Until 2014, the Russian Federation had a program for the mass formation of funded pensions using a portion of employer pension contributions for their employees. Today, citizens can create savings only through voluntary contributions. The mass savings program has been frozen. Previously generated savings, regardless of the sources of their receipt, can be received by citizens in the form of several types of payments. 168 Federal Law, about the funded part of the pension, contains little information. How to receive the funded part of your pension according to the law.

The concept of funded pension: what the law says

Every month the employer transfers an amount of 22% to the Pension Fund for each employee. Of this, 6% is used to form the funded part of the pension. The remaining 16% is transferred in different ways, depending on the chosen payment method. So, if the general method is chosen, then all the money is directed to the formation of the insurance part. If a mixed method is chosen, then 10% goes to the insurance part, and 6% to the savings part.

The main legislative acts regulating this issue are Law No. 424-FZ “On funded pensions”. It reveals the essence of one of the types of pension provision. In accordance with it, in certain cases, citizens are paid benefits.

Federal Law on pensions

Basic laws defining the procedure for assigning and calculating payments:

- Federal Law on Insurance Pensions No. 400 (dated December 28, 2013) – determines the conditions for receiving insurance pensions until January 1, 2015;

- Federal Law on State Pension Security No. 166 (dated December 15, 2001) - determines the conditions for assigning a state pension;

- Federal Law on funded pension No. 424 (December 28, 2013) - defines the grounds for receiving and the procedure for paying a funded pension;

- Federal Law on Compulsory Pension Insurance No. 167 (dated December 15, 2001) - defines the pension insurance system.

For pensions granted at the beginning of 2020, the following laws apply:

- Federal Law on Labor Pensions No. 173 (dated December 17, 2001);

- ZRF on state pensions in Russia No. 340-1 (dated November 20, 1990);

- on state pensions in the USSR (dated 07/14/1956).

These documents are no longer valid from the beginning of 2020.

However, they extend their effect to persons who worked during a period when there was no insurance pension system, to those dismissed from service since the beginning of 2002 and other cases that are not regulated by the new laws.

Who can apply for

The categories of citizens who are paid an insurance pension are listed in Federal Law No. 400.

Old-age benefits are paid (Article 7 of Federal Law No. 167):

- working under an employment or civil contract;

- receiving payments under copyright contracts and licensing agreements;

- entrepreneurs;

- notaries;

- arbitration managers;

- private practice without opening an individual entrepreneur;

- members of peasant farms;

- citizens who work abroad, if insurance premiums are paid;

- members of indigenous communities;

- clergy;

- foreigners and stateless persons;

- other categories.

Compensation for the loss of a breadwinner is provided to dependents:

- grandchildren, sisters, brothers and children of the deceased breadwinner;

- one of the parents or spouse;

- adoptive parents;

- grandfather, grandmother.

Disability benefits are provided to disabled people of all groups.

Federal Law No. 166 names a list of persons who receive a state pension.

State compensation for length of service is paid:

- federal government employees;

- test pilots;

- astronauts;

- military personnel.

Citizens affected by radiation receive state benefits for old age. For the most part, these are Chernobyl victims participating in the liquidation of the consequences of the disaster, evacuated from the exclusion zone, and who became disabled due to the disaster.

In the event of the death of the categories of citizens listed above, their dependents apply for compensation in the event of the loss of a breadwinner.

Payment from the state for disability is assigned:

- military personnel;

- WWII participants;

- who received the award “Resident of besieged Leningrad”;

- astronauts;

- victims of radiation (Article 17 of Federal Law No. 166).

Separately, it is worth mentioning the social pension, which is paid to disabled people, dependents who have lost their breadwinner, orphans, children without both parents, citizens belonging to small northern peoples, and also for old age (Article 18 of Federal Law No. 166).

How long must a woman have worked to retire? How to calculate a long-service pension for military personnel? Find out here.

Federal Law No. 168 on the funded part provides that it is available to the following categories of citizens:

- Born 1967 and younger who managed to choose it before the end of 2020;

- women born 1957–1966, men born 1953–1966 (insurance premiums were transferred in 2002-2004);

- participants of the Pension Co-financing Program;

- who disposed of maternity capital for the purpose of pension savings.

