- home

- Reference

- Experience

Due to constant changes in pension legislation, Russian citizens increasingly began to think about what kind of pension awaits them in the future. At the same time, most of them have little or no understanding of the intricacies of the ongoing reforms, and therefore cannot fully assess the scope of their pension rights and prepare for retirement properly.

Citizens have questions even at the level of basic terminology; for example, many do not see the difference, say, between work experience and insurance experience. However, this question is the most important one for assessing your future retirement security.

The concept of experience

In general, the concept of “experience” means the duration of something, any specific period. For example, the time spent working in a specific place, holding a particular position, is called length of service. According to the established rule, this period is calculated in calendar days, months and years.

In the field of pension provision, this term plays a very important meaning. So, in this case, length of service should be understood as a certain legal fact of the duration of the employment relationship, the parameter of which directly affects the possibility of assigning a pension and the size of the pension itself.

However, it should be taken into account that the law provides for several of its types, the differences between which are decisive for the assignment of monetary support.

Reference! The term “experience” is used in official regulations, which provide its definition in relation to a specific type of legal relationship. For example, Federal Law No. 400-FZ of December 28, 2013 “On Insurance Pensions” gives an understanding of the meaning of the term “insurance period”.

Functions of labor and insurance experience

The functions are as follows:

- use as a basis for calculation, transfer, formation of old-age pension, disability, loss of breadwinner;

- use for early retirement (when working in certain conditions, positions, places, etc.);

- use to establish a special salary bonus and remuneration for length of service (in situations provided for by the Federal Law “On Pensions in Russia”).

The insurance period is also used to accurately calculate the amount of benefits that an employee will receive due to temporary disability (sick leave). The benefits are assigned based on the employee’s provision of sick leave.

Related article: Insurance length and how it is calculated for sick leave in 2020

Types of length of service when taking into account future pensions

The current Russian legislation distinguishes the following types:

- Insurance. Taken into account when assigning a pension of the appropriate type.

- General labor. Includes periods of a person’s labor activity.

The difference between them will be discussed in the article below.

In addition, the legislation also establishes additional types of experience:

- Special. Certain types of activities require special working conditions under which early disability occurs. In this regard, a special calculation of these periods is necessary to assign preferential (early) pension benefits.

- Length of service. At its core, the concept of “length of service” is close to the term under consideration, but is used, as a rule, to calculate periods of service for the military, police and some other categories of citizens.

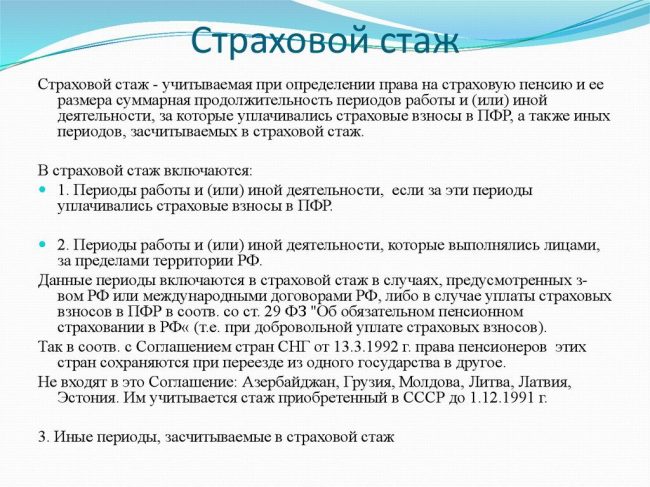

What is included in the insurance period

The insurance period includes time, or more precisely, periods of work of a citizen only if the following conditions are met:

- during these periods the citizen worked or carried out other activities;

- work or other activities were carried out on the territory of the Russian Federation;

- the citizen was a person insured in the compulsory pension insurance system;

- During these periods, insurance premiums were paid.

If at least one of the specified conditions is absent, then this period will not be included in the insurance period.

We draw attention to one important circumstance. If a citizen worked before January 1, 1991, and state social insurance contributions were paid for him, then this period is included in the insurance period. Also, periods of work from January 1, 1991 to January 1, 2002 are included in the insurance period, if during this period the unified social tax or the unified tax on imputed income was paid (for certain types of activities). For example, a citizen from 1980 to 2020 worked in different organizations and, at the same time, until December 31, 1990, employers paid insurance contributions to state social insurance, and from January 1, 1991 - payment of insurance contributions to the Pension Fund of the Russian Federation. In this case, the period from 1980 to 2020 will be included in the citizen’s insurance experience.

