Home / Labor Law / Payment and Benefits / Pension

Back

Published: March 25, 2016

Reading time: 7 min

0

6674

The specific amount that the pension cannot exceed is not indicated anywhere.

Theoretically, whatever we earned, that’s what we’ll get.

But there are still some nuances that can limit it in size or, on the contrary, make it larger.

- What affects the size of the old-age pension?

- Which specialists have the highest pensions in Russia?

What is needed to receive an old-age pension?

A citizen of the Russian Federation can count on receiving a pension in one of the following cases:

- by old age;

- in case of having a minimum work experience;

- if you have the required number of points.

Let's clarify the first point. To receive government old-age benefits, a man must be at least over 60 years old, while a woman must be 55 years old.

As for work experience, by the beginning of 2025 it must be more than 15 years. This is explained by the fact that in 2016, 7 years of experience was successfully approved. Subsequently, it will increase from year to year until it reaches 15 years.

In the third case, a person receives financial assistance based on the number of pension points. This is a conditional coefficient, which is calculated depending on the salary, as well as insurance contributions from the employer to the Pension Fund.

It should be noted that by 2025 it is necessary to accumulate at least three dozen of these points in order to count on receiving a pension. In 2020, their number was changed to 9. Every year the number will increase by 2.4. This will continue until the number reaches 30 points.

How is the pension calculated?

The old-age insurance pension is calculated based on three conditions.

Age. From 2028, men will retire at the age of 65 and women at 60. Now, in the second half of 2020, men aged sixty and a half and women aged fifty and a half are retiring.

Number of IPCs. In 2020, it is enough for a future pensioner to have 16.2 points, but in 2024 pensioners must have at least 28.2 points, and in 2026 and beyond - from 30 points.

Only if these conditions are met will the pensioner be able to receive an old-age insurance pension. Otherwise, he will have to wait another 5 years and apply for a social old-age pension, which is much less than the insurance one. The amount of the social pension is set by the state.

Everyone knows that a pension consists of two parts: insurance and funded. Pension points that determine length of service, including official salary. The size and right to insurance pension payments depend on them.

Pension points are paid for each working year. The more points accumulated before entering pension registration, the more the state will pay the pensioner. And also the size of the pension depends on the size of the salary, because the employer pays for the employee to the Pension Fund of the Russian Federation.

How to receive an old-age pension early?

The government provides the opportunity to apply for an insurance pension early. To do this, a citizen must qualify by:

- age;

- duration of insurance period;

- number of points;

- length of work experience.

Depending on the profession, the conditions for receiving government payments change. Let's take a closer look at the types of work and criteria required to receive a pension.

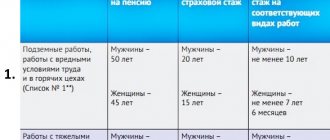

Production with hazardous conditions (hot shop and underground labor). The citizen's age must be 45 years for women and at least 50 years for men. In this case, the duration of the insurance period must reach 15 and 20 years, respectively, and the minimum period of service must be from 7.5 years and from 10 years, respectively.

Professions with difficult conditions. This category includes:

- employees of the metro or railway;

- drivers of trucks working at mining enterprises;

- geologists, topographers, people performing geological exploration, geophysical, prospecting and other types of survey work;

- workers of river, sea and fishing fleets. The exception is the personnel of port ships and ships for intracity or suburban use;

- craftsmen who are engaged in logging and timber rafting. This should include specialists who monitor the health of the equipment;

- flight crew.

For this category, the insurance period must be at least 20/25 years for women/men, respectively. In this case, the age must reach 50 and 55 years, respectively. As for the required work experience, for women it must exceed 10 years, and for male employees - 12.5 years.

Personnel of an agricultural enterprise, drivers of loading and unloading, road, and construction vehicles. To receive a pension, an employee in these areas must be 50 years old (applicable only to women). The duration of the insurance period must exceed 20 years, and the work experience must exceed 15.

Prison and pre-trial detention center employees. In this case, the man's age must exceed 55 years, while the woman must be over 50 years of age. As for work experience, it must be at least 15 and 20 years. At the same time, the duration of the insurance period stopped at 20/25 years, respectively.

Teams involved in loading and unloading operations at ports. This should also include engineering and technical personnel servicing civil aircraft and drivers of passenger transport. For men in this profession, the minimum required age is 55 years, the insurance period is 25 years, while the working experience must be more than 20 years. For a woman, these figures are 50, 20, and 15 years, respectively.

