Description

The National Non-State Pension Fund is a non-state pension fund. It offers insurance and pension savings services. It does not carry out any other activities, which pleases clients.

NPF "National" is a typical representative of NPFs in Russia. In it, the open contribution is not only preserved, but also slightly increased. At this point, all activities of the company cease. When the time comes, the organization pays cash to clients. You can transfer your savings to another NPF at any time.

Registration

The account creation process occurs in several stages. To avoid mistakes, it is recommended to follow the step-by-step instructions:

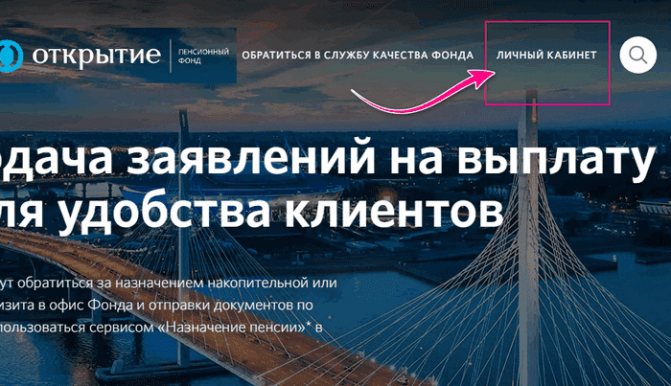

- Go to the official website of the pension background https://open-npf.ru/.

- In the upper right corner, go to your Personal Account.

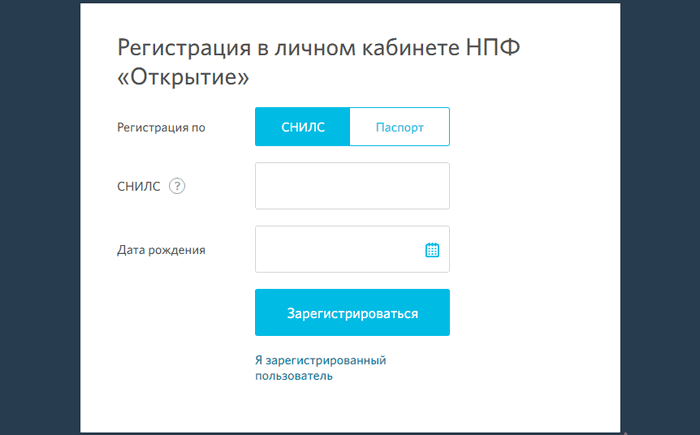

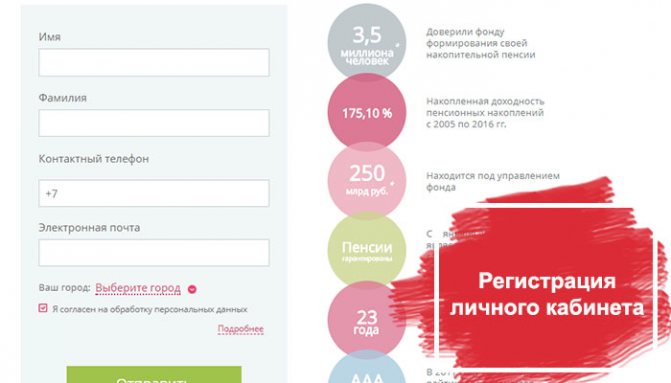

- Click on create a new account and fill in your personal information in the form that opens.

The client is given a choice between opening an account using SNILS or a passport. Depending on the selected document, you will need to fill in the fields with the personal data of the document. In both cases, additionally indicate the date of birth.

Registration of an account on the Internet is available to those clients who have entered into an agreement for the provision of services with NPF Otkritie. To do this, you need to contact the customer support service and go to the office of the bank and the Pension Fund to transfer current savings to another organization.

Company rating

What features of a company do potential investors pay attention to most often? NPF “First National Pension Fund” receives mixed reviews for its place in the rating of NPFs in Russia.

