About the fund

By the end of 2020, over 24 thousand people received this type of pension payment. The formation of pension savings in the fund is available to everyone. Pension provision consists of compulsory pension insurance and non-profit pension provision.

When concluding an agreement on non-state pension provision with NPF Transneft JSC, the client is provided with certain opportunities:

- Determining the frequency of contributions, i.e. their frequency;

- Establishing or changing the amount of such contributions;

- Changes in the frequency of accrual of non-state payments (reduction or increase);

- Suspension or resumption of payments without terminating the contract.

Important! If money under an NPO agreement is contributed by the client for his own benefit, it is not subject to personal income tax.

The essence of the activity of the Transneft pension fund is the formation of a certain amount in the client’s personal account by the time of his retirement. This allows you to issue lifetime payments or an urgent regime for receiving a non-state pension.

Reviews

Customer reviews correspond to the company's rating and confirm its reliability. Former employee Mikhail writes that he worked for the company itself for 37 years and receives a good pension in monetary terms. Edward writes:

Serious fund. And this is natural, since it was founded by a company that has a good founder. And most importantly, it shows serious profitability and is more reliable than the Pension Fund.

Alexander advises to trust the fund unconditionally, since it has many awards, the number of which is inferior to other NPFs. He himself already receives a pension here without delays, but estimates the level of profitability as 0.9%.

I’m not very happy with the cooperation with JSC Sergey, but these are the rules of document flow:

The staff gave us a list with the necessary papers. Documents must be certified by a notary, which is an additional expense. You will spend part of the already small amount just on them.

Ulyana was surprised by the fund’s low return in 2011, but this was due to a sharp drop in prices for shares and JSC securities.

If you are choosing a pension fund, be sure to watch the video below and decide whether Transneft fits the criteria.

Official website

The official website of NPF Transneft https://npf-transneft.ru provides complete information about this organization: founders, structure, investment policy, management companies. Here you can find financial performance data, annual reporting and data on the questions that users most often ask.

The resource contains schemes and documentation on voluntary pension provision, as well as the features of compulsory pension insurance:

- Savings of citizens;

- Transferring money to the fund;

- Support options;

- Transfer of savings to another insurer;

- Payment of funds, including to legal successors.

Special schemes have been developed for legal entities that comply with the law. Through the fund’s corporate programs, the employer can provide employees with a decent level of pensions in the form of an increase in government payments.

Official website of NPF Transneft

NPF Transneft has been on the market for a long time, or to be more precise, since 1993. The main, and most important, task of this fund is to implement and provide all existing types of services to pensioners without any restrictions, and serves as a stable increase in pensions. It is one of the most reliable pension funds among those presented.

You can also find more detailed information about the presented organization on their official website. On it you will be offered an extensive menu containing all the necessary data regarding this organization.

Elena Smirnova

Pension lawyer, ready to answer your questions.

Ask me a question

It is also worth noting that you should approach the choice of the fund in which you are ready to invest your funds very carefully and thoughtfully. For example, before making a choice, you need to familiarize yourself with such information and data regarding the profitability of the fund and also find out its reliability rating.

This information will help you make the right choice, since the indicators of these ratings guarantee you profit and regular income. Now let’s take a closer look at the data regarding our pension fund and its ratings.

Profitability

Profitability – one of the most important components of any rating is the profitability rating. The data presented in it is not just numbers, it is information that guarantees income to every pensioner who has deposits in it. The higher the number in the table, the greater the amount of your future income will be. For this fund this figure is 8.2, which is a very good level.

Reliability rating

Reliability rating – this rating also plays an important role in the system as a whole. Before you start investing, you should find out what the reliability rating of the presented organization is. If the level is less than A, then you should not invest in it. And if the level is above A, then you can be calm about your money. The Transneft fund has this rating of A++, which means stability and reliability.