For certain types of work, some previously presented conditions may not be taken into account. This list includes:

- People engaged in the extraction of any minerals by underground or open pit methods. This category also includes personnel of mine rescue units and teams building mines and mines. To apply for a pension, you only need to have more than 25 years of work experience. In the case of employees of leading units, the minimum duration of service must be 20 years.

- Textile industry specialists who engage in heavy or intensive work. To count on financial assistance, the minimum length of service for a woman must be 20 years, and age - 50 years.

- Flight and flight test personnel directly involved in research into parachute, aerospace and aeronautical technology.

- Employees working in the field of production, reception, and processing of seafood, as well as the crew of some fishing, sea and river vessels. For this and the above categories of citizens, the minimum required work experience for women stopped at 20 years, and for male personnel - 25 years. But if a person was forced to resign for health reasons, then the requirements are softened, decreasing by 5 years in both cases.

- Employees of the Ministry of Emergency Situations. For a firefighter to retire, he must be over 50 years old. In addition, he must serve at least 25 years.

- Citizens working in the emergency rescue service. In this case, age is practically not taken into account when applying for benefits. Sometimes it is still required that the person be over 40 years old. In this case, the minimum work experience in any case must be at least 15 years.

- Teachers. A teacher can retire if he has worked for more than 25 years.

- Artists of ballet groups, theater, circus and musical organizations. This category includes all those whose activities involve performing on stage. Age is practically not taken into account or the artist is required to be over 50 years old. In this case, the experience can vary from 15 to 30 years.

- Medical staff. Hospital staff who are involved in health care activities and who work in urban areas or rural areas can retire if they have reached 25 years of service. For urban doctors and in the case of a mixed version, the requirements are tightened and increased to 30 years.

The labor pension is assigned to a number of other groups of the population. For example, people who live and work in the Far North can receive financial assistance from the state.

What are pension points and how are they calculated?

The new pension legislation from 2020 has set a new condition for receiving an insurance pension. To qualify for an insurance pension, a working citizen must not only reach retirement age, but also have a certain number of individual coefficient points.

At the time of the introduction of this procedure, pensioners must have earned at least 6.6 IPC. Every year this amount increases along with the retirement age, and in the current year, 2020, this figure was 16.2 points. Its growth should end in 2025, when the retirement age reaches 65 for men and 60 for women. By this time, the required minimum IPC size will be 30 points.

As you can see, two concepts appear in pension calculations:

- Retirement age.

- Pension points.

Let's consider how they affect the procedure for calculating pension payments. The retirement age is established for all workers and employees as a certain threshold, upon reaching which he has the right to leave work and retire. At the same time, he is guaranteed to receive an old-age pension, equal today to the average Russian subsistence minimum, that is, a little more than 11 thousand rubles.

Expert opinion

Elena Koshereva

Pension lawyer, ready to answer your questions.

Ask me a question

Starting from January 1, 2019 As a result of the next reform, the pension threshold is gradually increasing and is 55.5 years for the female half of workers and 60.5 years for the male half of workers.

When a person reaches retirement age, in addition to the old-age pension, he has the right to receive an insurance pension. It is a substantial increase to the minimum old-age pension payment. The amount of this insurance pension directly depends on the IPC - the number of insurance points earned by a citizen during his working life.

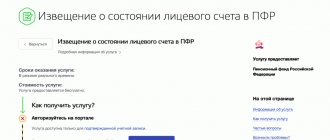

All information about pension rights and savings is in the PFR personal account. You can get it by ordering an extract.

Contact the pension fund or MFC. The extract will be given on paper on the day of application.

Send a request electronically through government services or your personal account on the Pension Fund website. The email response will come instantly.

For public services, you can find out the amount of savings in the section “Notice on the status of your personal account in the Pension Fund of the Russian Federation.”

To do this, you need to click on “Get a service.” The main reforms are aimed at tightening pension legislation. In addition to raising the retirement age, the conditions for receiving a pension are also becoming stricter. If in 2020 the minimum required length of service to make basic payments was 8 years, then by 2024 it will be 15 years. The same situation applies to cumulative points.

