Pension in Moscow for visiting pensioners in 2020

A visiting pensioner who has chosen the capital of the Russian Federation for permanent residence must understand several important points that allow him to qualify for a “Moscow” pension.

Thus, in accordance with the Decree of the Moscow Government of November 17, 2009 No. 1268-PP “On the regional social supplement to pensions,” a regional social supplement to pensions was established for non-working pensioners.

The conditions for the appointment and payment of regional social supplements are the following:

- the pensioner must be unemployed;

- the pensioner must be registered in Moscow at the place of residence;

- the pensioner must be a recipient of a pension in the city of Moscow.

What do you need to receive a Moscow pension?

Increased amounts of pension benefits also provide for special conditions for receiving them, which, first of all, relate to the payment of pensions upon reaching a specific age (55 years for women, 60 for men).

The procedure for assigning a pension benefit follows the following standard algorithm:

At the initial stage, the process of obtaining a capital pension does not differ from the procedure in other regions. A few months before the age required to receive benefits, the future pensioner should apply for an old-age pension in Moscow at one of the local branches of the UPFR.

Consultation on the documents required for submission and missing documents, as well as checking the correctness of filling out the papers already in the pensioner’s hands is carried out by an inspector, whose responsibilities include providing information and creating a pension file.

After following the recommendations and preparing a package of papers confirming that the person is entitled to a Moscow pension, his further intervention in the process of assigning payments is minimal.

To create a personal pension file, the package of papers must contain:

- Passport of the future recipient.

- A supporting document if the person is liable for military service.

- Employment history.

- Pension insurance card (SNILS).

- Certificate of salary received for a period of five years (provided by persons who worked before the beginning of 2002).

- If you have dependents, copies of their insurance certificates, passports or birth certificates.

- Any documentation confirming the availability of awards, scientific degrees and special titles.

- A statement indicating the method of receiving payments.

All of the above documentation should be provided to the inspector no later than one month before the actual departure.

After submitting the relevant application, the stage of consideration of it by the pension authority begins. The pension institution is given a maximum of one month to make a final decision.

If there are no questions regarding the composition of the package of papers and their completion, the registration procedure is completed on the day of retirement age, that is, on the recipient’s birthday, he receives a positive answer. Next, the pensioner only needs to pick up the pension certificate and wait for the first benefit payment.

Important!

An application for creating a personal file and calculating pension payments can also be submitted at the department of a multifunctional center that provides such services to the population.

Having received the certificate, the pensioner needs to contact the local social security department, where he will be issued a special Muscovite social card. The production of this card should take no more than one month.

This document is necessary to accrue additional money to the recipient in the form of allowances.

How is the pension supplement assigned and paid?

The following citizens can count on regional social supplement:

- citizens of the Russian Federation;

- Foreign citizens;

- stateless persons.

Important! All specified citizens must be registered at their place of residence in the city of Moscow.

It should be noted that for non-working pensioners registered in the city of Moscow at their place of residence, a regional social supplement is established if the total amount of their material support does not reach the city social standard.

City social standard is a social standard for the material support of non-working pensioners and disabled people receiving a pension (lifetime allowance) in the city of Moscow and registered at their place of residence in the city of Moscow, established by the Moscow Government (in 2020 it is 17,500 rubles, from September 1, 2020 - 19,500 rubles).

To be able to calculate pensions based on the city social standard, you must be registered at your place of residence in Moscow for at least 10 years.

Thus, if the amount of material support for a Moscow pensioner does not reach the pensioner’s subsistence level (in 2020 it is 12,115 rubles), then he will be required to receive a regional social supplement.

general information

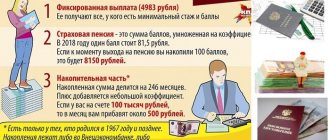

Citizens of the Russian Federation receive the right to receive pension benefits within the framework of all-Russian laws. People can claim this for various reasons. Most often, a pension is awarded in connection with reaching retirement age. It is different for women and men (60 and 65 years old, respectively). In addition, the pension is assigned:

- disabled people who have passed a medical and social examination;

- disabled citizens who have lost their only breadwinner;

- citizens who have completed their length of service (military personnel, astronauts, test pilots, civil servants);

- citizens in the absence of the required insurance period and the minimum amount of pension points.