The concept of insurance experience

As a result of the reforms of the pension system, the insurance period is of decisive importance when assigning an old-age pension. It should be understood as contributions were made to the Pension Fund for a citizen, including a foreign state that is a participant in the compulsory pension insurance system

The obligation to pay them lies with the employer, who makes the corresponding transfers. Their size is 22% of the employee’s accrued wages.

Attention! Persons who, in accordance with the procedure established by law, have registered as individual entrepreneurs, as well as self-employed and privately practicing specialists, are required to transfer insurance premiums independently at the approved rates.

Thus, the insurance period can be taken into account only if deductions have been made. If, even if there is an officially registered employment relationship, no contributions were made to the Pension Fund, then this period of work is not included in the length of service.

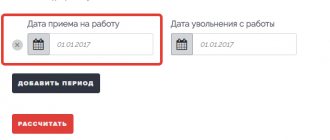

How is it calculated

The insurance period is calculated by adding up the periods when insurance premiums were paid for a person. For the most part, this is the time of direct work or entrepreneurial activity.

However, we should separately highlight the so-called insurance periods, the correct calculation of which is of great importance for the corresponding calculation.

In accordance with the law, these must include:

- being on sick leave;

- caring for a child up to 1.5 years old;

- maternity leave;

- time to care for an elderly person.

This list is not complete or exhaustive.

Many older citizens are concerned about how their insurance coverage will be calculated for periods of work before 2002. This is due to the fact that such a thing as “insurance premiums” simply did not exist until that time.

However, these individuals need not worry as all these periods are taken into account by the pension fund. Payments under UTII and Unified Social Tax in the period from 1991 to 2002, as well as social insurance contributions before 1991, are equal to insurance contributions.

Implications for future pension

Changes in pension legislation, carried out as part of the corresponding reform, imply stricter requirements for recipients of insurance pensions. One of them is having a sufficient number of years of insurance experience. So, in 2020, the minimum number is 10.

If a citizen has worked for less time, then an insurance pension cannot be assigned to him.

The insurance period is not the only criterion for assigning an insurance pension . In this case, such a parameter as the individual pension coefficient (IPC), expressed in points, is also of great importance. In 2020 there should be at least 16.2.

Important! The IPC parameter affects not only the very fact of the possible assignment of a pension, but also the amount of future security.

How is experience confirmed when applying for a pension?

The Russian Pension Fund strives to reduce the level of paper document flow, including when interacting with insured persons, to a minimum. In this regard, since 2015, pensions are calculated based on information from an individual insurance account. They are contained in a single database of the Pension Fund.

A citizen has the right to access the relevant information by ordering an extract from the Pension Fund. In addition, you can find out about the account status in your personal account on the fund’s website.

However, in some cases, information about length of service in the Pension Fund database may be incomplete. In this case, entries in the work book are taken into account.

The general rules for calculating the insurance period are established by Art. 13 of the Federal Law of December 28, 2013 No. 400-FZ “On Insurance Pensions”.

From the previous material “The concept and types of insurance experience under the new pension legislation,” we learned that

the presence of insurance experience is a necessary condition for the emergence of the right to pension provision in the form of compulsory pension insurance.

We also now know that the new pension legislation since 2015 distinguishes between two types of insurance coverage:

- insurance period , which gives the right to assign an insurance pension and

- special insurance experience - insurance experience that gives the right to assign an early old-age insurance pension.

In this material you will get acquainted with the procedure for calculating the insurance period.

The insurance period is always calculated in calendar order, i.e. according to the actual duration of work or other activities included in the insurance period.

In other words, one year of labor or other socially useful activity is counted as one year of insurance experience (unless other rules are provided by law).

Additionally, Federal Law No. 400-FZ “On Insurance Pensions” establishes a number of special rules for calculating the insurance period:

Rule No. 1 for calculating the insurance period

If a citizen has been granted a pension by another state in accordance with its legislation,

- then the periods that were taken into account in the length of service when assigning such a pension,

are not included in the insurance period when assigning an insurance pension in accordance with Russian legislation.

Rule No. 2 for calculating the insurance period

Periods of activity of persons

- who independently provide themselves with work (individual entrepreneurs, lawyers, arbitration managers, notaries engaged in private practice, and other persons engaged in private practice and who are not individual entrepreneurs),

- heads and members of peasant (farm) households,

- members of family (tribal) communities of indigenous peoples of the North, Siberia and the Far East of the Russian Federation, engaged in traditional economic sectors,

- periods of work for individuals (groups of individuals) under contracts

are included in the insurance period strictly on the condition that during these periods insurance contributions were paid to the Pension Fund of the Russian Federation.

