What do foundations do?

The main conditions provided by the funds include:

- payment of pensions, the amount of which corresponds to contributions;

- providing the population of the country with high-quality medicines, which they can receive free of charge;

- providing the population of the country with high-quality free medical care;

- providing citizens of the country with the opportunity to take a free flight once every 12 months.

The choice of fund largely depends on where the pensioner lives. Greek insurance funds pay not only labor pensions. Benefits are also paid to disabled citizens and families left without a breadwinner.

Procedure for receiving a pension

The pension system of the state in question is practically no different from other countries that are members of the European Union. To receive Social Security in old age, you need to save it. Accordingly, a working person in Greece needs to pay taxes in the amount of 6.67% of salary, and employers - 13.3%.

When retirement age arrives, all transferred money is transferred to ensims (insurance points). To receive the minimum pension, you need to collect at least 4,500 such points. Therefore, to receive one such ensim you will need to transfer at least 15 euros to the Pension Fund.

The difference is that each organization provides pensions to specific categories of workers:

- One fund is dedicated to pensions for government employees.

- The second is for hired workers.

- The third relates to the country's agronomic sector.

Social security of citizens

The government takes care of the unemployed, the elderly, and the disabled. Currently, there is a threat of insufficient financial provision of the national pension system, therefore it is planned to increase income taxes and social security contributions. The main tax burden is planned to be placed on persons with an annual income of more than 60 thousand euros.

Many people are interested in what the pension is like in Greece. There are three pension funds, one of which is intended for civil servants, the second for hired workers, and the third for workers in the agronomic sector. The average pension is about 360 euros. Since the country is in a stage of stagnation, an increase in social security for citizens is not expected in the near future.

Features of the pension system

In Greece, pensions and benefits are paid from three types of Social Funds :

- To provide for government employees.

- Other employees of Greek citizens.

- For payments to migrant workers.

In addition to the state ones, there are a number of professional and private savings insurance funds, into which you can make contributions at will; this allows you to receive additional payments to the state pension after reaching retirement age.

The following funds are produced from the same funds:

- payment of unemployment benefits;

- coverage of free medical care for pensioners and purchase of medicines

The amount of payments depends on a number of factors:

- Legislatively adopted living wage.

- The amount of contributions to the state and accumulative pension fund.

Employees pay 6.7% of their gross salary in Greece, with an additional 13.4% paid by the employer for each employee.

Business representatives and self-employed people pay the full tax of 20.1%.

- Labor and (insurance pension) length of service.

- Social status.

- Areas of activity (the retirement procedure for civil servants differs from the requirements for other categories of employees)

Social funds in Greece have the powers of banks, whose management has the right to invest accumulated funds in their own projects. This situation causes concern among many Greeks. The risk of losing everything is too great. The authorities are reassuring investors with state guarantees of pension payments, but how reliably the savings are protected is not entirely clear.

When do they retire

If you remember history and go back a couple of decades, the position of Greek pensioners was quite enviable. The pension in Greece was only 10 percent lower than the salary received during working hours.

The retirement age in Greece was calculated upon reaching 57 years of age and was accompanied by the accrual of benefits, bonuses and bonuses. This size, 10 years after the onset of the 21st century, reached the size of 1400-1500 Eurozone monetary units.

Why was the retirement age raised?

Today the picture is quite depressing. No one suspected that the economic situation would affect the situation of the Greek elderly, or rather, there was no intention of somehow negatively affecting their condition.

Exorbitant pension payments only exacerbated the already precarious situation of the economy, and therefore the next decision was predictable. The government cut benefits by one percent of gross domestic product, followed by a return of tax levies on the elderly. This was a permissive measure. Along with them, jobs were cut, mandatory contributions to the pension fund were sharply reduced, and the majority of the population simply left the country.

IMF creditors put forward more and more demands to change the size of pensions in Greece, which the government had to comply with. Expert commissions in the field of economics, which conducted numerous studies, revealed exorbitant generosity in pension payments. Therefore, increasing the retirement age and length of service became a natural response to their demands. Pension indexation has frozen until 2021.

Country insurance funds

There are 3 Federation Councils operating in the country. They have no significant differences; their activities are almost similar.

| Fund | Description |

| IKA | The largest fund in the country. |

| Regional State Administration | It provides services to both the local population and people from other countries. |

| Fund for civil servants. | — |

What do foundations do?

The main conditions provided by the funds include:

- payment of pensions, the amount of which corresponds to contributions;

- providing the population of the country with high-quality medicines, which they can receive free of charge;

- providing the population of the country with high-quality free medical care;

- providing citizens of the country with the opportunity to take a free flight once every 12 months.

The choice of fund largely depends on where the pensioner lives.

Greek insurance funds pay not only labor pensions. Benefits are also paid to disabled citizens and families left without a breadwinner.

Main disadvantages of funds

The functioning of such funds is very similar to the work of state banks. Greek officials treat their work as a profitable business.

The choice of fund largely depends on where the pensioner lives.

