According to statistics from the Bank of Russia, the past year was rather favorable for NPFs. The official rating of Russian NPFs 2020 in terms of reliability and profitability according to the Central Bank of Russia, published on the website of the Central Bank of the Russian Federation, after the recession in the fall-winter of 2020, there has been a small but steady increase in pension savings in non-state pension funds of the Russian Federation.

An updated rating of NPFs for 2020 has been published; this list can be considered outdated.

By the end of 2020 – beginning of 2020, the total volume of deposits increased by 3.1% and grew to an amount of over 2 trillion rubles. In general, the pension savings market is developing dynamically: the weak are leaving, the strong are staying and uniting with each other. If a year ago there were 77 non-state pension funds operating, then by 2020 there were only 43 of them, and the top ten leaders remained practically unchanged. In general, the total volume of savings of non-state pension funds of the Russian Federation reached 3.3 trillion rubles.

The rating of Russian NPFs for 2020 is divided into two tables - according to reliability (according to the amount of capital) and profitability (the growth rate of pension savings).

The data is based on the official reports of NPFs for the first quarter of 2020, published on the Central Bank website.

Features of 2020 and 2020

From the table with profitability indicators, we will see that most NPFs managed to outpace inflation in the last 1-2 years. It appears that this phenomenon is primarily due to the unique situation created by the Central Bank thanks to the high key rate and record low inflation. Positive real returns (returns minus inflation) could be shown with little or no risk. To do this, it was necessary to place funds in debt securities (bonds). Apparently, those few funds that showed insufficient results, including Gazfond, decided to place a significant part of the portfolio in equity securities (shares). Only NPF Magnit showed worse results than inflation in the first half of the year.

In the future, the advantages in the performance of non-state pension funds with debt securities in the portfolio may disappear. This will happen as the gap between the Central Bank key rate and inflation decreases.

Owners of the organization

Participatory shares in the authorized capital of NPF Sotsium are divided between:

- JSC NPF Ingosstrakh-pension - 99.9%;

- JSC "Invest-Polis" - 0.1%.

Fig.1. Logo

Indirectly, the final beneficiary of the fund, through the participation of the Ingosstrakh group, is the Italian company Assicurazioni Generali SpA, one of the largest insurers in all of Europe.

Rating construction methodology

The methodology for constructing the rating has been preserved without changes after significant revision in 2020. We took into account several comments made by NPF representatives.

Let us recall that the rating formula is based largely on long-term returns of funds since 2011 (7 years). In addition, profitability over the period of the last 3 years is taken into account. The latter was necessary to give slightly higher weight to those funds that have achieved improved results in recent years.

Funds with real returns less than zero for periods of 7 years and 3 years at the same time received a zero score in the rating.

Data on the results of NPF management were taken from the Central Bank website. Yields before 2011 are not taken into account in the ranking.

Level of trust in NPFs, NAFI survey

Percentage of respondents who answered “I completely trust” and “rather trust” to the question “How much do you trust non-state pension funds?” The NAFI initiative all-Russian survey was conducted in July 2020. 1,600 people were surveyed in 140 localities in 42 regions of Russia. Age: 18 years and older. The statistical error does not exceed 3.4%.

| 2012 | 2013 | 2014 | 04.2015 | 11.2015 | 07.2016 | 07.2017 |

| 19% | 19% | 19% | 19% | 22% | 24% | 15% |

In general, in 2020, the majority of Russian non-state pension funds showed that they know how to manage pension deposits. Despite the devaluation of the ruble, the profitability of most of them is higher than the inflation rate. And which NPF is the best - reliable or profitable - is up to you to decide.