Transneft corporate pension

The size of the Transneft corporate pension cannot be calculated in advance. The indicator depends on the time the employee joined the relevant program, the length of his work experience, the duration of the transfer of funds to the fund, as well as the choice of system. Employees are offered three options: savings, insurance, and accumulative.

The employee's income level also plays a role. The provision is about 40% of the salary level at the last place of work. From time to time, the level of provision is adjusted in accordance with the current cost of living. This process is called indexing.

The non-state pension fund Transneft offers a high level of security, including for old age. The minimum payment amount is 1,000 rubles. Qualified workers can count on more significant amounts.

To increase the amount of payments, the employee, on his own initiative, transfers funds to the Non-State Pension Fund in the selected amount.

Good to know! Pension contributions are made to the fund only in Russian rubles. The investor can enter into an agreement in his own favor or in favor of other persons.

Performance indicators

NPF Transneft has 72924 million rubles of its own funds

Information about activities is compiled annually and posted on the company’s official website, complying with regulatory documents. The most current information dates back to July 20, 2015, the period of reorganization. Even the results of the audit are attached. According to the financial results report, income from the placement of pension reserves amounted to 249,117 million rubles, from investing savings - 3,443 million rubles, from property intended for financial assets - 370 million rubles.

The profitability of NPF Transneft is 12.99%

But there is also more recent data - the end of the third quarter of last year. Own property amounted to 72,924 million rubles. Activities in the mandatory pension system made it possible to collect pension savings in the amount of 6,831 million rubles. Since 2012 they have doubled, and since 2011 they have tripled. In total, the NPF has 47 thousand insured persons, of which 567 people are currently receiving pensions. Payments have already amounted to about 12.8 million rubles. The profitability indicator is quite good and is equal to 13.23% according to the Central Bank.

Within the framework of non-state pension provision, JSC figures are more impressive. The amount of savings is equal to 65,185 million rubles. It has also doubled since the beginning of 2012 (34,317 million rubles). Almost 213 thousand people became participants in the program. In 2012 there were 165 thousand people. 20,895 people are already receiving pensions. These payments amounted to about 1255 million rubles. The fund's yield is 12.99%.

The company's investments are aimed at Russian stock and financial markets. And the profitability indicators cover the inflation rate and are higher than interest on deposits from most banks.

Reliability rating and profitability of Transneft

RA "Expert" confirmed the fund's reliability rating at the level of "A++" with a stable forecast. This is the maximum indicator indicating high reliability.

However, in 2020 this rating was withdrawn due to the expiration of the validity period. NPF refused to update the data.

The profitability of Transneft by the end of March this year was equal to 1.79% according to OPS, such data were provided by the Central Bank. Pension payments amounted to 5,861.20 rubles. For non-state collateral, by the same date the yield level reached 3.35%. Pension payments amounted to 698252.30599 rubles.

High ratings and profitability are largely due to the decent professional level of managers.

In addition, Transneft is a group of companies that own approximately 50 enterprises in different economic sectors.

Accordingly, the fund has the opportunity to diversify investments by investing in heterogeneous groups. This allows us to minimize the risk of losing the savings of NPF clients.

The procedure for assigning and paying a pension

The assignment of a corporate non-state pension is carried out by the Fund after receiving an order letter from the Investor regarding the Participant's right to receive a corporate non-state pension.

The Fund, within 15 working days from the date of receipt of the Investor’s authorization letter, calculates the amount and assigns a non-state pension, taking into account the amount of funds in the Participant’s personal pension account at the time of appointment.

The amount of the assigned corporate non-state pension is not subject to recalculation, except for the discovery of a technical error or indexation based on the results of the previous financial year.

The corporate non-state pension is assigned from the date specified by the Investor in the order letter. Pension payments are made by the Fund monthly from the 20th to the 31st of the current month.

An application to the Fund for the appointment and payment of a corporate non-state pension is submitted by the employee directly to the Investor, at any time after the onset of pension grounds, subject to dismissal from the Transneft system organizations. The Participant must attach the following documents to the application:

- a photocopy of the work record;

- a photocopy of the document confirming the assignment of the pension;

- photocopy of passport;

- a photocopy of the insurance certificate of compulsory (state) pension insurance;

- an individual's profile (information).