The company under study is located approximately in 17-18th place. This is far from leadership. Therefore, some potential investors are skeptical about the organization.

It is difficult to name the exact location of the fund in the rating of NPFs in Russia. You can simply say that the organization is not among the top 10 leaders in the country. But in the 20-30s you can find it.

Pros and cons of being an agent

Working in this field has many advantages and positive aspects for those who decide to realize themselves in this. At the same time, there are certain disadvantages that make this type of activity not so attractive. This should be discussed in more detail.

pros

- the opportunity to earn good money, since the ceiling of earning potential is limited only by the agent’s ability to work and his professional data;

- career growth - an experienced employee may well take the place of a mentor to new and less successful ones;

- free schedule without being tied to a specific place of work;

- participation in trainings and courses to improve cold sales skills;

- easy entry into the profession - for this work, most non-state pension funds do not require future workers to have a vocational education.

Minuses

- lack of stability in terms of earnings - agents do not receive wages without attracting new clients;

- high level of stress associated with communicating with completely different people, including those who are not always positive.

Important! Many are frightened by the prospect of public speaking, the skills of which are simply necessary for an NPF agent.

Other rating

But that's not all the organization has in store. The national rating agency evaluates NPFs based on many indicators. Basically, the list of leaders is compiled in relation to the volume of pension savings. But there are other components of the rating.

The National Non-State Pension Fund ranks 10th among pension funds in terms of pension reserves, as well as 14th in terms of capital volume. The company has maintained this position since 2014.

We can conclude that the company does not have the worst indicators. Therefore, it should not be excluded from pension funds in which it is planned to invest funds to form a pension in the future.

History of the Lukoil Garant Fund

NPF "Lukoil-Garant" was one of the largest in Russia and millions of our fellow citizens entrusted their funds to this organization as pension savings. However, in recent years, practically no information regarding the fund has been provided through public channels, which causes well-founded concerns on the part of citizens who form a pension in this NPF. Many of them believe that the fund went bankrupt and ceased to exist.

In fact, these rumors and fears are devoid of any factual basis. Let's look at what happened to the fund.

NPF Lukoil-Garant was registered in 1994 and was one of the oldest in Russia. Its founder was the oil company, which at that time became one of the leaders in oil production in our country.

Reference! Initially, the main function of the fund was to create additional social guarantees for oil company employees, which was necessary in the conditions in which the country found itself in the 90s.

For a long time, NPF Lukoil-Garant served only oil workers, that is, its activities did not go beyond the interests of the parent company. However, in 2004, a non-state fund entered the open market with the aim of conducting activities within the framework of the OPS.

After 2014, the requirements for non-state pension funds in the country have become significantly stricter. To continue operations, it was necessary to go through the corporatization procedure. This task was successfully completed by the fund one of the first among its competitors - in 2014.

A year later, OJSC Lukoil-Garant was included in the register of non-state pension funds that are participants in the insurance of relevant savings.

In 2020, the number of clients of this non-state fund amounted to more than 3 million people.

Reorganization

After the tightening of legislative requirements regarding the conduct of activities of existing non-state funds in the relevant market, a tendency began to be observed towards the liquidation of small funds or their merger with larger and more significant players.

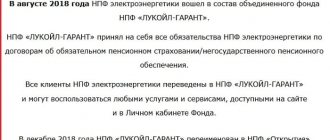

Thus, in 2020, the non-state fund discussed in the article was reorganized . This procedure took place in the form of the accession of smaller market players to NPF Lukoil-Garant. Thus, the NPF “RGS” and NPF “Electroenergetics” were included in this fund.

Lukoil-Garant assumed all the relevant obligations, and after some time it was renamed NPF Otkritie.

Thus, Lukoil-Garant, in fact, did not disappear from the market, but only became larger and changed its name. For clients of a non-state fund, these changes did not entail any losses. On the contrary, in this capacity the NPF has become more stable and reliable.

