The faction of the United Russia party in the State Duma offered the government several options for resuming the indexation of pensions for working pensioners: returning it in full, doing it in stages, or in relation to at least some categories of the population. This innovation is currently in the discussion stage. The first deputy head of the Duma faction of United Russia, Andrei Isaev, stated this in an interview with NEWS.ru. According to experts, the budget process is currently underway, including the PFR budget submitted to the State Duma on September 30. In addition, the second wave of the coronavirus epidemic has begun, so the relevance of distributing money to support consumer demand has returned to the political agenda. The Cabinet of Ministers did not respond to NEWS.ru's request.

Now all three of the above options are being considered by the Cabinet, and parliamentarians are taking part in the necessary consultations, Isaev added. Let us remind you that pensions of working pensioners have not been indexed since 2020.

It is clear that returning indexation to everyone working is a very expensive option. We proposed to allocate working disabled pensioners into a separate category. Now we are conducting a dialogue with the government and understand perfectly well that the ministers are based on the current financial capabilities of the state at the moment ,” Andrei Isaev told our publication.

He added that United Russia fundamentally advocates the gradual return of indexation.

Last Tuesday, October 6, President Vladimir Putin, at a meeting with leaders of State Duma factions, supported the leader of A Just Russia, Sergei Mironov, who raised the topic of fair indexation of pensions. As the media learned, the head of state instructed the Cabinet of Ministers to prepare proposals for renewing it for working pensioners.

Benefits for pensioners that not everyone knows about: in Moscow and the Moscow region

By applying for benefits and payments that few people know about from local government agencies, people can improve their financial situation. But you need to know what benefits are available and how to request them.

Annual benefits

Annual payments are made to veterans of the Great Patriotic War in the amount of 3 to 10 thousand rubles. Rehabilitated pensioners who had to suffer due to political repression are paid annually. About 100 thousand rubles are paid to disabled combat veterans living in Moscow and the Moscow region who took part in local wars.

One-time benefits for pensioners

Senior citizens are entitled to a one-time or one-time receipt of funds for the purpose of burial. The maximum amount is about 10 thousand rubles. For couples celebrating their wedding anniversary, payments are also due. Here the amount of the benefit depends on the years lived together:

See also:

Who is eligible for payments to low-income families in 2020?

- 50 years - 21120 rubles;

- 55 - 26400 rub.;

- 60 - 26400 rub.;

- 65 - 31680 rub.;

- 70 - 31680 rub.

On a note!

Jubilees who turn 100 years old are paid 26 thousand 400 rubles every subsequent year.

The payment is due in honor of Victory Day and other holidays. The exact amount has not yet been determined. By decree of the governor of the Moscow region, elderly people can receive one-time cash in the amount of 10 thousand.

What is the monthly financial assistance?

Many elderly people living in Moscow and the Moscow region have the right to financial assistance:

- Single pensioners over 70 years old – 1000 rubles.

- Labor veterans, blockade survivors, people awarded the medal “For the Defense of Moscow” - 300 rubles plus payment for a landline phone.

- Citizens who have served the state, WWII veterans - up to 18,000 rubles.

- Widows of heroes of Russia, USSR - 700 rubles.

- Family members of military personnel who died in combat - up to 1,000 rubles.

- Pensioners registered in Moscow for more than 10 years. The amount is determined individually, depending on the amount of the pension itself. The payment is brought to a minimum - 19,500 rubles. (for 2020).

- Citizens over 18 years of age, who have lost one of their parents, who have a disability, who combine full-time study with work, receive payment until they graduate or reach 23 years of age. It depends on the place, position and salary at work.

- Pensioners holding positions in state and municipal organizations related to education, sports, healthcare, public protection, culture, state veterinary work, archives and libraries, registry offices, employment centers can receive no more than 20,000 rubles;

- Pensioners working in the housing and communal services sector (janitors, workers, street and house cleaners) can receive additional payment depending on their place of work and position, but not more than 20 thousand rubles.

