The French pension system has a multi-level structure and also has a number of features that distinguish it from other European analogues. A pension in France consists of a basic and funded level, as well as a number of other benefits paid upon the occurrence of certain circumstances.

The system provides for 2 levels of payments - basic and cumulative. The first directly depends on the average monthly salary of the pensioner during his or her work experience, and the second is paid in accordance with the accumulated points. They are credited to the citizen’s account after each change of place of employment and allow them to significantly increase the amount of benefits received in the future.

Among other things, the pension system of this state provides for the possibility of paying “solidarity” benefits. Citizens whose expected pension payments do not exceed the minimum level have the right to count on it. In such a case, a solidarity pension of 800 euros is paid, which allows the pensioner to provide an adequate standard of living.

But there is also an optional, third level of pension, the payments of which are carried out by various social funds on the basis of citizens’ independently made contributions. As a rule, such funds are divided into private and professional.

Watch the video: Pension provision in France.

Return to contents

§ State social insurance system

First of all, it should be noted that Germany has a well-developed state social insurance system. It guarantees the protection of citizens in case of illness, unemployment, and also in old age. State pension insurance is part of the German social insurance system. Responsible for pension insurance throughout Germany is an institution called "Deutsche Rentenversicherung" . It deals with the calculation and payment of pensions (pension in German: Rente ). When starting work in Germany, a person becomes automatically insured in the state pension insurance system.

All insured persons in the pension insurance system receive a personal insurance number “Versicherungsnummer” and an account in this system. When contacting Deutsche Rentenversicherung, you must always have your insurance number. This number must also be provided to your employer along with the documents required when applying for a job in Germany. Registration in the state pension insurance system and obtaining this insurance number for a person who does not yet have one is carried out either by the employer, or by the labor exchange or health insurance office.

The Deutsche Rentenversicherung sends an annual information letter to every insured person over 27 years of age with information about how much pension they can expect upon retirement.

On separate pages of our website you can find information about social assistance and basic benefits in Germany, as well as benefits for the unemployed and child benefits.

Advantages of a distributed pension system

Thanks to a growing, stable economy and a basic government pension program, all citizens of retirement age in the United States receive defined benefits. The investment model of pension funds ensures the infusion of additional funds into the business.

Private funds compete for investment assets, improving reliability and quality of services. Companies offer employees favorable terms of the social package and increase rates on pension payments, winning the loyalty of employees.

At the same time, the practice of opening an IRA allows Americans not to rely on the state or employers, but to take care of the future on their own. Many US citizens use the funds accumulated over years of constant work to open their own business or invest in the business of younger relatives, ensuring an increase in family income.

In fact, retirement under this model becomes not a refusal to work, but a change in type of activity. The period of employment allows you to collect significant start-up capital. The ability to claim a partial payment of a state pension before reaching full retirement age and the availability of funds in the account encourages Americans to give up office work much earlier than 67 years of age.

A system of pension payments coming from unrelated sources allows Americans to count on at least a minimum amount of monthly cash income.

This model insures pensioners against the loss of all savings in the event of a government crisis or bankruptcy of an individual company.

§ Retirement age for men and women in Germany for 2020, 2020

At what age a person in Germany can go on an old-age pension depends on his year of birth. People born before 1947 reach retirement age at 65 years, then the year of retirement gradually increases and everyone born since 1964 reaches retirement age only at 67 years. Thus, both men and women reach normal retirement age in Germany at 65-67 years , depending on the year of birth. See the table below for more details.

Table 1: Retirement age in Germany

| Year of birth | Retirement age |

| until 1947 | 65 years old |

| 1947-1958 | To the age of 65, another 1 month is added for 1 past year* |

| 1958 | 66 years old |

| 1959-1963 | 2 more months are added to 66 years for the previous 1 year** |

| since 1964 | 67 years old |

* For example, if you were born in 1950, your normal retirement age is 65 years and 4 months (since 4 years have passed from 1947 to 1950, 1 month is added for each year) ** For example, if you were born in 1960, your normal retirement age was 66 years and 4 months (since 2 years passed from 1959 to 1960, 2 months are added for each year)

Retirement age may come earlier due to special circumstances provided for by law:

- For persons who have paid into pension insurance for at least 45 years, reaching retirement age occurs 2 years earlier, at 63-65 years, depending on the year of birth.

