The reform of pension legislation has left many people confused. The previously existing system of two pension components – funded and insurance – was “frozen” until 2020. But what does it mean. Can a person who regularly makes contributions to a pension fund to increase the savings portion count on a decent pension? Of course, the state made sure that it was possible to get your money back and, in case of forced or deliberate resignation from work, to maintain a normal financial condition. If retirement age has arrived, but the strength and desire to continue working remains, is it possible for a pensioner to receive a funded pension?

Will it be possible to return savings from non-state pension funds?

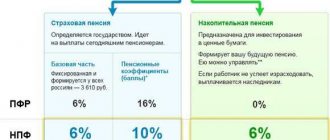

If a citizen decides to transfer part of the pension to a management company, this will increase the amount. The amount of income depends on the selected non-state pension fund. If you leave the money in the Pension Fund, the amount of the savings portion will not change. It will only be indexed in accordance with the inflation rate. In Article 5 of the Law “On Labor Pensions in the Russian Federation,” the funded part complements the insurance part and is accounted for in a separate account. Men and women who have reached the required age are eligible to receive payments. In this case, insurance experience and a sufficient number of pension points are required. The funded part of the pension can be provided at the time of retirement or before this period. If an agreement is concluded with a non-state pension fund, the savings part is provided one-time or monthly along with the insurance.

Note! To receive the total amount, you need to write an application to the Pension Fund and NPF.

If the pensioner dies, the remaining savings are received by the heir. Money from the NPF is provided in a lump sum. If part of the pension was formed with the help of maternity capital, the husband or minor children have the right to claim the amount. If the child continues his studies at a university, the possibility of crediting funds to the account is extended until he is 23 years old. The amount can be provided one-time or monthly.

The possibility of a one-time payment of the funded portion is available only to citizens belonging to a certain category. If a person continues to work after retirement age, no payments are provided. If all conditions are met, you need to contact the Pension Fund or use the State Services portal. Money is paid if a person is declared disabled or left without a breadwinner. Payments are accrued again only after 5 years. Persons who have taken early retirement have the right to take advantage of a funded pension before the established period. A complete list of conditions is presented in Articles 27–28 of Federal Law No. 173. The citizen himself, an authorized person if he has the appropriate document, or a legal successor under a will has the right to dispose of the amount.

Main deadlines

There are 2 main deadlines regarding one-time benefits from NPP:

- The period for consideration of the application and making a decision (1 month). This period is counted from the date of submission of the application. Within a month or after it has passed, the applicant is notified of the decision made - approval or refusal.

- Payment period (2 months). This period is counted from the date of the decision. It is important to understand that 2 months is the deadline, but in practice, payments often occur in the first weeks after approval.

The third term is the frequency of one-time payments. If a pensioner has received money from such a benefit, then the next time he can apply for it only after 5 full years .

Video about the timing of consideration and accrual of a one-time payment to private entrepreneurs:

Where to get it

Initially, the funded part of the pension is managed by Vneshtorgbank. Citizens know this organization as the Pension Fund. If the money has not been transferred, it is not inherited or transferred to the legal successor. In the event of the death of a pensioner, the amount remains at the disposal of the fund. If a person wants to make money work, they will need to draw up an agreement to transfer the amount to a non-state pension fund. In order for a pensioner to be granted the right to carry out transactions with the account, personal participation in the investment will be required.

If savings are stored in the Pension Fund of Russia, you need to visit the nearest branch of the organization. If you participate in the co-financing program, you will need to write an application to the MFC with which the agreement was previously concluded. You will need to attach a package of documents to your application. An employee of the institution will ask in what form the person plans to receive funds. If all the requirements of pension legislation are met, the application to claim the funded part of the Pension Fund or Non-State Pension Fund will be accepted for consideration and the papers will be transferred to higher authorities. The answer will be received within 30 calendar days.

Pension capital concept

Latest news for the “silent”: the compulsory pension insurance system, in which savings are formed by making mandatory contributions to the Pension Fund, is ineffective.

