According to the latest information, it is known that Vnesheconombank is engaged in servicing more than 55 million future pensioners of the Russian Federation. This list was also supplemented by those people who were undecided on their own choice of one of the portfolios provided by the state management company (GMC) or some private financial companies.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

8 (800) 700 95 53

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

Having invested funds, the State Management Company determines the method of their investment in order to guarantee maximum profit growth while maintaining minimal financial risks.

Private management company

Pension savings can be transferred to a private management company. Provided that an agreement on trust management of pension savings funds has been concluded between it and the Pension Fund of the Russian Federation. This agreement is concluded only with companies that have won a special competition.

This procedure is established by subparagraph 1 of paragraph 1 of Article 31 and paragraph 1 of Article 19 of the Law of July 24, 2002 No. 111-FZ.

When moving to a private management company, you can also choose the investment portfolio that, in the person’s opinion, is capable of ensuring the safety of pension savings and increasing them. This can be done provided that the management company offers more than one investment portfolio to choose from. This follows from subparagraph 1 of paragraph 1 of Article 31 of the Law of July 24, 2002 No. 111-FZ.

Situation: is it possible to transfer part of pension savings to one management company, and part to another?

Answer: no, you can't.

The Pension Fund of the Russian Federation transfers all pension savings to the organization chosen by the person (i.e., all funds accounted for in a special part of the individual personal account). This procedure follows from paragraph 2 of paragraph 2 of Article 34 of the Law of July 24, 2002 No. 111-FZ.

This is confirmed by the application form for choosing an investment portfolio (management company), approved by Resolution of the Pension Fund Board of January 21, 2020 No. 9p. It states that all pension savings are transferred to the management company.

Thus, pension savings can be transferred to only one management company.

Investment of money by the Pension Fund of the Russian Federation

If a person has never transferred pension savings either to a private management company or to a non-state pension fund (NPF), or has not submitted an application to select an investment portfolio in a state management company, then the Pension Fund of the Russian Federation invested them by default:

- into the investment portfolio of government securities of a state management company (for those who began forming pension savings before August 2, 2009);

- into the expanded investment portfolio of a state management company (for those who began forming pension savings after August 2, 2009).

This procedure follows from paragraph 4 of Article 14 and paragraph 1 of Article 34 of the Law of July 24, 2002 No. 111-FZ, parts 4–5 of Article 4 of the Law of July 18, 2009 No. 182-FZ.

Portfolio of Alfa Capital Management Company

Pension savings from the Pension Fund: 2,800,839,280.58 rubles

Yield for 1 year: 5.35%

Return for 3 years: 10.17%

The average yield by the end of 2020 was 4.74%, which corresponds to the results of the previous reporting date (4.75%), and more than half as low as 9.67% a year earlier.

Changes in macroeconomic indicators, primarily the dynamics of inflation and the policy of the Bank of Russia regarding the dynamics of the key rate, had a fundamental impact on the result.

Change of management company

Management companies and investment portfolios can be changed annually (clause 1, article 32, clause 2, article 34 of the Law of July 24, 2002 No. 111-FZ).

Your choice between investors for the next year must be made before December 31 of the current year (submit an application to the Pension Fund of the Russian Federation). For example, before December 31, 2020, you need to decide who to entrust pension savings for 2020. This follows from paragraph 4 of Article 32 of the Law of July 24, 2002 No. 111-FZ.

An exception is provided for citizens who decide to pay additional pension contributions, but do not have pension savings or they are not invested. Such citizens have the right to decide on an investor at the stage of submitting an application for payment of additional pension contributions. This procedure is established in Article 11 of the Law of April 30, 2008 No. 56-FZ. For more information about paying additional pension contributions, see How to start making additional contributions to a funded pension.

Accounting for pension funds

In general, it can be assumed that asset management by the state-owned company, VEB, is more conservative. It's her choice that makes it preferable in times that are tough for the economy, that is. during periods of recession. And private management companies can achieve better results when the economy is booming. In practice, citizens can choose a management company for their own pension savings no more than once a year: the application is submitted before December 31 of the current year in order to transfer the money to the next year.