- Women born before 1952 and fulfilling a number of other conditions provided by law can retire upon reaching 60 years of age.

- In addition, the disabled and some other groups of people also have the opportunity to retire at an earlier age.

What is the retirement age in France

Questions related to how old the French are when they retire are an extremely sensitive topic for French society. For a long time it was 60 years. However, as of 2020 it is already 62 years.

Important! French women and men can exercise their pension rights at the same age.

This reform was negatively received in France, however, the authorities of the republic announced further plans to increase the age when a citizen goes on vacation and has the right to start receiving pensions. Thus, official statements stated that after 2023 the French will become pensioners upon reaching the age of 67 years.

This statement caused widespread unrest in France, which ultimately forced the government to abandon its plans.

It should be noted that the retirement age in France, which is 62 years old, is being reduced for certain categories of citizens.

Thus, the right to early financial support can be used by:

- workers working in difficult and unhealthy conditions (miners, railway employees, etc.);

- persons who began working at the age of 18;

- prisoners of concentration camps, participants in military operations;

- disabled people injured as a result of work-related injuries.

This list is not completely exhaustive.

§ Pension insurance contributions in Germany

Contributions to the pension insurance system depend on the amount of wages; the more a person earns, the more he pays. The employer is responsible for transferring these insurance contributions. The contribution to pension insurance is taken from the employee’s salary and from the employer’s funds, i.e. 50% of the contribution is paid by the employee, and 50% by the employer . The total amount of the pension contribution is calculated as follows: 18.60% of the employee’s gross salary (that is, of the salary from which taxes and fees have not yet been withheld). However, there is a limit after which a person no longer pays insurance premiums: when receiving a salary of more than 6,900 euros, a person is charged pension insurance fees only for 6,900 euros, the remaining amount is free from payment of fees.

In August 2020, Germany decided that until 2025, pension contributions will not exceed 20% of the wages of employees.

If a person works as a minijob , earning less than 450 euros per month, then the pension insurance contribution is also 18.60% of the salary, but 15% is paid by the employer and only 3.6% by the employee.

Table 2: wage payments to the German social insurance system for 2020

| Insurance type | only % of gross salary | Employee's share | Employer's share |

| Pension insurance | 18.60 % | 9.30 % | 9.30 % |

| Health insurance | 14.60 % | 7.30 % | 7.30 % |

| Unemployment insurance | 2.40 % | 1.20 % | 1.20 % |

| Long-term care insurance | 3.05 % | 1.525 % | 1.525 % |

| TOTAL: | 38.650 % | 19.325 % | 19.325 % |

Chart 1 below shows the change in the pension insurance rate from an employee's salary in Germany.

Diagram 1. Change in % pension insurance rate from gross salary in Germany by year

As can be seen from this graph, the rate of contribution to the pension insurance fund in Germany from wages has been constantly increasing in recent decades, although in 2020 the level of pension collection has become lower and is at the level of 1990. Fee rates for other types of social insurance in Germany are also gradually increasing each year.

Pension amount

Looking at pensions in France in more detail, it should be noted that their size is influenced by a number of factors. First of all, this is work experience, which must be 41 years and 6 months to receive the full pension. If it is less, for every missing 3 months the amount of payments is reduced by 1.25%.

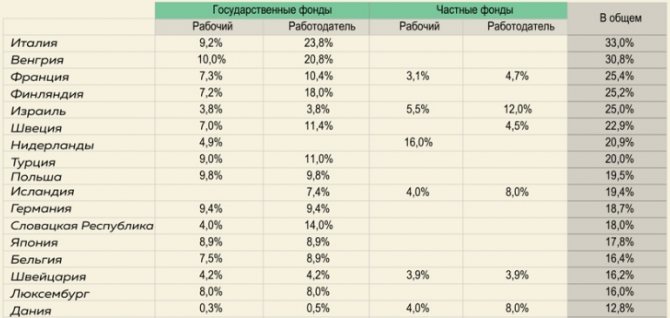

Amount of mandatory pension contributions by country

Among other things, the following features are taken into account:

- The period when a citizen was forced to be unemployed, including maternity leave for up to 6 months. It is taken into account when calculating length of service and does not reduce it.

