Germany

People born before 1947 retire at age 65.

For people born in 1947-1958, one more month is added to the retirement age of 65 for each year. Those. Germans born in 1958 retire at 66.

For people born between 1959 and 1963, retirement age is determined by adding two more months to age 66 for each year.

Thus, the retirement age is gradually increasing. Everyone born since 1964 will only retire at age 67.

Third pension level

The third element is when a person wants to voluntarily increase pension contributions. Contributions are tax deductible and are only taxed when paid. Interest on contributions is tax-deductible.

The amount of your old age pension depends on the type of policy chosen. The maximum amount of contributions that are deducted from income is indicated. This depends on wages and contributions to other insurance systems. This form of pension system is available only to professionally active people.

USA

Under the US Social Security Act of 1935, the minimum age to receive full retirement benefits was 65. In 1983, amendments were adopted to raise the retirement age to 67 years.

Persons born between 1943 and 1954 are entitled to receive full pension benefits at age 66. For citizens born after 1954, 2 months are added to the retirement age for each year. Thus, persons born in 1955 will retire at 66 years and two months, and persons born in 1960 at 67 years.

Capital repayment

In certain cases, BVG pension capital in Switzerland can be paid out in full at once. This is possible in the case of purchasing real estate, to pay off a mortgage loan, in case of starting your own business, when leaving Switzerland for permanent residence abroad, as well as when receiving a disability pension. At the same time, the main task of the second level of pension, together with the first, is to provide income for those who have retired at least at the level of 60% of their previous salary.

Czech

The retirement age depends on the year of birth, gender and number of children born (for women). For those born before 1936, the retirement age is 60 for men; for women it ranges from 53 (if she raised for at least five days) to 57 (without children).

For citizens born between 1936 and 1971, the retirement age increases annually by two months for men and by four months for women. For those born after 1971, the retirement age is 65 years.

Second pension level

The second element of the pension system is the payment of contributions calculated on the basis of earnings from a certain place of work (Berufliche Vorsorge / BV (G)-Prévoyance Professionelle / PP).

All employees whose annual income exceeds CHF 25,000 are required to contribute to a pension fund.

Contributions increase with employee age and range from 7-18% of gross remuneration.

For example: if a Swiss citizen has accumulated 400,000 francs in a BVG pension, then when he reaches retirement age he will receive monthly payments of 2,267 francs per month for life - in addition to his first level pension.

Summing up

In the very center of Europe, among the snow-capped Alps is the birthplace of Mozart and the Viennese waltzes. Life in this country seems ideal to an outside observer, but in reality, not only pleasant surprises await an immigrant from Russia in Austria. The mentality of Austrians is very different from the way Russians behave. This difference can become a big problem, which even good salaries, social guarantees and quality of life cannot compensate for. Therefore, before emigrating, you need to carefully study all the potential pros and cons of this decision.

Healthcare and medicine

Every resident of the country has insurance, but it does not fully cover treatment. If there is a chronic disease or any other health problems, a person must pay a larger amount. It is impossible to purchase medicine at a pharmacy without a doctor's prescription. If a citizen falls ill, he must go to the outpatient clinic to see a doctor. He either chooses a treatment regimen himself, prescribes medications, or transfers the patient to a specialist. Unless absolutely necessary, a person is not sent to a hospital. Medicines in Austria are conditionally free, but for each package you will have to pay a fee of 3-5 euros.

How do pensioners live in Switzerland?

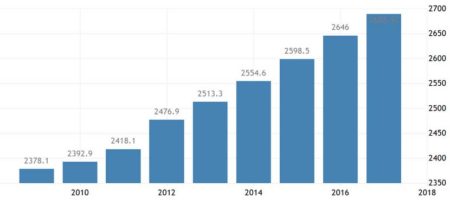

If we look at the statistical data, we can note that a fifth of the population of this country is at retirement age. Accordingly, the persons reached 64 and 65 years of age. Due to the fact that the population growth rate is small and the number of able-bodied people has decreased, a crisis has occurred in the pension system. A high level of quality of life and medical services provided; by the age of 65, citizens are in good physical shape.

The country experienced a surge in birth rates in the 1960s, which will lead to an increase in the number of elderly people by 2030. Currently, the allocated funds are not enough to meet the needs of pensioners. To meet the requirements of this category of citizens, the state needs to build about 100 houses intended for the elderly.

The situation can also be improved by increasing the number of services provided at home. The level of medicine in Switzerland is at a high level, psychologists work with these individuals, it is possible to attend clubs and group classes. For example, these are walking, traveling in groups, etc.

This group of citizens has the opportunity to use discounts on the purchase of plane tickets, which affects active recreation. Vegetable gardening and horticulture are considered only as a hobby.

Attitude towards Russians

Emigrants permanently residing in the republic note the negative perception of foreigners by local residents. They see immigrants, including Russians, as competitors who take their jobs and receive unemployment benefits at the expense of local taxpayers. The Russian diaspora in Austria numbers more than five thousand people. Former compatriots try to preserve their language, traditions, and culture. For this purpose, newspapers, magazines, brochures are published, and a radio station operates.

The presence of public organizations makes life easier for Russians in Austria. They were created by former compatriots to provide advice and support to new arrivals in various situations. There are many Russian-language sites on which emigrants will find advice and tips on how to act correctly in different circumstances, and explanations of the peculiarities of local legislation.

Pension system

Pensioners in Switzerland are provided with good benefits, but they would not be enough, since the country itself is expensive. Therefore, the pension system here is multi-level, and accordingly, there may be several payments.