Currently, to receive a pension, it is enough to have 13.8 points, and after the completion of the reform, 80 points will be required. All this will be necessary to guarantee a very modest basic part of the pension, which currently amounts to 8,000 rubles. To form the funded part, employers will need to make contributions to the pension fund. This means that controlling this process will not be easy.

The situation will be somewhat better for women. They will be able to retire 5 years earlier than men (despite the fact that they still have a longer life expectancy). In addition, for raising a preschool child you will be entitled to 1.8 pension savings points per year. This is more than when working in difficult conditions (1.5 - 1.7 points per year).

However, these figures are only coefficients. In fact, with a salary of 12 thousand rubles a year, a person will receive 2 points, and with earnings of 35 thousand - already 6 points. This means that only those who have worked for a long time in a well-paid and, moreover, official job will be able to receive a pension.

However, pension legislation is constantly changing, so it is not a fact that this will be the case in the future. If the economy in the country improves, then someday it may be changed. At least that's what we should hope for.

Now the average pension in Russia is 13.7 thousand rubles. But many people receive less than this amount.

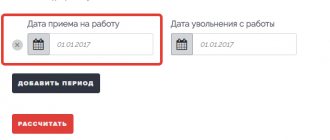

On June 25, 2013, a pension calculator was posted on the official website of the Ministry of Labor of the Russian Federation and the Pension Fund of the Russian Federation, in other words, a mechanism by which citizens of the Russian Federation can calculate their future pension.

But, according to the Minister of Labor of the Russian Federation, the calculator is not intended to determine the exact amount of the pension; it can only predict a certain amount given various indicators.

When calculating your future pension, you will be asked to enter the size of your salary, gender, length of military service, etc. in the columns. But the calculator gives the amount as of today, that is, as it would be if you retired tomorrow.

The calculator bases its calculations on the new pension formula, which is provided for in the Law “On Insurance Pensions” dated December 28, 2013 No. 400-FZ, effective from January 1, 2015.

But! It is worth remembering that the pension formula initially includes an instrument that can affect the size of the pension in the direction of its reduction. This is the so-called cost of the pension coefficient, which is set depending on the economic and demographic situation in the country and other indicators.

The size of the “white” salary before deduction of income tax, which goes towards the calculation and payment of mandatory insurance contributions to the Pension Fund, as well as length of service are the main factors for the formation of the number of pension points.

This year the maximum score is 8.26. From 2021, it is expected that they will increase to 10. This coefficient is determined for those citizens who direct their insurance contributions to form only an insurance pension. If it is formed simultaneously with the cumulative one, the maximum number of points per year will be 6.25.

For people born in 1966 and older, only the insurance type of pension formation is available. For citizens younger than the specified year, they have the opportunity to choose the method of calculating state benefits - funded and insurance or only insurance. However, people who made their choice before 12/31/15. simultaneously of two methods of pension formation, have the right at any time to refuse the funded part in favor of the insurance one. Thus, six percent of contributions are directed only to the accrual of the selected accumulation system.

| Year | Cost of 1 point in rubles |

| 2015 | RUB 71.41 |

| 2016 | RUB 74.27 |

| 2017 | RUB 78.58 |

| 2018 | RUB 81.49 |

| 2019 | 87.24 rub. |

| 2020 | 93 rub. |

To calculate your pension yourself, you need to understand how to convert points into rubles. There are calculations here that the calculator calculates points for, or you can calculate it yourself.

In order not to waste time on calculations in a column or in a calculator, we have created a unique system for calculating pensions. With this online calculator you can instantly and accurately calculate your pension in 2020. To do this, you need to fill in several fields, for example, the amount of salary received, gender, age, and so on.

IPK = (IPKs IPKn) x KvSP

- IPC is an individual pension coefficient, that is, how many points a pensioner has, starting from the date of receipt of the insurance portion of payments.

- IPKs – the number of points calculated from January 1, 2020.

- IPKn – points that are accrued starting from January 1, 2015 from the time when the pensioner began receiving insurance pension payments.

- KvSP is an increasing coefficient when the insurance pension increases, for example, upon the death of the breadwinner.

An individual entrepreneur pays insurance to the Pension Fund, so he can also receive a labor pension. To obtain it you must meet the following requirements:

- Reach retirement age. As of 2020, the retirement age for men is 60.5 years, and for women 55.5. But every year it increases, in 2028 it will be fixed at 60 years for women and 65 years for men.

