Home / Ruble

Back

Published: 11/19/2019

Reading time: 3 min

0

218

The pension system is undergoing significant changes. A significant portion of working Russians worry whether their current salaries will provide a decent standard of living in the future. Let's figure out the intricacies of pension calculations together.

- What determines the calculation of a pension and its size?

- What conditions are needed to receive a pension? Insurance

- Social

- Other conditions

What determines the calculation of a pension and its size?

The legislation of the Russian Federation, in addition to old-age pensions, provides for payments for the loss of a breadwinner and for disability. An old-age pension is granted upon reaching a certain age. Men can apply for security upon reaching 65 years of age, women - upon reaching 60 years of age . The legislation provides for earlier retirement for people with a certain social status, employed in hazardous and heavy industries, etc.

Age only gives the right, but does not guarantee the appointment of decent security. To receive a retirement pension, you must have a minimum insurance period. In 2020, the minimum insurance period for those entering retirement is 10 years. For those who reach retirement age in 2024, there will be a different requirement - a minimum of 15 years of service.

You need to understand that the insurance period means the period of official employment when the company pays insurance contributions for its employees. The length of service that gives the right to receive financial support includes non-working periods (for example, the period of caring for a young child up to 1.5 years old, etc.).

The size of the pension is determined by the number of points accrued (individual pension coefficient), as well as their value at the time of applying for security. The IPC is calculated using a complex formula based on the amount of wages. The higher its level, the higher the individual coefficient. Those applying for coverage in 2019 must have at least 16.2 points; those retiring in 2025 will have to accumulate 30 points.

The maximum IPC is also limited - in 2020, the maximum you can “earn” is 9.13 points; from 2021, the maximum coefficient will be 10 units .

Directly affects the amount of security and the cost of the coefficient. The price of 1 point in 2020 is 87.24 kopecks, and it is indexed (increased) every year.

Is studying at a university included in your work experience?

This question worries the minds of many citizens throughout Russia.

According to current legislation, this includes:

- Labor activity that is carried out in accordance with an agreement concluded between the employee and the employer.

- The time that a person is engaged in individual entrepreneurship.

- The time a person devoted to state or municipal services.

Besides:

- Time spent repaying one’s debt to one’s homeland, i.e., completing full military service.

- Time to care for a child under the age of one and a half years.

- He was unemployed, but was registered as a job seeker.

Since this list does not include studies in higher educational institutions, it means that it is not included in the work experience, regardless of the form of study (full-time, part-time).

What conditions are needed to receive a pension?

To receive payments, you must reach the age established by law, have a minimum amount of work experience and accumulate an IPC. In this case, you can apply for an insurance pension. If there is insufficient experience or points and it is not possible to increase them, then social benefits will be issued. Those who cannot qualify for an insurance pension, have not reached retirement age, but cannot work due to health reasons, have the opportunity to apply for disability payments.

Insurance

To apply for an old-age pension, you must contact the Pension Fund upon reaching the appropriate age. If the work experience is sufficient and the required number of points have been accumulated, then payments will be assigned.

There is an incentive program that allows a pensioner who has delayed retirement to receive greater security. For each year of later application, bonus points are calculated.

For example, when applying for security three years later, the fixed component will be increased by 19%, and the insurance payment will increase by 24%. The level of future pensions is significantly influenced by the size of contributions, and, accordingly, salary.

Social

Citizens who have reached retirement age but do not have the required minimum work experience or have not accumulated the required number of points can apply for social benefits.

After a five-year period after reaching retirement age, the right to receive a social pension arises. The amount of such payments will be an order of magnitude lower than insurance payments.

Other conditions

If a citizen is unable to work due to health reasons, he cannot apply for insurance coverage. In this case, according to a medical report, he has the right to apply for a disability pension.

Those working in certain sectors of the economy or the public sector have special conditions for retirement. They can issue payments upon accumulating a certain number of years of work experience, and not upon reaching an age limit.

Conclusion

The pensioner decides for himself whether to resign when he reaches retirement age or continue to work and receive a pension. This depends on the size of the calculated pension, as well as the size of pension supplements established by the state.

An employer needs to be understanding of its employee’s decision. Together with the personnel service employees, you need to provide your worker with all the necessary documents.

The employee, for his part, must understand that they are only helping him, and not issuing a pension for him.