In 2020, the funded pension is frozen.

This will last until at least 2020. Many citizens entered into agreements with non-state pension funds in order to transfer funds to them for management for the purpose of investment and conservation.

Payout selection

Before we move on to the question of choosing compensation, it is necessary to summarize what types of pensions are assigned in Russia in accordance with the Federal Law on Pensions.

Types of pensions:

- insurance (compensation for old age, disability, loss of breadwinner);

- state (long-service benefits, social pension, compensation in connection with old age, disability and loss of a breadwinner);

- cumulative.

Many citizens have the opportunity to receive several types of compensation at once.

If a person applies for several insurance pensions, he must choose one of them. You can receive compensation from the state together with insurance.

Civil servants, Chernobyl survivors, astronauts, disabled military personnel, and World War II participants have the right to receive two pensions.

Under certain circumstances (obtaining a disability group, the appearance of dependents, additional insurance contributions), a recalculation of compensation is possible at the choice of the pensioner (Article 23 of Federal Law No. 400).

Financing

Since the pension system provides three types of pensions, the sources of their financing are different.

- Insurance payments are financed from insurance proceeds from employers to the Pension Fund. Today this is 22% of the wage fund of each employee.

- The costs of paying state pensions are covered by interbudgetary transfers from the federal budget. The money is transferred to the Pension Fund, from where it is paid to pensioners.

- The funded pension is formed from the funds of the payment reserve, which include the pension savings of citizens who have chosen this type of payment. Separate records are kept for them.

Sources of urgent savings payment:

- pension savings (additional insurance contributions);

- income from the employer (6% of 22%);

- co-financing of pension savings;

- maternity capital allocated for this type of payment.

Until the end of 2020, citizens chose the pension option between purely insurance and funded together with insurance.

Those who missed all the deadlines will be assigned only an insurance pension.

Experience

The insurance period is taken into account when the old-age insurance pension is calculated.

The minimum value in 2020 was 8 years, in 2020 it increased to 9 years and by 2024 it will be 15 years. Early payment is possible (Article 30 of Federal Law No. 400).

Work experience includes:

- time of work in Russia (contributions were transferred to the Pension Fund);

- periods of work abroad (provided for by international treaties, insurance premiums were paid).

Under certain circumstances, length of service is taken into account to determine other types of pension benefits.

Other periods

Other periods that are added to the length of service:

- military service (other, equivalent to it);

- sick leave;

- maternity leave up to 1.5 years;

- the citizen does not work and receives benefits in connection with this;

- public Works;

- moving to another location due to government service;

- unjustified detention or imprisonment;

- care for the disabled or pensioners;

- residence of military wives (husbands) in areas where there is no work in their specialty;

- living abroad with a diplomat spouse;

- operational work within the framework of operational investigative activities.

How to calculate

The amount of insurance coverage is calculated over 30 day periods, which are converted into months.

Months in turn are converted to full years. If the periods coincide, the pensioner chooses one of them.

- Regardless of the category of citizens applying for a pension and the type of activity, periods are added to the insurance period if pension contributions have been received.

- If the future pensioner is a civil servant, military personnel, or astronaut, then the periods taken into account when assigning payments for length of service are not added to the length of service.

- For seasonal activities, the period of work during the season is taken as a full year.

- For authors of works, a calendar year is included in the length of service if the total amount of contributions transferred for the year is greater than the basic amount of insurance payments. If this amount is less, then the period is counted in months in proportion to the contributions received.

Periods before the beginning of 2020 are included in the length of service, taking into account the rules for calculating length of service according to the legislation in force at the time the work was performed.

Who can get it

Most citizens who allocate 6% of pension contributions to form a funded pension in a non-state pension fund hope to receive a lump sum payment upon retirement. However, not all of them can count on this. The law provides for the following conditions under which payment is made:

- Receiving funds in connection with the onset of disability.

- Receiving financial support due to the loss of a family breadwinner.

- Receiving a state pension along with the opportunity to retire in old age.

- Making pension contributions from 2002 to 2004 (payments were canceled from 2005).