- Insurance experience. This value refers to the period of insurance payments to the Pension Fund. Individual entrepreneurs pay it themselves, while their employer pays for ordinary workers. In 2020, the insurance period must be at least 10. But it increases every year, and in 2024 it will be 15 years.

- Minimum number of points. In 2020, this figure is 16.2 points. In 2025 it will increase to 30 points.

More on the topic Preferential pension for teachers in 2020: conditions of appointment and calculation

What is the difference between work and insurance benefits?

In current legislation there is no such concept as a labor pension. As a rule, it is replaced by the words “old-age insurance benefit”.

The main difference between the latter is that the senior citizen receives a payment in the amount of the income that he lost. Therefore, the main criterion, depending on which the amount of payments is calculated, is the insurance period. That is, Pension Fund employees take into account periods when the employer transferred a certain amount to the pension fund.

As for the labor pension, such a term existed back in the days of the USSR. At that time, attention was paid to the amount of contributions paid by the employer to the Pension Fund. At the same time, the length of work experience played practically no role.

Today there are so-called fixed payments. This is a type of labor pension. Its essence lies in the fact that a person receives a certain amount, which does not change from time to time. The amount of such payments is calculated at the time the pension is assigned.

What changes await Russian pensioners in 2020

https://www.youtube.com/watch?v=dVgJLAiGr7Q

This index is necessary to determine the amount of money needed to pay for primary needs:

- physiological: food, medicine, utility bills. In a word, everything that is necessary for a comfortable human life. 80% of the total amount is spent on them;

- social: visiting hospitals and other government institutions, organizing leisure time, education.

The minimum pension in Russia at the moment on average across regions is 8,726 rubles. Currently, the number of elderly people has increased. According to official data from the Pension Fund for 2020, there are a total of 45,687 million pensioners in Russia.

Of the total, monthly funds are received by:

- old age: 36004 million;

- for disability: 2280 million;

- due to loss of a breadwinner: 1625 million;

- separate payments (length of service, Chernobyl, etc.).

People who work but receive old-age pensions may receive social supplements from the federal or regional budget.

In accordance with the words of Anton Siluanov, who is a representative of the Ministry of Finance, from 2020 pensions should grow by at least 6% per year. This figure exceeds the inflation rate, so we can take into account that the level of pensions for Russians will gradually increase.

In this regard, information about what the minimum pension will be in Russia in 2020 becomes relevant, especially in light of the fact that, according to the Ministry of Finance, the nominal amount of average pension payments should reach 20,000 rubles.

With the beginning of the pension reform, the incomes of older Russians began to grow slowly, and the retirement age began to rise systematically. At the same time, every year it becomes more and more difficult for citizens to receive their well-deserved pensions, because the conditions for calculating payments are constantly becoming more stringent.

We tell you how much pensions will increase, at what age Russians and Russian women will retire, and how many years of service and pension points will be enough to receive an old-age insurance pension in 2020.

Russian citizens of advanced age expect pension increases every year. Pension benefits are reviewed regularly. There were no pension indexations carried out in September, as this was done in January.

Analysts are confident that cash allowances for pensioners will be revised in December. This year, a significant increase in pensions became possible, since the necessary amount of funds was allocated from the state treasury.

It is known that in early September, wages were increased for working pensioners. Despite this, pensioners who quit their jobs cannot be assigned pensions below the lowest subsistence level prescribed by the regional leadership.

Many of them have already approved the minimum subsistence level. Now the amount of pensions is calculated according to a unified methodology presented by employees of the Ministry of Labor.

We bring to your attention a complete list of new pension amounts from January 1, 2020 for all categories of pensioners, taking into account all currently known indexation coefficients.

How much will pensioners receive, taking into account social supplements? Almost all current and future pensioners know that in Russia there is no concept of a “minimum pension”. Of course, there is a social pension that those who have never worked receive, but it is never paid to anyone in its pure form.

All old-age pensioners whose income is below the regional subsistence level of the pensioner in the region of residence receive a social supplement to their pension up to the subsistence level.

Thus, the pensioner’s subsistence minimum (PMP) is the very minimum pension in Russia. And in 2020 it will increase at the federal level. But the regions have not yet decided on the final living wage figures. But first things first.

The minimum old-age pension in Russia is a very conditional concept. It is not officially established and is used only in everyday life. But there is such a thing as the value of the pensioner’s subsistence level (PMP).