Attention! Otkritie is directly related to the bank of the same name. The latter is its main shareholder. The bank itself is under the control of the Central Bank of the Russian Federation.

Profitability

An important factor is such an indicator as profitability. Many potential investors pay attention to it. After all, for some it is not enough that their pension savings will be safe and sound. I would like to increase them a little more. And the more, the better.

The national non-state pension fund has a good profitability, according to statistics. It is about 13.21% per year. But clients say the opposite. Some investors note that NPF National is not suitable for increasing pensions. The real yield here is about 5-8%. Therefore, it is clearly not worth counting on a significant increase in savings.

Due to such discrepancies, the National Non-State Pension Fund receives mixed reviews from clients. Some say they are happy with the increase in future pensions, while others call the organization deceivers and scammers. In fact, the discrepancies between the actual situation and statistics are easily explained by inflation. We can only say with confidence that NPF National does not offer the highest return. But the organization does not deceive its clients. Pension savings are indeed increasing. Although not as fast as we would like.

Official site

The website of NPF "Lukoil-Garant" has currently lost its significance and is not working. Nowadays, the Otkritie Foundation website operates online, on the pages of which you can get all the necessary and complete information about the foundation itself, its current activities, as well as opportunities and methods of transferring to the foundation.

This Internet resource is official, in this regard, the information posted on it should be considered as a priority.

Attention! If you have any urgent questions, you can contact the hotline

How to register a personal account

NPF Otkritie, for convenience, offers to create a personal account for individuals on its website. This is an effective tool for interacting with the fund, which allows you to solve many current issues in real time.

So, what opportunities become available after registering your personal account?

- obtaining information about the status of your personal account and the ability to find out the amount of savings;

- concluding a non-state pension agreement online;

- replenishment of a non-state pension account;

- submitting an application for payment;

- submission of details for pension transfer.

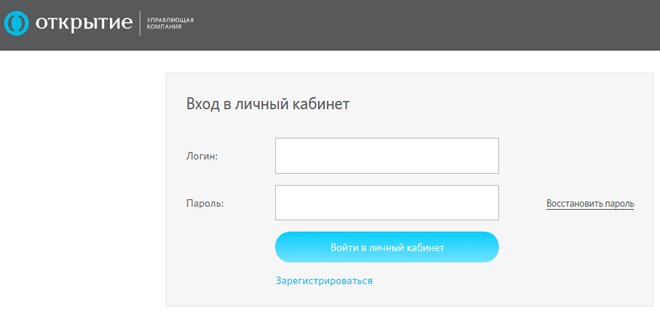

Registration and login instructions

Registering a personal account on the fund’s website is quite simple and does not take much time.

To do this, go to the “Personal Account” section. In the form that appears, you must select “Register”. Next, you need to enter either SNILS or passport details and date of birth. After this, confirmation occurs, a login and password are selected, and then the citizen can start using the account.

Reference! Only a person who is a client of the fund can register a personal account.

Logging into it, if you have registration, is not very difficult. To do this, enter your password and login in a special form.

Online calculator and how to use it

For clients of the fund, it is possible to calculate their future pension using an online calculator. To use it, you must enter the necessary data in special fields and click the appropriate button for calculation.

Reliability

Another important indicator is reliability. It is sometimes also called the level of trust or trust. The national rating agency gives a high rating to the NPF called “First National” in this area. Today, reliability is rated A++.

According to statistics, there are no higher trust indicators. This means that the National Non-State Pension Fund will not be abruptly closed, its license will not be taken away, you can entrust pension savings to the corporation and not be afraid for them.

But many are put off by the fund’s position, which is far from leadership, in the list of non-state pension funds in the country. A reliable, stable organization with good profitability, but for some reason it is far from the leading places. Why? What features of cooperation can be identified from the foundation? What are your visitors satisfied or dissatisfied with?