- Participation in the state co-financing program and making initial contributions (it is currently no longer possible to participate in this program).

- Availability of savings.

Along with deciding the question of when to receive the funded part of the pension, it must be taken into account that the pensioner has the right to address this issue no more than once every 5 years.

In addition, the year of birth matters. Here is the age at which the funded part of the pension is received:

- Men born before 1953 and women born before 1957.

- Men and women born in 1966 and earlier.

Deadlines for submitting documents and receiving due payments

To establish the receipt of the funded part of the pension, you need to contact the organization that forms it immediately after you have the right to receive this payment. However, according to the letter of the specific law we are interested in, you have the right to submit an application about a month or even earlier before you come into possession of the right you are looking for.

Review of information will take approximately 10 working days

From the date of submission of the application, consideration of information will take approximately 10 working days. Provided that you have not attached all the required documents, the process will not start all over again, you will only be given an explanation regarding what other documents you need to provide. Provided that you nevertheless provide them within the next three months, the date of filing the application will be considered the one on which you first submitted a correctly completed application.

Calculation of the amount of the pension payment will take a month from the moment you submit your application for consideration. Payments of funded pension in this case:

- will start next month;

- will be carried out simultaneously with the payment of the insurance pension.

There are several types of funded pensions

There are, however, several types of funded pensions, each of which implies a specific procedure for assigning and paying these accruals. We have already mentioned them in passing more than once in the text of this article.

Calculator for calculating pension savings compensation

Go to calculations

Table 5. What types of funded pensions exist

| View | Description |

| One-time payment | This type of payment allows pensioners to receive all the funds accumulated at the time of acquiring the right to contributions in full and immediately. Not everyone has the right to it. Among those who have such an opportunity, we can distinguish: · pensioners whose total amount of funded pension does not exceed 5% of the portion of the insurance pension; · citizens who receive a pension due to the loss of a breadwinner or disability; · pensioners who receive a minimum pension from the state, provided that they have no work experience at all. The decision on a lump sum pension payment is made approximately within a month after you submit a corresponding application to the Pension Fund. Provided that the organization that received the application makes a positive decision, the money is issued within another two months from the Pension Fund, and when applying to a non-state fund - within one month. Citizens who received such a payment can receive their funds again after another five years. |

| Urgent pension payment | The purpose of this payment is made when the right to an old-age pension arises. Payments are made monthly for the period established by the insured person, which cannot be less than 10 years. The formation of an urgent payment is made from additional insurance contributions. |

| Traditional funded pension payment | This type of payment involves the transfer of funds in the amount that was established according to the amount of accumulated funds in your pension account. The required payment is for life, and it will be transferred to you along with the main pension, or separately, at your request. |

Conditions for receiving a one-time payment

If a citizen expects to receive a one-time payment, the following conditions must be met:

- Reaching retirement age (in connection with the pension reform, this indicator is gradually increasing for men from 60 to 65 years old, and for women from 55 to 60 years old).

- Receiving a basic old-age pension.

- Work experience (in connection with the ongoing reform, the number of years of experience is gradually increasing from 5 to 15 years).

- Statements from the recipient.

Only if these conditions are met can you expect to receive a lump sum payment.

Before reaching retirement age, transfer of money is possible if a citizen has become disabled of group I, II or III. Funds are also paid upon the death of the family breadwinner.

Federal Law 168 in the latest edition

From January 1 to December 31, 2020, as in several previous years, funded pensions are completely frozen. Some citizens preferred to draw up agreements with non-state funds to save and increase the corresponding contributions. Citizens of other countries and persons who do not have citizenship of any state (subject to generally accepted grounds) are provided with a pension under the same conditions.

Federal Law 168 says this about the funded part of the pension: categories of people not specified in it who are entitled to federal payments must receive them in accordance with other national standards. The provisions of Russian law do not require confirmation of the fact of registration in the Russian Federation for the calculation of pension payments. When assigning pensions, the fact of life within Russia may be established taking into account information about the person’s continuous presence in the country.