Therefore, the Central Bank and the Ministry of Finance propose to carry out modernization, as a result of which citizens will make contributions from their salaries.

How to calculate a military pension yourself? When will there be an increase in pensions for working pensioners in 2020? Find out here.

When do pension payments begin after it is assigned? Read on.

Planned amount of deductions: 0-6%. The employer will deduct the appropriate amount from the employee’s salary and immediately transfer it to his account in the Non-State Pension Fund.

- It is assumed that the government will provide citizens with tax deductions on the amounts deducted.

- In addition, the account owner will have the right to early withdrawal of 1/5 of the accumulated funds (these funds can be spent for any purpose).

- In “difficult life situations” the money can be withdrawn completely.

These reforms are planned to be carried out in the near future, and therefore it is recommended to closely monitor all changes in the field of pension legislation.

What documents are required?

When figuring out how to withdraw the funded part of a pension from a pension fund, a citizen will find out that money can be provided in a lump sum, for an indefinite period or on an urgent basis. The option is chosen by the pensioner himself. The method of receiving the funded portion is indicated in the application. It must comply with the requirements of current legislation. In order for the money to be credited, you need to contact the management company or non-state pension fund and prepare a list of documents.

You will need to provide the following documents:

- pensioner's passport;

- SNILS;

- work book or contract;

- details of the account to which the pension will be transferred.

Documentation is provided during a personal visit or via the Internet. It is permissible to transfer papers by involving a trusted person in the procedure. However, his rights must be certified by contacting a notary. In some situations, additional documentation is required. The process of reviewing a personal case takes 1 month. Then appropriate decisions are made.

From what year is the funded pension accrued - who can count on payments

Consequently, the 6% transferred monthly by the employer is used to solve government problems. In addition, the state decided to direct all 22% of pension contributions directly to the Pension Fund. This will give pensioners the opportunity to receive guaranteed benefits. Experts provided the deputy with the results of such a program. And these results showed the effectiveness of taking such measures.

The budget shortfall of the Pension Fund is covered from the state budget. And the use of citizens’ funds will help reduce the amount of money taken from the budget for this purpose.

The applicant will have to:

- Prepare a package of documents. If the reason for early application is the presence of disability or the fact of the loss of a breadwinner, all this must be approved with the help of additional papers. Documents regarding qualifications and experience will be required. You can request a certificate about it from the Pension Fund. It will allow you to find out the standard pension amount. Sometimes a certificate from your last place of employment is required. It must contain the reason for dismissal.

- If a pensioner passes away and the legal successor applies to the NPF, a will is required. When registration is made through a representative, the standard list of papers includes a power of attorney. An appeal to the authorized body represents the fact of claiming rights to the balance of funded pension funds.

- Bank account details are provided. Pension payments will be transferred to them, unless otherwise provided.

- An application is being drawn up. You must use a ready-made sample. It can be obtained from the NPF. You will need to attach copies of the relevant documentation to the paper. Then all that remains is to wait for the decision.

How to collect funds after the death of a relative who was entitled to them?

Receiving benefits in lieu of a deceased relative is a common practice.

There are practically no differences from the procedure for receiving it by the pensioner himself. You need to write an application and provide documents in the same way - the Pension Fund will not work on a whim.

The main difference is the list of required papers :

- Any documentary evidence of the applicant’s relationship with the deceased (birth certificate indicating the parents, marriage certificate, etc. - depends on who exactly the deceased was).

- Death certificate.

- Additional documents, if any (power of attorney, papers on adoption or establishment of guardianship).

There are also differences in terms of payment receipt :

- The application must be submitted no later than 6 months after the death of the pensioner. If 6 months have expired, then you need to go to court and prove that the applicant really could not submit an application (for example, he was outside the country or did not know about the fact of death).

- Whenever the application is submitted, you will have to wait until the last day of 6 months from the date of death. This wait is necessary so that others wishing to receive the payment, if any, can submit similar applications. If there is more than one legal successor, then the Pension Fund decides who will get what share.