How to register and gain access

If you have not yet completed the registration procedure, you need to go to the registration page on the official Soglasie-OSP website, which is located at: https://account.soglasie-npf.ru/auth/

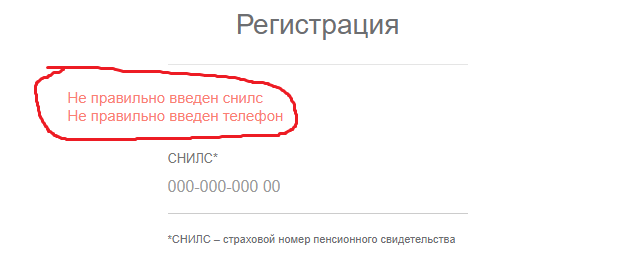

On this page you just need to enter your SNILS number, as well as the phone number that you indicated when concluding the pension insurance agreement, then click the “Register” button or press Enter on your keyboard.

SNILS – insurance number of the pension certificate

Please fill out the fields of the registration form carefully, otherwise you will receive a corresponding error message. If this happens to you, no problem, just enter your details again.

If you have made several attempts to register and nothing works, just call the NPF hotline back. The phone number is located at the top right.

About service

National Non-State Pension Fund does not receive the best reviews for the quality of customer service. More precisely, it does not suit everyone. Quite often, clients say that employees are not attentive to their work. No professionalism. There are constant queues at the company's branches, and sometimes there is confusion with documents. Sometimes there are even opinions about the illegal transfer of funds to the National Non-State Pension Fund from state pension funds. The organization refers to statements written personally by the investor, but in fact the person did not sign any such papers. Reviews like this are not uncommon. They occur quite often. Because of this, trust in the organization decreases.

However, we should not forget that all these statements are not supported by anything. The “First National” NPF is far from the worst organization. Some opinions emphasize the attentiveness of the employees and their polite attitude towards visitors. Yes, the speed of service leaves much to be desired, but such complaints can be found even among ideal funds.

It is impossible to say with certainty how well the National Non-State Pension Fund serves clients. The organization copes with its work and fulfills all the promised functions. But no one is immune from rudeness and unprofessional staff. This must be remembered.

Otkritie Foundation programs

In accordance with the peculiarities of Russian legislation, for each working citizen, organizations are required to pay certain amounts of money to the state pension fund. They are called insurance premiums because they go towards creating pension savings.

It should be noted that, in addition to the insurance one, the funded part of the pension can also be formed. In this case, part of the insurance premiums is directed to these purposes in the same way. A citizen has the right to determine an organization that will accumulate his savings. This can be either the Pension Fund or non-state pension funds.

NPF Otkritie participates in the mandatory pension program, so its main activity is the formation and payment of pension savings to citizens.

At the end of 2020, the formation of funded pensions in our country is frozen. At the moment there is no data regarding whether this system will subsequently function in one form or another.

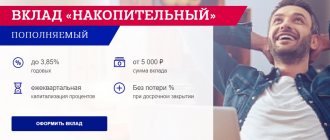

In addition, the fund offers citizens to form their pension by making additional insurance contributions (ASC). The essence of this program is that an OPS participant can transfer his own funds to his account in the fund. This allows you to significantly increase the size of your funded pension. In addition, the moratorium does not apply to DSV.

The NPF participated in the program of voluntary co-financing of pensions. Despite the fact that it was possible to join it until the end of 2015, more than 15 million citizens across the country became its participants. Its meaning lies in the fact that the state has pledged, at its own expense, to double the amount of savings generated for the funded pension.

Attention! To date, the pension co-financing program is not recruiting new participants.

The Otkrytie Foundation also proposes concluding a non-state pension insurance agreement to receive additional financial security in old age. Its conditions are selected for citizens within the framework of programs established by the fund itself.