Accounting in both options for managing pension savings is carried out by the Pension Fund. However, there is a third option - transfer them to a non-state pension fund. There are a total of 117 such funds registered in Russia as of October 2011. Typically, these are either industry funds, for example, LUKOIL-Garant, NPF Mosenergo, Transneft, and so on, or funds that are created by the management companies themselves or banks: NPF Renaissance Life and Pensions, NPF Raiffeisen, NPF Sberbank and so on. Be that as it may, asset management will be entrusted to the same management companies that have the necessary licenses. At the same time, when a non-state pension fund is selected, they will not be taken into account by the Pension Fund.

Within the framework of the 2002 pension reform, citizens were given the opportunity to transfer part of their pension contributions, the accumulative component of the labor pension, to a personal individual accumulative pension account and the choice of investing these funds through a state management company (Vnesheconombank) or a private management company

The profitability that can be acquired by working with non-state management companies is potentially higher than that of a state-owned company. The increase in investment returns is ensured due to a wider list of investment instruments in which it is allowed to invest funds, an active investment policy - private management companies will try to most dynamically monitor changes in the market value of securities, purchase investment instruments at the lowest price, and sell them at the highest prices. The resulting investment income will be used to increase the funded part of the pension of all future retirees. This is important because

funds and pension savings themselves are reliably protected.

Firstly, the guarantee of the security of funds lies in the fact that pension savings are invested within the boundaries of a strict investment declaration.

Please note that the state keeps records of all pension savings transferred to the management of private management companies. In this way, the state, represented by the Pension Fund, will bear responsibility for saving funds.

Secondly, all pension savings that are transferred to management companies are insured in accordance with the requirements established in the agreement with the Pension Fund.

Thirdly, the work of management companies in managing pension savings is regulated by an authorized independent body - a special depository, without whose permission the management company cannot carry out a single transaction.

Application for choosing a management company

Submit an application for choosing an investment portfolio (management company) to your branch of the Pension Fund of the Russian Federation. For information about which branch of the Pension Fund of the Russian Federation residents of Moscow and the Moscow region should apply to, see the table.

To transfer pension savings to a private management company, Vnesheconombank, or change the investment portfolio, an application can be submitted:

- on paper in the form approved by Resolution of the Pension Fund Board of January 21, 2020 No. 9p;

- electronic.

This is established in paragraphs 2 and 4 of Article 32 of the Law of July 24, 2002 No. 111-FZ.

Fill out the application in accordance with the Instructions approved by the Resolution of the Board of the Pension Fund of Russia dated May 12, 2020 No. 157p.

The paper application for the selection of an investment portfolio (management company), in particular, indicates:

- applicant's details (full name, date of birth, insurance certificate number);

- data of the management company where pension savings are transferred;

- name of the investment portfolio (if the company offers more than one option).

The Pension Fund of the Russian Federation places the application form and instructions for filling it out no later than September 1 of the current year on information stands in its territorial branches, as well as on the Internet. For example, on a single portal of state and municipal services. At a citizen’s request sent to the Pension Fund of the Russian Federation via the Internet, the application form and instructions for filling out will be sent in the form of an electronic document.

This procedure follows from paragraph 3 of Article 32 of Law No. 111-FZ of July 24, 2002, paragraphs 2–3 of the Procedure approved by Order of the Ministry of Finance of Russia of August 30, 2005 No. 109n, Instructions approved by the Resolution of the Board of the Pension Fund of Russia of May 12, 2020 city No. 157p.

Situation: is it necessary to submit an application for choosing an investment portfolio (management company) if a person wants to leave pension savings in the same management company for subsequent years under the same conditions?

Answer: no, it is not necessary.

Last year's statement will be valid for all subsequent years until the person wants to make changes. All newly received amounts of pension savings will be transferred to the selected management company. This follows from paragraph 1 of Article 32 of the Law of July 24, 2002 No. 111-FZ.

Situation: what should a person do who has submitted an application to choose a management company for pension savings, but later decided to change his decision? The deadline for submitting applications to the Pension Fund has not yet expired.