They receive a lot of money, which they invest in their own projects. Against this background, ordinary Greeks face the risk of losing their savings.

Despite numerous scandals, the work of the funds will not be structured in the near future.

Tax system in 2020

Greece offers a number of advantages for foreign companies. Taxes in Greece are not levied on those who do not have sources of income in the country. The taxation of shipowners remains very low, and therefore many wealthy foreigners prefer to register their yachts here. Property taxes in Greece for Russians are the same as for other foreigners. As a rule, for every 100 thousand euros of the value of the property you will need to pay a tax of 100 euros. Personal income tax in Greece is levied on a progressive scale.

Greek pension system

The reform affected not only the question of what pension will be in Greece in 2020, but also led to changes in the pension system. Thus, the following funds are the sources of social insurance for the population:

- ICA is the largest national insurance fund.

- RSA is a state fund that provides insurance to both the local population and migrants.

- Support for civil servants.

The task of the above funds is extremely simple - to accumulate funds for representatives of various professional fields and pay them after the citizen retires. In addition, the funds provide pensioners with free medical care, provide medications and offer the opportunity to fly for free on vacation no more than once a year. The competence of the funds also includes material support for people with disabilities and low-income families who have lost their breadwinner. Depending on which working category the funds are involved in accumulating funds, different funds are deposited in them. Nevertheless, the insurance conditions are identical everywhere; people give preference to funds based on territorial characteristics.

The social insurance system for pensioners is based on mandatory payments from employees and employers. The algorithm for calculating pensions in Greece is provided by law: the size of the pension is formed depending on the total amount contributed. The pension of future retirees largely depends on their length of service, since the decisive factor in calculating the amount is the period of deduction of contributions to the fund.

Level of medicine in the country

The level of medical care is quite good, there are many qualified specialists who speak English. State hospitals are overcrowded and there are few places in them. Bedding is not provided for patients; each patient uses his own. In private clinics, conditions are much better, but the cost of finding and treatment is high.

Read also: Higher education in Greece Job vacancies in Greece for Russians

Many tourists recover their health in Greece thanks to the amazingly warm climate and proximity to three beautiful seas. There are Greek hotels that also offer treatment services. To visit Greece, you must purchase travel health insurance.

What is the pension in Greece?

The size of pensions in Greece has been halved compared to the pre-crisis period (before 2009). Despite the reduction, the amount of pension payments in Greece in 2020 is almost the same as in economically prosperous Germany.

The minimum pension in Greece is equal to the country's standard subsistence minimum of 387 € per month. Those who receive a small pension until 2020 (after this period they plan to restructure the pension system) can qualify for an additional payment of 200 € per month.

The average pension in Greece depends on the area of employment:

- civil servants receive 770 - 820 €;

- employees and private owners 590 - 650 € (about 60% of the population) receive a pension below 700 €.

Until 2021, it is planned to increase the level of pension payments by 20%.

Conditions of retirement

Today the retirement age in Greece is 65 years. By 2021, it is planned to increase the retirement age to 67 years. In case of early retirement, 11% is lost for each year missing before the legally established period. To receive the minimum state old-age pension in Greece (384 €), you must have 15 years of insurance experience.

How to apply for a pension?

After reaching retirement age, you must submit an application to the Social Fund (the choice depends on the field of activity) for accrual of pension payments.

The following must be submitted along with the application:

- Copy of ID:

- for Greeks, passport;

- for foreigners, a foreign passport with a visa, a card confirming the status (residence permit, or permanent residence).

- Certificate of insurance experience.

Review of applications takes 30 days. The pensioner will receive a notification of the amount of pension payments to the address specified by him.

The amount of payments is calculated in accordance with the amount of contributions to the Social Funds. The amounts received are transferred through a special system into insurance points, the so-called “exims” (15 euros = 1 ensim). To receive the minimum pension, you must accumulate 4,500 points.

Unemployment benefits in Greece

The Greek Employment Service is preparing a new attempt to improve the criteria for registering persons who are unemployed and registered with the OAED.

At stage 1, the total number of mandatory “ensims” required to receive unemployment benefits will be reduced. Its size today is 360 euros.

Until 2020, citizens of the country who lost their jobs could count on government assistance if they managed to collect 160 ensims in 24 months.

Citizens of this country or the EU who are insured against unemployment are entitled to receive unemployment benefits in Greece

The unemployment situation in Greece is considered critical. According to statistics, for 53% of families, assistance from the state is the only source of livelihood. Finding work and vacancies in Greece is difficult.

Despite the requirements of the European Union, the country's authorities are not yet ready to cut the amount of benefits. In 2020, the unemployment benefit is 240-720 euros.

Not long ago, the country's authorities began paying benefits to bankrupt businessmen.

Persons with a state of emergency have always belonged to the unprotected category of employed citizens. Just 2 years ago, bankrupt entrepreneurs closing their private enterprise not only did not receive the “minimum wage” from the state, but could not even count on free medical care. service.

Now former businessmen have the opportunity to register at the labor exchange. The benefit for them is also 350 euros.