Results

What conclusions can be drawn from all of the above? The National Non-State Pension Fund is an undistinguished non-state pension fund. It offers standard services for insuring pension savings and forming their funded portion.

The organization receives mixed reviews. National Non-State Pension Funds are not scammers, but some negative aspects of service slip through during cooperation. Sometimes payments are delayed here, someone doesn’t like the conditions, someone complains about the branch employees. All of this is a standard complaint from NPF clients. You can consider the National Fund for the formation of deposits, but only if there is no suitable offer among the leaders of NPFs.

Registration in your personal account Lukoil-Garant: non-state pension fund

Do you want to become a client of the NPF? You will first need to register. Need to:

- Go to the website lukoil-garant.ru.

- Click on your personal account.

- Go to registration.

- There are two options - by passport or SNILS. Choose the one that suits you.

- Enter your personal information in the form.

- Check that the information is correct.

- Confirm it.

- After registration, you will be able to log in to your personal account at NPF Lukoil-Garant for individuals.

Where to find an NPF agent

As a rule, people with offers from non-state pension funds themselves go to apartments and houses in search of clients to conclude an agreement. However, a situation may well arise when a working citizen himself wants to transfer his pension savings to one or another fund. In this case, he may require the services of an agent. Finding such a specialist is easier than it seems.

Specialized sites

The websites of large pension brokers contain all the necessary information about the specifics of transferring the funded part of a pension to a non-state pension fund. In addition, such Internet resources contain contact information, using which you can find an agent of the desired non-governmental fund.

Working as an NPF agent is popular among many citizens. People are primarily attracted to this field by the opportunity to earn good money and a flexible work schedule. At the same time, it should be borne in mind that this type of activity requires significant dedication, since it involves hard and intense work with a variety of people. In this regard, communication skills and stress resistance are the leading personal qualities of an agent.

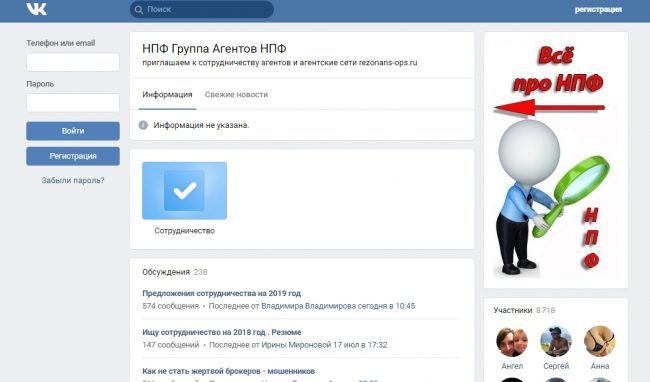

Social media

In many popular social networks, NPF agents create thematic groups that serve as a means of their internal communication.

In addition, many pension funds and brokers create their own pages and communities, by contacting the administrators of which you can find an NPF agent ready to advise on all issues related to the transfer of savings to a non-governmental organization.