First level (state)

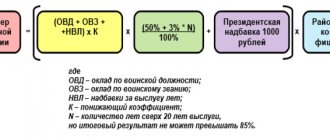

It assumes compulsory insurance of citizens by the state at the age of 20 years. Further, the Swiss pay 5.05% of their wages equally to the employer during the working period of their lives. The deposited funds are divided into three types of insurance:

- 0.15% - payment to a citizen due to the loss of a family breadwinner during combat operations.

- 0.7% - disability payment.

- 4.2% - payment upon reaching the age limit.

The pension amount varies between 1175–2350 francs. For a family of two, the maximum amount is CHF 3,525.

The maximum payment can only be received by those pensioners who have 45 years of continuous service (for men) and 44 years for the fairer sex. The average annual salary should be more than 84.6 thousand francs.

Unemployed citizens are not exempt from contributions. They are charged an annual amount of 425 francs. If a person is retired but continues to work and earns 1,400 francs or more, he must contribute to the formation of the pension.

With casual work, residents also pay contributions, 460 francs or more. Self-employed workers pay 9.5%, but the budget invested in capital is not taxed.

Foreigners who were employed in Switzerland and subsequently left the country will not be able to apply for a pension. However, you are allowed to receive the entire accumulated amount.

Second level (cumulative)

This type of pension contribution is also mandatory for employed citizens whose annual salary is more than 21,150 francs. This is the so-called funded part of pension contributions. It is paid based on the calculation coefficient: today it is 6.8%.

Savings deposits are made through savings banks. The employer chooses where to serve. If an employee quits and moves to another job, then the savings bank may be different. Therefore, he will have to personally transfer the accumulated amount into it.

Self-employed people may not contribute at this level, but are eligible to do so if they wish. Owners of independent professions can also do without deductions; for them there is the next level.

By making payments at the first two levels, the pensioner will receive 60% of the last average salary.

By the way, in some cases it is allowed to receive the amount of accumulated capital immediately:

- To pay off a mortgage loan.

- To purchase real estate.

- When receiving a disability pension.

- When going to live abroad.

- To open a business.

Third level (individual)

This form of savings is voluntary. It is managed by banks, insurance organizations and private pension funds. An individual form of savings is available to any Swiss and is welcomed by the state government.

Having third-tier savings, you can count on some tax benefits. Deposits are not taxed, but the same cannot be said about payments.

The contribution amount for hired workers is 6,365 francs, for the self-employed this amount is 31,824 francs or, alternatively, 20% of income. When getting a hired job, self-employed people can transfer accumulated funds from the third level to the second (savings). Such citizens have the right to retire earlier than others, not exceeding five years.

Can citizens of the Russian Federation receive a pension?

If a citizen, before immigrating to Switzerland, paid pension contributions on the territory of the Russian Federation for several years, he is probably interested in the possibility of receiving appropriate payments, even while abroad.

A similar feature is provided for by Russian legislation, however, several features should be taken into account:

- payments are made only in domestic currency;

- Receipt of funds is possible only to an account in one of the financial organizations of the Russian Federation at the client’s choice;

- Every year the pensioner must confirm the fact that he is alive.

To apply for a pension and clarify the conditions, a citizen will need to contact the Russian Pension Fund, the Department for Providing for Persons Living Abroad. Confirmation of being alive is carried out by visiting the Russian consulate in Switzerland. In this case, you will need to present a citizen's passport.

Basic taxes

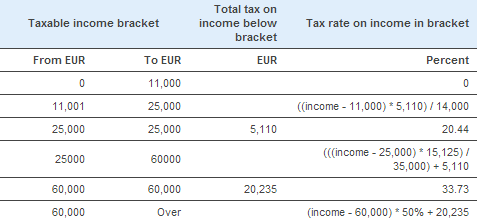

With fairly high salaries, the level of taxes in the country can be called democratic. It depends on the citizen’s income level.

The amount of taxes in Austria depends on the citizen’s income level

With an annual income of 60.0 thousand euros, an Austrian citizen undertakes to give 50% of the profit to the state. If the annual income is 25.0 thousand euros, the income tax rate is 35%. This size is considered the minimum.

VAT rate is 21%. In 2008, the country's authorities abolished the inheritance tax.

When selling real estate, the state takes 3.6% of the transaction amount. If the transaction is carried out by persons who are closely related, then the tax is 2%.

Many Austrians are Catholic. For this reason, citizens of the country are obliged to pay church taxes. Its amount depends on monthly earnings and on average varies from 300 to 410 euros per year.

It is not necessary to make contributions to the church, but Austrian society views this negatively.

Return to contents

Food expenses

Food prices in Austria are low. Even workers who work in the lowest paid jobs receive at least 1,000 euros. In provincial cities, about 250 euros per person are spent on food; life in the capital is somewhat more expensive. A trip to a fast food establishment will cost 7-9 euros. A visit to a restaurant with lunch for two will cost 45-50 euros.

Housing cost

If a Russian citizen wants to purchase real estate in Austria, he must first obtain a special permit for the purchase at the address of registration of the future building or apartment. Usually this is not difficult to do, the document is prepared quickly, subject to all the requirements of local authorities and the submission of the necessary papers.

For Russians who want to emigrate, get a job or study, it is of interest how much an apartment costs in Austria. The rental price depends on the location, but even in Vienna you can find affordable housing if the house is state-owned. Usually these are small premises, but with an acceptable rental price.

When signing the contract, you should remember the additional costs equivalent to 2 months’ payment. The money is placed on a non-refundable deposit. Long-term rental of a one-bedroom apartment varies between 500-650 euros per month, in the capital - from 550 to 750. Compared to Russia, utility tariffs in the republic are high. Water is often included in the rent, and prices for electricity and gas range from 150 to 200 euros per month for a 100 sq. m dwelling. m.