According to the provisions on the payment of funded pensions 168 Federal Law, they can be received by everyone who has the right to an old-age insurance payment. Such persons include those who can receive these payments ahead of schedule. When the actual amount of payments from accumulated funds is 5% or less than the level of insurance payment, the insured are given the right to receive savings in a lump sum.

What will be most interesting to future pensioners in the articles of Federal Law 168 is the provision that they themselves determine the procedure for calculating the funded pension. At their choice, additional amounts can be used either to increase it or to make an immediate pension payment. Such amounts include not only insurance premiums and money paid by employers, but also funds intended for co-financing pension savings (including maternity capital), and profits from their investment in various projects.

The Federal Law on funded pension provides for annual adjustment of its size. The amendment is introduced in the eighth month of each year and includes all additional funds that have been deposited into special accounts. The issuance of a funded pension is processed based on applications submitted at any time after the legal deadline for its payment. The insurance structure (PF of the Russian Federation) makes payments to the address indicated in the payment file (created at the place of residence).

Required documents

Documents are submitted in two stages. The first time you only need to present a document that certifies your right to receive a pension. The second time you need to prepare the following papers:

- A copy of your ID (with presentation of the original).

- SNILS.

- Certificate of a disabled beneficiary, or other document confirming the corresponding right to payment.

If this issue is dealt with not by the pension recipient, but by a trusted person, then a power of attorney should be issued for him to carry out specific actions, and the document should be certified by a notary. In some cases, other documents may be required. They should be presented upon request by employees of the organization where the applicant is applying.

Where to apply for an appointment

You need to apply for payment of funds to official funds

Provided that a citizen transfers funds to the account of the Pension Fund of our country, an application containing a request for the transfer of funds must be submitted to the territorial body of this fund according to the location of your:

- accommodation;

- registration.

In addition, bypassing a specific authority, you can immediately contact the Multifunctional Center.

Provided that the formation of the funded part of the pension was carried out in a non-state pension fund, the fund in question will continue to issue funds accumulated by the citizen during his life. Accordingly, you will need to contact it after collecting the relevant documents (also for registration, as well as payment of urgent and one-time financial payments).

Go for payment as soon as you become eligible to receive it

After you receive the right to receive a pension, you can appear at the desired organization at any time that is convenient for you, not immediately after the right comes into force, but after that after any amount of time.

Receiving a funded pension for a deceased relative

If a person who had pension savings dies, then his relatives can receive these funds. If desired, the pensioner personally appoints those to whom the money will be transferred. To do this, he needs to come to the Pension Fund and write a corresponding statement. He also has the right to indicate this right in his will. If neither one nor the other was done, then the funds are transferred by inheritance according to the law.

True, you need to understand that you will only be able to receive that part of the savings that has not yet been paid. True, there is an exception to this rule. If a citizen continues to work in retirement and at the same time transferred interest to the funded part, then, despite receiving part of the money from this pension, the amount may increase due to the investment of new invested funds. In this case, the heirs can count on that part of the pension that has not yet been indexed at the time of the pensioner’s death.

The rights of heirs to a funded pension have some restrictions, which are as follows:

- If the money was transferred from maternity capital, then upon the death of the mother, the spouse can receive it. If it is not there, then only born children.

- If the funds were transferred from her own savings, then the widow will be able to use the method of receiving the funded part of the deceased husband’s pension in accordance with her turn.

- If there is a will or an application to the Pension Fund of the Russian Federation, which sets out the will of the deceased, distribution is carried out in accordance with this procedure.

- If the deceased did not notify anyone where he kept the money and did not leave a will, then the heirs need to go to the nearest branch of the Pension Fund of Russia. Experts will tell you where they should go next.

Documents you need to have with you:

- Passport.

- A document confirming the death of a relative.

- Documentary proof of relationship with the deceased.

- An application to receive pension savings belonging to the deceased.

Pension Fund specialists must make a decision within 5 days after receiving the application. If it is decided to refuse an applicant, this must be motivated. If the outcome is positive, the funds are transferred in a way convenient for the applicant.

Rules for providing funds

Citizens can apply for the establishment and issuance of a funded pension at any time, immediately after reaching retirement age (persons who finish work early also have this right). The application form for a one-time payment can be downloaded here.