This “bonus” does not apply to everyone. Only those businessmen who have been registered with the OAEE State Entrepreneurs Fund for 36 months will be able to receive assistance from the state.

Other conditions for receiving assistance from the country’s authorities include:

- The size of the family's annual income. It should not exceed 30 thousand euros.

- There is no emergency at the moment.

- No debt on contributions to the insurance fund.

The payment period for such benefits varies from 3 to 9 months. More detailed information is presented in the plate.

| Duration of insurance | Duration of receiving unemployment benefits |

| 3-4 years | 3 months. |

| 5-6 years | 4 months. |

| 7-8 years | 5 months. |

| 9-10 years | 6 months. |

| 11-12 years old | 7 months. |

| 13-14 years old | 8 months. |

| 15 years | 9 months. |

Learn more about pensions in Greece from the video below.

Return to contents

How much do Greek pensioners receive?

In pre-crisis times, many could simply envy the pensions of Greek elderly people. What can you say now? From those 1500, only 350-850 euros remained. But this amount, of course, is not entirely final.

With earned work experience, the pensioner will receive ensims, which are insurance points. They are calculated from the total amount of cash receipts, minus the worker’s salary and the employer’s profit.

You will have to work hard to collect insurance points. Collecting the set amount of 4500 ensims is not an easy task. 1 ensim is equal to 15 euros. 15 euros are deducted and 1 ensim becomes legally earned in the employee’s pocket. The average threshold for a monthly set of ensims is 12 or 180 euros. This amount will provide basic savings for retirement.

The funded part of the pension is one of the components that influence the size of the Greek pension. Payments and all kinds of allowances are included in the pension. People who are unable to work due to health reasons, as well as low-income citizens, will receive assistance from the authorities.

Insurance contributions are related to bonuses. The size of the above contributions directly affects the formation of a future pension.

The size of the pension is influenced by the country's minimum subsistence level. The forecast for an increase in the minimum benefit for elderly people in two years is disappointing, only 375 Eurozone monetary units. 15 euros for 36 months is a drop in the ocean, but given the previously announced conditions of the IMF, this is simply great news. The old people of Greece are happy with this too.

The various components of the payment ultimately reach a single rate. Just a couple of years ago, the average pension in Greece in 2020 was seven hundred and twenty units of European currency, regardless of profit.

But the situation varies, since everyone’s compensation varies from the minimum to the average of six hundred euros to the maximum worked out, and those who deserve for their old age, as much as 800 euros. The average pension in Greece is not a symbol of prosperity, since most old people do not cross this threshold at all, but remain far beyond it at 750 euros. And this percentage of old people is more than half, and to be precise, up to 60%. When translated into the number of residents of the Greek side, the result is about 1 million 200 thousand people.

The pension assistance allocated to Greek pensioners consists of a basic share and a part that is formed through savings. In European countries, which includes Greece, they are introducing side payments for social assistance - disability benefits. The final calculation of compensation is formed from:

- norms of the allocated minimum for accommodation;

- the amount of transfer of contributions for the worker’s and employer’s pensions;

- length of service since the renewal of insurance;

- social status;

- area of occupation.

The last point is important, because the area of occupation of working Greeks in the civil service and the area of general work are different, both in terms of time worked and bonus compensation.

Greek pension: maximum and minimum

Eleven previous reforms to reduce the minimum pension in Greece did not stop the government this time either. The main motivation for the introduction of the new bill was a loan of 86 billion euros; the country will receive the third program assistance only after the first changes in the pension system. If in 2020 the maximum pension in Greece reached 2,700 euros per month, then in 2020 the “ceiling” is 2,300 euros. For citizens receiving multiple pensions, the maximum amount of state support has decreased by 600 euros, dropping to 3 thousand euros per month.

15 years of insurance - this is the period required to receive a state pension in Greece. The government justifies the established deadlines with the aim of protecting long-term unemployed people who are unable to fill their insurance days. Thus, as a result of the reform, the minimum retirement age in Greece was set at 67 years. Provided that the citizen’s work experience is 15 years, the state is ready to pay a monthly amount of 384 euros. The alternative retirement age in Greece is 62 years. However, in this case, the total work experience must reach 40 years. What is the average pension in Greece? As a result of the reforms, it reached the level of 500 euros per month.

Pensions in Greece - average benefits

In pre-crisis times, Greek pensions thundered throughout Europe: payments amounted to more than 10% of the country's GDP, while the standard figure in the Eurozone was 2-3%. Now, the life of elderly people in Greece is unlikely to arouse the envy of its European neighbors. Greek elderly people receive a monthly pension payment that ranges from 360 to 850 euros.

Thus, the minimum pension in Greece in 2020 is about 360 euros per month. The accumulative part of the payment is added to this amount if the citizen has completed the established length of service and has accumulated a sufficient number of ensims.

Ensims are insurance points that are calculated based on the amount of cash receipts deducted from the employee’s salary and the employer’s income.