The Investor sends an order letter to the Fund regarding the Participant’s right to a corporate non-state pension. Attached to the administrative letter:

— the Participant’s application to the Fund regarding the assignment and payment of a corporate non-state pension;

— employee personal data card in the form established in the pension agreement;

— consent sheet for the provision and processing of personal data;

- documents listed in paragraphs. 9.2.2. Pension rules of the Fund and certified by the HR department.

The amount of the corporate non-state pension is calculated by the Fund using actuarial calculations, based on the payment period, the amount of accrued pension payments indicated by the Investor in the letter of order, and the availability of funds in the joint or personal pension account.

After receiving all the documents necessary to resolve the issue of assigning a pension and if the necessary pension grounds are available, the Fund makes a decision on assigning a corporate non-state pension to the Participant from the date specified by the Investor in the order letter on assigning a corporate non-state pension to the Participant.

The Participant’s application for the appointment and payment of a corporate non-state pension and the Investor’s order letter may be sent to the Fund no earlier than the date of the Participant’s pension grounds, provided for in Section 8 of the Fund’s Pension Rules and the date of the Participant’s dismissal from the Transneft system organization.

The Fund makes a decision on assigning a corporate non-state survivor pension (pension scheme No. 6) to the dependent(s) of the deceased Participant from the date specified in the document confirming the assignment of the pension.

Each child who has lost both parents or the children of a deceased single mother is assigned a corporate non-state pension in the event of the loss of a breadwinner in an amount not less than the minimum subsistence level established in the place of residence. The amount of the assigned corporate non-state pension in the event of the loss of a breadwinner is subject to recalculation on the basis of the Investor’s order letter and while simultaneously complying with clause 8.2 or 8.6 of the Fund’s Pension Rules.

The Fund makes a decision to assign the Participant a corporate non-state disability pension (pension scheme No. 6) no earlier than the day following the day the disability is established and for the entire period of its validity. The assignment of a corporate non-state disability pension is made in accordance with the Investor’s letter of administration after the Participant’s dismissal from the Transneft system organization.

If the Participant is diagnosed with disability for a new period, the Investor sends an order letter to the Fund to extend the term of payment of the corporate non-state pension to the Participant for a new period from the date the disability is established for a new term.

When a Participant receiving a corporate non-state disability pension reaches the retirement age required for the assignment of an old-age pension established by the current legislation of the Russian Federation, and while simultaneously complying with clause 8.2 or 8.4 of the Pension Rules of the Fund, based on the Participant’s application, he is assigned a corporate non-state old-age pension in the manner established by the Pension Rules of the Fund. In this case, the payment of the corporate non-state disability pension to the Participant is terminated.

Pension payments, at the request of the Participant, can be made:

— to a personal or current bank account;

— by post at your place of residence;

— in the hands of the Participant — through the Fund’s cash desk (in compliance with the requirements established by the current legislation of the Russian Federation).

The frequency of payments of corporate non-state pensions is monthly.

A one-time payment of the entire amount of accrued pension payments is not permitted.

What additional pension does Transneft pay?

Transneft pays additional pensions on several grounds: old age, disability, loss of a breadwinner, and also under a shared participation program.

In total, employees are offered 10 pension schemes with different conditions to choose from. The amount of payments under the corporate program cannot be less than 2,000 rubles. In fact, pensioners are paid from 10,000 rubles. monthly. The Transneft pension program has been implemented since 2004 through a non-state fund of the same name owned by the company. PPF Transneft was created in 2000 specifically to provide pension services to employees of enterprises included in the group. In 2020, the Transneft corporate pension program was recognized by the Center for the Study of Pension Reforms as the best pension package among large enterprises in Russia. At the beginning of 2020, more than 26 thousand pensioners of the company received payments; working employees are offered 10 options for pension schemes to receive additional payments in old age.

