amount of an insurance pension, the body providing pension provision, no later than five working days from the date of the relevant decision, notifies the applicant about this, indicating the reason for the refusal and the procedure for appealing and at the same time returns all the documents submitted by him.

Is it necessary to apply to the Pension Fund after dismissal?

The second quarter of 2020 was the time when the law was adopted, which made it possible to submit simplified reports for each employee. The tax service is responsible for informing the fund when it comes to terminating the work of self-employed citizens.

After dismissal, they also fall under pension indexation if the conditions are met. Citizens have the right to provide the necessary information independently. But it is not necessary to visit one of the Pension Fund branches in person; many types of reports support remote service.

Who is responsible for late recalculation of payments?

The changed amounts are applied to pensions in practice no earlier than three months after dismissal. But sometimes it happens that the specified period has passed, and the amount of payments has remained virtually unchanged. The problem has several causes and nuances.

Several types of errors lead to this state of affairs:

- The employer continues to send lists to the Pension Fund without updates, although the dismissal has occurred and is recorded.

- The Pension Fund itself did not carry out indexation within the specified three-month period.

The time for termination of employment agreements is at the beginning of the month. Then you just need to wait - with a high probability the citizen’s name will appear on the lists, but a little later.

Any employee has the right to check whether the employer is sending the correct information to the Pension Fund of the Russian Federation. Copies of the lists are sent to citizens upon presentation of the first request. The appearance of the slightest inaccuracies leads to fines being imposed on managers.

It is recommended to personally monitor the processes related to pension indexation. If, after three months, payments arrive without updates, you need to contact the Pension Fund employees to get clarification.

What about 3 months?

Where did this information about the three months during which you have to wait for indexing come from? The fact is that data from employers arrives at the Pension Fund with a delay. They submit the SZV-M report with data on employees on the 15th of the month following the reporting month. That is, if a pensioner quits in September, the Pension Fund will learn about this only in October, and will pay the pension, taking into account indexation, only in November. At the same time, paying compensation for the entire delay. This is where the rumor arose that the resumption of indexation must wait 3 months after dismissal.

The rumor that in order to receive the promised 7% increase in pension in 2020 is also unfounded, one must not work as of January 1st. Dismissal even at the end of 2019 or later will still return the pensioner the right to indexation and he will receive this 7% pension, regardless of the month in which he quit.

Therefore, all calls for dismissal in connection with the cancellation of past pension indexations are a provocation. Employees of the Pension Fund urge working pensioners throughout Russia to be vigilant and not fall for the tricks of scammers. In addition, employers were also warned against wanting to take advantage of this situation and get rid of older employees.

Receiving compensation for missed indexations

There is only one solution - stopping any work activity. Pensioners can quit without working off if they are employed. And if before going on vacation they had never used this right. The main thing is that the application says about retirement in connection with reaching the appropriate age.

Dismissal with work for three days is the right of pensioners who re-employed after dismissal. The application is drawn up in such a way that leaving work is the reason for the citizen’s own desires. A total processing time of 2 weeks applies to situations where detailed information is not available on applications.

Why will a pensioner who quits his job receive an increased pension only in the third month?

This is due to the peculiarities of reporting of Russian organizations to the Pension Fund and the intricacies of the functioning of the Fund itself.

To make it easier to understand what is happening, let's take a specific example.

Suppose pensioner Ivanov right now, in July 2020, understands that he can no longer work in retirement or is forced to resign by some other circumstances. He writes a letter of resignation from his job.

Then events develop like this:

- In July, pensioner Ivanov quits his job and receives a paycheck.

- In August, his former employer submits a monthly report to the Pension Fund about its employees. In this report, Ivanov continues to appear as an employee, even if he officially worked for only one day.

- In September, the company where pensioner Ivanov worked again submits a report to the Pension Fund, where Ivanov is no longer listed as an employee of the company. This is how the Pension Fund becomes aware of the dismissal of a working pensioner and his right to recalculation.

- In October, pensioner Ivanov will receive an increased pension, the amount of which will take into account all those indexations that have passed the pensioner by. In a word, this is the pension that citizen Ivanov would have received if there had been no freeze.

A pensioner who quits his job does not need to write any special statements. The Pension Fund will increase your pension automatically.

What is the difference from last year? The pension fund does not immediately learn about the dismissal of a pensioner, and does not immediately recalculate the pension associated with this. The increased payment is received by the pensioner only in the third month.