In order for the minimum pension to be accrued in Greece, you must earn at least 4,500 ensims, with 1 ensim equivalent to 15 euros. In other words, in order to accumulate 1 ensim monthly, the amount of insurance contributions of the employee and employer must be at least 15 euros. And you need at least 12 such ensims per month (i.e. 180 euros), taking into account the work experience of 33 years. And this is only for the basic pension rate!

The size of the pension in Greece is also determined by the funded part. It consists of bonuses and social payments. Thus, the right to financial support from the state is given to low-income and needy citizens, disabled people, those who have lost their breadwinner, etc. As for bonuses, they depend on the amount of insurance contributions. The more interest you deduct from your salary, the higher your savings and, accordingly, the rate of your future pension.

Also, what kind of pension there will be in Greece, or rather its amount, determines the country’s cost of living. In recent years, its importance has increased, so by 2021 the projected minimum pension for Greece is 375 euros. At first glance, an increase of 15 euros over 3 years is not God knows what kind of increase, but taking into account the strict order of the IMF to freeze all indexations until 2021, this little thing is a joy for the Greek elderly.

Thus, the total amount of pensions is the sum of several payments. For example, in 2020 the average pension in Greece was about 720 euros. This is if you do not take into account the difference in income. Again, someone receives the “minimum wage”, someone has earned 600 euros in their entire life for a pension, and someone has worked as a civil servant and receives over 800. The situation is like in the famous joke: one gets cabbage, another gets minced meat, and In general, it turns out that everyone has a cabbage roll.

Therefore, you need to understand that, although the given figure for the average Greek pension for the Eurozone is far from the highest figure, many pensioners receive much less than 700 euros. According to statistics, Greeks with accrued pensions below 700 euros account for about 60% of the total number of pensioners. In other words, about 1.2 million Greek elderly people live below the “average” pension line.

In which countries do retirees have a high standard of living?

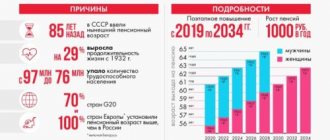

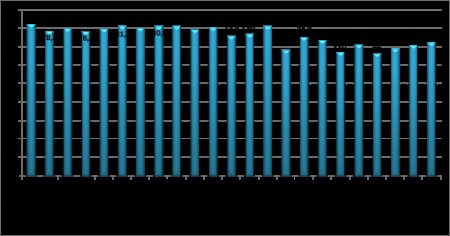

Retirement age in different countries is data of interest not only to economists and political scientists, but also to ordinary citizens.

The reform that started in Russia this year has caused excitement and indignation among the population. Many began to look towards Europe: they say, pensioners there are young, not like ours. And after the news that the retirement age in Italy was lowered, readers were generally indignant. PPT edition.

ru I decided to figure out which countries have what retirement age.

ConsultantPlus FREE for 3 days

Get access

Before we begin, we want to warn you: our task is to study the comparative table of retirement ages in other countries. It should reflect current data (February 2019), based on information in open sources on the RuNet. If you have other verified information, we are waiting for your comments.

Most experts are of the opinion that raising the retirement age is an effective step to overcome the consequences of the crisis in modern conditions. In an effort to test the method in practice, the population of EU countries, including Greece, began to massively implement the process of gradually increasing the retirement age.

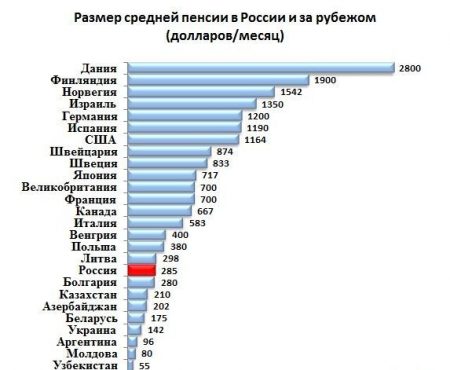

There is a list that represents 6 states where the pension system can be called developed.

- Denmark. Many people call Denmark a Mecca for older people. Residents of many European countries want to have a job in Denmark, as this will provide them with the opportunity to receive large government payments, more precisely, about $2,800 per month. People who have reached the age of 65 can receive these pensions.

- Finland. There is no maximum pension for old people in Finland, but the average is $1,900. The amount of the pension depends on the person’s length of service, as well as his salary. If a Finnish citizen does not reach the minimum, the state will pay him the missing amount. People who have reached the age of 65 can receive these payments.

- Norway. The highest retirement age for a person is set here, namely 67 years. But the pension is worth the wait for Norwegian workers. The standard of living in Norway is quite high, even despite the high taxes paid by workers and entrepreneurs.

- Czech Republic.

People can count on government payments from age 58. Their size is also quite large, which allows the elderly not to live in poverty. The average pension for older people in the Czech Republic is $1,000. 5 worst and best countries for retirement - Germany. About a quarter of the German population are pensioners. In this country the payments are also quite high for them. The average working German can count on a pension of 850 euros. Every old man in this country will receive assistance from the state in paying for utilities.