Negative points and program development

In addition to the positive characteristics, the introduction of corporate pension programs also involves some negative aspects. As a rule, they are associated with the development of these programs, costs and the impact of the stability and reliability of the selected non-state pension fund on the achievement of planned results. However, these disadvantages cannot be a priority, because the advantages in this case are much greater. In addition, they are qualitatively large-scale.

How can a corporate pension program be developed today? It is important to note that such a program, one way or another, is being developed by the company together with a non-state pension fund. The choice of the latter is made based on an analysis of the effectiveness of its activities over a certain period, as well as the presence of a positive rating in terms of reliability. In the process of forming a pension program, it would be advisable to highlight the following stages:

In conclusion, it should be noted that at all stages of implementation of the considered programs in the company, active activities are carried out by specialists from the HR department or a specially formed pension service. Thus, employees help all participants understand pressing issues and choose the most optimal savings scheme.

Corporate pension program

Firstly, all the funds that the company allocates for the implementation of corporate pension programs (CPP) go to the organization itself - to the employees, to their future pensions, helping to strengthen employee loyalty to the company.

Examples of corporate pensions in Russia

As a result, we can state that corporate pension programs (PPPs) help companies achieve solutions to a whole range of problems – both managerial and economic. By including workers on favorable terms for him in the CPP, the company provides him not only with stable work, but also a more comfortable future through a corporate pension.

To solve the tasks set in the formation of corporate pensions, a special service is being created in the company. It develops the main ways to achieve the set goals, and also ensures active interaction with the selected non-state pension fund.

Some messages from the President of Transneft PJSC N.P. Tokarev

- For budgetary organizations, indexing occurs in accordance with current labor legislation and other regulations.

- As for commercial enterprises , the indexation procedure for them is not defined in the Labor Code of the Russian Federation. Managers have the opportunity to independently set the timing and size of indexation through internal documents.

Cheat sheet on the article from the editors of BUKH.1S for those who do not have time

In this case, according to labor legislation, the salary must ensure a decent life for the working citizen and his family members, for which its amount should not be less than the established minimum wage.

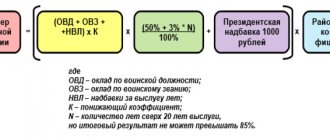

Preferential bonuses for former employees of the Ministry will be paid from the amount of calculated pension data, which depend on the age of the Ministry of Internal Affairs employee, his status and marital status. For example, employees of the Ministry of Internal Affairs who have received a long-service pension can receive such allowances as

Corporate sports are actively developing. In total, more than 6.5 thousand people in our system are involved in sports on a regular basis, almost a third of them - more than 2 thousand - participate in regularly held Transneft corporate sports competitions, winter and summer.

Indexation of Transneft corporate pensions in 2020

- With three years of service, the employee has the opportunity to participate in the accumulation of pension capital.

- After 7 years of work at Sberbank, an individual account is opened in the employee’s name, into which contributions are made.

The main difference between a corporate pension and other NGO schemes is the contribution of funds to the employee’s account by the employer. Recently, large companies have been actively implementing such a program, thereby ensuring the social protection of their employees.

The size of the pension in each specific case is determined individually, but is usually quite high and ranges from 10,000 rubles. It depends on the amount of contributions paid and the period of participation of a particular employee in the program.

Non-state Pension Fund "Transneft"

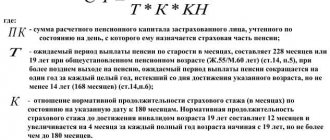

Urgent pension payment to insured persons is carried out only at the expense of additional insurance funded pension contributions, employer contributions, contributions to the formation of co-financing pension savings, income from their investment, part (funds) of maternity (family) capital, formation of directed funded pensions and income from their investments.

To pay pension funds in the form of a funded pension , a fixed- term lump-sum pension , or pay a payment to the insured person you must submit appropriate application to the Fund in one of the following ways in person :