The difference is that starting from 2020, the right to an increased pension in any case arises the very next month after leaving work.

Yes, the peculiarities of companies’ reporting to the Pension Fund of the Russian Federation are such that the Pension Fund will not be able to pay the indexed pension immediately. But pensioner Ivanov from our example in October will receive not only a higher pension for October, but also the difference between the old and new pension amounts for August and September. Just last year, pensioners after dismissal did not have such compensation for the first two months.

The reporting features described above also suggest to retirees that in some cases it is more profitable to quit at the end of one month rather than at the beginning of the next. Even if a person worked or was listed as working only on the first day of a month, and was already fired on the second day, in any case he is included in the company’s report for that month as an employee. This means that, in fact, he will have to wait a month longer for the recalculation of his pension after dismissal.

After dismissal: what can you do?

The recalculation may be canceled if the job registration takes place before the indexation itself is completed. Then the citizen is again given the status of a worker. It doesn’t matter whether we are talking about an old or new place of work. The Pension Fund of the Russian Federation receives the necessary information in any case.

It's best to rest for the first 90 days. And in the fourth month you can get settled again. It is enough to make sure that the recount is completed.

Dismissal gives pensioners the right to annual August indexation. The maximum amount for accruals is three pension points. Their prices are adjusted annually.

Do I need to resign to index my pension?

There are several tips to make finding the right solutions easier:

- You should make your own decisions about the possibility of dismissal and the correctness of this approach.

- The main thing is to make at least approximate mathematical calculations.

- It must be remembered that there are benefits for working pensioners.

The increase will be more noticeable if the pension itself is significant and indexation has been missed many times. Experts recommend writing applications if you are confident in your ability to live on one allowance without increases. If your health and strength allow it, then you can think about staying.

List of documents for the Pension Fund of the Russian Federation

In most cases, a passport and SNILS are enough to carry out recalculations in accordance with all the rules. You must submit an application to initiate the process. The document is handed over to one of the employees - during personal visits, or through representatives. It is acceptable to contact MFC employees to send documents. The same can be done using mail or the official website of the Pension Fund.

The following information is included in the text of the statements:

- List of papers that were used as evidence.

- Reasons why the procedure had to be started.

- Passport details.

The authorities give the inspector 5 days to study all the information provided. Then a decision is made, positive or negative.

On changes to the law by 2019

Starting from January 1, 2020, accruals to pensioners are planned to be made immediately, from the 1st day of the month following the time of dismissal.

As before, the procedure for approving an application in such a situation will take at least three months. But for this entire period, money will be compensated without fail.

Refusal to pay pensions to working pensioners is a proposal discussed by the State Duma on an ongoing basis. At least this will affect those who annually receive income only from work in the amount of 1 million rubles or more.

Comments (19)

Showing 19 of 19

- Lyudmila 01/26/2020 at 15:09

We working pensioners are outraged that our pensions are not indexed. We work and PF contributions are 22%. And those who do not work take care of themselves and their health.answer

- Svetlana 01/26/2020 at 17:31

Don't say that. I wrote an appeal to the Presidential Administration. And, naturally, they referred to the 2020 law. Of course it's not fair. We replenish the treasury, and we have nothing. It would be nice if they would return the entire amount that the person lost after leaving, but no - only from the moment of leaving.

In general, all production relies on pensioners. Young people do not want to work in low-paid jobs. A pensioner is always ready, but he is also discriminated against. Therefore, many people get hired without registering, so as not to lose on indexation. Where's the justice? In August I will receive an increase of 53 rubles, and a non-working person will receive 1000. Even if with a good salary they increase by 3 points, and this is 3 × 78. That's it.

answer

- Alexey 02/08/2020 at 16:00

My mother receives a pension of 7,094 rubles; she has to work because she can’t even survive on that kind of money. I try and help as much as I can. So very bad thoughts come. I want to curse the entire Government and everyone in power. How are you already annoying everyone with your increases, which affect everything: food, housing and communal services, gasoline, etc. You'll cut back and tighten your bellies there, otherwise you'll never get your salary. I am ashamed to live in a country where a deputy talks about an increase of 1000 rubles, and this is only for those who do not work. Our country is the richest, it’s just a pity that people are poor.