- France. In France, cash benefits for older people are calculated in the same way as in many other European countries. That is, the greater the experience and salary of a working person, the more money he will receive in old age. People who have reached the age of 60 can count on these payments.

Features of social payments to the elderly in other European countries

- Poland. This state has had social standards corresponding to European ones for many years. A person receiving an average pension can count on a fairly high standard of living even in the Polish capital of Warsaw. However, you shouldn’t think that you won’t be able to deny yourself anything, just that the life of an unemployed old man in Poland will be comfortable.

- Hungary. In Hungary, old people do not receive huge benefits, but they are not below the poverty line. The life of Hungarian pensioners is modest, but at the same time they do not go hungry at all. Many of them have the opportunity to earn additional income, for example, by working in a museum or library.

Average pension in different countries of the world, $/month. - Spain. Spanish old people certainly don’t have to complain about their standard of living, since it is quite high for them. The Spanish government pays due attention to the standard of living of this social category. The average payout here is between $800 and $900. This money is enough for Spaniards to live a comfortable life.

- Lithuania. But in Lithuania, the standard of living of old people is not so high. The fact is that the country has suffered greatly from the crisis. This was the impetus for a two-fold reduction in the size of average payments for the elderly. First, the size of pensions was reduced by 50%, and then by 70. Lithuanian elderly people are saved only by the absence of the need to pay for housing, since they are the legal owners of the land on which their houses are built. By comparison, in Germany people pay rent for their land.

Table: pensions in different European countries

| A country | Retirement age | Pension benefit amount | |

| For men | For women | ||

| Austria | 65 years old | 60 years | 2,000 euros |

| Albania | 65 years old | 60 years | 150 euros |

| Belarus | 60 years | 55 years | 314 Belarusian rubles |

| Belgium | 65 years old | 65 years old | 865 euros |

| Bulgaria | 65 years old | 63 years old | 575 leva |

| Bosnia and Herzegovina | 65 years old | 65 years old | 60 euros |

| Great Britain | 65 years old | 64 years old | 610 pounds |

| Hungary | 60 years | 55 years | 117,000 forints |

| Germany | 65.5 years | 65.5 years | For men – 1013 euros For women – 591 euros |

| Greece | 67 years old | 67 years old | 850 euros |

| Denmark | 65 years old | 65 years old | 2,800 euros |

| Ireland | 66 years old | 66 years old | 1,600 euros |

| Iceland | 67 years old | 67 years old | |

| Spain | 65 years and 3 months | 65 years and 3 months | 908 euros |

| Italy | 67 years old | 67 years old | 1000 euros |

| Cyprus | 65 years old | 65 years old | 1,300 euros |

| Latvia | 62 years 9 months | 62 years 9 months | 301 euro |

| Lithuania | 65 years old | 65 years old | 255 euros |

| Liechtenstein | 64 years old | 64 years old | 3,000 euros |

| Luxembourg | 65 years old | 65 years old | 2,400 euros |

| Malta | 62 years old | 62 years old | 700 euros |

| Moldova | 63 years old | 63 years old | 1495.72 lei |

| Netherlands | 68 years old | 68 years old | 2,292 euros |

| Norway | 67 years old | 67 years old | NOK 15,000 |

| Poland | 65 years old | 60 years | 382 euros |

| Portugal | 66 years 3 months | 66 years 3 months | 540 euros |

| Romania | 65 years old | 61 years old | 640 lei |

| Serbia | 64 years 5 months | 59 years and 5 months | 220 euros |

| Slovakia | 62 years old | 62 years old | 385 euros |

| Slovenia | 65 years old | 65 years old | 700 euros |

| Ukraine | 60 years | 60 years | 2,480 hryvnia |

| Finland | 63-68 years old | 63-68 years old | 1,210 euros |

| France | 62-67 years old | 62-67 | 1000 euros |

| Croatia | 65 years old | 62 years old | 1,340 kn |

| Montenegro | 65 years 8 months | 61 years old | 278 euros |

| Czech | 62 years and 10 months | 58-62 years | 420 euros |

| Switzerland | 65 years old | 64 years old | 2,000 francs |

| Sweden | '65 | '65 | 1 697 |

| Estonia | 65 years old | 65 years old | 410 euros |

More on the topic Alfa-Bank deposits for pensioners for 2020

The rating of such countries includes the following:

- Russia. The average payout is less than 100 euros.

- Bulgaria - 125 euros.

- Romania - 175 euros.

- Lithuania - 222 euros.

- Estonia - 232 euros.

- Latvia - 304 euros.

Recent pension reforms in Russia have made little difference to the lives of older people. Many of them do not have enough money to cover the minimum costs of food and housing and communal services.

Russian pensioners do not have the chance to travel around the world, like, for example, their German or Czech “colleagues”.

Pensioners in many European countries have been saving certain amounts for many years, which they then spend on travel. This is a common practice in developed and developing countries.

Thus, the minimum pension in Greece is about 60% of the income of the average citizen.

