In Russia, the amount of benefits for persons who have retired is formed from two parts: insurance and funded. And if the state has taken over the payment of the insurance benefit, then its funded part can be stored in both a public and private fund. And thanks to the investment activities of the fund, contributions from policyholders, as well as other sources, a substantial amount is accumulated. And it is quite reasonable that many are concerned about the question of whether it is possible to withdraw savings from pensions that were deducted from a citizen’s income. Read on to find out how you can withdraw money from your savings fund.

What are pension savings and how are they calculated?

Let us consider the mechanism for forming the funded part of the pension, its size and sources. This type of savings amounts to 6% of the amount transferred by the employer to the Pension Fund and is provided for persons born before 1967 inclusive. At the same time, citizens have the right to independently choose the method of increasing savings and the organization to which they will entrust the management of their own savings, having previously notified the Pension Fund of the Russian Federation.

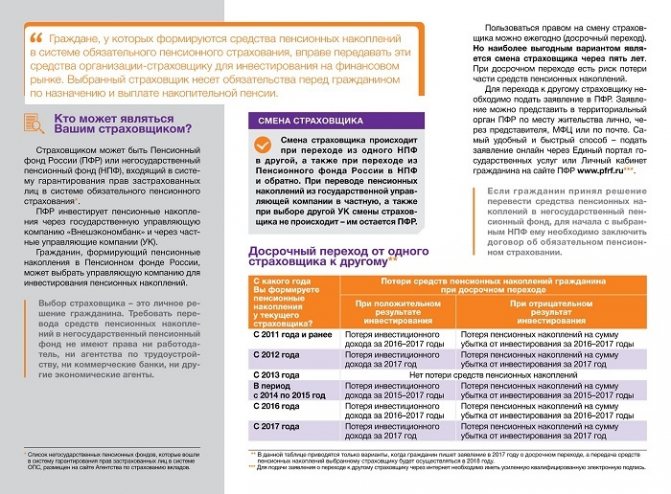

Below is information about who can be the insurer and how to change one fund to another.

The funded part of future pension contributions consists of the following resources:

- mandatory contributions by the employer in the amount of 22% of the employee’s salary, 6% of which goes to replenish the funded part of the pension;

- independent replenishment of the pension fund by a citizen, while he can change the amount of employer contributions at his own request, thereby influencing the amount of future payments.

As for storing the funded part of the pension, a citizen can trust the state Pension Fund or a private fund engaged in investments.

For those born after the specified period, the state offers to independently decide what deductions to make: form only an insurance type or accumulate funds in both insurance and savings accounts. For “silent people” who have not made a choice regarding pension savings, all cash receipts from the employer are used to create an insurance pension benefit.

What is the funded part of a pension?

The first sources of income are regular contributions that the employer is obliged to pay for the hired employee to the pension fund. They transfer specific percentage amounts to compulsory pension insurance.

This mandatory part forms your future savings for old age.

The total percentage is 22% and includes the following deductions:

- 6% is formed for compulsory pension in the future;

- the other 6% is transferred at the request of the person to other savings funds;

- and 10% is savings insurance.

Another source of income is contributions that a person makes independently to any organization that forms pension contributions.

You can demand from your employer that he transfer mandatory contributions only with 16%, and you independently transfer the other 6% to the selected fund.

Until 2020, a temporary moratorium on funded transfers has been introduced and all contributions of 22% are transferred to the pension insurance fund, in accordance with the law of December 15, 2001 No. 167-FZ, clause 4 of Art. 33.3; and Law of December 15, 2013 No. 352-FZ, Art. 6.1.

The new system helps you choose more favorable conditions for the formation of your future pension. You can gradually accumulate money, and then use it at your own discretion, after reaching the appropriate age (can it be used before retirement?).

At the same time, the citizen retains the right to receive a guaranteed pension, and although it is slightly more than the minimum subsistence level, if it is supplemented with savings, the final amount will be sufficient. Much depends on a person’s savings.

Can pension savings be withdrawn before retirement?