Submit another application to your branch of the Russian Pension Fund.

The Pension Fund of the Russian Federation will consider the application with the latest submission date. Provided that it is submitted before December 31 of the current year. The department will ignore the remaining applications (no matter how many there are).

This follows from paragraph 4 of Article 33 of the Law of July 24, 2002 No. 111-FZ.

Attention: the Russian Pension Fund will refuse to satisfy all applications received on the same day.

This rule applies if the following were received at the same time:

- several statements about the choice of investment portfolio (management company);

- application for choosing an investment portfolio (management company) and application for transfer to a non-state pension fund.

This follows from paragraph 7 of paragraph 3 of Article 33 of the Law of July 24, 2002 No. 111-FZ.

Retirement

Retirement is a long-awaited, exciting moment in a person’s life. A kind of summing up of one period of life and transition to another. How you prepare for it will determine your level of quality of life in retirement.

The essence of retirement.

The essence of retirement is to change your ideas about many things in life. This may include moving to a new permanent place of residence, changing the type of activity, and increased attention to one’s health.

When to start preparing for retirement?

Preparing for retirement must begin early. About a year or two before release. However, if you are planning to move to a new permanent place of residence, then it is better to start preparing about five years before retirement.

Determination of place of permanent residence.

Each person has his own criteria for choosing a place of permanent residence. However, there are general approaches to solving this issue. When choosing a permanent place of residence, you should be guided by the following criteria:

- safety of residence;

- proximity to medical facilities;

- accessibility of stores with everyday goods;

- transport accessibility of the home.

I have developed criteria for choosing a place to live in retirement in the form of a “Happy Life” mind map. We chose our house and place of residence in strict accordance with this map.

Do you want to get a free “Happy Life” mind map? Click to open a window.

Purchase and arrangement of housing.

Many people want to change their place of residence in retirement. They do this for various reasons. Some need to change the climate for medical reasons. Others want to be closer to nature and a piece of land.

For whatever reason you choose where to live, you need good housing. After all, you will live in it for many years.

Therefore, the choice of housing must be approached with all seriousness. You need to buy it in advance so that you have time to arrange it well by the time you move.

Reviewing assets and preparing them for retirement.

During your active life, you created assets in accordance with the pension plan. You chose them in such a way that they would give the maximum profitability at your risk level.

However, before you retire, you need to review your asset portfolio. In retirement, you should only have safe, risk-free assets.

Closing debt obligations.

Nowadays, many people actively use credit throughout their lives. This is normal if there is a stable, powerful financial cash flow during work.

However, after retirement, cash flow declines. Therefore, the debt burden should be reduced. In the best case scenario, all loans should be closed before retirement.

Regulating relations with relatives.

During our lives, each of us develops certain relationships with our relatives. Including financially. Some help their children get back on their feet, some help their brothers and sisters or their parents.

When you retire, you will not be able to fulfill all your previously assumed obligations. Therefore, you need to clearly define these obligations with your relatives.

Planning and preparing for life in retirement.

What is the best way to prepare for retirement? About five years before the event, make a plan to prepare for retirement. And do it slowly and wisely. This way, by the time you retire, you will have settled all the issues of transition to a different lifestyle. The psychological impact will be minimal.

Application methods

An application can be submitted:

- personally;

- through a representative (legal or authorized);

- through a transfer agent;

- through an organization (employer);

- by mail;

- through the MFC;

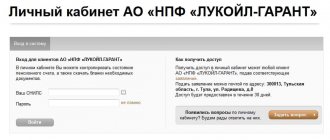

- in electronic form, by filling out an interactive form on the Unified Portal of State and Municipal Services or in the Personal Account on the website of the Pension Fund of the Russian Federation.

This follows from paragraph 4 of Article 32 of the Law of July 24, 2002 No. 111-FZ and paragraph 3 of the Instruction approved by the Resolution of the Board of the Pension Fund of Russia of May 12, 2020 No. 157p.

Situation: is it possible to submit an application for choosing an investment portfolio (management company) for pension savings, handwritten, typed on a typewriter or computer?

Answer: yes, you can.

