If inaccuracies were identified on the part of the PF representatives, including incorrect interpretation of the documentation provided, the difference in the underpaid amount is calculated and the pensioner receives it in full.

Therefore, if you notice that you receive less than others, you should definitely contact the relevant authorities. However, the legal framework for action in such situations is of great importance. You cannot do without qualified legal assistance in such situations.

Hence, it is important to take such help and follow the instructions of the professional carefully.

Call the number and our lawyers will advise you.

Where can I check whether my pension is calculated correctly?

Related article: Farewell to youth!

What awaits Russians if the funded pension is cancelled? To check the accrual of a pension, a pensioner should contact the Pension Fund of Russia (PFR) at the place of registration with an application addressed to the manager with a request to double-check the correctness of the accrual of the pension. After reviewing the pensioner’s application, employees will recheck the correctness of the pension calculation and report the results.

A pensioner’s application for recalculation of the pension amount is considered no later than five days from the date of receipt.

Recalculation of the pension amount is carried out from the 1st day of the month following the month in which the pensioner’s application for recalculation of the pension amount was accepted.

If it turns out that the pension amount was calculated incorrectly, the amount will be automatically corrected. In accordance with current legislation, there are cases of revision and recalculation of pensions due to incorrect calculation. Such errors are associated, first of all, with the human factor (error in the work book, certificate of employment, etc.).

How to recalculate your pension yourself

You can recalculate your old-age pension yourself and verify or doubt the calculations made. To do this, the main thing that should be before your eyes is a certificate of income for any 5 years or for the period 2000-2001, a work book.

Algorithm for calculating your pension amount independently:

- Ask the Pension Fund for an extract from your personal account with the data that is necessary for the calculation.

- Use the formula for calculating the insurance part of the pension as of January 1, 2002 or an online pension calculator.

- Calculation of the insurance part after 01/01/02. To do this, you will need the amount of insurance premiums paid by the employer, taking into account indexation. This information will be provided by the Pension Fund upon the citizen’s request. This is the pension capital that we need for the main calculation.

- Calculating the amount of valorization (we wrote about what this term is here) - increasing pension capital. The percentage of valorization is calculated for the years worked by the citizen before 1991. For the very fact of work, 10% is accrued and for each additional year 1%, but not more than 75% in total. The calculation of the old-age labor pension for citizens who began working before 2001 is made by adding up all the data received: insurance parts before and after January 1, 2002, valorization and the basic fixed amount of the pension benefit, which is established by the government. 5686 rubles 25 kopecks - this is the amount established from January 1, 2020.

- Calculation of the insurance part from 1.01.15. according to the new legislation, it is made by multiplying the IPC by the PC. The insurance part depends on the individual pension coefficient and PC, which is established by the government. IPC is a collection of points, which is based on employer contributions and depends on the size of the salary. The cost of 1 point is 18.6. When calculating, points are converted into rubles by multiplying employer contributions by the cost of 1 point.

Thus, independent calculations are not particularly difficult if you have all the information about your personal account before your eyes. In addition to the fact that it can be provided by the Pension Fund, you can see all the movement of funds in your account in your personal account on the government services website, after going through the registration procedure there.

Alternatively, you can use a virtual calculator to calculate the amount of your pension. The Internet is replete with similar offers, but it is better to use the calculator on the Pension Fund website - this is a more reliable option.

For those who are still far from retirement, it is also worth making calculations for the future in order to have an idea of what the size of the pension will be. If it seems insufficient, then it is appropriate to think about how to increase your official income today so as not to be upset about it tomorrow.

How and where can I check the status of my retirement account?

You can find out about the status of your individual personal account (IPA) as follows:

- in credit institutions with which the Pension Fund of Russia has concluded a corresponding agreement (through an operator or through ATMs, as well as in electronic form - through terminals or Internet banking of credit institutions (Sberbank of Russia OJSC, Bank Uralsib OJSC, Gazprombank OJSC, Gazprombank OJSC "Bank of Moscow", CJSC VTB Bank));

- on the portal of state and municipal services. To do this, you need to register on the portal, enter your personal account, select the “PFR” tab, the “Notification of the status of an individual personal account” item;

- in the territorial bodies of the Pension Fund of the Russian Federation at the place of residence. You must have an identification document with you, an insurance certificate of compulsory pension insurance. The application can also be sent to the territorial body of the pension fund by mail, attaching notarized copies of the passport and certificate of compulsory pension insurance.