- Insurance contributions paid by the employee over 40 years of work guarantee a premium.

- If a pensioner begins to receive benefits after 67 years of age, he has the right to receive its full amount, without taking into account length of service.

As a rule, the pension is about half the average salary of a citizen during his working life . Insurance payments are added to this amount, which allows some pensioners to receive income that exceeds that of the working population.

The average salary in France in 2020 is 2,900 euros.

Pension contributions for citizens amount to 16.35% of salary. In this case, half of this amount is paid by the employer, and the other half is paid by the employee. It is important to take into account that individual entrepreneurs and freelancers make such payments independently, in full.

The average pension, as a rule, reaches 1,000 euros, which corresponds to similar figures in European countries such as Italy and the UK. At the same time, it is somewhat inferior to pension payments in Spain, Germany, as well as in the Northern European region.

Watch the video: Old age in France.

Return to contents

§ Work experience and pension receipt

The right to receive a pension under pension insurance occurs only if the insured has participated in pension insurance for a minimum number of years. This minimum period of participation in pension insurance in Germany is 5 years (Mindestversicherungszeit, Wartezeit). Only after this can he be entitled to receive a pension.

If the insured expects to receive a pension due to a long or especially long period of participation in pension insurance, which gives him the opportunity to retire at an earlier age, these periods of participation in pension insurance should reach 35 and 45 years, respectively.

Participation in pension insurance includes not only the time during which a person pays statutory insurance premiums while working at an enterprise, but also the time during which a person received unemployment benefits (ALG-I), cared for a child during the first three years of his or her life (Kindererziehungszeiten) or a sick family member. While caring for a child, despite the fact that the person does not pay insurance fees, he will be calculated a pension in the amount that is accrued on average to each insured person.

In general, it must be said that the size of the pension in Germany depends on the size of contributions and the duration of payment of contributions to the state pension insurance system.

Pensions for different categories of people

The wages of citizens in the United States significantly exceed the world level. There are professions in the country that are in great demand and highly paid: programmers, doctors, military, police. Accordingly, the size of pensions is significant.

In the Russian understanding, a pension is the amount that a person receives monthly; in America, it exists only for police officers, military personnel, firefighters and postal service workers; they have a government subsidy of $40,000 or more. The rest of the citizens determine it themselves, that is, based on contributions to the pension fund.

Sooner or later, the presidents of the country also become pensioners. They, naturally, are in a more advantageous position than other citizens, since they can themselves initiate an upward indexation of payments for high-ranking officials.

§ How to get a pension in Germany: applying for a pension

Receiving any type of pension in Germany is only possible after submitting an application for a pension (Rentenantrag). This application can be written without a specific form, and also, to speed up its consideration, using the special forms provided. These forms are available on the Deutsche Rentenversicherung Antrag auf Versichertenrente page

The application for a pension must be accompanied by documents that were not taken into account by Pension Insurance, for example: confirmation of completion of education, time of receipt of unemployment benefits, birth certificates of children and others.

In addition, when submitting your application, you will be required to provide the following information:

- Tax identification number (Steueridentifikationsnummer)

- Bank account number and bank code (IBAN and BIC)

- Passport or International Passport (Personalausweis or Reisepass)

- Health insurance card

It is recommended to submit an application for a pension three months before retirement age. Late application for a pension may result in a later start to receiving your pension.

How do retirees live in the USA?

The concept of standard of living includes wages, cost of living, and the balance between the income and expenditure parts of the family budget.

American regions have significant differences in all major indicators, but there are general patterns in their relationships.

As an example, consider the budget of an average married couple from Houston per month (dollars):

- The salaries of spouses, office workers, total 4600.