See also:

What benefits are available to labor veterans in Moscow and other regions of the Russian Federation in 2020?

For those who are over 65 years old and have a low salary in the Moscow region, an additional payment to their pension is provided - 1000 rubles.

Only those citizens who have been permanently registered in Moscow and the Moscow region for more than 10 years can receive payments, which not everyone knows about.

What benefits are due by age in Moscow and the Moscow region: what is required

There is a list of benefits for people of retirement age (men - 60 years old, women - 55 years old) in Moscow and the Moscow region. Such benefits are established by regional authorities. It is important that the insurance period is sufficient to assign a pension and corresponding benefits to a person in old age:

- Tax benefits for real estate. This tax may not be paid by pensioners who own an apartment, house, or building with an area of no more than 50 square meters. m, garage, workshop and parking space. The benefit applies only to one of the listed objects.

- Subsidies for housing and communal services. The subsidy is allocated when the cost of utilities exceeds 10% of the income of all family members who are permanently registered in this place of residence. Citizens over 70 years of age receive a 50% discount on major home repairs as additional support. After 80 years, people are completely exempt from such payments.

- Support for unemployed people of retirement age. In Moscow, the payment reaches 12,578 rubles, in the region - 9,980 rubles. An additional payment is made for working persons of a similar category. These are people working in the housing and communal services sector, disabled people of groups 1 and 2, employees of the organization OJSC "Wardrobe Service Plant".

- Muscovites have the opportunity to use a special social card - the Muscovite card. It is entitled to benefits. Payments are received on it, the balance of which is charged at 4% per annum. Such a card can act as a compulsory medical insurance policy.

- Preferential conditions include free travel on public transport.

- Some categories of card holders can receive medicines free of charge;

- Many Moscow pharmacies provide discounts of up to 30%.

- Payment of utility bills without additional commission.

- Free use of ground transportation, except minibuses and taxis.

- For medical reasons, senior citizens are provided with the opportunity for free rest and treatment in sanatoriums (up to 18 days). Those who do not work can use the service of dental prosthetics. Payment is made from the budget of the city and region.

- Compensation of 250 rubles for the use of a landline telephone.

- Visits to cultural events, theaters, museums, concerts with a discount of up to 50% of the ticket price. Pensioners can attend some events free of charge.

Attention!

All necessary payments can be processed through the Pension Fund, MFC or the State Services portal.

This business is not profitable for either funds or pensioners

Returns on voluntary pension programs (VPPs) of non-state pension funds (NPFs) in the long term are only slightly higher than inflation and lower than those accumulated for deposits. In such conditions, NGOs are not in demand either among corporate clients or citizens. The lack of mass supply also hinders. At first, mandatory pension products (OPS) were the priority for NPFs, which overshadowed NPOs; now they are embarrassed by the low margins of voluntary savings.

The average accumulated account-based profitability of clients of currently existing private funds for NGOs for six years - from 2014 to 2019 - amounted to 149.5%, according to calculations of the Pensopathology project (Kommersant got acquainted with them) based on NPF data. This figure was only 3.6 percentage points higher than inflation for the same period and was lower than the accumulated return on deposits (with a maturity of over one year), which amounted to 156.2% over six years. However, on average, voluntary programs turned out to be little better than mandatory ones (their return was 146.8%).

The pension reserves of non-state pension funds (including liabilities for non-state pensions and the insurance reserve) at the end of 2020 amounted to 1.4 trillion rubles, clients of non-state pension funds were 6.2 million people. At the beginning of 2014, reserves amounted to 0.8 trillion rubles, the number of participants in voluntary programs was 6.8 million. Thus, funds for NGOs in the funds over six years grew by only 66.2%, and the number of NPF clients for NGOs even decreased . This indicates the stagnation of voluntary pension programs.