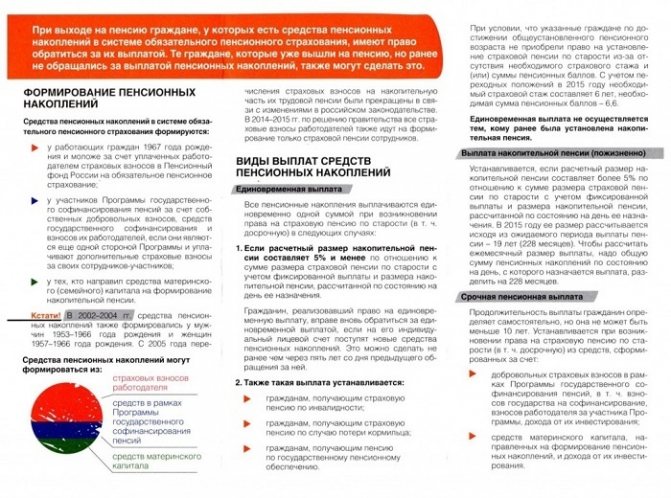

How can you withdraw savings from your pension? For this purpose, the pensioner’s decision alone will not be enough. The payments of the accumulated savings themselves come in several types:

1. One-time . Citizens can count on receiving full payment of all accumulated funds:

- if the volume of accumulation is less than 5% of the amount of old-age payments, taking into account the fixed payment and the funded part, calculated on the day of assignment of pension payments.

- in case of premature retirement due to disability;

- upon reaching retirement age by a person receiving a social pension, but who does not have social experience to accrue a guaranteed labor pension. This may also be due to insufficient work experience or the required number of pension coefficients.

2. Urgent . This type provides payments for a period determined by the citizen himself who has reached retirement age. The minimum period established by law is at least 10 years.

3. Indefinite . With this type of payment, the savings portion is distributed into equal shares. They are paid in installments upon the citizen’s retirement throughout his life. Of course, what this period will be is unknown. As a result, the legislation defines 234 months – that’s just over 19 years.

4. According to Art. 4 of Law No. 360, heirs can claim the funded part in the event of the death of a pensioner .

Attention: if you refuse the funded part of the pension, only 16% of the compensatory pension is formed with 0% of the funded part.

Is it possible to withdraw savings from a pension before retirement age?

You can count on the fact that you will be able to withdraw pension savings only when you reach the required age: for women this is 60 years old, for men - 65. Payments can be withdrawn before the established age only:

- upon the loss of a breadwinner;

- when registering disability groups I–III;

- categories of persons defined by law who enjoy a grace period when entering a well-deserved retirement: teachers, military personnel, geologists, medical workers, railway workers, workers of the Far North.

In other cases, it will be possible to withdraw savings from a pension only upon reaching the age specified by law for retirement.

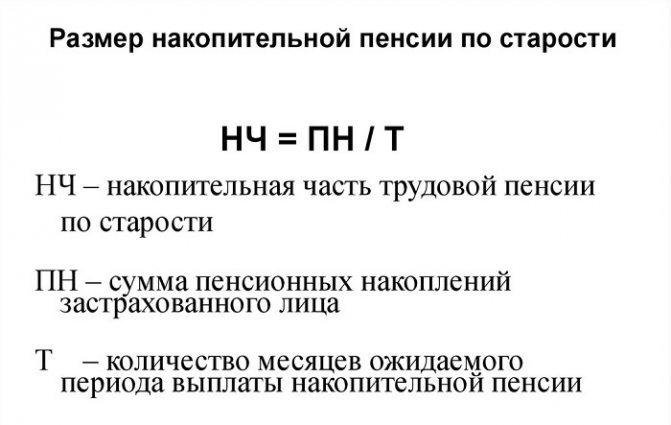

How is the payout amount calculated?

You can obtain a calculation of the preliminary amount of savings from the fund to which you have entrusted the management of your funds. You should also go there when the deadline for receiving a pension benefit arrives to fill out a package of required documents and calculate the amount of payments.

The accrual of pension payments is calculated according to special formulas developed by law. The formulas contain the payment of the insurance part of the pension guaranteed by the state, taking into account appropriate benefits and subsidies, as well as the calculation of the savings funds available in the account on the date of the citizen’s application.

The legislation provides for all possibilities to withdraw the funded part of the pension.

Formal opportunity

Current legislation leaves citizens the opportunity to withdraw all their savings (namely the funded part) immediately, even before the age of 65 (for men).