In order for funds to be provided, a person must fill out an application and submit it directly to where the savings are stored.

This is interesting: Where land is given to large families

In simple terms, if the money was transferred to the management company, then the payments will be handled by the Pension Fund of the Russian Federation.

If the funds were transferred to the Non-State Pension Fund (NPF), then he will be responsible for assigning accruals.

The insured person can choose one of three types of financial payments. Namely:

The latter type can only be chosen by people of certain categories (disabled people, people receiving survivor subsidies, etc.).

How is the calculation made?

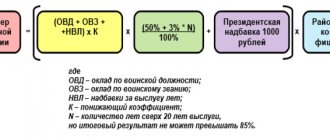

In order to calculate the amount of pension contributions, the formula is used:

| NP | Direct amount that is paid to a person in person |

| Mon | Total pension savings that a citizen has in his account by the time the period when their payment can begin |

| T | Average coefficient of the expected period of accrual of pension savings, calculated in months |

In the event that it is necessary to calculate a fixed-term funded pension:

| JV | Urgent payment of funded pension |

| Mon | The amount of total savings stored in a person’s account |

| T | The period for accrual of funds/ which is indicated in the application (according to the law, the period must be at least 10 years) |

With a one-time payment, citizens receive the entire amount of money “in their hands” at once. This opportunity is provided only to the following categories of people:

- citizens whose total savings are less than 5% of the insurance pension;

- persons who have been assigned benefits for the loss of a breadwinner, disability, or state pension benefits for elderly citizens with a small number of points or insufficient work experience;

- pensioners who are the spouse or direct relatives of a person with savings savings who died before retirement.

A one-time benefit cannot be assigned to people who have previously received it. As for pensioners, they have this right, however, not earlier than after 5 years.

What documents need to be submitted

In order for a person to be assigned a funded pension in a non-state pension fund or PF of the Russian Federation, it is necessary to provide a certain list of documents:

- application for the accrual of funds;

- passport of a citizen of the Russian Federation;

- pension certificate;

- SNILS;

- pensioner's ID.

Additional types of documentation may be required for the calculation of savings payments.

Peculiarities of filing an application with a non-state Pension Fund

Non-state pension funds are created for the sole purpose of making a profit. Non-state Funds take citizens' savings (accumulative capital) and invest in various projects in order to increase the amount of money.

Despite the fact that these are private commercial structures, they are strictly controlled by:

Some of the most reliable non-governmental organizations include:

The principle of using the savings funds of the Pension Fund of the Russian Federation and Non-State Pension Funds is identical. Both organizations invest money in various projects.

In difficult economic situations, when a budget deficit occurs, the Pension Fund of the Russian Federation uses these funds to calculate pensions for elderly people.

In addition, a non-state fund does not have the right to use more than 15% of its income for its needs, and in the Pension Fund of the Russian Federation there is no such restriction. If necessary, a citizen has the right to transfer his own savings from one NPF to another.

The procedure for receiving the savings of a deceased relative

Relatives of the deceased have the right to receive his savings. However, in this case, they may have a question: when can they receive a pension?

According to the law, savings can be passed on to heirs only if:

- the person died before the start of urgent or permanent payments;

- after the establishment of a fixed-term pension;

- after establishing the issuance of a lump sum (possibly if it was not previously transferred to the deceased).

If a citizen died after the appointment of an indefinite pension, then its balance is not subject to return to the second spouse and relatives.

The following heirs have the priority right to receive a funded pension of a person who has passed away:

If the deceased does not have them, then brothers, sisters, second cousins or strangers can become heirs, however, if they are included in the will.

Cumulative savings in the Russian Pension Fund or Non-State Pension Fund is an excellent addition that allows a person to improve their standard of living in old age.

In addition, such a pension can be a good financial support not only for the pensioner himself, but also for his relatives in the event of the death of the recipient.

Video: what is a funded pension payment

- Due to frequent changes in legislation, information sometimes becomes outdated faster than we can update it on the website.

- All cases are very individual and depend on many factors. Basic information does not guarantee a solution to your specific problems.