Previously, the driver of NGOs was corporate programs (CPS), the golden age of which, according to PwC director Natalia Parkhamovich, occurred in the early 2000s. Now, according to a PwC survey, they are experiencing a crisis (see Kommersant on February 27). “Funds have largely lost interest in PPC against the backdrop of the rapid development of OPS since the end of the first decade of the century - a product that is easier to attract and less expensive than corporate NPO,” notes PwC partner Karina Khudenko. However, a number of large corporations, against the backdrop of the suspension of mandatory pension insurance, including the introduction of significant restrictions on the transfer of pension savings, are again thinking about checkpoints (see Kommersant on July 3).

The closure of the OPS market also prompted the development of individual pension plans (IPP) for NPFs. Large non-state pension funds, which previously mainly specialized in compulsory pension insurance, have turned their attention to the development of voluntary pension insurance. The first to enter the mass segment of individual NGOs was Sberbank NPF (January 2020), and now an increasing number of its colleagues are joining it (see Kommersant on June 26).

However, despite these efforts, no serious growth of NGOs in terms of the volume of new contributions is yet visible, as evidenced by the indicators for the individual investment program of the same NPF Sberbank (see “Kommersant” dated May 14). “We believe that NPFs have the opportunity to wedge their pension programs into consumption (citizens’ funds for current needs. - Kommersant”

) when they can show high profitability,” noted earlier Advisor to the First Deputy Chairman of the Central Bank Stepan Kuznetsov. According to him, only this “will allow the NGO market to revive and “it will be possible to at least somehow compete with other financial products,” provided that the profitability shown by NPFs “will be conditionally in the area of OFZ borrowing.”

“The inexpressive profitability of Russian non-state pension funds for non-profit organizations, which in general does not exceed the profitability of deposits, is, in particular, one of the obstacles to the choice of voluntary programs by clients,” says Ms. Khudenko. She notes that citizens have the opportunity to receive a small tax deduction on contributions to NGOs, and this somewhat increases investment attractiveness. However, the expert admits, NGOs cannot compete with spending on current needs in the mass segment.

“Increasing business margins could help in the development of the NGO sector, since it is now inferior to insurance and management companies,” says Evgeniy Biezbardis, head of the Pensopathology project. This measure, he said, would increase the supply of NGOs on the market, which could also generate demand among private clients.

Ilya Usov

Additional social benefits

A pensioner who has minors or a dependent spouse in their care should receive a supplement to their pension. At the same time, the pension increases significantly: for one dependent - by 1/3 of the fixed rate, for two - 2/3 of the rate, for three or more the full rate of 5334 rubles is paid. For citizens over 80 years of age and disabled people of group 1, the rate is doubled.

If a pensioner is over 80 years old or disabled in the first group and needs constant supervision, and there is a non-working able-bodied person nearby who is ready to provide care, the pensioner receives a pension compensation of 1,200 rubles.

You can complete all the necessary paperwork at the Pension Fund. If the caregiver goes to work, the bonus is not paid.

New bill on non-state pensions

Bill No. 722163-7, adopted on October 8, 2020 in the first reading, proposes to amend Article 10 of Federal Law No. 75-FZ. The authors of this document are trying to make non-state pensions more popular among Russians and attractive to them. If the document is adopted in three readings, then:

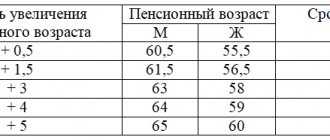

- Citizens will have the opportunity to receive a non-state pension on the old terms: taking into account the retirement ages that were in effect previously (55 years for women, 60 for men).

- Those who enter into an agreement with a non-state pension fund can count on receiving payments already at pre-retirement age; certain categories of beneficiaries (disabled people, workers of the Far North, etc.) will retain their privileges.

- It is planned that this change will make non-state pensions interesting not only for working citizens, but will also attract self-employed persons, foreigners, citizens with dependents and employees to accumulate future pensions.