Where to complain?

Article on the topic

Government bonus. Why are government officials' pensions increasing? If you are not sure about the correct calculation of your pension, contact the head of the pension fund department with a written statement. In your application, ask for payment information. Fund employees are required to respond, and in writing.

An extract on the accrual of pensions from the fund is issued upon request only once a year.

If, after receiving the statement, you have any doubts about the correctness of pension calculation, you should contact the higher authority - the regional branch of the Pension Fund.

If after contacting the regional Pension Fund you still have questions, contact a lawyer (advocate), as you may have to go to court. Incorrect calculation of pensions by the courts is often recognized as illegally underestimated.

Ten points on the Pension Fund scale

A pension point is a complex coefficient that characterizes a person’s work activity as a whole from the point of view of calculating a pension. It would even be more correct to say that we are talking about all activities that are not always associated with labor in the traditional sense.

The procedure for determining the number of points depends on the billing period.

Expert opinion

Davydov Alexander Yurievich

Civil law consultant with 20 years of practice. Author of numerous articles on legal topics

After 01/01/2015, the basis for calculation is the pension contributions transferred by the employer or the citizen himself (for example, if he is an individual entrepreneur).

The number of points is determined based on the relationship between actual insurance premiums (IC) and their maximum possible amount (MC). The calculation is made in accordance with the formula given in clause 18 of Art. 15 of Law No. 400-FZ:

For example, with a salary of 30 thousand rubles. per month (360 thousand rubles per year), the number of points for 2020 will be as follows:

IPC = ((360 x 16%) / (1021 x 16%)) x 10 = (57.6 /163.36) x 10 = 3.53

Future retirees with higher incomes should keep in mind that the number of points that can be “earned” per year is limited. The limits are specified in Appendix 4 to Law No. 400-FZ. For 2018 this is 8.7, then the maximum will gradually increase and by 2021 it will reach 10 points per year.

All pension rights earned before 2020 are subject to “conversion” into points. For this purpose, the due insurance pension at the end of 2014 is determined “in the old way”, i.e. based on length of service and salary. Then its size is recalculated into points based on the cost of 1 IPC at the beginning of 2020 - 64.1 rubles.

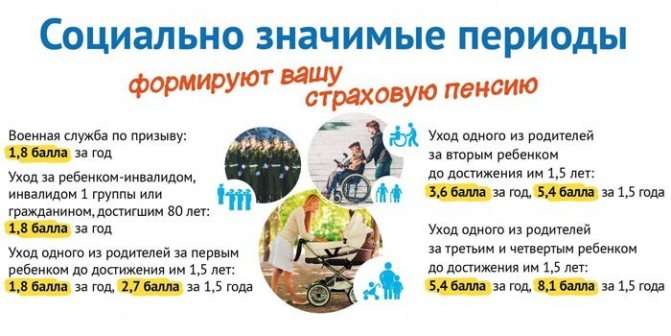

In addition, additional points can be obtained for “non-insurance” periods in accordance with clause 12 of Art. 15 of Law No. 400-FZ. This could be military service, child care, living with a military spouse at the place of service, etc.

For each year within such a period, 1.8 points are generally awarded. Mothers with many children can count on a larger number of IPCs. For each year of caring for a second child, you can get 3.6 points, and for the third and fourth, 5.4 points each.

Applying for a pension later also increases the number of points. The corresponding coefficients are given in Appendix 1 to Law 400-FZ. The maximum number of points can increase by 2.32 times. True, for this you need to retire 10 years later than expected.

What is the minimum length of service required to receive a pension?

From 2020, the minimum total length of service for receiving an old-age pension will be gradually increased. From 6 years to 1 year per year for 10 years. Those whose total length of service by 2025 will be less than 15 years have the right to apply to the Pension Fund for a social pension (women at 60 years old, men at 65 years old).

In 2025, the minimum total length of service to receive an old-age pension will reach 15 years.

Read more about pension calculation in the help>>

Errors in calculating benefits

Persons receiving state support are considered a socially vulnerable group. Authorized bodies guarantee security in the area under consideration. The calculation of old-age pensions is not always correct. No one is immune from errors in benefit calculations.