In addition, there is a funded pension, which is a monthly lifetime payment of pension savings formed from insurance contributions from employers and income from their investment. Such a payment can significantly increase the amount of pension benefits received.

Along with the state pension system, there is non-state voluntary pension provision. By making contributions to a non-state pension fund, a future pensioner can form another pension. The employer can also participate in non-state pension provision. In this case, the pension will be called corporate.

Hint: there are also special pension payments for civil servants, military personnel, and test pilots. They are awarded and financed by the relevant ministry or department.

Capital surcharges apply only to Muscovites. And recipients registered in the Moscow Region (MO) can apply for bringing the state pension payment up to the subsistence level.

Hint: the subsistence level (LS) is the amount of money needed to survive. It is determined at the local and national level quarterly.

Who will not receive a regional social supplement to their pension?

In accordance with clause 8 of the Procedure for assigning and paying regional social supplements to pensions to non-working pensioners, citizens do not have the right to a regional social supplement in the following cases:

- are not pension recipients in the city of Moscow;

- not registered in the city of Moscow by registration authorities;

- permanently or temporarily (more than six months) reside outside the Russian Federation (regardless of the fact of deregistration in the city of Moscow);

- permanently or temporarily reside in state inpatient social service institutions, educational, training and medical institutions for children and adolescents (with the exception of persons admitted for a five-day stay);

- are, according to certificates from educational institutions, fully supported by the state;

- undergo military (alternative) conscription service;

- are undergoing compulsory treatment in specialized institutions or are serving sentences in places of detention under a court verdict.

Receiving capital pension payments when moving

After moving to Moscow from another region, pensioners often wonder who has the right to receive a pension in Moscow and how a newcomer can apply for it.

Important!

The very fact of moving to the capital will not affect the amount of payments. Any allowances and benefits accrued to the recipient of benefits for state merit, based on length of service, work in dangerous or harmful conditions, are not subject to change.

At the same time, the amount of security is affected by Moscow surcharges, the right to accrual of which is available to both native residents and non-resident recipients.

Pension benefits in the capital are issued in favor of citizens who meet all the criteria and fulfill all the established conditions.

At the same time, due to the expansion of Moscow territories, the total number of recipients of pension benefits and benefits increases every year, which leads to huge expenses from the city budget. At the moment, more than 3.5 million city residents receive various types of pension payments in Moscow.

To reduce the burden on Moscow's budgetary funds, the authorities periodically tighten the grounds for receiving additional allowances. At the same time, pensioners who were previously accrued additional funds are not subject to the tightening and can receive bonuses in the usual amount.

Author: Liliya Dorofeeva, practicing lawyer

How is the regional social supplement determined?

To apply for a regional social supplement, a Moscow pensioner must contact the department of social protection of the population of the Moscow region at the place of residence (stay), providing the following documents:

- written statement;

- documents and information on the establishment of pensions, other monetary payments and the provision of social support measures included in the total amount of financial support for the pensioner.

Important! In the application for the appointment of a regional social supplement, the pensioner must sign an obligation to promptly (within 10 days) notify the social protection department of the Moscow region, which pays this supplement, about the occurrence of circumstances leading to a change in the amount of the regional social supplement or termination of its payment.

We are starting to apply for a Moscow pension

It is recommended to arrange the first visit at least three months before the 55th and 60th birthdays for men and women, respectively.

Then there will be more time to fulfill all the requirements of regulatory authorities.

First, Pension Fund employees conduct consultations based on primary documents that are already in hand. The applicant will be informed which items from the mandatory list are missing and whether the papers present are filled out correctly. Further registration for those who need a Moscow pension, who have the right to receive it, requires minimal intervention.