- This is, in essence, the very same amount of the minimum wage, since all non-working pensioners whose total amount of material support does not reach the value of the pensioner’s subsistence level (PLS) in the region of his residence are given a federal or regional social supplement to their pension up to the value of the PMS.

- In other words, a non-working pensioner in Russia should not receive payments less than the pensioner’s subsistence level (PL) in the region of his residence.

- This means that the cost of living of a pensioner in a particular region of the Russian Federation can be conditionally considered the size of the minimum pension in this territory.

According to the Russian Pension Fund, the average old-age pension in Russia at the end of 2020 - beginning of 2020 is approximately 14,100 rubles.

If we compare it with wages, then, according to analysts’ calculations, this pension amount is about 40% of the average earnings in Russia.

The average social pension is 9,045 rubles.

The average pension paid to disabled children is 13,699 rubles.

Pensions received by citizens with disabilities due to military trauma average 30,700 rubles.

It is worth noting that in the post-Soviet space, the Russian Federation is one of the richest countries in terms of pension provision for citizens. The only competition we can have is the Baltic region, but it is worth considering that in the Baltic states the costs of utilities for all the “earnings” of pensioners are quite high.

If you pay attention to the pension policy pursued by the state, it can be noted that compared to the 90s of the twentieth century, the crisis in this area has begun to fade away.

Moreover, the average pension is growing (according to conservative estimates) 2 times faster than consumer price inflation. This is facilitated by the indexation of pensions carried out by the Government of the Russian Federation twice a year - 01.02 and 01.04 (find out how pension indexation will occur from 2019).

Having reached the age established by law, a citizen begins to think about what minimum pension awaits him?

Note that in Russian legislation the concept of “minimum pension” does not exist; its size depends on various circumstances.

The minimum amount of an old-age pension should not be lower than the minimum subsistence level for pensioners established in the region of residence of the pensioner.

But if such a situation nevertheless occurs (a citizen’s old-age pension with all allowances is below the subsistence level for pensioners), then additional social benefits are established for the pensioner: in such an amount that the pension is equal to the regional subsistence level. The social supplement is established based on the pensioner’s application. Working pensioners are not entitled to social benefits.

More on the topic Regional Maternity Capital in Bryansk in 2020, description and conditions for obtaining the amount of family capital in Bryansk

The minimum pension may be increased in the following cases:

- a citizen crosses the 80-year mark;

- one or more relatives are dependent on him;

- the insurance pension is indexed;

- pensioner goes to work.

In order to receive at least the minimum old-age pension in Russia, you must have at least 15 years of work experience. But the thing is that not everyone has it. In this case, you will be paid a social pension.

Of course, those who are closer to the state feeding trough. First of all, this is a large army of officials. In total, according to official data, there are 1.1 million people. Officials in the lowest official category receive about 20 thousand rubles. Heads of department - 42 thousand. Chairman of the committee - 60 thousand rubles (this is in addition to the regular pension).

At the same time, it is difficult to determine the official’s true pension. After all, it is influenced by other factors: civil ranks, positions, and so on.

In addition to officials, high pensions can be received by the military, deputies, judges, other officials and the president. Let's look at each category in more detail.

If you look for who has the largest old-age pension in Russia, then, first of all, among personal pensioners. The fact is that some people are paid special pensions. That’s why they are called “personal pensioners.” These include employees of the presidential administration, tax services, heads, managers, employees of corporations, and commercial organizations. The pension of the last two categories also includes additional payments from the companies where they worked.

Former cosmonauts, test pilots, and retired judges also receive high personal pensions. They have over 100 thousand rubles a month. Heroes of Russia, Heroes of the USSR, Heroes of Labor and so on receive less, but still a lot. Also, former prosecutors, regional and municipal deputies and officials have large pensions - around 50 thousand rubles.

The pensions of former security officials of various departments and the military are significantly lower (but higher than average). In this case, the pension amount is 25 thousand rubles. But it can be from 16 to 50 thousand. Various benefits may also be provided, including spa treatment.

Judges' pensions can vary between 50-140 thousand rubles. This is due to their level (federal ones receive more than regional ones), titles, academic degrees, length of service, and knowledge of foreign languages.

And cosmonauts have the largest pensions - over 400 thousand rubles.