But the amount of your monthly contributions to the NPF should not exceed 5% of the pension assigned by the state. And here the amount turns out to be so small that it becomes impossible to bypass this nuance.

And the part of the capital itself will be small. As they say, “the game is not worth the candle.” To summarize, we can conclude that the state is really closing off opportunities for early receipt of your accumulated capital, which should be paid to you in old age.

And, partly, they are right about this. Today, when our fellow citizens are taking out loans and microloans en masse, they do not think at all about leaving something for themselves for old age. And if you give them the opportunity to operate with these funds, then they will also be quickly spent. As a result, we will get a whole generation of old people who have no pension at all.

It’s better to take care of your old age in advance and don’t rely on the state for it. Improve your financial literacy, regularly invest small amounts in conservative low-risk assets, and the issue of deductions will concern you less and less every year.

What to do if the insured person dies before retirement

Cases of premature death of the policyholder before reaching retirement age are quite common. What will be the fate of the money then and can the relatives of the deceased withdraw their savings from the pension? In such circumstances, pension savings are considered an inheritance, and the legislation takes into account the possibility of withdrawing the funded part of the policyholder's pension to the relatives of the deceased, but subject to certain conditions.

All funds are divided according to the will of the policyholder. A citizen must first make a written order in the event of his death to the fund where the savings funds are stored, and determine the circle of persons and the size of the share that each of the heirs will receive.

But few people expect a quick death, and therefore, even in the case of a long illness, people hope for a favorable outcome. Therefore, in the absence of a will, the accumulated funds in the policyholder’s account will be distributed in equal parts, according to the law, among the heirs of the first two orders.

Legal successors can withdraw savings from the policyholder’s pension only in the following cases:

- payments have not yet been established for the deceased;

- if there is an unpaid balance of the established benefit;

- a lump sum payment was claimed but not paid.

Important : heirs cannot withdraw savings from a pension if the deceased has chosen indefinite payments.

List of required documents

As mentioned earlier, payments are made in two categories: the pension itself (accruals based on length of service and earnings) and the funded part. Everything is clear with the first one, but the second one completely depends on how much money you transferred to the Pension Fund before you reached retirement age.

Expert opinion

Polyakov Kirill Yaroslavovich

Lawyer with 7 years of experience. Specialization: criminal law. Extensive experience in drafting contracts.

In this case, you can trace the trend that the more you invest in your future throughout your life, the higher your pension will be (precisely based on the funded part, which is individual for each citizen).

But what documents are needed for this? So, before going to the Pension Fund, you must prepare the following papers:

- copies and originals of passport pages;

- identification code;

- salary certificate from place of employment;

- certificate and copies of agreements on the transfer of funds to the NPF account for accumulation.

This list is enough to establish a document due to which you will be paid a pension in two parts.

How to withdraw pension savings: documents and nuances

It is worthwhile to first familiarize yourself with the options for receiving funds when drawing up an application for partial payment of pension savings:

- One-time payment . Those who have a small amount of savings in their account - about 5% of the insurance pension - can count on obtaining permission to withdraw the entire amount. After completing the application immediately, the entire amount can be received within two months.

- Payment on time . This type of payment provides for a certain period, no more than 10 years. In this case, the entire amount of savings is distributed in equal shares and paid monthly. This also includes maternity capital funds and contributions to the pension co-financing program.

- Regular payment method . This method is the most familiar and frequently used. The savings part is divided into equal amounts and added to the monthly payments of the insurance part.

- In the event of the death of the policyholder, funds can be paid in full to the heirs, subject to the conditions of the inheritance law.

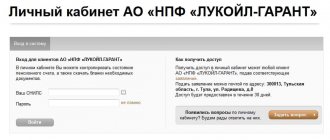

To withdraw pension savings entrusted to the Pension Fund of the Russian Federation, you must contact the territorial body of the fund in person, through the MFC or an authorized representative with a notarized power of attorney. In this case, you must present a passport, pension certificate, SNILS and other documents required by the fund’s specialists to process the payment.