Procedure for obtaining a Moscow pension

The process is accelerated if the citizen follows the established rules.

A complete package of documents is provided to the inspector at least a month before retirement age. Typically, the entire list of papers for a particular case is discussed during initial consultations.

After this, all you have to do is sign and fill out a special application.

You should also keep track of additional papers, the list of which is established separately for each citizen. We can say that it is at this moment that the formation of a pension case is completed, ready for further consideration. Please note: it is recommended to write down the contact information of the inspector who works with a particular citizen. Then you will be able to control the paper review process yourself.

Procedure and deadlines for considering an application for a pension

The pension certificate is collected immediately after confirmation has been received from the Pension Fund that the review procedure has been completed. The sooner the document is received, the faster the first financial aid is transferred to the citizen. The certificate indicates the amount of benefits from the state, with the definition of the national currency.

The regulatory body itself is given no more than 30 days to make a final decision. If no questions arise, the answer is sent to the pensioner right on his birthday.

Receiving Moscow pension benefits in case of moving

Some elderly people are faced with how to receive a Moscow pension after moving. For this you will need the following documents:

- passport;

- SNILS;

- statement.

These documents are sent to the Pension Fund branch, which generates the relevant requests.

List of documents for processing Moscow old-age payments

Passport and work book are the main types of documents required when resolving such an issue.

It is also important to have with you:

- an agreement where one of the parties is a branch of Sberbank. It is necessary to indicate the details of social cards intended for pensioners;

- certificates of rank with awards, corresponding books;

- birth certificates, supplemented by pension insurance cards for all supported dependents;

- salary certificate for 60 months. Needed for those who worked before 2002;

- pension insurance card;

- document for those liable for military service if they have the appropriate status.

Sometimes employees of a pension organization may request other documents if they are provided by the employer.

Receiving pension benefits and bonuses

When the citizen has a pension certificate in his hands, the next step is to contact the one-stop service of the district office of the Social Security Administration. Social cards for Muscovites are issued here.

Manufacturing takes up to 30 days, no more.

Certain categories of citizens can receive a Moscow supplement to their pension. Finally, the last step involves communicating with representatives of the department that deals with social allowances. Increases are issued here if appropriate reasons are present.

In this case, the following conditions must be met:

- official registration in Moscow for at least 10 years;

- lack of employment. Working pensioners are not entitled to payments;

- the total amount of pension payments received is not less than 17,500 rubles.

Unfortunately, every year the established conditions for additional payment of payments change in the direction of tightening.

What is the size of the regional social supplement?

The size of the regional social pension supplement for each non-working pensioner is determined individually and depends on:

- the total amount of his material support;

- type of registration in the city of Moscow: at the place of residence or at the place of stay.

| Category of citizens | Calculation of regional social supplement |

| Citizens registered at their place of residence in Moscow | RSD = GSS – MO RSD – regional social supplement GSS - city social standard MO - material support Example No. 1. Determination of the regional supplement for a pensioner. The total amount of financial support for pensioner Ivanov I.I. is 11145 rubles. The size of the regional social supplement is 19500-11145 = 8355 rubles |

| Citizens registered at their place of residence in Moscow | RSD = PM – MO RSD – regional social supplement PM – the cost of living MO - material support Example No. 2. Determination of the regional supplement for a pensioner. The total amount of financial support for pensioner Matveev M.M. is 10112 rubles. The size of the regional social supplement is 12115-10112=2003 rubles |

Statistical data for the Moscow region

A number of regional factors influence the amount of pensioner’s maintenance. The authorities' goal is to prevent large numbers of the population from falling into poverty. Therefore, governments are working to bring the level of income of pensioners to the PM level. It consists of the following:

- monitoring of the incomes of the disabled population is carried out;

- Social measures are being developed and implemented for groups receiving minimal benefits.