Pensions in Russia vary not only depending on where a person worked, but also by region. The highest average pension in Chukotka is 22 thousand rubles. In second place is the Kamchatka Territory - 20.6 thousand rubles. In third place is the Nenets Autonomous Okrug (19.9 thousand rubles). Large average pension in Yakutia - 17 thousand rubles. In Moscow, pensions are somewhat smaller, but those who have lived there for a long time can receive a higher amount. We are talking about native Muscovites.

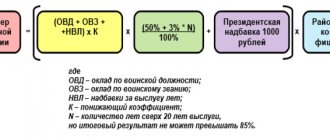

It is known that pension payments to military categories are carried out through the Ministry of Defense. The order of registration is also different for them. Initially, you need to register with the military registration and enlistment office at the place of registration, then collect the required documents and take them to the commissariat, to the pension department.

Where and how to apply for an old-age pension?

The legislation of the Russian Federation states that financial payments are processed by the pension authority, which is located at the place of registration (residence) of the citizen. Accordingly, if a person has moved to another district or city, he will have to contact the department again. In this case, you must provide the entire package of documentation.

What will you need to apply for a pension? The list should include the following:

- statement;

- residence permit or passport of a citizen of the Russian Federation;

- SNILS document;

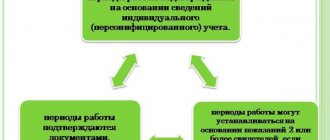

- a certificate indicating the average salary for 5 consecutive years up to 2002. In this case, the department that will deal with the registration will pay special attention to data for 2000 and 2001. Since this information was provided by employers and also recorded by the Pension Fund;

a package of documentation confirming the length of work experience. Please note that the papers must contain your full name, date of birth, period and place of work, basis for issuance, position, as well as the date when the document was issued. It is also worth adding here the documents that are issued after dismissal.

In some cases the list may be expanded. The employee of the pension department will indicate which additional documents need to be provided.

If you have any problems or questions, you can count on advice from a PF employee. He must tell you in detail what documents you will need and how to fill them out. After clarification of all questions, the citizen is given 3 months to collect all the necessary papers.

What do we have besides pensions?

Due to the fact that pensioners (the majority) are not engaged in labor activities, they are considered a socially unprotected category of citizens.

That is why, in addition to pension provision, pensioners can count on other benefits and allowances.

- Tax legislation has provided “indulgences” for pensioners in the form of exemption from property tax; the pension is not taxed, and you can also receive a property deduction for the purchase of real estate if you apply for it within 3 years after retirement (pensioners are allowed to apply for a deduction for the previous 3 years, unlike other citizens).

- In the healthcare sector, everything is also good: all pensioners are covered by the compulsory health insurance program and have the right to receive medical care free of charge. Citizens receiving a minimum old-age or disability pension are required to sell prescription medications at a 50 percent discount.

- Compensation for payments for housing and communal services. If a pensioner is recognized as low-income, then he is entitled to a subsidy to pay for utilities. In addition, some regions provide compensation for housing costs as an additional measure of social support.

- Preferential travel on public transport, provided for by regional legislation.

If we summarize federal and local legislation, we can conclude that in addition to pensions, citizens have the right to additional benefits provided to them by the state.

Rules for calculating payments

At the beginning of 2020, the government adopted innovations in the Pension Fund. Most of all this affected the insurance pension. It began to be calculated using a completely new formula. Moreover, first of all, employees look at the number of points that a person was able to receive during his work. As for the funded component, it is calculated in the same way as when serving people born after 1967.

The exact formula for calculating pensions is quite complex. It's better to use another method. Today, any citizen of the Russian Federation with Internet access can independently calculate the amount of state financial assistance using a special calculator. You can find the program on the official website of the Pension Fund.

All that is required from the user is to fill in the fields with the necessary information. So, you will need to specify:

- floor;

- salary size;

- the length of your military service;

- work experience, etc.

It should be noted that the calculator uses financial data for 2020 to make calculations. For example, the software transfers 1 pension point as 74 rubles 27 kopecks. At the same time, the fixed payment stopped at 4,558 rubles 93 kopecks, and the maximum salary before taxes, from which the insurance premium must be deducted, is equal to 66,334 rubles for one month.

If you were unable to figure out the calculator presented on the PF website, then you can find its analogues. Fortunately, there are a huge number of similar services on the Internet.