answer

Those who work all their lives make insurance contributions... The proverb is right: whoever is lucky, gets the heap on him. Very unfair treatment of working pensioners.

answer

Most pensioners are forced to work in order to somehow have enough to live. It’s either a debt trap, or the children have problems. Why do we work and are not paid our full pension? I have more than 50 years of experience, but I am forced to work because of debts. At one time I went out of business, and the children need help, they also have a mortgage, children and problems. Not only do they deduct 50% from the pension and salary. payments, and they do not pay an honestly earned pension. When will we have justice? And why is there not enough money in the budget for working pensioners?

answer

We work because pensions are low - 12 thousand rubles. It’s good if 2 pensioners live. What if you live alone? Salary 12 tr. and pension 12 tr. - and still poverty. I can’t cover the roof, it’s leaking, I need 100 thousand rubles. At such prices, the family income should be at least 70 thousand rubles. Utilities 6 thousand rubles. per month. I can’t replace the TV, it’s antediluvian, 20 years old. Horror! Who are you saving on?

We work and live in rural areas. Land plot of 50 acres, we will grow products - no sales. There are only losses from cows and piglets. There is no sales of products either. Where else can you earn money, tell me, if you are so smart? Why does my neighbor (non-working pensioner) live with her husband, it’s easier for her, she gets indexation, but I don’t (single)? But I have children and grandchildren who study at universities for a fee and have taken out mortgages for housing. And they need help - I won’t get help from them either. So we live in poverty, and they still don’t pay me extra (indexation), which is what I’m supposed to do. Very disappointing and unfair. At least they reconsidered, if the income exceeded 50 thousand, you can not pay indexation, but not 23 thousand rubles.

answer

Olga 01/31/2020 at 11:01

I completely agree and support the option of indexation for those working whose total income is not even 50 thousand rubles, but less than 30 thousand rubles.

answer

My pension is 13 thousand rubles, my salary is 12 thousand rubles? utilities about 7 tr. To buy anything other than food, you have to earn extra money, but in rural areas you can’t earn much, and we really need indexation. And I am in favor of adding at least those who have a total income of less than 30 thousand rubles.

answer

We work not because we want to, but because pensions are low - 12 thousand rubles. Try to live! And I'm also paying the mortgage. Where is the justice? I earned a pension and raised two children alone. And so I saved on everything, I thought that at least in retirement I could afford something, but no. The state decided that it would be good for me: both a pension and a job. It's a shame and unfair! Almost 40 years of experience.

answer

Everything is contrary to the Constitution. The constitutional courts will be overwhelmed with work. Have I earned a pension? and it decreases. It is being eaten up by inflation. It is legal?

answer

Tired of listening to lies. It is we, pensioners, who earned our pensions. The government forgot that we had monthly deductions from our salaries throughout the years. And there is no need to say that we are parasites on the current working population, especially since we also work, and we are also charged taxes. All this talk about indexation for working pensioners so that they can come to the referendum and vote “yes”. They will still deceive you.

answer

I have been receiving a service pension since 2014. I have been working as a physical education teacher since 1986. I still have 9 years until retirement. Yes, I am still full of strength and can work. Yes, my students take prizes in the district and region. Once I was subject to indexation, I was assigned a pension of 7,235 rubles, now I receive 9,036 rubles. And the pension is according to certificate 11036. I pay income tax of 13%, and they contribute to the pension fund for me. And we don't care about indexing. And it’s not a fact that the lost money will be returned if you retire.

Why don’t the deputies and ministers and the entire gubernatorial band of brothers and bureaucrats adjacent to them freeze their additional payments? What do they want? So that the people rise up? And how can I respect such a state and government?

answer

As I understand it, indexation is paid for my 40 years of experience. Or I'm wrong? And why do the Duma and the Government care about my official work? My organization pays taxes regularly, including to the pension fund. Independent economists have calculated that these payments are quite enough to pay indexation to working pensioners. And there is no need for us to “powder” our brains. We demand our due for 40 years of experience and the desire to continue working and not lie on the couch.

answer

Why such injustice? I worked in the north, pension was 16,000, I work now - 15,000. Yes, one might say, great money. Let's calculate the rent (yes, I receive compensation) plus loans. We lived in the north, earned an apartment in a residential complex. You probably don't know what it is. This is a youth housing complex. During the day they worked at their main job, and in the evening at a construction site for free in order to get an apartment. We retired and decided it was time to move. Our apartments at the Boguchanskaya hydroelectric power station cost pennies in Krasnoyarsk. We took out a loan, now we’re working and working off it. I would also like to sit at home and spit at the ceiling.