The main indicators influencing accruals for pensioners of the Moscow Region are collected in the table:

When can you lose your right to receive a regional social supplement?

The right to receive a regional social supplement is lost by pensioners in the following cases:

- death of a pensioner (recognized as dead or missing);

- loss of the right to a pension;

- the recipient of a survivor's pension or a disabled child reaches the age of 18, if he is in an employment relationship;

- the total amount of financial support for a pensioner exceeds the value of the city social standard (the living wage of a pensioner);

- deregistration of a pensioner at his place of residence in Moscow;

- expiration of registration at the place of stay in the city;

- a pensioner entering a paid job (concluding an employment contract);

- conclusion by a pensioner of a civil law contract, copyright or licensing agreement;

- obtaining a certificate of state registration (license to carry out certain activities, other documents issued in the prescribed manner for carrying out professional activities) as individual entrepreneurs, private notaries, lawyers, detectives;

- admission of a citizen for permanent or temporary residence to a state stationary social service institution, educational, training or medical institution for children and adolescents (with the exception of a five-day stay);

- deprivation of liberty of a pensioner or placement for compulsory treatment in a specialized institution by a court verdict;

- departure of a citizen to live outside the Russian Federation (regardless of the fact of deregistration at the place of residence in Moscow).

Who has the right to count on the Moscow Prize?

A limited number of citizens can count on receiving the Moscow Prize. To enter the circle of the chosen ones, you must fulfill the following requirements:

- belong to the category of persons of retirement age;

- have official registration in the capital;

- live in the city for 10 years;

- do not have officially employed status.

For the last point, there are a number of exceptions in the form of work activities that are considered low-paid. This category includes work as a librarian, cleaner, concierge and activities in the housing and communal services sector.

The following categories of citizens cannot count on Moscow payments:

- receiving pension payments in another Russian region;

- left the country for a period of 6 months or more;

- being treated in a psychiatric institution;

- serving sentences in a prison institution.

To be able to receive a Moscow pension, a citizen must meet certain criteria. The main ones include age, length of service and the nature of contributions to the Pension Fund.

Tax benefits for pensioners in Moscow

In accordance with Art. 407 of the Tax Code of the Russian Federation, citizens who have reached the age of 55 years (women) and 60 years (men) have the right to receive tax benefits in relation to the following types of taxable items:

- apartment, part of an apartment or room;

- residential building or part of a residential building;

- premises or structures used exclusively as creative workshops, ateliers, studios, as well as residential buildings, apartments, rooms used to organize non-state museums, galleries, libraries open to the public - for the period of such use;

- economic building or structure, in relation to economic buildings or structures, the area of each of which does not exceed 50 square meters and which are located on land plots provided for the conduct of personal subsidiary plots, dacha farming, vegetable gardening, horticulture or individual housing construction;

- garage or parking space.

Important! Individuals entitled to tax benefits established by the legislation on taxes and fees submit an application for a tax benefit to the tax authority of their choice, and also have the right to submit documents confirming the taxpayer’s right to a tax benefit.

It should be noted that the benefit is provided only for one object of the pre-retirement person’s choice.

Advantages of Moscow pensioner status

Many Russians are attracted by good city surcharges for non-working pensioners in Moscow. The premiums are explained by the fact that the cost of living in the capital is higher than in other regions of the Russian Federation. Food and services are also more expensive. In addition, a large share of finance circulates in the capital. This allows the authorities to maintain a higher material standard of living for the elderly.

The size of a Muscovite's pension

The minimum pension in Moscow is:

- RUB 12,115 for visitors from other regions;

- 19,500 rub. for those who have lived in the capital for 10 years or more.

If the amount of money is less than the subsistence level, the person is entitled to an increase from the city budget. This measure of social assistance is the “Luzhkov pension”. It is named after the Moscow mayor, with whose approval such a program was launched in 2007. In 2018, the average pension in the capital was 14,410 rubles.