Reasons why mistakes are made:

- human factor;

- malfunction of the software.

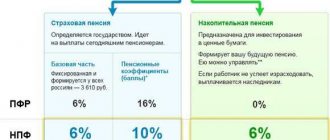

Therefore, it is necessary to know how a pensioner can check whether benefits are calculated correctly. Currently, there are two parts that make up pension payments.

This system is new, so it is not fully understood by citizens. For this reason, there may be an opinion that the pension has been calculated incorrectly.

What social benefits are provided for pensions?

Article on the topic

European-style pension: how the elderly live in Spain, Germany and Poland If the total amount of cash payments to a non-working pensioner is lower than the pensioner’s subsistence level established in the region of his residence, then he is provided with a federal or regional social supplement to his pension.

The federal social supplement to pension is set in such an amount as to:

additional payment + pension = minimum living wage for a pensioner in a given region.

If the pensioner works, no additional payment is made.

A regional surcharge is established if the cost of living of a pensioner in the region is higher than the cost of living of a pensioner in the Russian Federation.

The cost of living for a specific region can be found on the website >>

The federal social supplement to the pension is paid by the territorial body of the Pension Fund of the Russian Federation (PFR), and the regional one - by the authorized executive body of the constituent entity of the Russian Federation.

See also: Minimum pension in Russia from January 1, 2020 →

Procedure for ignoring a request for recalculation

You can check your IPC not only by contacting the Pension Fund; other methods are also provided. For example, a citizen can carry out calculations independently. In this case, you will need to have information from your work book, a certificate showing your income for the last 5 years and a calculator.

The sequence of actions is presented as follows:

- the length of the experience coefficient is initially set;

- calculations of average monthly income are made;

- information regarding the average salary for one month is clarified (the period for which the calculation is carried out is taken into account);

- pension capital is calculated;

- the resulting value is multiplied by the inflation rate;

- the number of contributions made for insurance is added (the funds contributed to the fund on the date of calculation of the pension are taken into account);

- the amount of insurance payment from the funds is added.

After completing these steps, you will be able to find out the amount of your pension benefit.

When calculating odds, 55% is used as a basis. For female representatives, this indicator is established if they have 20 years of experience; for males, 5 years more work is required. If a citizen continues to work, the coefficient increases by 1%. The maximum value of the additional indicator is set at 20%.

Once the average daily salary has been established, you will need to calculate the ratio of the average earnings to this indicator. If a citizen did not work in the Far North, then the ratio will be 1.2 or less. To calculate the amount, the length of service coefficient is multiplied by the resulting ratio and the average daily salary in the country.

To calculate this indicator, you will need to perform several sequential actions.

Including:

- the basic part of the pension benefit is subtracted from the amount received in the calculations reflected above;

- the resulting indicator is multiplied by the period during which payments will be made.

The basic component of the pension changes every year. This must be taken into account when making calculations. To check the inflation rate set for a specific period, you can turn to various electronic resources. The insurance portion of the accrual is equal to the figure obtained by dividing the pension capital by the approximate time during which the pension is paid.

What is included in work experience?

Related news

Russians do not hope for a state pension. Total length of service is understood as the total duration of labor and other socially useful activities until January 1, 2002, which includes:

- periods of work as a worker, employee (including hired work outside the territory of the Russian Federation), member of a collective farm or other cooperative organization; periods of other work in which the employee, not being a worker or employee, was subject to compulsory pension insurance; periods of work (service) in paramilitary security, special communications agencies or in a mine rescue unit, regardless of its nature; periods of individual labor activity, including in agriculture;

- periods of creative activity of members of creative unions - writers, artists, composers, filmmakers, theater workers, as well as writers and artists who are not members of the relevant creative unions;

- service in the Armed Forces of the Russian Federation and other military formations created in accordance with the legislation of the Russian Federation, the United Armed Forces of the Commonwealth of Independent States, the Armed Forces of the former USSR, internal affairs bodies of the Russian Federation, foreign intelligence agencies, federal security service agencies, federal executive authorities, which provide for military service, the former state security bodies of the Russian Federation, as well as in the state security bodies and internal affairs bodies of the former USSR (including during periods when these bodies were called differently), stay in partisan detachments during the civil war and Great Patriotic War;

- periods of temporary disability that began during the period of work, and the period of being on disability of groups I and II, received as a result of an injury associated with production or an occupational disease;

- the period of stay in places of detention beyond the period assigned during the review of the case;

- periods of receiving unemployment benefits, participating in paid public works, moving in the direction of the employment service to another area and finding employment.