- Federal property tax and local school tax (paid once a year): – 1000 for a house worth 150 thousand; – 2500 (regardless of the presence of schoolchildren in the family).

- Car insurance for a year – 1500.

- Groceries costs for 2 people are about 1000 + purchase tax (each supermarket has its own).

- Public transport fare – 90.

- Internet – 500.

- Mobile communications – 100.

- Fitness center subscription – 35.

- Dinner at a restaurant – 35.

- Education – 20,000-40,000 per year, depending on the prestige of the university. The amount is deferred from the birth of the child.

- Medicine: – 1000 – call an ambulance; – 20 – consultation with a doctor. * – The insurance company does not pay for calling an ambulance and subsequent hospitalization, or the cost of medications. Operations are partially paid.

- Real estate. The rental price depends on the region and location of the block. In Houston, in areas that are safe to live in, the cost of a 1-room apartment is 1000/1300 (outskirts/center).

The income of pensioners is comparable to the salary of a young couple, while there is no need to save money for children’s education, and there is old-age insurance. Many U.S. retirees are giving up a car to cut insurance and fuel costs. With an average benefit, citizens of retirement age can afford to travel around the country and abroad.

§ Types of pensions in Germany

Depending on the life situation, age, gender and other conditions, a person can be paid different types of pensions starting at different ages. The following list shows all the main types of pensions in Germany:

- Regular old age pension (Regelaltersrente);

- Pension from 63/65 years depending on the year of birth for persons working for a long time (45 years of participation in pension insurance);

- Increased pension for persons who, due to illness or accident, can no longer work or can only work on a limited basis (Erwerbsminderungsrente);

- Pension for women over 60 years of age, born before 1952 and meeting certain other requirements (Altersrente für Frauen);

- Pension for miners who work permanently underground, from the age of 60;

- Pension for a widow or widower, or orphan of the deceased (Hinterbliebenenrente);

- Grundsicherung - benefit due to a low amount of earned pension.

Additional social support programs

There are a number of measures aimed at social protection of pensioners. Thus, most of them have significant benefits on tax-related issues. This applies, first of all, to various property payments.

Attention! Also, pensioners receiving a minimum pension have benefits in paying for housing and food.

It should be noted that the conditions for preferential support may vary depending on the specific department of the country.

§ Pensions for disability, illness

As noted earlier on the page, in the event of incapacity for work (total or partial) due to illness or accident, a person can count on receiving a pension until reaching retirement age (Erwerbsminderungsrenten). A person can start receiving this pension even if he has not paid into pension insurance for the minimum period currently set at 5 years. If an accident occurs at work, already at the very beginning of work (if only one contribution to pension insurance is paid), a person can count on receiving a disability pension. Occupational disease that limits ability to work is also taken into account. If the disability occurs due to a domestic injury or illness, only those who have paid contributions to pension insurance (12 contributions) for at least 1 year can receive a pension.

Before a decision is made to pay a disability pension, it must generally be determined whether restoration to work is possible through medical or vocational rehabilitation. A partial disability pension is paid if a person can work less than 6 hours a day, not only in his specialty, but in any job. This is established on the basis of medical examinations and expert opinions.

For disabled people with a degree (Grad der Behinderung, GdB) of 50% or more in Germany, it is possible to retire at an earlier age. This also requires meeting certain conditions and prerequisites. More details can be found in the brochure, link at the bottom of the page.

Disadvantages in the American pension system

Economic analysts have been predicting the collapse of this “house of cards” for years now. Lately their voices have sounded more concerned.

Here are the reasons:

- Since 2014, there has been a decline in the birth rate. The largest age group in the US population is also retiring. It is believed that it will be difficult to provide them with pensions.

- The number of officially registered unemployed is growing.

- Over the past half century, household incomes have declined significantly. The consequence of this phenomenon will be that the state does not receive taxes.

- The value of the yield of securities is lost (they were purchased by funds with the money of investors).

- From time to time, regional authorities borrow funds from the pension treasury.

But the most important problem of the looming crisis is the increase in the retirement age with a simultaneous reduction in pensions.