At what salary can Russians lose their old-age insurance pension?

One of the conditions for assigning insurance coverage is the accumulation of the required number of points. Over your entire work experience, you need to “collect” 30 points, that is, 0.75 points annually . If the salary before taxes is 50 thousand rubles, then the coefficient will increase over the year to 5.22. To accumulate the minimum required 0.75 points, you need to receive at least 68,400 rubles per year.

If the salary is lower, then by the time of retirement the insured will have a low pension coefficient. As a result, the insurance pension will be delayed for five years.

What is included in the total work experience?

To understand what is included in it, you need to highlight its main types:

It includes:

- total time of work;

- accumulated time of socially useful activities;

This time is not affected by:

- nature of the work;

- transfers from one job to another;

- various reasons for work interruptions.

All periods will be calculated according to the calendar. It includes:

- all working days from the start of work until its completion;

- all weekends;

- all holidays;

- all other non-working days

- all holidays.

Also, there is a whole list of other activities that affect it.

Let us highlight the main ones:

- Service in the armed forces and other formations of a similar nature.

- In the Ministry of Internal Affairs, intelligence, counterintelligence and everything like that.

Also, the following periods of a person’s life will be included:

- Training in schools, institutes, various colleges.

- Studying in graduate school, residency, doctoral studies.

Special

This type assumes:

- A certain amount of time spent working in a certain specialty.

- This or that amount of time spent on socially useful activities related to the position held or professional activity.

It is he who influences the old-age pension associated with special working conditions.

The following activities are included in the special experience:

- Labor related to underground work.

- Activities under life-threatening working conditions (various radiation, seismic activity, etc.).

- Activities of various expeditions (polar and others).

- The work of representatives of the fair sex in difficult and life-threatening conditions.

- Activities related to flight testing.

Continuous

This type implies the time that the employee spent at one single enterprise. According to modern laws, it remains uninterrupted if less than a month has passed from the moment of dismissal to starting a new job.

How not to be left without a pension and secure your old age

It makes sense for the more active younger generation to think about their own future now. Anton Tabakh, chief economist of the Expert RA rating agency, notes that people in the “gray” sector of the economy cannot count on a pension. To ensure a decent old age, according to the expert, it is necessary to either come out of the shadows, pay taxes and fees, or think about your future maintenance on your own (open a bank deposit, invest money in real estate, etc.). Therefore, you need to decide for yourself what is more important – today’s high salary, but in an “envelope”, or a future decent pension.

Doctor of Economic Sciences Sergei Smirnov is sure that the problem of modern society is the lack of planning skills. Retirement is a reason to think about your future, and you need to look at it not as a need to work until you die, but as an opportunity to plan your own future. After all, no one forbids those receiving a high “gray” salary from making savings for the future today, but you need to think about such contributions not two or three years before retirement, but at the very early stage of career growth.

It is quite difficult to ensure a decent old age during the transition period. Therefore, legislative changes come into force gradually: the retirement age and minimum work experience requirements increase annually. Those who are still far from retirement should plan their future today so as not to end up with nothing in their old age.

Didn't find the answer to your question? Call hotline 8. It's free.

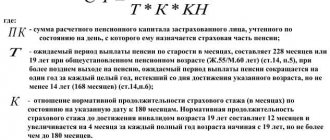

We calculate the IPC for each stage

For each period of time, the IPC is calculated differently. The first period lasts until 2002, the second covers 2002-2014, and the third begins after 01/01/2015.

Period until 2002

It is heterogeneous, the following parameters matter here.

- Duration of Soviet work experience (until 1991);

- Number of years worked before 2002;

- Amount of earnings.

It is at this stage that active citizens achieve significant success in increasing their pension security. It also matters how successfully, or rather, how competently the options for calculating earnings are chosen.

Everything that was taken into account is collected, the pension is calculated in rubles, and the final figure is converted into pension points (IPC), acting according to a specially prescribed algorithm.

Period 2002-2014

Starting from 01/01/2002, the Pension Fund of the Russian Federation has all the information about the labor activities of citizens. The pension capital is formed from the amount of contributions, and the length of service itself (the amount of time worked) does not play a role at this stage. Unless it is a permit - it should be enough to receive an insurance pension.

This fragment is calculated in rubles and then converted into IPC pension points.