However, in this case it is necessary to proceed from the application form for the selection of an investment portfolio (management company), approved by Resolution of the Board of the Pension Fund of the Russian Federation dated January 21, 2020 No. 9p. That is, list all the necessary details and take into account the location of this data in the original form.

This follows from paragraph 2 of the Instruction, approved by Resolution of the Board of the Pension Fund of Russia dated May 12, 2020 No. 157p.

Submitting an application through an organization

Only persons who have decided to pay voluntary pension contributions and submit an application in the form DSV-1 (approved by Decree of the Government of the Russian Federation of July 28, 2008 No. 225p) can submit an application for choosing an investment portfolio (management company) through an organization (employer).

This is established by paragraph 4 of Article 32 of the Law of July 24, 2002 No. 111-FZ, part 1 of Article 4 and part 2 of Article 11 of the Law of April 30, 2008 No. 56-FZ.

The receipt of the application must be confirmed.

Applying in person

If you bring an application to the Pension Fund of the Russian Federation in person, through a representative or employer, agency employees are required to issue a receipt indicating that they received it. The form of the receipt was approved by Resolution of the Board of the Pension Fund of the Russian Federation dated May 2, 2007 No. 101p.

The services of a transfer agent are free for the applicant - they are paid for by the Pension Fund of the Russian Federation (Section 7 of Appendix 1 to Order of the Ministry of Finance of Russia dated August 21, 2003 No. 79n).

Submitting an application electronically

An application for choosing an investment portfolio (management company) can be submitted electronically by filling out an interactive form through a single portal of state and municipal services or a Personal Account on the website of the Pension Fund of the Russian Federation. The procedure for filling out the interactive form is prescribed in the Instructions approved by Resolution of the Board of the Pension Fund of Russia dated May 12, 2020 No. 157p.

The conditions that must be met for one or another application method are given in the table.

Decision of the Pension Fund of the Russian Federation

Having received an application for choosing an investment portfolio (management company), the branch of the Pension Fund of the Russian Federation can:

- satisfy the application;

- refuse the application;

- leave the application without consideration.

Employees of the Pension Fund of the Russian Federation must notify the person about the decision made by March 31 of the year following the year in which the application for choosing an investment portfolio (management company) was submitted. If a person submitted an application via the Internet, then the Pension Fund of the Russian Federation also sends a corresponding notification in the form of an electronic document.

This procedure is established in paragraph 2 of Article 33 of the Law of July 24, 2002 No. 111-FZ.

For reasons for refusing to approve or consider an application, see the table.

Situation: what should a person do if the Pension Fund of the Russian Federation did not notify him of the decision made on the application to select an investment portfolio (management company) for pension savings?

Please contact the Russian Pension Fund with a written request for clarification of the situation.

Employees of the Pension Fund of the Russian Federation must notify the person about the decision made by March 31 of the year following the year in which the application for choosing an investment portfolio (management company) was submitted. Moreover, if a person submitted an application via the Internet, then the Pension Fund of the Russian Federation also sends a corresponding notification in the form of an electronic document. This follows from paragraph 2 of Article 33 of the Law of July 24, 2002 No. 111-FZ.

The Pension Fund of the Russian Federation may not notify a person about the decision made on the application to select an investment portfolio (management company), for example, if:

- the application is granted;

- the application was not received by the Pension Fund of the Russian Federation;

- The applicant’s data is incorrect (it is unknown to whom and where to send notifications).

Therefore, in order to find out the reason why the Pension Fund of the Russian Federation did not notify a person of its decision, you need to contact him with a written request. Employees of the Pension Fund of the Russian Federation are required to provide a response within three months from the date of receipt. This procedure is provided for by paragraph of Article 33 of the Law of July 24, 2002 No. 111-FZ.

Situation: what to do if the Pension Fund of the Russian Federation unlawfully refused to accept (left without consideration) an application for investing pension savings?

Submit a written complaint to the branch of the Pension Fund of the Russian Federation that refused to satisfy the application (leaving it without consideration) or to a higher division of the Pension Fund of the Russian Federation (Articles 2 and 8 of the Law of May 2, 2006 No. 59-FZ).