I work, there are deductions, but where do they go? Not working. I'm not against non-working people, it's their right. But don't offend me. As one of the Government said, working pensioners live richly and what indexation. Laughter, in August they will add 261 rubles, so what? I’ll buy an extra liter of milk a month. Bravo. The Pension Fund buys expensive cars, buildings, luxury renovations for work, they steal (they just shake a finger and that’s it), etc. And I have no money. Maybe the Government will think about it or try to live like us for at least a month.

answer

The state itself creates deception. Many pensioners work unofficially, receiving a gray salary and a full pension with indexation. It’s a shame for pensioners who worked honestly and conscientiously all their lives, replenishing the state treasury, which is what officially working pensioners are doing now. And our Government thanks them for this in a very “original” way. Many pensioners have never worked, took care of their health, received a minimum old-age pension, and now their pension has already become higher than the pensions of workers with 40 years of experience.

answer

Don't make empty promises, gentlemen in power. We will not vote for you!

answer

I am sure that every working pensioner hopes for a fair decision by the Government to return the compensation debt for all years. Most people work after retirement due to lack of funds for living, so it is unfair to deprive them of compensation.

answer

I am 70 years old. More than 50 years of production experience. What is happening with the pensions of working pensioners is a negative example for modern youth. The children say: “Why did you father work all your life, lose your health, become disabled, and yet you receive a pension of 20 thousand rubles?” It’s better not to work, get a decent salary now and stay healthy. And then work out the minimum length of service for a pension and receive a free pension supplement. The one who didn’t work is sitting on a bench near the entrance, healthy and laughing at you. Their pension is greater than yours, because... you work and what you get, you spend on medicine. The conclusion is that the state will always deceive. You won’t live to see compensation; you’ll die at work.”

answer

It is a shame to live in a country where people, having reached retirement age, are forced to work until they die, since it is not only impossible to live on this pension, but also to die. And again, another deception with indexation for working pensioners, as much as possible... Not only do they try to “heat it up” in every possible way when applying for a pension, but after that they come up with any tricks just to humiliate.

My husband worked in a military unit as a civilian employee. So when the time came to retire, the archives reported that the data of this military unit on the calculation of salaries was flooded by the sewer system for as long as 33 years. In this regard, he was awarded the minimum pension and there was no one to blame... Swallowed...

And the pension age reform is a complete comedy. It was said - “smooth increase”. Yeah, it’s smooth - I had two years left before the reform, and three more were added. In a word, they do what they want.

answer

Share your opinionCancel reply

Read other news on this topic

- 334 28.02.2020

Indexation of pensions for disabled people in 2020

The scheme for increasing pensions in 2020 provides for indexation for disabled people of groups 1, 2, 3 and disabled children.

- 1 320 07.06.2019

Recalculation of pensions above the PMP

April 01, 2020

- 921 20.07.2020

Pension increase in 2021

Non-working pensioners receiving any type of insurance pension (old age, disability or loss of a breadwinner) will have their assigned pension payments indexed in 2021.

All news

How can I find out about the amount of future payments after dismissal?

One of the acceptable options is to issue a certificate or extract in your Personal Account, on the official website of the Pension Fund. To do this, you will need to register on the State Services website and log in there.

Obtaining certificates involves completing the following steps:

- Visit your Personal Account on the Pension Fund website.

- Go to the Pensions section. Next, select the item “Order a certificate of pension amount.”

- A window will open where all you have to do is click on the “Request” button.

- In the “request history” section, citizens are shown the result of the request.

The result is information regarding the standard amount of pension payments and compensation for the period while the job is maintained. From the same certificates they will learn what compensation will be after dismissal. Contacting the Pension Fund client service also opens access to the document and the information contained in it.

Transition from social pension to insurance

Those with at least 5 years of work experience are paid an insurance or labor pension. The main thing is to take into account the time when the contributions were transferred. The social pension is assigned a minimum amount for those who have no work experience. Therefore, this collateral option is less profitable.

If you have work experience, at least in a minimal amount, it is always recommended to switch from a social pension to a labor pension. You can complete the required time even after reaching the appropriate age limits.