results

table 2

| License | Fund name | Rating |

| 434 | Consent of NPF | 100 |

| 359/2 | First industrial alliance NPF | 97 |

| 377/2 | Volga-Capital NPF | 94 |

| 320/2 | Society NPF | 91 |

| 436 | Neftegarant NPF | 89 |

| 23/2 | Diamond Autumn NPF | 86 |

| 433 | Surgutneftegaz NPF | 83 |

| 308/2 | Social development of NPF | 80 |

| 12/2 | Hephaestus NPF | 77 |

| 347/2 | Defense Industrial Fund NPF | 74 |

| 78/2 | Big NPF | 71 |

| 288/2 | National Non-State Pension Fund | 69 |

| 56/2 | Khanty-Mansiysk NPF | 66 |

| 437 | Atomfond NPF | 63 |

| 106/2 | Defense-industrial complex NPF | 60 |

| 407/2 | RGS NPF | 57 |

| 378/2 | UMMC-Perspective | 54 |

| 57/2 | Vladimir NPF | 51 |

| 318/2 | Trust of NPF | 49 |

| 237/2 | Trust (Orenburg) NPF | 46 |

| 346/2 | Transneft NPF | 43 |

| 415 | Alliance NPF | 40 |

| 67/2 | SAFMAR (European) NPF | 37 |

| 158/2 | Rostvertol NPF | 34 |

| 430 | Gazfond pension savings NPF | 31 |

| 41/2 | Sberbank NPF | 29 |

| 269/2 | VTB pension fund | 26 |

| 175/2 | Stroykompleks NPF | 23 |

| 412 | Education NPF | 20 |

| 3/2 | Electric power industry NPF | 17 |

| 360/2 | Professional NPF | 14 |

| 94/2 | Telecom-Soyuz NPF | 11 |

| 281/2 | Magnet NPF | 9 |

| 432 | Lukoil-Garant NPF | 0 |

| 431 | Future (Stalfond) NPF | 0 |

The top three included NPF Soglasie, First Industrial Alliance and Volga-Capital. The funds were highly rated due to their consistently high level of returns over 7-year and 3-year horizons at the same time. It is interesting to note that NPF Soglasiya has one of the lowest standard deviations of returns (2.06%), which is usually typical for bond portfolios. The standard deviation indicators of fund returns are shown in the table detailing the management parameters.

If NPF Soglasie remains a leader for the second year in a row (NPF Rating 2016), then the other two funds received high scores mainly due to the high management results of the last two years. Both funds are quite small in terms of the number of persons insured.

In general, of the millionaires, only NPF Soglasie showed good management results. All other large funds took positions in the ranking in the second half. This may be due to the ongoing process of mergers and acquisitions. The quality of management is still on the back burner.

Of last year's leaders, only NPF Socium remained in the top ten funds. In addition, NPF Neftegarant remains in the top ten for two years in a row.

NPF Lukoil-Garant and NPF Future received a zero score this year , since the results of their management are worse than inflation for all periods of time considered.

Table 3 displays data on the return on investment of all funds in the period 2011 - 2020. In 2020, the profitability for the first half of the year is shown.

Table 3

| License | Fund name | Real return 7 years | Real profitability 3 years | 2017/6 | 2016 | 2015 | 2014 | 2013 | 2012 |

| Inflation | 2,4% | 5,4% | 12,9% | 11,4% | 6,5% | 6,6% | |||

| VEB state securities | 8,31% | 18,29% | 11,4% | 12,2% | 15,3% | 0,0% | 6,9% | 8,5% | |

| VEB extended | 5,11% | 11,69% | 8,8% | 10,5% | 13,2% | 2,7% | 6,7% | 9,2% | |

| 269/2 | VTB pension fund | 0,08% | 10,84% | 10,5% | 10,3% | 10,76% | 4,4% | 5,9% | 8,7% |

| 41/2 | Sberbank NPF | -3,90% | 9,67% | 10,1% | 9,6% | 10,70% | 2,7% | 7,0% | 7,0% |

| 432 | Lukoil-Garant NPF | -5,39% | -0,02% | 3,3% | 8,2% | 8,96% | 6,8% | 8,9% | 7,6% |

| 320/2 | Society NPF | 6,69% | 11,68% | 9,4% | 10,6% | 12,43% | 7,1% | 8,5% | 8,2% |

| 67/2 | SAFMAR (European) NPF | 0,59% | 4,53% | 3,4% | 9,4% | 12,60% | 11,1% | 7,7% | 7,8% |

| 430 | Gazfond pension savings NPF | -2,42% | 8,86% | 2,9% | 13,2% | 13,92% | 2,8% | 7,2% | 7,7% |

| 3/2 | Electric power industry NPF | -2,15% | 1,16% | 4,3% | 8,9% | 8,46% | 9,0% | 8,4% | 7,8% |

| 431 | Future (Stalfond) NPF | -10,14% | -4,57% | 3,9% | 4,1% | 7,5% | 8,0% | 7,0% | 6,1% |

| 436 | Neftegarant NPF | 6,15% | 8,87% | 8,3% | 10,8% | 10,57% | 7,3% | 8,0% | 7,9% |

| 106/2 | Defense-industrial complex NPF | -1,04% | 13,19% | 10,5% | 10,6% | 12,87% | 1,9% | 7,0% | 7,53% |