Types of pensions in Russia

In the Russian Federation, there are several types of pensions, which are divided according to the conditions of assignment. According to Federal Law No. 166 of December 15, 2001, the pension can be:

- Old-age insurance (otherwise called labor insurance) - to receive it, you must reach retirement age, have at least the minimum insurance period and the required number of points.

- Social - payments of this type are assigned in the event of the loss of a breadwinner, disabled people or persons who have lived to old age but do not have the necessary length of service.

- State - such provision is intended to compensate for lost income for certain categories of citizens (for example, victims of radiation, military pensioners or test pilots). This type of accrual depends on a number of conditions - the absence of another form of income, the presence of work experience, etc.

What determines the size of the pension?

Absolutely every person who is close to retirement age begins to think about what the minimum payment amount is and what it depends on. It is important to understand that in each case, financial assistance will be different. After all, a number of factors influence the final amount.

Today there is no concept of a minimum pension. However, the legislation contains a list of parameters that actually indicate its lower limit. First of all, the payment amount cannot be less than the subsistence level. However, it is different for each region. Today, the minimum benefit amount reaches 4,558 rubles 93 kopecks.

If the pension for one reason or another is less than the subsistence minimum, then the required amount is added through social payments. You can receive them only when the pensioner does not work and has written a special application.

The minimum payment amount may increase in the following cases:

- if the citizen’s age has exceeded 80 years;

- if the pensioner started working;

- if he supports one or more relatives;

- if the pension was indexed.

As for the size of the maximum pension, no specific amount is known today. Indeed, in this case, the person’s age, his work experience, the size and number of pension contributions, as well as the average salary are also taken into account.

It should be noted that in the next few years the age at which a person can retire will not increase. In addition, the government decided to reward those citizens who decided to work for a few more years. Depending on the duration of this period, the size of the pension increases. Accordingly, the later a person stopped working, the more financial assistance he will receive from the state. This decision was made in order to increase the percentage of the working population and reduce the Pension Fund's expenses.

Amount of fixed payment to the insurance pension

As of the end of 2020, the fixed pension payment is equal to 4805.11 rubles, which are accrued every month. This amount can be increased if the pensioner is included in the preferential list - then, depending on the category, the amount of the additional payment will be 6246.64-21622.99 rubles. The table shows the categories of citizens who have the right to a monthly fixed payment:

| Category of citizens | Monthly payment amount, rubles | |

| Having no dependents - citizens over 80 years of age or disabled people of the first group | 9610,22 | |

| Citizens of the same category with 1-2-3 dependents | 11211,92-12813,62-14415,32 | |

| Citizens under 80 years of age who do not have a disability of the first group and have 1-2-3 dependents | 6406,81-8008,51-9610,21 | |

| Residents of the Far North (and areas that are equivalent to it) | When using the increasing coefficient, the pension will increase by the specified amount | |

| Citizens, having worked for 15 or more years in the regions of the Far North, and having a work experience for men of 25 years or more, for women 5 years less. | Persons without dependents under 80 years of age and in the absence of disability of the first group | 6246,64 |

| Persons over 80 years of age who have no dependents or have a disability of the first group | 12493,28 | |

| Persons with 1-2-3 dependents under 80 years of age and in the absence of disability of the first group | 8328,85-10411,06-12493,27 | |

| Persons with 1-2-3 dependents over 80 years of age or if there is a disability of the first group | 14575,49-16657,70-18739,91 | |

| Citizens, having worked for 20 or more years in the regions of the Far North, and having a work experience for men of 25 years or more, for women 5 years less. | Persons without dependents under 80 years of age and in the absence of disability of the first group | 7207,67 |

| Persons over 80 years of age who have no dependents or have a disability of the first group | 14415,34 | |

| Persons with 1-2-3 dependents under 80 years of age and in the absence of disability of the first group | 9610,22-12012,77-14415,32 | |

| Persons with 1-2-3 dependents over 80 years of age or if there is a disability of the first group | 16817,89-19220,44-21622,99 | |

What is pension indexation?

In essence, indexation is the process of increasing pensions. The size of the additional amount depends entirely on the activity of rising prices for services, as well as consumer goods. The main task of such a procedure is to level out inflation, as well as provide older citizens with everything they need.

Indexation is carried out annually. The decision is made on April 1. At a meeting of the Government of the Russian Federation, it determines how much the pension will increase. In this case, the final decision is made after reviewing the income of the Pension Fund.