Rule No. 3 for calculating the insurance period

Citizens who receive a long service pension or a disability pension in accordance with the Law of the Russian Federation of February 12, 1993 No. 4468-1 “On Military Pensions”,

- when determining their right to an insurance pension

are not included in the insurance period

- periods of service preceding the assignment of a disability pension, or periods of service, work and (or) other activities taken into account when determining the amount of a long service pension in accordance with this Law.

In this case, the following are considered included in the insurance period:

- all periods that were counted towards length of service, including periods that do not affect the amount of long service pension or disability pension, in accordance with the specified Law “On Military Pensions”.

Rule No. 4 for calculating the insurance period

Citizens from among the astronauts,

- who receive a long service pension or a disability pension in accordance with Federal Law of December 15, 2001 No. 166-FZ “On State Pension Provision in the Russian Federation”,

- when determining their right to an insurance pension

are not included in the insurance period

- periods of work (service) and (or) other activities preceding the assignment of a disability pension, or periods of work (service) and other activities taken into account when determining the amount of the long-service pension in accordance with the specified Law No. 166-FZ “On State Pension Provision” In Russian federation",

unless otherwise established by an international treaty of the Russian Federation.

Rule No. 5 for calculating the insurance period

Periods of work during the full navigation period on water transport and during the full season in organizations of seasonal industries, determined by the Government of the Russian Federation1,

taken into account when calculating the insurance period

- in such a way that the duration of the insurance period in the corresponding calendar year is a full year.

That is, one full navigation period or full season worked is counted as one calendar year of insurance experience (from January 1 to December 31).

If the full navigation period or full season has not been completed,

- then this period is taken into account in the insurance period based on the time actually worked.

Rule No. 6 for calculating the insurance period

Persons who

- in the corresponding calendar year they performed work under copyright contracts,

- as well as to authors of works who, in the corresponding calendar year, received payments and other remuneration under agreements on the alienation of the exclusive right to works of science, literature, art, publishing license agreements, license agreements on granting the right to use works of science, literature, art,

this period is counted towards the insurance period

- for one full calendar year (from January 1 to December 31)

- provided that the total amount of insurance contributions paid to the Pension Fund of the Russian Federation from payments and other remuneration received under these agreements during a given calendar year

- amounted to at least the fixed amount of the insurance contribution for compulsory pension insurance 2.

If the total amount of insurance premiums paid during a calendar year for these persons is less than the fixed amount of the insurance contribution for compulsory pension insurance,

- The insurance period includes a period (in months) of duration calculated in proportion to the insurance premiums paid,

- but not less than one calendar month (30 days).

If there are other periods of work and (or) other activities in the corresponding calendar year, the period counted towards the insurance period in connection with the payment of insurance contributions to the Pension Fund of the Russian Federation from payments and other remunerations under these contracts,

- is taken into account in such a way that the insurance period for the corresponding calendar year does not exceed one year (12 months).

Rule No. 7 for calculating the insurance period

When calculating the insurance period in order to determine the right to an insurance pension

- periods of work and (or) other activities that took place before January 1, 2020 and

- counted towards the length of service when assigning a pension in accordance with the legislation in force during the period of performance of work (activity),

may be included in the insurance period

- using the rules for calculating the relevant length of service provided for by the specified legislation (including taking into account the preferential procedure for calculating length of service), at the choice of the insured person 3.

1 Decree of the Government of the Russian Federation of July 4, 2002 No. 498 “On approval of the list of seasonal industries, work in organizations for which during the full season when calculating the insurance period is taken into account in such a way that its duration in the corresponding calendar year is a full year”; Resolution of the Council of Ministers of the RSFSR dated July 4, 1991 No. 381 “On approval of the List of seasonal work and seasonal industries, work in enterprises and organizations of which, regardless of their departmental affiliation, for a full season is counted towards the length of service for granting a pension for a year of work.”

2 The fixed amount of the insurance premium is determined in accordance with Art. 14 of the Federal Law of July 24, 2009 No. 212-FZ “On insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund.” For 2020, the fixed amount of the insurance premium is 18,610.80 rubles.