| 433 | Surgutneftegaz NPF | 3,39% | 13,16% | 9,4% | 11,6% | 12,94% | 3,0% | 7,6% | 9,87% |

| 237/2 | Trust (Orenburg) NPF | -0,02% | 8,38% | 9,4% | 10,1% | 9,60% | 5,4% | 8,4% | 8,30% |

| 318/2 | Trust of NPF | 3,39% | 3,42% | 4,5% | 7,4% | 12,27% | 7,5% | 7,4% | 9,87% |

| 407/2 | RGS NPF | 1,05% | 9,02% | 8,5% | 11,8% | 9,56% | 7,54% | 6,22% | 7,99% |

| 78/2 | Big NPF | 2,58% | 10,54% | 10,4% | 9,6% | 11,33% | 6,15% | 7,25% | 7,67% |

| 288/2 | National Non-State Pension Fund | -0,70% | 14,76% | 12,1% | 11,5% | 11,90% | 1,65% | 4,94% | 7,02% |

| 281/2 | Magnet NPF | -6,28% | 0,22% | 2,2% | 10,9% | 7,74% | 0,86% | 13,30% | 9,74% |

| 412 | Education NPF | -2,95% | 2,49% | 6,6% | 7,0% | 9,43% | 5,91% | 8,39% | 9,58% |

| 308/2 | Social development of NPF | 0,38% | 17,02% | 14,7% | 8,6% | 14,49% | 0,88% | 6,90% | 6,10% |

| 56/2 | Khanty-Mansiysk NPF | -0,56% | 13,89% | 9,3% | 9,6% | 15,84% | 0,44% | 6,61% | 6,80% |

| 347/2 | Defense Industrial Fund NPF | 1,96% | 11,65% | 7,1% | 12,3% | 13,06% | 6,48% | 7,51% | 6,99% |

| 94/2 | Telecom-Soyuz NPF | -7,75% | 4,39% | 7,6% | 9,1% | 8,42% | 2,11% | 5,74% | 7,35% |

| 23/2 | Diamond Autumn NPF | 1,70% | 16,22% | 10,7% | 12,6% | 13,59% | 2,15% | 5,34% | 7,20% |

| 415 | Alliance NPF | -2,65% | 11,74% | 10,6% | 9,8% | 12,15% | 0,00% | 9,84% | 6,37% |

| 57/2 | Vladimir NPF | 0,23% | 9,41% | 9,5% | 8,8% | 11,92% | 5,40% | 7,46% | 7,45% |

| 377/2 | Volga-Capital NPF | 7,08% | 13,97% | 9,7% | 11,3% | 13,69% | 7,59% | 8,96% | 7,35% |

| 12/2 | Hephaestus NPF | -0,40% | 15,96% | 8,2% | 12,0% | 16,65% | 0,62% | 7,37% | 6,62% |

| 359/2 | First industrial alliance NPF | 6,60% | 15,00% | 10,2% | 12,2% | 13,34% | 2,73% | 8,68% | 8,35% |

| 360/2 | Professional NPF | -5,30% | 2,93% | 7,2% | 8,3% | 8,11% | 3,27% | 7,40% | 7,07% |

| 158/2 | Rostvertol NPF | -0,14% | 5,11% | 7,3% | 8,8% | 9,71% | 6,95% | 8,27% | 6,90% |

| 434 | Consent of NPF | 15,44% | 5,26% | 7,0% | 9,8% | 9,13% | 9,84% | 8,92% | 14,23% |

| 175/2 | Stroykompleks NPF | -2,33% | 3,75% | 5,6% | 6,4% | 12,51% | 5,01% | 7,67% | 7,28% |

| 346/2 | Transneft NPF | -1,60% | 10,86% | 9,9% | 8,8% | 12,97% | 2,38% | 6,65% | 7,16% |

| 378/2 | UMMC-Perspective | -1,90% | 13,27% | 10,9% | 10,4% | 12,75% | 2,19% | 6,07% | 6,80% |

| 437 | Atomfond NPF | 1,27% | 10,71% | 10,6% | 10,2% | 10,74% | 4,55% | 8,22% | 6,59% |

Real profitability is the final result of management after subtracting inflation.

Types of pension programs offered by the fund

JSC NPF Sotsium allows its clients to form pension savings under the OPS and NPO programs.

For OPS, the parameters approved by law apply. The fund houses the accumulative part of mandatory insurance contributions. By investing funds transferred to a non-state pension fund, the total amount can increase if the return for the period is positive.