Additional payments and allowances

- "Luzhkov bonus".

- Regional surcharge up to the subsistence level.

- Cash increase for people over 80 years of age.

- Additional payments to heroes, disabled people, veterans, etc.

- Monthly compensation for working public sector pensioners.

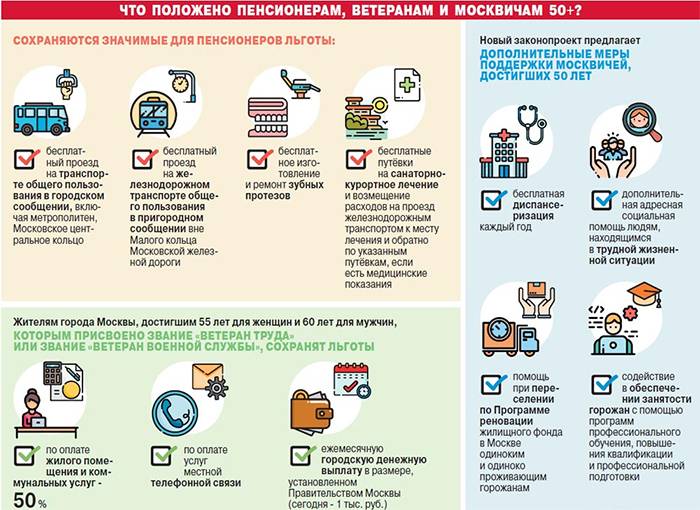

Benefits and privileges

- food, clothing for the poor;

- free pass;

- skip-the-line service in clinics and hospitals;

- discounts on medicines;

- sanitary resort treatment;

- discount on utilities.

Benefits for pensioners in Moscow in 2020

In accordance with the legislation of Moscow, pensioners have a number of the following benefits:

| Benefit | Normative act |

| Free travel on public urban passenger transport of the city of Moscow, the Moscow Metro, including the Moscow monorail transport system, and suburban railway transport. | Decree of November 18, 2014 No. 668-PP “On the issuance, issuance and maintenance of social cards in the city of Moscow” |

| Free production and repair of dentures (except for the cost of paying for the cost of precious metals and metal-ceramics) | Moscow Law of September 26, 2020 No. 19 “On additional measures to support residents of the city of Moscow in connection with changes in federal legislation in the field of pensions” |

| Free voucher for sanatorium-resort treatment and reimbursement of expenses for travel by rail to the place of treatment and back | |

| Residents of the city of Moscow of retirement age who have been awarded the title “Veteran of Labor” or the title “Veteran of Military Service” additionally: 1) for payment of housing and utilities in the amount of 50 percent of the fee; 2) monthly monetary compensation to telephone network subscribers to pay for local telephone services provided in the city of Moscow, in the amount established by the Moscow Government; 3) monthly city cash payment in the amount established by the Moscow Government, provided that the cash income of the specified person does not exceed one million eight hundred thousand rubles per year. |

Where to go to apply for benefits?

You can apply for such a benefit by contacting your local UPFR branch. To do this, you must provide the specialist with:

- personal documents of the citizen (passport with a note about registration in Moscow);

- pensioner's certificate;

- insurance account card (SNILS);

- application requesting payment of benefits.

Important: only residents of the capital itself can count on the benefit provided by the mayor; such additional payment does not apply to pension recipients living in neighboring cities and regions.

How to become a Moscow pensioner if you live in Siberia

If we do have a pension, it is obvious that it will be higher for Moscow pensioners, and not for regional ones.

Is it possible for a simple boy from the Siberian region to become a Moscow pensioner in the future if he buys a share in the cheapest Moscow apartment, registers there for at least 10 years, but remains to live and work in his region?

What are the pitfalls of such an investment in the future? Is this even legal?

The idea of becoming a Moscow pensioner will require investments, and they will begin to generate profits only after 20 years - and that’s not a fact.

Let's look at your scheme in detail.