How to calculate your pension yourself

You can personally try to determine the amount of due old age pension payments if you think that your pension has been calculated incorrectly. For this you will need a calculator.

It is important to understand that the calculation will only be approximate.

Only a Pension Fund specialist can tell you the exact amount of the old-age pension after studying the payment file.

Payments are calculated by age, taking into account the following data:

- Salary data. You can get them from your employer. If the company is liquidated, you should order a certificate from the archives. To do this, you need to personally contact the appropriate organization. It is impossible to obtain such information on the Internet.

- Duration of official work activity. You can check the information using your work record book.

- The presence of non-insurance periods - times when you did not work for objective reasons. For example, they were on maternity leave or served in the army.

- Retirement age.

Old age pension formula

When calculating the old age pension, the formula is used:

SPS = FV x PC1 + IPCtot. x SPB x PK2 + NChP, where:

- SPS – the amount of accrued old-age insurance pension.

- PV - the amount of the fixed payment at the time of calculation of the pension (in 2020 - 5,334.19 rubles).

- PC1 and PC2 are increasing coefficients. Rely on later retirement. You can view them in Law No. 400-FZ “On Insurance Pensions” (December 28, 2013). When a pension is assigned at the generally established age, they are equal to 1.

- IPKobshch . – the number of pension points for the entire period of work.

- SPB - the cost of one SP at the time of recalculation of the old-age pension (in 2020 - 87.24 rubles).

- NPE is the funded part of the pension, if you formed it.

In order to calculate the pension according to the IPC, you need to know that in different periods different formulas were used to determine the number of PB. This is due to the ongoing pension reforms. Conventionally, working time is divided into 3 periods:

- until 2002;

- from 2002 to 2020;

- after 2020.

Based on this, IPKobshch. can be defined as:

IPKobshch. = IPK2001 + IPK2002–2014 + IPK2015 + IPKnon-insurance, where:

- IPK2001 - the number of PB earned during Soviet times and up to January 31, 2001 inclusive;

- IPK2002–2015 – number of points from January 1, 2002 to December 31, 2014 inclusive;

- IPK2015 – the number of PB accrued starting from 2020.

- IPC non-insurance – the number of pension points for non-insurance periods.

Calculation of points for calculating pensions

You can view your pension points online. To get started, you should go to the Pension Fund website. There you can use a special calculator.

To independently determine the amount of your old-age pension, adhere to the following formulas:

- Until 2002. The amount of pension capital is divided by the cost of 1PB as of January 2020 (64.10 rubles).

- From 2002 to 2020. The insurance part of the pension is divided by the cost of 1PB as of January 2020 (64.10 rubles).

- From 2020. All insurance contributions from your paycheck are automatically converted into points. To do this, the received amount is divided by the standard amount of contributions to the insurance pension. It is 16% of the maximum contributory earnings, which is determined by the Government of the Russian Federation annually). The total value is multiplied by 10.

Please note that the maximum IPC is limited by law. Regardless of your accrued salary, you are entitled to no more than:

- 7.39 PB for 2020;

- 7.83 for 2020;

- 8.26 for 2020;

- 8.70 for 2020;

- 9.13 for 2020

For each full year related to non-insurance periods, 1.8 PB must be accrued for the following circumstances:

- compulsory military service;

- caring for a disabled person of group I, a pensioner over 80 years old or a disabled child;

- detention if the citizen is subsequently rehabilitated;

- being with a military spouse in an area where it is impossible to get a job in your specialty (maximum 5 years);

- residence outside the borders of Russia, if the spouse is a representative of embassies, diplomatic missions (no more than 5 years).

- Benefits for disabled people of group 1 in 2020 that you need to know about

- Signs of toenail fungus

- These 10 Foods Will Clean Your Arteries and Prevent Heart Attacks

The number of PB accrued for each year of caring for a child until the child turns 1.5 years old depends on the child’s birth order:

- for the first – 1,8;

- for the second – 3,6;

- for the third and fourth – 5,2.