You can file a complaint:

- on paper;

- electronic.

This follows from paragraph 1 of Article 4 of the Law of May 2, 2006 No. 59-FZ.

Regardless of the method of filing a complaint, state the current situation and give your arguments.

When filing a complaint electronically, be sure to include the following:

- your last name, first name, patronymic (if any);

- your postal or email address (depending on which of the specified addresses you want to receive a response to).

Please attach to your complaint:

- application for the selection of an investment portfolio (management company), which was submitted to the Pension Fund of the Russian Federation;

- notification of refusal to satisfy the application (about leaving the application without consideration), which was sent by the Pension Fund of the Russian Federation.

When filing a complaint on paper, attach the documents as copies.

If the complaint is submitted electronically, submit the documents:

- in electronic form along with the complaint;

- separately on paper in the form of copies or originals.

This follows from Article 7 of the Law of May 2, 2006 No. 59-FZ.

The Pension Fund of the Russian Federation is obliged to respond within 30 days from the date of registration of a person’s written request. In exceptional cases, the period may be extended by no more than 30 days with notification of the citizen who filed the complaint. This procedure is provided for in paragraph 3.1 of the Instruction, approved by Resolution of the Pension Fund Board of November 2, 2007 No. 275p, Article 12 of the Law of May 2, 2006 No. 59-FZ. In addition, the Pension Fund of the Russian Federation, based on the results of consideration of the appeal, must take measures if the applicant’s rights have been violated (clause 1 of Article 10 of the Law of May 2, 2006 No. 59-FZ).

The main components of pensions for citizens of the Russian Federation

| Cumulative | Insurance | |

| Formation process | In monetary terms | In conditional points, the price of which will vary depending on the economic situation |

| Where | In the process of investment | From the contribution of working citizens |

| What does it represent? | Funds deposited into a bank account | State obligations for the distribution of funds among citizens |

| Indexing process | Depends on the level of return on investment | Focusing on the current demographic and economic situation in Russia |

| Possibility of inheritance | Maybe | Impossible |

See what documents are needed to obtain SNILS. What does the value of a pension point mean? Find it at the link.

Satisfaction of the application

If the Pension Fund of the Russian Federation has satisfied the person’s application, then no later than March 31 of the year following the year in which the application was submitted, the pension savings will be transferred to the selected management company (clause 1 of Article 34 of the Law of July 24, 2002 No. 111- Federal Law).

The pension savings of citizens who submitted an application for choosing an investment portfolio (management company) simultaneously with an application for payment of additional pension contributions will be transferred within three months from the day the Pension Fund of the Russian Federation received the corresponding application (Part 3 of Article 11 of the Law of 30 April 2008 No. 56-FZ).

Portfolio of Management Company Leader

Yield for 1 year: 6.84%

Return for 3 years: 11.18%

The largest companies that left the list of participants in the rating: Management Company "AK BARS Capital" (NAV for the 3rd quarter - 2,068.44 million rubles), Management Company "BFA" (NAV for the 3rd quarter - 1,211.87 million rubles .) and TKB Investment Partners (NAV for the 3rd quarter – 668.34 million rubles)

Notice from the Pension Fund of the Russian Federation

The Pension Fund of the Russian Federation sends notification about the status of an individual personal account and about the results of investing pension savings only when a citizen applies for this information. This information must be sent within 10 days from the date of application and can be provided both on paper and in the form of an electronic document.

This procedure is established in paragraphs 2 and 3 of Article 32 of the Law of July 24, 2002 No. 111-FZ and paragraph 9 of Article 16 of the Law of April 1, 1996 No. 27-FZ.

A reliable financial management option

Vnesheconombank (VEB) has been doing an excellent job of managing and distributing pension savings for more than 10 years. VEB guarantees a high and stable income, taking into account the current level of inflation, with a minimum of risks, which has made the State Guarantee Company the most popular and reliable instrument for investing pension investments.

More than half of the country's future pensioners trust their funds to Vnesheconombank, while the rest have placed their finances in non-state financial companies.