Investments around the world in one tool

I hereby express and confirm my consent to the processing of my personal data, as defined by the Federal Law “On Personal Data” No. 152-FZ dated July 27, 2006 (hereinafter referred to as “Processing”), transferred to any of the Operators (as defined below) or received/available from at least one/one Operator in another legal way, for the purposes of: concluding/executing/facilitating the execution of an agreement concluded with me, or a person represented by me, or of which I am a beneficiary, or considering the possibility of concluding an agreement, in including trust management agreements, loan agreements, agreements on the provision and use of bank cards, service agreements with any of the Operators; Operators receive information about these agreements; exercise of the rights and legitimate interests of the Operators or third parties, including the settlement of overdue debts under these agreements in the event of non-fulfillment or improper fulfillment of contractual obligations by me, assessment of my solvency with the involvement of partners by the Operators, conclusion and execution of an agreement for the assignment (or pledge) of rights (claims) under the specified agreements (in the absence of a prohibition in the agreement) with any third parties; or to achieve socially significant goals, in order to create/improve the quality/promote goods, works, services on the market, including through direct contacts of Operators with the subject of personal data to obtain information about other products and services of Operators, provision of services, in statistical and other research purposes, for access control purposes, as well as for the purpose of providing one or more (one or more) Operator(s) with my Personal Data (as defined below), including (but not limited to) photographs of my face (individual biometric characteristics of my face); surname, first name, patronymic; identity document details; year, month, day and place of birth; citizenship; address; contact numbers, postal addresses, email addresses and other information provided by me for concluding contracts with any of the Operators or during the period of their validity, contained in applications, letters, agreements and other documents (received by the Operators or one of the Operators also in electronic form) ; information specified in questionnaires and other forms to be filled out, information about property and property rights, data on contracts (including their names, numbers and dates of their conclusion), data on accounts opened with Operators, data contained in the reporting documents of Operators before by me, as well as updated (updated, changed) data received by at least one of the Operators subsequently, by any of the following methods, including (but not limited to) collection, recording, systematization, accumulation, storage, clarification (updating, changing), extraction, use, transfer (distribution, provision, access), depersonalization, blocking, deletion, destruction of personal data, as well as combining Personal data received by at least one of the Operators from other Operators, both using automation tools (including information -telecommunication systems and networks), and without the use thereof, to the following persons (hereinafter referred to as the Operator, Operators) or their legal successors: (1) Joint Stock Company "Otkritie Broker", located at the address: 115114, Russian Federation, Moscow , st. Letnikovskaya, 2, building 4 and OGRN 1027739704772; (2) Limited Liability Company “Manager”, located at the address: 115114, Russian Federation, Moscow, st. Kozhevnicheskaya, 14, building 5 and OGRN 1027739072613; (3) Public joint stock company Bank Otkritie Financial Corporation, located at the address: 115114, Russian Federation, Moscow, st. Letnikovskaya, 2, building 4 and OGRN 1027739019208; (4) IRS (US Internal Revenue Service) and withholding agents for FATCA compliance purposes; (5) Insurance Limited Liability Company, located at the address: 109028, Moscow, Serebryanicheskaya embankment, building 29, floor 4, room No. 47-71; (6) Public joint-stock company "Rosgosstrakh Bank", located at the address: Russian Federation, 107078, Moscow, st. Myasnitskaya, 43, building 2 and OGRN 1027739004809; (7) Joint Stock Company "Bank DOM.RF", located at the address: Russian Federation, 125009, Moscow, st. Vozdvizhenka, 10 and OGRN 1037739527077; (8) Public joint stock company Insurance, located at the address: 140002, Moscow region, Lyubertsy, st. Parkovaya, 3; (9) Joint Stock Company "ALFA-BANK", located at the address: Russian Federation, 107078, Moscow, st. Kalanchevskaya, 27 and OGRN 1027700067328; (10) Joint-stock company "Non-state pension fund "Otkritie", located at the address: 129110, Moscow, st. Gilyarovskogo, 39, building 3; (11) other persons with whom Otkritie Broker JSC interacts when performing transactions on behalf of Otkritie Management Company LLC within the framework of the agreement concluded with me and indicated on the website www.open-broker.ru in the “Documents and Disclosure” section or in the “Information Disclosure” section on the website www.open-am.ru. I also express and confirm my consent to the Operator making decisions that give rise to legal consequences in relation to me or otherwise affect my rights and