IPC after 01/01/2015 and for other periods

From this moment, Federal Law-400 begins to work, and the pension capital, again, depends only on the amount of contributions to the Pension Fund. The very method of calculating pension points is changing again; the “annual IPC” coefficient is calculated using a new formula, taking into account changes in key parameters.

When forming accruals for non-insurance periods (SPnst), activities that have social significance are taken into account. This includes caring for children and the disabled, military service, and so on. For such work, pension points are awarded; the accrual method is regulated by Federal Law No. 400, Article 15, Clause 12.

Taxes and fees

In conclusion, let’s see how the issue of taxation of “pension payments”, the basis for which is an agreement to terminate the employment contract, will be resolved.

Income tax and personal income tax

These payments are not taken into account when taxing profits, since they are not related to activities aimed at generating income, as required by paragraph 1 of Art. 252 of the Tax Code of the Russian Federation. This conclusion directly follows from the Ruling of the Supreme Court of the Russian Federation dated September 23, 2016 No. 305-KG16-5939, which was discussed above.

As for personal income tax, by virtue of clause 3 of Art. 217 of the Tax Code of the Russian Federation, only those payments related to dismissal are exempt from this tax, which, firstly, are provided for by the current legislation of the Russian Federation, legislative acts of the constituent entities of the Russian Federation, decisions of representative bodies of local self-government and, secondly, are compensatory. In this case, none of the conditions are met: the “pension part” of the social package is not provided for by any regulatory act. And it is not compensation, as the Supreme Court directly pointed out in Ruling No. 305-KG16-5939 dated September 23, 2016. So personal income tax on “pension” amounts paid to former employees will have to be calculated and withheld.

Insurance premiums

With insurance premiums, everything is somewhat more complicated. On the one hand, the payments in question do not fall under subclause. 2 p. 1 art. 422 of the Tax Code of the Russian Federation, which exempts payments upon dismissal from insurance contributions, for exactly the same reasons as under clause 3 of Art. 217 Tax Code of the Russian Federation.

But, on the other hand, payments within the framework of labor relations are recognized as the object of taxation of insurance premiums for organizations (subclause 1, clause 1, article 420 of the Tax Code of the Russian Federation). And these relationships, as we have already found out, end with the issuance of an order to terminate the employment contract. At the same time, it is obvious that payments based on the agreement to terminate the employment contract are made outside the scope of the employment relationship, which ceased from the moment the relevant order was issued by the employer. And, therefore, they do not form an object of taxation with insurance premiums.

However, the tax authorities approach this issue differently. In their opinion, the agreement to terminate the employment contract is an integral part of the employment contract itself. This means that payments that are made on the basis of such an agreement form the object of taxation with insurance premiums and can be exempt from taxation only in the cases mentioned in Art. 422 of the Tax Code of the Russian Federation (see letter of the Federal Tax Service of Russia for Moscow dated August 28, 2017 No. 20-15 / [email protected] ).

Contributions from payments to members of the board of directors

The letter of the Ministry of Finance of Russia dated May 18, 2018 No. 03-15-06/33782, which we mentioned at the very beginning of the article, concluded that it is necessary to pay insurance contributions from “pension” payments accrued after the dismissal of the employee. In this case, the argument is given that the additional payment is made on the basis of an employment contract and, therefore, should be considered as a payment within the framework of the employment relationship.

However, as we have already found out, the inclusion of a “pension” condition in an employment contract means that the entire amount must be paid as a lump sum on the day of dismissal. Therefore, in this part the argumentation of the authors of the letter is not entirely correct. However, the general conclusion made in the letter remains valid. The fact is that in the situation discussed in the letter, the individual receiving the “pension social package” was also a member of the company’s board of directors. And taking into account the legal position of the Constitutional Court of the Russian Federation, set out in rulings No. 1169-O and No. 1170-O dated 06.06.2016, the relationship between the company and a member of the board of directors is subject to regulation by civil law, since in order to obtain the appropriate status in this case the will of both parties (both society and an individual) is required. Consequently, an individual, agreeing to carry out certain activities in the interests of society as a member of the board of directors, assumes the responsibility to perform the functions necessary for this. Essentially, we are talking about the conclusion of a civil contract for the provision of services between the company and a member of the board of directors, which entails the obligation of the company to charge insurance premiums for payments in favor of these individuals (subclause 1, clause 1, article 420 of the Tax Code of the Russian Federation).