The reform, which provides for pension financing from the state budget rather than from contributions, implies an increase in insurance premiums by 1.5%. Thus, employers pay one percentage point, and employees - ½ percentage point: this approach is designed to maintain the pensions of current retirees at the same level.

As political scientists and economists note, the size of pensions in Greece will be significantly reduced in the near future. The Skai TV channel carried out calculations and published the following economic forecasts: the difference between the size of pensions for current and future retirees could range from 15 to 35%.

Upon retirement, the fund is obliged to provide the client with:

- Regular payment of accrued pension benefits.

- Free health insurance.

- Payment for travel or flights to a vacation spot.

- Providing necessary medications.

- Payment of additional social charges (if there is a legal right).

As you can see, on the one hand, the system is too cruel, because the requirements for receiving a pension are extremely high and the amount of payments is constantly being reduced. But on the other hand, older people have access to social benefits, free medical services and paid annual leave.

I haven’t heard about the crisis in Greece, by God, I’m just deaf. Central TV channels trumpeted about it, it was discussed at regional forums and on social networks... And everyone wondered: will Greece collapse the European Union? Will the Greeks achieve the preservation of social benefits and high pensions? Will the Greeks be able to defend their retirement age, which at the time of the collapse was the lowest in Europe?

Relax, everything is fine in Greece. Much better than now in Russia. At least, this is evidenced by objective indicators of the country’s economy:

- GDP per capita is 2 times higher than ours (23 thousand dollars versus 11.5 thousand).

- Economic growth is 2.3% per year versus our 1.8%.

- Inflation is 0.9% for the year against ours... I don’t even know what figure to name - the planned 4% or the real 14%.

And yes, the Greeks’ salaries are no match for ours, and pensions before the crisis were very high, and benefits... I’ll talk about their size another time, and today – about the retirement age.

More on the topic Minimum pension from January 1, 2020: table by region, how much will be the cost of living and what is the amount of social supplement

All figures given above refer to the current year. By 2020. Ten years ago, when the debt crisis broke out, everything was sad - a budget deficit, colossal debts, the actual default on which forced Greece to stop fulfilling its social obligations to the population.

The decision to raise the retirement age helped Greece get out of the collapse. The population was harshly thrown out, because the government simply did not have the money to sponsor the Greeks.

Pension reduction and lack of indexation

Today, the state apparatus has reduced social payments to 12% for the vast majority of pensioners. Note that today about 2.6 million people live in Greece.

This situation greatly aggravates the financial situation of most people. This measure does not apply to those pensioners who earn less than six hundred euros and work in hazardous work.

Pensions will be reduced in the following cases:

- Early retirement.

- Those who retired at 50-55 years old will lose the most.

- The amount of payments was significantly affected by the increase in the tax on health insurance. This figure today is 6%.

In the next few years, Greek pensioners will have to rely only on themselves, because the indexation of payments at the request of the European Union Commission will not be applied until January 1, 2021.

To summarize, we note that the Greek pension system is not going through the best of times. 2020 will most likely be the same as the last year, and accordingly, no significant improvement in the quality of life for the older generation is expected. The situation is not significantly covered by the additional allowance, but the crisis picture is disappointing.

Experts note that now is the best time to move to this country for permanent residence, but the economic situation is so alarming that Greece is not the best option for emigrating in 2020.

Social benefits for pensioners

The economic situation in Greece is not conducive to providing benefits. The government is forced to make unpopular decisions. For example, pensioners were deprived of the opportunity to withdraw unlimited cash from ATMs. Now they are subject to a general restriction that does not allow withdrawals of more than 60 € per day from the account.

Attention

An exception is made only for holders of bank cards from foreign banks.

In large cities, passengers over 65 years of age are given a discount on public transport, museums and historical monuments.

On the problems of the pension regime in Greece

Effective social insurance systems in many European countries are now bursting at all seams.

Until about 2005, Greece was considered the country where the wealthiest retirees live. They received 96% of their previous salaries and essentially maintained their previous lifestyle in retirement without working.

The average salary in Greece was 2,000 euros, and the retirement age began at 57 years. Having gone on vacation, pensioners had the opportunity to live without denying themselves anything: traveling around the world, purchasing real estate in other countries.

In the context of the economic crisis and events taking place in Greece itself, it turned out that the lion's share of GDP is spent on paying pension benefits. Taking into account the fact that the population is aging, it has become obvious that the government, along with other measures to overcome the crisis, needs to raise the retirement age.

The main reasons that prompted the state to adopt a law changing the retirement age:

- A sharp drop in natural population growth.

- Reduction in the number of working-age population.

- The outflow of the local population to other countries in search of high earnings.

- Increasing number of people of retirement age.

- High unemployment rate.

- Reducing wages.

- Reducing employer contributions to funds.

- Corruption is the plunder of insurance funds by officials.

Economists considered that, at a minimum, raising the retirement age to 65 years, and in the future to 67, would move the process of gradual collapse of the system as a whole off the ground. This will allow Greece to save 1 billion euros annually.