In addition to the availability of documents and the desire of the policyholder, some other conditions are required to receive payments:

- availability of funds in the fund;

- reaching retirement age;

- occurrence of an insured event (disability, loss of a breadwinner, etc.);

- availability of all documents necessary to assign payment;

- a correctly completed application;

Upon reaching retirement age, a standard package of documents is provided:

- pensioner's ID;

- passport of a citizen of the country;

- work book, which records the entire work experience of the pensioner;

- pension certificate.

Is it possible to withdraw savings from a pension if a pension is assigned early in the event of an insured event? To do this, you must provide additional documents certifying this right. This may be a death certificate of the policyholder or a commission conclusion on obtaining a disability group.

How to withdraw money from a non-state pension fund?

The state has given citizens the right to independently determine in which fund the funded part of their pension should be formed. There are quite a lot of organizations on the financial market that will provide services for placing citizens’ funds in order to form a pension. But they all have a trust management agreement for pension savings with the Pension Fund of the Russian Federation and are controlled by it.

If a non-state fund is chosen, this does not mean that funds cannot be moved. Citizens have the opportunity to transfer them from NPFs to Pension Funds and back, and also entrust the management of funds to a financial management company.

There is a strong opinion that placement in a private fund gives the right to cash out pension savings at any time. This is wrong. As with a government fund, the placement agreement is conditional. This means that in order to withdraw money you need to wait for the occurrence of an event or fact. And the very fact of the attack will have to be documented.

How to withdraw savings if they are entrusted to a private organization? Let's consider, for example, how to withdraw money from Sberbank NPF.

The official website of Sberbank contains information on how you can withdraw money from the funded part of your pension and on what grounds:

- savings must be placed in a non-state pension fund at the time of application;

- approaching retirement age;

- the applicant for receiving funds is the heir of the person who placed the funds in the NPF;

- the occurrence of an event that is an insured event and the law provides for it as a basis for early receipt of pension payments: obtaining a disability group, loss of a breadwinner, obtaining the status of having many children, and others;

- a pensioner belongs to a preferential category.

The NPF is contacted with an application, to which the necessary documents are attached. Including those confirming the occurrence of a fact that is the basis for early termination of the contract. Each such case is individual, so it is better to consult with an NPF specialist.

However, it must be remembered that private funds are bound by the same legal requirements as the Pension Fund of the Russian Federation.

How to receive payments from NPF

To withdraw pension savings from a non-state pension fund that you have chosen yourself, you need to directly apply to the fund to prepare documents for payments. The list of documents should be agreed upon directly with the organization.

The application form that must be submitted is approved by Law No. 75-FZ, Art. 36.28 p.p. 4, 5.

After submitting the application, the policyholder receives notification of its acceptance. Within ten days, a decision is made on the assignment of payments or refusal. After which the policyholder must receive notice of the NPF’s decision. The procedure and amount of payments must be agreed upon directly with the organization.

If the issue is resolved positively, payments are made from the moment the application and required documents are submitted. The calculation is made according to the following scheme: the total amount of savings is divided by the expected payment period. In this case, personal income tax is not charged from the funded part.

When can you withdraw savings from your pension?

The regulations for receiving payments from the accumulation fund determine that it is not enough to be a participant in the accumulation program. For a guaranteed payment, it is required that the citizen fits one of certain categories:

- reaching retirement age: for women – 60 years, for men – 65;

- receipt of disability (if there are supporting documents);

- another possibility provided for by the legislation of the Russian Federation;

- availability of funds in the policyholder's savings account.

To calculate payments, an application is submitted to the fund that the citizen independently chose to accumulate funds.

Is it possible to return?

Yes, you can receive the funded part of your pension, but it all depends on the situation. Workers can receive the money as a lump sum before they retire. This is possible if they received a disability of 1, 2, 3 groups. In addition, a lump sum payment is possible if the loss of a breadwinner has occurred (No. 360-FZ, Art. No. 4).

How much money will be available to a citizen depends on the state of his personal account. The starting point will be the date from which he will be assigned a lump sum payment.

Important! Those pensioners who decide to continue working cannot count on receiving payments.

If we talk about an urgent pension, it will come every month. The amount will be received during the period for which the citizen was insured. But it is worth considering that this period cannot be made less than 10 years. The difference between the savings part and the insurance part is that the funds can be bequeathed to heirs.