Fig.3. Choosing a pension program

Non-state pension provision is a voluntary initiative of a citizen or legal entity, employer for its employees to accumulate an additional amount by the time of retirement. The client chooses the program parameters independently. "Socium" offers the following accommodation options:

- enterprise for the benefit of its employees;

- by an individual in favor of his appointed successor;

- with a limited payment period or on a lifetime basis.

Attention! The client sets the amount of the NGO contribution independently; the key requirement in this case is the regularity of depositing funds into his own personal account.

How the contract is concluded

Every employed citizen is already an insured person either in the Pension Fund of Russia or in one of the NPFs of Russia. To transfer the funded part of the pension under compulsory pension insurance to Sotsium, you will need to conclude an agreement with the company and send a statement of intention to transfer to the Pension Fund of Russia by the end of this year.

You can submit documents:

- Personally visiting the company's office.

- By sending certified copies of your passport and insurance certificate (SNILS), signed and completed agreement, questionnaire and consent to data processing in 3 copies by Russian Post.

- Through the online registration form in the appropriate section on the company’s official website.

- By sending the completed package of documents by email.

.

.

.

Important! The transition to NPF "Socium" is considered complete after the transfer of funds from the Pension Fund of Russia or another fund.

After the agreement comes into force, the client is invited to start using the capabilities of the Personal Account on the company’s website.

The client is invited to conclude an agreement on non-state pension provision during a personal visit to the branch or by sending a passport and SNILS by e-mail for the employees to prepare a package of documents. After concluding an agreement, you must deposit an initial amount into your personal account, which can range from 1,000 rubles.

Attention! The agreement is considered valid from the moment the first payment is made.

Fig.4. Data entry form for making a contribution

Depositing funds through NGOs is available through a special form on the company’s website, which will allow you to avoid errors in payment details that often occur with other types of transactions.

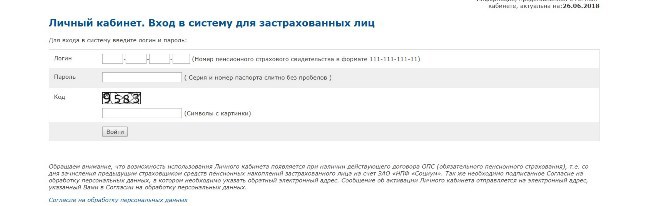

Client's personal account

The use of the online pension savings management service is available only to those clients who are among the insured persons of the fund and have consented to the processing of personal data. Using the resource, the user can:

- receive information about the transfer of funds to a personal account;

- track current savings amounts;

- change your contact information;

- submit applications for pension payments to the fund.

Fig.5. Registration in your personal account

To register you will need to enter:

- login (SNILS number);

- password (series, consecutive passport number without separating marks);

- verification code shown in the picture.

Important! It is necessary to provide the NPF with your e-mail information in order to complete the registration procedure in your Personal Account.

Statistics

A complete table with fund management parameters for the period 2011 - 2020 is attached. The table includes the following information:

- Standard deviation of NPF return (risk)

- Average annual real return over a period of 7 years

- Real return over a period of 7 years

- Accumulated return over a period of 7 years

- Annual real return over a period of 3 years

- Real return over a period of 3 years

- Accumulated profitability over a period of 3 years

- Number of insured 2014, 2020, 2020, 2020

Payments

NPF Sotsium receives negative reviews for payments to clients in times of need. There are also positive opinions, but they are much smaller. Most often you can see information that Sotsium makes payments with huge delays. Some people fail to receive their funds for a long time. NPF Sotsium is sometimes even accused of fraud and misappropriation of investors’ money. All this occurs extremely often. Among the confirmations of such negativity, one can only highlight news about defrauded investors who go to rallies to attract the attention of the population.

But among the numerous negativity, sometimes there are reviews indicating that NPF Sotsium makes payments in full and without any delays. Some people are surprised by the negative reviews. Therefore, it is difficult to say exactly how much “Socium” is a conscientious company.

Contacts

Official website of NPF Sotsium

https://npfsocium.ru/ On the official website you can find the history of the fund, a list of its founders, regulatory documents, and a lot of background information. To calculate your pension, you can use the online calculators presented on the website for the compulsory pension insurance and non-governmental pension programs.

Email mail

Address

119017, Moscow, Golikovsky lane, 7

Hotline number

8

+7 / Secretaries / +7 (495) 728-72-36 fax