§ How many pensioners are there in Germany?

The number of pensioners in Germany is not much more than 25 million people. Detailed information with distribution by gender and land is presented in the following table.

Table 3: Number of pensioners in Germany as of July 1, 2019

| Lands of Germany | Number of men retired | Number of women retired | Total number of pensioners |

| Western part of Germany (FRG) | 7’633’245 | 12’269’439 | 15’266’490 |

| Eastern Germany (GDR) | 1’943’889 | 3’225’790 | 3’887’778 |

| TOTAL | 9’577’134 | 15’495’229 | 25’072’363 |

Pros of working in retirement in the USA

You can continue to work after reaching retirement age in the United States. Every year the amount of the future pension will increase due to additional contributions. Once you reach age 70, benefits will increase an additional 8% for each year you defer.

Another situation is when a citizen has retired but continues to work. In this case, he receives double income: a state pension and a salary. The share of such citizens is constantly growing; in 2018 it was 20%.

If the salary exceeds the established maximum, the benefit amount is reduced:

| Deduction amount | Condition |

| 50% less | Below retirement age |

| 33.3% less | Over retirement age |

Only annual income is taken into account. If the salary for one month is more than the maximum, and for another - less, then for the month with less income you can receive the full amount.

§ Pension and divorce

Upon divorce in Germany, the principle of equalization of pension savings (Versorgungsausgleich) applies, according to which both spouses' pensions will be divided equally between the husband and wife. Thus, if one of the spouses earned a larger pension than the other, for example, if the woman was raising children and housework, then upon divorce, the monthly pensions will be divided equally. The distribution of pensions in this way is made by the court during a divorce without any statements.

Comments (0)

Share your opinionCancel reply

Read other news on this topic

- 68 05.10.2020

Military pensions in 2021

Military pensioners and employees dismissed from service in the Russian Guard, the Ministry of Emergency Situations, the Ministry of Internal Affairs, the Federal Penitentiary Service and other structures will receive a planned increase in pensions in 2021.

- 1 521 20.05.2019

Increasing length of service to 25 for military pensions

New law No. 350-FZ dated 03.

- 370 26.03.2020

Military pensions from April 1, 2020

Every year, starting April 1, Russia increases military pensions for pensioners receiving various types of social benefits.

All news

§ Links to laws and official websites on the topic: pensions in Germany

Basic information about pensions in Germany is presented on the official website of the Deutsche Rentenversicherung Pension Insurance and the website of the Ministry of Labor, as well as in the legislative documents governing the provision of pensions.

- Deutsche Rentenversicherung, official website

- Brochure "Reha und Rente für schwerbehinderte Menschen"

- Sozialgesetzbuch (SGB) - Retirement age

- Sozialgesetzbuch (SGB) - § 50 Wartezeiten - Minimum period of participation in pension insurance

- BMAS, website of the Ministry of Labor

- Rentenwertbestimmungsverordnung - RWBestV - pension calculation, current figures

Detailed information about the size and calculation of pensions in Germany is available on a separate page on our website.

Footnotes:

The euro exchange rate in the tables is taken as of October 16, 2020 and is 91.58 rubles at the rate of the European Central Bank. Exchange rates in Germany

- Pages:

- 1

- Pension in Germany: length of service, age, types of pension, registration

- Average and minimum pension in Germany, pension calculation

- Related topics:

- Unemployment benefits in Germany

- Minimum salary in Germany

- How and where to look for work in Germany

- Employment agencies and intermediaries in Germany

- Fraud and deception in job advertisements

- Documents for applying for a job in Germany

- Advice and help centers in Germany for migrants

- Free German courses in Germany

Waiting for change

In America now the average pension is $1200-1500 , old age benefits are issued on average upon reaching 63 years of age. But it is expected that the financial state of pensions in the country will deteriorate and pension reform will be required. This topic is widely discussed.

Some have proposed increasing tax rates, which could preserve the structure of Social Security benefits. Democrats demand the status quo be maintained. Republicans believe it is necessary to pay benefits only upon reaching full retirement age, which will certainly cause public discontent.