3 This norm expresses the position of the Constitutional Court of the Russian Federation (Resolution No. 2-P of January 29, 2004 “On the case of verifying the constitutionality of certain provisions of Article 30 of the Federal Law “On Labor Pensions in the Russian Federation” in connection with requests from groups of deputies of the State Duma, as well as the State Assembly (Il Tumen) of the Republic of Sakha (Yakutia), the Duma of the Chukotka Autonomous Okrug and complaints from a number of citizens") that in connection with changes in pension legislation, the deterioration of the conditions for the implementation of citizens’ rights to pension provision is not allowed, incl. in terms of calculating length of service and the amount of pension according to the norms of previously existing legislation.

If you have any questions about your work experience, or you find yourself in a difficult situation, then an online duty lawyer is ready to advise you on this issue for free.

If you have any questions about the violation of your rights, or you find yourself in a difficult life situation, then an online duty lawyer is ready to advise you on this issue for free.

INSURANCE EXPERIENCE

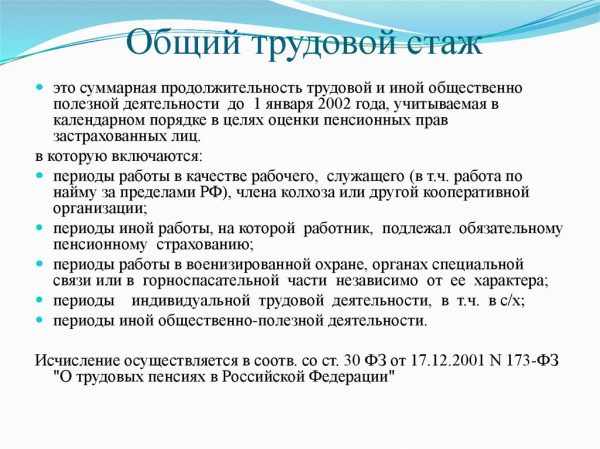

What is work experience

It should be understood as all periods when a person carried out labor activities. Until 2002, pensions were paid taking into account this indicator. Today, length of service is not actually used when assigning pension benefits. However, it can be taken into account when establishing various benefits, benefits, and so on.

What it is?

The length of service coefficient is intended to numerically reflect the degree of influence of accumulated experience on the final amount of the pension. It is used in relation to work experience before 2002. In the modern formula, it is converted into a pension capital indicator.

The minimum required length of service has been set for the length of service coefficient.:

- for the male population it is 25 years;

- for women its value is at the level of 20 years.

If this amount of work was observed under the conditions of official employment, the pensioner, according to the old formula, was assigned a benefit in the amount of 55% of his average income.

Each year worked above the specified limit allowed the coefficient to increase by 0.1. The maximum limit is 0.75.

What do pension points depend on?

The length of service coefficient depends on the total number of years worked before 2002. Its value can vary from 0.55 to 0.75 units. If the minimum level is not reached, then pension reduction mechanisms will be applied.

The periods:

- undergoing training in educational institutions after graduating from high school;

- providing care for disabled people of group 1, children with disabilities, and elderly people in need of care;

- unjustified detention or exile;

- care for young children (under 3).

An additional influencing factor may be the use of a multiplying factor. This is relevant for cases of working in the exclusion zone after the Chernobyl accident, serving in conscription, or recovering from an injury received during hostilities.

What is the difference between work experience and insurance experience?

Although these two concepts may seem identical in meaning, there are important differences between them.

First of all, there is a significant difference in the calculation method. Thus, length of service takes into account only periods of work activity. The latter involves, for the most part, hired work. The insurance company takes into account all periods during which contributions were made to the pension fund. This also applies to business activities.

Secondly, insurance is used as one of the criteria for assigning a pension. References to labor in the current legislation are fragmentary. It is not taken into account when assigning pension benefits. At its core, seniority is a kind of legal rudiment.

Previously, in the legislation there was such a concept as “continuous work experience”. It should be understood as periods of constant work without significant breaks associated with dismissal. The amount of temporary disability benefits received directly depended on it. However, it was canceled back in 2006 as contrary to the Basic Law of the country, and therefore is not used in calculations at this time.

Despite the similarity of definitions, there are fundamental differences between labor and insurance types of length of service. The first is practically not used in the current conditions, while the value of the second is an important criterion for assigning pension benefits.

How to calculate the insurance period for sick leave

Several periods can be used to pay temporary disability benefits:

- full month (30 days);

- calendar year (full).

It is worth noting that when making calculations it is important to take into account every day. After all, the insurance period includes the entire period - from the beginning of work until the opening of a certificate of temporary incapacity for work.

The amount of payments directly depends on the time worked:

- less than six months - the minimum wage is taken into account;

- up to 5 years - 60% of the average salary;

- from 5 to 8 years - 80% of the average salary;

- over 8 years - 100% of the average salary.