What determines the size of savings payments from a pension?

First of all, the amount of payments will depend on the funds transferred to the account.

Subject to the conditions specified above, a citizen can withdraw savings from a pension by submitting a package of documents along with an application to the institution, whose specialists will perform a control calculation of the amount of the monthly payment. In this case, it is worth requesting a registered copy of the application, since payments, if the decision is positive, are made from the moment the documents are submitted. If you wish, you can make an approximate calculation yourself: divide the savings into equal parts, depending on the type of payments. This portion is not subject to taxation.

The calculation of the size of the funded part of the pension is presented below:

You can withdraw your pension savings early if you meet certain requirements. But, despite the fact that a pensioner can manage his voluntary contributions himself, this is not easy to do. To withdraw savings, certain conditions are required. You can withdraw savings from your pension one-time, with installment payments, or in parallel with the insurance part, during the same period. In addition, in the event of the death of the policyholder, his legal successors can withdraw pension savings.

How to return funds?

The procedure is not complicated, it consists of the following steps:

- First you need to contact the organization that has been entrusted with managing the money. In order to find out who exactly is in charge of management, you need to contact the Pension Fund. You can obtain information at the MFC, or issue an extract through State Services.

- If the money is in the Pension Fund, then you must first select a fund branch. An application for processing payments can be submitted by mail or through a representative.

- You need to bring your passport and SNILS to the PF. In addition, you need to write a statement.

- If payments will be issued simultaneously with the insurance pension, you must attach your work record, as well as other documents confirming your length of service. You must write an application.

Reference! The appeal will be considered, and the applicant will be notified of the decision within 10 working days. The law does not establish a deadline for filing papers.

What programs does Blastostoyaniya operate?

In total, there are two areas that have become the main ones for the company’s activities:

- Pension programs designed specifically for Russian Railways employees.

- Individual offers for people who do not work for Russian Railways.

About the program for railway workers

The bottom line is that the employer and employee of the company participate in equal shares in the formation of savings. The terms of a specific contract depend on which service option the client chooses.

According to standard schemes, several solutions are proposed:

- The ability to choose inheritance: it is either absent or applies to personal or state savings.

- Contribution amount: minimum, maximum, optimal.

- Limitation on the number of heirs. Or the absence of such conditions.

A non-state pension is paid in the following circumstances:

- Upon dismissal from Russian Railways.

- With participation in the program for at least 5 years.

- Reaching the generally established retirement age.

Individual programs for employees of other companies

Any citizen, not only Russian Railways employees, can be a party to such agreements. Personal savings are involved in the formation of a pension.

The frequency of payment of contributions along with their amounts is determined by the citizen himself. The main thing is that the first payment is at least 10 thousand rubles. Subsequent contributions can be made for any amount.

In this case, an open-ended contract is concluded. The participant can terminate it at any time when the following conditions are met:

- More than a year has passed since the conclusion. Then the entire amount of investment is returned, as well as the income received on its basis.

- If less than 12 months from the date of conclusion, then the investment will be returned along with income at a guaranteed rate of up to 4 percent.

No more than two months must pass from the date of early termination before the money is returned.

Detailed step-by-step instructions

It is quite difficult to make such instructions, since the reasons provided by law are as follows:

- death of the insured person;

- retirement of the insured person;

- special merits at work;

- severe forms of diseases, which are provided for by the Code of the Russian Federation, are caused by working environment conditions;

- lump sum payment of savings;

- urgent payment of pension;

- necessary payments.

However, you should first find your retirement savings and then find out about the amount of money. Next, let's look at everything point by point.

- Now the Internet provides enormous opportunities, so securing an electronic queue for yourself on a given day is the easiest thing to do, and we recommend starting with this. Since the Russian Federation has a system that allows citizens to independently form a pension, everything depends on each individual citizen of the country.

- Determine accumulated money. Find reports on their accrual to the Pension Fund or Non-State Pension Fund.

- Before going to the Pension Fund, you are required to prepare the following documents:

- copies and originals of passport pages;

- identification code;

- salary certificate from place of employment;

- certificate and copies of agreements on the transfer of funds to the Pension Fund account for accumulation.

This list is enough to establish a document due to which you will be paid a pension in two parts.