- It is proposed to clarify the pension grounds, excluding from them the condition of having an insurance period, and the procedure for applying for a non-state pension.

If this law is adopted, an additional non-state pension in the GasFond or Soglasiya will become possible for those Russians who are already thinking about future pension provision, but do not want to wait for the age set by the state.

You can download the text of bill No. 722163-7 and read it here.

For whom is this translation relevant?

Investing in a non-state pension fund is relevant primarily for people with high salaries . The fact is that the average return on non-state pension funds today is 10%.

This means that if a citizen made contributions to a non-state pension fund, then upon reaching retirement age he will receive benefits three times greater than what the state can pay on a monthly basis.

Important. Investing in a non-state pension fund is ideal for citizens whose monthly income exceeds 40,000 rubles.

The fact is that pension contributions cannot be avoided anyway. But if such payments go where they need to go, then after reaching a certain age they can bring considerable benefit to a citizen who has worked for the required period.

Regional surcharges

A number of allowances are paid to pensioners from the local budget; according to experts, their amounts range from 3,000 to 4,000 rubles. These include payments to Veterans of Labor. The supplement is separate from the cost of living calculation.

The title is awarded if certain conditions are met during the work experience (continuity in work, distinctive signs, etc.). You can apply for it by contacting the local branches of the Pension Fund. The amount of the bonus and payment is regulated by the regional budget.

Local authorities may expand the list of conditions for receiving additional payments, for example, for continuous long-term work at certain enterprises.

Regional payments also include payments for work in difficult, harmful conditions. Although citizens' eligibility for this position is determined by national law, the payment procedure is determined at the local level.

Additional payments to pensions for working and non-working pensioners

For unemployed citizens whose payments are below the subsistence level, indexation will be carried out taking into account the latest changes in legislation. Previously, the accrued pension was indexed, then an increase was added to the level of the subsistence minimum, and this determined the monetary limit. According to the new provision, the pension will be indexed only after the supplement has been credited to the subsistence level , which will increase the amount of payments for a significant category of citizens.

The increase in pensions will also affect working pensioners. Indexation is not carried out for them, however, if an organization transfers insurance premiums for a working pensioner, then his pension is subject to recalculation for the previous year.

Payment of EDV and DEMO

The Pension Fund reminded us of two additives that not all citizens know about. This is a monthly cash payment (MAP), which is assigned and paid at the place of residence by the regional Fund.

It is received by:

- WWII veterans;

- combatants;

- minor prisoners of war (concentration camps, ghettos);

- victims of radiation.

A complete list of categories of citizens can be obtained by contacting the Pension Fund or viewing the website.

If a pensioner is entitled to bonuses in several categories, he is paid only one, but the highest is taken into account . The amount is indexed annually. In 2020, taking into account inflation, it increased by 3%.

To obtain an EDV, you need to contact your local Pension Fund office, submit an application, and provide the necessary documents. Today, during the pandemic, all procedures can be carried out remotely.

Additional monthly financial support (DEMO) is assigned regardless of location. Paid in the amount of 500 or 1000 rubles through the local Pension Fund.

The amount of the supplement depends on which category the pensioner belongs to. For example, an increase of 1000 rubles is assigned to:

- disabled people and WWII participants;

- disabled people injured in war;

- citizens who were minor prisoners in places of forced detention, ghettos or concentration camps.

An increase of 500 rubles will be received by:

- Military personnel who served from June 22, 1941 to September 3, 1945, but were not in the combat zone;

- Widows of fallen military personnel and disabled veterans of the Second World War;

- Prisoners of concentration camps, ghettos;

- Citizens awarded the “Resident of besieged Leningrad” award.

Material support is paid together with a pension at the place of residence.

For pensioners who meet several conditions, additional payments are made one at a time - the largest. All procedures related to clarification and registration of allowances can be done remotely. Documents are submitted on the Pension Fund website or through the State Services service.