The issue of paying real pensioners has worsened in the country to the point that the government was forced to reduce the amount of pensions by more than half. Pension costs today average 500 euros.

This measure reduced costs, but did not solve the problem globally, so the issue of raising the age limit was brought up for discussion by the legislative branch of the new Greek government.

Political reform in Germany in the twentieth century

The first pension was issued to the Germans by order of Chancellor Bismarck. The start date for these payments is 1889. They were intended for civil servants and workers who lived to be 70 years old. However, this was a political trick.

The fact is that in the second half of the 19th century, the average life expectancy of the average German was 45 years. And the retirement age is 70 years. Thus, only a few received it.

Residents of Germany were ironic about this, calling pensions “sums for the dead.” But, even despite this, no one could ignore the pension decree, and payments were made regularly.

The state used another trick: retirement for the Germans of that time began at the age of 70, and since many did not live to this age, all the money intended for pensions remained in the state treasury.

Ranking of pensions in the world

How were the funds accrued? Workers and employees paid a percentage of their wages into the pension treasury. It is believed that this reform in Germany was related to the then demographic problem. It turns out that the state was trying to increase the birth rate and preserve the nation in this way.

When Adolf Hitler came to power, he did not make any significant changes to this reform.

The pension system that Chancellor Bismarck established worked for more than a century. However, significant changes occurred in the 20th century. In 1953, Chancellor Adenauer came to power. He lowered the retirement age by 5 years. That is, people could qualify for state benefits when they reached 65 years of age.

Adenauer also developed the so-called solidarity agreement between generations. According to this agreement, a percentage of the workers' wages was regularly deducted in favor of the elderly and children.

In many European countries this pension system is still in effect.

What proportions of contributions to the German pension treasury apply in 2020? Entrepreneurs, like employees, are charged 50%.

The average pension in modern Germany is 1,270 euros. The maximum amount of this benefit is 2200 euros. The state also takes responsibility for paying utility bills for pensioners.

The governments of many developing European countries are interested in ensuring that older people receive a pension amount sufficient to meet their needs. The main direction of many European pension reforms is to increase the retirement age.

There is a rational grain in this, because many old people, despite their age, have jobs, and, consequently, a constant source of income.

Many employers prefer to keep pensioners on their staff rather than young employees, as they have extensive work experience and work skills honed over the years.

New bill

Reforming the pension system implies not only a significant reduction in the size of pensions in Greece, but also the establishment of a unified social insurance fund and an increase in the level of contributions.

As part of the reform, the government plans to act in three areas:

- changing the social insurance procedure;

- quantitative growth of funds specializing in insurance and pensions;

- development of a profitable alternative for obligations to creditors.

The main objective of the bill was to unite all functioning social insurance funds into a single one. Systematization led to the following: new rates, recalculation of pensions for years of work experience, and as a consequence - a reduction in the amount of state support for future retirees. However, the incomes of current pensioners remained at the same level.

The government's pension reform plan was based on a new algorithm for calculating the basic pension and changes in replacement rates.

Which categories of citizens lost their pensions?

- Pensioners who received a double pension. There are 200 thousand of them. They receive a minimum of 320 euros;

- Widows who continue to work or receive their money from the state will not receive it in full for their spouse if three years have passed since death;

- Disability pensioners from fifty to sixty-six and nine-tenths percent of the degree of disability receive a pension 50% less than the usual one, and with 67-79.9% - 75% of it;

- People with an insurance period of less than 15 years will now receive only 130 euros per month;

- People who receive money from other governments;

- Citizens who receive ΕΚΑΣ benefits (a decision regarding them will be made in 2020);

- Changes in the size of payments for people who retired from other pension funds. They plan to develop other solutions specifically for them.

Now the Greek government is striving to do everything necessary to solve all pension problems. In general, they are to blame for them insofar as the treasury suffers due to the fact that it does not receive sufficient payments. Meanwhile, one cannot deprive people of what they have earned.

What does the pension system look like in Greece?

There are several sources of social insurance in Greece:

- The ICA Fund is the largest state insurance fund.

- The Regional State Administration Fund provides insurance under the auspices of the state not only of the local population, but also of people from other countries.

- Fund for civil servants.

Funds were also created to accumulate funds from individual professional fields - doctors, lawyers, engineers, sailors, etc. Conditions provided by the funds:

- Payment of pension benefits in accordance with contributions.

- Free health care in retirement.

- Providing free medicines.

- Free flight to your holiday destination once a year.

Each fund is responsible for accumulating funds for a separate category of workers, therefore the funds deposited in them differ depending on the level of wages and profitability of enterprises. But the conditions of all policyholders are almost identical, so most people chose a fund to accumulate funds based on territorial characteristics.

The entire system is based on mandatory payments made by the employee and the employer. Under the law, the size of the future pension is determined based on the total amount of contributions. In addition to paying labor pensions, the funds must pay benefits to disabled people and families with the loss of a breadwinner.