- Payment of benefits occurs no later than the 20th day of the next month (that is, 7 months from the date of death).

Video on how to obtain a deceased person’s private property:

Features of legislation

Information about the status of a citizen’s individual account is displayed in the SZI-6 form. Here information is recorded on the amount of the contribution that went to the funded part. The certificate can be obtained from the Pension Fund or through the official website of the organization. The request is made in your personal account. Using the document, it will be possible to predict the size of the monthly increase. If a pensioner applies to a non-state pension fund for a funded portion, there will also be no problems.

If you want to receive a one-time payment, you must fulfill the following conditions:

- the monthly amount of savings does not exceed 5% of the insurance pension;

- if the accumulated amount of experience or points is not enough, the citizen will be denied payment;

- at the time of application, the person must stop working;

- The application will be approved only if it has not been submitted previously.

If an urgent payment of a funded pension is planned, the calculation will be made using a special formula. The minimum period for accrual is 10 years. It is periodically revised taking into account data on the life expectancy of pensioners. In 2014, the legislation underwent changes. As a result, the funded part of the pension was frozen. Citizens who managed to save a certain amount could take advantage of the right to earn money for their old age. Subsequently, all contributions were transferred strictly to the Pension Fund. No increase was provided. In the future, it is planned to return to the previous investment system. The total pension amount is mainly based on length of service. The use of an income scheme can improve the future of a pensioner.

Note! Investment allows you to increase the amount of monthly payments that a citizen will receive in hand.

The main problem with receiving the funded portion is the death of the insured person. But the point is that all copies of documents must be certified. The procedure will entail additional waste of time and money. The result is not always positive. If the pensioner died before the funded pension was assigned, relatives have the right to receive the amount in full. It is necessary to take into account that NPFs may be declared bankrupt. At the same time, the Bank of the Russian Federation acts as a guarantee of maintaining insurance premiums. However, refunds are made only at nominal value. All investment income will be lost.

Freezing the funded part of pensions in 2019

The Russian state has to take a number of measures to maintain a normal economic situation in the country. Because of this, funding for some social programs is reduced or stopped altogether. While funds allocated for the development of these programs are transferred to support more significant government projects.

The most pressing issue is about pensions. The lack of funds in the country's Pension Fund does not allow for the payment of all regular necessary social benefits to the population.

It was decided to eliminate the situation with the problem of payment of benefits by freezing pension benefits.

Additional recommendations

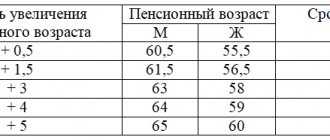

If a citizen wants to increase the size of their funded pension, they need to competently approach the selection of a management company or non-state pension fund. There must be an economic incentive to transfer funds. Usually it is a high percentage of profitability and liquidity. It's easiest to understand with an example. Let's say a person was born in 1980. Under previous rules, retirement would have taken place in 2035. However, the deadline has now been extended. As a result, a woman can go on a well-deserved rest only in 2040. Let’s assume that during the period of the co-financing program, which could be used from 2009 to 2014, the salary was 40,000 rubles. average. This would make it possible to receive interest income in the amount of about 38,000. At the same time, bonuses and salaries are not taken into account. The above amount is formed only on the basis of employer contributions. The average annual rate of the Central Bank of the Russian Federation is 11%. To calculate the amount of savings, the indicator must be multiplied by the total number of years for retirement. The result is a fairly large amount.

When the savings part was frozen, it was planned that in the future there would also be an increase in the size of savings. According to expert calculations, the increase in pension will be about 3,000 rubles. per month. Even if the non-state pension fund is closed, the citizen will not lose anything. Funds stored in NPFs are indexed in accordance with established ratios. The amount of payment is influenced by the amount invested under the maternity capital program. If a family has two or more children and government support funds are used to co-finance the mother’s pension, the increase will be significant. If a citizen cannot find a job, it is permissible to provide care for a disabled person or a person who has reached the age of 80. This period will be taken into account when calculating the pension and accruing pension points. The information is stored in the Pension Fund register.