legitimate interests, based solely on automated processing of my Personal Data (applies if consent is given in writing in accordance with the Federal Law “On Personal Data” "). This consent is valid indefinitely and can be revoked in part or in full on the basis of a written application sent to the Operator to whom such consent was provided. At the same time, I am aware that full or partial withdrawal of this consent may lead to the impossibility of fulfilling/assisting the execution of the concluded contract. This consent is revoked from the date of receipt of written notice of the revocation of this consent by the Operator. In case of withdrawal of this consent, the Operator/Operators are obliged to stop performing actions related to the Processing of Personal Data, with the exception of actions related to the Processing of Personal Data, the obligation to perform which is assigned to the Operator/Operators by legislative and other regulatory legal acts of the Russian Federation, and other cases when the operator has the right process personal data without my consent on the grounds provided for by federal laws. If the personal data is not provided by the Personal Data Subject, the person providing the Subject’s personal data hereby guarantees and confirms that he has received the appropriate consents of all the Subjects indicated by him, and also that all Subjects are informed about the processing of their personal data by the Operators. I hereby express my full and unconditional consent to the receipt by PJSC Bank FC Otkritie / PJSC Rosgosstrakh Bank of information about me from any credit history bureaus (one or more) contained in the main part of my credit history in the volume, manner and terms, which are provided for by the Federal Law of December 30, 2004 No. 218-FZ “On Credit Histories”. Consent is provided for the purposes of: checking PJSC Bank FC Otkritie / PJSC Rosgosstrakh Bank of the information provided by me to PJSC Bank FC Otkritie / PJSC Rosgosstrakh Bank or other Operators when accepting services and / or concluding agreements with PJSC Bank "FC Otkritie" / PJSC "Rosgosstrakh Bank" and/or other Operators; verification by PJSC Bank FC Otkritie / PJSC Rosgosstrakh Bank of information about me in the process of providing me with banking services and/or other / PJSC Rosgosstrakh Bank, other Operators; checking PJSC Bank FC Otkritie / PJSC Rosgosstrakh Bank information when forming PJSC Bank FC Otkritie / PJSC Rosgosstrakh Bank proposals for credit, banking and other products. The right to choose a credit history bureau is granted by me to PJSC Bank FC Otkritie / PJSC Rosgosstrakh Bank at their discretion and does not require additional approval from me. I hereby express my full and unconditional consent to receive from any of the persons specified in this paragraph information about products and services, commercial offers of the persons specified in this paragraph, including through postal services and telecommunication networks (telephone, fax, mobile radiotelephone communications, etc.) at the address of permanent registration, address of actual residence, email address, contact phone numbers), use of your contact information LLC Management Company "OTKRITIE", JSC "Otkritie Broker", PJSC Bank "FC Otkritie", PJSC " Rosgosstrakh Bank", PJSC IC "Rosgosstrakh", LLC "IC "Rosgosstrakh Life", JSC "NPF "Otkritie" to keep in touch with me, make phone calls to the phone numbers specified in this Questionnaire, send SMS messages to those specified in this Questionnaire telephone numbers, and emails to the email address specified in this Questionnaire, including those of an advertising nature, for the purpose of offering services, conducting surveys, questionnaires, conducting advertising and marketing research in relation to the services provided, both individually and jointly, and also invitations to seminars (courses, lectures, training).

How to become an NPF agent

There are two ways to get a job in the capacity discussed in the article: directly or through a pension broker. Both of these forms of employment are popular at the moment.

- Directly, without an intermediary. Many pension funds are constantly looking for employees and regularly announce the recruitment of new ones. Each newcomer must undergo special training before starting their work function. It is usually completely free.

- Through a pension broker . This method is increasingly gaining popularity. Its essence lies in the fact that a certain legal entity enters into a regular agency agreement with a non-state pension fund and undertakes to attract subagents to fulfill obligations under it, becoming a pension broker.

In practice, it does not matter much for an agent which form of cooperation with NPFs to choose - directly or through intermediaries.

Search vacancies

There is no shortage of jobs in this area. Announcements of open vacancies can be found on any popular employment site. In addition, NPFs or pension brokers themselves publish information about the search for employees on their websites on the Internet.

It should be remembered that although there are a large number of reputable offers, the applicant can still contact scammers . In this regard, you should never start working without first concluding an agency agreement, the study of all points of which is mandatory before signing.