In the context of the crisis in the country, the state stopped regular support for pension insurance, so their costs increased and revenues decreased. A new pension law was adopted in Greece in 2020, which outlined new insurance conditions and described the procedure for gradually increasing the retirement age.

According to experts, the new complicated insurance system in the country will lead to raising the age limit for different groups of people from 2 to 7 years. Those who joined the system after 2005 will be the most disadvantaged by the reform, since a short period of deduction will have a decisive effect on calculating the size of their future pension.

For now, the result of raising the age limit should be the number 67. The pension period has been increased by another 15 years and a very detailed pension formation scheme has been developed, which depends on many factors:

- Beginning of the insurance period.

- Work experience.

- Total investment amounts.

An innovation in the law is the gradual equalization of the retirement age of men and women.

Until 2021, Greece plans to gradually increase the age to 65 years, and from 2024 changes will be made to the law, which will also depend on statistical data on the life expectancy of the country's citizens.

The state took upon itself the obligation to support the funds financially, and left the formation of the basic part entirely to itself.

Monthly expenses of Greeks

The standard of living in 2020 is such that renting a home can be very inexpensive, since in payment for this the owners ask for enough money to pay taxes and bills for the maintenance of the property. Therefore, renting a house will be very inexpensive. To rent an apartment of approximately 65 square meters, you will need 300 euros per month. For 500 euros you can get a four-room apartment for use. In summer the houses are hot, but in winter it is very cold. In order to save money, heating is turned on in houses for several hours a day.

Product prices

Visitors to Greece often eat in cafes and restaurants. Their prices are different. The cuisine here is unique; many tourists try to try all the local dishes. Prices in Greece for the main menu are as follows:

- second chicken or pork - from 8 to 15 euros;

- seafood cocktail – from 8 to 15 euros;

- appetizer of eggplant and meat – 4 euros.

You can buy food in markets and supermarkets. As a rule, fruits and vegetables in the markets in Greece are very cheap. You can buy olives, fish, spices, and homemade wine inexpensively. It is recommended to visit the market at the end of the day, when prices drop there. In this case, you won’t have to spend a lot on food. For those who prefer to cook on their own, average food prices:

- kilogram of beef – 8 euros;

- kilogram of chicken fillet – 5 euros;

- kilogram of fish (minke whale, swordfish, perka, sea bream, salmon, dorado) - from 6 to 9 euros;

- a dozen eggs – from 2 euros;

- liter of milk – 1 euro;

- liter of thick yogurt – from 2 to 4 euros.

Don’t forget that there are delicious cheeses here and, of course, a real treasure, the basis of local cuisine - olive oil.

Housing cost

It is possible for our compatriots to buy real estate in Greece. If a foreigner purchases real estate worth at least 250 thousand euros, then he and his relatives immediately receive a residence permit in this country.

When purchasing properties on the islands, you should take into account that you need to legally formalize the transaction correctly. To buy property in Crete, you will need to enlist the support of a qualified lawyer. His fee is one percent of the value of the property if the amount is up to 44 thousand euros. If the cost is from 44 thousand to 1 million euros, then the reward will be 0.5 percent. You also need to take into account VAT, which is 23 percent. Contacting a lawyer for a home buyer is necessary because he can check with the National Land Registry whether the property belongs to the seller, as well as its “purity”.

The cost includes the notary's fee. If you need to buy land in 2020 in Greece, and its cost is up to 120 thousand euros, then notarization will cost 1% of the amount. The higher the purchase price, the lower the percentage paid to the notary.

To register the contract you will need to pay 0.475% of the amount. There is also a fee for legalization in the National Land Cadastre. Purchasing a home in Greece involves mandatory payment of tax, which is at least 10 percent of its cost.

If a commercial or residential property has already been purchased, then the owner must pay a fee of 800 to 1200 euros for connecting to water and electricity sources. The cost of utilities for everything is approximately 1000 euros per year. An apartment or building by the sea will cost more.

Adverse changes

Members of the European Commission believe that increasing the minimum work experience will help save the Greek economy. Today this period is 33 years. By 2022 it will be increased by 7 years.

To receive pension payments, a citizen of the country will have to reach 65 years of age.

In case of early retirement, the amount of monthly payments will decrease by 11% for each “untimely” 12 months.

This will hit people who went on vacation at the age of 50-55 the hardest.

The size of pensions was influenced by an increase in the medical tax. insurance. Today its figure is 6%.

Social Benefits for most Greek pensioners were reduced to 11%. This affected those people who received more than 600 euros and did not work in hazardous work.

What will happen after the reform

She is a politician because her actions rarely show any positive aspects. It can be understood that the measures are only temporary in order to correct such a difficult situation.

But the temporary measure has dragged on for too long and is already ten years old. The next year, in the forecasts of international financiers, is regarded as a year of increase in Greece's GDP. If this event occurs, it will be remembered as something incredible in the life of Greece since the onset of the crisis.

This hope extends to the standard of living of the population as a whole, including pensioners. For now, we have to live only with hopes and dreams of a bright future.