That's why FREE expert consultants work for you around the clock!

- via the form (below), or via online chat

- Call the hotline:

- Moscow and the Region

- St. Petersburg and region

- Regions

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

Receiving a funded pension indefinitely

The transfer of money is carried out depending on the amount that has been accumulated over the entire period. In this case, the payment is transferred for life every month. That's why it's called perpetual. The amount of the funded pension is calculated based on the expected payment period. Currently it is 246 months. The calculation is made by dividing the total amount in the account by 246.

It is possible to divide this amount into fewer months. Then you should wait a little while deciding when you can receive the funded part of your pension. The number will decrease with the number of months that have passed since the right to leave has arisen. However, it must be at least 168 months.

Who falls under 168 Federal Law

This regulatory act regulates the procedure for pension insurance, which is mandatory for everyone entering into an employment relationship under a contract. Workers will receive a pension that is determined by wages, or more precisely, by insurance contributions, which the employer transfers in a specially established manner.

Federal Law 168 regulates this procedure: the amount of payments, their frequency, the circle of paying persons and organizations, patterns of use and documentation. Those eligible to receive the funded part of the pension include:

- people born in 1967 and younger who chose this scheme before 01/01/2019;

- female persons born 1957-1966;

- males born after December 31, 1952, but before January 1, 1967;

- participating in the pension co-financing program;

- who have decided to use maternity capital as a means of pension savings.

This is interesting: Characteristics of a clerk for an award

Advantages and disadvantages of funded pension

The decision to transfer part of pension contributions to a management company or non-state pension fund has both positive and negative sides. The benefits are as follows:

- Possibility of choice. The future pensioner decides for himself what will happen to the funded part of the pension, where he will invest the corresponding interest. Moreover, a citizen has the right to change his choice whenever he wishes.

- Opportunity to earn high interest rates. If the NPF makes profitable investments, the citizen will ultimately receive an amount higher than that allocated by the state.

- The funded pension can be inherited by close relatives. This right does not apply to insurance payments.

- There is a risk of losing only profit. The money that was invested will be returned in any case.

- Thanks to interest, you can increase the size of your future pension.

All these advantages also have a downside in the form of disadvantages. These include the following:

- High risks. If all the money remains in the Pension Fund, the amount will certainly increase, although not by much. But in the case of a transfer to a non-state pension fund, it is unknown what will happen to the funded part of the pension. There is a risk of being left completely without profit. And due to inflation, this money may completely depreciate, since indexation is not carried out in relation to it.

- Risks can be insured. Then there will definitely be a profit, but the citizen will have to incur additional expenses.

- Withdrawal of commissions. Not everyone carefully reads the contract when concluding it. Meanwhile, it may provide for some provisions that could easily deprive the investor of interest. For example, there may be fees for cash withdrawals or penalties for early termination of the contract.

Under what conditions is the type of pension we are interested in assigned?

So, it is necessary not only to belong to a certain category of citizens in order to ultimately receive the right to a funded pension, but also to comply with a number of certain conditions, only under which one can still receive it. Let's consider what conditions we are talking about.

You can receive a pension only if certain conditions are met.

Table 2. Under what series of conditions do citizens have the right to form and subsequently receive a funded pension.

| Condition | Detailed description |

| A citizen has the right to an old-age pension | Thus, it is possible to receive a funded pension only if the citizen has the right to a traditional old-age pension, also received early. |

| Deductions were made to the personal account | If appropriate deductions have been made to a citizen’s individual personal account, he can also receive a funded pension. |

| A certain amount of pension | Provided that the amount of the funded pension is more than 5% in comparison with the amount of the insurance pension, as of the day when the funded pension is assigned, citizens can also receive the accumulated funds due to them. |

| Please note: if the pension amount is less than 5%, which we mentioned above, then citizens who are insured will be able to receive the entire accumulated amount as a lump sum payment. |

Please remember that legislation may change, please check for updated information periodically

Please note : the current procedure for providing funded pensions was previously subject to some changes, and other rules and regulations were introduced into it. Therefore, keep in mind that the Federal Law we are talking about today may also change, and keep track of these changes.